Key Insights

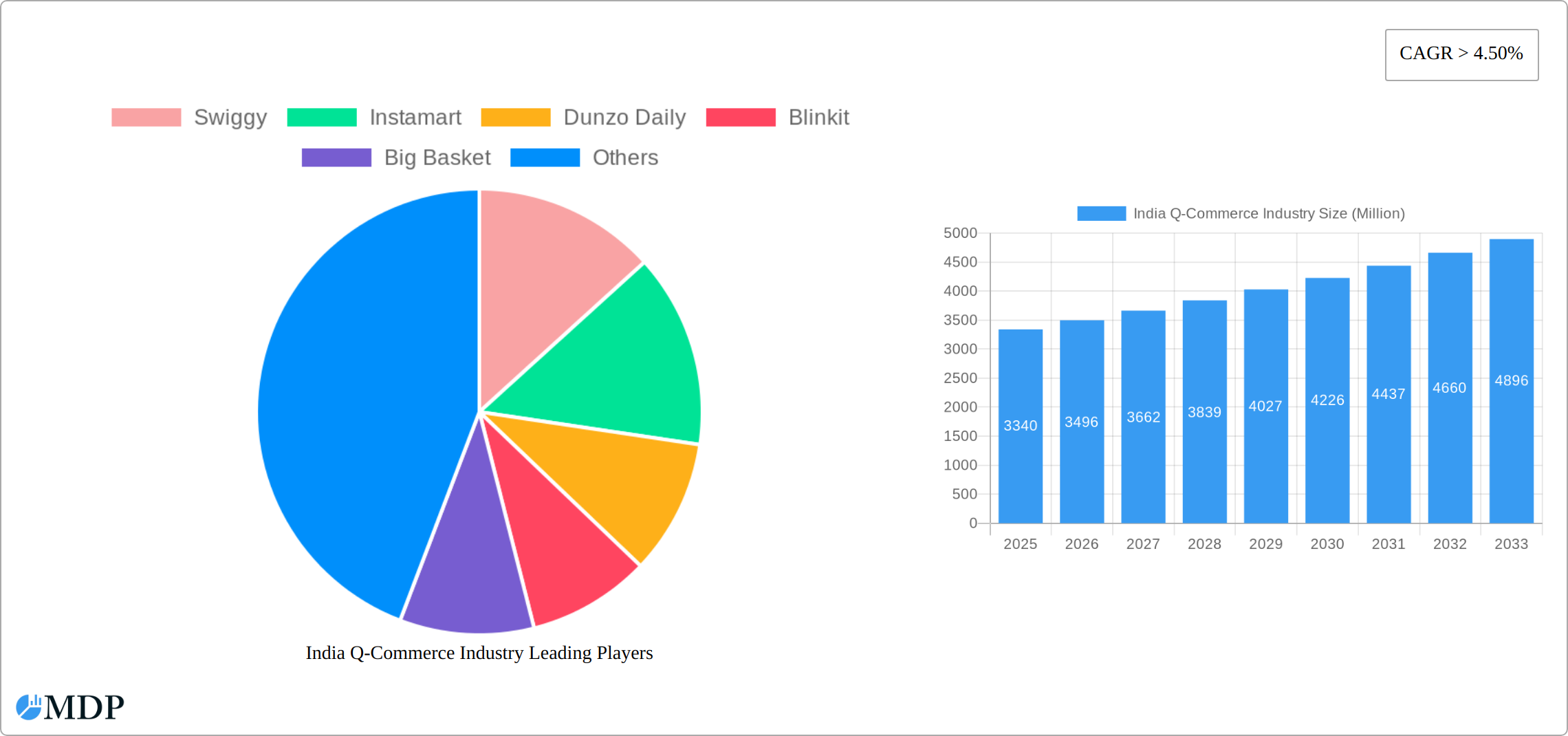

The Indian quick-commerce (Q-commerce) market, valued at $3.34 billion in 2025, is experiencing explosive growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4.5% from 2025 to 2033. This surge is fueled by several key factors. Increasing smartphone penetration and internet access across India, particularly in urban and semi-urban areas, have broadened the market's reach. Consumer preferences are shifting towards convenience, with on-demand delivery services providing a compelling alternative to traditional grocery shopping. Furthermore, aggressive marketing campaigns by major players, coupled with competitive pricing strategies and attractive promotions, are driving significant adoption. The market is witnessing intense competition among prominent players such as Swiggy Instamart, Blinkit, Zepto, and BigBasket, each striving to capture market share through technological advancements, improved logistics, and expanded product offerings. Despite this competitive landscape, the market's growth is also facilitated by the increasing adoption of digital payment methods and a robust delivery infrastructure that continues to expand its reach across the country.

India Q-Commerce Industry Market Size (In Billion)

While the Q-commerce sector presents significant opportunities, challenges remain. Maintaining profitability amidst intense competition and managing operational costs, including last-mile delivery expenses and maintaining inventory efficiency, are ongoing concerns. Concerns around food safety and quality also need to be addressed to sustain customer trust. Regulation and infrastructure limitations in certain regions may also hinder growth. Despite these hurdles, the long-term outlook for the Indian Q-commerce market remains optimistic, driven by the evolving consumer landscape, technological advancements, and the sustained rise in disposable incomes. The market segmentation is likely diverse, including categories like groceries, daily essentials, pharmaceuticals, and other convenience items. The future will likely witness a consolidation of players as well as an increase in specialization within specific niches.

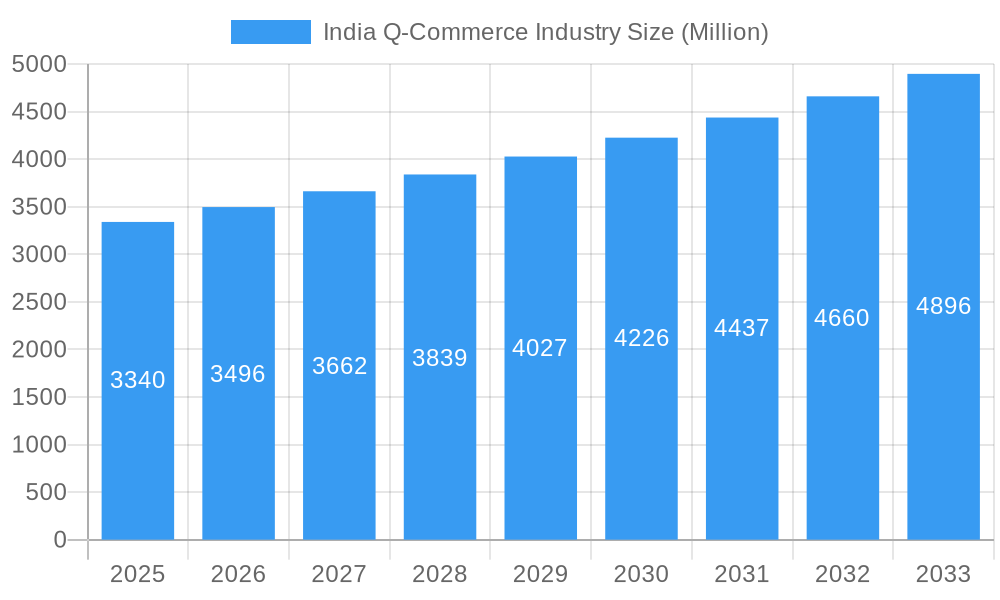

India Q-Commerce Industry Company Market Share

India Q-Commerce Industry Report: 2019-2033 - Market Dynamics, Trends, and Future Outlook

Unlocking the explosive growth potential of India's burgeoning quick-commerce sector. This comprehensive report provides an in-depth analysis of the India Q-Commerce industry, covering market size, trends, competitive landscape, and future projections from 2019 to 2033. Ideal for investors, entrepreneurs, and industry stakeholders seeking actionable insights into this rapidly evolving market.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

India Q-Commerce Industry Market Dynamics & Concentration

The Indian Quick Commerce (Q-Commerce) market is a vibrant and fiercely competitive arena, characterized by rapid evolution and strategic consolidation. Leading platforms such as Swiggy Instamart, Blinkit, Zepto, and Dunzo Daily are engaged in an intense battle for market dominance, leading to a dynamic landscape where mergers, acquisitions, and strategic partnerships are common. Projections for market share in 2025 highlight this competition: Swiggy Instamart is anticipated to hold approximately [Insert XX]%, Blinkit around [Insert XX]%, Zepto at approximately [Insert XX]%, and Dunzo Daily around [Insert XX]%. The remaining market share will be distributed among other significant players, including BigBasket, Grofers, Flipkart Quick, and Supr Daily. The regulatory environment, while continuously adapting, is increasingly prioritizing consumer welfare and fair market practices. Innovation is a key differentiator, spurred by advancements in AI-driven logistics, predictive inventory management, and sophisticated last-mile delivery optimization. Traditional retail channels, including neighborhood kirana stores and larger offline supermarkets, are experiencing mounting pressure from the unparalleled convenience and speed offered by Q-commerce solutions. End-user preferences strongly lean towards time-saving, immediate gratification, and an extensive product selection, which are the core value propositions driving the sector's robust growth. The trend of mergers and acquisitions has been on a steady ascent, with an estimated [Insert XX] deals recorded between 2020 and 2024, underscoring the industry's drive towards consolidation and synergistic growth.

India Q-Commerce Industry Industry Trends & Analysis

The Indian Q-commerce industry is experiencing exponential growth, driven by several key factors. The increasing penetration of smartphones and internet access, coupled with a growing preference for convenience and speed among consumers, is fueling this rapid expansion. Technological disruptions, particularly in areas like last-mile delivery and supply chain management, are enabling greater efficiency and scalability. The CAGR for the period 2025-2033 is projected to be xx%. Market penetration is expected to reach xx% by 2033, driven by increasing consumer adoption and platform expansion. Consumer preferences are shifting towards a seamless omnichannel experience, demanding efficient and reliable delivery services. The competitive dynamics are characterized by intense rivalry, requiring companies to constantly innovate and optimize their offerings to stay ahead.

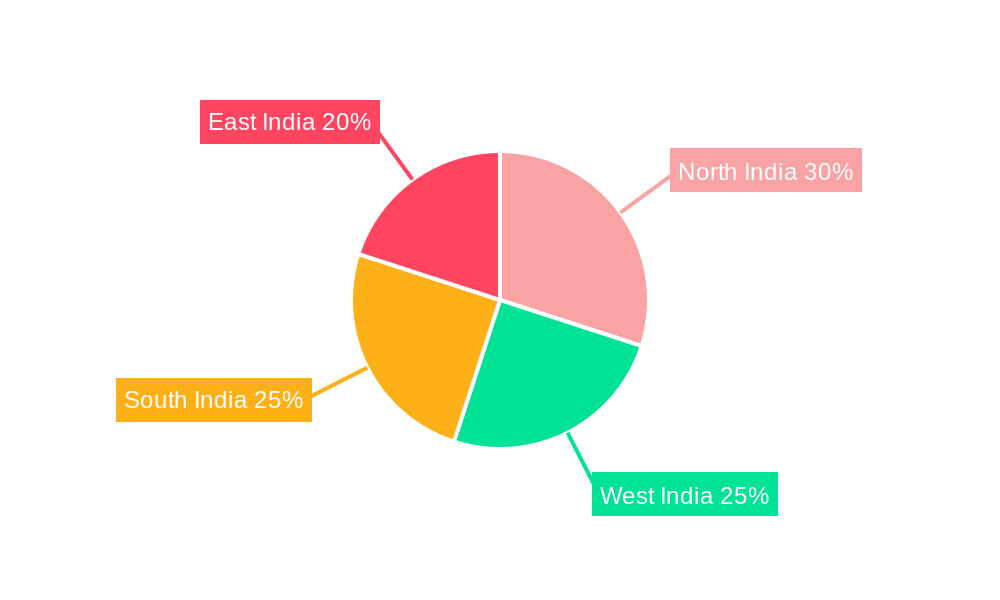

Leading Markets & Segments in India Q-Commerce Industry

While the reach of Q-commerce is steadily expanding across India, the most significant market concentration currently lies within Tier 1 metropolitan areas such as Mumbai, Delhi, Bengaluru, and Hyderabad. This dominance is a direct result of several synergistic factors: higher internet and smartphone penetration rates, a dense concentration of urban populations, and more developed logistical and infrastructural frameworks.

- Key Market Drivers:

- Elevated disposable incomes among urban consumers.

- Well-established and efficient logistics networks.

- Widespread adoption of smartphones and internet connectivity.

- High population density in metropolitan centers.

This concentration in metropolitan regions is a clear indicator of the critical role of consumer density and robust logistical capabilities in the Q-commerce model. The efficiency of last-mile delivery is paramount to success, a feat that is most effectively achieved in areas blessed with well-developed road infrastructures and a readily available pool of delivery personnel.

India Q-Commerce Industry Product Developments

The evolution of product offerings within the Q-commerce sector is marked by a strategic expansion beyond traditional grocery items. Companies are increasingly venturing into delivering restaurant meals, essential pharmaceuticals, and a broader spectrum of daily necessities. Technological innovation remains a cornerstone of these developments, with substantial investments being channeled into AI-powered inventory management systems, dynamic route optimization algorithms, and sophisticated personalized recommendation engines. The overarching goal is to significantly enhance the customer experience through features such as real-time order tracking, a variety of convenient payment solutions, and intuitive, user-friendly interfaces. These advancements are strategically designed to foster higher customer retention rates and attract a wider user base in an intensely competitive marketplace.

Key Drivers of India Q-Commerce Industry Growth

A confluence of powerful factors is propelling the significant growth trajectory of the Indian Q-Commerce industry. Foremost among these is the escalating penetration of smartphones and widespread internet access across the nation, democratizing online shopping for an unprecedented segment of the population. Concurrently, rising disposable incomes and evolving consumer lifestyles are igniting a surging demand for the unparalleled convenience and speed of delivery services. Furthermore, supportive government policies and targeted initiatives aimed at fostering digital commerce are cultivating an increasingly favorable ecosystem for industry expansion. Finally, continuous technological advancements in logistics and delivery operations are relentlessly improving efficiency and scalability, acting as potent accelerators for the sector's overall growth.

Challenges in the India Q-Commerce Industry Market

The Q-commerce sector faces several challenges. High operating costs, including logistics and warehousing, are a significant hurdle. Competition is fierce, squeezing profit margins. Regulatory uncertainty regarding licensing and permits can also hinder growth. Lastly, maintaining consistent delivery times, especially during peak hours, poses a considerable operational challenge, impacting customer satisfaction and brand reputation. These factors collectively impact profitability and sustainable growth in the sector.

Emerging Opportunities in India Q-Commerce Industry

The future of the India Q-commerce industry holds immense potential. Technological breakthroughs like drone delivery and autonomous vehicles could significantly improve efficiency and reduce costs. Strategic partnerships with retailers and manufacturers can expand product offerings and enhance supply chain management. Expansion into smaller cities and towns, tapping into underserved markets, presents a significant growth opportunity.

Leading Players in the India Q-Commerce Industry Sector

- Swiggy Instamart

- Blinkit

- Zepto

- Dunzo Daily

- Big Basket

- Grofers

- Flipkart Quick

- Supr Daily

- Zomato (leveraging its existing network for potential Q-commerce integration)

- (Please Note: This list is illustrative and not exhaustive; the market is dynamic and includes emerging players and strategic partnerships.)

Key Milestones in India Q-Commerce Industry Industry

- February 2023: Zomato launched Zomato Instant, a quick commerce delivery service focusing on affordable, home-style cooked food. This significantly expanded Zomato's service offerings and increased competition in the sector.

- December 2023: Walmart's acquisition of Flipkart and subsequent launch of Flipkart Quick in 20 cities marked a major entry of a global giant into the Indian Q-commerce market, increasing competitive pressure and investment in the sector.

Strategic Outlook for India Q-Commerce Industry Market

The Indian Q-commerce market is poised for significant growth, driven by increasing consumer adoption, technological advancements, and strategic investments. Companies that successfully navigate the challenges of logistics, competition, and regulation will be well-positioned to capitalize on this immense potential. Focus on innovation, customer experience, and strategic partnerships will be key to long-term success in this dynamic market.

India Q-Commerce Industry Segmentation

-

1. Product Type

- 1.1. Groceries

- 1.2. Personal Care

- 1.3. Fresh Food

- 1.4. Other Product Types

-

2. Company Type

- 2.1. Pureplay

- 2.2. Non-pureplay

India Q-Commerce Industry Segmentation By Geography

- 1. India

India Q-Commerce Industry Regional Market Share

Geographic Coverage of India Q-Commerce Industry

India Q-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market

- 3.3. Market Restrains

- 3.3.1. Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market

- 3.4. Market Trends

- 3.4.1. Rising Entry of Startups into the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Q-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Groceries

- 5.1.2. Personal Care

- 5.1.3. Fresh Food

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Company Type

- 5.2.1. Pureplay

- 5.2.2. Non-pureplay

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Swiggy

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Instamart

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dunzo Daily

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Blinkit

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Big Basket

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zepto

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grofers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Flipkart Quick

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Supr Daily

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zomato**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Swiggy

List of Figures

- Figure 1: India Q-Commerce Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Q-Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: India Q-Commerce Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Q-Commerce Industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: India Q-Commerce Industry Revenue Million Forecast, by Company Type 2020 & 2033

- Table 4: India Q-Commerce Industry Volume Billion Forecast, by Company Type 2020 & 2033

- Table 5: India Q-Commerce Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Q-Commerce Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: India Q-Commerce Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: India Q-Commerce Industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: India Q-Commerce Industry Revenue Million Forecast, by Company Type 2020 & 2033

- Table 10: India Q-Commerce Industry Volume Billion Forecast, by Company Type 2020 & 2033

- Table 11: India Q-Commerce Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Q-Commerce Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Q-Commerce Industry?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the India Q-Commerce Industry?

Key companies in the market include Swiggy, Instamart, Dunzo Daily, Blinkit, Big Basket, Zepto, Grofers, Flipkart Quick, Supr Daily, Zomato**List Not Exhaustive.

3. What are the main segments of the India Q-Commerce Industry?

The market segments include Product Type, Company Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market.

6. What are the notable trends driving market growth?

Rising Entry of Startups into the Market.

7. Are there any restraints impacting market growth?

Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market.

8. Can you provide examples of recent developments in the market?

February 2023: Zomato launched a quick commerce delivery service known as Zomato Instant. The aim is to provide customers with home-style cooked food at affordable prices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Q-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Q-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Q-Commerce Industry?

To stay informed about further developments, trends, and reports in the India Q-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence