Key Insights

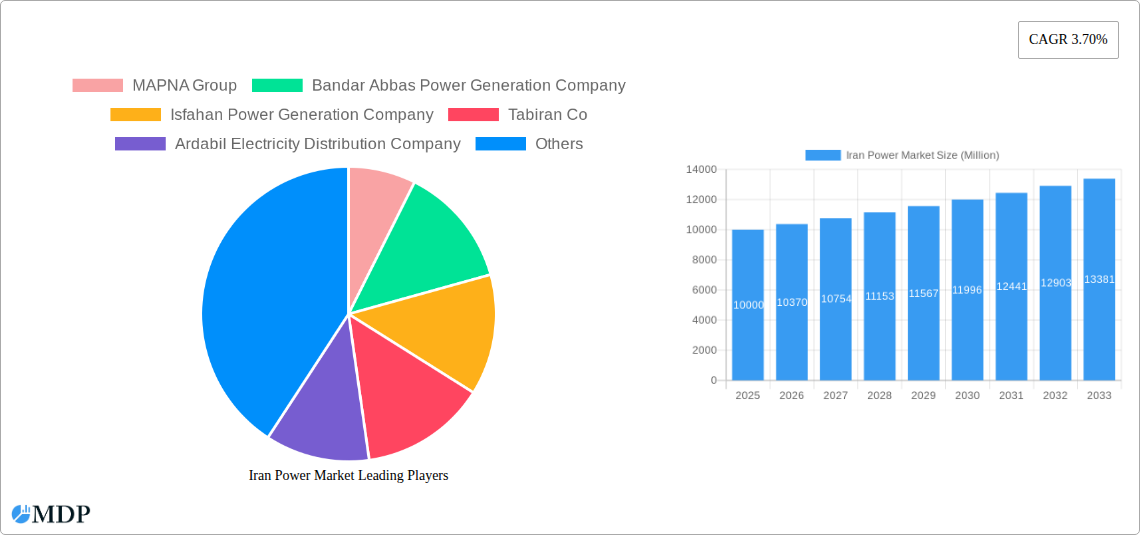

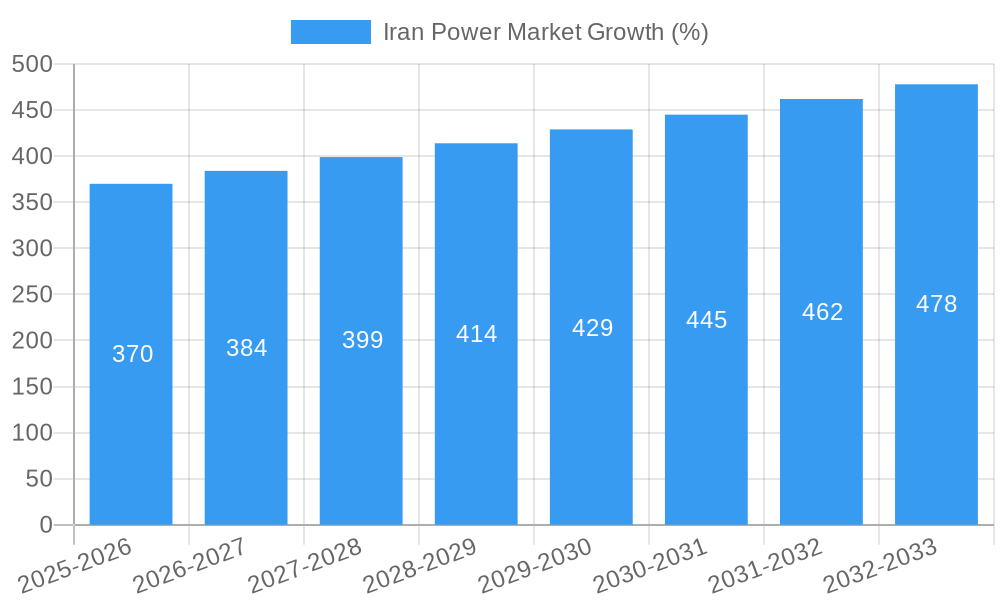

The Iranian power market, valued at approximately $XX million in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 3.70% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing industrialization and urbanization are significantly boosting electricity demand across residential, commercial, and industrial sectors. Furthermore, government initiatives aimed at improving energy infrastructure and expanding access to electricity in underserved regions are contributing to market growth. The shift towards renewable energy sources, such as solar power, is a notable trend, driven by both environmental concerns and the need to diversify the country's energy mix away from reliance on fossil fuels (natural gas and oil). However, the market faces constraints, including potential financial limitations in large-scale infrastructure projects, geopolitical challenges, and the need for continued investment in modernizing the existing power grid to handle increasing capacity and integrate renewables effectively. The market is segmented by generation source (natural gas, oil, renewables, nuclear, others) and end-user (residential, commercial, industrial). Key players include MAPNA Group, Bandar Abbas Power Generation Company, and others, actively participating in the development and expansion of the power sector.

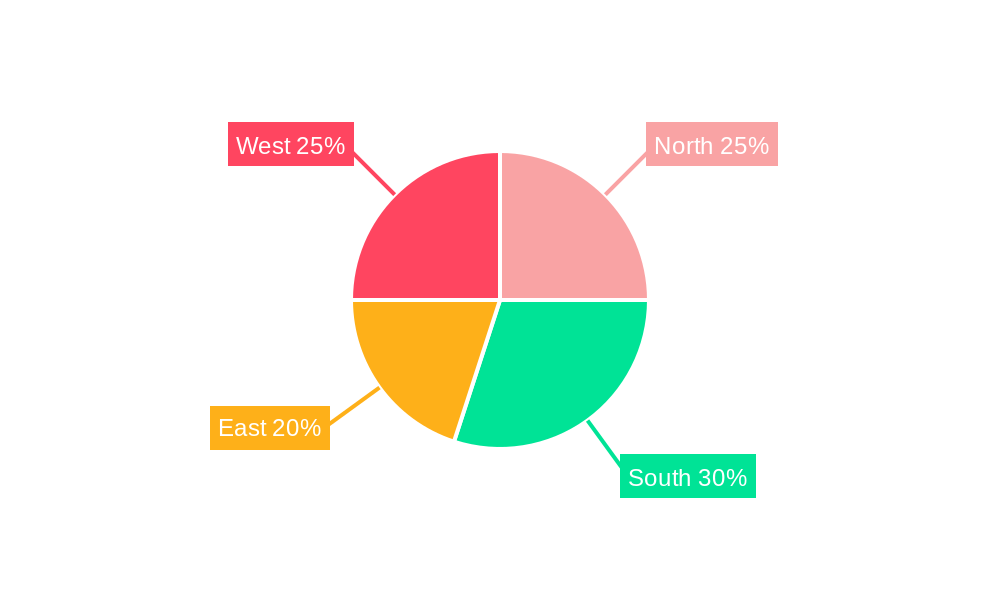

The regional distribution of the Iranian power market is significant, with variations in demand across the North, South, East, and West regions reflecting differing levels of industrial activity and population density. The forecast period (2025-2033) offers lucrative opportunities for companies involved in power generation, transmission, and distribution. Further growth will hinge on the successful implementation of government policies promoting renewable energy integration, attracting foreign investment, and resolving challenges associated with grid modernization and ensuring energy security. The market’s evolution will necessitate strategic planning and adaptability to navigate the complexities of the geopolitical landscape and the ongoing transition towards a more sustainable and diverse energy mix.

Iran Power Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Iranian power market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. Covering the period from 2019 to 2033, with a base year of 2025, this study unveils the market's intricacies, growth drivers, and future potential. The report meticulously examines market dynamics, key players, emerging trends, and challenges, providing a robust foundation for strategic decision-making. Download now to gain a competitive edge in the Iranian energy sector. High-traffic keywords: Iran power market, Iranian electricity market, power generation Iran, renewable energy Iran, MAPNA Group, energy sector Iran, Iranian power plants, electricity consumption Iran, power market forecast Iran.

Iran Power Market Market Dynamics & Concentration

The Iranian power market, valued at xx Million in 2024, exhibits a moderately concentrated structure with MAPNA Group holding a significant market share. The market is driven by increasing energy demand fueled by population growth and industrialization. However, stringent government regulations and sanctions significantly impact investment and technology adoption. Product substitution is limited due to infrastructural constraints, yet the growing adoption of renewables is gradually changing this dynamic. M&A activity has been relatively subdued in recent years (xx deals in the historical period), primarily due to economic sanctions and political instability.

- Market Concentration: Highly concentrated in the generation segment, with MAPNA Group leading the market; more fragmented in distribution.

- Innovation Drivers: Government initiatives promoting renewable energy, although limited by sanctions.

- Regulatory Framework: Stringent regulations and bureaucratic processes pose significant challenges.

- Product Substitutes: Limited viable substitutes, with renewables gaining traction.

- End-User Trends: Increasing demand from residential and industrial sectors.

- M&A Activity: Low levels of M&A activity, with xx deals recorded between 2019-2024.

Iran Power Market Industry Trends & Analysis

The Iranian power market is projected to witness a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is primarily driven by the government's focus on infrastructure development and industrial expansion, despite challenges posed by international sanctions. Technological disruptions are gradually emerging with a focus on renewable energy integration. However, the market remains heavily reliant on fossil fuels (natural gas and oil). Consumer preferences are shifting towards more reliable and sustainable energy sources, but affordability and access remain key constraints. Competitive dynamics are shaped by the dominance of state-owned entities, alongside the presence of private players like KPV Solar Iran. Market penetration of renewables is gradually increasing but still remains low compared to fossil fuels.

Leading Markets & Segments in Iran Power Market

Natural gas is the dominant generation source, accounting for xx% of the total generation capacity in 2025. The industrial sector is the largest end-user, consuming xx% of the total electricity generated.

Key Drivers for Natural Gas Dominance:

- Abundant domestic reserves.

- Established infrastructure.

- Relatively low cost compared to other sources.

Key Drivers for Industrial Sector Dominance:

- High energy intensity of industrial processes.

- Government support for industrial growth.

- Limited energy efficiency measures in some industries.

Dominance Analysis: The dominance of natural gas highlights the reliance on fossil fuels despite increasing renewable energy targets. The industrial sector's high energy consumption underscores the need for energy efficiency improvements and sustainable solutions.

Iran Power Market Product Developments

Recent product innovations have focused on improving the efficiency of existing power plants and integrating renewable energy technologies. Emphasis is on cost-effective solutions tailored to the Iranian climate and infrastructure. Competitive advantages stem from locally produced technology and reduced reliance on imports, although technological advancement is limited by international sanctions.

Key Drivers of Iran Power Market Growth

Growth in the Iranian power market is driven by several factors including government investments in infrastructure projects, increasing industrialization, population growth leading to higher residential demand, and a push towards greater self-reliance in energy generation. The shift towards renewable energy, albeit slow, also contributes to long-term growth prospects.

Challenges in the Iran Power Market Market

The Iranian power market faces significant challenges, including international sanctions limiting access to advanced technology and foreign investment. The aging infrastructure, unreliable power supply in certain regions, and funding constraints for upgrading the grid also hinder growth. Furthermore, political instability adds further uncertainty. These factors collectively result in an estimated xx Million loss in potential investment per year.

Emerging Opportunities in Iran Power Market

Significant opportunities exist in developing renewable energy sources to diversify the energy mix. Strategic partnerships with international companies (when sanctions allow) to introduce advanced technologies can unlock substantial growth. Investing in smart grid technologies and improving grid efficiency can further enhance market potential.

Leading Players in the Iran Power Market Sector

- MAPNA Group

- Bandar Abbas Power Generation Company

- Isfahan Power Generation Company

- Tabiran Co

- Ardabil Electricity Distribution Company

- KPV Solar Iran

- Besat Power Generation Management Company

- Zahedan Power Generation Company

- Azerbaijan Power Generation Company

- Fars Power Generation Company

- List Not Exhaustive

Key Milestones in Iran Power Market Industry

- 2020: Launch of several solar power projects despite limitations.

- 2022: Government announces ambitious renewable energy targets.

- 2023: Implementation of new energy efficiency regulations for industries.

- Further milestones require additional data

Strategic Outlook for Iran Power Market Market

The future of the Iranian power market hinges on overcoming the current challenges posed by sanctions and political uncertainty. Focused investments in renewable energy infrastructure, energy efficiency upgrades, and smart grid technologies will be crucial for unlocking substantial long-term growth. Strategic partnerships, when feasible, can greatly accelerate this progress.

Iran Power Market Segmentation

-

1. Generation Source

- 1.1. Natural Gas

- 1.2. Oil

- 1.3. Renewables

- 1.4. Nuclear

- 1.5. Other Generation Sources

-

2. Transmission and Distribution

- 2.1. Transmission lines

- 2.2. Distribution networks

- 2.3. Smart grid technologies

-

3. End User

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

Iran Power Market Segmentation By Geography

- 1. Iran

Iran Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Power Demand4.; Growth of Renewables

- 3.3. Market Restrains

- 3.3.1. 4.; Unstable Political Scenario of the Country

- 3.4. Market Trends

- 3.4.1. Natural Gas Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Generation Source

- 5.1.1. Natural Gas

- 5.1.2. Oil

- 5.1.3. Renewables

- 5.1.4. Nuclear

- 5.1.5. Other Generation Sources

- 5.2. Market Analysis, Insights and Forecast - by Transmission and Distribution

- 5.2.1. Transmission lines

- 5.2.2. Distribution networks

- 5.2.3. Smart grid technologies

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Generation Source

- 6. North Iran Power Market Analysis, Insights and Forecast, 2019-2031

- 7. South Iran Power Market Analysis, Insights and Forecast, 2019-2031

- 8. East Iran Power Market Analysis, Insights and Forecast, 2019-2031

- 9. West Iran Power Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 MAPNA Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bandar Abbas Power Generation Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Isfahan Power Generation Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Tabiran Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Ardabil Electricity Distribution Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 KPV Solar Iran

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Besat Power Generation Management Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Zahedan Power Generation Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Azerbaijan Power Generation Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Fars Power Generation Company*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 MAPNA Group

List of Figures

- Figure 1: Iran Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Power Market Share (%) by Company 2024

List of Tables

- Table 1: Iran Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Power Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Iran Power Market Revenue Million Forecast, by Generation Source 2019 & 2032

- Table 4: Iran Power Market Volume gigawatt Forecast, by Generation Source 2019 & 2032

- Table 5: Iran Power Market Revenue Million Forecast, by Transmission and Distribution 2019 & 2032

- Table 6: Iran Power Market Volume gigawatt Forecast, by Transmission and Distribution 2019 & 2032

- Table 7: Iran Power Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Iran Power Market Volume gigawatt Forecast, by End User 2019 & 2032

- Table 9: Iran Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Iran Power Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 11: Iran Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Iran Power Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 13: North Iran Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: North Iran Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 15: South Iran Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Iran Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 17: East Iran Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: East Iran Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 19: West Iran Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: West Iran Power Market Volume (gigawatt) Forecast, by Application 2019 & 2032

- Table 21: Iran Power Market Revenue Million Forecast, by Generation Source 2019 & 2032

- Table 22: Iran Power Market Volume gigawatt Forecast, by Generation Source 2019 & 2032

- Table 23: Iran Power Market Revenue Million Forecast, by Transmission and Distribution 2019 & 2032

- Table 24: Iran Power Market Volume gigawatt Forecast, by Transmission and Distribution 2019 & 2032

- Table 25: Iran Power Market Revenue Million Forecast, by End User 2019 & 2032

- Table 26: Iran Power Market Volume gigawatt Forecast, by End User 2019 & 2032

- Table 27: Iran Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Iran Power Market Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Power Market?

The projected CAGR is approximately 3.70%.

2. Which companies are prominent players in the Iran Power Market?

Key companies in the market include MAPNA Group, Bandar Abbas Power Generation Company, Isfahan Power Generation Company, Tabiran Co, Ardabil Electricity Distribution Company, KPV Solar Iran, Besat Power Generation Management Company, Zahedan Power Generation Company, Azerbaijan Power Generation Company, Fars Power Generation Company*List Not Exhaustive.

3. What are the main segments of the Iran Power Market?

The market segments include Generation Source, Transmission and Distribution, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Power Demand4.; Growth of Renewables.

6. What are the notable trends driving market growth?

Natural Gas Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Unstable Political Scenario of the Country.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Power Market?

To stay informed about further developments, trends, and reports in the Iran Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence