Key Insights

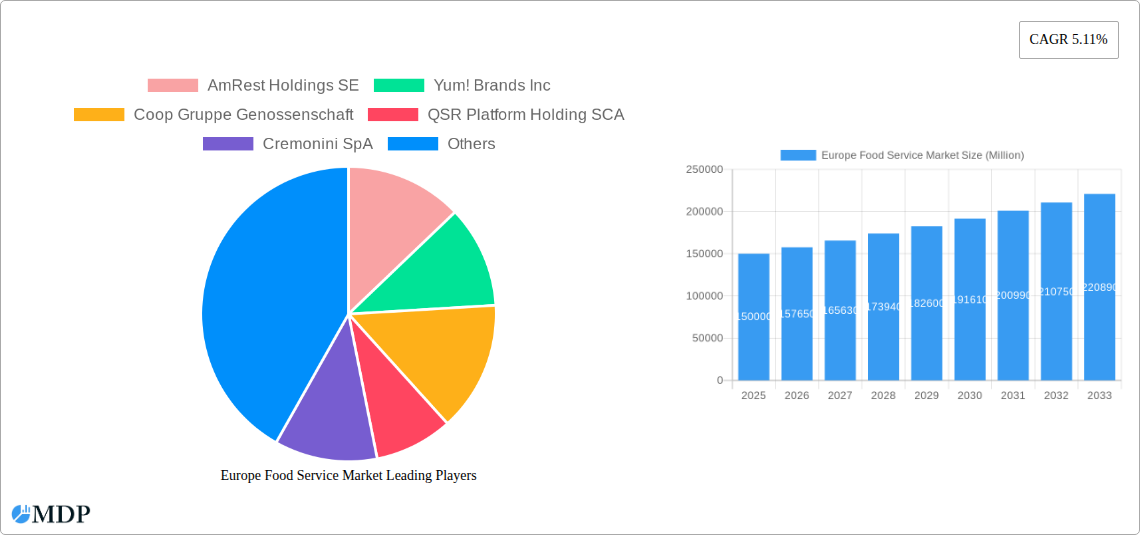

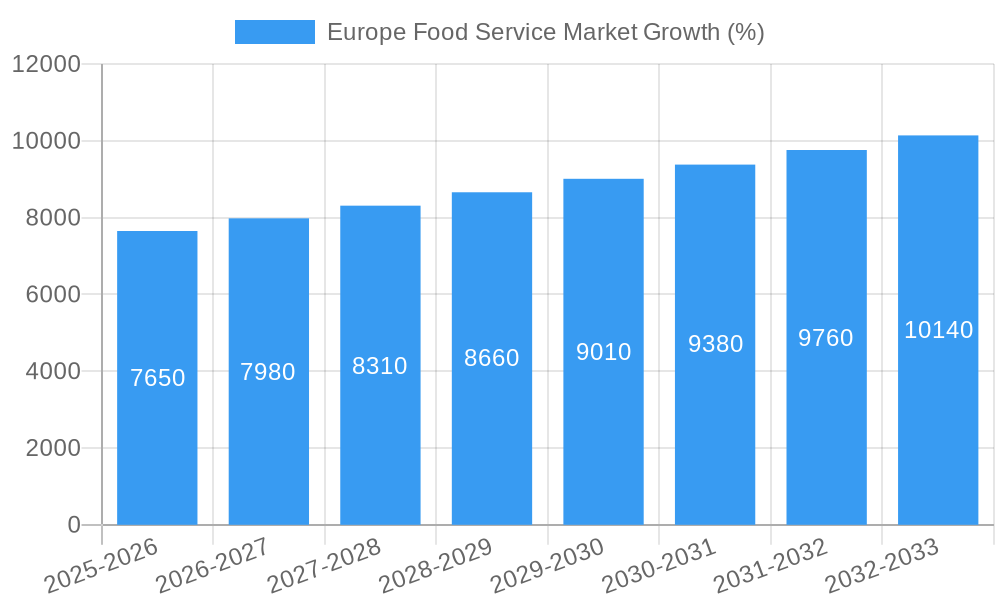

The European food service market, valued at approximately €[Estimate based on XX Million and market trends; a reasonable estimate might be €150 Billion in 2025] in 2025, is projected to experience robust growth, driven by several key factors. The rising disposable incomes across major European economies, coupled with evolving consumer preferences towards convenience and diverse culinary experiences, are significantly fueling market expansion. The increasing popularity of quick-service restaurants (QSRs), cafes, and bars, particularly within bustling urban centers and tourist destinations, is a major contributor. Furthermore, the growth of online food delivery platforms and the expansion of chained outlets into new markets are shaping market dynamics. While challenges exist, such as fluctuating food prices and labor shortages, the market's overall trajectory remains positive, indicating considerable growth potential.

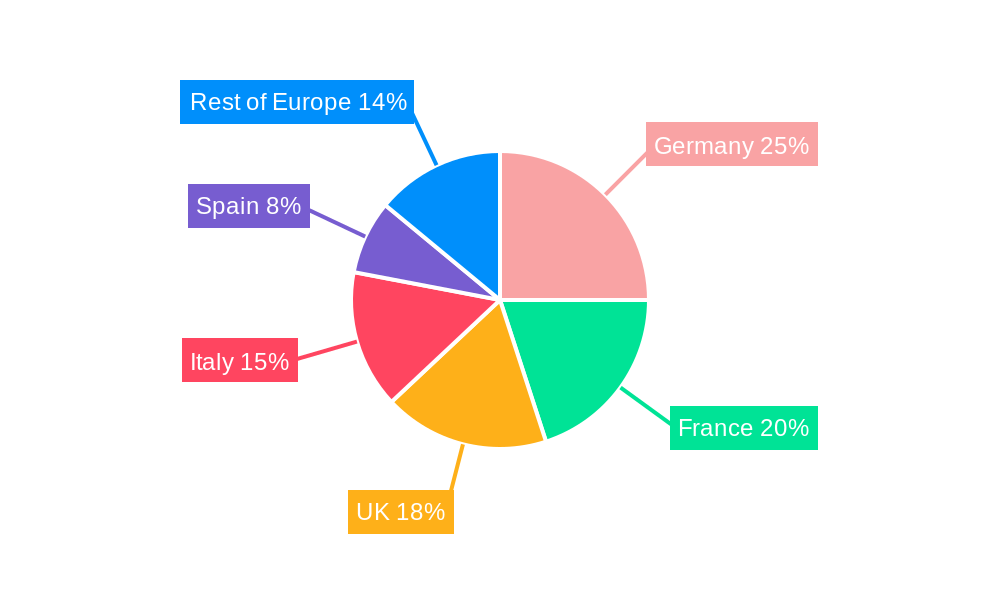

Significant regional variations are evident within the European food service market. Germany, France, the United Kingdom, and Italy represent the largest markets, exhibiting robust growth due to strong consumer spending and established food service infrastructure. However, emerging markets within Eastern Europe and the Nordics also present lucrative opportunities for expansion, driven by increasing urbanization and rising tourism. The segmentation of the market, with various outlet types (chained vs. independent) and food service types (QSRs, cafes, bars, etc.), provides further opportunities for specialization and targeted marketing strategies. The competitive landscape is characterized by both established international players and local chains, highlighting the need for differentiation and innovation to maintain a strong market position. Future growth will likely be shaped by factors such as sustainability initiatives, technological advancements in restaurant operations, and the ongoing adaptation to changing consumer preferences.

Europe Food Service Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Food Service Market, covering market dynamics, industry trends, leading segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders seeking to understand and capitalize on the market's growth potential. The report incorporates detailed analysis of historical data (2019-2024) to provide a robust foundation for future projections. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Europe Food Service Market Market Dynamics & Concentration

The Europe Food Service Market is characterized by a dynamic interplay of factors influencing its concentration and growth. Market concentration is moderate, with several large multinational chains alongside numerous smaller independent operators. Key drivers of innovation include technological advancements in food preparation, delivery, and customer engagement. Stringent regulatory frameworks, particularly regarding food safety and hygiene, significantly impact operational costs and strategies. The market experiences competition from various product substitutes, including home-cooked meals and meal delivery services. Changing consumer preferences, including increasing demand for healthy and sustainable options, are reshaping the market landscape. Furthermore, mergers and acquisitions (M&A) activity remains substantial, with xx M&A deals recorded in the last five years, reflecting consolidation trends within the industry. Market share is distributed across various segments, with chained outlets holding approximately xx% and independent outlets accounting for xx%.

Europe Food Service Market Industry Trends & Analysis

The Europe Food Service Market is experiencing robust growth, driven primarily by several key factors. Rising disposable incomes and changing lifestyles have fueled increased demand for convenience and diverse food options. Technological disruptions, including online ordering platforms and automated kitchen technologies, are enhancing operational efficiency and customer experience. Consumer preferences are shifting towards healthier, ethically sourced, and personalized dining experiences. Competitive dynamics are intensifying, with established players continually innovating to maintain market share and attract new customers. The market penetration of online food delivery services is growing steadily, with xx% market penetration in 2024, projected to reach xx% by 2033. The market is expected to grow at a CAGR of xx% during the forecast period due to these factors. The increasing popularity of quick-service restaurants (QSRs) is another key driver, along with the expansion of café and bar chains across various European countries.

Leading Markets & Segments in Europe Food Service Market

The United Kingdom, Germany, and France represent the leading markets in the Europe Food Service Market, collectively accounting for approximately xx% of the total market value. Key drivers for this dominance include strong economies, well-developed infrastructure, and high consumer spending on food services.

- Country-Specific Drivers:

- United Kingdom: High consumer spending, robust tourism sector, and strong presence of international QSR chains.

- Germany: Large population, high disposable income, and increasing preference for convenience food.

- France: Strong culinary culture, significant tourism, and a thriving café and restaurant scene.

The "Chained Outlets" segment dominates the market with approximately xx% share, showcasing the strength of established brands. The "Leisure" location segment exhibits substantial growth due to increasing tourism and leisure activities. The "Cafes & Bars" foodservice type accounts for a significant portion of the market due to changing consumer preferences and the ever-increasing number of cafés.

Europe Food Service Market Product Developments

Recent product innovations include the introduction of healthier menu options, plant-based alternatives, and customized meal options catering to dietary restrictions. Technological advancements in food preparation, such as automated cooking systems and customized ingredient dispensing, are improving efficiency and consistency. These developments are enhancing customer experiences and expanding market reach by catering to diverse consumer preferences and lifestyle choices.

Key Drivers of Europe Food Service Market Growth

Several factors are fueling the growth of the Europe Food Service Market. Rising disposable incomes enable consumers to spend more on dining out. The increasing popularity of convenient food options, like QSRs and food delivery services, is another major driver. Technological innovations in food preparation and delivery are enhancing customer satisfaction and operational efficiency. Finally, supportive government policies and infrastructure development are facilitating the expansion of the food service sector.

Challenges in the Europe Food Service Market Market

The Europe Food Service Market faces several challenges. Stringent food safety regulations increase operational costs. Supply chain disruptions, exacerbated by geopolitical events, can impact food availability and prices. Intense competition among numerous operators necessitates continuous innovation and differentiation. Rising labor costs and staff shortages pose operational challenges to many businesses.

Emerging Opportunities in Europe Food Service Market

The market offers substantial long-term growth opportunities. The rising adoption of innovative food preparation technologies such as AI-powered menu recommendations and robot-assisted kitchen operations enhances operational efficiency and customer experience. Strategic partnerships, such as collaborations with technology firms and agricultural businesses, can improve supply chains and enhance food sourcing. Expansion into underpenetrated markets or targeting specific demographic segments offers significant growth potential.

Leading Players in the Europe Food Service Market Sector

- AmRest Holdings SE

- Yum! Brands Inc

- Coop Gruppe Genossenschaft

- QSR Platform Holding SCA

- Cremonini SpA

- The Restaurant Group PLC

- Groupe Bertrand

- PizzaExpress (Restaurants) Limited

- Autogrill SpA

- Groupe Le Duff

- Domino's Pizza Enterprises Ltd

- Restalia Grupo de Eurorestauracion SL

- Costa Coffee

- Starbucks Corporation

- Mitchells & Butlers PLC

- Restaurant Brands International Inc

- McDonald's Corporation

- LSG Group

- Gategroup

- Whitbread PLC

- Greggs PLC

Key Milestones in Europe Food Service Market Industry

- August 2023: Starbucks announced a USD 32.78 Million investment to open 100 new outlets in the UK, reflecting strong growth expectations.

- April 2023: QSR Platform Holding SCA partnered with Foodtastic to bring the Pita Pit brand to France and Western Europe (50 new outlets), signaling expansion into new markets.

- March 2023: McDonald's France temporarily replaced its potatoes with vegetable fries, demonstrating responsiveness to consumer preferences and market trends.

Strategic Outlook for Europe Food Service Market Market

The Europe Food Service Market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and strategic expansion initiatives by major players. Companies focused on innovation, sustainability, and efficient operations are best positioned to capitalize on future opportunities. The market's resilience to economic fluctuations and ongoing adaptability to changing consumer trends suggest a positive outlook for the forecast period.

Europe Food Service Market Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Europe Food Service Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Food Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. Germany Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 AmRest Holdings SE

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Yum! Brands Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Coop Gruppe Genossenschaft

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 QSR Platform Holding SCA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Cremonini SpA

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 The Restaurant Group PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Groupe Bertrand

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 PizzaExpress (Restaurants) Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Autogrill SpA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Groupe Le Duff

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Domino's Pizza Enterprises Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Restalia Grupo de Eurorestauracion SL

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Costa Coffee

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Starbucks Corporation

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Mitchells & Butlers PLC

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Restaurant Brands International Inc

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 McDonald's Corporation

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 LSG Group

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 Gategroup

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 Whitbread PLC

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.21 Greggs PLC

- 13.2.21.1. Overview

- 13.2.21.2. Products

- 13.2.21.3. SWOT Analysis

- 13.2.21.4. Recent Developments

- 13.2.21.5. Financials (Based on Availability)

- 13.2.1 AmRest Holdings SE

List of Figures

- Figure 1: Europe Food Service Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Food Service Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Europe Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Europe Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Europe Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 15: Europe Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 16: Europe Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 17: Europe Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Food Service Market?

The projected CAGR is approximately 5.11%.

2. Which companies are prominent players in the Europe Food Service Market?

Key companies in the market include AmRest Holdings SE, Yum! Brands Inc, Coop Gruppe Genossenschaft, QSR Platform Holding SCA, Cremonini SpA, The Restaurant Group PLC, Groupe Bertrand, PizzaExpress (Restaurants) Limited, Autogrill SpA, Groupe Le Duff, Domino's Pizza Enterprises Ltd, Restalia Grupo de Eurorestauracion SL, Costa Coffee, Starbucks Corporation, Mitchells & Butlers PLC, Restaurant Brands International Inc, McDonald's Corporation, LSG Group, Gategroup, Whitbread PLC, Greggs PLC.

3. What are the main segments of the Europe Food Service Market?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

August 2023: Coffee shop chain Starbucks announced plans to invest USD 32.78 million toward opening 100 new outlets across the United Kingdom in 2023, as it expects its growth momentum to continue.April 2023: QSR Platform Holding SCA announced that it would be partnering with Foodtastic to bring the Pita Pit brand to France and Western Europe by opening 50 Pita Pits. In return, Foodtastic will expand O'Tacos in Canada by opening at least 50 locations in 2023.March 2023: McDonald's France replaced its potatoes with french fries and offered vegetable fries for a limited time. During this period, beets, carrots, and parsnips replaced the famous potato fries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Food Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Food Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Food Service Market?

To stay informed about further developments, trends, and reports in the Europe Food Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence