Key Insights

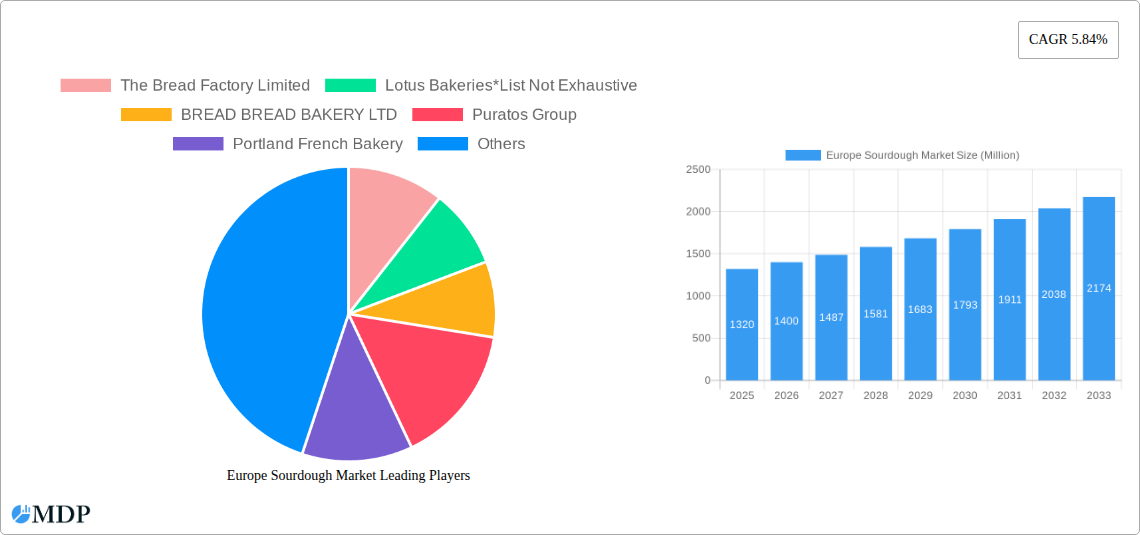

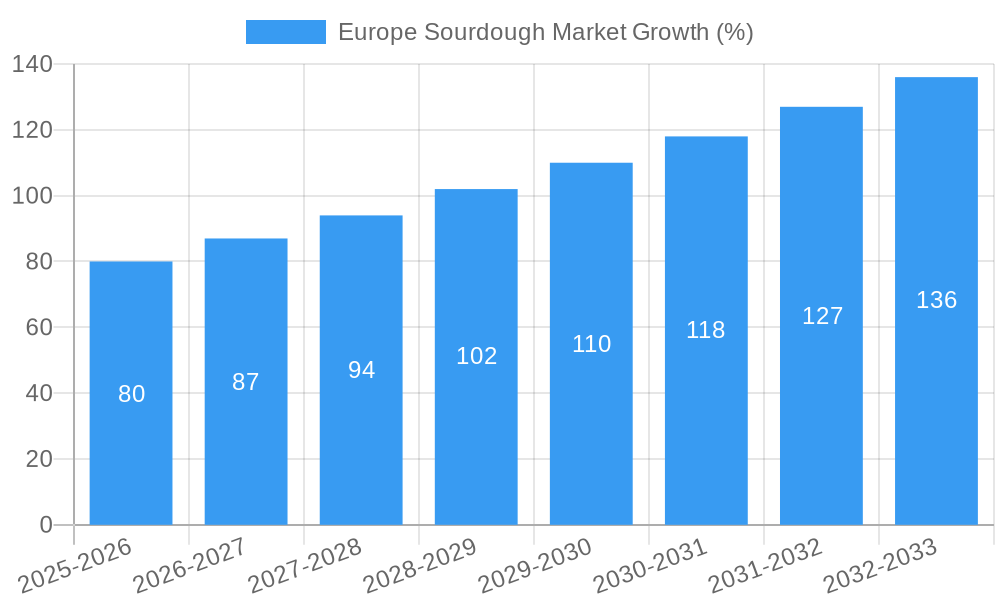

The European sourdough market, valued at €1.32 billion in 2025, is projected to experience robust growth, driven by increasing consumer demand for healthier and artisan breads. The rising popularity of sourdough bread, attributed to its perceived health benefits (improved digestibility, higher nutritional value) and unique flavor profile, fuels market expansion. This trend is particularly strong amongst health-conscious consumers and those seeking premium, artisanal food experiences. The market is segmented by application (bread and buns holding the largest share, followed by pizza bases and cakes) and end-user (industrial bakeries, foodservice, and retail sectors, with industrial bakeries likely dominating due to scale). Germany, France, Italy, and the UK represent key regional markets, reflecting established baking traditions and strong consumer preferences for sourdough. While the market faces potential restraints from fluctuating raw material prices (particularly flour and grains) and competition from mass-produced bread, the overall positive consumer sentiment and continued innovation within the sourdough sector (e.g., development of sourdough starters, improved production efficiency) suggest a sustained period of growth. The estimated Compound Annual Growth Rate (CAGR) of 5.84% from 2025 to 2033 indicates substantial expansion potential, with the market expected to surpass €2.2 billion by 2033. This growth is further propelled by the increasing presence of artisan bakeries and a growing emphasis on locally sourced ingredients within the food industry.

The competitive landscape is characterized by a mix of large multinational players like Puratos Group and Aryzta, alongside smaller, specialized artisan bakeries such as The Bread Factory Limited and Portland French Bakery. These companies are actively responding to market trends through product diversification (e.g., offering various sourdough types and flavors) and expansion into new distribution channels (online sales, partnerships with supermarkets). Successful companies are likely to be those able to balance the needs of industrial-scale production with the authenticity and quality demanded by consumers seeking genuine artisan sourdough products. Future growth will depend on successfully navigating factors such as maintaining consistent product quality, effectively managing supply chain challenges, and continuing to innovate to cater to evolving consumer preferences.

Europe Sourdough Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Sourdough Market, offering invaluable insights for industry stakeholders, investors, and market entrants. Covering the period 2019-2033, with a focus on the estimated year 2025, this report leverages historical data (2019-2024) and forecast projections (2025-2033) to deliver a robust understanding of market dynamics and future growth trajectories. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX%.

Europe Sourdough Market Market Dynamics & Concentration

The European sourdough market is characterized by a moderately concentrated landscape, with key players such as Puratos Group, Aryzta, and IREKS GmbH holding significant market share. However, a number of smaller, specialized bakeries and artisan producers also contribute significantly to the overall market volume. Market concentration is influenced by factors including economies of scale in production, access to distribution networks, and brand recognition. Innovation, driven by consumer demand for healthier and more sustainable products, is a key driver, with companies investing in research and development of new sourdough starter cultures, fermentation techniques, and ingredient combinations. Regulatory frameworks concerning food safety and labeling influence product formulation and marketing strategies. The presence of alternative leavening agents creates substitutability, while end-user trends towards healthier eating habits and convenience boost the demand for sourdough products across various applications. M&A activity, as evidenced by recent acquisitions by Puratos Group, further shapes market consolidation and competitive dynamics. Over the study period, approximately XX M&A deals were recorded, with a notable increase in XX and a slight decline in XX. The market share of the top three players is estimated at XX% in 2025.

Europe Sourdough Market Industry Trends & Analysis

The European sourdough market is experiencing robust growth, driven by several key factors. Increasing consumer awareness of the health benefits associated with sourdough bread, such as improved digestibility and enhanced nutritional value, is a major catalyst. This is further fueled by the rising popularity of artisanal and handcrafted foods, with consumers increasingly seeking authentic and high-quality products. Technological advancements in sourdough fermentation techniques and ingredient sourcing are also contributing to market expansion. The shift towards healthier lifestyles and a greater focus on gut health are significant consumer preferences influencing purchasing decisions. Competitive dynamics are characterized by both established industry players and emerging artisanal brands, creating a diverse and dynamic marketplace. Market penetration of sourdough products in various applications continues to grow, particularly within the retail and foodservice sectors. The market exhibits significant regional variations, with specific countries showing stronger adoption rates than others, attributed to cultural preferences and economic conditions.

Leading Markets & Segments in Europe Sourdough Market

The Bread and Buns segment holds the largest market share within the application category, driven by traditional consumption patterns and the versatility of sourdough in various bread types. Within end-user segments, the Retail sector dominates, reflecting the widespread availability of sourdough products in supermarkets and specialty stores.

- Key Drivers for Bread and Buns Segment: Established consumer preferences, diverse product offerings, and suitability for mass production.

- Key Drivers for Retail Segment: Extensive distribution networks, ease of accessibility for consumers, and strong brand presence.

Germany and France are leading markets in Europe, demonstrating significant consumption rates.

- Key Drivers for Germany: Strong baking tradition, high disposable incomes, and a preference for high-quality bakery products.

- Key Drivers for France: Rich culinary heritage, strong emphasis on artisanal bread-making, and government support for traditional food industries.

A detailed analysis reveals that while the UK market displays strong growth potential, Italy shows a preference for traditional pizza bases, creating niche opportunities for specialized sourdough products. Market dominance is attributed to a blend of cultural traditions, consumer preferences, established distribution channels, and economic factors.

Europe Sourdough Market Product Developments

Recent product innovations focus on enhancing the nutritional profile of sourdough products, using ancient grains and incorporating functional ingredients. New sourdough starter cultures, optimized for specific applications (e.g., pizza bases, cakes), are being developed. Competitive advantages are derived from unique flavor profiles, health claims, and convenient packaging formats that align with evolving consumer demands. Technological advancements in fermentation monitoring and automation are further enhancing production efficiency.

Key Drivers of Europe Sourdough Market Growth

Technological advancements in fermentation control, ingredient sourcing, and product formulation are driving growth. The rising consumer preference for healthier and more natural foods, along with supportive government regulations promoting sustainable agriculture and food production, further contribute to market expansion. Economic factors such as increasing disposable incomes in several European countries are also boosting demand for premium bakery products like sourdough.

Challenges in the Europe Sourdough Market Market

Supply chain disruptions, fluctuating raw material prices, and intense competition from established players and new entrants pose significant challenges. Regulatory hurdles concerning food labeling and ingredient standards may impact product development and marketing. Consumer perceptions of sourdough, particularly regarding its longer production time and potentially higher cost compared to conventional breads, also represent a limitation. These factors can cumulatively impact market growth by approximately XX% annually.

Emerging Opportunities in Europe Sourdough Market

The expanding interest in gut health and the growing demand for sustainable and ethically sourced ingredients offer significant opportunities. Strategic partnerships between sourdough producers and ingredient suppliers, as exemplified by Puratos Group's collaborations, can unlock new product development avenues. Market expansion into emerging segments, such as gluten-free sourdough and sourdough-based snacks, presents additional growth potential.

Leading Players in the Europe Sourdough Market Sector

- The Bread Factory Limited

- Lotus Bakeries

- BREAD BREAD BAKERY LTD

- Puratos Group

- Portland French Bakery

- Ernst Bocker GmbH & Co KG

- Aryzta

- Real Bread and Food Company

- IREKS GmbH

- Riverside Sourdough

Key Milestones in Europe Sourdough Market Industry

- January 2021: Puratos Group collaborates with EverGrain to develop nutritious bakery products using sustainable barley ingredients. This signals a shift towards healthier and more sustainable product offerings.

- January 2022: Puratos Group acquires Profimix, enhancing its product portfolio and market position in health and well-being products. This acquisition strengthens its market share and expands its product offerings.

- August 2022: Puratos Group partners with Shiru to explore sustainable plant-based protein ingredients for baked goods. This partnership showcases the increasing focus on sustainable and innovative ingredients within the industry.

Strategic Outlook for Europe Sourdough Market Market

The European sourdough market exhibits strong growth potential driven by evolving consumer preferences and technological advancements. Strategic opportunities lie in product diversification, expansion into new markets, and the development of sustainable and innovative product offerings. Collaborations and partnerships will play a key role in driving market expansion and innovation, especially within the area of plant-based ingredients and sustainable production practices. The long-term outlook remains positive, with a projected continuous increase in market size driven by the factors described above.

Europe Sourdough Market Segmentation

-

1. Application

- 1.1. Bread and Buns

- 1.2. Pizza Bases

- 1.3. Cakes

- 1.4. Other Applications

-

2. End User

- 2.1. Industrial Bakeries

- 2.2. Foodservice

- 2.3. Retail

Europe Sourdough Market Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. Germany

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

Europe Sourdough Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Preference for Healthy Food and Beverage Driving the Sourdough Demand in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Bread and Buns

- 5.1.2. Pizza Bases

- 5.1.3. Cakes

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Industrial Bakeries

- 5.2.2. Foodservice

- 5.2.3. Retail

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. Germany

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Spain Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Bread and Buns

- 6.1.2. Pizza Bases

- 6.1.3. Cakes

- 6.1.4. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Industrial Bakeries

- 6.2.2. Foodservice

- 6.2.3. Retail

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. United Kingdom Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Bread and Buns

- 7.1.2. Pizza Bases

- 7.1.3. Cakes

- 7.1.4. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Industrial Bakeries

- 7.2.2. Foodservice

- 7.2.3. Retail

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Germany Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Bread and Buns

- 8.1.2. Pizza Bases

- 8.1.3. Cakes

- 8.1.4. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Industrial Bakeries

- 8.2.2. Foodservice

- 8.2.3. Retail

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. France Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Bread and Buns

- 9.1.2. Pizza Bases

- 9.1.3. Cakes

- 9.1.4. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Industrial Bakeries

- 9.2.2. Foodservice

- 9.2.3. Retail

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Italy Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Bread and Buns

- 10.1.2. Pizza Bases

- 10.1.3. Cakes

- 10.1.4. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Industrial Bakeries

- 10.2.2. Foodservice

- 10.2.3. Retail

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Russia Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Bread and Buns

- 11.1.2. Pizza Bases

- 11.1.3. Cakes

- 11.1.4. Other Applications

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. Industrial Bakeries

- 11.2.2. Foodservice

- 11.2.3. Retail

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Rest of Europe Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Application

- 12.1.1. Bread and Buns

- 12.1.2. Pizza Bases

- 12.1.3. Cakes

- 12.1.4. Other Applications

- 12.2. Market Analysis, Insights and Forecast - by End User

- 12.2.1. Industrial Bakeries

- 12.2.2. Foodservice

- 12.2.3. Retail

- 12.1. Market Analysis, Insights and Forecast - by Application

- 13. Germany Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 14. France Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 15. Italy Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 16. United Kingdom Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 17. Netherlands Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 18. Sweden Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 19. Rest of Europe Europe Sourdough Market Analysis, Insights and Forecast, 2019-2031

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 The Bread Factory Limited

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Lotus Bakeries*List Not Exhaustive

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 BREAD BREAD BAKERY LTD

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 Puratos Group

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 Portland French Bakery

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Ernst Bocker GmbH & Co KG

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Aryzta

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Real Bread and Food Company

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 IREKS GmbH

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Riverside Sourdough

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 The Bread Factory Limited

List of Figures

- Figure 1: Europe Sourdough Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Sourdough Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Sourdough Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Sourdough Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Europe Sourdough Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Europe Sourdough Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Sourdough Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Sourdough Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Sourdough Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Sourdough Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Sourdough Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Sourdough Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Sourdough Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Sourdough Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Sourdough Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Europe Sourdough Market Revenue Million Forecast, by End User 2019 & 2032

- Table 15: Europe Sourdough Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Sourdough Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Europe Sourdough Market Revenue Million Forecast, by End User 2019 & 2032

- Table 18: Europe Sourdough Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Sourdough Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Europe Sourdough Market Revenue Million Forecast, by End User 2019 & 2032

- Table 21: Europe Sourdough Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Sourdough Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Europe Sourdough Market Revenue Million Forecast, by End User 2019 & 2032

- Table 24: Europe Sourdough Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Sourdough Market Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Europe Sourdough Market Revenue Million Forecast, by End User 2019 & 2032

- Table 27: Europe Sourdough Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Europe Sourdough Market Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Europe Sourdough Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Europe Sourdough Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Europe Sourdough Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Europe Sourdough Market Revenue Million Forecast, by End User 2019 & 2032

- Table 33: Europe Sourdough Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Sourdough Market?

The projected CAGR is approximately 5.84%.

2. Which companies are prominent players in the Europe Sourdough Market?

Key companies in the market include The Bread Factory Limited, Lotus Bakeries*List Not Exhaustive, BREAD BREAD BAKERY LTD, Puratos Group, Portland French Bakery, Ernst Bocker GmbH & Co KG, Aryzta, Real Bread and Food Company, IREKS GmbH, Riverside Sourdough.

3. What are the main segments of the Europe Sourdough Market?

The market segments include Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Preference for Healthy Food and Beverage Driving the Sourdough Demand in Europe.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

August 2022: The Puratos Group partnered with Shiru, an ingredient company, to explore sustainable plant-based protein ingredients for baked goods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Sourdough Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Sourdough Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Sourdough Market?

To stay informed about further developments, trends, and reports in the Europe Sourdough Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence