Key Insights

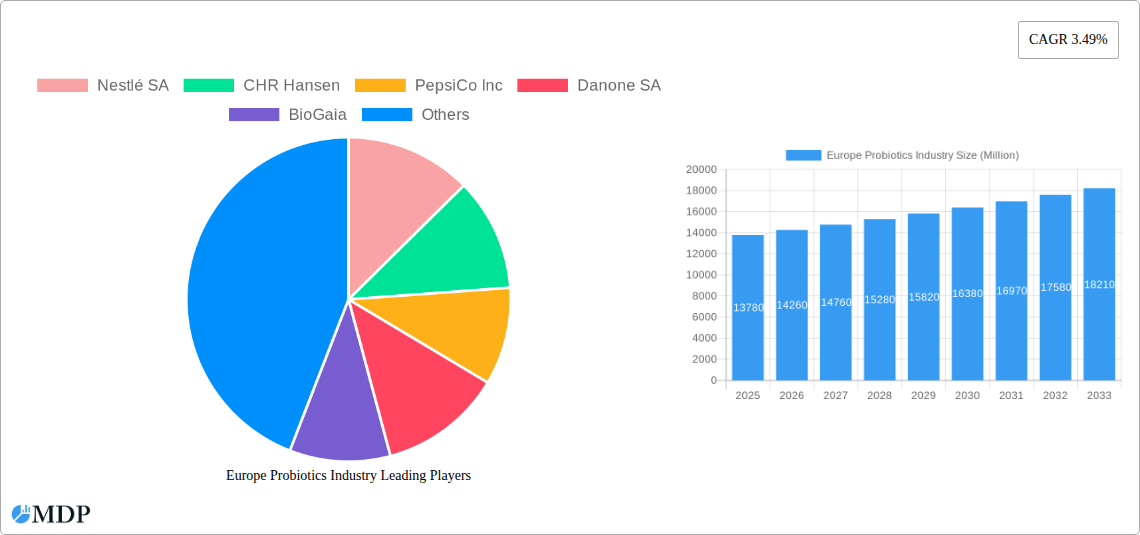

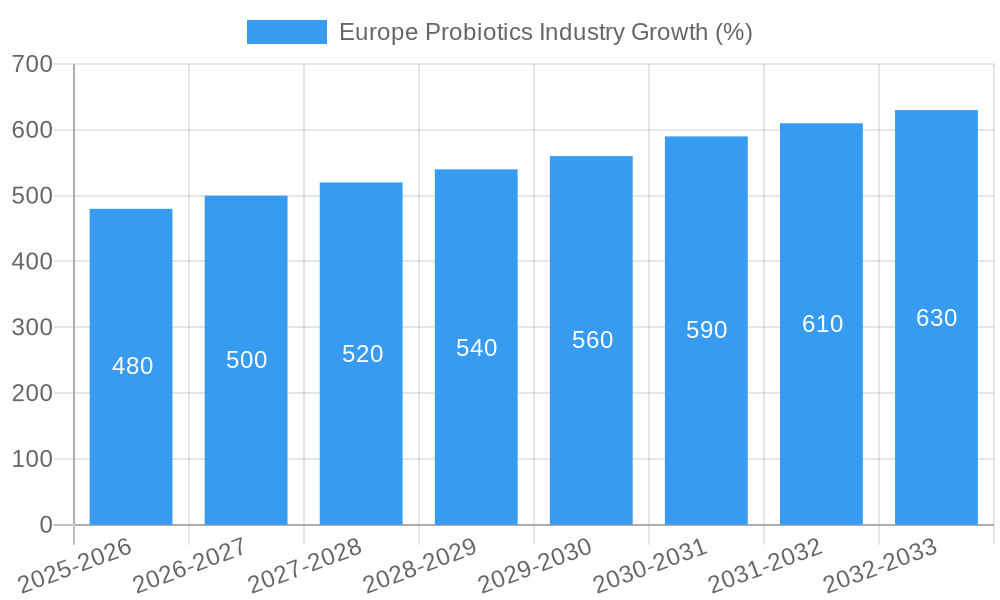

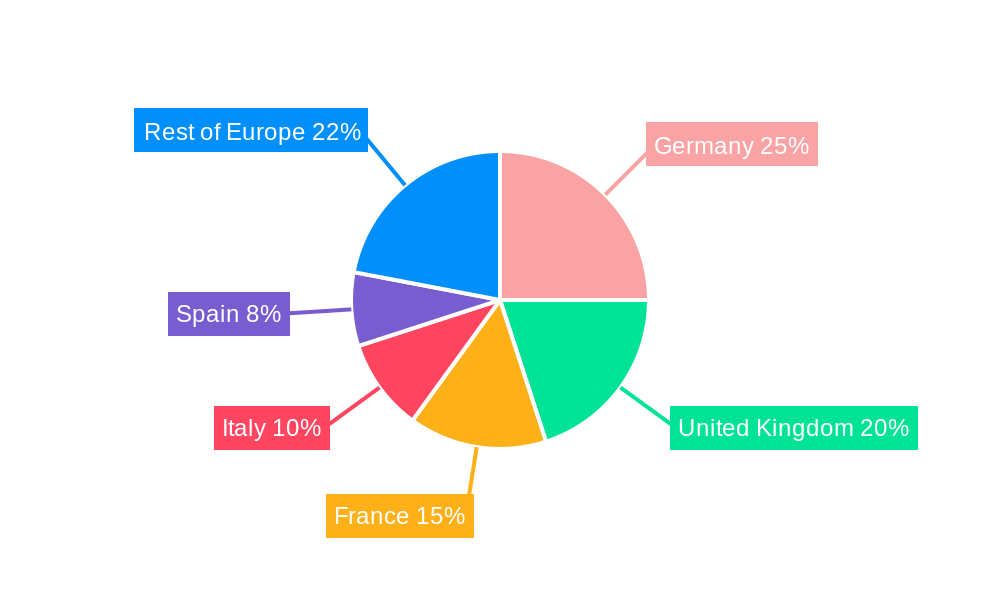

The European probiotics market, valued at €13.78 billion in 2025, is projected to experience steady growth, driven by increasing consumer awareness of gut health and its connection to overall well-being. The market's Compound Annual Growth Rate (CAGR) of 3.49% from 2019 to 2024 suggests a consistent trajectory, likely to continue through the forecast period (2025-2033). Key drivers include the rising prevalence of digestive disorders, a growing demand for natural health solutions, and the increasing integration of probiotics into functional foods and beverages. The functional food and beverage segment holds a significant share, fueled by consumer preference for convenient and palatable probiotic delivery methods. Germany, the United Kingdom, and France represent the largest national markets, reflecting high consumer spending on health and wellness products. However, growth in other European countries, such as Italy and Spain, is also anticipated, reflecting changing dietary habits and increased health consciousness. Growth is further supported by probiotic manufacturers expanding their product lines to cater to diverse consumer needs, including specialized formulations for specific health concerns. Challenges include maintaining product quality and shelf-life, managing consumer expectations regarding efficacy, and navigating evolving regulatory landscapes.

The competitive landscape is characterized by a mix of established multinational corporations like Nestlé and Danone, alongside specialized probiotic companies like BioGaia. These companies are engaged in strategic initiatives, including product innovation, mergers and acquisitions, and expanding distribution channels to strengthen their market presence. The increasing availability of probiotics through supermarkets, pharmacies, and online channels expands market access, boosting overall sales. The market is expected to witness a continued rise in demand for premium and specialized probiotic products, contributing to the overall growth trajectory. While the current market size indicates considerable potential, future expansion will depend on addressing consumer concerns about efficacy and product safety, alongside fostering further research and innovation in the field of probiotic science.

Europe Probiotics Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe probiotics industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. From market size and growth projections to competitive landscapes and emerging trends, this report offers a 360-degree view of the industry's past, present, and future. Covering the period 2019-2033, with a focus on 2025, this study is an essential resource for strategic decision-making. The report analyzes key segments including functional food & beverage, dietary supplements, and animal feed, across major European countries like Germany, UK, France, and more. Expect detailed breakdowns of market concentration, leading players (Nestlé SA, Chr. Hansen, PepsiCo Inc, Danone SA, BioGaia, and more), and crucial industry developments. Maximize your understanding of this burgeoning market and gain a competitive edge.

Europe Probiotics Industry Market Dynamics & Concentration

The European probiotics market exhibits a moderately concentrated structure, with a few major players holding significant market share. Nestlé SA, Chr. Hansen, and Danone SA are among the leading companies, accounting for an estimated xx% of the total market in 2025. However, the market also features several smaller players, fostering competition and innovation. Market concentration is influenced by factors such as brand recognition, distribution networks, and research & development capabilities.

Innovation Drivers: Significant investments in research and development, coupled with the increasing demand for health and wellness products, are key innovation drivers. The development of new probiotic strains with enhanced functionalities and targeted health benefits fuels market growth.

Regulatory Frameworks: EU regulations regarding food safety and labeling play a crucial role in shaping the market. Strict regulations ensure product quality and consumer safety, impacting market entry and product development strategies.

Product Substitutes: While probiotics offer unique health benefits, consumers may opt for alternative products like prebiotics or other dietary supplements, presenting a competitive challenge.

End-User Trends: Growing consumer awareness of gut health and its connection to overall well-being fuels demand for probiotics. The increasing prevalence of lifestyle diseases further drives market growth.

M&A Activities: The European probiotics market witnessed xx M&A deals between 2019 and 2024. These activities reflect strategic efforts by major players to expand their product portfolios, enhance market reach, and acquire innovative technologies.

Europe Probiotics Industry Trends & Analysis

The European probiotics market is experiencing robust growth, with a projected CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the increasing prevalence of digestive disorders, rising consumer awareness of gut health, and the growing popularity of functional foods and beverages. Technological advancements, such as the development of novel probiotic strains and improved delivery systems, are further accelerating market expansion. Consumer preferences are shifting towards products with natural ingredients and clear health benefits, shaping product development strategies.

The market penetration of probiotics in various product categories continues to rise, driven by increasing consumer acceptance and availability of probiotic-rich products in diverse retail channels. Competitive dynamics are characterized by fierce competition among established players and emerging players, leading to product innovation and pricing strategies.

Leading Markets & Segments in Europe Probiotics Industry

Germany, the United Kingdom, and France represent the leading markets for probiotics in Europe, driven by strong consumer demand, developed healthcare infrastructure, and high disposable incomes. The functional food and beverage segment dominates the market, accounting for approximately xx% of total revenue in 2025, followed by dietary supplements. Supermarkets/hypermarkets represent the most significant distribution channel, providing widespread access to probiotic products.

- Key Drivers for Leading Markets:

- Germany: Strong regulatory framework, high consumer health consciousness, and established distribution networks.

- United Kingdom: High consumer spending on health and wellness products, strong retail infrastructure.

- France: Increasing awareness of gut health and rising demand for functional foods.

- Other Countries: Growth in other European countries is influenced by factors like rising disposable incomes, increasing health awareness and the expansion of distribution channels.

The Animal Feed segment is experiencing steady growth, driven by increasing demand for animal feed additives that promote animal health and productivity.

Europe Probiotics Industry Product Developments

Recent years have witnessed significant product innovations in the European probiotics market, including the development of novel probiotic strains with enhanced functionalities, targeted health benefits, and improved stability. Companies are focusing on developing products with better shelf life, improved delivery systems, and enhanced taste and texture to cater to the evolving consumer preferences. These innovations contribute to increased market competitiveness and broader consumer appeal.

Key Drivers of Europe Probiotics Industry Growth

The European probiotics market is propelled by several key growth drivers, including:

- Rising consumer awareness of gut health: Growing understanding of the gut-brain axis and the role of probiotics in maintaining overall health and well-being.

- Increased prevalence of digestive disorders: The rising incidence of irritable bowel syndrome (IBS), inflammatory bowel disease (IBD), and other digestive problems drives demand for probiotic solutions.

- Technological advancements: Innovations in probiotic strain development and delivery systems lead to more effective and convenient products.

- Favorable regulatory environment: Supportive regulations facilitate market expansion and encourage innovation.

Challenges in the Europe Probiotics Industry Market

The European probiotics market faces several challenges, including:

- Stringent regulatory requirements: Meeting stringent safety and labeling regulations can increase product development costs and time-to-market.

- Supply chain disruptions: Global supply chain challenges can impact the availability of raw materials and finished products.

- Intense competition: The market is characterized by intense competition among established and emerging players, leading to price wars and pressure on profit margins. The competitive landscape is further complicated by the presence of private label products offering price competition. This leads to approximately xx Million in lost revenue for the major players annually.

Emerging Opportunities in Europe Probiotics Industry

Several emerging opportunities exist in the European probiotics market, including:

- Expansion into new applications: Exploration of probiotics in areas like skin health, mental health, and immunomodulation offers significant growth potential.

- Strategic partnerships and collaborations: Collaborations between probiotic manufacturers, research institutions, and healthcare providers can lead to the development of innovative products and improved market access.

- Market expansion in emerging economies: Growth potential in Eastern European countries with rising incomes and growing health awareness.

Leading Players in the Europe Probiotics Industry Sector

- Nestlé SA

- Chr. Hansen

- PepsiCo Inc

- Danone SA

- BioGaia

- Lifeway Foods Inc

- Archer Daniels Midland

- Yakult Honsha

- Daflorn MLM5 Ltd

- Bio-K Plus International Inc

Key Milestones in Europe Probiotics Industry Industry

- September 2022: BioGaia announced a partnership with Skinome to develop a probiotic concentrate for skin health, signifying expansion into new applications.

- August 2022: BioGaia announced expansion of its product line with new bacterial strains and a new fermentation pilot plant, highlighting investments in research and development.

- February 2021: Perrigo and Probi signed a pan-European agreement to launch premium probiotic products, demonstrating strategic partnerships driving market expansion.

Strategic Outlook for Europe Probiotics Industry Market

The European probiotics market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and strategic partnerships. Future market potential is significant, particularly in areas like personalized nutrition, targeted health benefits, and innovative delivery systems. Companies that invest in research and development, build strong brands, and adapt to evolving consumer needs are well-positioned to succeed in this dynamic market.

Europe Probiotics Industry Segmentation

-

1. Product Type

- 1.1. Functional Food and Beverage

- 1.2. Dietary Supplements

- 1.3. Animal Feed

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Pharmacies/Health Stores

- 2.3. Convenience Stores

- 2.4. Other Distribution Channels

Europe Probiotics Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Probiotics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.49% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Specialty

- 3.2.2 Organic

- 3.2.3 and Green Coffee; Growing In-House Production of Coffee in the Country

- 3.3. Market Restrains

- 3.3.1. Change in Climatic Conditions Impacting Coffee Plantations

- 3.4. Market Trends

- 3.4.1. Growing Demand for Functional Food and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food and Beverage

- 5.1.2. Dietary Supplements

- 5.1.3. Animal Feed

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Pharmacies/Health Stores

- 5.2.3. Convenience Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Probiotics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Nestlé SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 CHR Hansen

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 PepsiCo Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Danone SA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BioGaia

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Lifeway Foods Inc *List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Archer Daniels Midland

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yakult Honsha

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Daflorn MLM5 Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Bio-K Plus International Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Nestlé SA

List of Figures

- Figure 1: Europe Probiotics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Probiotics Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Probiotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Probiotics Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Probiotics Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Europe Probiotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Probiotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Probiotics Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Europe Probiotics Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Europe Probiotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Probiotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Probiotics Industry?

The projected CAGR is approximately 3.49%.

2. Which companies are prominent players in the Europe Probiotics Industry?

Key companies in the market include Nestlé SA, CHR Hansen, PepsiCo Inc, Danone SA, BioGaia, Lifeway Foods Inc *List Not Exhaustive, Archer Daniels Midland, Yakult Honsha, Daflorn MLM5 Ltd, Bio-K Plus International Inc.

3. What are the main segments of the Europe Probiotics Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Specialty. Organic. and Green Coffee; Growing In-House Production of Coffee in the Country.

6. What are the notable trends driving market growth?

Growing Demand for Functional Food and Beverages.

7. Are there any restraints impacting market growth?

Change in Climatic Conditions Impacting Coffee Plantations.

8. Can you provide examples of recent developments in the market?

September 2022: BioGaia announced its partnership with Skinome to research and develop a probiotic concentrate with living bacteria that will support the skin microbiome and improve skin health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Probiotics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Probiotics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Probiotics Industry?

To stay informed about further developments, trends, and reports in the Europe Probiotics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence