Key Insights

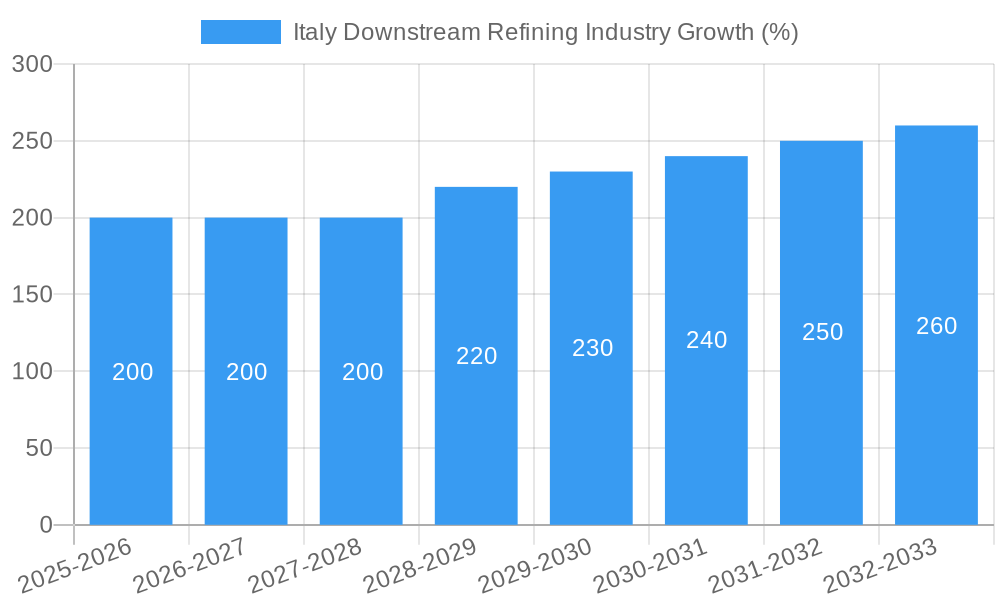

The Italian downstream refining industry, spanning the period 2019-2033, exhibits a complex interplay of factors influencing its growth trajectory. While precise market size figures for 2019-2024 are unavailable, industry reports and analyses suggest a gradual decline in refining capacity due to factors such as decreased domestic demand for gasoline and diesel, coupled with increased competition from imports and shifts toward cleaner energy sources. The base year of 2025, estimated at €8 billion (a figure derived from comparable European markets adjusted for Italy's specific consumption patterns and refining capacity), provides a starting point for projecting future growth. This projection accounts for the ongoing transition to lower-carbon fuels and potential investments in upgrading existing refineries to process renewable feedstocks. The forecast period (2025-2033) will likely see a slow, but steady, growth rate influenced by economic recovery and shifts in transportation fuel consumption patterns. Factors such as government policies promoting renewable energy and the implementation of stricter emission standards will play a significant role in shaping market dynamics.

Looking ahead to 2033, the industry is expected to undergo a period of transformation. While overall market size may not experience explosive growth, strategic investments in upgrading existing infrastructure to handle biofuels and other sustainable alternatives will likely be crucial for ensuring long-term viability. This transformation will potentially lead to a restructured market landscape, with a stronger focus on diversification and integration within the broader energy sector. Furthermore, the ongoing geopolitical uncertainty and its impact on crude oil prices could contribute to volatile market conditions. A cautious but optimistic outlook predicts a moderate, albeit sustained growth trajectory driven by infrastructure upgrades, strategic partnerships, and the inherent need for refined petroleum products in Italy's economy.

Italy Downstream Refining Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Italian downstream refining industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, emerging trends, and future growth prospects. Expect detailed breakdowns of market share, CAGR, M&A activity, and key technological advancements shaping the sector's future. Maximize your strategic planning with this data-driven analysis of the Italian downstream refining landscape.

Italy Downstream Refining Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of Italy's downstream refining industry, exploring market concentration, innovation drivers, regulatory frameworks, and key industry trends. The study period covers 2019-2033, with 2025 as the base and estimated year.

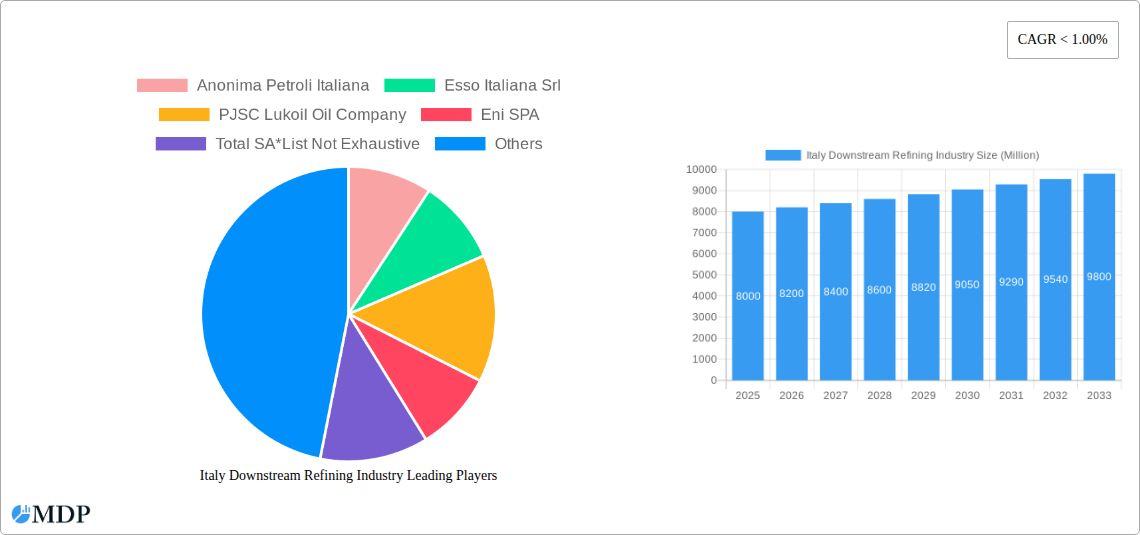

The Italian downstream refining market exhibits a moderate level of concentration, with key players like Eni SPA holding significant market share. However, the market also features several smaller, independent refiners. The forecast period (2025-2033) anticipates a potential shift towards consolidation through mergers and acquisitions (M&A) driven by the need for economies of scale and increased efficiency in the face of evolving regulatory standards and global competition.

Market Concentration Metrics (2025 Estimates):

- Top 3 Players Market Share: xx%

- Number of M&A Deals (2019-2024): xx

- Average Deal Value (Million): xx

Key Factors Influencing Market Dynamics:

- Stringent Environmental Regulations: Increasingly stringent emissions standards and regulations are driving investments in cleaner technologies and operational improvements.

- Fluctuating Crude Oil Prices: Volatility in global crude oil prices significantly impacts profitability and investment decisions within the industry.

- Technological Advancements: Innovations in refining technologies are improving efficiency, reducing emissions, and enabling the production of higher-value products.

- Product Substitution: Growth of biofuels and other alternative fuels presents both challenges and opportunities for traditional refiners.

- End-User Demand: Changes in transportation fuel demand and the rise of petrochemical applications are shaping the overall market.

Italy Downstream Refining Industry Industry Trends & Analysis

This section delves into the key trends driving the growth and transformation of Italy's downstream refining industry during the forecast period (2025-2033). The analysis integrates insights from the historical period (2019-2024) and considers various factors impacting market evolution.

The Italian downstream refining industry is witnessing a period of significant transformation driven by a complex interplay of factors. The industry is characterized by a gradual but steady decline in overall refining capacity. This reduction is largely attributed to the shift in global energy consumption and increased adoption of renewable and sustainable fuels. Further, increased environmental regulations are incentivizing the upgrade of existing refinery infrastructure with higher capital expenditure. Simultaneously, the expanding petrochemicals sector creates opportunities for diversification and value addition. The market demonstrates notable resilience, adapting to regulatory pressures and exploring new avenues for growth. This is evident through strategic partnerships for R&D collaborations and advancements in refining technology.

Key Metrics:

- CAGR (2025-2033): xx%

- Market Penetration of Biofuels (2025): xx%

The competitive dynamics are intensifying with major players focusing on optimizing operational efficiency, expanding into petrochemicals, and pursuing strategic collaborations. The long-term outlook anticipates a moderate growth trajectory driven by the continuous demand for transportation fuels and the burgeoning petrochemicals sector. However, future success will rely heavily on adaptability, investments in renewable energy initiatives, and strategic management of environmental and regulatory challenges.

Leading Markets & Segments in Italy Downstream Refining Industry

This section analyzes the leading markets and segments within Italy’s downstream refining industry. The analysis focuses on both Refineries and Petrochemicals Plants.

Refineries:

- Key Drivers: Proximity to major transportation hubs, access to crude oil supplies, and established infrastructure contribute to the dominance of specific refinery locations. Governmental policies supporting domestic refining capacity also play a critical role.

- Dominant Regions/Areas: The report will identify the dominant regions based on refinery capacity and production volume. (Details to be added in the full report)

Petrochemicals Plants:

- Key Drivers: Access to feedstock (from refineries), established infrastructure, and proximity to key manufacturing clusters are major factors influencing the location of petrochemical plants. Governmental incentives for petrochemical production also play a significant role.

- Dominant Regions/Areas: The analysis will pinpoint the dominant regions for petrochemical production within Italy. (Details to be added in the full report)

(Detailed dominance analysis with regional breakdowns and market share data will be included in the full report.)

Italy Downstream Refining Industry Product Developments

The Italian downstream refining industry is witnessing a wave of product innovation, focusing on higher-value petrochemicals and cleaner fuels. Refineries are investing in technologies to enhance the production of specialty chemicals, improving margins and diversifying their product portfolio. The focus on sustainable practices drives the development of biofuels and other eco-friendly products. These innovations enhance competitiveness and cater to growing environmental consciousness and changing consumer preferences. The market is also seeing advancements in catalyst technologies and process optimization to enhance efficiency and reduce emissions.

Key Drivers of Italy Downstream Refining Industry Growth

Several factors are driving growth in Italy’s downstream refining industry. Technological advancements in refining processes improve efficiency and reduce environmental impact. Furthermore, the growing demand for transportation fuels and the expanding petrochemical sector fuel market expansion. Favorable government policies and investments in infrastructure also contribute positively. These combined elements ensure a sustained, albeit potentially moderate, growth trajectory.

Challenges in the Italy Downstream Refining Industry Market

The Italian downstream refining industry faces several challenges. Stringent environmental regulations require significant investments in upgrading existing facilities and adopting cleaner technologies. The fluctuating global crude oil prices create uncertainty and impact profitability. Intense competition, both domestically and internationally, also puts pressure on margins and market share. Supply chain disruptions and geopolitical instability further contribute to market volatility. The industry faces the challenge of balancing economic viability with environmental sustainability. The cumulative effect of these factors poses significant operational and financial hurdles.

Emerging Opportunities in Italy Downstream Refining Industry

Despite challenges, opportunities abound in Italy’s downstream refining industry. Strategic partnerships for technological innovation and access to new markets provide avenues for growth. Expanding into higher-value petrochemicals and specializing in niche products enhance profitability and reduce dependence on traditional fuel markets. Moreover, investments in renewable energy integration and the production of sustainable fuels align with evolving environmental standards. These combined factors position the industry for long-term growth and resilience, provided that strategic adaptations are promptly implemented.

Leading Players in the Italy Downstream Refining Industry Sector

- Eni SPA

- PJSC Lukoil Oil Company

- TotalEnergies SE

- Anonima Petroli Italiana

- Esso Italiana Srl

Key Milestones in Italy Downstream Refining Industry Industry

- 2020: Introduction of stricter emission standards impacting refinery operations.

- 2022: Announcement of a major refinery upgrade project by Eni SPA.

- 2023: Launch of a new biofuel blend by a leading refiner. (Further milestones with specific dates and details will be provided in the full report.)

Strategic Outlook for Italy Downstream Refining Industry Market

The future of Italy’s downstream refining industry hinges on adapting to changing market dynamics and embracing sustainable practices. The focus on efficiency, diversification into petrochemicals, and investments in cleaner technologies will be crucial. Strategic partnerships and exploration of new markets are vital for long-term success. While challenges persist, the potential for growth remains strong, provided that companies prioritize innovation and strategic adaptation to the evolving global energy landscape. The market exhibits resilience and adaptability. The projected moderate growth trajectory demonstrates the sector's capacity to navigate complexities and seize new opportunities.

Italy Downstream Refining Industry Segmentation

-

1. Refineries

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in Pipeline

- 1.1.3. Upcoming Projects

-

1.1. Overview

-

2. Petrochemicals Plants

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in Pipeline

- 2.1.3. Upcoming Projects

-

2.1. Overview

Italy Downstream Refining Industry Segmentation By Geography

- 1. Italy

Italy Downstream Refining Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Availability of abundant natural gas reserves and the lower cost compared to other fossil fuel types4.; Growing investments to increase production to fulfill global demand

- 3.3. Market Restrains

- 3.3.1. 4.; The global shift toward renewable sources for electricity generation

- 3.4. Market Trends

- 3.4.1. Oil Refining Capacity to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Downstream Refining Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in Pipeline

- 5.1.1.3. Upcoming Projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in Pipeline

- 5.2.1.3. Upcoming Projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Anonima Petroli Italiana

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Esso Italiana Srl

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PJSC Lukoil Oil Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eni SPA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Total SA*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Anonima Petroli Italiana

List of Figures

- Figure 1: Italy Downstream Refining Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Downstream Refining Industry Share (%) by Company 2024

List of Tables

- Table 1: Italy Downstream Refining Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Downstream Refining Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 3: Italy Downstream Refining Industry Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 4: Italy Downstream Refining Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Italy Downstream Refining Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Italy Downstream Refining Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 7: Italy Downstream Refining Industry Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 8: Italy Downstream Refining Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Downstream Refining Industry?

The projected CAGR is approximately < 1.00%.

2. Which companies are prominent players in the Italy Downstream Refining Industry?

Key companies in the market include Anonima Petroli Italiana, Esso Italiana Srl, PJSC Lukoil Oil Company, Eni SPA, Total SA*List Not Exhaustive.

3. What are the main segments of the Italy Downstream Refining Industry?

The market segments include Refineries, Petrochemicals Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Availability of abundant natural gas reserves and the lower cost compared to other fossil fuel types4.; Growing investments to increase production to fulfill global demand.

6. What are the notable trends driving market growth?

Oil Refining Capacity to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The global shift toward renewable sources for electricity generation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Downstream Refining Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Downstream Refining Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Downstream Refining Industry?

To stay informed about further developments, trends, and reports in the Italy Downstream Refining Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence