Key Insights

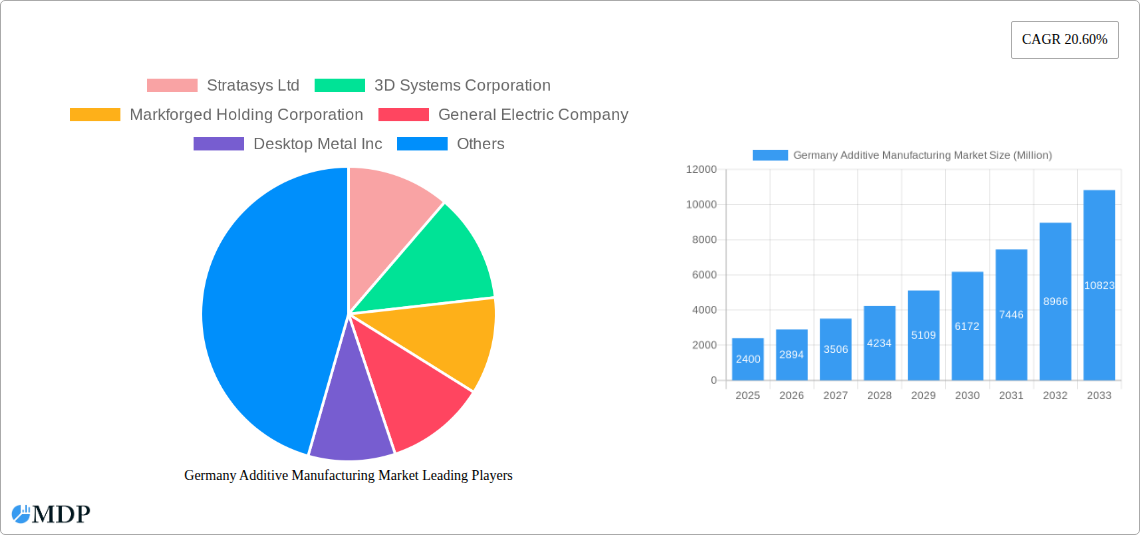

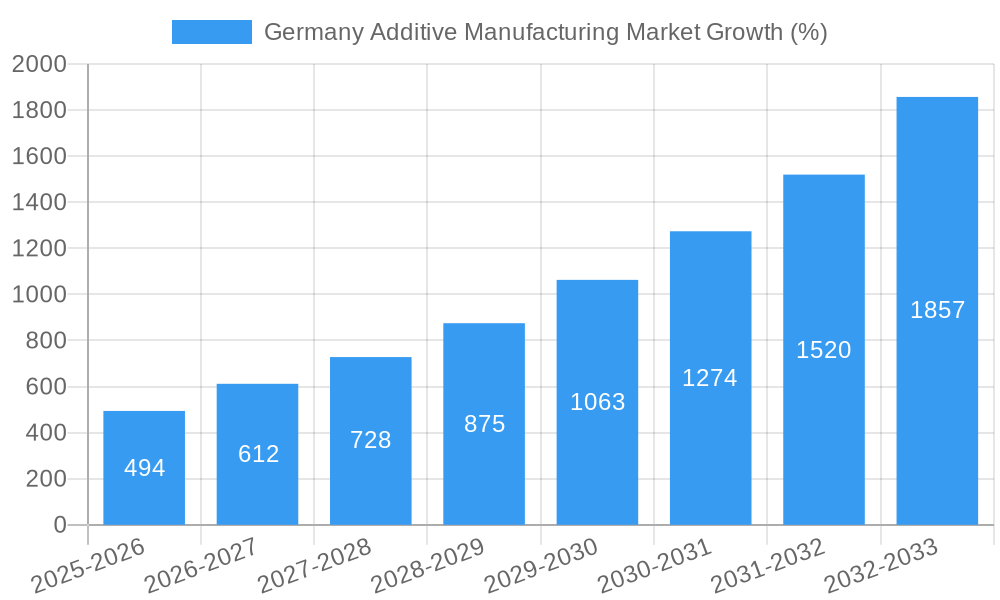

The German additive manufacturing (AM) market is experiencing robust growth, driven by increasing adoption across diverse sectors like automotive, aerospace, and medical devices. The market, valued at approximately €2.4 billion in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) of 20.6% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the rising demand for customized and lightweight components is pushing manufacturers to adopt AM technologies for improved efficiency and reduced material waste. Secondly, advancements in AM technologies, particularly in materials science and printing speeds, are broadening the range of applications and improving the quality of produced parts. Furthermore, government initiatives promoting technological innovation and industrial digitization within Germany are fostering a favorable environment for AM market growth. Key players like Stratasys, 3D Systems, and EOS are actively contributing to this expansion through continuous innovation and strategic partnerships. However, challenges such as high initial investment costs, skilled labor shortages, and concerns surrounding material consistency and scalability continue to pose some restraints to the market's overall growth.

Despite these restraints, the long-term outlook for the German AM market remains positive. The increasing focus on sustainability and the growing adoption of Industry 4.0 principles are further expected to boost demand for AM technologies. The market segmentation will likely see continued growth in the aerospace and medical device sectors, given their high demand for complex, customized parts. Furthermore, emerging applications in areas such as personalized medicine and consumer products are anticipated to significantly contribute to the market's expansion during the forecast period. The continued focus on research and development by both established players and innovative startups within Germany will further propel this dynamic market forward.

Germany Additive Manufacturing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany Additive Manufacturing (AM) market, encompassing market dynamics, industry trends, leading players, and future growth prospects. Covering the period 2019-2033, with a base year of 2025, this report is an indispensable resource for industry stakeholders, investors, and strategic decision-makers seeking actionable insights into this rapidly evolving sector. The German AM market, valued at xx Million in 2025, is projected to experience significant growth, reaching xx Million by 2033, exhibiting a CAGR of xx%.

Germany Additive Manufacturing Market Market Dynamics & Concentration

The German additive manufacturing market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is moderately high, with several key players holding significant market share, while numerous smaller companies cater to niche segments. However, the market exhibits signs of consolidation, fueled by mergers and acquisitions (M&A) activities. Between 2019 and 2024, approximately xx M&A deals were recorded, indicating a trend of larger players acquiring smaller firms to expand their technological capabilities and market reach. Innovation is a key driver, with continuous advancements in 3D printing technologies such as selective laser melting (SLM), binder jetting, and material jetting leading to enhanced production efficiency and expanded application possibilities. The German government's supportive regulatory framework, emphasizing technological advancement and industrial competitiveness, further fuels market growth. While traditional manufacturing processes remain prevalent, AM is increasingly adopted for prototyping, tooling, and end-use part production, driven by the need for customized solutions and shorter lead times. The competitive landscape is further shaped by the availability of substitute technologies, though AM's unique advantages in customization and complex geometry creation often provide a compelling alternative. End-user trends show increasing adoption across diverse sectors, including automotive, aerospace, healthcare, and consumer goods.

- Market Share of Top 5 Players: xx% (2024)

- Number of M&A Deals (2019-2024): xx

- Key Innovation Drivers: Material Development, Process Optimization, Software Advancements

Germany Additive Manufacturing Market Industry Trends & Analysis

The German additive manufacturing market demonstrates strong growth momentum, driven by several key factors. Technological advancements, notably in high-speed printing and multi-material capabilities, are significantly expanding the applications of AM. Consumer preferences are shifting towards customized and personalized products, creating a lucrative niche for AM technologies. The increasing adoption of Industry 4.0 principles and digitalization initiatives is also fostering the integration of AM into smart manufacturing ecosystems. However, competitive dynamics are intensifying as new players enter the market, creating pressures on pricing and margins. The rising demand for lightweight and high-strength components in various industries is propelling market growth, particularly within the aerospace and automotive sectors. The market penetration of AM is increasing across several applications, including tooling, prototyping, and end-use parts manufacturing. This trend is fueled by the growing demand for rapid prototyping, mass customization, and on-demand manufacturing.

- CAGR (2025-2033): xx%

- Market Penetration in Automotive Sector (2024): xx%

- Market Penetration in Aerospace Sector (2024): xx%

Leading Markets & Segments in Germany Additive Manufacturing Market

The German additive manufacturing market is geographically diverse, with robust growth across major industrial hubs and regions. While specific regional data needs further analysis for precise breakdowns, we can highlight the importance of areas like Baden-Württemberg and Bavaria as prominent centers for AM activity due to their strong manufacturing base and concentration of technology companies. These regions also benefit from substantial government support for technological advancement and skilled workforce development.

- Key Drivers in Leading Regions:

- Strong manufacturing base and industrial clusters.

- Government incentives and funding for research and development.

- Presence of skilled workforce and specialized institutions.

- Well-established supply chains and infrastructure.

The most dominant segments within the German AM market include aerospace, automotive, and medical. These sectors are driving growth due to the unique advantages AM offers in producing complex geometries, lightweight components, and personalized medical devices. The automotive industry leverages AM for rapid prototyping, tooling, and specialized parts, while the aerospace sector utilizes it for producing lightweight and high-strength components. Within the medical sector, AM is revolutionizing the production of personalized implants and surgical tools. Further segmentation data requires additional research and will be updated in future iterations of this report.

Germany Additive Manufacturing Market Product Developments

Recent years have witnessed significant product innovations in the German AM market, reflecting the industry's commitment to technological advancement. New materials with enhanced properties, such as high-temperature polymers and metal alloys, have broadened the applications of AM. Improved software and hardware solutions have enhanced printing speeds, precision, and automation capabilities. Furthermore, the development of hybrid manufacturing processes, which combine AM with traditional techniques, is opening up new possibilities for producing complex and high-value components. These developments are enhancing the competitive advantages of AM by offering greater flexibility, faster turnaround times, and reduced costs.

Key Drivers of Germany Additive Manufacturing Market Growth

Several factors are driving the growth of the German additive manufacturing market. Technological advancements, including the development of new materials and printing processes, are expanding the capabilities and applications of AM. Economic incentives, such as government subsidies and tax breaks, are stimulating investment in AM technologies. The supportive regulatory framework, which promotes innovation and industrial competitiveness, also plays a significant role in driving market growth. Increasing demand for customized and personalized products further fuels market expansion. The rising adoption of digital manufacturing technologies is facilitating the integration of AM into smart factories and Industry 4.0 ecosystems.

Challenges in the Germany Additive Manufacturing Market Market

Despite its significant growth potential, the German AM market faces several challenges. Regulatory hurdles related to material certification and product safety can hinder market expansion. Supply chain disruptions, particularly concerning specialized materials and equipment, can impact production efficiency and lead times. Intense competitive pressure, with both established players and new entrants vying for market share, can affect pricing and profitability. The relatively high cost of AM equipment compared to traditional manufacturing processes can limit its adoption by smaller companies. The skilled labor shortage in certain areas also impacts productivity.

Emerging Opportunities in Germany Additive Manufacturing Market

Several emerging trends offer significant opportunities for long-term growth in the German AM market. Technological breakthroughs, such as advancements in multi-material printing and high-speed manufacturing processes, are creating new market opportunities. Strategic partnerships between AM technology providers and end-use industries are fostering innovation and driving market adoption. The expansion of AM applications into new sectors, such as construction and energy, is generating considerable growth potential. The increasing focus on sustainability and environmentally friendly manufacturing processes is driving the development of eco-friendly AM materials and technologies.

Leading Players in the Germany Additive Manufacturing Market Sector

- Stratasys Ltd

- 3D Systems Corporation

- Markforged Holding Corporation

- General Electric Company

- Desktop Metal Inc

- EOS GmBH

- Fraunhofer IGCV

- SLM Solutions

- Protolabs

- Shapeway Holdings Inc

- Velo3D Inc

- *List Not Exhaustive

Key Milestones in Germany Additive Manufacturing Market Industry

- July 2024: BASF's Forward AM division was formed, consolidating its additive manufacturing business, including Sculpteo. This enhances customer support and market responsiveness.

- June 2024: Quantica secured EUR 19.7 Million in Series A funding, boosting its growth and market presence.

- March 2024: Gefertec GmbH launched the arc80X WAAM machine, offering customizable functionalities to meet diverse customer needs.

Strategic Outlook for Germany Additive Manufacturing Market Market

The future of the German additive manufacturing market looks promising, with considerable growth potential driven by technological advancements, increasing industry adoption, and supportive government policies. Strategic partnerships, further investments in R&D, and expansion into new applications will be key to unlocking the full potential of this transformative technology. The market's continued evolution toward sustainable and eco-friendly manufacturing practices will further solidify its position as a vital component of Germany's advanced manufacturing landscape.

Germany Additive Manufacturing Market Segmentation

-

1. Component

-

1.1. Hardware

-

1.1.1. By Technology

- 1.1.1.1. Extrusion

- 1.1.1.2. Vat Photopolymerization

- 1.1.1.3. Powder Bed Fusion

- 1.1.1.4. Material Jetting

- 1.1.1.5. Others (DED and Binder Jetting)

-

1.1.1. By Technology

-

1.2. Materials

- 1.2.1. Metal

- 1.2.2. Polymers

- 1.2.3. Ceramics and Construction

- 1.3. Services

-

1.1. Hardware

-

2. End User Industry

- 2.1. Automotive

- 2.2. Aerospace & Defense

- 2.3. Healthcare

- 2.4. Electronics

- 2.5. Construction and Other Emerging Industries

Germany Additive Manufacturing Market Segmentation By Geography

- 1. Germany

Germany Additive Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Manufacturing Sector in the Country; Rising Government Stringent Laws Towards Carbon Emission

- 3.3. Market Restrains

- 3.3.1. Growing Manufacturing Sector in the Country; Rising Government Stringent Laws Towards Carbon Emission

- 3.4. Market Trends

- 3.4.1. Metals are Expected to Observe a Considerable Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Additive Manufacturing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.1.1. By Technology

- 5.1.1.1.1. Extrusion

- 5.1.1.1.2. Vat Photopolymerization

- 5.1.1.1.3. Powder Bed Fusion

- 5.1.1.1.4. Material Jetting

- 5.1.1.1.5. Others (DED and Binder Jetting)

- 5.1.1.1. By Technology

- 5.1.2. Materials

- 5.1.2.1. Metal

- 5.1.2.2. Polymers

- 5.1.2.3. Ceramics and Construction

- 5.1.3. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace & Defense

- 5.2.3. Healthcare

- 5.2.4. Electronics

- 5.2.5. Construction and Other Emerging Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Stratasys Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3D Systems Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Markforged Holding Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Electric Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Desktop Metal Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EOS GmBH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fraunhofer IGCV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SLM Solutions

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Protolabs

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Shapeway Holdings Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Velo3D Inc *List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Stratasys Ltd

List of Figures

- Figure 1: Germany Additive Manufacturing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Additive Manufacturing Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Additive Manufacturing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Additive Manufacturing Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Germany Additive Manufacturing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Germany Additive Manufacturing Market Volume Billion Forecast, by Component 2019 & 2032

- Table 5: Germany Additive Manufacturing Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 6: Germany Additive Manufacturing Market Volume Billion Forecast, by End User Industry 2019 & 2032

- Table 7: Germany Additive Manufacturing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Germany Additive Manufacturing Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Germany Additive Manufacturing Market Revenue Million Forecast, by Component 2019 & 2032

- Table 10: Germany Additive Manufacturing Market Volume Billion Forecast, by Component 2019 & 2032

- Table 11: Germany Additive Manufacturing Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: Germany Additive Manufacturing Market Volume Billion Forecast, by End User Industry 2019 & 2032

- Table 13: Germany Additive Manufacturing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Germany Additive Manufacturing Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Additive Manufacturing Market?

The projected CAGR is approximately 20.60%.

2. Which companies are prominent players in the Germany Additive Manufacturing Market?

Key companies in the market include Stratasys Ltd, 3D Systems Corporation, Markforged Holding Corporation, General Electric Company, Desktop Metal Inc, EOS GmBH, Fraunhofer IGCV, SLM Solutions, Protolabs, Shapeway Holdings Inc, Velo3D Inc *List Not Exhaustive.

3. What are the main segments of the Germany Additive Manufacturing Market?

The market segments include Component, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Manufacturing Sector in the Country; Rising Government Stringent Laws Towards Carbon Emission.

6. What are the notable trends driving market growth?

Metals are Expected to Observe a Considerable Growth.

7. Are there any restraints impacting market growth?

Growing Manufacturing Sector in the Country; Rising Government Stringent Laws Towards Carbon Emission.

8. Can you provide examples of recent developments in the market?

July 2024: BASF's Forward AM division took over BASF's additive manufacturing business, which includes the Sculpteo service. The division will operate under the name Forward AM Technologies. Backed by BASF, this strategic move seeks to enhance customer support and market responsiveness. The company will continue to offer its solutions and services to its strong customer base across the globe.June 2024: Quantica successfully raised its Series A funding, totaling EUR 19.7 million. The funding extension was spearheaded by West Hill Capital, a British private equity and venture capital firm. They were joined by a family-owned company from the dental sector, Quantica's management team, and Big Bang Angels, a venture capital firm from Korea.March 2024: Gefertec GmbH unveiled its arc80X Wire Arc Additive Manufacturing (WAAM) machine, which supports a range of welding systems from various manufacturers. This feature empowers customers to tailor the machine to their specific needs. Furthermore, this adaptability means the machine can be upgraded or modified should customers decide to incorporate new functionalities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Additive Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Additive Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Additive Manufacturing Market?

To stay informed about further developments, trends, and reports in the Germany Additive Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence