Key Insights

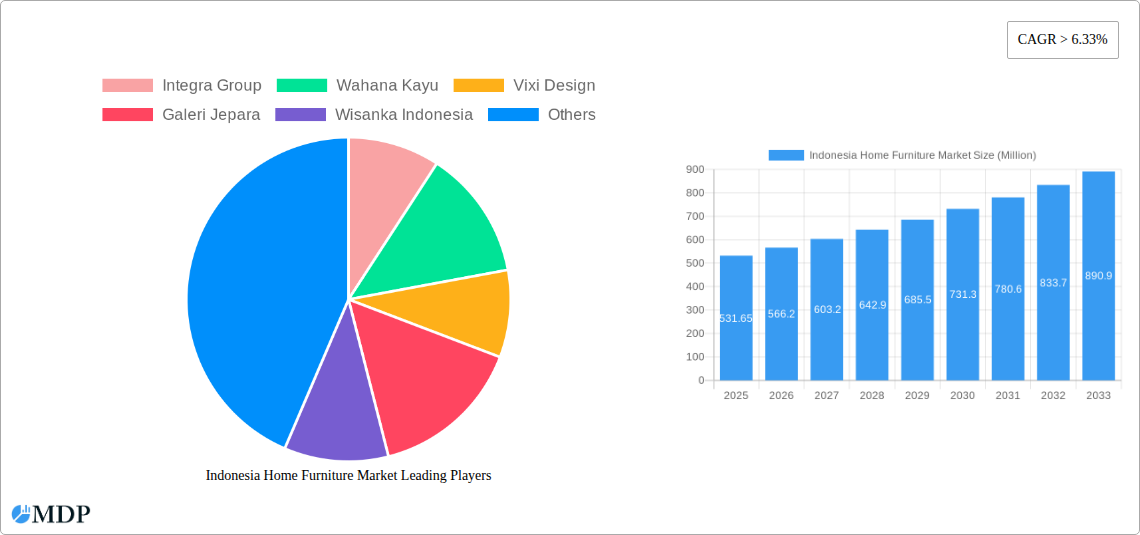

The Indonesian home furniture market presents a compelling investment opportunity, exhibiting robust growth potential. With a market size exceeding [Estimate based on available data - For example, if the value unit is in millions and you have a CAGR and a base year, you can estimate the 2025 market size. Let's assume a 2024 market size of $500 million. With a CAGR of 6.33%, the 2025 market size would be approximately $531.65 million]. This positive trajectory is driven by several key factors. A burgeoning middle class with rising disposable incomes fuels increased demand for home furnishings, particularly in urban areas. Furthermore, the growing popularity of modern and minimalist home designs aligns with the increasing availability of stylish, affordable furniture options. E-commerce platforms are significantly expanding market reach, enabling both domestic and international players to tap into this vast consumer base. However, challenges remain. Fluctuations in raw material prices, particularly wood, can impact production costs and profitability. Competition, especially from established international brands, necessitates strategic pricing and product differentiation. The government's focus on sustainable practices also presents both an opportunity and a challenge, requiring businesses to adopt eco-friendly manufacturing processes.

The market is segmented by distribution channel (home centers, flagship stores, specialty stores, online stores, others), material (wood, metal, plastic, others), and application (home, office, hospitality, others). The dominance of wood in furniture manufacturing reflects Indonesia's rich natural resources; however, the market is witnessing increasing adoption of metal and plastic for specific furniture types, driven by modern design trends and cost considerations. Key players such as Integra Group, Wahana Kayu, Vixi Design, and others, along with international brands like IKEA, are vying for market share. Regional disparities exist, with concentrated demand in major urban centers. The forecast period (2025-2033) anticipates continued growth, albeit with potential adjustments based on macroeconomic conditions and evolving consumer preferences. Companies focusing on innovative designs, sustainable practices, and efficient distribution networks are poised to capture a significant share of the expanding market.

Indonesia Home Furniture Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indonesia Home Furniture Market, offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's current state, future trajectory, and key players. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This report is crucial for understanding market dynamics, identifying growth opportunities, and formulating effective strategies in this burgeoning market.

Indonesia Home Furniture Market Dynamics & Concentration

The Indonesian home furniture market is characterized by a blend of established players and emerging businesses. Market concentration is moderate, with a few large players holding significant market share, but numerous smaller companies contributing to overall volume. Integra Group, Wahana Kayu, and Wisanka Indonesia are some of the prominent players, each commanding a significant share of the market. However, the market exhibits fragmentation due to the presence of numerous smaller, regional manufacturers and retailers. Recent mergers and acquisitions (M&A) activity has been relatively low (xx deals in the last 5 years), suggesting a period of consolidation. Innovation drivers in the market include the adoption of sustainable materials, technological advancements in design and manufacturing, and evolving consumer preferences toward modern and minimalist styles. The regulatory framework impacting the industry encompasses policies related to environmental sustainability, labor standards, and import/export regulations. Product substitutes include imported furniture and alternative home décor options. End-user trends reflect increasing demand for functional, durable, and aesthetically pleasing furniture, influenced by global design trends and rising disposable incomes.

- Market Share (Estimated 2025): Integra Group (xx%), Wahana Kayu (xx%), Wisanka Indonesia (xx%), Others (xx%).

- M&A Activity (2019-2024): xx deals.

- Key Innovation Drivers: Sustainable materials, technological advancements, evolving consumer preferences.

Indonesia Home Furniture Market Industry Trends & Analysis

The Indonesian home furniture market is experiencing robust growth driven by several factors. Rising disposable incomes, increasing urbanization, and a growing middle class are key contributors to this expansion. The market is witnessing a shift toward online sales channels, with e-commerce platforms gaining prominence. Technological disruptions, such as the adoption of 3D printing and automation in manufacturing, are enhancing efficiency and customization. Consumer preferences are evolving toward modern, minimalist designs and sustainable materials, reflecting global trends. Competitive dynamics are intensifying, with both domestic and international players vying for market share. The market growth rate is expected to maintain a significant pace in the coming years, fuelled by sustained economic growth and increasing construction activity.

- CAGR (2025-2033): xx%

- Market Penetration of Online Sales (2025): xx%

- Key Growth Drivers: Rising disposable incomes, urbanization, e-commerce growth, technological advancements.

Leading Markets & Segments in Indonesia Home Furniture Market

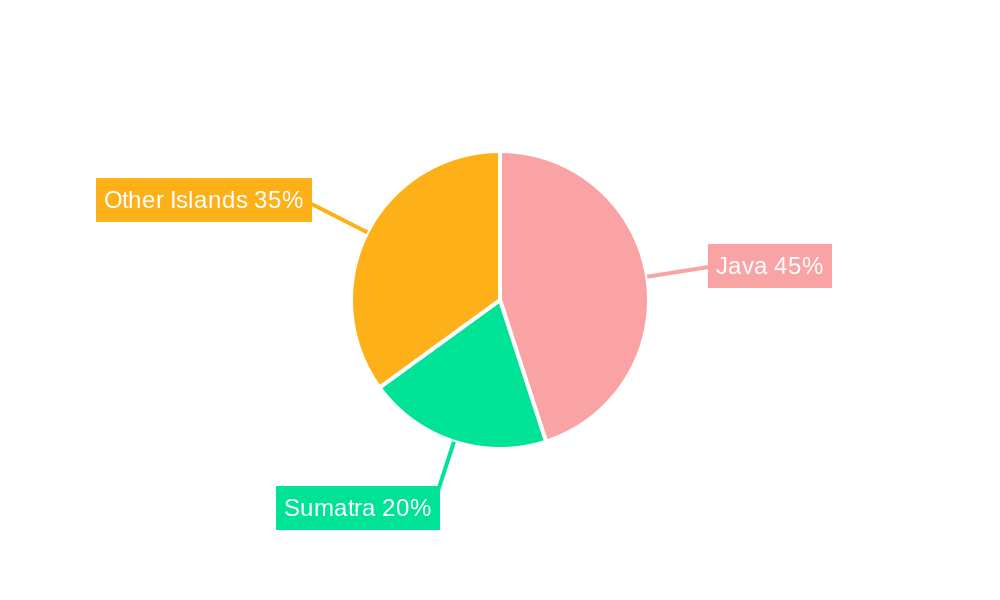

The dominant segment in the Indonesian home furniture market is home furniture, accounting for the largest share of revenue (xx%). Within distribution channels, home centers and flagship stores hold a substantial share, although online stores are showing rapid growth. Wood remains the dominant material, owing to its aesthetic appeal and cultural significance. However, the demand for metal and plastic furniture is also growing, reflecting the increasing preference for modern and durable options. Geographically, Java and major metropolitan areas represent the strongest markets, benefiting from higher population density, greater purchasing power, and developed infrastructure.

- Key Drivers for Home Furniture Dominance: Large household sizes, cultural preference for traditional furniture.

- Key Drivers for Home Center/Flagship Store Dominance: Established retail infrastructure, brand recognition, wider product selection.

- Key Drivers for Wood Material Dominance: Cultural preference, aesthetic appeal, perceived quality.

- Key Drivers for Java Market Dominance: Higher population density, greater purchasing power, established infrastructure.

Indonesia Home Furniture Market Product Developments

Recent product developments in the Indonesian home furniture market are characterized by a focus on innovation and customization. Manufacturers are incorporating sustainable materials, such as bamboo and recycled wood, into their product lines. Smart furniture, incorporating technology for enhanced functionality and user experience, is gaining traction. The market is also witnessing an increasing trend toward modular and customizable furniture, allowing consumers to tailor their purchases to specific needs and preferences. These innovations aim to cater to the growing demand for environmentally friendly, functional, and aesthetically appealing furniture.

Key Drivers of Indonesia Home Furniture Market Growth

The Indonesian home furniture market's growth is propelled by several factors. Firstly, the country's robust economic growth contributes to rising disposable incomes and increased consumer spending on home furnishings. Secondly, rapid urbanization leads to increased demand for new housing and furniture. Thirdly, government initiatives promoting sustainable development and local manufacturing stimulate the sector. Lastly, the increasing adoption of e-commerce facilitates wider market access and consumer convenience.

Challenges in the Indonesia Home Furniture Market

The Indonesian home furniture market faces challenges including fluctuations in raw material prices, dependence on imported components, and intense competition from foreign manufacturers. These factors contribute to fluctuating profit margins and affect the industry's long-term growth prospects. Supply chain disruptions, potentially amplified by geopolitical events, further pose risks to manufacturing and distribution efficiencies.

Emerging Opportunities in Indonesia Home Furniture Market

Emerging opportunities exist through tapping into the growing demand for eco-friendly furniture and the expansion into underserved rural markets. Strategic partnerships with international design houses and investment in advanced manufacturing techniques can further unlock growth potential. The development of specialized furniture for specific segments, such as the hospitality industry, represents another significant opportunity.

Leading Players in the Indonesia Home Furniture Market Sector

- Integra Group

- Wahana Kayu

- Vixi Design

- Galeri Jepara

- Wisanka Indonesia

- Dawood Indonesia

- IKEA

- Republic Furniture Jepara

- Vivere Group

- Raisa House Of Excellence

Key Milestones in Indonesia Home Furniture Market Industry

- January 2022: Indonesia approved a USD 6 billion merger of telco units of Qatar's Ooredoo and Hong Kong's CK Hutchison. (Indirect impact on overall economic climate, potentially affecting consumer spending).

- October 2022: Indonesian furniture retailer Febelio declared bankruptcy due to financial difficulties brought about by the pandemic and its failure to raise new funding. (Highlights the challenges faced by some businesses in the sector).

Strategic Outlook for Indonesia Home Furniture Market

The Indonesian home furniture market presents significant long-term growth potential driven by favorable demographic trends, economic expansion, and increasing consumer spending. Strategic opportunities lie in embracing sustainable practices, leveraging technological advancements, and focusing on design innovation to cater to evolving consumer preferences. Companies can achieve competitive advantage by investing in efficient supply chains, strengthening brand presence, and expanding their online retail capabilities.

Indonesia Home Furniture Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Home Furniture Market Segmentation By Geography

- 1. Indonesia

Indonesia Home Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.33% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Growth in Urbanization

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives

- 3.4. Market Trends

- 3.4.1. Growing Urbanization is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Home Furniture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Integra Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wahana Kayu

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vixi Design

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Galeri Jepara

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wisanka Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dawood Indonesia**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IKEA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Republic Furniture Jepara

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vivere Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Raisa House Of Excellence

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Integra Group

List of Figures

- Figure 1: Indonesia Home Furniture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Home Furniture Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Home Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Home Furniture Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Indonesia Home Furniture Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Indonesia Home Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Indonesia Home Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Indonesia Home Furniture Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Indonesia Home Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Home Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Indonesia Home Furniture Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Indonesia Home Furniture Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Indonesia Home Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Indonesia Home Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Indonesia Home Furniture Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Indonesia Home Furniture Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Home Furniture Market?

The projected CAGR is approximately > 6.33%.

2. Which companies are prominent players in the Indonesia Home Furniture Market?

Key companies in the market include Integra Group, Wahana Kayu, Vixi Design, Galeri Jepara, Wisanka Indonesia, Dawood Indonesia**List Not Exhaustive, IKEA, Republic Furniture Jepara, Vivere Group, Raisa House Of Excellence.

3. What are the main segments of the Indonesia Home Furniture Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Growth in Urbanization.

6. What are the notable trends driving market growth?

Growing Urbanization is Driving the Market.

7. Are there any restraints impacting market growth?

Availability of Alternatives.

8. Can you provide examples of recent developments in the market?

January 2022: Indonesia approved a USD 6 billion merger of telco units of Qatar's Ooredoo and Hong Kong's CK Hutchison.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Home Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Home Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Home Furniture Market?

To stay informed about further developments, trends, and reports in the Indonesia Home Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence