Key Insights

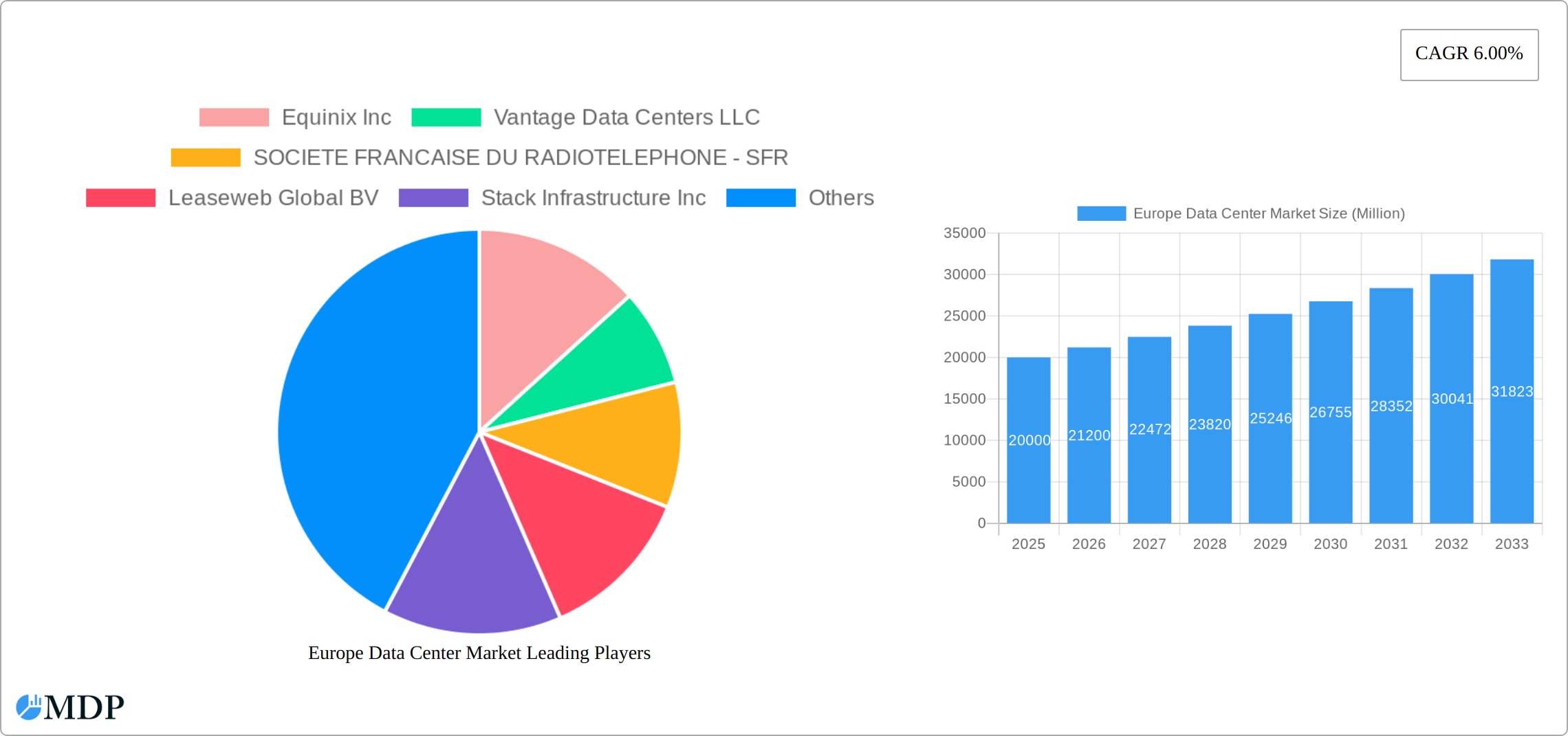

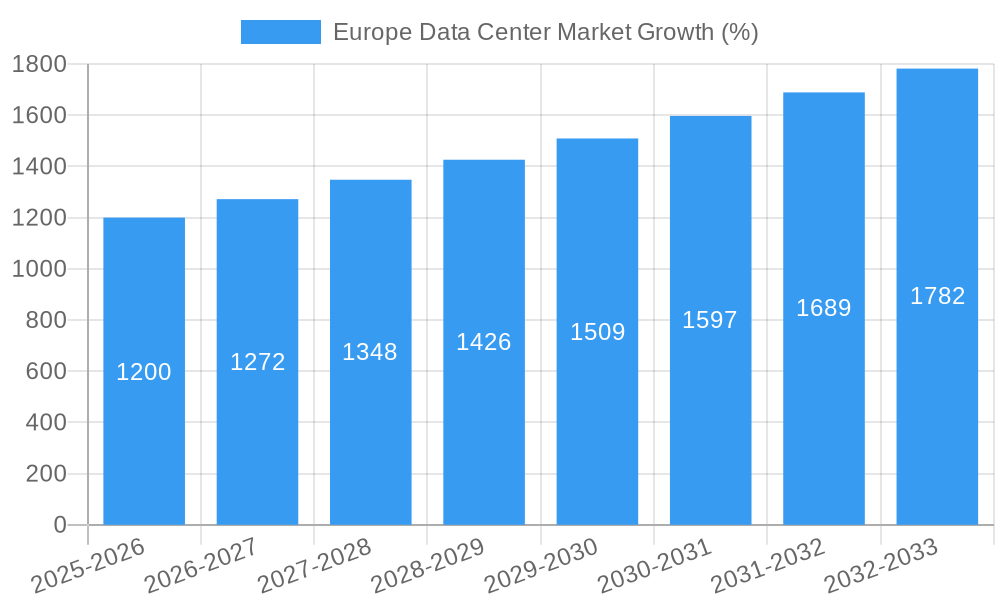

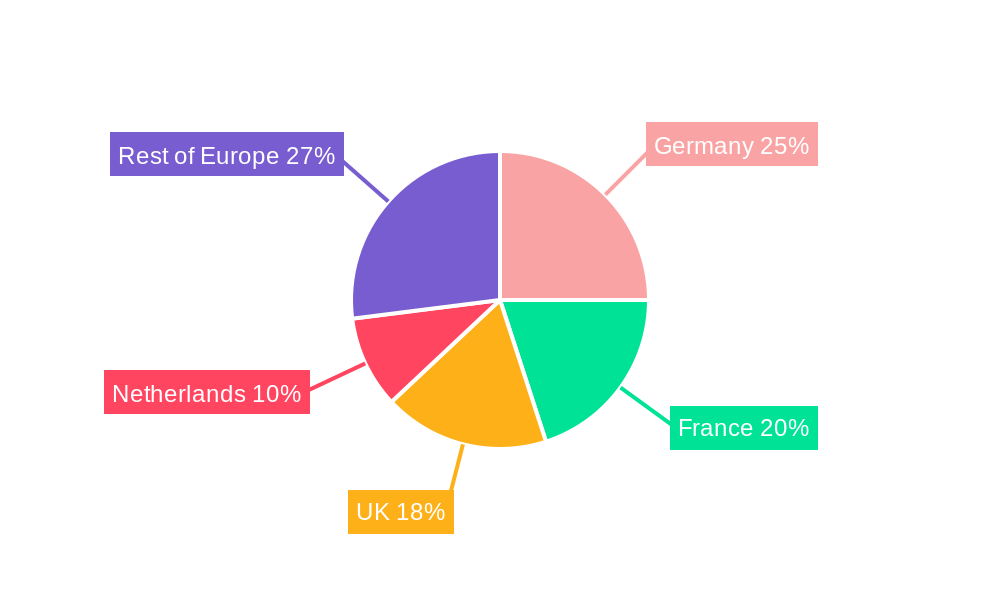

The European data center market, valued at approximately €XX million in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 6% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of cloud computing and digital transformation initiatives across various industries, including finance, healthcare, and technology, are significantly boosting demand for data center infrastructure. Furthermore, the growing need for edge computing to support low-latency applications and the rising volume of data generated by the Internet of Things (IoT) are contributing to market growth. Germany, France, and the UK represent the largest national markets within Europe, driven by strong digital economies and established IT infrastructure. The market is segmented by data center size (small, medium, mega, massive, large), tier type (Tier 1-4), and utilization (utilized, non-utilized), reflecting the diverse needs of various users. Competition is fierce, with major players like Equinix, Vantage Data Centers, and Digital Realty vying for market share alongside regional providers.

However, the market faces some challenges. High capital expenditure required for building and maintaining data centers, stringent regulatory compliance requirements, and potential power shortages in certain regions pose constraints to growth. The trend towards hyperscale data centers, requiring significant investment and land acquisition, is reshaping the competitive landscape. Companies are also increasingly focusing on sustainable data center operations, driven by environmental concerns and rising energy costs, leading to investments in renewable energy sources and energy-efficient technologies. This focus on sustainability, coupled with continued digital transformation, will continue to shape the future of the European data center market, creating opportunities for innovative providers and sustainable practices.

Europe Data Center Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Data Center Market, covering the period 2019-2033, with a focus on market dynamics, industry trends, leading segments, key players, and future outlook. The report utilizes extensive data and analysis to offer actionable insights for industry stakeholders, investors, and businesses operating within this rapidly evolving sector. Expect detailed market sizing (in Millions), CAGR projections, and competitive landscape assessments.

Europe Data Center Market Dynamics & Concentration

The European data center market is experiencing significant growth, driven by increasing digitalization, cloud adoption, and the expanding need for robust IT infrastructure. Market concentration is moderate, with several large players dominating alongside a growing number of smaller, specialized providers. The market is characterized by intense competition, with companies focusing on innovation, strategic partnerships, and acquisitions to gain market share.

Market Concentration: The top 5 players hold approximately xx% of the market share (estimated 2025). This demonstrates a moderately consolidated market with opportunities for both established players and emerging entrants.

Innovation Drivers: Technological advancements such as AI, IoT, and edge computing are fueling demand for advanced data center solutions. The development of energy-efficient infrastructure and sustainable practices is also a key driver.

Regulatory Frameworks: Varying data privacy regulations across European countries create both challenges and opportunities for data center providers. Compliance and security are paramount considerations.

Product Substitutes: Cloud computing and other distributed IT models offer some level of substitution, but the need for on-premise and colocation data centers remains strong for various applications.

End-User Trends: The increasing demand for digital services across diverse sectors, including finance, healthcare, and manufacturing, is driving data center growth. The adoption of hybrid and multi-cloud strategies further fuels this demand.

M&A Activities: The data center sector has witnessed a significant number of mergers and acquisitions (xx deals in the past five years) as companies seek to expand their footprint and service offerings. This trend is expected to continue.

Europe Data Center Market Industry Trends & Analysis

The European data center market is projected to witness robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Several factors contribute to this expansion. The increasing adoption of cloud computing, particularly by enterprises, is a significant driver. Furthermore, the growth of big data analytics, the Internet of Things (IoT), and artificial intelligence (AI) are demanding ever-greater data storage and processing capabilities. The shift towards hybrid cloud infrastructure necessitates robust data center solutions to ensure seamless connectivity and data management. Government initiatives promoting digital transformation are also positively impacting market growth. Competitive dynamics are characterized by consolidation, innovation, and investment in next-generation technologies, such as edge data centers and AI-powered infrastructure management systems. Market penetration of hyperscale data centers is expected to reach xx% by 2033.

Leading Markets & Segments in Europe Data Center Market

The United Kingdom, Germany, and France represent the leading markets within Europe, driven by robust digital economies, favorable regulatory environments, and strong investments in digital infrastructure. The large data center segment commands the largest market share, reflecting the increasing demand for high-capacity solutions.

- Key Drivers for the UK: Strong government support for digital transformation, robust telecommunications infrastructure, and a large pool of skilled IT professionals.

- Key Drivers for Germany: A thriving automotive industry with significant digitalization initiatives, a strong manufacturing base, and increasing cloud adoption.

- Key Drivers for France: Government investments in digital infrastructure, increasing demand for cloud services, and a growing startup ecosystem.

Country Dominance: The United Kingdom maintains a leading position due to its established digital infrastructure and strong governmental support. Germany is catching up rapidly, benefiting from its robust industrial sector and increasing digitalization efforts.

Data Center Size Dominance: The large and mega data center segments are dominant, indicating a preference for scale and capacity among end users.

Tier Type Dominance: Tier III and Tier IV data centers are favored due to their high availability and reliability requirements.

Absorption Dominance: Utilized capacity significantly outweighs non-utilized capacity, showing strong demand.

Other End-User Dominance: A diverse mix of end-users drives market growth across different industries.

Europe Data Center Market Product Developments

The data center market is witnessing significant product innovations focusing on efficiency, scalability, and sustainability. This includes the adoption of advanced cooling technologies, modular designs, and AI-powered infrastructure management systems. These developments enhance operational efficiency, reduce costs, and improve the environmental footprint of data centers. Competition is driving innovation towards customized solutions that cater to specific industry requirements and technological advancements.

Key Drivers of Europe Data Center Market Growth

The growth of the European data center market is fueled by several key factors. First, the increasing adoption of cloud computing across various industries is driving demand for robust and scalable data center infrastructure. Second, the rise of big data analytics and the Internet of Things (IoT) creates massive amounts of data requiring substantial storage and processing capabilities. Third, stringent data privacy regulations are propelling the need for secure and compliant data centers within Europe.

Challenges in the Europe Data Center Market

The European data center market faces challenges including the scarcity of skilled labor, energy costs, and regulatory complexities. Finding and retaining experienced data center professionals is critical. High energy consumption is a significant operational expense, especially with increasing electricity prices. Navigating the diverse regulatory landscape across various European countries adds complexity to operations and expansion plans. These factors can impact profitability and growth.

Emerging Opportunities in Europe Data Center Market

The emergence of edge computing, the growing adoption of AI and machine learning, and the increasing focus on sustainability present significant opportunities. Edge computing is transforming data processing by bringing it closer to users, reducing latency and improving efficiency. AI and machine learning are enhancing data center management by optimizing resource allocation, predicting failures, and automating operations. The integration of renewable energy sources and sustainable practices is creating demand for greener data center solutions.

Leading Players in the Europe Data Center Market Sector

- Equinix Inc

- Vantage Data Centers LLC

- SOCIETE FRANCAISE DU RADIOTELEPHONE - SFR

- Leaseweb Global BV

- Stack Infrastructure Inc

- Digital Realty Trust Inc

- CyrusOne Inc

- Telehouse (KDDI Corporation)

- Virtus Data Centres Properties Ltd (STT GDC)

- Global Switch Holdings Limited

- NTT Ltd

Key Milestones in Europe Data Center Market Industry

- December 2022: STACK Infrastructure announces the purchase of 74 acres, increasing its campus capacity by 100MW. This expansion signifies significant investment and growth in the data center sector.

- January 2023: CyrusOne acquires an office complex in Frankfurt, Germany, planning to convert it into a data center campus. This illustrates strategic acquisitions to expand capacity and presence in key markets.

- February 2023: Data4 plans to open a new data center site in Hanau, Germany, creating a campus on a former army barracks site. This showcases the continued growth and expansion of data center facilities across Europe.

Strategic Outlook for Europe Data Center Market

The future of the European data center market appears bright, with continued strong growth driven by digital transformation, cloud adoption, and technological advancements. Strategic opportunities exist for companies focusing on sustainability, edge computing, and AI-powered solutions. Partnerships and acquisitions will likely continue to reshape the market landscape, creating both challenges and opportunities for players of all sizes.

Europe Data Center Market Segmentation

-

1. Data Center Size

- 1.1. Large

- 1.2. Massive

- 1.3. Medium

- 1.4. Mega

- 1.5. Small

-

2. Tier Type

- 2.1. Tier 1 and 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

- 3.1. Non-Utilized

-

4. Colocation Type

- 4.1. Hyperscale

- 4.2. Retail

- 4.3. Wholesale

-

5. End User

- 5.1. BFSI

- 5.2. Cloud

- 5.3. E-Commerce

- 5.4. Government

- 5.5. Manufacturing

- 5.6. Media & Entertainment

- 5.7. Telecom

- 5.8. Other End User

Europe Data Center Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Data Center Size

- 5.1.1. Large

- 5.1.2. Massive

- 5.1.3. Medium

- 5.1.4. Mega

- 5.1.5. Small

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 and 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Non-Utilized

- 5.4. Market Analysis, Insights and Forecast - by Colocation Type

- 5.4.1. Hyperscale

- 5.4.2. Retail

- 5.4.3. Wholesale

- 5.5. Market Analysis, Insights and Forecast - by End User

- 5.5.1. BFSI

- 5.5.2. Cloud

- 5.5.3. E-Commerce

- 5.5.4. Government

- 5.5.5. Manufacturing

- 5.5.6. Media & Entertainment

- 5.5.7. Telecom

- 5.5.8. Other End User

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Data Center Size

- 6. Germany Europe Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Data Center Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Data Center Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Equinix Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Vantage Data Centers LLC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 SOCIETE FRANCAISE DU RADIOTELEPHONE - SFR

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Leaseweb Global BV

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Stack Infrastructure Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Digital Realty Trust Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 CyrusOne Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Telehouse (KDDI Corporation)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Virtus Data Centres Properties Ltd (STT GDC)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Data

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Global Switch Holdings Limited

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 NTT Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Equinix Inc

List of Figures

- Figure 1: Europe Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Europe Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 4: Europe Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 5: Europe Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 6: Europe Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 7: Europe Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 8: Europe Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 9: Europe Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 10: Europe Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 11: Europe Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: Europe Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 13: Europe Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Europe Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 15: Europe Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Germany Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: France Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Italy Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: United Kingdom Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Kingdom Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Netherlands Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Netherlands Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Sweden Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Sweden Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Europe Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 32: Europe Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 33: Europe Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 34: Europe Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 35: Europe Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 36: Europe Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 37: Europe Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 38: Europe Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 39: Europe Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 40: Europe Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 41: Europe Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Europe Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: United Kingdom Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Germany Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Germany Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: France Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Italy Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Italy Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Spain Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Spain Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Netherlands Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Netherlands Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Belgium Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Belgium Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Sweden Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Sweden Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Norway Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Norway Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 61: Poland Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Poland Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 63: Denmark Europe Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Denmark Europe Data Center Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Data Center Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Europe Data Center Market?

Key companies in the market include Equinix Inc, Vantage Data Centers LLC, SOCIETE FRANCAISE DU RADIOTELEPHONE - SFR, Leaseweb Global BV, Stack Infrastructure Inc, Digital Realty Trust Inc, CyrusOne Inc, Telehouse (KDDI Corporation), Virtus Data Centres Properties Ltd (STT GDC), Data, Global Switch Holdings Limited, NTT Ltd.

3. What are the main segments of the Europe Data Center Market?

The market segments include Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

February 2023: The French data center company Data4 will open a new site in Hanau, Germany. On the site of a former army barracks in Hanu, east of Frankfurt, P3 Logistic Parks, a European logistics real estate company backed by GIC, revealed plans for a sizable data center park last year. Following its purchase of the roughly 20-hectare site from P3, Data4 intends to develop a campus of its data centers.January 2023: CyrusOne acquired an office complex in Frankfurt, Germany, planning to turn it into a data center campus. The investment group Corum had sold the Europark office complex in Frankfurt for EUR 95 million (USD 102.3 million), before confirming that CyrusOne was the buyer.December 2022: The purchase of 74 extra acres in Prince William County's center was announced by STACK Infrastructure, the digital infrastructure partner to the majority of enterprises in the world. The freshly purchased acreage will increase the campus's 250MW capacity by 100MW.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Data Center Market?

To stay informed about further developments, trends, and reports in the Europe Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence