Key Insights

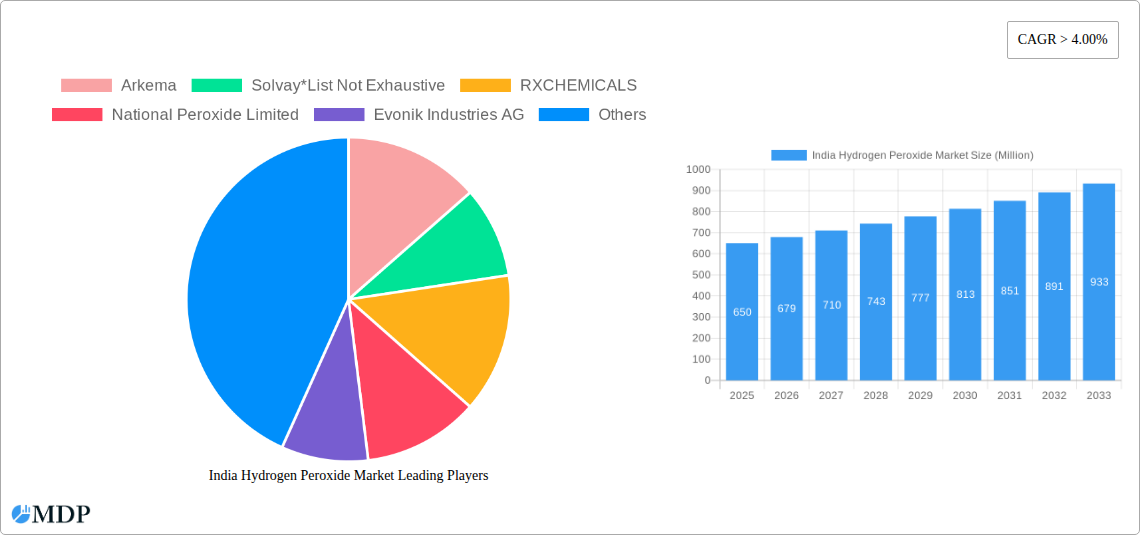

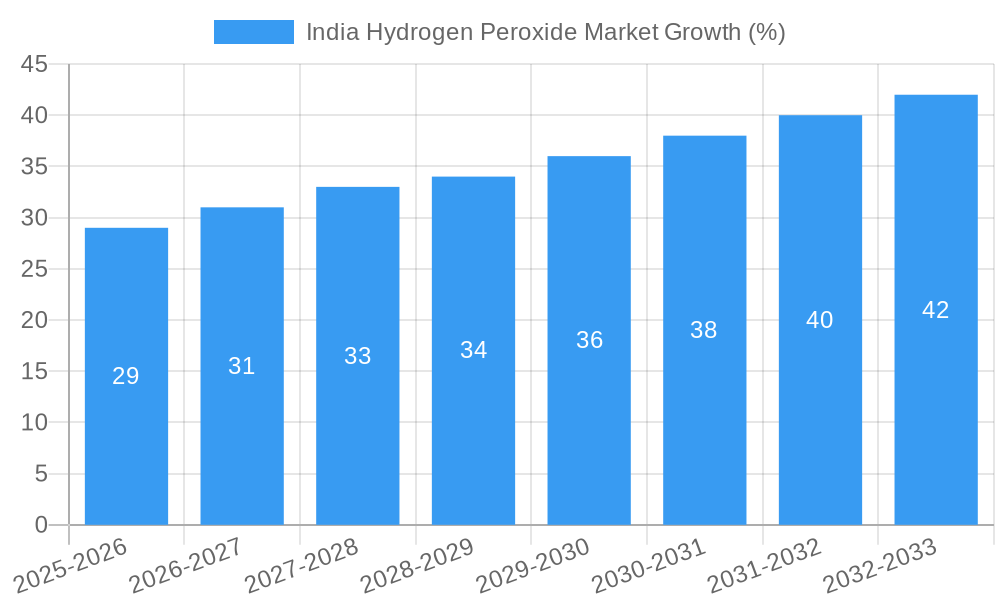

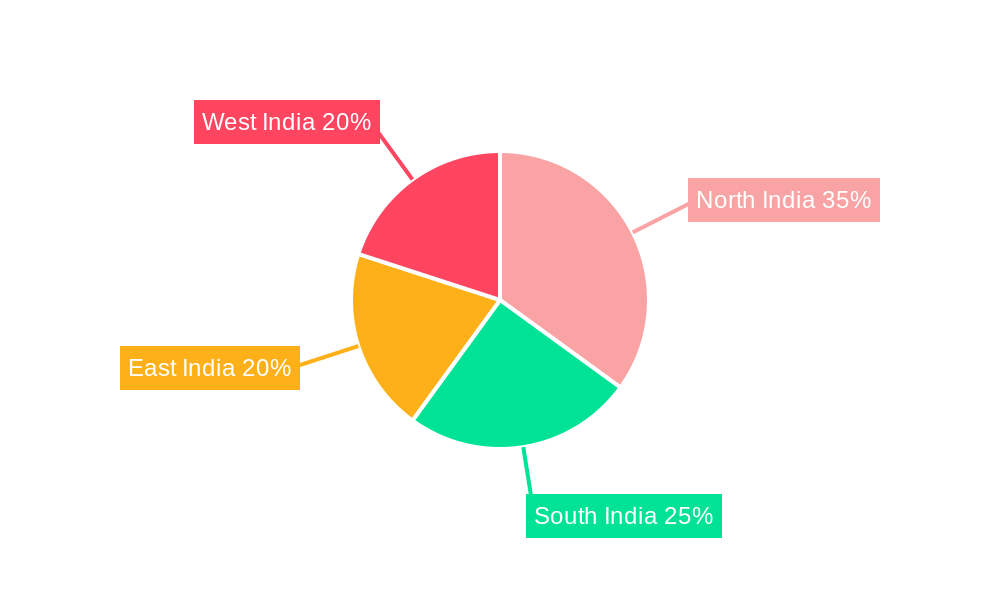

The India hydrogen peroxide market, valued at approximately ₹650 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 4% from 2025 to 2033. This growth is fueled by increasing demand across diverse sectors. The pulp and paper industry, a significant consumer, relies on hydrogen peroxide for bleaching, while the chemical synthesis sector utilizes it as an oxidant in various processes. Furthermore, the expanding wastewater treatment and food and beverage industries are contributing to market expansion, driven by heightened hygiene standards and the need for effective disinfection. Growth is also spurred by the increasing adoption of hydrogen peroxide in cosmetics and healthcare applications for its antiseptic properties, and in the textile industry for bleaching and cleaning. The market segmentation reveals a significant share held by the disinfectant function of hydrogen peroxide, followed by bleaching and oxidant applications. Regional variations exist, with North and West India showing relatively higher growth due to the concentration of industrial activity. Key players like Arkema, Solvay, and Evonik Industries AG are driving innovation and expanding their market presence. However, factors such as price fluctuations of raw materials and stringent environmental regulations may act as potential restraints on market growth.

The market's future hinges on several factors including technological advancements in hydrogen peroxide production, increasing government regulations promoting sustainable practices in various industries, and the emergence of newer applications. The consistent demand from established sectors coupled with the exploration of new applications across sectors such as electronics and packaging suggests a promising trajectory for the India hydrogen peroxide market over the forecast period. The entry of new players and strategic partnerships could further intensify competition and drive innovation, ultimately influencing the market dynamics and shaping its future landscape. Continuous monitoring of raw material costs, technological advancements, and regulatory changes will be crucial for companies operating in this market to ensure sustained success.

India Hydrogen Peroxide Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India Hydrogen Peroxide Market, offering invaluable insights for stakeholders across the value chain. Spanning the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, trends, leading players, and future opportunities. Maximize your understanding of this burgeoning market with data-driven analysis and actionable strategies. Search terms: India Hydrogen Peroxide Market, Hydrogen Peroxide India, India Peroxide Market, Hydrogen Peroxide Market Size India, Hydrogen Peroxide Industry India.

India Hydrogen Peroxide Market Market Dynamics & Concentration

The India hydrogen peroxide market is characterized by a moderately concentrated landscape, with key players like Arkema, Solvay, RXCHEMICALS, National Peroxide Limited, Evonik Industries AG, Chemplast Sanmar Limited, Indian Peroxide Limited, PCIPL (Prakash Chemicals International Private Limited), Hindustan Organic Chemicals Ltd (HOCL), Aditya Birla Chemicals, Gujarat Alkalies and Chemical Limited, Meghmani Finechem Limited (MFL), and AkzoNobel NV holding significant market share. The market share of the top 5 players is estimated at xx% in 2025. Innovation is a key driver, with companies focusing on developing eco-friendly and high-performance formulations. Stringent regulatory frameworks concerning safety and environmental impact influence market practices. Substitutes, such as chlorine-based bleaching agents, pose a competitive threat, though hydrogen peroxide's environmentally friendly nature provides a key advantage. End-user trends show a growing preference for sustainable and efficient solutions. M&A activity has been moderate, with approximately xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2025).

- Innovation Drivers: Eco-friendly formulations, high performance products.

- Regulatory Frameworks: Stringent safety and environmental regulations.

- Product Substitutes: Chlorine-based bleaching agents.

- End-User Trends: Growing preference for sustainable solutions.

- M&A Activity: Approximately xx deals between 2019 and 2024.

India Hydrogen Peroxide Market Industry Trends & Analysis

The India hydrogen peroxide market exhibits a robust growth trajectory, driven by expanding industrial applications and rising consumer demand. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as improved production processes and novel formulations, contribute significantly to market expansion. Consumer preferences increasingly favor environmentally friendly and safe products, bolstering the demand for hydrogen peroxide. Intense competition among established players and emerging companies shapes market dynamics. Market penetration in key sectors like pulp & paper and wastewater treatment remains substantial, but opportunities exist for further expansion in other sectors.

Leading Markets & Segments in India Hydrogen Peroxide Market

The dominant segments in the India hydrogen peroxide market are diversified across both product function and end-user industry.

Product Function: Disinfectant and bleaching applications collectively dominate, driven by robust demand from various industries and households. The "Other Product Functions" segment (antiseptic, dishwasher, and vegetable wash) shows promising growth, fuelled by increasing health consciousness and consumer demand for effective cleaning solutions.

End-user Industry: The pulp and paper industry remains a major consumer, followed by the chemical synthesis and wastewater treatment sectors. Growth in the food and beverage, cosmetics and healthcare, and textile industries fuels segment expansion. The "Other End-user Industries" segment, comprising electronics and packaging, among others, is steadily expanding.

Regional Dominance: (Data needed to fill this section. Possible options are to highlight Western India, Southern India or other regions based on actual data analysis.) Key drivers in these regions include robust industrial growth, supportive government policies, and improved infrastructure.

India Hydrogen Peroxide Market Product Developments

Significant advancements in hydrogen peroxide production technologies focus on enhancing efficiency, safety, and reducing environmental impact. Formulations tailored for specific applications, such as high-concentration solutions for industrial processes or low-concentration solutions for household use, are gaining traction. The market witnesses ongoing innovation in packaging and delivery systems, improving ease of use and safety. These developments improve the market fit and competitive advantages of hydrogen peroxide over substitute products.

Key Drivers of India Hydrogen Peroxide Market Growth

Several factors propel the growth of the India hydrogen peroxide market. Technological advancements result in more efficient and cost-effective production methods. Growing industrialization and urbanization contribute to increased demand across multiple sectors. Government initiatives promoting environmental sustainability and stringent regulations on harmful chemicals further encourage adoption. The increasing awareness of hygiene and sanitation, particularly in healthcare and food processing, fuels demand for hydrogen peroxide-based disinfectants.

Challenges in the India Hydrogen Peroxide Market Market

Despite the positive outlook, the market faces certain challenges. Fluctuations in raw material prices impact production costs and profitability. Stricter environmental regulations increase compliance costs. Intense competition among established and emerging players requires companies to offer competitive pricing and superior product quality. The transportation and handling of hydrogen peroxide also pose logistical challenges. These factors collectively influence market dynamics.

Emerging Opportunities in India Hydrogen Peroxide Market

The India hydrogen peroxide market presents promising long-term growth opportunities. Technological breakthroughs in areas like stabilized hydrogen peroxide formulations expand applications. Strategic partnerships and collaborations between manufacturers and end-users unlock new market segments. Government initiatives promoting clean technologies open doors for increased hydrogen peroxide adoption. Expansion into new geographical areas and untapped end-user sectors offer significant potential for market growth.

Leading Players in the India Hydrogen Peroxide Market Sector

- Arkema

- Solvay

- RXCHEMICALS

- National Peroxide Limited

- Evonik Industries AG

- Chemplast Sanmar Limited

- Indian Peroxide Limited

- PCIPL (Prakash Chemicals International Private Limited)

- Hindustan Organic Chemicals Ltd (HOCL)

- Aditya Birla Chemicals

- Gujarat Alkalies and Chemical Limited

- Meghmani Finechem Limited (MFL)

- AkzoNobel NV

Key Milestones in India Hydrogen Peroxide Market Industry

- (Data needed to fill this section with specific dates and details of important industry developments)

Strategic Outlook for India Hydrogen Peroxide Market Market

The India hydrogen peroxide market is poised for sustained growth, driven by technological innovation, increasing industrialization, and heightened environmental consciousness. Strategic investments in research and development, expansion into high-growth segments, and collaborative partnerships will be crucial for sustained market success. Focus on sustainable manufacturing practices and compliance with stringent environmental regulations will be critical for long-term competitiveness. The market presents substantial opportunities for players to capture significant market share through strategic initiatives and product differentiation.

India Hydrogen Peroxide Market Segmentation

-

1. Product Function

- 1.1. Disinfectant

- 1.2. Bleaching

- 1.3. Oxidant

- 1.4. Other Pr

-

2. End-user Industry

- 2.1. Pulp and Paper

- 2.2. Chemical Synthesis

- 2.3. Wastewater Treatment

- 2.4. Mining

- 2.5. Food and Beverage

- 2.6. Cosmetics and Healthcare

- 2.7. Textiles

- 2.8. Other En

India Hydrogen Peroxide Market Segmentation By Geography

- 1. India

India Hydrogen Peroxide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Utilization in the Food Processing Industry; Application in the Paper and Pulp Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Health Hazards Associated with Long-term Exposure of Hydrogen Peroxide; Other Restraints

- 3.4. Market Trends

- 3.4.1. Paper and Pulp Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Hydrogen Peroxide Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Function

- 5.1.1. Disinfectant

- 5.1.2. Bleaching

- 5.1.3. Oxidant

- 5.1.4. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Pulp and Paper

- 5.2.2. Chemical Synthesis

- 5.2.3. Wastewater Treatment

- 5.2.4. Mining

- 5.2.5. Food and Beverage

- 5.2.6. Cosmetics and Healthcare

- 5.2.7. Textiles

- 5.2.8. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Function

- 6. North India India Hydrogen Peroxide Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Hydrogen Peroxide Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Hydrogen Peroxide Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Hydrogen Peroxide Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Arkema

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Solvay*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 RXCHEMICALS

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 National Peroxide Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Evonik Industries AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Chemplast Sanmar Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Indian Peroxide Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 PCIPL (Prakash Chemicals International Private Limited)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hindustan Organic Chemicals Ltd (HOCL)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Aditya Birla Chemicals

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Gujarat Alkalies and Chemical Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Meghmani Finechem Limited (MFL)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 AkzoNobel NV

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Arkema

List of Figures

- Figure 1: India Hydrogen Peroxide Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Hydrogen Peroxide Market Share (%) by Company 2024

List of Tables

- Table 1: India Hydrogen Peroxide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Hydrogen Peroxide Market Revenue Million Forecast, by Product Function 2019 & 2032

- Table 3: India Hydrogen Peroxide Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: India Hydrogen Peroxide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Hydrogen Peroxide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Hydrogen Peroxide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Hydrogen Peroxide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Hydrogen Peroxide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Hydrogen Peroxide Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Hydrogen Peroxide Market Revenue Million Forecast, by Product Function 2019 & 2032

- Table 11: India Hydrogen Peroxide Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: India Hydrogen Peroxide Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Hydrogen Peroxide Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the India Hydrogen Peroxide Market?

Key companies in the market include Arkema, Solvay*List Not Exhaustive, RXCHEMICALS, National Peroxide Limited, Evonik Industries AG, Chemplast Sanmar Limited, Indian Peroxide Limited, PCIPL (Prakash Chemicals International Private Limited), Hindustan Organic Chemicals Ltd (HOCL), Aditya Birla Chemicals, Gujarat Alkalies and Chemical Limited, Meghmani Finechem Limited (MFL), AkzoNobel NV.

3. What are the main segments of the India Hydrogen Peroxide Market?

The market segments include Product Function, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Utilization in the Food Processing Industry; Application in the Paper and Pulp Industry; Other Drivers.

6. What are the notable trends driving market growth?

Paper and Pulp Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Health Hazards Associated with Long-term Exposure of Hydrogen Peroxide; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Hydrogen Peroxide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Hydrogen Peroxide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Hydrogen Peroxide Market?

To stay informed about further developments, trends, and reports in the India Hydrogen Peroxide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence