Key Insights

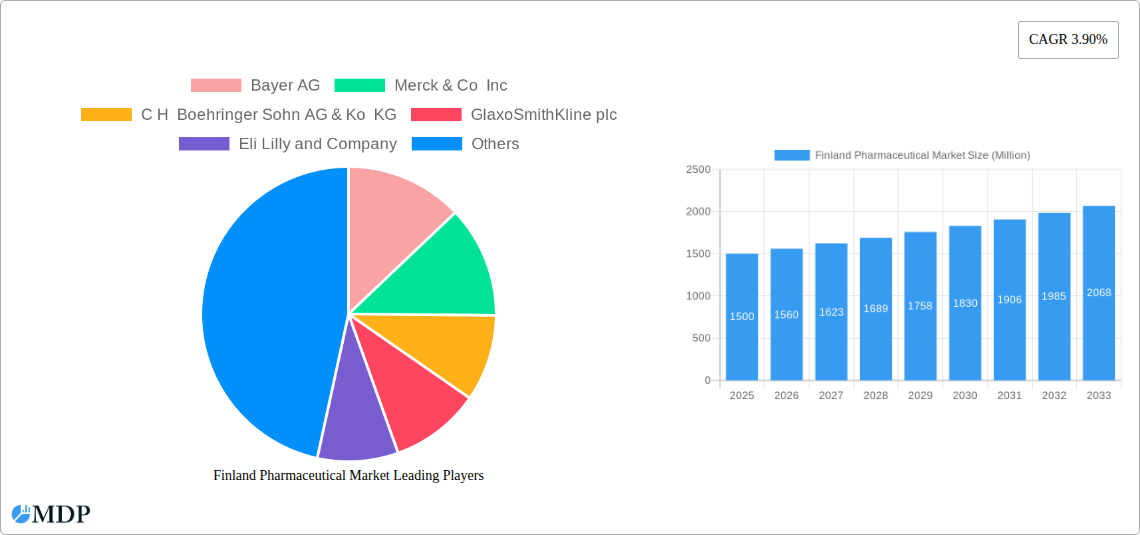

The Finland pharmaceutical market, valued at approximately €1.5 billion in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.90% from 2025 to 2033. This growth is driven by several key factors. An aging population, increasing prevalence of chronic diseases like cardiovascular conditions and diabetes, and rising healthcare expenditure contribute significantly to market expansion. Furthermore, growing awareness of health and wellness, coupled with increased access to advanced medical technologies and treatments, fuels demand for both prescription and over-the-counter (OTC) pharmaceuticals. The market is segmented by therapeutic class, with Alimentary Tract and Metabolism, Cardiovascular System, and Nervous System drugs representing significant portions of the market. Prescription drugs dominate the market share, reflecting the reliance on physician-prescribed medications for managing chronic and acute conditions. Leading pharmaceutical companies like Bayer AG, Merck & Co Inc, and others play a vital role in supplying the Finnish market. However, challenges remain, including stringent regulatory procedures, pricing pressures from generics, and potential fluctuations in healthcare policy.

The Finnish pharmaceutical landscape is highly regulated, influencing market dynamics. The robust regulatory framework, while ensuring drug safety and efficacy, may introduce challenges for new drug approvals and market entry. This regulatory environment compels pharmaceutical companies to invest heavily in research and development, clinical trials, and regulatory compliance. The competitive landscape is characterized by both multinational pharmaceutical giants and local players. The market is shaped by the ongoing introduction of innovative therapies and the growing demand for cost-effective generic alternatives. The successful navigation of this dynamic environment requires a strategic approach that balances innovation with cost management to meet the evolving needs of the Finnish healthcare system and patients.

Finland Pharmaceutical Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Finland pharmaceutical market, covering market dynamics, industry trends, leading segments, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry stakeholders seeking actionable insights into this dynamic market. The report leverages robust data and expert analysis to deliver a clear understanding of the Finnish pharmaceutical landscape, encompassing both historical performance (2019-2024) and future projections.

Finland Pharmaceutical Market Dynamics & Concentration

The Finland pharmaceutical market is characterized by a moderate level of concentration, with a handful of multinational pharmaceutical companies holding significant market share. While precise market share figures for each company are proprietary and unavailable for public release, we estimate that the top 10 players account for approximately xx% of the total market value. Innovation is driven by the need to address an aging population and rising prevalence of chronic diseases. The regulatory framework, overseen by the Finnish Medicines Agency (Fimea), is stringent but supportive of innovation, encouraging R&D investment. Generic competition is a significant factor, especially within the OTC drug segment. M&A activity has been relatively modest in recent years, with an estimated xx mergers and acquisitions concluded between 2019 and 2024. End-user trends indicate a growing preference for convenient dosage forms and personalized medicine.

- Market Concentration: Estimated top 10 players holding xx% market share.

- Innovation Drivers: Aging population, chronic disease prevalence, regulatory support.

- Regulatory Framework: Stringent but supportive, overseen by Fimea.

- Product Substitutes: Generic drugs, alternative therapies.

- M&A Activity: Approximately xx deals between 2019 and 2024.

- End-user Trends: Preference for convenient dosage forms and personalized medicine.

Finland Pharmaceutical Market Industry Trends & Analysis

The Finnish pharmaceutical market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by factors such as the increasing prevalence of chronic diseases, a growing elderly population, and rising healthcare expenditure. Technological advancements, such as the development of biosimilars and targeted therapies, are also contributing to market expansion. However, pricing pressures from generic competition and stringent regulatory requirements pose challenges. Market penetration of innovative drugs is steadily increasing, with xx% market penetration of novel therapies anticipated by 2033. Competitive dynamics are intense, with both established multinational companies and emerging biotech firms vying for market share. Consumer preferences are shifting towards more convenient and accessible healthcare solutions.

Leading Markets & Segments in Finland Pharmaceutical Market

While comprehensive regional breakdowns are limited, the market is primarily concentrated within urban areas and major population centers. Among the ATC/Therapeutic Classes, the Cardiovascular System, Nervous System, and Antineoplastic and Immunomodulating Agents segments are anticipated to dominate the market due to the high prevalence of associated conditions. The Prescription Drugs (Rx) segment constitutes the largest portion of the market, while the OTC market displays moderate growth potential.

- Dominant Segments: Cardiovascular System, Nervous System, Antineoplastic and Immunomodulating Agents, Prescription Drugs (Rx).

- Key Drivers:

- High Prevalence of Chronic Diseases: Cardiovascular diseases, neurological disorders, and cancer are prevalent.

- Aging Population: Increased demand for pharmaceutical products for age-related conditions.

- Healthcare Expenditure: Steady growth in healthcare spending.

Finland Pharmaceutical Market Product Developments

Significant product innovation is evident in the Finnish market, with an emphasis on advanced therapies, biosimilars, and personalized medicine approaches. These developments are driven by technological advancements in drug delivery systems, genomics, and proteomics. The market is also witnessing increasing competition in the generic drug space, leading to pricing pressures and increased focus on differentiated products with unique value propositions.

Key Drivers of Finland Pharmaceutical Market Growth

Growth in the Finland pharmaceutical market is driven by several key factors. The aging population, resulting in increased demand for medications for age-related diseases, is a major contributor. Furthermore, rising healthcare expenditure and increased government support for pharmaceutical research and development foster innovation and market expansion. Advances in biotechnology and the development of targeted therapies also contribute significantly.

Challenges in the Finland Pharmaceutical Market

The Finland pharmaceutical market faces challenges such as stringent regulatory hurdles impacting the speed of new drug approvals and increasing generic competition. Supply chain complexities and cost pressures also impact profitability. These factors necessitate a strategic approach to mitigate risk and ensure sustainable growth.

Emerging Opportunities in Finland Pharmaceutical Market

The Finnish pharmaceutical market presents significant opportunities for growth. Technological advancements in areas like gene therapy and personalized medicine offer substantial potential for the development of novel treatments. Strategic collaborations between pharmaceutical companies and research institutions can further accelerate innovation. Expanding into new therapeutic areas and leveraging digital technologies also present lucrative avenues for growth.

Leading Players in the Finland Pharmaceutical Market Sector

- Bayer AG

- Merck & Co Inc

- C H Boehringer Sohn AG & Ko KG

- GlaxoSmithKline plc

- Eli Lilly and Company

- F Hoffmann-La Roche AG

- AstraZeneca plc

- AbbVie Inc

- Bristol Myers Squibb Company

- Sanofi S A

Key Milestones in Finland Pharmaceutical Market Industry

- August 2023: Finland granted EUR 10 Million to Orion in funding and EUR 20 Million for the development of a pharmaceutical research ecosystem. This signifies a commitment to fostering innovation and reducing R&D timelines.

- July 2023: Biovian Oy invested EUR 50 Million to expand its drug manufacturing facility. This investment strengthens Finland's capabilities in advanced therapy medicinal products (ATMP) manufacturing.

Strategic Outlook for Finland Pharmaceutical Market

The Finland pharmaceutical market exhibits strong potential for future growth, driven by an aging population, increased healthcare expenditure, and ongoing technological advancements. Strategic opportunities lie in focusing on innovative therapies, particularly in areas like personalized medicine and advanced therapies. Collaborations with research institutions and strategic partnerships will be crucial for driving innovation and capturing market share in this competitive landscape.

Finland Pharmaceutical Market Segmentation

-

1. ATC/Therapeutic Class

- 1.1. Alimentary Tract and Metabolism

- 1.2. Blood and Blood Forming Organs

- 1.3. Cardiovascular System

- 1.4. Dermatologicals

- 1.5. Genito Urinary System and Sex Hormones

- 1.6. Systemic Hormonal Preparations,

- 1.7. Antiinfectives For Systemic Use

- 1.8. Antineoplastic and Immunomodulating Agents

- 1.9. Musculo-Skeletal System

- 1.10. Nervous System

- 1.11. Antipara

- 1.12. Respiratory System

- 1.13. Sensory Organs

- 1.14. Other ATC/Therapeutic Classes

-

2. Prescription Type

-

2.1. Prescription Drugs (Rx)

- 2.1.1. Branded

- 2.1.2. Generic

- 2.2. OTC Drugs

-

2.1. Prescription Drugs (Rx)

Finland Pharmaceutical Market Segmentation By Geography

- 1. Finland

Finland Pharmaceutical Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Significant research and development programs; Rising Incidence of Chronic Disease

- 3.3. Market Restrains

- 3.3.1. Highly Expensive Patented Drugs

- 3.4. Market Trends

- 3.4.1. Prescription Drugs Segment is Expected to Hold Significant Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Finland Pharmaceutical Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 5.1.1. Alimentary Tract and Metabolism

- 5.1.2. Blood and Blood Forming Organs

- 5.1.3. Cardiovascular System

- 5.1.4. Dermatologicals

- 5.1.5. Genito Urinary System and Sex Hormones

- 5.1.6. Systemic Hormonal Preparations,

- 5.1.7. Antiinfectives For Systemic Use

- 5.1.8. Antineoplastic and Immunomodulating Agents

- 5.1.9. Musculo-Skeletal System

- 5.1.10. Nervous System

- 5.1.11. Antipara

- 5.1.12. Respiratory System

- 5.1.13. Sensory Organs

- 5.1.14. Other ATC/Therapeutic Classes

- 5.2. Market Analysis, Insights and Forecast - by Prescription Type

- 5.2.1. Prescription Drugs (Rx)

- 5.2.1.1. Branded

- 5.2.1.2. Generic

- 5.2.2. OTC Drugs

- 5.2.1. Prescription Drugs (Rx)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Finland

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bayer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Merck & Co Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 C H Boehringer Sohn AG & Ko KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GlaxoSmithKline plc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly and Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 F Hoffmann-La Roche AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AstraZeneca plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AbbVie Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bristol Myers Squibb Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sanofi S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bayer AG

List of Figures

- Figure 1: Finland Pharmaceutical Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Finland Pharmaceutical Market Share (%) by Company 2024

List of Tables

- Table 1: Finland Pharmaceutical Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Finland Pharmaceutical Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Finland Pharmaceutical Market Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 4: Finland Pharmaceutical Market Volume K Unit Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 5: Finland Pharmaceutical Market Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 6: Finland Pharmaceutical Market Volume K Unit Forecast, by Prescription Type 2019 & 2032

- Table 7: Finland Pharmaceutical Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Finland Pharmaceutical Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Finland Pharmaceutical Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Finland Pharmaceutical Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Finland Pharmaceutical Market Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 12: Finland Pharmaceutical Market Volume K Unit Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 13: Finland Pharmaceutical Market Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 14: Finland Pharmaceutical Market Volume K Unit Forecast, by Prescription Type 2019 & 2032

- Table 15: Finland Pharmaceutical Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Finland Pharmaceutical Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Finland Pharmaceutical Market?

The projected CAGR is approximately 3.90%.

2. Which companies are prominent players in the Finland Pharmaceutical Market?

Key companies in the market include Bayer AG, Merck & Co Inc, C H Boehringer Sohn AG & Ko KG, GlaxoSmithKline plc, Eli Lilly and Company, F Hoffmann-La Roche AG, AstraZeneca plc, AbbVie Inc, Bristol Myers Squibb Company, Sanofi S A .

3. What are the main segments of the Finland Pharmaceutical Market?

The market segments include ATC/Therapeutic Class, Prescription Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Significant research and development programs; Rising Incidence of Chronic Disease.

6. What are the notable trends driving market growth?

Prescription Drugs Segment is Expected to Hold Significant Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Highly Expensive Patented Drugs.

8. Can you provide examples of recent developments in the market?

August 2023: Finland granted EUR 10 million to Orion in funding and EUR 20 million for the development of a pharmaceutical research ecosystem in Finland to reduce the time taken by pharmaceutical R&D to develop drugs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Finland Pharmaceutical Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Finland Pharmaceutical Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Finland Pharmaceutical Market?

To stay informed about further developments, trends, and reports in the Finland Pharmaceutical Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence