Key Insights

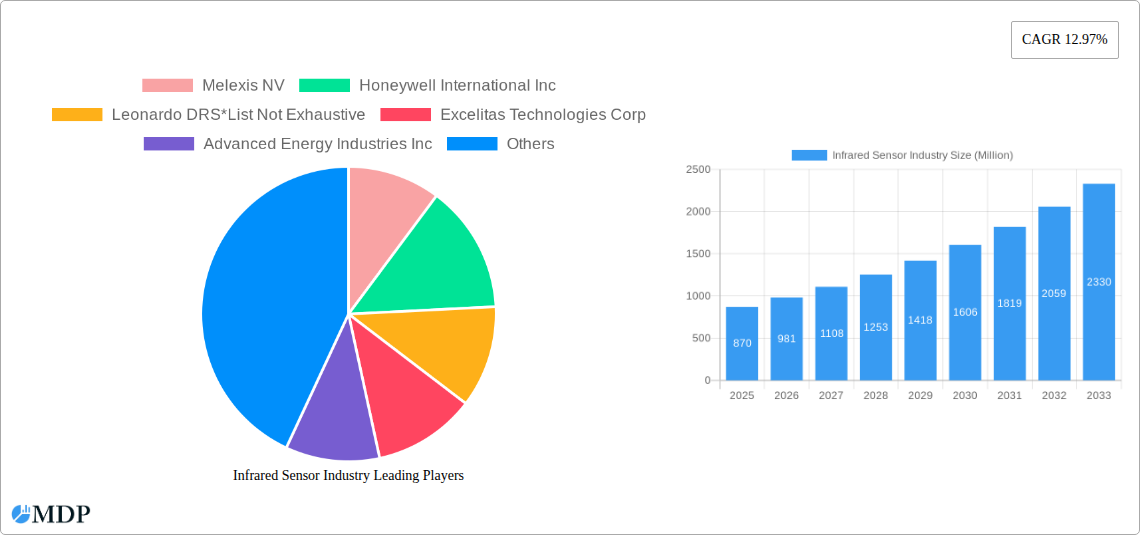

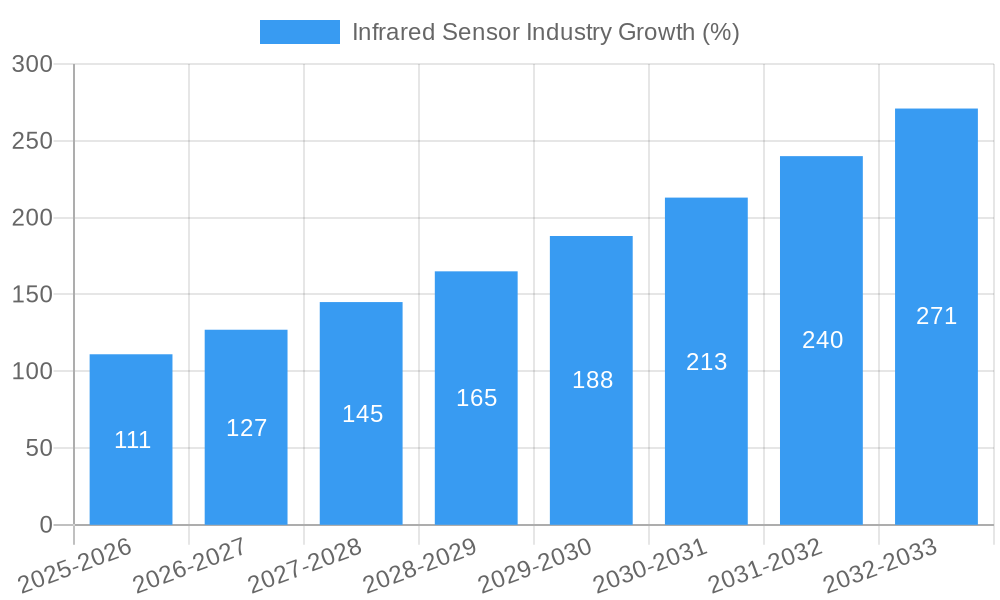

The infrared sensor market, valued at $0.87 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 12.97% from 2025 to 2033. This expansion is fueled by several key factors. The increasing adoption of infrared sensors across diverse sectors, including automotive (for advanced driver-assistance systems and autonomous driving), healthcare (for non-invasive diagnostics and thermal imaging), and industrial automation (for process monitoring and quality control), is a major catalyst. Furthermore, ongoing technological advancements leading to smaller, more energy-efficient, and cost-effective sensors are widening their application possibilities. The development of sophisticated sensor array technologies and improved image processing capabilities further enhances the market’s appeal. Growth is also expected to be driven by increasing demand for enhanced safety features in vehicles, the expansion of smart infrastructure initiatives, and the growing adoption of Industry 4.0 technologies. Competition within the market is intense, with established players like Honeywell International Inc., Melexis NV, and Teledyne FLIR Systems Inc. vying for market share alongside emerging innovative companies.

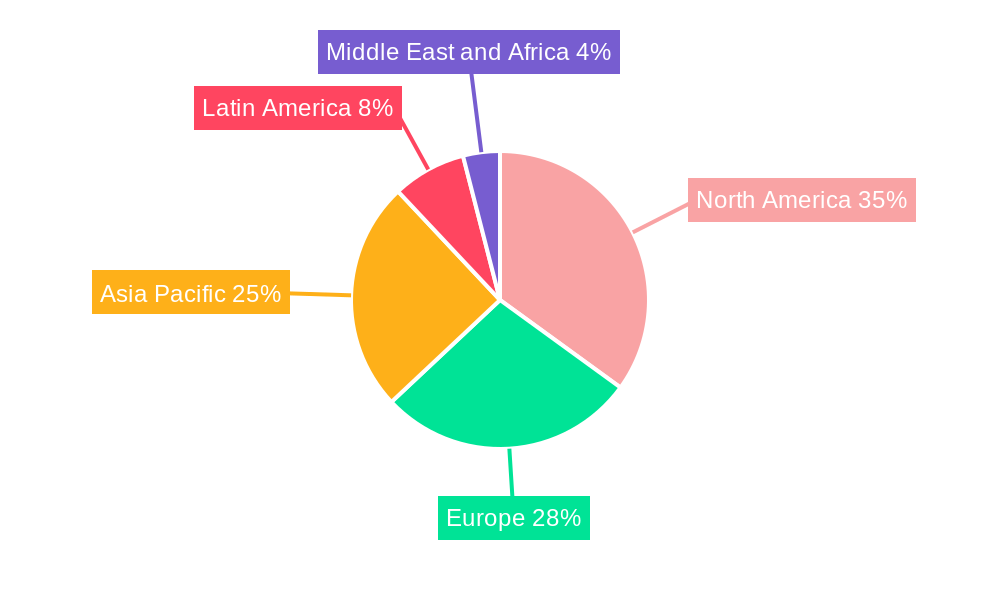

Regional market dynamics show variations in growth trajectories. North America, currently a significant market, is likely to maintain its leading position due to technological innovation and substantial investments in R&D. The Asia-Pacific region is expected to witness rapid growth, fueled by rising industrialization and increasing disposable incomes in developing economies. Europe will remain a significant contributor, driven by strong government support for advanced technology and environmental monitoring initiatives. The market segmentation by type (Near Infrared, Infrared, Far Infrared) and end-user industry (healthcare, automotive, aerospace, etc.) indicates significant opportunities for specialized sensor applications tailored to specific needs, promising niche market development and continued overall growth. While potential restraints like high initial investment costs and complex integration processes could partially hinder the market's trajectory, these are likely to be outweighed by the substantial growth drivers outlined above.

Infrared Sensor Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Infrared Sensor industry, covering market dynamics, leading players, technological advancements, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Infrared Sensor Industry Market Dynamics & Concentration

The infrared sensor market exhibits a moderately consolidated structure, with key players like Melexis NV, Honeywell International Inc, and Leonardo DRS holding significant market share. However, the presence of several other established and emerging companies fosters healthy competition. Market concentration is influenced by factors such as technological innovation, strategic mergers and acquisitions (M&A), and stringent regulatory frameworks. Innovation drives the industry, particularly in areas like enhanced resolution, sensitivity, and miniaturization, pushing the development of advanced sensors for diverse applications. Government regulations, particularly concerning safety and environmental standards, play a significant role in shaping market dynamics and influencing product development. Product substitutes, such as ultrasonic sensors and other imaging technologies, present competitive challenges. End-user trends in automation, safety, and non-contact sensing strongly influence market demand. The report analyzes xx M&A deals in the last five years, highlighting their impact on market consolidation and technological advancements.

- Market Share: Top 5 players hold approximately xx% of the market share (2025).

- M&A Activity: A significant increase in M&A activity observed in recent years (xx deals between 2020-2024).

- Innovation Drivers: Miniaturization, enhanced sensitivity, improved resolution, and cost reduction.

- Regulatory Landscape: Stringent safety and environmental standards impacting product design and manufacturing.

Infrared Sensor Industry Industry Trends & Analysis

The infrared sensor market is experiencing robust growth, driven by increasing adoption across various end-user industries. The Compound Annual Growth Rate (CAGR) is estimated to be xx% during the forecast period (2025-2033). This growth is fueled by several key factors: rising demand for automation and process optimization in manufacturing; the expanding use of infrared sensors in automotive applications (ADAS, autonomous driving); growing investments in healthcare technologies, especially in medical imaging and diagnostics; and increasing defense spending driving advancements in surveillance and targeting systems. Technological disruptions, such as the development of advanced materials and signal processing techniques, are further enhancing sensor performance and reducing costs, boosting market penetration. Competitive dynamics are characterized by both fierce rivalry amongst established players and the emergence of innovative startups. Market penetration is increasing most rapidly in emerging economies due to rapid industrialization and infrastructure development.

Leading Markets & Segments in Infrared Sensor Industry

The North American region holds a dominant position in the infrared sensor market, driven by strong demand from aerospace and defense, automotive, and healthcare sectors. The Asia-Pacific region is expected to experience substantial growth due to expanding industrialization and increasing investments in infrastructure.

By End-User Industry:

- Aerospace and Defense: High growth fueled by military modernization programs and enhanced surveillance systems. Key drivers include government initiatives, technological advancements, and increasing defense budgets.

- Automotive: Significant growth attributed to the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies. Drivers include stringent safety regulations, consumer demand for enhanced vehicle safety, and technological advancements.

- Healthcare: Strong growth propelled by the rising demand for non-invasive diagnostics and medical imaging. Drivers include advancements in medical technology, increased prevalence of chronic diseases, and rising healthcare expenditure.

- Manufacturing: Steady growth driven by automation and process optimization initiatives. Key drivers are increasing industrial automation, improving efficiency, and stringent quality control requirements.

By Type:

- Near Infrared (NIR): Wide application in various sectors, including industrial process monitoring and medical imaging.

- Infrared: Dominates the market due to diverse applications across various sectors.

- Far Infrared (FIR): Growing applications in thermal imaging and remote sensing.

Infrared Sensor Industry Product Developments

Recent innovations focus on enhancing sensor sensitivity, resolution, and miniaturization while reducing power consumption. The integration of advanced signal processing techniques and artificial intelligence (AI) capabilities further improves sensor performance and enables advanced applications. These developments cater to growing market demand for higher accuracy, faster response times, and more energy-efficient solutions across diverse applications, from automotive safety to advanced manufacturing processes.

Key Drivers of Infrared Sensor Industry Growth

Technological advancements, such as the development of more sensitive and cost-effective sensors, drive industry growth. Expanding applications in various sectors, including automotive, healthcare, and industrial automation, further stimulate market expansion. Government regulations and incentives focused on safety and environmental protection also contribute significantly. The increasing need for non-contact sensing solutions across many sectors further fuels market growth.

Challenges in the Infrared Sensor Industry Market

Intense competition amongst existing and new players poses a significant challenge to market players. Supply chain disruptions, particularly regarding raw materials and components, impact production and pricing. Stringent regulatory requirements, especially concerning safety and environmental standards, increase development and compliance costs. These factors combined, negatively impact profitability and overall market growth. The cumulative impact is estimated to reduce market growth by xx% by 2030.

Emerging Opportunities in Infrared Sensor Industry

The integration of advanced AI and machine learning capabilities presents significant opportunities for enhancing sensor performance and developing novel applications. Strategic collaborations and partnerships between sensor manufacturers and end-users unlock new market avenues and accelerate product innovation. Expanding into emerging markets with rapidly developing industrial sectors offers considerable growth potential. Investment in research and development to improve sensor technology and broaden applications will drive further growth.

Leading Players in the Infrared Sensor Industry Sector

- Melexis NV

- Honeywell International Inc

- Leonardo DRS

- Excelitas Technologies Corp

- Advanced Energy Industries Inc

- Mitsubishi Electric Corporation

- Sick AG

- Austria Micro Systems (AMS) AG

- Teledyne Imaging

- Yokogawa Electric Corporation

- Teledyne FLIR Systems Inc

- Murata Manufacturing Co Ltd

- Amphenol Advanced Sensors

Key Milestones in Infrared Sensor Industry Industry

- December 2022: Leonardo DRS secures a contract to supply third-generation FLIR sensors to the US Army, marking a significant advancement in long-range infrared sensing technology.

- December 2022: Mitsubishi Electric launches a new 80x60-pixel thermal-diode infrared sensor capable of measuring temperatures up to 200°C, expanding the application of infrared sensors in industrial and commercial settings.

Strategic Outlook for Infrared Sensor Industry Market

The infrared sensor market is poised for continued expansion, driven by ongoing technological advancements, increasing demand across diverse applications, and strategic investments in R&D. Opportunities abound in developing innovative sensor technologies, expanding into new markets, and forging strategic partnerships to consolidate market share and drive future growth. The focus on miniaturization, enhanced sensitivity, and integration with AI and machine learning technologies will shape future market trends.

Infrared Sensor Industry Segmentation

-

1. Type

- 1.1. Near Infrared (NIR)

- 1.2. Far Infrared (FIR)

-

2. End-user Industry

- 2.1. Healthcare

- 2.2. Aerospace and Defense

- 2.3. Automotive

- 2.4. Commercial Applications

- 2.5. Manufacturing

- 2.6. Oil and Gas

- 2.7. Other End-user Industries

Infrared Sensor Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Infrared Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need for Wireless Communications; Growing Demand for Home Automation Products and Smart Devices

- 3.3. Market Restrains

- 3.3.1. Requirement of Advanced Micro level Technical Competence for Developing Ceramic Capacitors

- 3.4. Market Trends

- 3.4.1. Near Infrared (NIR) To Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Near Infrared (NIR)

- 5.1.2. Far Infrared (FIR)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Healthcare

- 5.2.2. Aerospace and Defense

- 5.2.3. Automotive

- 5.2.4. Commercial Applications

- 5.2.5. Manufacturing

- 5.2.6. Oil and Gas

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Near Infrared (NIR)

- 6.1.2. Far Infrared (FIR)

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Healthcare

- 6.2.2. Aerospace and Defense

- 6.2.3. Automotive

- 6.2.4. Commercial Applications

- 6.2.5. Manufacturing

- 6.2.6. Oil and Gas

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Near Infrared (NIR)

- 7.1.2. Far Infrared (FIR)

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Healthcare

- 7.2.2. Aerospace and Defense

- 7.2.3. Automotive

- 7.2.4. Commercial Applications

- 7.2.5. Manufacturing

- 7.2.6. Oil and Gas

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Near Infrared (NIR)

- 8.1.2. Far Infrared (FIR)

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Healthcare

- 8.2.2. Aerospace and Defense

- 8.2.3. Automotive

- 8.2.4. Commercial Applications

- 8.2.5. Manufacturing

- 8.2.6. Oil and Gas

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Near Infrared (NIR)

- 9.1.2. Far Infrared (FIR)

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Healthcare

- 9.2.2. Aerospace and Defense

- 9.2.3. Automotive

- 9.2.4. Commercial Applications

- 9.2.5. Manufacturing

- 9.2.6. Oil and Gas

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Near Infrared (NIR)

- 10.1.2. Far Infrared (FIR)

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Healthcare

- 10.2.2. Aerospace and Defense

- 10.2.3. Automotive

- 10.2.4. Commercial Applications

- 10.2.5. Manufacturing

- 10.2.6. Oil and Gas

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Near Infrared (NIR)

- 11.1.2. Far Infrared (FIR)

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Healthcare

- 11.2.2. Aerospace and Defense

- 11.2.3. Automotive

- 11.2.4. Commercial Applications

- 11.2.5. Manufacturing

- 11.2.6. Oil and Gas

- 11.2.7. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pacific Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East and Africa Infrared Sensor Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Melexis NV

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Honeywell International Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Leonardo DRS*List Not Exhaustive

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Excelitas Technologies Corp

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Advanced Energy Industries Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Mitsubisihi Electric Corporation

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Sick AG

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Austria Micro Systems (AMS) AG

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Teledyne Imaging

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Yokogawa Electric Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Teledyne FLIR Systems Inc

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Murata Manufacturing Co Ltd

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Amphenol Advanced Sensors

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.1 Melexis NV

List of Figures

- Figure 1: Global Infrared Sensor Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Infrared Sensor Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Infrared Sensor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Infrared Sensor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Infrared Sensor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Infrared Sensor Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Infrared Sensor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Infrared Sensor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Infrared Sensor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Infrared Sensor Industry Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Infrared Sensor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Infrared Sensor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Infrared Sensor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Australia and New Zealand Infrared Sensor Industry Revenue (Million), by Type 2024 & 2032

- Figure 31: Australia and New Zealand Infrared Sensor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 32: Australia and New Zealand Infrared Sensor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Australia and New Zealand Infrared Sensor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Australia and New Zealand Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Australia and New Zealand Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Infrared Sensor Industry Revenue (Million), by Type 2024 & 2032

- Figure 37: Latin America Infrared Sensor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 38: Latin America Infrared Sensor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Latin America Infrared Sensor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Latin America Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Latin America Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Middle East and Africa Infrared Sensor Industry Revenue (Million), by Type 2024 & 2032

- Figure 43: Middle East and Africa Infrared Sensor Industry Revenue Share (%), by Type 2024 & 2032

- Figure 44: Middle East and Africa Infrared Sensor Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 45: Middle East and Africa Infrared Sensor Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 46: Middle East and Africa Infrared Sensor Industry Revenue (Million), by Country 2024 & 2032

- Figure 47: Middle East and Africa Infrared Sensor Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Infrared Sensor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Infrared Sensor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Infrared Sensor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Infrared Sensor Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Infrared Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Infrared Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Infrared Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Infrared Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Infrared Sensor Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Infrared Sensor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Infrared Sensor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Infrared Sensor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Infrared Sensor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Infrared Sensor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Infrared Sensor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Infrared Sensor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Infrared Sensor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Infrared Sensor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Infrared Sensor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global Infrared Sensor Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Infrared Sensor Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 32: Global Infrared Sensor Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Infrared Sensor Industry?

The projected CAGR is approximately 12.97%.

2. Which companies are prominent players in the Infrared Sensor Industry?

Key companies in the market include Melexis NV, Honeywell International Inc, Leonardo DRS*List Not Exhaustive, Excelitas Technologies Corp, Advanced Energy Industries Inc, Mitsubisihi Electric Corporation, Sick AG, Austria Micro Systems (AMS) AG, Teledyne Imaging, Yokogawa Electric Corporation, Teledyne FLIR Systems Inc, Murata Manufacturing Co Ltd, Amphenol Advanced Sensors.

3. What are the main segments of the Infrared Sensor Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need for Wireless Communications; Growing Demand for Home Automation Products and Smart Devices.

6. What are the notable trends driving market growth?

Near Infrared (NIR) To Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Requirement of Advanced Micro level Technical Competence for Developing Ceramic Capacitors.

8. Can you provide examples of recent developments in the market?

December 2022 - Leonardo DRS to provide third-generation FLIR sensors for US Army. As part of this contract, the company will start low-rate initial production of the FLIR Dewar Cooler Bench (DCB) long-range sensor. The new infrared sensors are being procured to replace the US Army's existing second-generation sensors, called Horizontal Technology Integration (HTI). The DCB sensor will support the conversion of infrared radiation into video images and provide next-generation FLIR sights. It will offer several range and resolution enhancements to improve situational awareness, especially under contested battlefield environments or rough weather conditions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Infrared Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Infrared Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Infrared Sensor Industry?

To stay informed about further developments, trends, and reports in the Infrared Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence