Key Insights

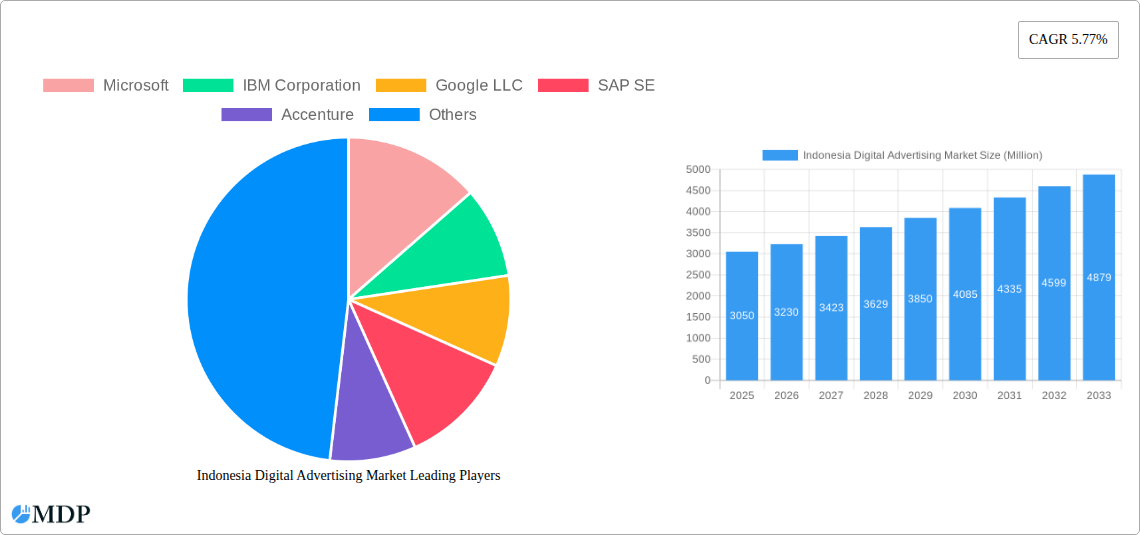

The Indonesian digital advertising market is experiencing robust growth, projected to reach a market size of $3.05 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 5.77% from 2019 to 2033. This expansion is fueled by several key drivers. Firstly, Indonesia's rapidly expanding internet and smartphone penetration is creating a vast pool of digitally engaged consumers. Secondly, the increasing adoption of e-commerce and digital platforms by businesses across various sectors, including FMCG, telecom, healthcare, and media & entertainment, is significantly boosting advertising spend. Thirdly, the rise of social media influencers and the sophistication of targeted advertising technologies are enhancing campaign effectiveness and return on investment. This trend is further amplified by the increasing prevalence of video and audio advertising formats, which are proving particularly engaging for the Indonesian audience. However, challenges remain, such as concerns around data privacy and ad fraud, which could potentially restrain market growth if not adequately addressed. Furthermore, the digital literacy gap in certain regions might necessitate targeted initiatives to fully unlock the market's potential. The market is segmented by advertising type (audio, video, influencer, banner, search, classifieds), platform (desktop, mobile), industry, and region (Java, Sumatra, Kalimantan, and others), offering diverse opportunities for investment and strategic growth. The strong presence of major global technology companies such as Google, Microsoft, and Amazon, alongside local players, further indicates a dynamic and competitive landscape.

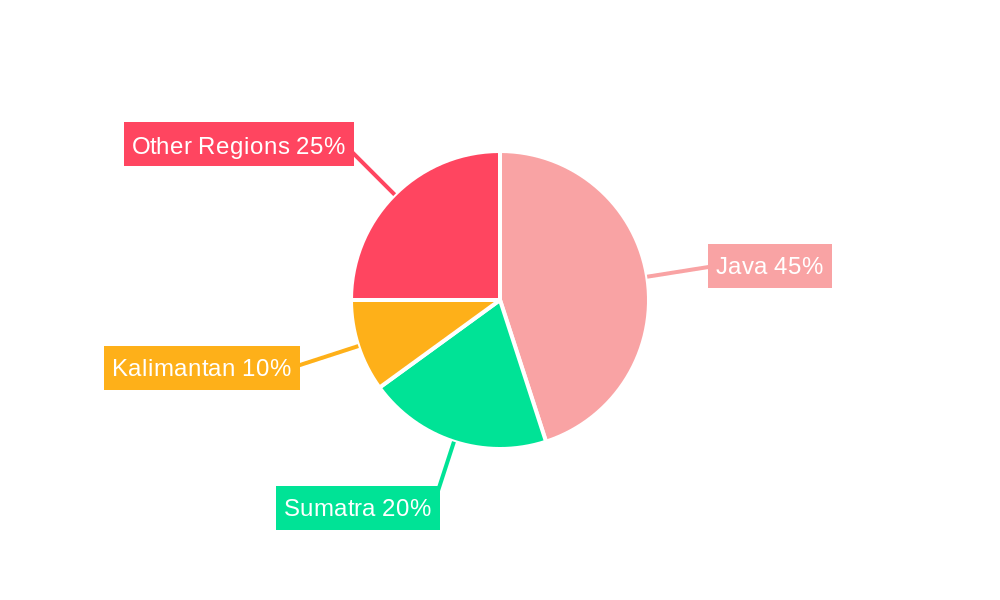

The forecast period (2025-2033) suggests continued expansion, driven by the increasing sophistication of digital marketing techniques, the growing adoption of programmatic advertising, and further penetration of mobile advertising. Specific regional growth may vary due to factors such as infrastructure development and digital literacy levels. Java, given its high population density and economic activity, is likely to remain a dominant region, although Sumatra and Kalimantan will likely see significant growth as their digital infrastructure improves and the adoption of digital advertising increases amongst businesses. The market will likely see further consolidation among players, with large companies merging or acquiring smaller firms to enhance their market share and service offerings. Continuous innovation in advertising technology and a focus on user experience will be crucial for success in this dynamic market.

Indonesia Digital Advertising Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indonesia Digital Advertising Market, covering the period 2019-2033, with a focus on the estimated year 2025. Uncover invaluable insights into market dynamics, industry trends, leading segments, and key players shaping this rapidly evolving landscape. Maximize your understanding of growth opportunities and challenges within this lucrative market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

Indonesia Digital Advertising Market Market Dynamics & Concentration

The Indonesian digital advertising market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is currently moderate, with a few major players holding significant shares, but a fragmented landscape of smaller agencies and specialized firms also exists. Innovation is a key driver, with advancements in programmatic advertising, data analytics, and influencer marketing continually shaping the market. The regulatory framework, while evolving, plays a crucial role in shaping data privacy concerns and advertising standards. The emergence of new technologies, such as AI-powered ad targeting, provides substitutes for traditional advertising methods. End-user trends, particularly among Indonesia’s large and increasingly digitally-savvy youth population, are driving demand for engaging and personalized ad experiences.

Mergers and acquisitions (M&A) activity is accelerating, reflecting a push for consolidation and expanded capabilities. In 2024, xx M&A deals were recorded, resulting in a xx% increase in market share for top players. Notable examples include Accenture’s acquisition of Jixie (see Key Milestones). This trend is expected to continue, further shaping market concentration. The key metrics highlight a growing market with a strong competitive landscape, which emphasizes data-driven strategies and technological advancements.

Indonesia Digital Advertising Market Industry Trends & Analysis

The Indonesian digital advertising market exhibits robust growth, driven by increasing internet and smartphone penetration, rising disposable incomes, and a burgeoning e-commerce sector. The market is experiencing a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033), surpassing the xx% CAGR observed during the historical period (2019-2024). This growth is propelled by technological advancements such as AI-powered ad targeting, which allows for more efficient and personalized ad campaigns, resulting in enhanced customer engagement and return on investment. Consumer preferences are shifting towards video advertising and influencer marketing, creating opportunities for specialized agencies. The market exhibits intense competition among established players and new entrants, leading to constant innovation and price adjustments. Market penetration rates have seen significant progress, with the number of internet users and associated ad exposures growing at a healthy pace. This competitive landscape favors companies adept at adopting new technologies and adapting to the evolving needs of advertisers and consumers.

Leading Markets & Segments in Indonesia Digital Advertising Market

The Indonesian digital advertising market demonstrates significant variation across different segments and regions.

By Type:

- Video Advertising: Dominates the market due to its high engagement rates and suitability for mobile platforms. Key drivers include the increasing popularity of video streaming services and social media platforms.

- Influencer Advertising: Experiences rapid growth due to its authenticity and ability to connect with target audiences on a personal level. Indonesia’s large social media presence drives high demand.

- Search Advertising: Remains a key channel for direct response marketing, aided by improvements in search algorithms and targeting capabilities.

- Banner Advertising: Continues to hold a significant share, though its effectiveness is challenged by evolving consumer habits and ad-blocking technologies.

- Audio Advertising: Growing gradually, with the rise of podcast consumption and music streaming services offering new opportunities.

- Classifieds: Contributes steadily to market revenue due to the sustained high need for classified advertisements across various sectors.

By Platform:

- Mobile: Represents the leading platform, driven by widespread smartphone adoption and mobile-first consumer behavior.

- Desktop: While still relevant, its share is declining due to increased mobile usage.

By Industry:

- FMCG: The largest contributor, with a substantial share due to broad reach and ongoing marketing investments. Brands rely on digital channels to enhance product awareness and consumer engagement.

- Telecom: A significant segment employing digital advertising to attract new subscribers and market new service offerings.

- Media and Entertainment: A dynamic sector actively utilizing digital advertising to promote content and attract viewership.

- Healthcare: Growth is driven by the need to enhance customer awareness, accessibility, and reach.

- Other Industries: Other industries including e-commerce, retail, and finance are exhibiting increasing digital advertising spend.

By Region:

- Java: Dominates the market due to its high population density, economic activity, and advanced digital infrastructure.

- Sumatra: Displays significant potential for growth given its expanding internet connectivity and e-commerce development.

- Kalimantan: Currently exhibits slower growth than other regions but holds long-term potential.

- Other Regions: Collectively contribute to the market, with varying growth trajectories based on regional development.

Key drivers for the dominant segments and regions include robust economic growth, expanding internet and mobile penetration, and government initiatives promoting digitalization.

Indonesia Digital Advertising Market Product Developments

Recent product innovations include AI-driven ad personalization, sophisticated audience targeting capabilities, and enhanced analytics dashboards providing real-time campaign performance insights. These developments leverage technological advancements, offering improved return on investment for advertisers. The market is moving towards a more data-driven and outcome-focused approach to digital advertising, favoring solutions that provide measurable results and improved campaign effectiveness.

Key Drivers of Indonesia Digital Advertising Market Growth

The Indonesian digital advertising market’s growth is driven by several factors: a young and digitally savvy population embracing mobile-first technologies, the expanding e-commerce sector, and the increased use of social media. Government initiatives aimed at improving digital infrastructure further fuels market expansion. Additionally, improving mobile penetration and affordability accelerate digital advertising adoption.

Challenges in the Indonesia Digital Advertising Market Market

Challenges include the prevalence of ad fraud, concerns over data privacy, and the relatively nascent stage of programmatic advertising in Indonesia. These factors hinder the growth of the market and require continuous improvement in data security and regulatory standards. Additionally, there is a need to develop more sophisticated measurement and analytics tools to enable more effective campaign evaluation. The fragmented nature of the media landscape presents challenges to achieving consistent audience reach and media measurement.

Emerging Opportunities in Indonesia Digital Advertising Market

Long-term growth is driven by the expansion of 5G networks, increasing adoption of advanced ad technologies like AI and machine learning, and the rise of new digital platforms. Strategic partnerships between technology companies and advertising agencies will provide new opportunities for innovative solutions. Furthermore, growth in the e-commerce and fintech sectors fuels continued demand for digital advertising solutions. The rise of video and influencer marketing presents substantial opportunities for further market expansion.

Leading Players in the Indonesia Digital Advertising Market Sector

- Microsoft

- IBM Corporation

- Google LLC

- SAP SE

- Accenture

- Hewlett Packard Enterprise Development LP

- Amazon Web Services Inc

- Oracle

- Apple Inc

- Intel Corporation

Key Milestones in Indonesia Digital Advertising Market Industry

- December 2023: Accenture’s acquisition of Jixie enhances its marketing transformation capabilities, improving personalized experiences for Indonesian clients.

- December 2023: TikTok’s investment in GoTo Group and collaboration on e-commerce services marks a significant development for digital commerce and advertising in Indonesia.

Strategic Outlook for Indonesia Digital Advertising Market Market

The Indonesian digital advertising market holds significant future potential. Continued growth in internet and smartphone penetration, coupled with increasing e-commerce activity and evolving consumer preferences, presents lucrative opportunities. Strategic partnerships, technological innovation, and data-driven approaches will be crucial for success in this competitive and fast-growing market. Companies that adapt to evolving consumer behavior and leverage emerging technologies will be best positioned for long-term growth.

Indonesia Digital Advertising Market Segmentation

-

1. Type

- 1.1. Audio Advertising

- 1.2. Video Advertising

- 1.3. Influencer Advertising

- 1.4. Banner Advertising

- 1.5. Search Advertising

- 1.6. Classifieds

-

2. Platform

- 2.1. Desktop

- 2.2. Mobile

-

3. Industry

- 3.1. FMCG

- 3.2. Telecom

- 3.3. Healthcare

- 3.4. Media and Entertainment

- 3.5. Other Industries

Indonesia Digital Advertising Market Segmentation By Geography

- 1. Indonesia

Indonesia Digital Advertising Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.77% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift from Traditional to Online Advertising; Increasing Use of Recommendation Engines

- 3.3. Market Restrains

- 3.3.1. Lack of Communication Between Publisher and Advertiser

- 3.4. Market Trends

- 3.4.1. Video Advertising to Grow at a Significant Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Digital Advertising Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Audio Advertising

- 5.1.2. Video Advertising

- 5.1.3. Influencer Advertising

- 5.1.4. Banner Advertising

- 5.1.5. Search Advertising

- 5.1.6. Classifieds

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Industry

- 5.3.1. FMCG

- 5.3.2. Telecom

- 5.3.3. Healthcare

- 5.3.4. Media and Entertainment

- 5.3.5. Other Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Microsoft

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Google LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SAP SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Accenture

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hewlett Packard Enterprise Development LP

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amazon Web Services Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oracle

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Apple Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intel Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Microsoft

List of Figures

- Figure 1: Indonesia Digital Advertising Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Digital Advertising Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Digital Advertising Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Digital Advertising Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Indonesia Digital Advertising Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Indonesia Digital Advertising Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Indonesia Digital Advertising Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 6: Indonesia Digital Advertising Market Volume K Unit Forecast, by Platform 2019 & 2032

- Table 7: Indonesia Digital Advertising Market Revenue Million Forecast, by Industry 2019 & 2032

- Table 8: Indonesia Digital Advertising Market Volume K Unit Forecast, by Industry 2019 & 2032

- Table 9: Indonesia Digital Advertising Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Indonesia Digital Advertising Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Indonesia Digital Advertising Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Indonesia Digital Advertising Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Indonesia Digital Advertising Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Indonesia Digital Advertising Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 15: Indonesia Digital Advertising Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 16: Indonesia Digital Advertising Market Volume K Unit Forecast, by Platform 2019 & 2032

- Table 17: Indonesia Digital Advertising Market Revenue Million Forecast, by Industry 2019 & 2032

- Table 18: Indonesia Digital Advertising Market Volume K Unit Forecast, by Industry 2019 & 2032

- Table 19: Indonesia Digital Advertising Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Indonesia Digital Advertising Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Digital Advertising Market?

The projected CAGR is approximately 5.77%.

2. Which companies are prominent players in the Indonesia Digital Advertising Market?

Key companies in the market include Microsoft, IBM Corporation, Google LLC, SAP SE, Accenture, Hewlett Packard Enterprise Development LP, Amazon Web Services Inc, Oracle, Apple Inc, Intel Corporation.

3. What are the main segments of the Indonesia Digital Advertising Market?

The market segments include Type, Platform, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift from Traditional to Online Advertising; Increasing Use of Recommendation Engines.

6. What are the notable trends driving market growth?

Video Advertising to Grow at a Significant Rate.

7. Are there any restraints impacting market growth?

Lack of Communication Between Publisher and Advertiser.

8. Can you provide examples of recent developments in the market?

December 2023: Accenture announced the acquisition of the business of media and marketing technology company Jixie. Jixie’s digital marketing platform will be integrated into Accenture to strengthen its marketing transformation capabilities, helping Indonesian clients deliver more personalized experiences to enhance customer engagement for sustainable business growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Digital Advertising Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Digital Advertising Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Digital Advertising Market?

To stay informed about further developments, trends, and reports in the Indonesia Digital Advertising Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence