Key Insights

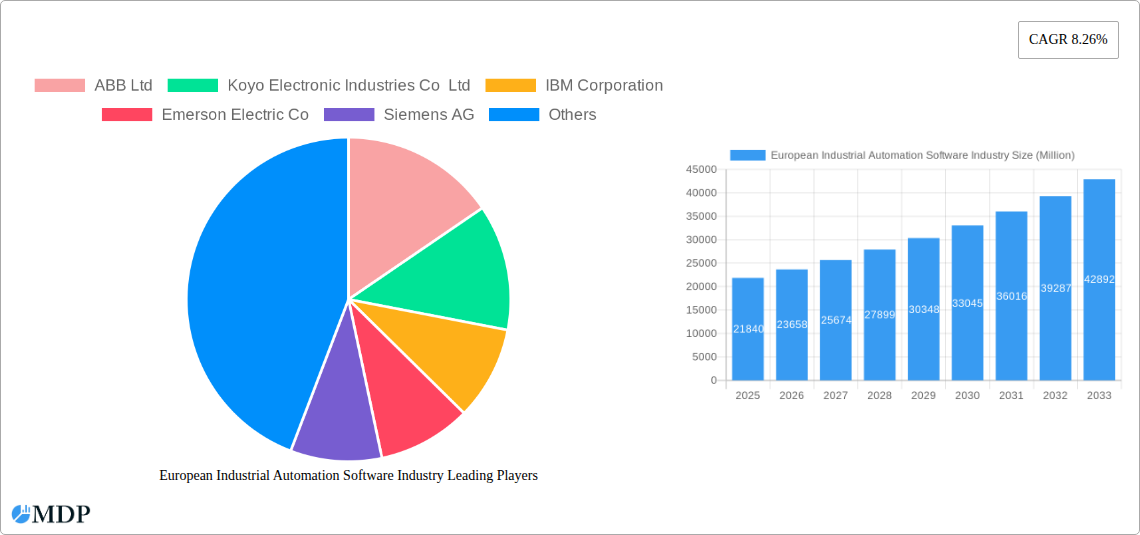

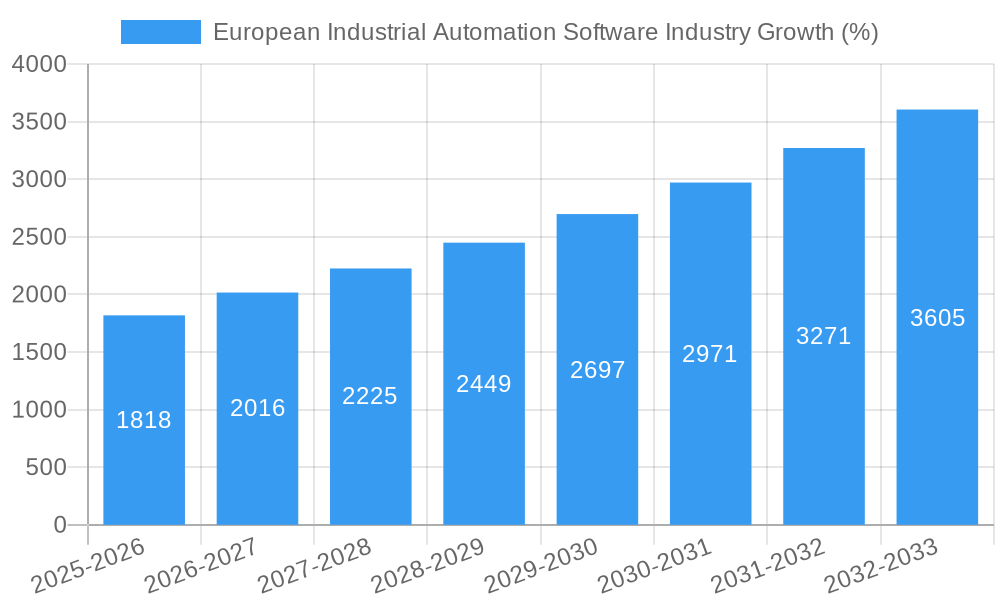

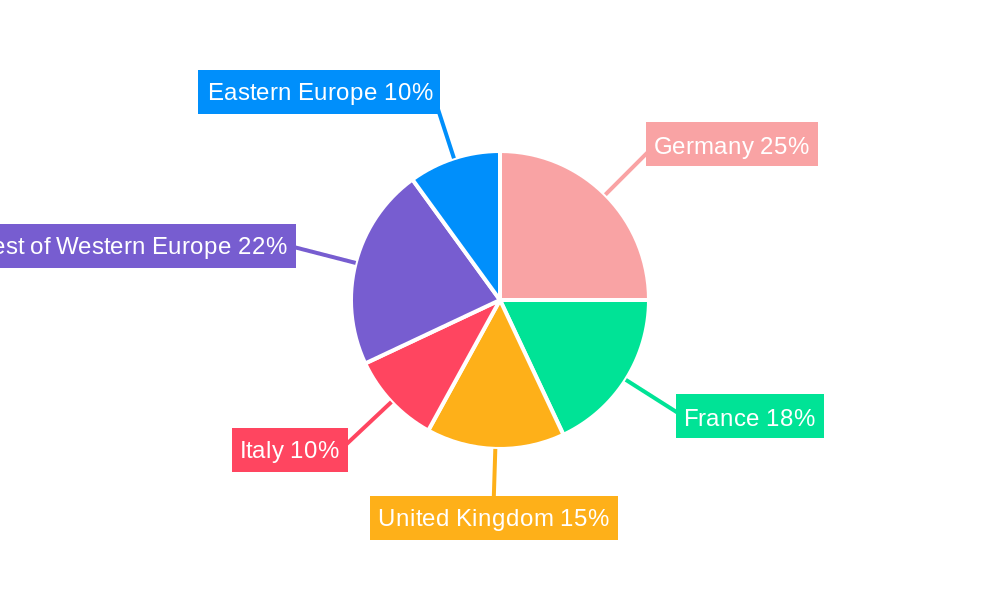

The European industrial automation software market, valued at €21.84 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.26% from 2025 to 2033. This expansion is driven by several key factors. Increasing adoption of Industry 4.0 principles across manufacturing sectors like automotive, food and beverage, and chemicals necessitates sophisticated software solutions for enhanced efficiency, productivity, and data-driven decision-making. Furthermore, the rising demand for predictive maintenance and asset performance optimization, fueled by the need to minimize downtime and operational costs, is a significant driver. Government initiatives promoting digitalization within European industries are also contributing to market growth. Competition is fierce among established players like ABB, Siemens, and Rockwell Automation, alongside emerging technology providers specializing in niche areas such as advanced process control and operator training simulators. The market is segmented by software type (MES, APM, APC, PLM, OTS, Industrial Control Systems) and end-user industry, with significant growth expected in sectors prioritizing automation and digital transformation. Germany, France, and the UK represent the largest national markets, benefiting from well-established industrial bases and high technological adoption rates. However, growth potential also exists in Eastern Europe as industries modernize and invest in automation technologies.

The market's growth trajectory is, however, subject to certain constraints. High initial investment costs associated with implementing and integrating advanced automation software can be a barrier to entry for smaller companies. Cybersecurity concerns relating to interconnected industrial systems are a significant challenge, demanding robust security measures and potentially hindering rapid adoption. Furthermore, a shortage of skilled personnel capable of developing, implementing, and maintaining these complex systems poses a potential limitation on market expansion. Nevertheless, the long-term outlook for the European industrial automation software market remains positive, driven by ongoing technological advancements, increasing digitalization efforts, and a sustained focus on improving industrial efficiency and productivity. Specific growth within segments will be influenced by factors such as industry-specific regulatory changes and the speed of adoption of new technologies.

European Industrial Automation Software Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European Industrial Automation Software market, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, leading players, emerging trends, and future growth opportunities. The market is segmented by software type, end-user industry, and geography, providing a granular understanding of the diverse landscape. Expected to reach xx Million by 2033, the market presents significant potential for growth and innovation.

European Industrial Automation Software Industry Market Dynamics & Concentration

The European industrial automation software market is characterized by a moderately concentrated landscape, with key players like ABB Ltd, Siemens AG, and Rockwell Automation Inc. holding significant market share. However, the market also features several mid-sized and smaller players, contributing to a dynamic competitive environment. Innovation is a key driver, fueled by the increasing adoption of Industry 4.0 technologies, such as AI, IoT, and cloud computing. Stringent regulatory frameworks, particularly concerning data privacy and cybersecurity, influence market developments. Product substitutes, such as legacy systems and in-house solutions, pose a competitive challenge. End-user trends, including the demand for enhanced productivity, operational efficiency, and data-driven insights, shape market growth. M&A activity is prevalent, reflecting the consolidation trend in the industry. For instance, the acquisition of Hochrainer GmbH by Wipro PARI in July 2022 signifies the ongoing expansion and consolidation efforts within the sector.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Innovation Drivers: Industry 4.0 technologies (AI, IoT, Cloud), demand for data analytics, and improved operational efficiency.

- Regulatory Frameworks: GDPR, NIS Directive, and other cybersecurity regulations significantly impact market dynamics.

- M&A Activity: xx deals recorded between 2019 and 2024, indicating a consolidated market.

European Industrial Automation Software Industry Industry Trends & Analysis

The European industrial automation software market is experiencing robust growth, driven by the increasing adoption of automation across various industries. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of AI-powered solutions and cloud-based platforms, are transforming market dynamics, enabling predictive maintenance and optimized resource allocation. Consumer preferences are shifting towards software solutions that offer enhanced flexibility, scalability, and integration capabilities. Competitive dynamics are intense, with major players investing heavily in R&D and strategic partnerships to gain a competitive edge. Market penetration of advanced automation software solutions is steadily increasing, particularly in sectors like automotive and chemical manufacturing. This growth is further fueled by government initiatives promoting digitalization and automation across the European Union.

Leading Markets & Segments in European Industrial Automation Software Industry

Germany, the United Kingdom, and France represent the leading markets in Europe, driven by robust industrial bases and high levels of automation adoption. Within software segments, Manufacturing Execution Systems (MES) and Asset Performance Management (APM) are the largest, reflecting the growing need for real-time production monitoring and optimized asset utilization. In terms of end-user industries, the Oil and Gas, Chemical and Petrochemical, and Automotive sectors are major consumers of industrial automation software.

- Leading Countries: Germany, United Kingdom, France (due to established industrial bases and government support for digitalization).

- Dominant Software Segments: MES, APM, and Industrial Control Systems Software.

- Key End-User Industries: Oil & Gas, Chemical & Petrochemical, Automotive & Transportation.

- Key Drivers for Germany: Strong automotive and manufacturing industries, robust digital infrastructure, and government initiatives promoting Industry 4.0.

- Key Drivers for UK: Significant investments in automation technologies, a robust IT sector, and a focus on industrial efficiency.

- Key Drivers for France: Growing adoption of automation solutions across various industries, and a focus on digital transformation initiatives.

European Industrial Automation Software Industry Product Developments

Recent product innovations focus on AI-powered predictive maintenance, cloud-based solutions, and enhanced cybersecurity features. These advancements offer businesses improved operational efficiency, reduced downtime, and enhanced data security. The competitive advantage lies in the ability to integrate seamlessly with existing infrastructure and provide valuable data-driven insights to optimize operations. Technological trends favour solutions that are flexible, scalable, and adaptable to the evolving needs of businesses.

Key Drivers of European Industrial Automation Software Industry Growth

The European industrial automation software market's growth is driven by several factors:

- Technological advancements: AI, IoT, cloud computing, and advanced analytics are enabling smarter and more efficient automation solutions.

- Economic factors: The need for increased productivity, cost reduction, and improved operational efficiency is driving automation adoption.

- Regulatory pressures: Compliance with industry regulations, especially regarding safety and cybersecurity, is accelerating the adoption of advanced software solutions.

Challenges in the European Industrial Automation Software Industry Market

The market faces several challenges:

- High implementation costs: The initial investment required for implementing advanced software solutions can be substantial, hindering adoption by smaller companies.

- Integration complexities: Integrating new software with existing systems can be challenging and time-consuming.

- Cybersecurity risks: The increasing connectivity of industrial systems raises concerns about data breaches and cyberattacks. This translates to approximately xx Million in potential losses annually due to downtime.

Emerging Opportunities in European Industrial Automation Software Industry

Long-term growth is driven by:

- Advancements in AI and machine learning: These technologies enable predictive maintenance and optimized resource allocation.

- Growing adoption of cloud-based solutions: Cloud computing offers scalability and flexibility, catering to diverse business needs.

- Expansion into new markets and industries: Emerging technologies present exciting opportunities for market expansion in untapped sectors.

Leading Players in the European Industrial Automation Software Industry Sector

- ABB Ltd

- Koyo Electronic Industries Co Ltd

- IBM Corporation

- Emerson Electric Co

- Siemens AG

- OMRON Corporation

- Daifuku Co Ltd

- Rockwell Automation Inc

- Yokogawa Electric Corporation

- Honeywell International Inc

- List Not Exhaustive

Key Milestones in European Industrial Automation Software Industry Industry

- July 2022: Wipro PARI acquires Hochrainer GmbH, expanding its European presence.

- February 2021: Liebherr Mining expands its use of Operator Training Simulators through a collaboration with ThoroughTec Simulation.

Strategic Outlook for European Industrial Automation Software Market

The European industrial automation software market holds significant growth potential, driven by continuous technological advancements, increasing digitization across various industries, and supportive government policies. Strategic opportunities lie in developing innovative AI-powered solutions, strengthening cybersecurity features, and expanding into new markets and industries. Companies that effectively address the challenges of integration complexity and high implementation costs will be well-positioned for success.

European Industrial Automation Software Industry Segmentation

-

1. Type of Software

- 1.1. Manufacturing Execution Systems (MES)

- 1.2. Asset Performance Management (APM)

- 1.3. Advanced Process Control (APC)

- 1.4. Product Lifecycle Management (PLM)

- 1.5. Operator Training Simulator (OTS)

- 1.6. Industri

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemical and Petrochemical

- 2.3. Power

- 2.4. Water and Wastewater

- 2.5. Food and Beverage

- 2.6. Automotive and Transportation

- 2.7. Other End-user Industries

European Industrial Automation Software Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

European Industrial Automation Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Launch of Stringent Energy Conservation Standards and Drive for Local Processing Across Various Geographies; Growing Need for Mass Production with Reduced Operating Costs; Adoption of Emerging Technologies such as IoT and AI in Industrial Environments

- 3.3. Market Restrains

- 3.3.1. High Maintenance and Operation Cost

- 3.4. Market Trends

- 3.4.1. Launch of Stringent Energy Conservation Standards and the Drive for Local Processing is Driving the Market in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Software

- 5.1.1. Manufacturing Execution Systems (MES)

- 5.1.2. Asset Performance Management (APM)

- 5.1.3. Advanced Process Control (APC)

- 5.1.4. Product Lifecycle Management (PLM)

- 5.1.5. Operator Training Simulator (OTS)

- 5.1.6. Industri

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Power

- 5.2.4. Water and Wastewater

- 5.2.5. Food and Beverage

- 5.2.6. Automotive and Transportation

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Software

- 6. Germany European Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 7. France European Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy European Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom European Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands European Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden European Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe European Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ABB Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Koyo Electronic Industries Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 IBM Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Emerson Electric Co

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Siemens AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 OMRON Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Daifuku Co Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Rockwell Automation Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Yokogawa Electric Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Honeywell International Inc *List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 ABB Ltd

List of Figures

- Figure 1: European Industrial Automation Software Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: European Industrial Automation Software Industry Share (%) by Company 2024

List of Tables

- Table 1: European Industrial Automation Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: European Industrial Automation Software Industry Revenue Million Forecast, by Type of Software 2019 & 2032

- Table 3: European Industrial Automation Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: European Industrial Automation Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: European Industrial Automation Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: European Industrial Automation Software Industry Revenue Million Forecast, by Type of Software 2019 & 2032

- Table 14: European Industrial Automation Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: European Industrial Automation Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark European Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Industrial Automation Software Industry?

The projected CAGR is approximately 8.26%.

2. Which companies are prominent players in the European Industrial Automation Software Industry?

Key companies in the market include ABB Ltd, Koyo Electronic Industries Co Ltd, IBM Corporation, Emerson Electric Co, Siemens AG, OMRON Corporation, Daifuku Co Ltd, Rockwell Automation Inc, Yokogawa Electric Corporation, Honeywell International Inc *List Not Exhaustive.

3. What are the main segments of the European Industrial Automation Software Industry?

The market segments include Type of Software, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Launch of Stringent Energy Conservation Standards and Drive for Local Processing Across Various Geographies; Growing Need for Mass Production with Reduced Operating Costs; Adoption of Emerging Technologies such as IoT and AI in Industrial Environments.

6. What are the notable trends driving market growth?

Launch of Stringent Energy Conservation Standards and the Drive for Local Processing is Driving the Market in Europe.

7. Are there any restraints impacting market growth?

High Maintenance and Operation Cost.

8. Can you provide examples of recent developments in the market?

July 2022: Wipro PARI, an industrial automation company, announced the acquisition of Freilassing-based automation technology and assembly systems supplier Hochrainer GmbH. This acquisition is expected to further help the company in expanding its presence in Europe and consolidate its global position.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Industrial Automation Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Industrial Automation Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Industrial Automation Software Industry?

To stay informed about further developments, trends, and reports in the European Industrial Automation Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence