Key Insights

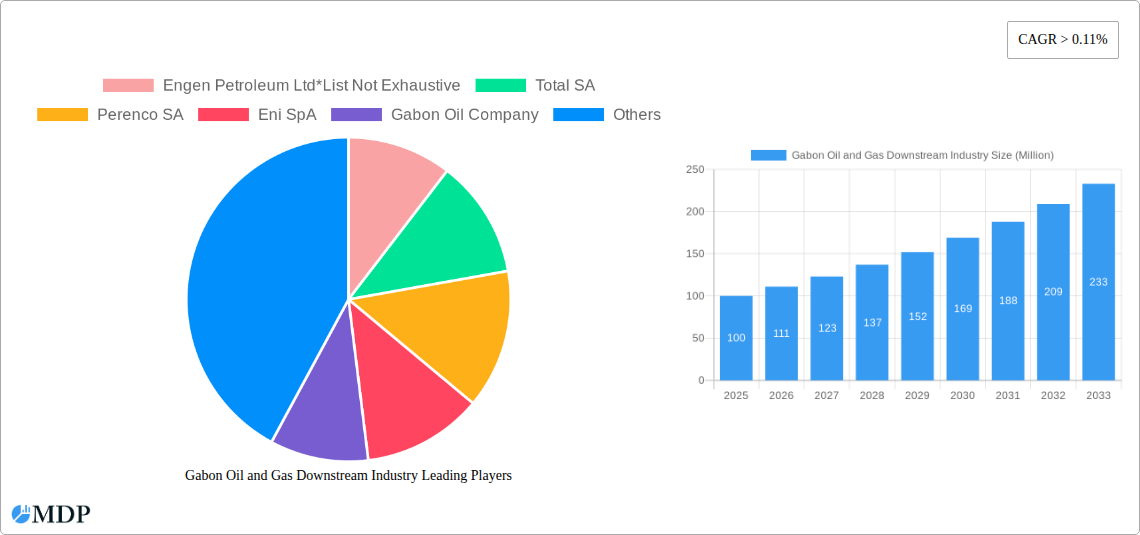

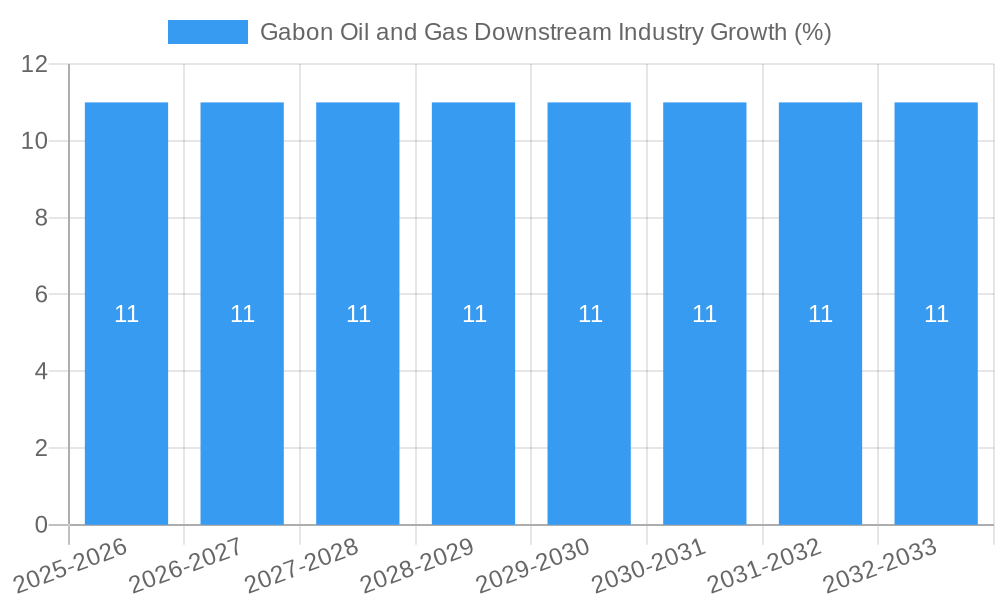

The Gabon Oil and Gas Downstream Industry, encompassing refineries and petrochemical plants, exhibits a positive growth trajectory, fueled by consistent demand and strategic investments. The market, currently valued at (estimated) $XX million in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) exceeding 11% from 2025 to 2033. This growth is driven by increasing domestic consumption of refined petroleum products, expanding petrochemical production to support the nation's industrial development, and potential for regional exports. Key players such as Engen Petroleum Ltd, Total SA, Perenco SA, Eni SpA, and the Gabon Oil Company are actively shaping the market landscape through capacity expansions, technological advancements, and strategic partnerships. However, challenges remain, including the volatility of global oil prices, infrastructure limitations, and environmental concerns surrounding the industry's carbon footprint. Addressing these restraints will be crucial for sustaining the projected growth.

The forecast period (2025-2033) anticipates significant expansion in both refinery and petrochemical segments. Refinery capacity upgrades and new investments are likely, driven by the need to meet escalating domestic fuel demand and potentially capitalize on regional export opportunities. Similarly, the petrochemical segment will benefit from government initiatives aimed at diversifying the economy and promoting value-added manufacturing. While precise figures for future market size require detailed market research, extrapolating from the given CAGR and considering industry trends suggests considerable growth potential over the next decade. The industry's future hinges on effective management of these growth drivers and potential challenges, including strategic infrastructure development, environmental compliance, and diversification of revenue streams.

Gabon Oil and Gas Downstream Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Gabon Oil and Gas Downstream Industry, covering market dynamics, leading players, key trends, and future growth prospects from 2019 to 2033. It's an essential resource for industry stakeholders, investors, and anyone seeking to understand this dynamic market. The report leverages extensive data analysis, incorporating historical data (2019-2024), base year (2025), and forecast data (2025-2033) to offer actionable insights and strategic guidance.

Gabon Oil and Gas Downstream Industry Market Dynamics & Concentration

The Gabonese oil and gas downstream sector exhibits a moderately concentrated market structure, with a few major international and national players dominating. Market share analysis reveals that Total SA and Perenco SA hold significant positions, each accounting for approximately xx% and xx% of the market, respectively, in 2025 (estimated). Engen Petroleum Ltd, Eni SpA, and the Gabon Oil Company contribute to the remaining market share.

Several factors influence market concentration. Stringent regulatory frameworks, including environmental regulations and licensing requirements, create barriers to entry for new players. The capital-intensive nature of refinery and petrochemical plant construction further limits market entrants. Innovation, primarily driven by technological advancements in refining processes and petrochemical production, is another key factor. While significant M&A activity is not observed recently, the count of M&A deals in the historical period (2019-2024) stood at xx. Product substitution, mainly through the adoption of biofuels and alternative energy sources, presents a challenge to traditional players, necessitating continuous innovation and adaptation. End-user trends show a growing demand for higher-quality petroleum products and specialized petrochemicals, impacting product diversification strategies.

Gabon Oil and Gas Downstream Industry Industry Trends & Analysis

The Gabonese oil and gas downstream market is projected to experience a CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by increasing domestic consumption, driven by population growth and economic expansion. Technological disruptions, such as advancements in refinery technologies enhancing efficiency and reducing environmental impact, are also significant drivers. Consumer preferences shift toward cleaner and more sustainable fuel options, pushing companies to invest in cleaner technologies and diversify product offerings. Competitive dynamics are characterized by price competition and a focus on operational efficiency, with leading players continuously seeking to optimize their operations and expand market share. Market penetration of refined petroleum products remains high, exceeding xx% in 2025 (estimated). The industry’s growth also significantly depends on government policies and investments, such as infrastructural developments.

Leading Markets & Segments in Gabon Oil and Gas Downstream Industry

The dominant segment within the Gabonese oil and gas downstream industry is refineries. Several factors contribute to the dominance of this segment:

- Strong domestic demand: Gabon has a significant demand for refined petroleum products, including gasoline, diesel, and jet fuel, fueling the growth of the refinery sector.

- Government support: The government's focus on ensuring energy security and supporting domestic refining capacity strengthens the sector.

- Strategic location: Gabon's geographical location facilitates exports to regional markets, bolstering refinery operations.

The petrochemical plants segment is comparatively smaller, though projected to grow steadily at a CAGR of xx% during the forecast period driven by increased demand for petrochemical feedstocks in related manufacturing industries. However, limited investment and infrastructural constraints hinder more significant expansion. The primary region driving growth is Libreville, where most of the refining and petrochemical facilities are concentrated.

Gabon Oil and Gas Downstream Industry Product Developments

Recent product developments emphasize efficiency and sustainability. Refining technologies are focusing on improving yield and reducing emissions, while petrochemical plants are exploring new, more sustainable feedstocks and production processes. These developments address both consumer demand for environmentally friendly products and evolving regulatory requirements. The market fit for these innovative products is strong, as they align with global trends towards cleaner energy and circular economy principles.

Key Drivers of Gabon Oil and Gas Downstream Industry Growth

Several factors fuel the growth of the Gabonese oil and gas downstream sector. Firstly, increasing domestic demand for refined petroleum products and petrochemicals due to population growth and economic expansion is a major driver. Secondly, government initiatives supporting the development of the downstream sector, including investments in infrastructure and regulatory reforms, provide favorable conditions. Thirdly, technological advancements in refining and petrochemical production improve efficiency and reduce environmental impact, enhancing competitiveness.

Challenges in the Gabon Oil and Gas Downstream Industry Market

The Gabonese oil and gas downstream sector faces challenges, including supply chain disruptions which lead to an estimated xx% increase in production costs in 2025. Regulatory hurdles, including licensing requirements and environmental regulations, add operational complexity and costs. The sector also faces intense competition, impacting profit margins. These challenges influence investment decisions and overall market growth.

Emerging Opportunities in Gabon Oil and Gas Downstream Industry

The Gabonese downstream sector presents several attractive long-term opportunities. Technological advancements, like the adoption of cleaner technologies and renewable energy integration, offer considerable potential. Strategic partnerships with international players bring in expertise and capital, strengthening the industry. Expanding into regional markets through export diversification can significantly broaden the market reach and increase revenue streams.

Leading Players in the Gabon Oil and Gas Downstream Industry Sector

- Engen Petroleum Ltd

- Total SA

- Perenco SA

- Eni SpA

- Gabon Oil Company

Key Milestones in Gabon Oil and Gas Downstream Industry Industry

- June 2022: Vaalco Energy's anticipated production surge following the commissioning of its third well in Gabon signals increased output and potential market share gains.

- November 2022: BW Energy's offshore drilling campaign, with anticipated first oil in late Q1 2023, signifies new investment and production capacity additions to the market.

Strategic Outlook for Gabon Oil and Gas Downstream Industry Market

The Gabon oil and gas downstream market presents significant long-term growth potential driven by consistent domestic demand and ongoing investments in infrastructure and technology. Strategic opportunities for players involve embracing sustainable practices, capitalizing on regional market expansion, and leveraging technological advancements to enhance efficiency and reduce environmental impact. The market's future success hinges on adapting to global energy trends and navigating the challenges posed by supply chain dynamics and regulatory changes.

Gabon Oil and Gas Downstream Industry Segmentation

-

1. Refineries

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in Pipeline

- 1.1.3. Upcoming Projects

-

1.1. Overview

-

2. Petrochemicals Plants

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in Pipeline

- 2.1.3. Upcoming Projects

-

2.1. Overview

Gabon Oil and Gas Downstream Industry Segmentation By Geography

- 1. Gabon

Gabon Oil and Gas Downstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 0.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Declining Solar Panel Costs4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Upfront Cost

- 3.4. Market Trends

- 3.4.1. Oil Refining Capacity Growth to Remain Stagnant

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Gabon Oil and Gas Downstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in Pipeline

- 5.1.1.3. Upcoming Projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Petrochemicals Plants

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in Pipeline

- 5.2.1.3. Upcoming Projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Gabon

- 5.1. Market Analysis, Insights and Forecast - by Refineries

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Engen Petroleum Ltd*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Total SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Perenco SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eni SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gabon Oil Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Engen Petroleum Ltd*List Not Exhaustive

List of Figures

- Figure 1: Gabon Oil and Gas Downstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Gabon Oil and Gas Downstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 3: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 4: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Refineries 2019 & 2032

- Table 7: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Petrochemicals Plants 2019 & 2032

- Table 8: Gabon Oil and Gas Downstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gabon Oil and Gas Downstream Industry?

The projected CAGR is approximately > 0.11%.

2. Which companies are prominent players in the Gabon Oil and Gas Downstream Industry?

Key companies in the market include Engen Petroleum Ltd*List Not Exhaustive, Total SA, Perenco SA, Eni SpA, Gabon Oil Company.

3. What are the main segments of the Gabon Oil and Gas Downstream Industry?

The market segments include Refineries, Petrochemicals Plants.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Declining Solar Panel Costs4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Oil Refining Capacity Growth to Remain Stagnant.

7. Are there any restraints impacting market growth?

4.; High Upfront Cost.

8. Can you provide examples of recent developments in the market?

June 2022: Houston-based Vaalco Energy expects a surge in reserves and production after its third well in 2022 goes online later this month, as it completes the drilling of another well offshore in Gabon.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gabon Oil and Gas Downstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gabon Oil and Gas Downstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gabon Oil and Gas Downstream Industry?

To stay informed about further developments, trends, and reports in the Gabon Oil and Gas Downstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence