Key Insights

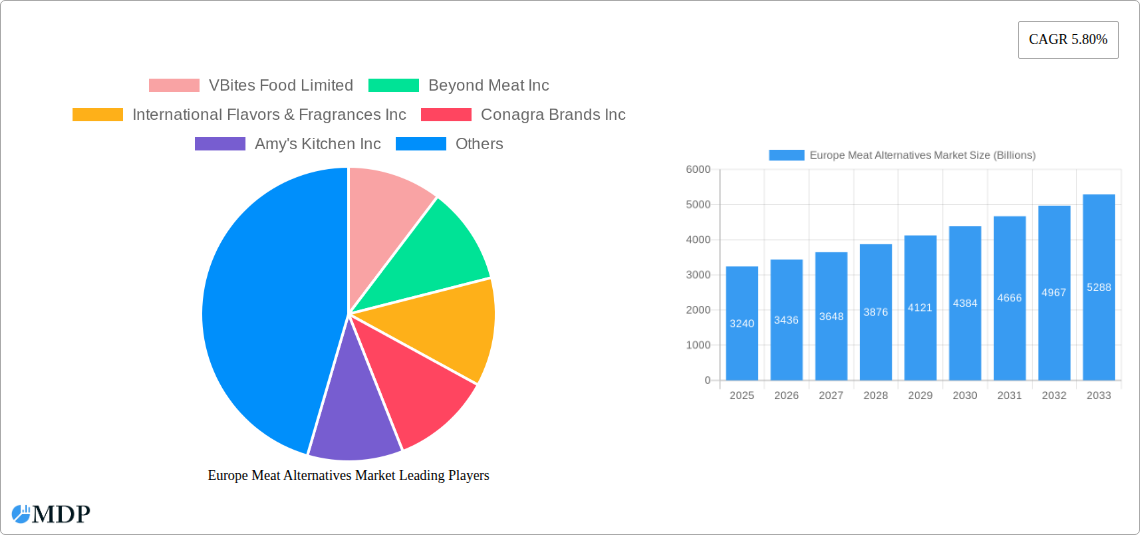

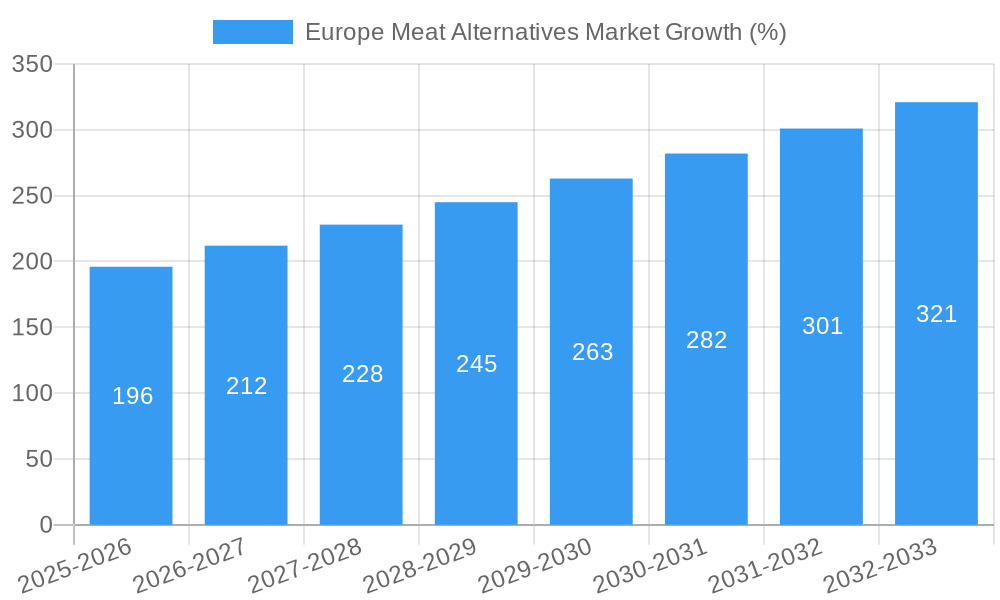

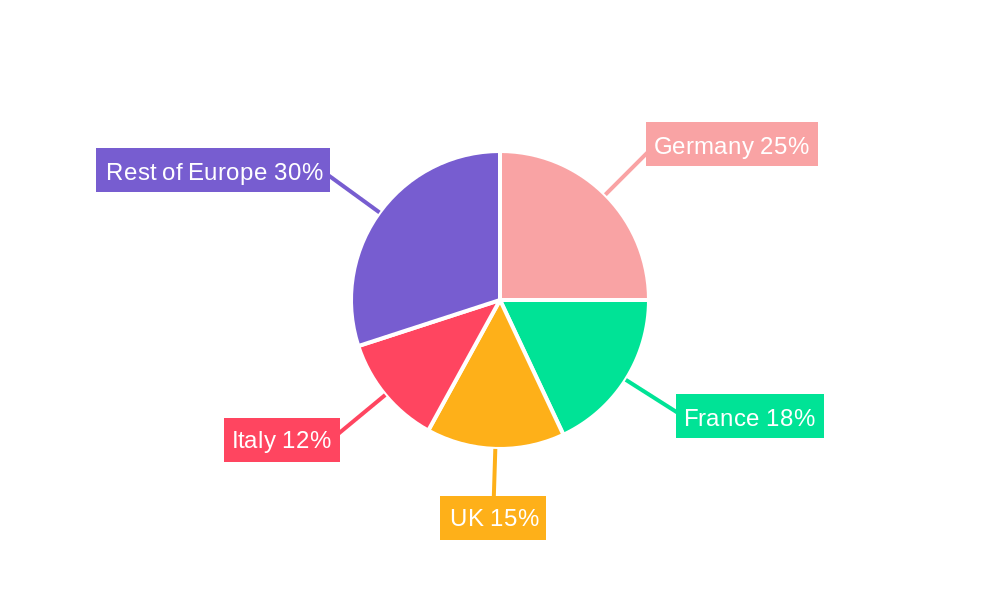

The European meat alternatives market, valued at €3.24 billion in 2025, is projected to experience robust growth, driven by increasing consumer awareness of health and environmental benefits associated with plant-based diets. A compound annual growth rate (CAGR) of 5.80% from 2025 to 2033 indicates a significant expansion, reaching an estimated €5.2 billion by 2033. Key drivers include rising concerns about animal welfare, the growing popularity of veganism and vegetarianism, and the increasing availability of innovative and palatable meat alternatives in various formats like tempeh, tofu, textured vegetable protein, and other meat substitutes. The market's segmentation reflects diverse consumer preferences and consumption habits, with both off-trade (retail) and on-trade (food service) channels playing crucial roles in market penetration. Leading companies like Beyond Meat, Vbites, and Amy's Kitchen are at the forefront of innovation, constantly introducing new products to meet evolving consumer demands. The strong presence of established food giants like Conagra Brands and Associated British Foods further underlines the market's growth potential. Germany, France, the UK, and Italy represent significant market segments within Europe, reflecting their higher consumer purchasing power and established plant-based food markets. However, challenges remain, including overcoming consumer perceptions about taste and texture, as well as ensuring sustainable sourcing of ingredients for production.

Continued growth hinges on overcoming these challenges. The market will likely see further diversification of product offerings, with a stronger focus on mimicking the taste, texture, and nutritional profile of traditional meat products. Sustainability certifications and transparent supply chains will gain importance, appealing to environmentally conscious consumers. Technological advancements in the production of meat alternatives, including cell-based and cultivated meat, are poised to significantly influence the market landscape in the coming years, offering high-quality, sustainable alternatives. Further penetration into the on-trade sector will also be key to accelerating market expansion. Strategic partnerships and collaborations between established food companies and innovative startups will play a significant role in driving growth and innovation within the European meat alternatives market.

Europe Meat Alternatives Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the rapidly expanding Europe Meat Alternatives Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Valued at Billions in 2025, the market is poised for significant growth, reaching Billions by 2033. This report covers the historical period (2019-2024), base year (2025), and forecasts the market's trajectory until 2033.

Europe Meat Alternatives Market Market Dynamics & Concentration

The Europe meat alternatives market is characterized by increasing market concentration, driven by both organic growth and mergers & acquisitions (M&A). The market share held by the top 5 players in 2025 is estimated at xx%, indicating a moderately consolidated landscape. However, significant innovation and the entry of new players are creating a dynamic competitive environment. Several factors contribute to this dynamic:

- Innovation Drivers: Continuous R&D efforts are resulting in improved product texture, taste, and nutritional profiles, driving consumer adoption. New technologies are focusing on creating more sustainable and cost-effective production methods.

- Regulatory Frameworks: EU regulations concerning food labeling, safety, and sustainability are shaping market practices and influencing consumer choices. These regulations are expected to evolve further, presenting both challenges and opportunities for market players.

- Product Substitutes: The market faces competition from traditional meat products, but also from other plant-based protein sources and emerging technologies like cultivated meat. This competitive pressure is driving innovation and affordability.

- End-User Trends: Growing consumer awareness of health, environmental, and ethical concerns related to meat consumption is fueling demand for meat alternatives. This shift is particularly pronounced among younger demographics and in urban areas.

- M&A Activities: The market has witnessed a significant number of mergers and acquisitions (xx deals in the past 5 years), demonstrating a consolidation trend amongst industry players. Key examples include the recent House Foods Group acquisition of Keystone Natural Holdings.

Europe Meat Alternatives Market Industry Trends & Analysis

The Europe meat alternatives market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by several key factors:

- Market Growth Drivers: The increasing demand for healthier and more sustainable food options is a primary driver. Changing consumer lifestyles, including the rise of veganism and vegetarianism, also contribute significantly. Government initiatives promoting sustainable food systems and reducing meat consumption also play a role.

- Technological Disruptions: Advances in food technology, such as 3D printing and precision fermentation, are creating novel meat alternatives with enhanced texture and taste profiles. These innovations are expected to disrupt existing production processes and create new market opportunities.

- Consumer Preferences: Consumer preferences are shifting towards more plant-based diets, driven by health, environmental, and ethical considerations. This shift is leading to increased demand for diverse and convenient meat alternatives. The increasing availability of meat alternatives in various retail channels and food service outlets is also boosting market growth.

- Competitive Dynamics: The market is characterized by intense competition, with both established food companies and startups vying for market share. This competition is driving innovation, product diversification, and price reductions, ultimately benefiting consumers. Market penetration of meat alternatives in Europe is projected to reach xx% by 2033, up from xx% in 2025.

Leading Markets & Segments in Europe Meat Alternatives Market

While the entire European market shows strong growth, specific regions and product segments demonstrate particularly high potential. Germany and the UK are leading markets, benefiting from high consumer awareness and adoption of plant-based diets.

- Dominant Segments:

- Type: Tofu and textured vegetable protein (TVP) currently hold the largest market share, owing to their established presence and cost-effectiveness. However, "other meat substitutes," encompassing innovative products like plant-based burgers and sausages, are experiencing the fastest growth.

- Distribution Channel: The off-trade channel (supermarkets, grocery stores) dominates the market, reflecting the increasing availability of meat alternatives in mainstream retail outlets. However, the on-trade channel (restaurants, cafes) is showing promising growth due to the increasing integration of meat alternatives into menus.

Key Drivers for Leading Markets/Segments:

- Germany: Strong regulatory support for sustainable food systems, high consumer awareness, and a large retail infrastructure contribute to Germany's leading position.

- UK: Similar to Germany, the UK benefits from a high level of consumer awareness, strong retail infrastructure, and increasing regulatory focus on sustainable food.

- Tofu & TVP: Established production processes, cost-effectiveness, and wide consumer acceptance contribute to these segments’ dominance.

- Other Meat Substitutes: Innovation, consumer preference for novel products, and successful marketing strategies fuel the rapid growth of this segment.

Europe Meat Alternatives Market Product Developments

Recent product launches highlight continuous innovation in the meat alternatives sector. International Flavors & Fragrances Inc.'s SUPRO® TEX soy-based protein offers enhanced product design possibilities. Beyond Meat’s expansion into Germany exemplifies efforts to increase market penetration with diversified product lines. This ongoing innovation in taste, texture, and affordability drives market growth and broadens consumer appeal.

Key Drivers of Europe Meat Alternatives Market Growth

Several factors contribute to the sustained growth of the Europe meat alternatives market:

- Technological advancements: Continuous improvements in production technologies are reducing costs and improving product quality.

- Rising consumer awareness: Growing awareness of the health, environmental, and ethical concerns related to meat consumption fuels demand.

- Government support: Several EU policies promote sustainable food systems and support the development of the plant-based food sector.

Challenges in the Europe Meat Alternatives Market Market

Despite significant growth potential, the market faces certain challenges:

- Regulatory hurdles: Navigating complex food safety and labeling regulations across different European countries can be costly and time-consuming.

- Supply chain issues: Securing consistent and sustainable supplies of raw materials can be challenging, especially for niche ingredients.

- Competitive pressures: The market is characterized by strong competition, putting pressure on prices and margins. This necessitates constant innovation and efficient operations for market success.

Emerging Opportunities in Europe Meat Alternatives Market

The long-term growth outlook is positive, driven by several factors:

- Technological breakthroughs: Emerging technologies, such as cultivated meat, have the potential to revolutionize the market.

- Strategic partnerships: Collaborations between established food companies and innovative startups can accelerate product development and market penetration.

- Market expansion: Expanding into new markets within Europe and beyond can unlock significant growth opportunities.

Leading Players in the Europe Meat Alternatives Market Sector

- VBites Food Limited

- Beyond Meat Inc

- International Flavors & Fragrances Inc

- Conagra Brands Inc

- Amy's Kitchen Inc

- Associated British Foods PLC

- Monde Nissin Corporation

- Plant Meat Limited

- Vitasoy International Holdings Ltd

- House Foods Group Inc

- JBS SA

- The Tofoo Co Ltd

Key Milestones in Europe Meat Alternatives Market Industry

- September 2023: House Foods Group Inc. acquired 100% of Keystone Natural Holdings, LLC, expanding its presence in North America and Europe.

- July 2023: Beyond Meat launched new plant-based chicken products in over 1,600 REWE stores across Germany, significantly increasing its market reach.

- March 2023: International Flavors & Fragrances Inc. launched SUPRO® TEX, a new plant-based protein, offering enhanced formulation possibilities for manufacturers.

Strategic Outlook for Europe Meat Alternatives Market Market

The Europe meat alternatives market is poised for sustained growth, driven by technological advancements, changing consumer preferences, and supportive government policies. Strategic opportunities exist for companies that can leverage innovation, build strong brands, and develop efficient supply chains to meet the increasing demand for diverse and affordable meat alternatives. The market's potential extends beyond current segments, with future growth likely driven by novel product categories and expansion into new European markets.

Europe Meat Alternatives Market Segmentation

-

1. Type

- 1.1. Tempeh

- 1.2. Textured Vegetable Protein

- 1.3. Tofu

- 1.4. Other Meat Substitutes

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Europe Meat Alternatives Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Meat Alternatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Tempeh

- 5.1.2. Textured Vegetable Protein

- 5.1.3. Tofu

- 5.1.4. Other Meat Substitutes

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Meat Alternatives Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 VBites Food Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Beyond Meat Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 International Flavors & Fragrances Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Conagra Brands Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Amy's Kitchen Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Associated British Foods PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Monde Nissin Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Plant Meat Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Vitasoy International Holdings Lt

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 House Foods Group Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 JBS SA

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 The Tofoo Co Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 VBites Food Limited

List of Figures

- Figure 1: Europe Meat Alternatives Market Revenue Breakdown (Billions, %) by Product 2024 & 2032

- Figure 2: Europe Meat Alternatives Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Meat Alternatives Market Revenue Billions Forecast, by Region 2019 & 2032

- Table 2: Europe Meat Alternatives Market Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Europe Meat Alternatives Market Revenue Billions Forecast, by Type 2019 & 2032

- Table 4: Europe Meat Alternatives Market Volume K Units Forecast, by Type 2019 & 2032

- Table 5: Europe Meat Alternatives Market Revenue Billions Forecast, by Distribution Channel 2019 & 2032

- Table 6: Europe Meat Alternatives Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 7: Europe Meat Alternatives Market Revenue Billions Forecast, by Region 2019 & 2032

- Table 8: Europe Meat Alternatives Market Volume K Units Forecast, by Region 2019 & 2032

- Table 9: Europe Meat Alternatives Market Revenue Billions Forecast, by Country 2019 & 2032

- Table 10: Europe Meat Alternatives Market Volume K Units Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 13: France Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 14: France Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 25: Europe Meat Alternatives Market Revenue Billions Forecast, by Type 2019 & 2032

- Table 26: Europe Meat Alternatives Market Volume K Units Forecast, by Type 2019 & 2032

- Table 27: Europe Meat Alternatives Market Revenue Billions Forecast, by Distribution Channel 2019 & 2032

- Table 28: Europe Meat Alternatives Market Volume K Units Forecast, by Distribution Channel 2019 & 2032

- Table 29: Europe Meat Alternatives Market Revenue Billions Forecast, by Country 2019 & 2032

- Table 30: Europe Meat Alternatives Market Volume K Units Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 32: United Kingdom Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 33: Germany Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 34: Germany Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 35: France Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 36: France Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 37: Italy Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 38: Italy Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 39: Spain Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 40: Spain Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 41: Netherlands Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 42: Netherlands Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 43: Belgium Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 44: Belgium Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 45: Sweden Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 46: Sweden Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 47: Norway Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 48: Norway Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 49: Poland Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 50: Poland Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

- Table 51: Denmark Europe Meat Alternatives Market Revenue (Billions) Forecast, by Application 2019 & 2032

- Table 52: Denmark Europe Meat Alternatives Market Volume (K Units) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Meat Alternatives Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Europe Meat Alternatives Market?

Key companies in the market include VBites Food Limited, Beyond Meat Inc, International Flavors & Fragrances Inc, Conagra Brands Inc, Amy's Kitchen Inc, Associated British Foods PLC, Monde Nissin Corporation, Plant Meat Limited, Vitasoy International Holdings Lt, House Foods Group Inc, JBS SA, The Tofoo Co Ltd.

3. What are the main segments of the Europe Meat Alternatives Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.24 Billions as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

September 2023: House Food Groups Inc. acquired 100% of Keystone Natural Holdings, LLC (“KNH”), a leading manufacturer of tofu and plant-based foods in North America. The acquisition is meant to assist the company's expansion in United States and Europe with tofu as their core product.July 2023: Beyond Meat expanded its range in Germany with two new plant-based chicken-style products: Beyond Nuggets and Beyond Tenders in over 1,600 REWE stores across Germany.March 2023: International Flavors & Fragrances Inc. launched its new plant-based protein SUPRO® TEX which offers endless product design and formulation opportunities with its high-process tolerance, neutral flavor and color. SUPRO® TEX is based on soy protein.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billions and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Meat Alternatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Meat Alternatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Meat Alternatives Market?

To stay informed about further developments, trends, and reports in the Europe Meat Alternatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence