Key Insights

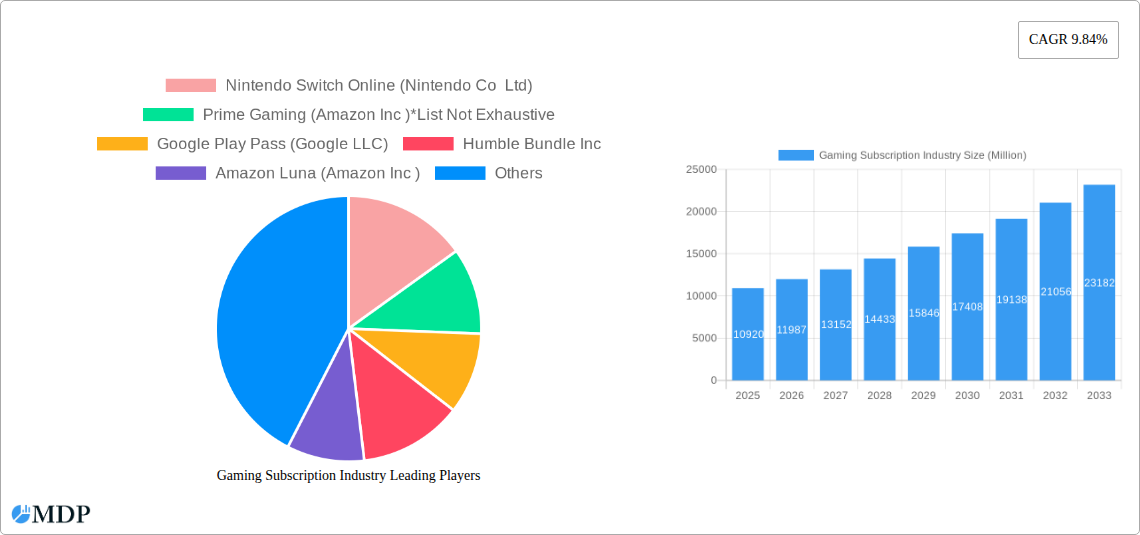

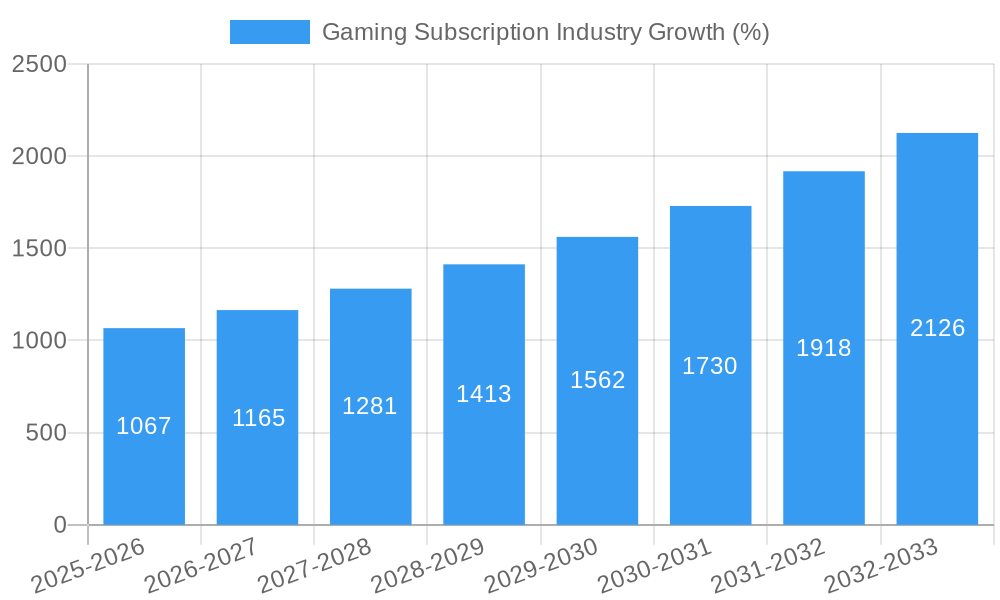

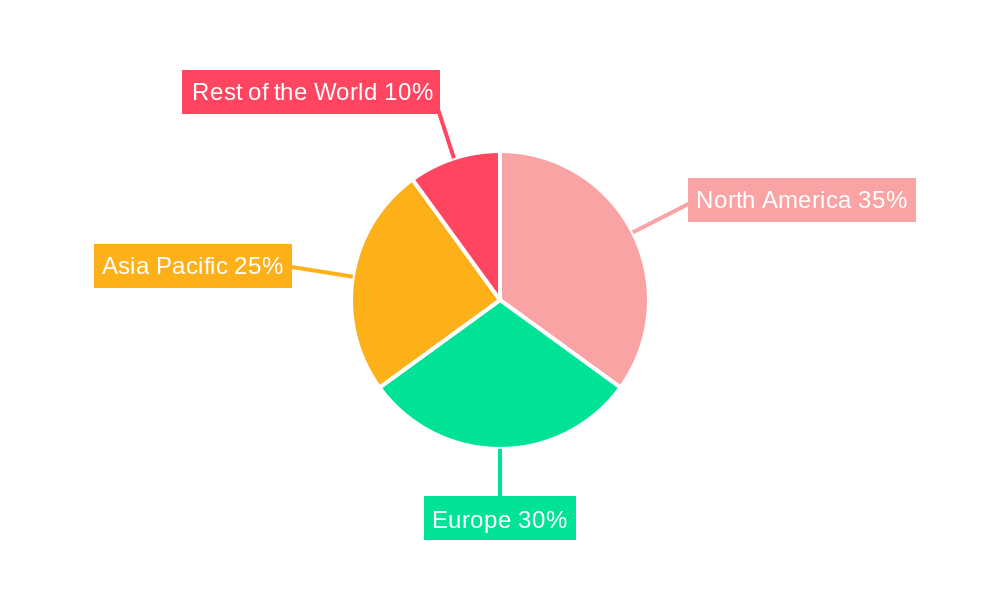

The global gaming subscription market, valued at $10.92 billion in 2025, is experiencing robust growth, projected to expand significantly by 2033. A compound annual growth rate (CAGR) of 9.84% indicates a consistently expanding market driven by several key factors. The increasing popularity of cloud gaming, offering seamless access to high-quality games across various devices, is a major catalyst. This is further fueled by the rising adoption of mobile gaming, particularly among younger demographics, and the growing demand for convenient and cost-effective access to a diverse gaming library. Subscription services provide this convenience, offering value for money compared to individual game purchases. Competitive pricing strategies employed by major players like Microsoft (Xbox Game Pass), Sony (PlayStation Now), and Nintendo (Nintendo Switch Online) contribute significantly to market growth. The segment breakdown reveals mobile gaming as a substantial revenue contributor, reflecting the widespread accessibility of smartphones and tablets. While PC-based and console gaming maintain significant market shares, the mobile segment's rapid growth indicates a shift in consumer preferences and gaming habits. Geographic analysis suggests North America and Europe as mature markets, while the Asia-Pacific region shows high growth potential, driven by rising disposable incomes and increasing internet penetration. The continued evolution of game technology and the expansion of high-speed internet infrastructure are expected to further propel the market's trajectory in the coming years.

The competitive landscape is characterized by both established giants and emerging players, leading to continuous innovation in subscription models and game offerings. The integration of social features, exclusive content, and early access to new releases are key competitive differentiators. The industry is expected to witness further consolidation through mergers and acquisitions as companies strive for market share dominance. Potential challenges include the increasing cost of developing high-quality games, the need for continuous content updates to retain subscribers, and managing the complexities of global distribution and regulatory compliance. Nevertheless, the overall outlook for the gaming subscription market remains positive, promising strong growth and substantial revenue generation throughout the forecast period. The market's sustained growth is expected to be driven by a continuous increase in game quality, the emergence of new gaming platforms, and the ever-growing demand for convenient and affordable access to a vast library of games.

Gaming Subscription Industry Market Report: 2019-2033

Dive into the dynamic world of gaming subscriptions with this comprehensive market report, projecting a multi-billion dollar industry by 2033. This in-depth analysis covers key market trends, leading players (including Nintendo Switch Online, Prime Gaming, Google Play Pass, and more), and future growth opportunities. The report uses data from 2019-2024 (historical period), with a base year of 2025 and a forecast period extending to 2033. The study period spans from 2019 to 2033. Projected revenue figures are in Millions.

Gaming Subscription Industry Market Dynamics & Concentration

The gaming subscription market exhibits a moderately concentrated landscape, with several major players vying for market share. Key drivers of innovation include advancements in cloud gaming technology, the increasing popularity of mobile gaming, and the ongoing pursuit of enhanced user experiences. Regulatory frameworks, while evolving, generally favor market competition, though regional variations exist. Product substitutes, such as individual game purchases, still pose competition, but the convenience and value proposition of subscription services are driving significant market penetration. End-user trends point toward a preference for curated content libraries and cross-platform compatibility. Mergers and acquisitions (M&A) activity has been moderate, with xx deals recorded between 2020 and 2024, primarily focused on strengthening content libraries and expanding into new geographical markets. Market share is currently dominated by a few key players, with the top 5 holding approximately xx% of the market.

Gaming Subscription Industry Industry Trends & Analysis

The gaming subscription market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is fueled by several factors, including rising smartphone penetration, particularly in emerging markets, improved internet infrastructure, and the increasing affordability of gaming subscriptions. Technological disruptions, such as the advancement of cloud gaming and the development of more immersive VR/AR experiences, are further accelerating market expansion. Consumer preferences are shifting towards flexible, on-demand access to a vast library of games, rather than individual game purchases. This trend, combined with intense competition among industry giants, is driving down prices and enhancing the value proposition for subscribers. Market penetration is expected to reach xx% globally by 2033.

Leading Markets & Segments in Gaming Subscription Industry

The global gaming subscription market is characterized by regional variations in growth trajectories. North America and Europe currently dominate the market, accounting for approximately xx% of the global revenue in 2024. However, Asia-Pacific is poised for significant expansion, driven by increasing smartphone adoption and rising disposable incomes.

Key Drivers:

- North America & Europe: Strong gaming culture, high internet penetration, and high disposable income.

- Asia-Pacific: Rapid smartphone adoption, expanding internet access, and growing interest in esports.

Segment Dominance:

- Mobile Gaming: Mobile gaming subscription services are witnessing the fastest growth, driven by high smartphone penetration and easy accessibility. This segment is projected to contribute xx Million in revenue by 2033.

- Console Gaming: Remains a significant segment, benefiting from established user bases and the release of new consoles. However, its growth rate is moderate compared to mobile gaming.

- PC-based Gaming: This segment has a strong and established audience, showing steady growth supported by the increasing popularity of PC gaming tournaments and streaming.

Gaming Subscription Industry Product Developments

Recent product innovations center around enhanced cloud gaming capabilities, offering seamless cross-platform play and improved streaming quality. Companies are focusing on developing personalized recommendation engines and social features to boost user engagement. These advancements contribute to a more streamlined and enjoyable user experience, strengthening the competitive advantages of subscription services.

Key Drivers of Gaming Subscription Industry Growth

The growth of the gaming subscription industry is driven by a confluence of factors:

- Technological advancements: Cloud gaming technologies are reducing barriers to entry and expanding accessibility.

- Economic factors: The affordability of subscription models compared to individual game purchases is attracting a broader audience.

- Regulatory support: Favourable regulatory environments in many regions are fostering market growth.

Challenges in the Gaming Subscription Industry Market

The gaming subscription market faces challenges, including:

- Intense competition: The market is highly competitive, with established players and emerging entrants vying for market share.

- Content acquisition costs: Securing high-quality gaming content can be expensive, impacting profitability.

- Network infrastructure limitations: Reliable internet access remains a barrier in many regions, hindering growth.

Emerging Opportunities in Gaming Subscription Industry

Significant growth opportunities exist through strategic partnerships with game developers, expansion into emerging markets, and integration with virtual reality (VR) and augmented reality (AR) technologies. Further innovation in cloud gaming and personalized content recommendations will unlock substantial long-term growth potential.

Leading Players in the Gaming Subscription Industry Sector

- Nintendo Switch Online (Nintendo Co Ltd)

- Prime Gaming (Amazon Inc)

- Google Play Pass (Google LLC)

- Humble Bundle Inc

- Amazon Luna (Amazon Inc)

- PlayStation Now (Sony Corporation)

- EA Play (Electronic Arts Inc)

- Tencent Holdings Ltd

- Uplay Pass (Ubisoft)

- Xbox (Game Pass) (Microsoft Corporation)

- Epic games Inc

- GeForce Now (NVIDIA)

- Apple Arcade (Apple Inc)

Key Milestones in Gaming Subscription Industry Industry

- March 2022: Nintendo Switch Online announced the addition of three Sega Genesis games (Light Crusader, Super Fantasy Zone, and Alien Soldier), expanding its game library and enhancing its value proposition.

- March 2022: Google Play Pass launched in India, offering a curated collection of 1000+ titles, demonstrating the expansion of mobile gaming subscriptions into emerging markets.

Strategic Outlook for Gaming Subscription Industry Market

The gaming subscription market is poised for continued growth, driven by technological innovation, increasing accessibility, and evolving consumer preferences. Strategic partnerships, market expansion into untapped regions, and the development of innovative game experiences will be key to capturing market share and driving long-term success. The market is projected to reach xx Million by 2033, presenting significant opportunities for both established players and new entrants.

Gaming Subscription Industry Segmentation

-

1. Gaming Type

- 1.1. Console Gaming

- 1.2. PC-based Gaming

- 1.3. Mobile Gaming

Gaming Subscription Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Gaming Subscription Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Tools to Make Work Seamless and Agile; Continuous Innovation in Team Collaborative Tool Offerings

- 3.3. Market Restrains

- 3.3.1. Compliance and Governance Issues

- 3.4. Market Trends

- 3.4.1. Mobile gaming to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Gaming Type

- 5.1.1. Console Gaming

- 5.1.2. PC-based Gaming

- 5.1.3. Mobile Gaming

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Gaming Type

- 6. North America Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Gaming Type

- 6.1.1. Console Gaming

- 6.1.2. PC-based Gaming

- 6.1.3. Mobile Gaming

- 6.1. Market Analysis, Insights and Forecast - by Gaming Type

- 7. Europe Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Gaming Type

- 7.1.1. Console Gaming

- 7.1.2. PC-based Gaming

- 7.1.3. Mobile Gaming

- 7.1. Market Analysis, Insights and Forecast - by Gaming Type

- 8. Asia Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Gaming Type

- 8.1.1. Console Gaming

- 8.1.2. PC-based Gaming

- 8.1.3. Mobile Gaming

- 8.1. Market Analysis, Insights and Forecast - by Gaming Type

- 9. Australia and New Zealand Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Gaming Type

- 9.1.1. Console Gaming

- 9.1.2. PC-based Gaming

- 9.1.3. Mobile Gaming

- 9.1. Market Analysis, Insights and Forecast - by Gaming Type

- 10. Latin America Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Gaming Type

- 10.1.1. Console Gaming

- 10.1.2. PC-based Gaming

- 10.1.3. Mobile Gaming

- 10.1. Market Analysis, Insights and Forecast - by Gaming Type

- 11. Middle East and Africa Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Gaming Type

- 11.1.1. Console Gaming

- 11.1.2. PC-based Gaming

- 11.1.3. Mobile Gaming

- 11.1. Market Analysis, Insights and Forecast - by Gaming Type

- 12. North America Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pacific Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Rest of the World Gaming Subscription Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Nintendo Switch Online (Nintendo Co Ltd)

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Prime Gaming (Amazon Inc )*List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Google Play Pass (Google LLC)

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Humble Bundle Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Amazon Luna (Amazon Inc )

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 PlayStation Now (Sony Corporation)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 EA Play (Electronic Arts Inc )

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Tencent Holdings Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Uplay Pass (Ubisoft)

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Xbox (Game Pass) (Microsoft Corporation)

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Epic games Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 GeForce Now (NVIDIA)

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Apple Arcade (Apple Inc )

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Nintendo Switch Online (Nintendo Co Ltd)

List of Figures

- Figure 1: Global Gaming Subscription Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Gaming Subscription Industry Revenue (Million), by Gaming Type 2024 & 2032

- Figure 11: North America Gaming Subscription Industry Revenue Share (%), by Gaming Type 2024 & 2032

- Figure 12: North America Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Gaming Subscription Industry Revenue (Million), by Gaming Type 2024 & 2032

- Figure 15: Europe Gaming Subscription Industry Revenue Share (%), by Gaming Type 2024 & 2032

- Figure 16: Europe Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Europe Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Gaming Subscription Industry Revenue (Million), by Gaming Type 2024 & 2032

- Figure 19: Asia Gaming Subscription Industry Revenue Share (%), by Gaming Type 2024 & 2032

- Figure 20: Asia Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Asia Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Australia and New Zealand Gaming Subscription Industry Revenue (Million), by Gaming Type 2024 & 2032

- Figure 23: Australia and New Zealand Gaming Subscription Industry Revenue Share (%), by Gaming Type 2024 & 2032

- Figure 24: Australia and New Zealand Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Australia and New Zealand Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Latin America Gaming Subscription Industry Revenue (Million), by Gaming Type 2024 & 2032

- Figure 27: Latin America Gaming Subscription Industry Revenue Share (%), by Gaming Type 2024 & 2032

- Figure 28: Latin America Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Latin America Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Gaming Subscription Industry Revenue (Million), by Gaming Type 2024 & 2032

- Figure 31: Middle East and Africa Gaming Subscription Industry Revenue Share (%), by Gaming Type 2024 & 2032

- Figure 32: Middle East and Africa Gaming Subscription Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Middle East and Africa Gaming Subscription Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Gaming Subscription Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Gaming Subscription Industry Revenue Million Forecast, by Gaming Type 2019 & 2032

- Table 3: Global Gaming Subscription Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Gaming Subscription Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Gaming Subscription Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Gaming Subscription Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Gaming Subscription Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Gaming Subscription Industry Revenue Million Forecast, by Gaming Type 2019 & 2032

- Table 13: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Gaming Subscription Industry Revenue Million Forecast, by Gaming Type 2019 & 2032

- Table 15: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Gaming Subscription Industry Revenue Million Forecast, by Gaming Type 2019 & 2032

- Table 17: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Gaming Subscription Industry Revenue Million Forecast, by Gaming Type 2019 & 2032

- Table 19: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Gaming Subscription Industry Revenue Million Forecast, by Gaming Type 2019 & 2032

- Table 21: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Gaming Subscription Industry Revenue Million Forecast, by Gaming Type 2019 & 2032

- Table 23: Global Gaming Subscription Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gaming Subscription Industry?

The projected CAGR is approximately 9.84%.

2. Which companies are prominent players in the Gaming Subscription Industry?

Key companies in the market include Nintendo Switch Online (Nintendo Co Ltd), Prime Gaming (Amazon Inc )*List Not Exhaustive, Google Play Pass (Google LLC), Humble Bundle Inc, Amazon Luna (Amazon Inc ), PlayStation Now (Sony Corporation), EA Play (Electronic Arts Inc ), Tencent Holdings Ltd, Uplay Pass (Ubisoft), Xbox (Game Pass) (Microsoft Corporation), Epic games Inc, GeForce Now (NVIDIA), Apple Arcade (Apple Inc ).

3. What are the main segments of the Gaming Subscription Industry?

The market segments include Gaming Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 10.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Tools to Make Work Seamless and Agile; Continuous Innovation in Team Collaborative Tool Offerings.

6. What are the notable trends driving market growth?

Mobile gaming to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Compliance and Governance Issues.

8. Can you provide examples of recent developments in the market?

March 2022- The Nintendo Switch Online (Nintendo Co. Ltd) announced new additions that include three Sega Genesis games. Light Crusader, Super Fantasy Zone, and Alien Soldier are among the most recent additions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gaming Subscription Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gaming Subscription Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gaming Subscription Industry?

To stay informed about further developments, trends, and reports in the Gaming Subscription Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence