Key Insights

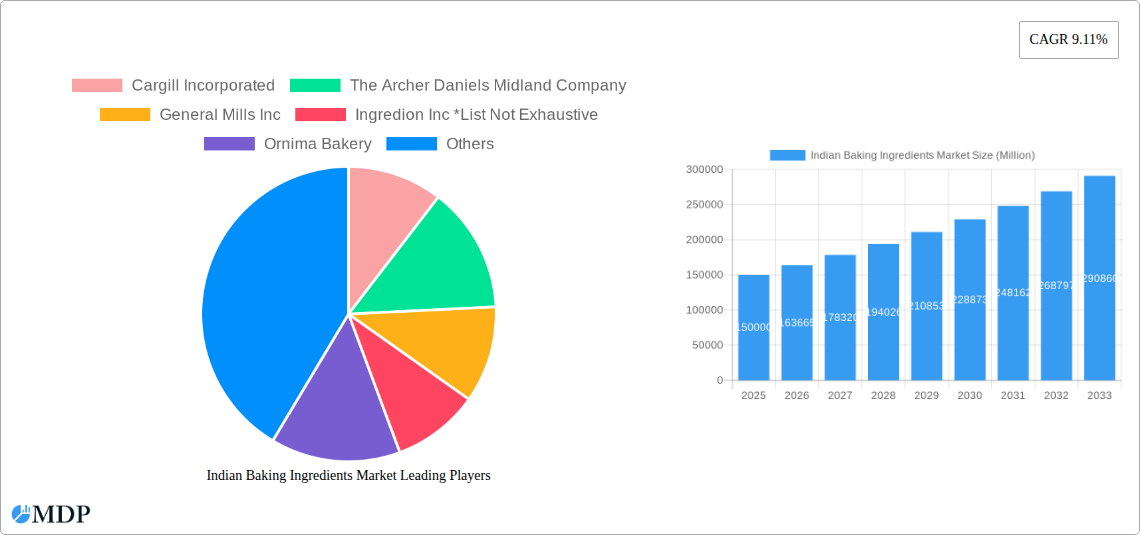

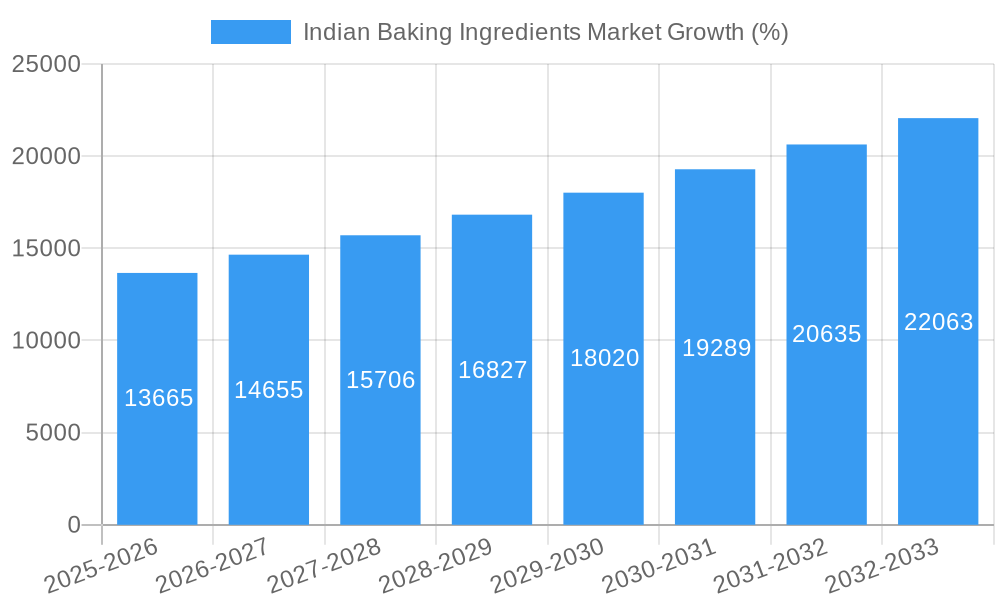

The Indian baking ingredients market, valued at approximately ₹150 billion (estimated based on common market size values and the provided CAGR) in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.11% from 2025 to 2033. This expansion is fueled by several key drivers. The rising popularity of Western-style baked goods, coupled with increasing disposable incomes and changing consumer preferences towards convenience and premium food products, significantly contribute to market growth. Furthermore, the burgeoning food service industry, including cafes, bakeries, and restaurants, creates substantial demand for high-quality baking ingredients. The expanding organized retail sector and the growing adoption of online food delivery platforms further accelerate market penetration. While increasing raw material costs and fluctuating prices pose challenges, the market's inherent growth potential and the innovative product development within the baking industry are expected to mitigate these restraints. Segment-wise, the baking enzymes and leavening agents segment is likely to dominate due to its essential role in baking processes, while the breads, cakes, and pastries application segment will remain the largest consumer.

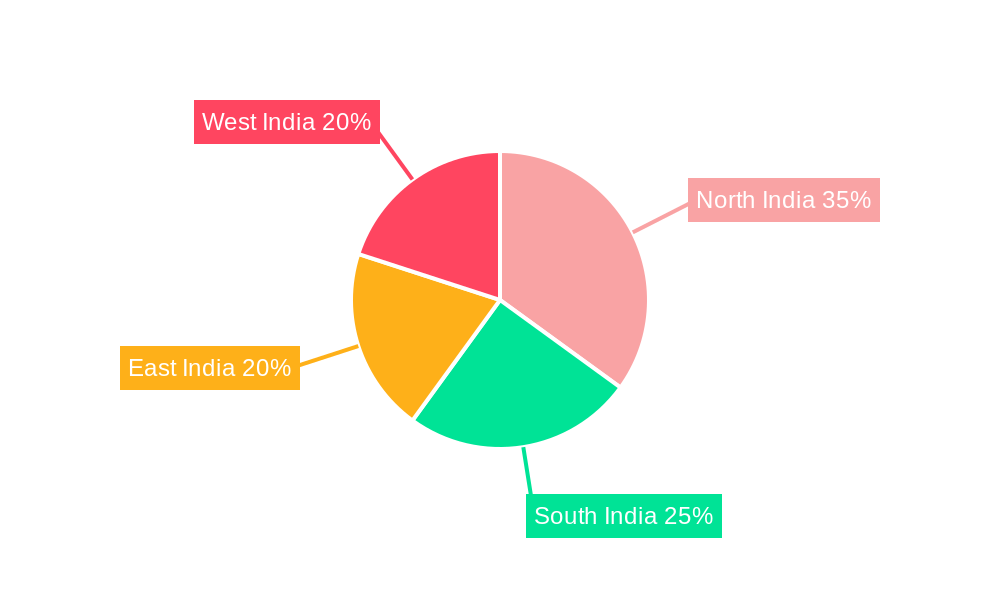

Regional variations within India are also anticipated. North and West India, with their established food processing industries and higher per capita income, are likely to witness higher market penetration compared to the East and South, although growth potential across all regions is substantial. Key players such as Cargill, ADM, and General Mills are strategically investing in expanding their presence in India through strategic partnerships, acquisitions, and new product launches. The market is also witnessing the emergence of regional and local players catering to niche consumer demands, contributing to market dynamism and competition. Overall, the Indian baking ingredients market presents significant opportunities for both established multinational corporations and ambitious domestic businesses. The forecast period of 2025-2033 promises consistent growth fueled by favorable market dynamics and consumer behavior.

Indian Baking Ingredients Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indian baking ingredients market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed examination of market dynamics, trends, leading players, and future projections, this report serves as a crucial resource for navigating this rapidly evolving sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The market is projected to reach xx Million by 2033.

Indian Baking Ingredients Market Market Dynamics & Concentration

The Indian baking ingredients market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is moderately high, with a few major players like Cargill Incorporated, The Archer Daniels Midland Company, and General Mills Inc. holding significant market share. However, smaller regional players and specialized ingredient suppliers also contribute significantly. Innovation is a key driver, with companies continually developing new ingredients and technologies to meet evolving consumer preferences and industry demands. The regulatory framework, encompassing food safety and labeling regulations, influences product development and market entry. The market witnesses considerable M&A activity, with a reported xx number of deals in the past five years, primarily driven by expansion strategies and acquisition of specialized technologies. Product substitutes, such as naturally derived ingredients, present both challenges and opportunities, influencing ingredient choices and driving innovation in the natural and clean-label space. End-user trends, especially the rising preference for convenience foods and artisanal baked goods, are reshaping the demand for specific ingredients.

- Market Share: Cargill and ADM collectively hold approximately xx% of the market share (estimated).

- M&A Activity: An average of xx M&A deals per year were recorded between 2019 and 2024 (estimated).

- Innovation Drivers: Growing demand for convenience foods, health-conscious baking, and clean-label products.

- Regulatory Landscape: Stringent food safety regulations and labeling requirements.

- Key Substitutes: Naturally sourced ingredients and alternatives to traditional preservatives.

Indian Baking Ingredients Market Industry Trends & Analysis

The Indian baking ingredients market exhibits robust growth, driven by a combination of factors. The burgeoning Indian middle class, with its increasing disposable incomes and changing dietary preferences, fuels the demand for diverse baked goods. This trend is further accelerated by the rising popularity of Western-style bakeries and cafes, coupled with increased urbanization and a growing preference for convenience foods. Technological advancements in ingredient processing and formulation significantly impact the market. The introduction of novel ingredients and innovative technologies enhances product quality, shelf life, and functional properties. Consumer preferences are shifting towards healthier and more natural options, driving the demand for clean-label ingredients and reduced-sugar alternatives. Intense competition among established and emerging players necessitates continuous innovation and strategic partnerships to maintain market share. The market is estimated to witness a CAGR of xx% during the forecast period (2025-2033), with a market penetration of xx% in key segments by 2033 (estimated).

Leading Markets & Segments in Indian Baking Ingredients Market

The Indian baking ingredients market demonstrates significant regional variations. While urban areas like Mumbai, Delhi, and Bangalore contribute significantly to market volume, the growth in smaller cities and towns suggests a rapidly expanding market base. Among the ingredient types, fats and shortenings, sweeteners, and leavening agents are the most dominant segments, contributing to the majority of market revenue. In terms of application, breads, cakes and pastries, and cookies and biscuits account for a significant portion of the market.

Key Drivers:

- Economic Growth: Rising disposable incomes and increased spending on food.

- Urbanization: Expanding urban population and increased consumption of processed foods.

- Changing Consumer Preferences: Growing demand for convenience and variety in baked goods.

- Government Initiatives: Support for food processing industries and infrastructure development.

Dominance Analysis:

The Fats and Shortenings segment holds the largest market share due to its crucial role in texture and flavor enhancement in baked goods. The Breads, Cakes, and Pastries application segment dominates due to their high consumption rates in India.

Indian Baking Ingredients Market Product Developments

Recent years have witnessed significant product innovations in the Indian baking ingredients market. Companies are focusing on developing clean-label ingredients, functional ingredients that improve nutritional value, and ingredients that enhance texture, flavor, and shelf life. The use of natural colors and flavors, along with the development of healthier alternatives to traditional ingredients, reflects the growing consumer demand for healthier baked goods. Technological advancements like enzyme technology are also influencing product development, improving efficiency and reducing processing times.

Key Drivers of Indian Baking Ingredients Market Growth

The growth of the Indian baking ingredients market is propelled by several key drivers. Firstly, the burgeoning middle class with increased disposable income is significantly increasing the demand for packaged and convenience foods, including baked goods. Secondly, rapid urbanization is leading to changing lifestyles and food habits, favoring convenient and readily available baked goods. Finally, supportive government initiatives and policies focused on infrastructure development within the food processing sector are also driving growth.

Challenges in the Indian Baking Ingredients Market Market

The Indian baking ingredients market faces several challenges. Fluctuations in raw material prices, particularly for imported ingredients, pose a significant risk to profitability. Maintaining consistent supply chain logistics across diverse geographic locations also presents operational hurdles. Furthermore, intense competition and the rising popularity of substitutes such as naturally sourced ingredients necessitates continuous innovation and adaptation.

Emerging Opportunities in Indian Baking Ingredients Market

The Indian baking ingredients market presents lucrative opportunities for growth. The increasing demand for healthier and functional ingredients creates a strong market for clean-label and organic products. Strategic partnerships between ingredient suppliers and food manufacturers can unlock synergies and increase market access. Exploring niche market segments, such as gluten-free and vegan baking, can further fuel market growth.

Leading Players in the Indian Baking Ingredients Market Sector

- Cargill Incorporated

- The Archer Daniels Midland Company

- General Mills Inc

- Ingredion Inc

- Ornima Bakery

- Tate & Lyle PLC

- Koninklijke DSM NV

- Associated British Foods PLC

- Puratos NV

- British Bakels Ltd

Key Milestones in Indian Baking Ingredients Market Industry

- October 2021: Cargill launched SimPure 92260, a soluble rice flour, globally, impacting the market with a maltodextrin substitute for bakery applications.

- October 2021: Koninklijke DSM NV acquired First Choice Ingredients, enhancing its portfolio of dairy-based savory flavorings for bakery products.

- January 2022: Cargill opened its first innovation center in India, focusing on food and beverage solutions, including bakery ingredients, strengthening its local presence and capabilities.

Strategic Outlook for Indian Baking Ingredients Market Market

The Indian baking ingredients market holds significant promise for long-term growth. Continued innovation in ingredient technology, strategic partnerships, and expansion into niche markets will be crucial for success. Focusing on sustainability, health and wellness, and convenience will be key factors in shaping future market trends and attracting both consumers and investors.

Indian Baking Ingredients Market Segmentation

-

1. Type

- 1.1. Baking Enzymes

- 1.2. Leavening Agents

- 1.3. Fats and Shortenings

- 1.4. Sweeteners

- 1.5. Colors and flavors

- 1.6. Preservatives

- 1.7. Other Types

-

2. Application

- 2.1. Breads

- 2.2. Cakes and Pastries

- 2.3. Rolls and Pies

- 2.4. Cookies and Biscuits

- 2.5. Other Applications

Indian Baking Ingredients Market Segmentation By Geography

- 1. India

Indian Baking Ingredients Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Plant Based Alternatives; Expanding Application of Pea Protein Toward Food Fortification

- 3.3. Market Restrains

- 3.3.1. Low Awareness and Application of the Additive

- 3.4. Market Trends

- 3.4.1. The Sweeteners Segment is Growing at a Faster Pace

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indian Baking Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Baking Enzymes

- 5.1.2. Leavening Agents

- 5.1.3. Fats and Shortenings

- 5.1.4. Sweeteners

- 5.1.5. Colors and flavors

- 5.1.6. Preservatives

- 5.1.7. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Breads

- 5.2.2. Cakes and Pastries

- 5.2.3. Rolls and Pies

- 5.2.4. Cookies and Biscuits

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India Indian Baking Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 7. South India Indian Baking Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 8. East India Indian Baking Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 9. West India Indian Baking Ingredients Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Cargill Incorporated

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 The Archer Daniels Midland Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Mills Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ingredion Inc *List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Ornima Bakery

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tate & Lyle PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Koninklijke DSM NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Associated British Foods PLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Puratos NV

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 British Bakels Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Cargill Incorporated

List of Figures

- Figure 1: Indian Baking Ingredients Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indian Baking Ingredients Market Share (%) by Company 2024

List of Tables

- Table 1: Indian Baking Ingredients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indian Baking Ingredients Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Indian Baking Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Indian Baking Ingredients Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Indian Baking Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India Indian Baking Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India Indian Baking Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India Indian Baking Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India Indian Baking Ingredients Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Indian Baking Ingredients Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Indian Baking Ingredients Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Indian Baking Ingredients Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indian Baking Ingredients Market?

The projected CAGR is approximately 9.11%.

2. Which companies are prominent players in the Indian Baking Ingredients Market?

Key companies in the market include Cargill Incorporated, The Archer Daniels Midland Company, General Mills Inc, Ingredion Inc *List Not Exhaustive, Ornima Bakery, Tate & Lyle PLC, Koninklijke DSM NV, Associated British Foods PLC, Puratos NV, British Bakels Ltd.

3. What are the main segments of the Indian Baking Ingredients Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Plant Based Alternatives; Expanding Application of Pea Protein Toward Food Fortification.

6. What are the notable trends driving market growth?

The Sweeteners Segment is Growing at a Faster Pace.

7. Are there any restraints impacting market growth?

Low Awareness and Application of the Additive.

8. Can you provide examples of recent developments in the market?

January 2022: Cargill announced that it opened its first innovation center in India to develop solutions for the food and beverage market. This innovation center is spread over almost 17,000 square feet and includes a sensory lab and demonstration kitchen with capabilities to serve dairy, beverage, bakery, and convenience food industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indian Baking Ingredients Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indian Baking Ingredients Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indian Baking Ingredients Market?

To stay informed about further developments, trends, and reports in the Indian Baking Ingredients Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence