Key Insights

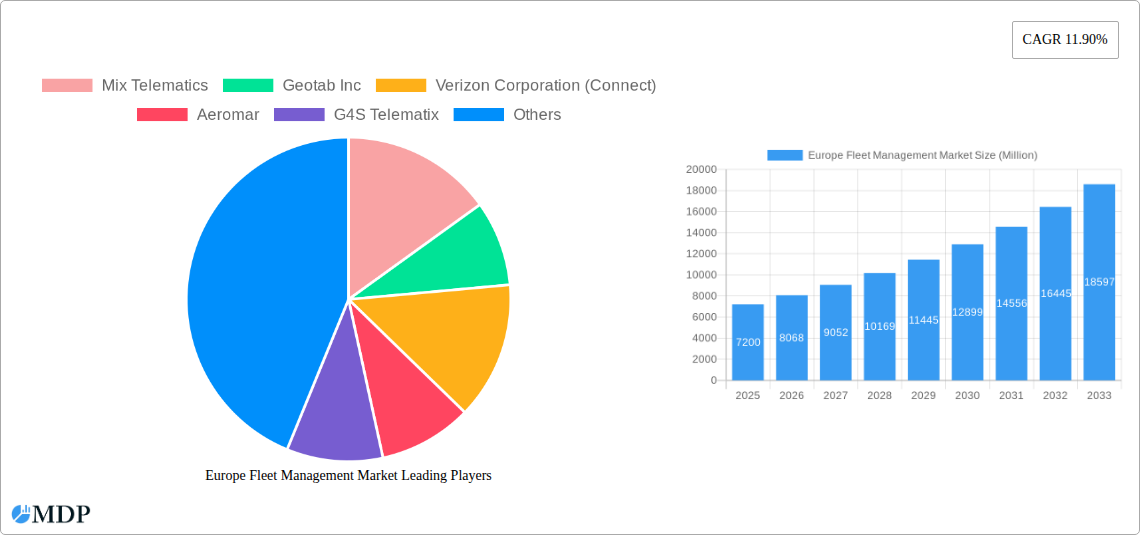

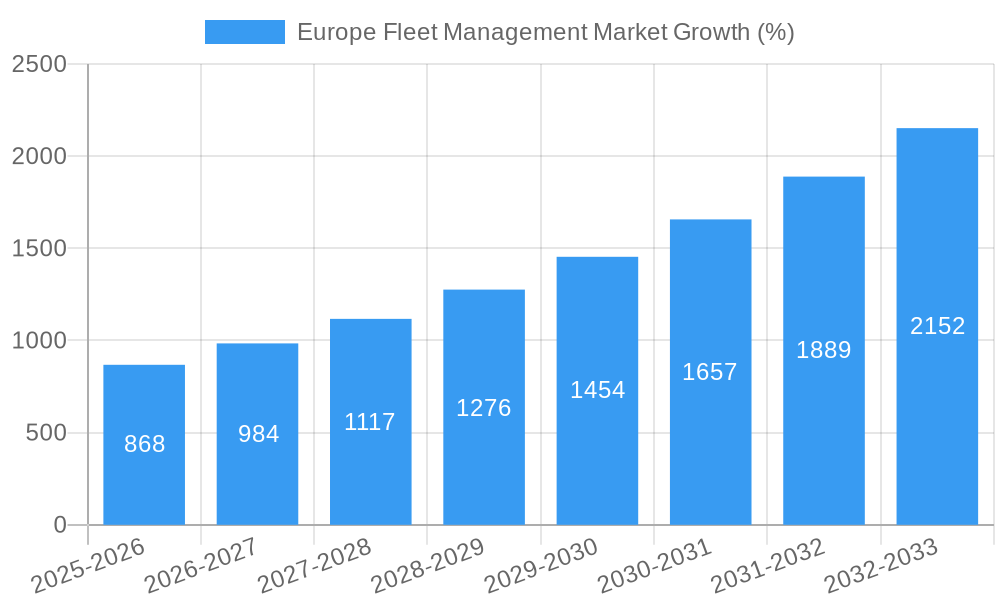

The European fleet management market, valued at €7.2 billion in 2025, is projected to experience robust growth, driven by increasing adoption of telematics solutions across diverse sectors. The Compound Annual Growth Rate (CAGR) of 11.9% from 2025 to 2033 indicates a significant market expansion, fueled by several key factors. Stringent government regulations promoting road safety and efficient transportation are compelling businesses to adopt fleet management systems. Furthermore, the rising need for enhanced operational efficiency, reduced fuel consumption, and optimized driver behavior contribute to the market's upward trajectory. The integration of advanced technologies like AI and IoT within fleet management platforms is revolutionizing the industry, enabling real-time data analysis for proactive maintenance, improved route planning, and enhanced asset tracking. Significant market segmentation exists based on end-user vertical (transportation leading the way), geographic location (Germany and the UK holding significant market share), deployment type (on-demand solutions gaining traction), and major applications (asset and driver management being particularly prominent). Competition is fierce, with established players like Geotab, Mix Telematics, and Verizon Connect vying for market dominance alongside regional specialists.

The market's growth is not without its challenges. High initial investment costs for implementing comprehensive fleet management systems can act as a restraint, particularly for smaller businesses. Concerns regarding data security and privacy, as well as the complexities of integrating diverse systems, also pose hurdles. However, the long-term benefits in terms of cost savings, increased efficiency, and improved safety are anticipated to outweigh these challenges, ensuring sustained growth. The continued expansion of the transportation and logistics sectors across Europe, along with increasing focus on sustainability within these industries, further strengthens the long-term outlook for the European fleet management market. Germany, the UK, and France are expected to remain key contributors to the overall market size, though growth in other European countries is also anticipated.

Europe Fleet Management Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Fleet Management Market, offering actionable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report covers market dynamics, leading players, emerging trends, and future growth potential. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Europe Fleet Management Market Dynamics & Concentration

The European fleet management market is characterized by a moderately concentrated landscape with several major players vying for market share. The market's dynamism is driven by several factors, including increasing adoption of telematics technologies, stringent government regulations concerning safety and emissions, and the growing need for optimized logistics and operational efficiency across various sectors.

Market Concentration: The top 5 players currently hold approximately xx% of the market share, indicating a consolidated yet competitive environment. The market witnessed xx M&A deals in the past five years, signifying consolidation and expansion strategies among key players.

Innovation Drivers: The market is heavily influenced by technological advancements like the Internet of Things (IoT), Artificial Intelligence (AI), and advanced analytics. These technologies are enabling the development of sophisticated fleet management solutions that offer enhanced visibility, predictive maintenance, and optimized routing.

Regulatory Frameworks: Stringent emission regulations and safety standards within the EU are driving the adoption of fleet management systems to improve fuel efficiency and driver behavior. The regulatory landscape plays a significant role in shaping market growth and influencing investment decisions.

Product Substitutes: While there are few direct substitutes for comprehensive fleet management solutions, simpler tracking systems or manual processes exist. However, the sophisticated features and cost-effectiveness of integrated platforms make them increasingly preferable.

End-User Trends: The transportation sector remains the dominant end-user, but other sectors like energy, construction, and manufacturing are increasingly adopting fleet management solutions to enhance productivity and control costs.

Europe Fleet Management Market Industry Trends & Analysis

The Europe Fleet Management Market exhibits strong growth potential, driven by several key factors. The increasing penetration of connected vehicles, coupled with the demand for real-time data and analytics, is fueling market expansion. Furthermore, the rising focus on sustainability and reduced carbon emissions is prompting businesses to adopt fuel-efficient solutions and optimize fleet operations for improved environmental performance. The market is also witnessing a shift towards cloud-based solutions due to their scalability and cost-effectiveness. The CAGR for the forecast period is estimated at xx%, indicating a robust growth trajectory. Market penetration in key sectors is increasing steadily, particularly in the transportation and logistics industries. Competitive dynamics are shaped by factors like technological innovation, service offerings, pricing strategies, and strategic partnerships.

Leading Markets & Segments in Europe Fleet Management Market

By End User Vertical: The Transportation sector remains the dominant segment, accounting for approximately xx% of the market, followed by Energy and Construction. Growth in these segments is primarily driven by the need to improve operational efficiency, reduce fuel consumption, and enhance driver safety.

- Transportation: High demand for real-time tracking and optimized routing.

- Energy: Requirement for efficient asset management and maintenance of distributed infrastructure.

- Construction: Need for enhanced productivity and site safety.

- Manufacturing: Optimization of logistics and supply chain management.

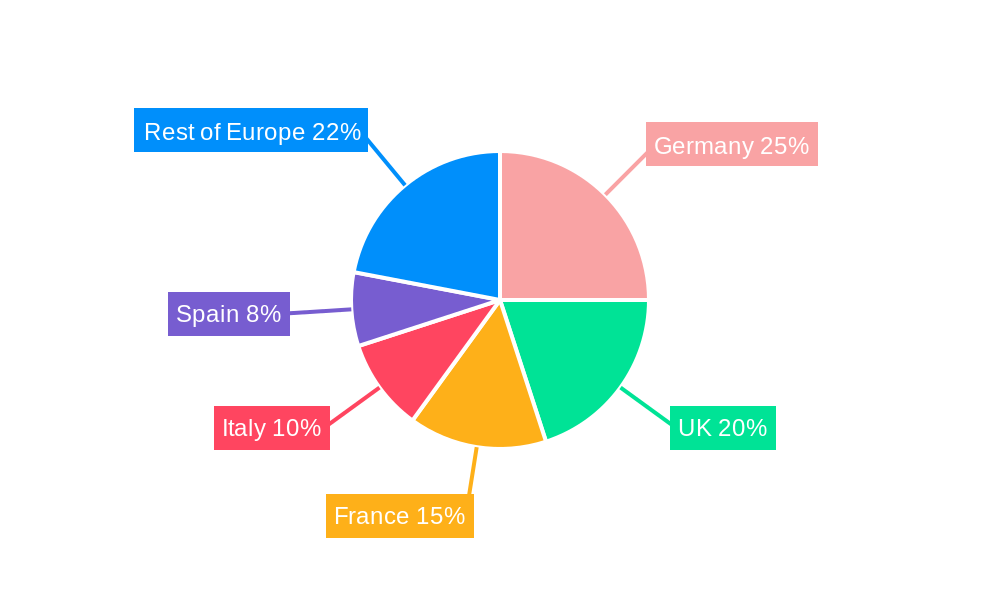

By Country: Germany, the United Kingdom, and France constitute the largest markets, driven by strong economic activity, developed infrastructure, and robust adoption of advanced technologies.

- Germany: Strong automotive industry and advanced technological infrastructure.

- United Kingdom: Large logistics sector and significant focus on efficient operations.

- France: Growing adoption of telematics solutions across various industries.

By Deployment Type: The on-demand model is gaining traction, owing to its flexibility and scalability. On-premise solutions continue to hold a significant market share, primarily in large enterprises with established IT infrastructure.

By Major Applications: Asset management, driver management, and safety and compliance management are currently the most widely adopted applications. The demand for risk management and operations management solutions is also growing, highlighting the increasing focus on comprehensive fleet optimization.

Europe Fleet Management Market Product Developments

Recent product developments are focused on integrating advanced technologies such as AI, machine learning, and predictive analytics to enhance fleet visibility, optimize routes, and predict maintenance needs. The integration of these technologies leads to improved efficiency, reduced operational costs, and enhanced driver safety. This is reflected in the market's increasing adoption of cloud-based platforms offering scalable and feature-rich solutions.

Key Drivers of Europe Fleet Management Market Growth

The market is driven by several key factors:

- Technological advancements: IoT, AI, and big data analytics are enabling sophisticated fleet management solutions.

- Stringent regulations: EU emission standards and safety regulations are mandating improved fleet efficiency and safety.

- Economic growth: Continued economic growth across Europe fuels demand for efficient logistics and transportation.

Challenges in the Europe Fleet Management Market Market

The market faces several challenges:

- High initial investment costs: Implementing fleet management systems can be expensive for smaller businesses.

- Data security concerns: Protecting sensitive data related to vehicle location, driver behavior, and operational details is critical.

- Integration complexities: Integrating fleet management solutions with existing IT infrastructure can be challenging.

Emerging Opportunities in Europe Fleet Management Market

The market presents several promising opportunities:

- Expansion into emerging markets within Europe: untapped potential exists in regions with less mature fleet management adoption.

- Strategic partnerships and collaborations: Collaborations between technology providers and fleet operators can lead to innovative solutions.

- Development of integrated solutions: Integrating fleet management with other business operations, such as supply chain management, enhances efficiency.

Leading Players in the Europe Fleet Management Market Sector

- Mix Telematics

- Geotab Inc

- Verizon Corporation (Connect)

- Aeromar

- G4S Telematix

- ABAX

- EcoFleet

- Trimble Navigation

- Viasaet Group

- Inseego Group

- ArealControl

- EasyFleet

Key Milestones in Europe Fleet Management Market Industry

- March 2023: Wejo Group Limited launched Road Health, enhancing road safety and infrastructure planning.

- September 2022: Ford Pro expanded its fleet management suite, making it more accessible to small businesses.

Strategic Outlook for Europe Fleet Management Market Market

The future of the Europe Fleet Management Market is promising, driven by ongoing technological advancements, increasing regulatory pressure, and the growing need for efficient and sustainable operations. Strategic partnerships, expansion into new markets, and the development of integrated solutions will be crucial for success in this dynamic market. The market's focus on sustainability, data security, and integrated solutions will shape its trajectory in the coming years.

Europe Fleet Management Market Segmentation

-

1. Deployment Type

- 1.1. On-demand

- 1.2. On-Premises

-

2. Major Applications

- 2.1. Asset Management

- 2.2. Information Management

- 2.3. Driver Management

- 2.4. Safety and Compliance Management

- 2.5. Risk Management

- 2.6. Operations Management

- 2.7. Other Solutions

-

3. End User Vertical

- 3.1. Transportation

- 3.2. Energy

- 3.3. Construction

- 3.4. Manufacturing

- 3.5. Other End-Users

Europe Fleet Management Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Fleet Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Market Regulations Coupled with Growing Emphasis on Operational Efficiency; Collaborations between Aftermarket Providers and LCV Manufacturers; Evolving Pricing Models and Emergence of Internet of Transportation

- 3.3. Market Restrains

- 3.3.1. Threat of Data Breaches; High Costs Associated With Installations

- 3.4. Market Trends

- 3.4.1. Asset Management Application Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Fleet Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. On-demand

- 5.1.2. On-Premises

- 5.2. Market Analysis, Insights and Forecast - by Major Applications

- 5.2.1. Asset Management

- 5.2.2. Information Management

- 5.2.3. Driver Management

- 5.2.4. Safety and Compliance Management

- 5.2.5. Risk Management

- 5.2.6. Operations Management

- 5.2.7. Other Solutions

- 5.3. Market Analysis, Insights and Forecast - by End User Vertical

- 5.3.1. Transportation

- 5.3.2. Energy

- 5.3.3. Construction

- 5.3.4. Manufacturing

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. Germany Europe Fleet Management Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Fleet Management Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Fleet Management Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Fleet Management Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Fleet Management Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Fleet Management Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Fleet Management Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Mix Telematics

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Geotab Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Verizon Corporation (Connect)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Aeromar

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 G4S Telematix

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ABAX

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 EcoFleet

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Trimble Navigation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Viasaet Group

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Inseego Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 ArealControl

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 EasyFleet

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Mix Telematics

List of Figures

- Figure 1: Europe Fleet Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Fleet Management Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Fleet Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Fleet Management Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 3: Europe Fleet Management Market Revenue Million Forecast, by Major Applications 2019 & 2032

- Table 4: Europe Fleet Management Market Revenue Million Forecast, by End User Vertical 2019 & 2032

- Table 5: Europe Fleet Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Fleet Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Fleet Management Market Revenue Million Forecast, by Deployment Type 2019 & 2032

- Table 15: Europe Fleet Management Market Revenue Million Forecast, by Major Applications 2019 & 2032

- Table 16: Europe Fleet Management Market Revenue Million Forecast, by End User Vertical 2019 & 2032

- Table 17: Europe Fleet Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Fleet Management Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Fleet Management Market?

The projected CAGR is approximately 11.90%.

2. Which companies are prominent players in the Europe Fleet Management Market?

Key companies in the market include Mix Telematics, Geotab Inc, Verizon Corporation (Connect), Aeromar, G4S Telematix, ABAX, EcoFleet, Trimble Navigation, Viasaet Group, Inseego Group, ArealControl, EasyFleet.

3. What are the main segments of the Europe Fleet Management Market?

The market segments include Deployment Type, Major Applications, End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Market Regulations Coupled with Growing Emphasis on Operational Efficiency; Collaborations between Aftermarket Providers and LCV Manufacturers; Evolving Pricing Models and Emergence of Internet of Transportation.

6. What are the notable trends driving market growth?

Asset Management Application Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Threat of Data Breaches; High Costs Associated With Installations.

8. Can you provide examples of recent developments in the market?

March 2023: Wejo Group Limited, one of the global leaders in Smart Mobility for software and cloud solutions for connected, autonomous, and electric vehicle data, announced the availability of its Road Health, offered by NIRA Dynamics, across selected European markets. Road Health is a transformative solution aggregating data insights across roads so governments can shift from reactive to proactive road safety and make informed infrastructure decisions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Fleet Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Fleet Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Fleet Management Market?

To stay informed about further developments, trends, and reports in the Europe Fleet Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence