Key Insights

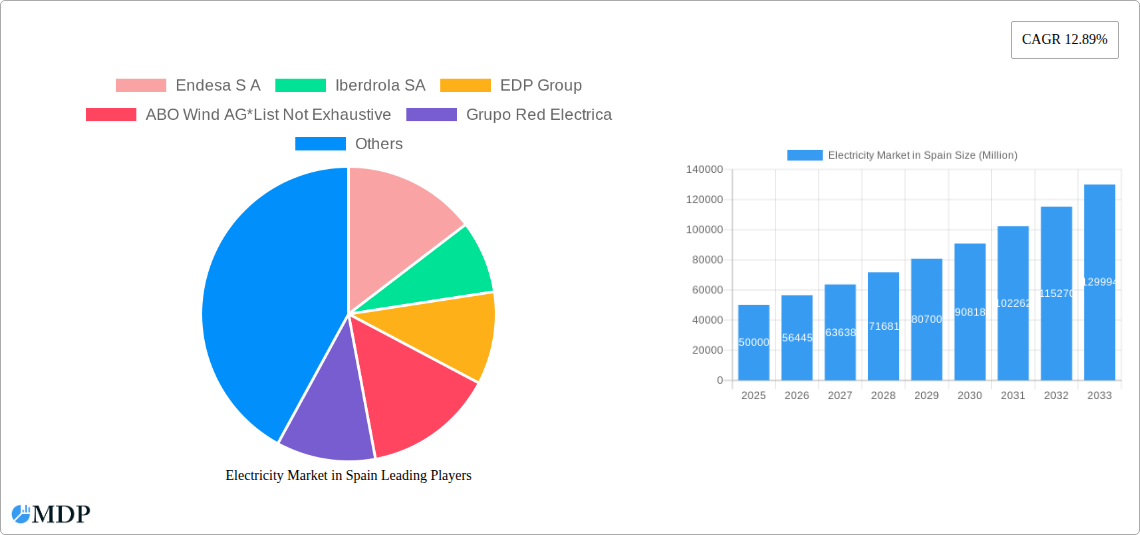

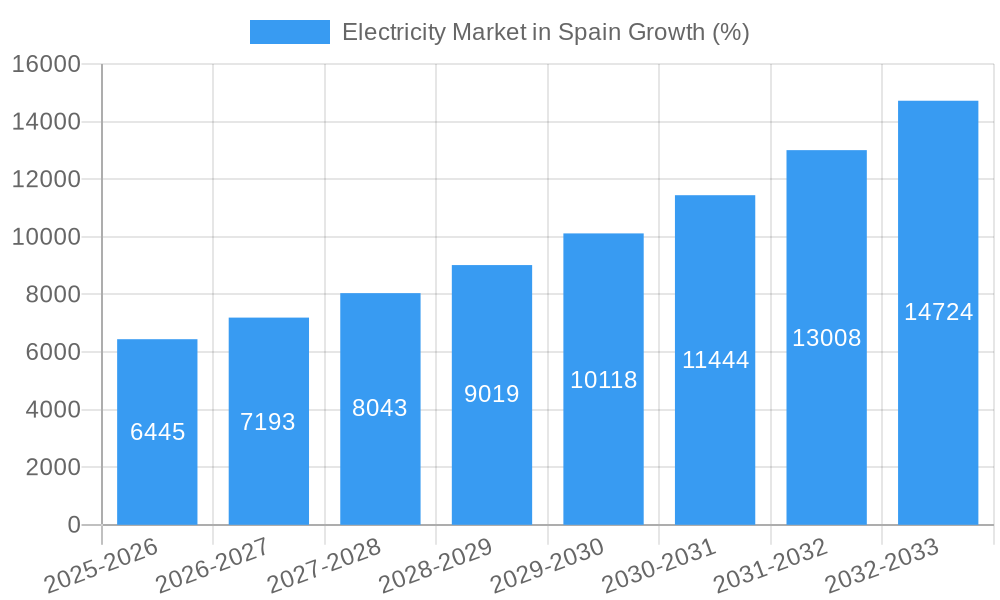

The Spanish electricity market, valued at approximately €XX million in 2025 (assuming a logical estimation based on the provided CAGR and market trends), is experiencing robust growth, projected at a compound annual growth rate (CAGR) of 12.89% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing energy demand driven by economic growth and population increase is a primary factor. Furthermore, the Spanish government's commitment to renewable energy sources, particularly solar and wind power, is significantly impacting the market. This transition is evident in the expanding segments dedicated to renewable energy generation, outpacing the growth of traditional thermal and nuclear power sources. However, challenges remain. Fluctuations in global energy prices and the intermittent nature of renewable energy sources present obstacles to consistent and reliable power supply. Regulatory hurdles and the need for substantial infrastructure investments to support the renewable energy transition also pose constraints on market growth. Key players such as Endesa S.A., Iberdrola S.A., EDP Group, and Naturgy Energy Group S.A. are actively navigating these dynamics, investing in renewable energy projects and grid modernization to maintain market share and capitalize on growth opportunities.

The competitive landscape is characterized by both established energy giants and emerging renewable energy companies. Competition is intensifying, particularly within the renewable energy segment, driving innovation and efficiency improvements. The market is segmented by power generation source, with thermal, hydroelectric, nuclear, and renewable energy sources contributing to the overall mix. The renewable energy segment is experiencing the fastest growth, propelled by supportive government policies and falling technology costs. Looking ahead, the Spanish electricity market is poised for continued expansion, but success will hinge on the successful integration of renewable energy sources, the mitigation of price volatility, and the effective management of infrastructure development challenges. Further market analysis focusing on specific renewable energy sub-segments (solar PV, onshore/offshore wind) and detailed regional breakdowns would provide even more granular insights.

Electricity Market in Spain: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Spanish electricity market, covering market dynamics, industry trends, leading players, and future outlook. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and policymakers seeking to understand and navigate this dynamic sector. The report leverages detailed market data and insights to offer actionable intelligence for informed decision-making. Key market players such as Endesa S.A., Iberdrola SA, EDP Group, ABO Wind AG, Grupo Red Electrica, Naturgy Energy Group S.A., Nordex SE, and Total Energies SE are analyzed within the context of market trends and developments.

Electricity Market in Spain Market Dynamics & Concentration

The Spanish electricity market exhibits a moderately concentrated structure, with several major players commanding significant market share. Endesa S.A. and Iberdrola SA, for instance, hold a combined market share estimated at xx% in 2025, driven by their extensive generation and distribution networks. Market concentration is influenced by factors such as regulatory frameworks promoting competition, ongoing M&A activity, and technological advancements driving innovation.

- Market Concentration: xx% held by top 5 players in 2025 (estimated).

- Innovation Drivers: Increased renewable energy adoption, smart grid technologies, and energy storage solutions.

- Regulatory Frameworks: EU directives on renewable energy targets and market liberalization shape competition and investment.

- Product Substitutes: Growing competition from distributed generation, particularly solar PV systems, is impacting traditional utilities.

- End-User Trends: Increasing demand for clean energy and energy efficiency is driving market transformation.

- M&A Activity: An average of xx M&A deals per year in the historical period (2019-2024) indicates significant consolidation within the market.

Electricity Market in Spain Industry Trends & Analysis

The Spanish electricity market is characterized by strong growth driven by several key factors. The sector's Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033). This growth is fueled by rising energy consumption, supportive government policies promoting renewable energy, and ongoing investments in grid infrastructure upgrades. Technological disruptions, such as the increasing adoption of renewable energy sources (solar and wind) and smart grid technologies, are significantly reshaping the competitive landscape. Consumer preferences are shifting toward cleaner and more sustainable energy sources, further driving market transformation.

Market penetration of renewable energy sources has reached xx% in 2025, exceeding the government’s targets. The increasing penetration of decentralized generation technologies has also led to increased competition among electricity providers.

Leading Markets & Segments in Electricity Market in Spain

Renewable energy sources are the dominant segment within the Spanish electricity market, fueled by government incentives and abundant renewable resources. While thermal, hydroelectric, and nuclear power still contribute, their market share is gradually declining compared to renewable sources.

Key Drivers of Renewable Energy Dominance:

- Favorable Government Policies: Subsidies, feed-in tariffs, and renewable energy targets.

- Abundant Resources: Spain's geographic location is ideal for solar and wind power generation.

- Technological Advancements: Cost reductions in solar PV and wind turbine technologies have made them increasingly competitive.

Detailed Dominance Analysis: The share of renewable energy in total power generation is projected to surpass xx% by 2033, driven by significant investments in new solar and wind farms across the country. This shift presents significant opportunities for renewable energy companies, while traditional thermal power plants face increasing pressure.

Electricity Market in Spain Product Developments

Recent product innovations focus on improving the efficiency and reliability of renewable energy technologies, such as advanced wind turbine designs and high-efficiency solar panels. Smart grid technologies are also being implemented to enhance grid management and integration of intermittent renewable sources. The market is witnessing a rise in energy storage solutions, like battery storage, to address the intermittency challenges of renewable energy sources. These developments are improving the cost-competitiveness and reliability of renewable energy, increasing market penetration and driving growth.

Key Drivers of Electricity Market in Spain Growth

Several factors fuel the growth of Spain's electricity market:

- Strong Government Support: Policies promoting renewable energy and energy efficiency.

- Technological Advancements: Cost reductions in solar and wind technologies.

- Economic Growth: Increased energy demand from expanding industrial and residential sectors.

- EU Climate Goals: Spain's commitment to reducing greenhouse gas emissions drives renewable energy adoption.

Challenges in the Electricity Market in Spain Market

The Spanish electricity market faces several challenges:

- Grid Infrastructure Limitations: Upgrading the grid to accommodate increased renewable energy integration.

- Intermittency of Renewables: Managing the variability of solar and wind power generation.

- Regulatory Uncertainty: Changes in government policies can impact investment decisions.

- International Competition: Competition from other European energy markets.

Emerging Opportunities in Electricity Market in Spain

Significant opportunities exist for growth within the Spanish electricity market. These include:

- Expansion of Renewable Energy: Further deployment of solar, wind, and other renewable energy sources.

- Energy Storage Solutions: Increased adoption of battery storage and other energy storage technologies to address intermittency issues.

- Smart Grid Technologies: Investing in advanced grid management systems to improve efficiency and reliability.

- Green Hydrogen Production: Development of green hydrogen production facilities using renewable energy.

Leading Players in the Electricity Market in Spain Sector

- Endesa S.A.

- Iberdrola SA

- EDP Group

- ABO Wind AG

- Grupo Red Electrica

- Naturgy Energy Group S.A.

- Nordex SE

- Total Energies SE

Key Milestones in Electricity Market in Spain Industry

- December 2022: RWE commissioned its 40.8 MW Rea Unificado wind farm in Soria, featuring nine Nordex turbines. This project significantly boosted RWE's renewable energy capacity in Spain and showcases advancements in large-scale wind power technology.

- February 2023: Repsol initiated clean energy production at its PI project in Castilla y León, a 175 MW wind farm complex across Palencia and Valladolid provinces. This marks Repsol's entry into large-scale renewable energy projects, signifying a shift towards diversification in the Spanish energy sector.

Strategic Outlook for Electricity Market in Spain Market

The Spanish electricity market holds significant long-term growth potential, driven by continued investment in renewable energy, smart grid technologies, and energy storage solutions. Strategic partnerships, technological advancements, and favorable regulatory frameworks are expected to accelerate growth. The increasing integration of renewable energy will continue to reshape the market dynamics, creating new opportunities for innovative companies and driving overall sector expansion. Furthermore, Spain's focus on green hydrogen presents significant long-term opportunities for market players.

Electricity Market in Spain Segmentation

-

1. Power Generation Source

- 1.1. Thermal

- 1.2. Hydroelectric

- 1.3. Nuclear

- 1.4. Renewable

- 2. Power Transmission and Distribution

Electricity Market in Spain Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electricity Market in Spain REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.89% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Integration of Renewable Energy4.; Supportive Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High infrastructure costs

- 3.4. Market Trends

- 3.4.1. Renewable Expected to be a Significant Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electricity Market in Spain Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 5.1.1. Thermal

- 5.1.2. Hydroelectric

- 5.1.3. Nuclear

- 5.1.4. Renewable

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 6. North America Electricity Market in Spain Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 6.1.1. Thermal

- 6.1.2. Hydroelectric

- 6.1.3. Nuclear

- 6.1.4. Renewable

- 6.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution

- 6.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 7. South America Electricity Market in Spain Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 7.1.1. Thermal

- 7.1.2. Hydroelectric

- 7.1.3. Nuclear

- 7.1.4. Renewable

- 7.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution

- 7.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 8. Europe Electricity Market in Spain Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 8.1.1. Thermal

- 8.1.2. Hydroelectric

- 8.1.3. Nuclear

- 8.1.4. Renewable

- 8.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution

- 8.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 9. Middle East & Africa Electricity Market in Spain Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 9.1.1. Thermal

- 9.1.2. Hydroelectric

- 9.1.3. Nuclear

- 9.1.4. Renewable

- 9.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution

- 9.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 10. Asia Pacific Electricity Market in Spain Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 10.1.1. Thermal

- 10.1.2. Hydroelectric

- 10.1.3. Nuclear

- 10.1.4. Renewable

- 10.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution

- 10.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Endesa S A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Iberdrola SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 EDP Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ABO Wind AG*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Grupo Red Electrica

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Naturgy Energy Group S A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nordex SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Total Energies SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Endesa S A

List of Figures

- Figure 1: Global Electricity Market in Spain Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Spain Electricity Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 3: Spain Electricity Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Electricity Market in Spain Revenue (Million), by Power Generation Source 2024 & 2032

- Figure 5: North America Electricity Market in Spain Revenue Share (%), by Power Generation Source 2024 & 2032

- Figure 6: North America Electricity Market in Spain Revenue (Million), by Power Transmission and Distribution 2024 & 2032

- Figure 7: North America Electricity Market in Spain Revenue Share (%), by Power Transmission and Distribution 2024 & 2032

- Figure 8: North America Electricity Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Electricity Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Electricity Market in Spain Revenue (Million), by Power Generation Source 2024 & 2032

- Figure 11: South America Electricity Market in Spain Revenue Share (%), by Power Generation Source 2024 & 2032

- Figure 12: South America Electricity Market in Spain Revenue (Million), by Power Transmission and Distribution 2024 & 2032

- Figure 13: South America Electricity Market in Spain Revenue Share (%), by Power Transmission and Distribution 2024 & 2032

- Figure 14: South America Electricity Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Electricity Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Electricity Market in Spain Revenue (Million), by Power Generation Source 2024 & 2032

- Figure 17: Europe Electricity Market in Spain Revenue Share (%), by Power Generation Source 2024 & 2032

- Figure 18: Europe Electricity Market in Spain Revenue (Million), by Power Transmission and Distribution 2024 & 2032

- Figure 19: Europe Electricity Market in Spain Revenue Share (%), by Power Transmission and Distribution 2024 & 2032

- Figure 20: Europe Electricity Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Electricity Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Electricity Market in Spain Revenue (Million), by Power Generation Source 2024 & 2032

- Figure 23: Middle East & Africa Electricity Market in Spain Revenue Share (%), by Power Generation Source 2024 & 2032

- Figure 24: Middle East & Africa Electricity Market in Spain Revenue (Million), by Power Transmission and Distribution 2024 & 2032

- Figure 25: Middle East & Africa Electricity Market in Spain Revenue Share (%), by Power Transmission and Distribution 2024 & 2032

- Figure 26: Middle East & Africa Electricity Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Electricity Market in Spain Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Electricity Market in Spain Revenue (Million), by Power Generation Source 2024 & 2032

- Figure 29: Asia Pacific Electricity Market in Spain Revenue Share (%), by Power Generation Source 2024 & 2032

- Figure 30: Asia Pacific Electricity Market in Spain Revenue (Million), by Power Transmission and Distribution 2024 & 2032

- Figure 31: Asia Pacific Electricity Market in Spain Revenue Share (%), by Power Transmission and Distribution 2024 & 2032

- Figure 32: Asia Pacific Electricity Market in Spain Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Electricity Market in Spain Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electricity Market in Spain Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Electricity Market in Spain Revenue Million Forecast, by Power Generation Source 2019 & 2032

- Table 3: Global Electricity Market in Spain Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 4: Global Electricity Market in Spain Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Electricity Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Electricity Market in Spain Revenue Million Forecast, by Power Generation Source 2019 & 2032

- Table 7: Global Electricity Market in Spain Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 8: Global Electricity Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Electricity Market in Spain Revenue Million Forecast, by Power Generation Source 2019 & 2032

- Table 13: Global Electricity Market in Spain Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 14: Global Electricity Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Electricity Market in Spain Revenue Million Forecast, by Power Generation Source 2019 & 2032

- Table 19: Global Electricity Market in Spain Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 20: Global Electricity Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Electricity Market in Spain Revenue Million Forecast, by Power Generation Source 2019 & 2032

- Table 31: Global Electricity Market in Spain Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 32: Global Electricity Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Electricity Market in Spain Revenue Million Forecast, by Power Generation Source 2019 & 2032

- Table 40: Global Electricity Market in Spain Revenue Million Forecast, by Power Transmission and Distribution 2019 & 2032

- Table 41: Global Electricity Market in Spain Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Electricity Market in Spain Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electricity Market in Spain?

The projected CAGR is approximately 12.89%.

2. Which companies are prominent players in the Electricity Market in Spain?

Key companies in the market include Endesa S A, Iberdrola SA, EDP Group, ABO Wind AG*List Not Exhaustive, Grupo Red Electrica, Naturgy Energy Group S A, Nordex SE, Total Energies SE.

3. What are the main segments of the Electricity Market in Spain?

The market segments include Power Generation Source, Power Transmission and Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Integration of Renewable Energy4.; Supportive Government Policies.

6. What are the notable trends driving market growth?

Renewable Expected to be a Significant Sector.

7. Are there any restraints impacting market growth?

4.; High infrastructure costs.

8. Can you provide examples of recent developments in the market?

February 2023: In Castilla y León, Spain, the Spanish energy provider Repsol started producing clean energy at PI, its first renewable project. The PI project, situated in the provinces of Palencia and Valladolid, consists of seven wind farms with a total installed capacity of 175 MW.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electricity Market in Spain," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electricity Market in Spain report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electricity Market in Spain?

To stay informed about further developments, trends, and reports in the Electricity Market in Spain, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence