Key Insights

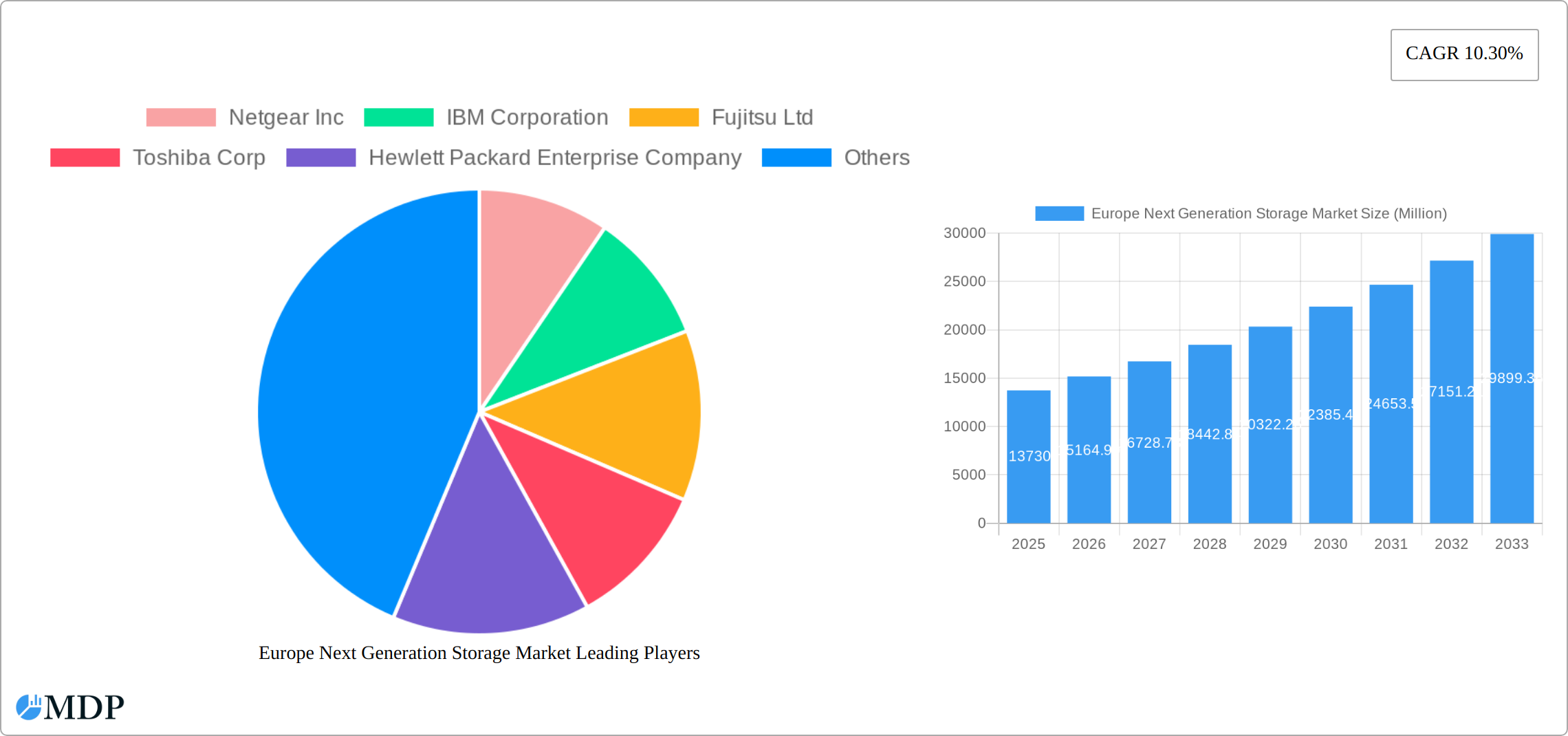

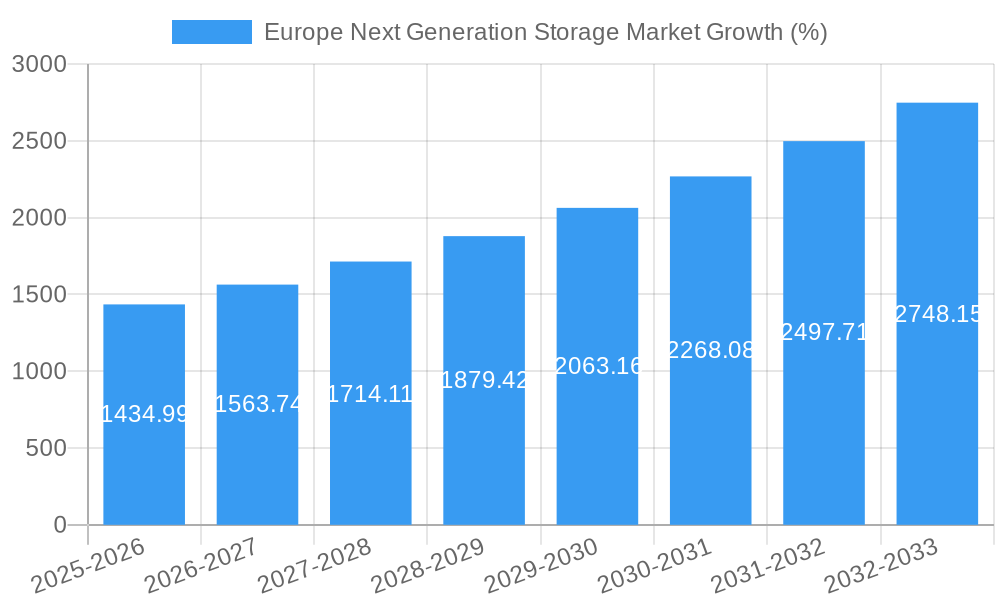

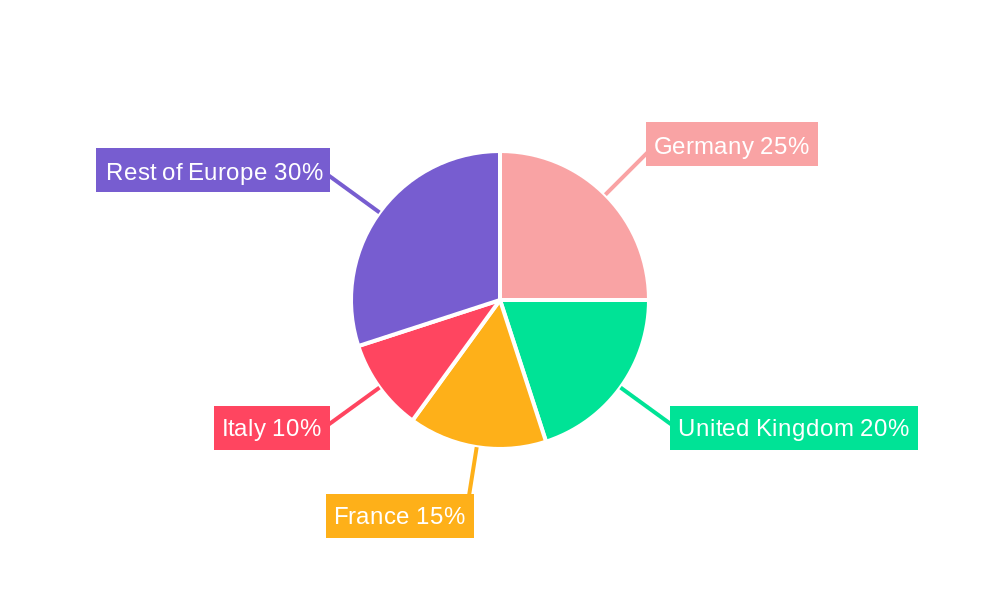

The European next-generation storage market, valued at €13.73 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.30% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of cloud computing and big data analytics across various sectors, including BFSI, retail, IT and telecom, healthcare, and media and entertainment, necessitates efficient and scalable storage solutions. Furthermore, the rising demand for data security and disaster recovery measures is pushing organizations to adopt advanced storage technologies like object-based storage and SAN solutions offering enhanced data protection and resilience. The transition from legacy storage systems to next-generation technologies like NVMe and the increasing adoption of hybrid cloud strategies are further contributing factors. Germany and the United Kingdom are expected to be the leading markets within Europe, driven by strong digital transformation initiatives and a thriving IT sector. However, high initial investment costs associated with implementing these next-generation storage systems and the complexity involved in integrating them with existing infrastructure pose challenges to market growth. Nonetheless, the long-term benefits in terms of improved performance, scalability, and cost efficiency are expected to outweigh these initial hurdles, ensuring sustained market expansion throughout the forecast period.

The market segmentation reveals a diverse landscape. Direct Attached Storage (DAS) remains prevalent, particularly in smaller businesses, but Network Attached Storage (NAS) and Storage Area Networks (SAN) are gaining traction due to their scalability and centralized management capabilities. The shift towards cloud-native applications is driving the adoption of File and Object-based Storage (FOBS) solutions, while block storage continues to be crucial for applications requiring high performance and low latency. Major players like Netgear, IBM, Fujitsu, Toshiba, Hewlett Packard Enterprise, Scality, Hitachi, Dell, DataDirect Networks, NetApp, and Pure Storage are actively competing in this dynamic market, constantly innovating and expanding their product portfolios to meet evolving customer demands. The continued investment in research and development of advanced storage technologies, along with strategic partnerships and mergers and acquisitions, will further shape the competitive landscape in the years to come.

Europe Next Generation Storage Market Report: 2019-2033

Unlocking Growth in Europe's Dynamic Next-Generation Storage Landscape: A Comprehensive Market Analysis

This comprehensive report provides an in-depth analysis of the Europe Next Generation Storage Market, offering invaluable insights for stakeholders across the storage ecosystem. Covering the period 2019-2033, with a base year of 2025, this study meticulously examines market dynamics, industry trends, leading players, and emerging opportunities, empowering businesses to make informed strategic decisions. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Europe Next Generation Storage Market Market Dynamics & Concentration

The European next-generation storage market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is currently moderate, with several key players holding significant but not dominant market share. Innovation is a key driver, fueled by the ever-increasing demand for data storage and processing capabilities across various end-user industries. Stringent data privacy regulations across Europe, such as GDPR, significantly impact market dynamics, encouraging investment in secure storage solutions. The market also faces pressure from product substitutes, including cloud storage services, which are steadily gaining traction. End-user trends toward digital transformation, cloud adoption, and big data analytics are key growth catalysts.

Significant M&A activity has been observed in the recent past, with xx mergers and acquisitions recorded between 2019 and 2024. These transactions reflect the consolidation efforts within the industry and the pursuit of expanding market reach and technological capabilities. The market share distribution is as follows (Estimated 2025):

- NetApp Inc: xx%

- Dell Inc: xx%

- Hewlett Packard Enterprise Company: xx%

- Others: xx%

Europe Next Generation Storage Market Industry Trends & Analysis

The European next-generation storage market exhibits robust growth driven by several factors. The burgeoning adoption of cloud computing, the proliferation of big data, and the increasing demand for high-performance computing (HPC) are primary drivers. Technological disruptions, such as the transition to NVMe technology and the rise of software-defined storage, are reshaping the competitive landscape. Consumer preferences are shifting towards scalable, flexible, and cost-effective storage solutions, pushing vendors to innovate and offer cloud-integrated and hybrid storage options. Market penetration of next-generation storage technologies is steadily increasing, with a projected xx% market penetration by 2033. The CAGR for the overall market during the forecast period is estimated at xx%. Competitive dynamics are intense, with established players and new entrants vying for market share through product differentiation, strategic partnerships, and technological advancements.

Leading Markets & Segments in Europe Next Generation Storage Market

The UK and Germany represent the largest national markets within Europe for next-generation storage, driven by strong technological adoption and robust IT infrastructure. The "Rest of Europe" segment also shows promising growth potential.

Dominant Segments:

- Storage System: SAN (Storage Area Network) currently holds the largest market share, followed by NAS (Network Attached Storage) and DAS (Direct Attached Storage). However, NAS and particularly cloud-based storage solutions are experiencing significant growth due to their scalability and cost-effectiveness.

- Storage Architecture: Block storage dominates currently, owing to its performance and reliability advantages in enterprise applications. However, File and Object-based Storage (FOBS) is rapidly gaining traction due to its suitability for unstructured data management and cloud integration.

- End-User Industry: The BFSI (Banking, Financial Services, and Insurance) sector and the IT and Telecom sector are the key consumers of next-generation storage solutions due to high data volumes and stringent security requirements. Growth in other sectors like Healthcare and Media & Entertainment is also observed.

Key Drivers:

- UK: Strong government support for digital transformation initiatives, well-established IT infrastructure.

- Germany: Robust industrial base, high adoption of advanced technologies in various sectors.

- Rest of Europe: Increasing digitalization efforts across various countries, expanding cloud adoption.

Europe Next Generation Storage Market Product Developments

Recent product innovations focus on increased storage capacity, improved performance, enhanced security features, and better integration with cloud platforms. The market is witnessing a shift towards software-defined storage, NVMe-based solutions, and AI-powered storage management systems. These developments are primarily driven by the need for efficient data management in cloud and hybrid cloud environments, as well as enhancing data security and resilience. The competitive advantage lies in offering tailored solutions catering to specific end-user needs, coupled with robust customer support and seamless integration capabilities.

Key Drivers of Europe Next Generation Storage Market Growth

Several factors fuel the growth of the European next-generation storage market. Technological advancements, including NVMe technology and improved storage density, are continuously improving storage performance and cost-effectiveness. The growing adoption of cloud computing and big data analytics necessitates robust storage solutions. Furthermore, increasing government investments in digital infrastructure and supportive regulatory frameworks are propelling market growth. For example, the EU's Digital Single Market strategy incentivizes digital transformation across member states.

Challenges in the Europe Next Generation Storage Market Market

The market faces challenges such as high initial investment costs for next-generation storage solutions, potentially restricting adoption among smaller enterprises. Supply chain disruptions can lead to delays and increased costs. Intense competition amongst established and emerging vendors also puts pressure on profit margins. The regulatory landscape, while supportive of innovation, can create compliance complexities. These factors may cumulatively impact market growth by xx% by 2028.

Emerging Opportunities in Europe Next Generation Storage Market

Significant opportunities exist in expanding into emerging markets within Europe, particularly in countries with growing digital economies. The development of innovative storage solutions tailored to specific industry needs, such as healthcare and media & entertainment, represents a major opportunity. Strategic partnerships and collaborations between storage vendors and cloud service providers can unlock significant market expansion opportunities. Moreover, advancements in areas like AI-driven data management can further enhance storage efficiency and security.

Leading Players in the Europe Next Generation Storage Market Sector

- Netgear Inc

- IBM Corporation

- Fujitsu Ltd

- Toshiba Corp

- Hewlett Packard Enterprise Company

- Scality Inc

- Hitachi Ltd

- Dell Inc

- DataDirect Networks

- NetApp Inc

- Pure Storage Inc

Key Milestones in Europe Next Generation Storage Market Industry

- September 2022: Seagate Technology Holdings launched its next-generation Exos X systems, significantly improving enterprise-class storage performance.

- February 2022: Toshiba Corporation announced plans to introduce a 30TB HDD by 2023, addressing the growing demand for high-capacity storage from cloud providers.

- January 2023: Google and Telefonica partnered for digital transformation, integrating Google Cloud with Telefonica's infrastructure in Spain, setting a high standard for data security and protection.

Strategic Outlook for Europe Next Generation Storage Market Market

The future of the European next-generation storage market is bright, driven by continuous technological innovation, increasing data volumes, and the expansion of cloud computing. Strategic partnerships and the development of tailored solutions for specific industry verticals will be key growth accelerators. The market's potential lies in leveraging advanced technologies such as AI and machine learning to enhance storage efficiency, security, and data analytics capabilities, ultimately driving further market expansion and value creation.

Europe Next Generation Storage Market Segmentation

-

1. Storage System

- 1.1. Direct Attached Storage (DAS)

- 1.2. Network Attached Storage (NAS)

- 1.3. Storage Area Network (SAN)

-

2. Storage Architecture

- 2.1. File and Object-based Storage (FOBS)

- 2.2. Block Storage

-

3. End-User Industry

- 3.1. BFSI

- 3.2. Retail

- 3.3. IT and Telecom

- 3.4. Healthcare

- 3.5. Media and Entertainment

Europe Next Generation Storage Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Next Generation Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Volume of Digital Data; Rising Adoption of Solid-state Devices; Increasing Proliferation of Smartphones

- 3.2.2 Laptops

- 3.2.3 and Tablets

- 3.3. Market Restrains

- 3.3.1. Lack of Data Security in Cloud- and Server-based Services

- 3.4. Market Trends

- 3.4.1. IT and telecom segment is expected to grow at a higher pace.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Storage System

- 5.1.1. Direct Attached Storage (DAS)

- 5.1.2. Network Attached Storage (NAS)

- 5.1.3. Storage Area Network (SAN)

- 5.2. Market Analysis, Insights and Forecast - by Storage Architecture

- 5.2.1. File and Object-based Storage (FOBS)

- 5.2.2. Block Storage

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. IT and Telecom

- 5.3.4. Healthcare

- 5.3.5. Media and Entertainment

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Storage System

- 6. Germany Europe Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Next Generation Storage Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Netgear Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 IBM Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Fujitsu Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Toshiba Corp

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hewlett Packard Enterprise Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Scality Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Hitachi Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Dell Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 DataDirect Networks

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 NetApp Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Pure Storage Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Netgear Inc

List of Figures

- Figure 1: Europe Next Generation Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Next Generation Storage Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Next Generation Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Next Generation Storage Market Revenue Million Forecast, by Storage System 2019 & 2032

- Table 3: Europe Next Generation Storage Market Revenue Million Forecast, by Storage Architecture 2019 & 2032

- Table 4: Europe Next Generation Storage Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: Europe Next Generation Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Next Generation Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Next Generation Storage Market Revenue Million Forecast, by Storage System 2019 & 2032

- Table 15: Europe Next Generation Storage Market Revenue Million Forecast, by Storage Architecture 2019 & 2032

- Table 16: Europe Next Generation Storage Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 17: Europe Next Generation Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Next Generation Storage Market?

The projected CAGR is approximately 10.30%.

2. Which companies are prominent players in the Europe Next Generation Storage Market?

Key companies in the market include Netgear Inc, IBM Corporation, Fujitsu Ltd, Toshiba Corp, Hewlett Packard Enterprise Company, Scality Inc, Hitachi Ltd, Dell Inc, DataDirect Networks, NetApp Inc, Pure Storage Inc.

3. What are the main segments of the Europe Next Generation Storage Market?

The market segments include Storage System, Storage Architecture, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Volume of Digital Data; Rising Adoption of Solid-state Devices; Increasing Proliferation of Smartphones. Laptops. and Tablets.

6. What are the notable trends driving market growth?

IT and telecom segment is expected to grow at a higher pace..

7. Are there any restraints impacting market growth?

Lack of Data Security in Cloud- and Server-based Services.

8. Can you provide examples of recent developments in the market?

January 2023 - Google and Telefonica signed a deal for digital transformation and an advance 5G mobile edge computing system in Spain. Google cloud region will integrate the Highest worldwide security and data protection standards for Telefonica's Madrid region infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Next Generation Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Next Generation Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Next Generation Storage Market?

To stay informed about further developments, trends, and reports in the Europe Next Generation Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence