Key Insights

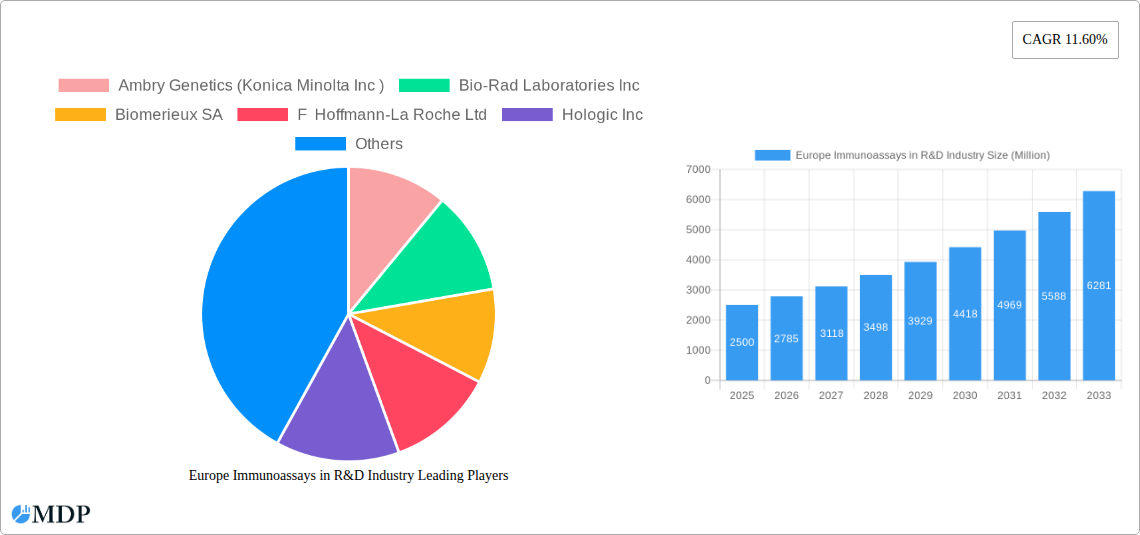

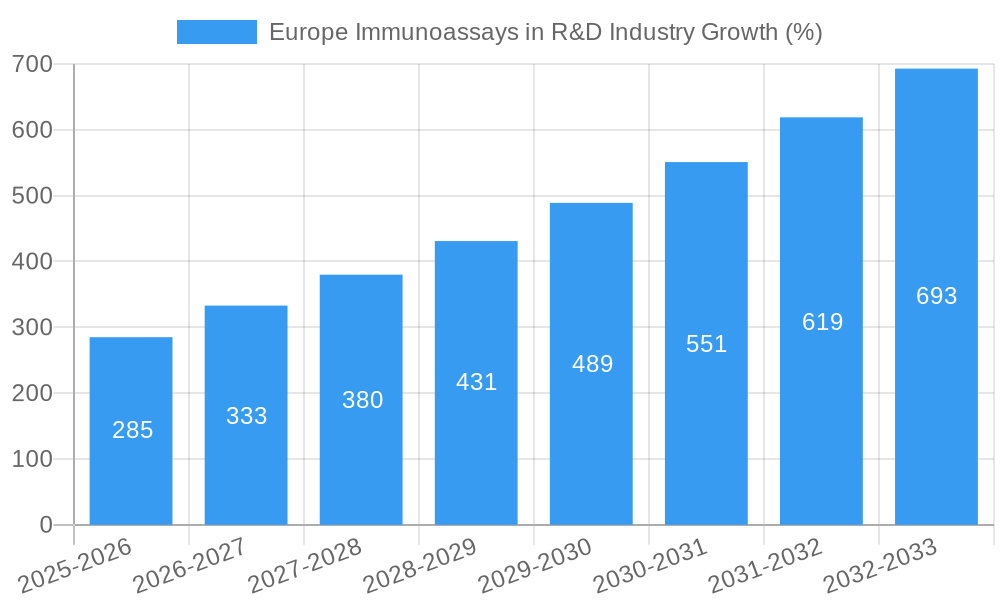

The European immunoassays market within the R&D industry is experiencing robust growth, driven by the increasing prevalence of chronic diseases like cancer and the rising demand for early and accurate diagnostics. The market's compound annual growth rate (CAGR) of 11.60% from 2019 to 2024 suggests a significant expansion, projected to continue through 2033. Key drivers include advancements in immunoassay technologies, such as OMICS technology and improved immunoassays, enabling more sensitive and specific biomarker detection. Furthermore, substantial investments in research and development by pharmaceutical and biotechnology companies are fueling innovation and expanding the applications of immunoassays across various cancer types (prostate, breast, lung, colorectal, cervical, and others). The market segmentation reveals a strong emphasis on protein and genetic biomarkers, with OMICS technology leading the technological landscape. The competitive landscape is characterized by established players like Thermo Fisher Scientific, Roche, and Bio-Rad, alongside emerging companies that are introducing novel technologies and expanding testing capabilities. The presence of strong regulatory frameworks in European countries further supports market growth by ensuring the quality and reliability of immunoassay-based diagnostic tools.

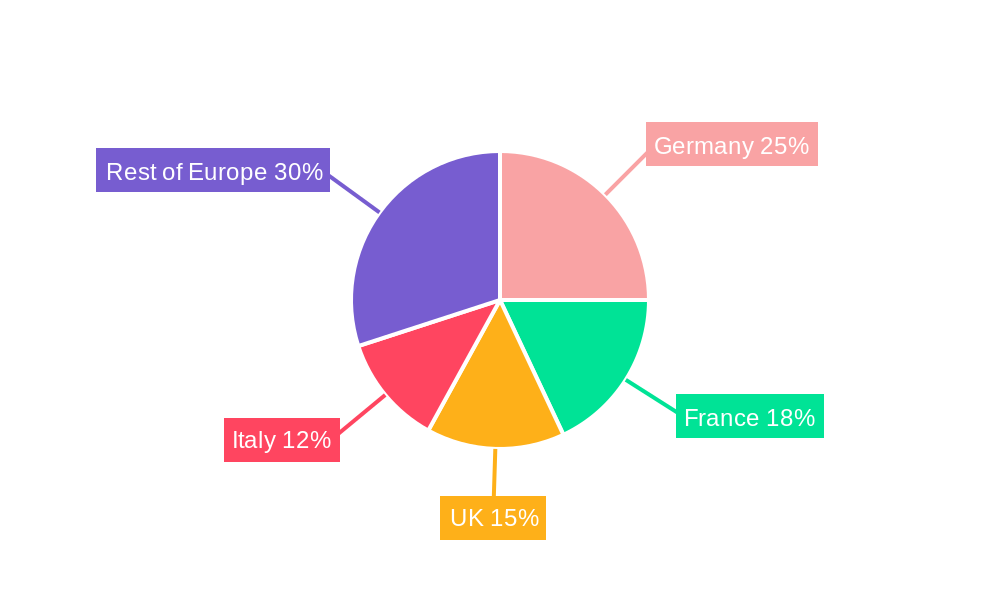

This growth trajectory is anticipated to be further bolstered by increasing government funding for cancer research, rising healthcare expenditure, and the growing adoption of personalized medicine approaches. However, potential restraints include high costs associated with advanced technologies, stringent regulatory requirements, and the need for skilled professionals to operate and interpret the results from complex assays. The geographical distribution within Europe reflects a significant market share held by major economies like Germany, France, and the UK, driven by their established healthcare infrastructure and robust research ecosystems. Future market developments will be shaped by the continuous evolution of immunoassay technologies, integration with other diagnostic methods, and the expansion of applications beyond oncology to encompass other disease areas such as infectious diseases and autoimmune disorders. The increasing use of point-of-care testing and telemedicine platforms also hold significant potential for future growth.

Europe Immunoassays in R&D Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Immunoassays in R&D industry, offering valuable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this report analyzes market dynamics, trends, leading players, and future opportunities. The report leverages extensive primary and secondary research to provide a granular understanding of this rapidly evolving market. Key segments analyzed include various diseases (Prostate, Breast, Lung, Colorectal, Cervical Cancers, and Others), biomarker types (Protein, Genetic, and Others), and profiling technologies (OMICS, Imaging, Immunoassays, and Cytogenetics). The report is crucial for businesses seeking to understand market opportunities, competitive dynamics, and future growth potential within the European immunoassays R&D landscape.

Europe Immunoassays in R&D Industry Market Dynamics & Concentration

The European immunoassays market in the R&D sector is characterized by a moderately concentrated landscape, with a few large multinational corporations holding significant market share. The market share of the top 5 players is estimated to be xx% in 2025. Innovation plays a crucial role, driven by advancements in profiling technologies and the development of novel biomarkers. Stringent regulatory frameworks, such as those set by the European Medicines Agency (EMA), influence product development and market entry. The market experiences competitive pressures from substitute technologies, including genomics and proteomics-based approaches. End-user trends, including increased demand for personalized medicine and early disease detection, are shaping market growth. Mergers and acquisitions (M&A) activity has been moderate in recent years, with an estimated xx M&A deals occurring between 2019 and 2024. Key players are strategically investing in research and development to expand their product portfolios and enhance their market position.

- Market Concentration: Top 5 players hold approximately xx% market share in 2025.

- Innovation Drivers: Advancements in OMICS technologies, development of novel biomarkers.

- Regulatory Frameworks: Stringent EMA regulations influence product development and market entry.

- Product Substitutes: Genomics, proteomics, and other molecular diagnostic technologies.

- End-User Trends: Growing demand for personalized medicine and early disease detection.

- M&A Activity: Approximately xx M&A deals occurred between 2019 and 2024.

Europe Immunoassays in R&D Industry Industry Trends & Analysis

The European immunoassays R&D market exhibits robust growth, driven by factors like the rising prevalence of chronic diseases, increasing demand for early diagnostics, and ongoing technological advancements. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). The market penetration of immunoassays in various disease areas is steadily increasing, with a notable uptake observed in oncology research. Technological disruptions, such as the development of high-throughput screening platforms and advanced imaging techniques, are enhancing the efficiency and accuracy of immunoassay-based research. Consumer preferences are shifting toward more personalized and targeted therapies, fueling demand for sophisticated biomarker profiling. Competitive dynamics are intense, with leading players focusing on strategic partnerships, acquisitions, and product innovation to maintain their market position.

Leading Markets & Segments in Europe Immunoassays in R&D Industry

Germany and the United Kingdom represent the leading markets in Europe for immunoassays in R&D. Their dominance is attributed to robust healthcare infrastructure, substantial investments in R&D, and the presence of numerous pharmaceutical and biotechnology companies. Other key countries include France, Italy, and Spain.

- By Disease: Prostate cancer, breast cancer, and lung cancer are currently dominant segments due to high prevalence rates and extensive research activities.

- By Type: Protein biomarkers hold a larger market share compared to genetic biomarkers, primarily owing to their relative ease of detection and established analytical methods.

- By Profiling Technology: Immunoassays dominate the market due to their established reliability, cost-effectiveness, and widespread availability.

Key drivers for market dominance include:

- Strong Healthcare Infrastructure: Well-funded hospitals and research institutions.

- Government Support: Favorable research funding and regulatory policies.

- Presence of Major Players: Concentration of leading companies in the region.

Europe Immunoassays in R&D Industry Product Developments

Recent product innovations in the immunoassay market emphasize improved sensitivity, specificity, and automation. These advancements allow for high-throughput screening, reducing turnaround times and lowering costs. The market is seeing the development of multiplex assays that can simultaneously detect multiple biomarkers. These innovations are enhancing the efficiency and diagnostic capabilities of immunoassay techniques. The focus on integrating immunoassays with other technologies, such as genomics and imaging, offers enhanced diagnostic accuracy and personalized treatment strategies.

Key Drivers of Europe Immunoassays in R&D Industry Growth

The growth of the European immunoassays market in R&D is primarily fueled by several key factors: the rising prevalence of chronic diseases such as cancer, the increasing demand for early and accurate disease diagnostics, significant technological advancements in immunoassay technologies, and substantial investments in research and development from both public and private sectors within Europe. Furthermore, favorable regulatory environments and supportive government policies promoting innovation further contribute to market expansion.

Challenges in the Europe Immunoassays in R&D Industry Market

The European immunoassays R&D market faces challenges such as stringent regulatory requirements, resulting in high development costs and extended approval timelines. Supply chain disruptions and price volatility of raw materials are potential risks. Intense competition from established players and emerging companies further complicates the market. The cost associated with developing and validating novel biomarkers is another factor limiting market growth.

Emerging Opportunities in Europe Immunoassays in R&D Industry

The long-term growth of the European immunoassays R&D market hinges on technological advancements like the development of highly sensitive and specific assays for early disease detection. Strategic partnerships between research institutions, pharmaceutical companies, and diagnostic companies can accelerate innovation and market penetration. Expansion into new therapeutic areas and the exploration of novel biomarker targets create additional opportunities for growth.

Leading Players in the Europe Immunoassays in R&D Industry Sector

- Ambry Genetics (Konica Minolta Inc)

- Bio-Rad Laboratories Inc

- Biomerieux SA

- F Hoffmann-La Roche Ltd

- Hologic Inc

- Thermo Fisher Scientific Inc

- Epigenomics AG

- Quest Diagnostics

- Qiagen AG

- Creative Diagnostics

- 23andMe

- Johnson & Johnson Services Inc

- Illumina Inc

- Abbott Laboratories Inc

- PerkinElmer Inc

- Agilent Technologies

Key Milestones in Europe Immunoassays in R&D Industry Industry

- November 2020: Agilent Technologies launched the Biomarker Pathologist Training Program.

- March 2020: Proteomedix announced the commercial availability of Proclarix in Europe.

Strategic Outlook for Europe Immunoassays in R&D Industry Market

The future of the European immunoassays R&D market is promising. Continued technological advancements, a growing focus on personalized medicine, and the increasing prevalence of chronic diseases will drive market growth. Strategic partnerships and collaborations will play a crucial role in accelerating innovation and market penetration. The market is poised for significant expansion in the coming years, presenting substantial opportunities for both established players and emerging companies.

Europe Immunoassays in R&D Industry Segmentation

-

1. Disease

- 1.1. Prostate Cancer

- 1.2. Breast Cancer

- 1.3. Lung Cancer

- 1.4. Colorectal Cancer

- 1.5. Cervical Cancer

- 1.6. Other Diseases

-

2. Type

- 2.1. Protein Biomarkers

- 2.2. Genetic Biomarkers

- 2.3. Other Types

-

3. Profiling Technology

- 3.1. OMICS Technology

- 3.2. Imaging Technology

- 3.3. Immunoassays

- 3.4. Cytogenetics

Europe Immunoassays in R&D Industry Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Immunoassays in R&D Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Burden of Cancer and Higher Acceptance for Treatment; Increasing Focus on Innovative Drug Development

- 3.3. Market Restrains

- 3.3.1. High Cost of Diagnosis

- 3.4. Market Trends

- 3.4.1. The Lung Cancer Segment is Expected to Hold a Major Market Share in the European Cancer Biomarkers Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Immunoassays in R&D Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Disease

- 5.1.1. Prostate Cancer

- 5.1.2. Breast Cancer

- 5.1.3. Lung Cancer

- 5.1.4. Colorectal Cancer

- 5.1.5. Cervical Cancer

- 5.1.6. Other Diseases

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Protein Biomarkers

- 5.2.2. Genetic Biomarkers

- 5.2.3. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 5.3.1. OMICS Technology

- 5.3.2. Imaging Technology

- 5.3.3. Immunoassays

- 5.3.4. Cytogenetics

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Spain

- 5.4.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Disease

- 6. Europe Europe Immunoassays in R&D Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Disease

- 6.1.1. Prostate Cancer

- 6.1.2. Breast Cancer

- 6.1.3. Lung Cancer

- 6.1.4. Colorectal Cancer

- 6.1.5. Cervical Cancer

- 6.1.6. Other Diseases

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Protein Biomarkers

- 6.2.2. Genetic Biomarkers

- 6.2.3. Other Types

- 6.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 6.3.1. OMICS Technology

- 6.3.2. Imaging Technology

- 6.3.3. Immunoassays

- 6.3.4. Cytogenetics

- 6.1. Market Analysis, Insights and Forecast - by Disease

- 7. United Kingdom Europe Immunoassays in R&D Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Disease

- 7.1.1. Prostate Cancer

- 7.1.2. Breast Cancer

- 7.1.3. Lung Cancer

- 7.1.4. Colorectal Cancer

- 7.1.5. Cervical Cancer

- 7.1.6. Other Diseases

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Protein Biomarkers

- 7.2.2. Genetic Biomarkers

- 7.2.3. Other Types

- 7.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 7.3.1. OMICS Technology

- 7.3.2. Imaging Technology

- 7.3.3. Immunoassays

- 7.3.4. Cytogenetics

- 7.1. Market Analysis, Insights and Forecast - by Disease

- 8. France Europe Immunoassays in R&D Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Disease

- 8.1.1. Prostate Cancer

- 8.1.2. Breast Cancer

- 8.1.3. Lung Cancer

- 8.1.4. Colorectal Cancer

- 8.1.5. Cervical Cancer

- 8.1.6. Other Diseases

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Protein Biomarkers

- 8.2.2. Genetic Biomarkers

- 8.2.3. Other Types

- 8.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 8.3.1. OMICS Technology

- 8.3.2. Imaging Technology

- 8.3.3. Immunoassays

- 8.3.4. Cytogenetics

- 8.1. Market Analysis, Insights and Forecast - by Disease

- 9. Italy Europe Immunoassays in R&D Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Disease

- 9.1.1. Prostate Cancer

- 9.1.2. Breast Cancer

- 9.1.3. Lung Cancer

- 9.1.4. Colorectal Cancer

- 9.1.5. Cervical Cancer

- 9.1.6. Other Diseases

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Protein Biomarkers

- 9.2.2. Genetic Biomarkers

- 9.2.3. Other Types

- 9.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 9.3.1. OMICS Technology

- 9.3.2. Imaging Technology

- 9.3.3. Immunoassays

- 9.3.4. Cytogenetics

- 9.1. Market Analysis, Insights and Forecast - by Disease

- 10. Spain Europe Immunoassays in R&D Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Disease

- 10.1.1. Prostate Cancer

- 10.1.2. Breast Cancer

- 10.1.3. Lung Cancer

- 10.1.4. Colorectal Cancer

- 10.1.5. Cervical Cancer

- 10.1.6. Other Diseases

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Protein Biomarkers

- 10.2.2. Genetic Biomarkers

- 10.2.3. Other Types

- 10.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 10.3.1. OMICS Technology

- 10.3.2. Imaging Technology

- 10.3.3. Immunoassays

- 10.3.4. Cytogenetics

- 10.1. Market Analysis, Insights and Forecast - by Disease

- 11. Rest of Europe Europe Immunoassays in R&D Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Disease

- 11.1.1. Prostate Cancer

- 11.1.2. Breast Cancer

- 11.1.3. Lung Cancer

- 11.1.4. Colorectal Cancer

- 11.1.5. Cervical Cancer

- 11.1.6. Other Diseases

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Protein Biomarkers

- 11.2.2. Genetic Biomarkers

- 11.2.3. Other Types

- 11.3. Market Analysis, Insights and Forecast - by Profiling Technology

- 11.3.1. OMICS Technology

- 11.3.2. Imaging Technology

- 11.3.3. Immunoassays

- 11.3.4. Cytogenetics

- 11.1. Market Analysis, Insights and Forecast - by Disease

- 12. Germany Europe Immunoassays in R&D Industry Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Immunoassays in R&D Industry Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Immunoassays in R&D Industry Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Immunoassays in R&D Industry Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Immunoassays in R&D Industry Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Immunoassays in R&D Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Immunoassays in R&D Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Ambry Genetics (Konica Minolta Inc )

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Bio-Rad Laboratories Inc

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Biomerieux SA

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 F Hoffmann-La Roche Ltd

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Hologic Inc

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Thermo Fisher Scientific Inc

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Epigenomics AG

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Quest Diagnostics

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Qiagen AG

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Creative Diagnostics

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 23andMe

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.12 Johnson & Johnson Services Inc

- 19.2.12.1. Overview

- 19.2.12.2. Products

- 19.2.12.3. SWOT Analysis

- 19.2.12.4. Recent Developments

- 19.2.12.5. Financials (Based on Availability)

- 19.2.13 Illumina Inc

- 19.2.13.1. Overview

- 19.2.13.2. Products

- 19.2.13.3. SWOT Analysis

- 19.2.13.4. Recent Developments

- 19.2.13.5. Financials (Based on Availability)

- 19.2.14 Abbott Laboratories Inc

- 19.2.14.1. Overview

- 19.2.14.2. Products

- 19.2.14.3. SWOT Analysis

- 19.2.14.4. Recent Developments

- 19.2.14.5. Financials (Based on Availability)

- 19.2.15 PerkinElmer Inc *List Not Exhaustive

- 19.2.15.1. Overview

- 19.2.15.2. Products

- 19.2.15.3. SWOT Analysis

- 19.2.15.4. Recent Developments

- 19.2.15.5. Financials (Based on Availability)

- 19.2.16 Agilent Technologies

- 19.2.16.1. Overview

- 19.2.16.2. Products

- 19.2.16.3. SWOT Analysis

- 19.2.16.4. Recent Developments

- 19.2.16.5. Financials (Based on Availability)

- 19.2.1 Ambry Genetics (Konica Minolta Inc )

List of Figures

- Figure 1: Europe Immunoassays in R&D Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Immunoassays in R&D Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 3: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Profiling Technology 2019 & 2032

- Table 5: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Immunoassays in R&D Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Immunoassays in R&D Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Immunoassays in R&D Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Immunoassays in R&D Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Immunoassays in R&D Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Immunoassays in R&D Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Immunoassays in R&D Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 15: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Profiling Technology 2019 & 2032

- Table 17: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Germany Europe Immunoassays in R&D Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 20: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Profiling Technology 2019 & 2032

- Table 22: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 24: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Profiling Technology 2019 & 2032

- Table 26: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 28: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 29: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Profiling Technology 2019 & 2032

- Table 30: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 32: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Profiling Technology 2019 & 2032

- Table 34: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Disease 2019 & 2032

- Table 36: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 37: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Profiling Technology 2019 & 2032

- Table 38: Europe Immunoassays in R&D Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Immunoassays in R&D Industry?

The projected CAGR is approximately 11.60%.

2. Which companies are prominent players in the Europe Immunoassays in R&D Industry?

Key companies in the market include Ambry Genetics (Konica Minolta Inc ), Bio-Rad Laboratories Inc, Biomerieux SA, F Hoffmann-La Roche Ltd, Hologic Inc, Thermo Fisher Scientific Inc, Epigenomics AG, Quest Diagnostics, Qiagen AG, Creative Diagnostics, 23andMe, Johnson & Johnson Services Inc, Illumina Inc, Abbott Laboratories Inc, PerkinElmer Inc *List Not Exhaustive, Agilent Technologies.

3. What are the main segments of the Europe Immunoassays in R&D Industry?

The market segments include Disease, Type, Profiling Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Burden of Cancer and Higher Acceptance for Treatment; Increasing Focus on Innovative Drug Development.

6. What are the notable trends driving market growth?

The Lung Cancer Segment is Expected to Hold a Major Market Share in the European Cancer Biomarkers Market.

7. Are there any restraints impacting market growth?

High Cost of Diagnosis.

8. Can you provide examples of recent developments in the market?

In November 2020, Agilent Technologies announced the launch of the Biomarker Pathologist Training Program, a global initiative created to empower pathologists to score biomarkers accurately and confidently.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Immunoassays in R&D Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Immunoassays in R&D Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Immunoassays in R&D Industry?

To stay informed about further developments, trends, and reports in the Europe Immunoassays in R&D Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence