Key Insights

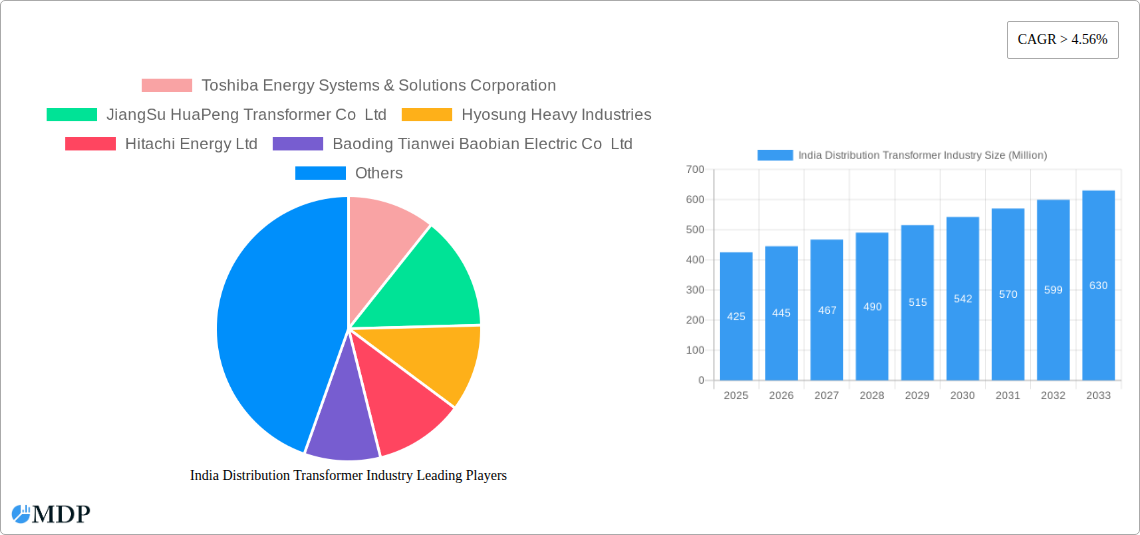

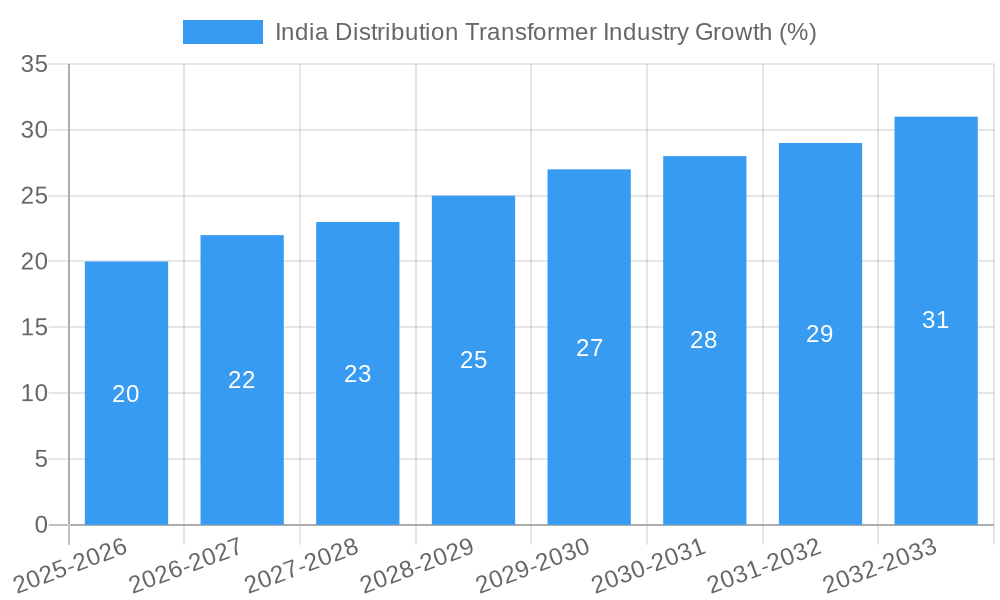

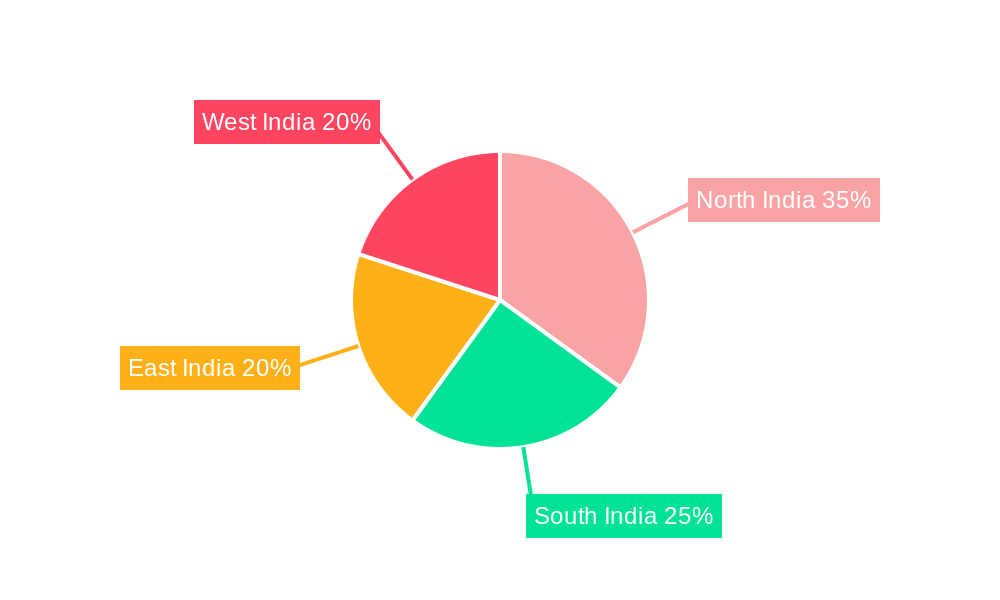

The India distribution transformer market, valued at approximately ₹35 billion (USD 425 million) in 2025, is experiencing robust growth, projected to expand at a CAGR of over 4.56% from 2025 to 2033. This expansion is fueled by several key drivers: India's burgeoning electrification initiatives reaching rural areas, rapid industrialization and urbanization leading to increased electricity demand, and the government's focus on improving the country's aging power infrastructure. The increasing adoption of smart grid technologies and the shift towards renewable energy integration are further bolstering market growth. Market segmentation reveals a significant demand for transformers in the 500 kVA - 2500 kVA capacity range, driven by industrial and commercial applications. Dry-type transformers are gaining traction due to their enhanced safety features and environmental benefits. Pad-mounted transformers dominate the mounting type segment, offering ease of installation and maintenance. Three-phase transformers constitute the majority of the market share, reflecting the prevalence of three-phase power systems in India. However, challenges remain, including supply chain disruptions, potential price fluctuations of raw materials like steel and copper, and the need for continuous technological advancements to enhance efficiency and reliability. Key players like Toshiba, Hitachi, and Schneider Electric are strategically investing in R&D and expanding their distribution networks to capitalize on this growing market. Regional variations exist, with North and West India exhibiting stronger growth prospects due to higher infrastructure development activities.

The forecast period (2025-2033) anticipates a steady increase in market size, primarily driven by government investments in infrastructure projects and a rising demand for electricity across all sectors. This growth, however, might be influenced by macroeconomic factors and global supply chain dynamics. The competitive landscape remains dynamic, with both domestic and international players vying for market share. Future success will hinge on companies' ability to innovate, offer cost-effective solutions, and adapt to evolving regulatory norms. The market is expected to see increased focus on energy efficiency standards, leading to higher adoption of advanced transformer technologies. The focus on smart grids and renewable energy integration is poised to reshape the distribution transformer market in India in the coming years, demanding solutions that are smart, reliable, and sustainable.

India Distribution Transformer Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the India distribution transformer industry, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this report projects robust growth driven by expanding energy infrastructure and rising electricity demand. The report segments the market by capacity (Below 500 kVA, 500 kVA - 2500 kVA, Above 2500 kVA), type (Oil-filled, Dry Type), mounting type (Pad-mounted, Pole-mounted), and phase (Single Phase, Three Phase), offering granular market sizing and forecasting. Key players like Toshiba Energy Systems & Solutions Corporation, Jiangsu HuaPeng Transformer Co Ltd, and others are analyzed for their market share and strategic moves.

Keywords: India Distribution Transformer Market, Distribution Transformer Market Size, Distribution Transformer Industry, Transformer Market India, Power Transformer Market, Oil-filled Transformer, Dry-type Transformer, Pad-mounted Transformer, Pole-mounted Transformer, Single-Phase Transformer, Three-Phase Transformer, CAGR, Market Share, Market Forecast, Industry Trends, Competitive Landscape

India Distribution Transformer Industry Market Dynamics & Concentration

The Indian distribution transformer market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller domestic players ensures a competitive environment. Market concentration is influenced by factors including economies of scale in manufacturing, access to advanced technologies, and strong distribution networks. Innovation is primarily driven by the need for improved efficiency, enhanced reliability, and the integration of smart grid technologies. Stringent regulatory frameworks, including safety standards and environmental regulations, play a crucial role in shaping industry practices. The increasing adoption of dry-type transformers as a substitute for oil-filled transformers due to safety and environmental concerns is impacting market dynamics. End-user trends, particularly towards renewable energy integration and smart grid deployment, are key growth drivers. Recent years have witnessed a moderate level of M&A activity, with approximately xx deals in the last five years, indicating consolidation trends within the sector. Leading players are focusing on strategic acquisitions to expand their product portfolios and geographic reach. The market share of the top 5 players is estimated at xx% in 2025.

India Distribution Transformer Industry Industry Trends & Analysis

The Indian distribution transformer market is poised for significant growth, driven by rapid urbanization, industrialization, and government initiatives aimed at enhancing the country's power infrastructure. The market experienced a CAGR of xx% during 2019-2024 and is projected to grow at a CAGR of xx% during 2025-2033, reaching a market value of xx Million by 2033. Technological disruptions, such as the adoption of smart grid technologies and digitalization, are transforming industry practices. Consumer preferences are shifting towards energy-efficient and environmentally friendly transformers, driving demand for dry-type and other advanced transformer designs. Competitive dynamics are characterized by intense price competition, particularly in the lower capacity segments. The market penetration of smart grid-enabled transformers remains relatively low but is expected to increase significantly in the coming years driven by government incentives and smart city initiatives. This growth is further fueled by increasing demand for reliable power supply in rural areas and the expansion of the renewable energy sector.

Leading Markets & Segments in India Distribution Transformer Industry

The Northern and Western regions of India dominate the distribution transformer market due to higher electricity consumption and robust infrastructure development. The 500 kVA - 2500 kVA capacity segment holds the largest market share, driven by its suitability for a wide range of applications. Oil-filled transformers remain the most prevalent type, although the adoption of dry-type transformers is gaining traction. Pad-mounted transformers are more widely used compared to pole-mounted transformers in urban areas. Three-phase transformers account for the majority of market share, reflecting the predominance of three-phase power distribution systems.

- Key Drivers for Dominant Segments:

- 500 kVA - 2500 kVA Capacity Segment: This segment caters to the majority of industrial and commercial applications.

- Oil-filled Transformers: Established technology with cost advantages.

- Pad-mounted Transformers: Suitable for urban areas with limited space.

- Three-Phase Transformers: Aligns with the prevailing power distribution infrastructure.

- Government policies promoting infrastructure development and renewable energy integration.

- Economic growth and industrial expansion fueling electricity demand.

The continued expansion of the electricity grid, coupled with government initiatives to improve power distribution, will further solidify the dominance of these segments in the coming years.

India Distribution Transformer Industry Product Developments

Recent product innovations focus on enhancing efficiency, reliability, and environmental sustainability. Manufacturers are introducing advanced cooling systems, improved insulation materials, and smart grid compatible features. The integration of digital sensors and monitoring systems enables predictive maintenance and optimizes operational efficiency. Dry-type transformers are gaining popularity due to their enhanced safety features and reduced environmental impact compared to oil-filled counterparts. These innovations cater to the increasing demand for reliable and sustainable power solutions.

Key Drivers of India Distribution Transformer Industry Growth

Several factors fuel the growth of the Indian distribution transformer industry. The government's emphasis on rural electrification and infrastructure development is a major driver. The rapid expansion of the renewable energy sector necessitates a robust distribution network. Technological advancements, such as the development of energy-efficient transformers and smart grid technologies, are also crucial. Economic growth and industrialization further increase the demand for reliable power supply. For example, the government's initiatives under the Smart Cities Mission are driving substantial investment in upgrading power distribution infrastructure.

Challenges in the India Distribution Transformer Industry Market

The industry faces challenges such as fluctuating raw material prices, which impact production costs. The complex regulatory landscape and obtaining necessary approvals can create delays. Intense competition, particularly from domestic players, keeps profit margins under pressure. Supply chain disruptions and the availability of skilled labor are also potential constraints. These factors contribute to the overall complexity of operating within this market. The impact of these challenges is estimated to reduce the market growth by approximately xx% in the forecast period.

Emerging Opportunities in India Distribution Transformer Industry

Long-term growth hinges on embracing technological advancements. Strategic partnerships with renewable energy companies and grid operators present significant opportunities. Expanding into underserved regions and tapping into the growing demand for smart grid solutions offers further potential. Innovative financing models and exploring export markets can unlock additional growth avenues for industry players. The integration of IoT and AI in transformer management will create new opportunities in the coming years.

Leading Players in the India Distribution Transformer Industry Sector

- Toshiba Energy Systems & Solutions Corporation

- Jiangsu HuaPeng Transformer Co Ltd

- Hyosung Heavy Industries

- Hitachi Energy Ltd

- Baoding Tianwei Baobian Electric Co Ltd

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Siemens Energy AG

- CG Power and Industrial Solutions Ltd

- Bharat Heavy Electricals Limited

*List Not Exhaustive

Key Milestones in India Distribution Transformer Industry Industry

- December 2021: The Transformers & Rectifiers India Ltd. secured orders worth INR 72 crore (approximately xx Million) for distribution transformers from Gujarat Energy Transmission Corporation (GETCO). This highlights the growing demand for transformers in the power distribution sector.

- December 2021: Tata Power Delhi Distribution Ltd (DDL), in collaboration with Toshiba Transmission & Distribution Systems (India) Pvt. Ltd, installed a 630 kVA submersible distribution transformer in New Delhi. This innovative solution demonstrates technological advancements in the industry.

Strategic Outlook for India Distribution Transformer Industry Market

The Indian distribution transformer market exhibits significant long-term growth potential. Continued infrastructure development, increasing urbanization, and the expansion of the renewable energy sector will drive demand. Strategic partnerships, technological innovation, and efficient supply chain management will be crucial for players to capitalize on these opportunities. The focus on smart grid technologies and energy efficiency will shape the future of the industry. Expanding into rural electrification projects will also create significant market opportunities.

India Distribution Transformer Industry Segmentation

-

1. Capacity

- 1.1. Below 500 kVA

- 1.2. 500 kVA - 2500 kVA

- 1.3. Above 2500 kVA

-

2. Type

- 2.1. Oil-filled

- 2.2. Dry Type

-

3. Mounting Type

- 3.1. Pad-mounted

- 3.2. Pole-mounted

-

4. Phase

- 4.1. Single Phase

- 4.2. Three Phase

India Distribution Transformer Industry Segmentation By Geography

- 1. India

India Distribution Transformer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; High Electricity Demand from Industries4.; Enhancement in Economic Activities

- 3.3. Market Restrains

- 3.3.1. 4.; The Complex Maintenance Process of Components And the Emergence of Toxic Wastes that Affect the Environment

- 3.4. Market Trends

- 3.4.1. Below 500 kVA Capacity to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Distribution Transformer Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 5.1.1. Below 500 kVA

- 5.1.2. 500 kVA - 2500 kVA

- 5.1.3. Above 2500 kVA

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Oil-filled

- 5.2.2. Dry Type

- 5.3. Market Analysis, Insights and Forecast - by Mounting Type

- 5.3.1. Pad-mounted

- 5.3.2. Pole-mounted

- 5.4. Market Analysis, Insights and Forecast - by Phase

- 5.4.1. Single Phase

- 5.4.2. Three Phase

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Capacity

- 6. North India India Distribution Transformer Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Distribution Transformer Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Distribution Transformer Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Distribution Transformer Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Toshiba Energy Systems & Solutions Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 JiangSu HuaPeng Transformer Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Hyosung Heavy Industries

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hitachi Energy Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Baoding Tianwei Baobian Electric Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mitsubishi Electric Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Schneider Electric SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Siemens Energy AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 CG Power and Industrial Solutions Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bharat Heavy Electricals Limited*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Toshiba Energy Systems & Solutions Corporation

List of Figures

- Figure 1: India Distribution Transformer Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Distribution Transformer Industry Share (%) by Company 2024

List of Tables

- Table 1: India Distribution Transformer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Distribution Transformer Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: India Distribution Transformer Industry Revenue Million Forecast, by Capacity 2019 & 2032

- Table 4: India Distribution Transformer Industry Volume K Units Forecast, by Capacity 2019 & 2032

- Table 5: India Distribution Transformer Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 6: India Distribution Transformer Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 7: India Distribution Transformer Industry Revenue Million Forecast, by Mounting Type 2019 & 2032

- Table 8: India Distribution Transformer Industry Volume K Units Forecast, by Mounting Type 2019 & 2032

- Table 9: India Distribution Transformer Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 10: India Distribution Transformer Industry Volume K Units Forecast, by Phase 2019 & 2032

- Table 11: India Distribution Transformer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 12: India Distribution Transformer Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 13: India Distribution Transformer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Distribution Transformer Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 15: North India India Distribution Transformer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: North India India Distribution Transformer Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: South India India Distribution Transformer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South India India Distribution Transformer Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: East India India Distribution Transformer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: East India India Distribution Transformer Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: West India India Distribution Transformer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: West India India Distribution Transformer Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: India Distribution Transformer Industry Revenue Million Forecast, by Capacity 2019 & 2032

- Table 24: India Distribution Transformer Industry Volume K Units Forecast, by Capacity 2019 & 2032

- Table 25: India Distribution Transformer Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: India Distribution Transformer Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 27: India Distribution Transformer Industry Revenue Million Forecast, by Mounting Type 2019 & 2032

- Table 28: India Distribution Transformer Industry Volume K Units Forecast, by Mounting Type 2019 & 2032

- Table 29: India Distribution Transformer Industry Revenue Million Forecast, by Phase 2019 & 2032

- Table 30: India Distribution Transformer Industry Volume K Units Forecast, by Phase 2019 & 2032

- Table 31: India Distribution Transformer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: India Distribution Transformer Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Distribution Transformer Industry?

The projected CAGR is approximately > 4.56%.

2. Which companies are prominent players in the India Distribution Transformer Industry?

Key companies in the market include Toshiba Energy Systems & Solutions Corporation, JiangSu HuaPeng Transformer Co Ltd, Hyosung Heavy Industries, Hitachi Energy Ltd, Baoding Tianwei Baobian Electric Co Ltd, Mitsubishi Electric Corporation, Schneider Electric SE, Siemens Energy AG, CG Power and Industrial Solutions Ltd, Bharat Heavy Electricals Limited*List Not Exhaustive.

3. What are the main segments of the India Distribution Transformer Industry?

The market segments include Capacity, Type, Mounting Type, Phase.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; High Electricity Demand from Industries4.; Enhancement in Economic Activities.

6. What are the notable trends driving market growth?

Below 500 kVA Capacity to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; The Complex Maintenance Process of Components And the Emergence of Toxic Wastes that Affect the Environment.

8. Can you provide examples of recent developments in the market?

In December 2021, The Transformers & Rectifiers India Ltd. was awarded orders of various transformers, including distribution transformers, for the total contract value of INR 72 crore from Gujarat Energy Transmission Corporation (GETCO).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Distribution Transformer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Distribution Transformer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Distribution Transformer Industry?

To stay informed about further developments, trends, and reports in the India Distribution Transformer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence