Key Insights

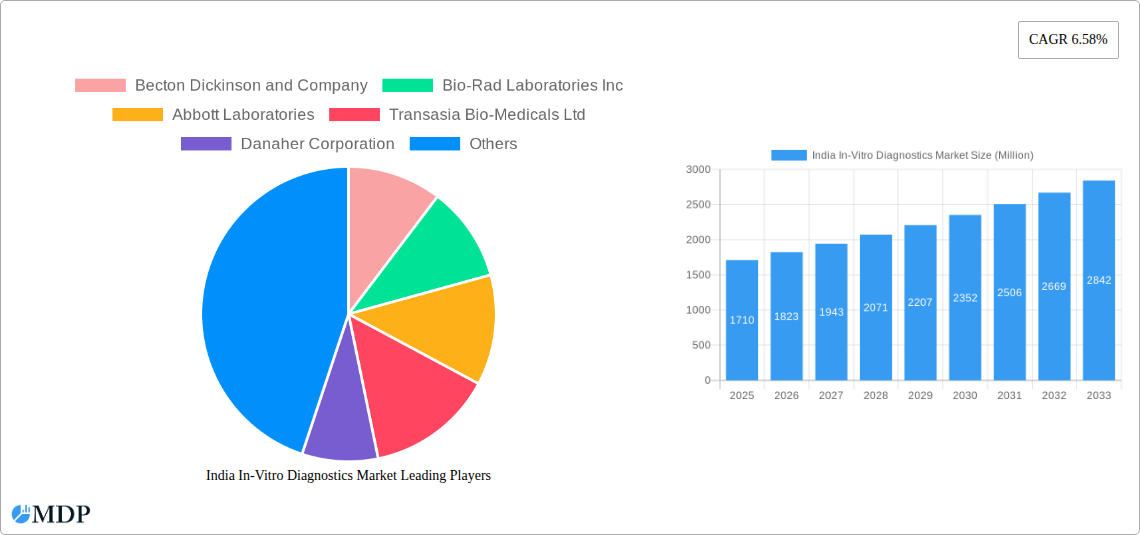

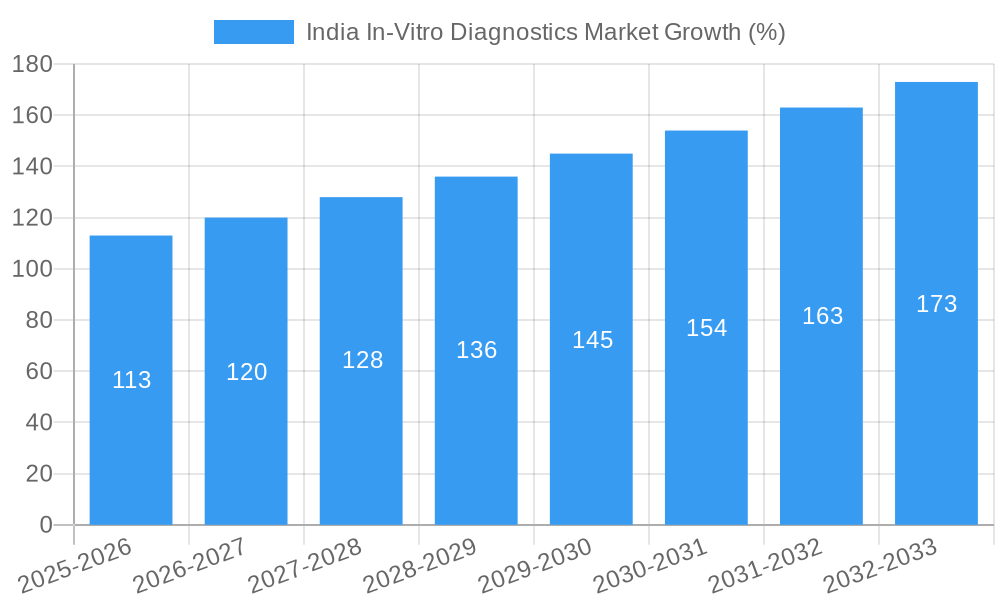

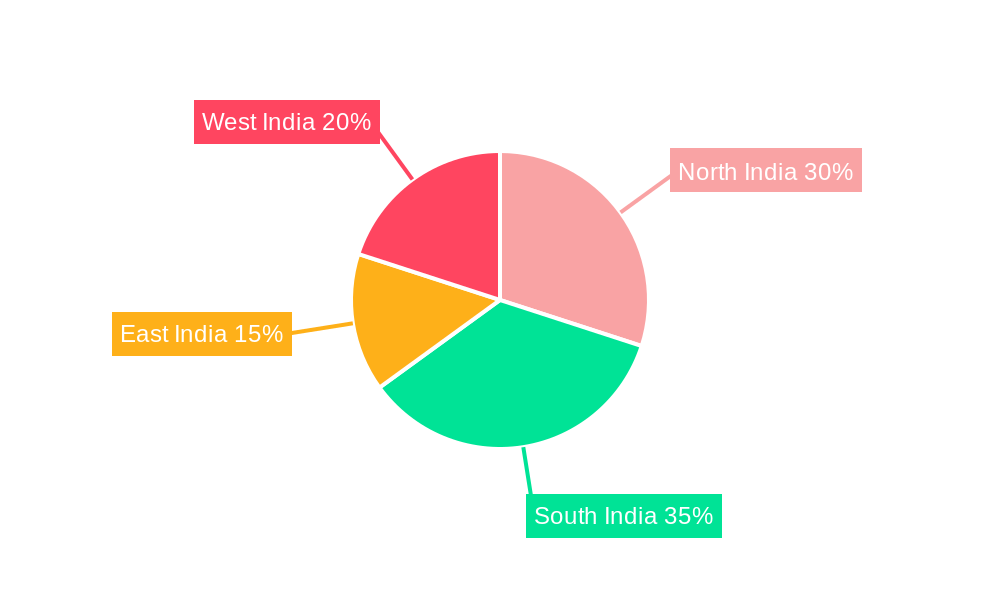

The India In-Vitro Diagnostics (IVD) market is experiencing robust growth, projected to reach a substantial size driven by several key factors. The market's Compound Annual Growth Rate (CAGR) of 6.58% from 2019 to 2024 indicates a significant upward trajectory, fueled by rising prevalence of chronic diseases like diabetes, cancer, and cardiovascular ailments. Increased healthcare expenditure, improving healthcare infrastructure, and a growing awareness of preventive healthcare are further contributing to market expansion. The significant segmentations within the market, including Clinical Chemistry, Molecular Diagnostics, and Hematology testing, reflect diverse diagnostic needs. The increasing adoption of advanced technologies like molecular diagnostics and point-of-care testing is transforming the landscape, offering faster and more accurate results. Furthermore, the growing presence of multinational IVD companies alongside domestic players fosters competition and innovation. The market is witnessing a shift towards sophisticated instruments and reagents, while the disposable IVD devices segment is gaining traction due to its convenience and hygiene benefits. Hospitals and diagnostic laboratories remain the primary end-users, though the contribution of clinics is steadily increasing. Geographical variations exist across India, with regions like North and South India showing potentially higher growth rates due to better healthcare infrastructure and higher disease prevalence. The forecast period of 2025-2033 promises continued expansion, indicating significant investment opportunities within this dynamic sector.

The future growth of the Indian IVD market is expected to be influenced by government initiatives promoting affordable healthcare access and technological advancements driving miniaturization and automation. However, challenges like high costs of advanced technologies, particularly in rural areas, and infrastructural limitations in certain regions might pose constraints on market penetration. Nevertheless, the burgeoning middle class, with increasing disposable incomes and health consciousness, presents a significant opportunity for growth. The strategic focus of key players on expanding their product portfolios, strengthening distribution networks, and investing in research and development will further shape the market landscape. The market's segmentation provides detailed insights into specific areas of high growth potential. Focusing on these areas, especially within the burgeoning molecular diagnostics and point-of-care testing segments, will be crucial for companies aiming to capitalize on the market's growth prospects.

India In-Vitro Diagnostics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the India In-Vitro Diagnostics (IVD) market, offering invaluable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future opportunities. The report covers key segments, including Test Type, Product, Usability, Application, and End-user, offering a granular understanding of this rapidly evolving market. Expected market value is predicted to reach xx Million by 2033.

India In-Vitro Diagnostics Market Dynamics & Concentration

This section analyzes the competitive landscape of the Indian IVD market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is characterized by a mix of multinational corporations and domestic players. The top players, including Becton Dickinson and Company, Bio-Rad Laboratories Inc., Abbott Laboratories, Transasia Bio-Medicals Ltd., Danaher Corporation, Thermo Fisher Scientific, F Hoffmann-La Roche AG, bioMérieux SA, Sysmex Corporation, and Arkray Inc., hold a significant market share, although the exact figures vary by segment. However, the increasing number of smaller players presents a more fragmented market landscape. The market share for the top 5 companies is estimated at xx%, while the overall market concentration (using Herfindahl-Hirschman Index or similar) is approximately xx.

- Innovation Drivers: Technological advancements in molecular diagnostics, automation, and point-of-care testing are key drivers.

- Regulatory Framework: Stringent regulatory approvals and quality control measures influence market growth. The rising adoption of digital health technologies plays a crucial role.

- Product Substitutes: The absence of easily available substitutes strengthens the market.

- End-User Trends: Increasing prevalence of chronic diseases is driving demand across various segments.

- M&A Activities: The number of M&A deals in the Indian IVD market in the last five years is estimated to be around xx, indicating consolidation and expansion efforts within the sector.

India In-Vitro Diagnostics Market Industry Trends & Analysis

The Indian IVD market is experiencing significant growth, driven by factors such as rising prevalence of chronic diseases (diabetes, cardiovascular diseases, cancer), increasing healthcare expenditure, growing awareness about preventive healthcare, and government initiatives to improve healthcare infrastructure. The market is witnessing a shift towards advanced diagnostic technologies like molecular diagnostics and point-of-care testing, fueled by technological disruptions and changing consumer preferences. The CAGR for the market during the historical period (2019-2024) was approximately xx%, while the projected CAGR for the forecast period (2025-2033) is estimated at xx%. This growth is further propelled by increased investments in R&D and the entry of new players. Competitive dynamics are intensifying with both domestic and international players vying for market share. Market penetration is highest in urban areas but is steadily increasing in rural regions due to improved access and awareness.

Leading Markets & Segments in India In-Vitro Diagnostics Market

The Indian IVD market demonstrates diverse growth across different segments.

By Test Type:

- Clinical Chemistry: Holds the largest market share due to high demand for routine tests. Key drivers include increasing prevalence of diabetes and cardiovascular diseases.

- Molecular Diagnostics: Shows high growth potential, driven by technological advancements and increasing demand for infectious disease testing.

- Hematology: Significant growth driven by increasing prevalence of blood-related disorders.

- Immuno Diagnostics: Experiencing substantial growth due to rising cases of autoimmune diseases.

- Other Test Types: Includes microbiology, urinalysis, etc., contributing a significant portion to the market.

By Product:

- Reagents: Dominate the market due to consistent demand.

- Instruments: High capital expenditure associated with instruments leads to a slower growth rate compared to reagents.

- Other Products: Includes consumables and accessories.

By Usability:

- Disposable IVD Devices: Higher market share driven by convenience and hygiene considerations.

- Reusable IVD Devices: Smaller market share due to higher maintenance costs.

By Application:

- Infectious Disease: Large market share driven by the prevalence of infectious diseases.

- Diabetes: Significant market share driven by the high prevalence of diabetes.

- Cancer/Oncology: Strong growth potential driven by increasing cancer incidence.

- Cardiology: Growing market share driven by the rising prevalence of cardiovascular diseases.

- Autoimmune Disease: Increasing prevalence fuels market growth.

- Nephrology: Growth driven by the rising incidence of kidney-related diseases.

- Other Applications: Includes toxicology, endocrinology, etc.

By End-user:

- Diagnostic Laboratories: Hold the largest share due to high testing volumes.

- Hospitals and Clinics: Significant market share due to in-house testing capabilities.

- Other End-users: Includes research institutions and home testing.

Key Drivers for Dominant Segments: Economic growth, improved healthcare infrastructure, government initiatives promoting healthcare access, and rising awareness about diagnostics play a significant role in driving market dominance across different segments.

India In-Vitro Diagnostics Market Product Developments

Recent product innovations in the Indian IVD market emphasize point-of-care diagnostics, rapid testing solutions, and automation. Companies are focusing on developing user-friendly, cost-effective, and accurate diagnostic tools. The integration of AI and mobile technologies is transforming the diagnostic landscape, enabling faster and more efficient testing processes. This focus on technology differentiation, enhanced performance, and ease of use provides competitive advantages to companies.

Key Drivers of India In-Vitro Diagnostics Market Growth

Several factors contribute to the growth of the India IVD market:

- Rising Prevalence of Chronic Diseases: The increasing incidence of diseases like diabetes, cancer, and cardiovascular diseases fuels the demand for diagnostic testing.

- Government Initiatives: Government policies aimed at improving healthcare infrastructure and access are driving market growth.

- Technological Advancements: Innovations in molecular diagnostics and point-of-care testing are expanding market opportunities.

- Rising Healthcare Expenditure: Increased spending on healthcare contributes to higher demand for diagnostic services.

Challenges in the India In-Vitro Diagnostics Market

The Indian IVD market faces certain challenges:

- Regulatory Hurdles: The complex regulatory landscape can hinder market entry and product approvals.

- Price Sensitivity: Price sensitivity among consumers and healthcare providers can limit adoption of advanced technologies.

- Infrastructure Gaps: Inadequate healthcare infrastructure in certain regions limits access to diagnostic services.

- Supply Chain Issues: Disruptions in the global supply chain can impact the availability of IVD products.

Emerging Opportunities in India In-Vitro Diagnostics Market

The Indian IVD market presents significant growth opportunities:

- Technological Breakthroughs: Advancements in AI, big data analytics, and genomics are creating new avenues for innovation.

- Strategic Partnerships: Collaborations between domestic and international players can accelerate market growth.

- Market Expansion: Expansion into underserved rural areas offers substantial potential.

- Growing Adoption of Telemedicine: Integration of IVD with telemedicine creates new business models.

Leading Players in the India In-Vitro Diagnostics Market Sector

- Becton Dickinson and Company

- Bio-Rad Laboratories Inc

- Abbott Laboratories

- Transasia Bio-Medicals Ltd

- Danaher Corporation

- Thermo Fisher Scientific

- F Hoffmann-La Roche AG

- bioMérieux SA

- Sysmex Corporation

- Arkray Inc

Key Milestones in India In-Vitro Diagnostics Market Industry

- June 2022: Genes2Me Pvt. Ltd launched the CoviEasy Self-test Rapid Antigen kit for COVID-19, supported by an AI-driven mobile app. This milestone highlights the growing adoption of self-testing and the integration of technology in diagnostics.

- February 2022: Mylab Discovery Solutions launched CoviSwift, a point-of-care (POC) testing solution significantly faster than traditional RT-PCR testing. This underscores the increasing demand for rapid and efficient diagnostic solutions.

Strategic Outlook for India In-Vitro Diagnostics Market Market

The Indian IVD market exhibits substantial long-term growth potential, driven by technological advancements, increasing healthcare expenditure, and rising prevalence of chronic diseases. Strategic opportunities lie in developing affordable and accessible diagnostic solutions, leveraging technological innovations, and forming strategic partnerships to expand market reach. Focus on point-of-care diagnostics, personalized medicine, and digital health integration will be crucial for success in this dynamic market.

India In-Vitro Diagnostics Market Segmentation

-

1. Test Type

- 1.1. Clinical Chemistry

- 1.2. Molecular Diagnostics

- 1.3. Hematology

- 1.4. Immuno Diagnostics

- 1.5. Other Test Types

-

2. Product

- 2.1. Instrument

- 2.2. Reagent

- 2.3. Other Products

-

3. Usability

- 3.1. Disposable IVD Devices

- 3.2. Reusable IVD Devices

-

4. Application

- 4.1. Infectious Disease

- 4.2. Diabetes

- 4.3. Cancer/Oncology

- 4.4. Cardiology

- 4.5. Autoimmune Disease

- 4.6. Nephrology

- 4.7. Other Applications

-

5. End-user

- 5.1. Diagnostic Laboratories

- 5.2. Hospitals and Clinics

- 5.3. Other End-users

India In-Vitro Diagnostics Market Segmentation By Geography

- 1. India

India In-Vitro Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.58% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Prevalence of Chronic Diseases; Increasing Use of Point-of-care (POC) Diagnostics; Rising Awareness and Acceptance of Personalized Medicine and Companion Diagnostics

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations; Cumbersome Reimbursement Procedures

- 3.4. Market Trends

- 3.4.1. Molecular Diagnostics Segment is Expected to Grow in the India In-Vitro Diagnostics Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Clinical Chemistry

- 5.1.2. Molecular Diagnostics

- 5.1.3. Hematology

- 5.1.4. Immuno Diagnostics

- 5.1.5. Other Test Types

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Instrument

- 5.2.2. Reagent

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Usability

- 5.3.1. Disposable IVD Devices

- 5.3.2. Reusable IVD Devices

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Infectious Disease

- 5.4.2. Diabetes

- 5.4.3. Cancer/Oncology

- 5.4.4. Cardiology

- 5.4.5. Autoimmune Disease

- 5.4.6. Nephrology

- 5.4.7. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by End-user

- 5.5.1. Diagnostic Laboratories

- 5.5.2. Hospitals and Clinics

- 5.5.3. Other End-users

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. North India India In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India In-Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Becton Dickinson and Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bio-Rad Laboratories Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Abbott Laboratories

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Transasia Bio-Medicals Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Danaher Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Thermo Fisher Scientific*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 F Hoffmann-La Roche AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 bioMérieux SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sysmex Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Arkray Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: India In-Vitro Diagnostics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India In-Vitro Diagnostics Market Share (%) by Company 2024

List of Tables

- Table 1: India In-Vitro Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India In-Vitro Diagnostics Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 3: India In-Vitro Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: India In-Vitro Diagnostics Market Revenue Million Forecast, by Usability 2019 & 2032

- Table 5: India In-Vitro Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: India In-Vitro Diagnostics Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 7: India In-Vitro Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India In-Vitro Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: North India India In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South India India In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: East India India In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: West India India In-Vitro Diagnostics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: India In-Vitro Diagnostics Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 14: India In-Vitro Diagnostics Market Revenue Million Forecast, by Product 2019 & 2032

- Table 15: India In-Vitro Diagnostics Market Revenue Million Forecast, by Usability 2019 & 2032

- Table 16: India In-Vitro Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: India In-Vitro Diagnostics Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 18: India In-Vitro Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India In-Vitro Diagnostics Market?

The projected CAGR is approximately 6.58%.

2. Which companies are prominent players in the India In-Vitro Diagnostics Market?

Key companies in the market include Becton Dickinson and Company, Bio-Rad Laboratories Inc, Abbott Laboratories, Transasia Bio-Medicals Ltd, Danaher Corporation, Thermo Fisher Scientific*List Not Exhaustive, F Hoffmann-La Roche AG, bioMérieux SA, Sysmex Corporation, Arkray Inc.

3. What are the main segments of the India In-Vitro Diagnostics Market?

The market segments include Test Type, Product, Usability, Application, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.71 Million as of 2022.

5. What are some drivers contributing to market growth?

High Prevalence of Chronic Diseases; Increasing Use of Point-of-care (POC) Diagnostics; Rising Awareness and Acceptance of Personalized Medicine and Companion Diagnostics.

6. What are the notable trends driving market growth?

Molecular Diagnostics Segment is Expected to Grow in the India In-Vitro Diagnostics Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulations; Cumbersome Reimbursement Procedures.

8. Can you provide examples of recent developments in the market?

In June 2022, Genes2Me Pvt. Ltd launched the CoviEasy Self-test Rapid Antigen kit for COVID-19, which is supported by an AI-driven mobile app.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India In-Vitro Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India In-Vitro Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India In-Vitro Diagnostics Market?

To stay informed about further developments, trends, and reports in the India In-Vitro Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence