Key Insights

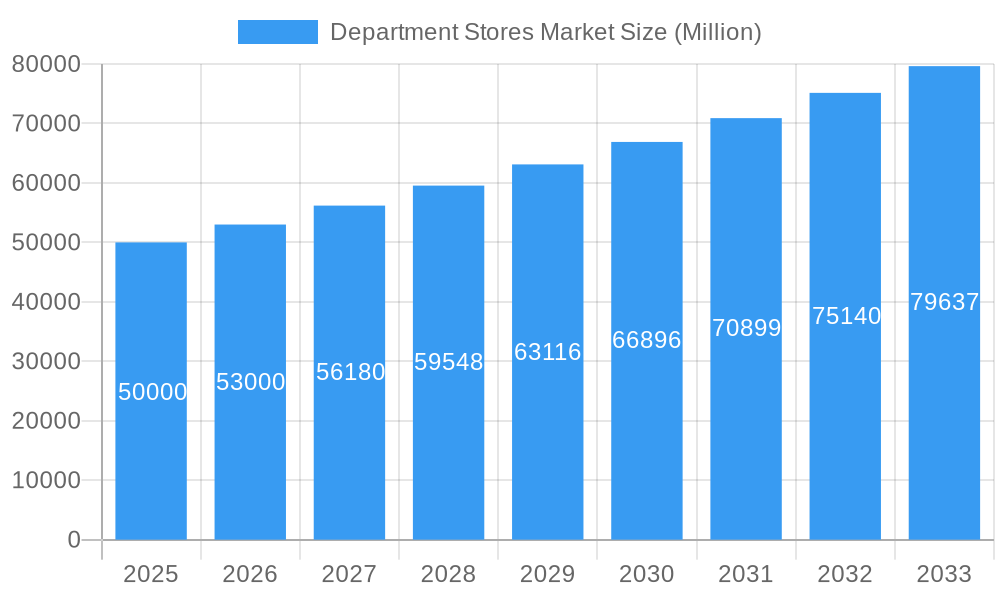

The global department store market, currently experiencing robust growth, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes in developing economies are driving increased consumer spending on apparel, cosmetics, and home goods, core offerings of department stores. The ongoing shift towards omnichannel retail strategies, encompassing both online and brick-and-mortar operations, enhances customer reach and convenience, boosting sales. Furthermore, strategic partnerships and collaborations between department stores and popular brands introduce exclusive product lines, attracting a wider customer base. However, the market faces challenges such as increasing competition from e-commerce giants and discount retailers, necessitating continuous innovation and adaptation to maintain market share. The rise of fast fashion and changing consumer preferences require department stores to focus on delivering unique experiences and personalized services.

Department Stores Market Market Size (In Billion)

Despite these challenges, the market's segmentation offers significant growth opportunities. Premium department stores focusing on luxury goods and curated experiences are demonstrating resilience, catering to high-spending consumers. Mid-range department stores are adapting by implementing loyalty programs, personal shopping services, and enhanced in-store experiences to maintain customer engagement. Geographic expansion into emerging markets presents lucrative avenues for growth, although careful market analysis and localization strategies are crucial to navigate local preferences and regulations. Key players like Marks & Spencer, Macy's, and Walmart are constantly innovating their strategies to capture this growth, including investments in technology, supply chain optimization, and strategic acquisitions. The market's future trajectory will depend on the ability of department stores to successfully blend the convenience of online shopping with the experiential aspects of physical retail.

Department Stores Market Company Market Share

Department Stores Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Department Stores Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report delves into market dynamics, trends, leading players, and future opportunities. The study period is 2019–2033, base year 2025, estimated year 2025, and forecast period 2025–2033. Historical period is 2019–2024. The market size is predicted to reach xx Million by 2033.

Department Stores Market Market Dynamics & Concentration

The department store market exhibits a moderate level of concentration, with a few major players holding significant market share. However, the landscape is dynamic, influenced by several factors. Market share data for 2024 indicates that Walmart Inc. holds approximately xx% market share, followed by Macy's Inc. at xx%, and Target Corporation at xx%. The remaining market share is distributed among numerous regional and smaller players. Innovation in areas such as omnichannel retailing, personalized shopping experiences, and sustainable practices are key drivers, while regulatory frameworks concerning consumer protection and fair competition play a vital role. Product substitutes, including online marketplaces and specialty stores, pose a significant competitive challenge. End-user trends, such as the increasing preference for convenience and personalized experiences, are shaping the market's evolution. Finally, M&A activity, though not exceptionally high in recent years (estimated xx deals in the past five years), plays a role in shaping market consolidation.

Department Stores Market Industry Trends & Analysis

The Department Stores Market is undergoing a significant transformation driven by several key trends. The market experienced a CAGR of xx% during the historical period (2019-2024), and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing consumer spending in developing economies, particularly in Asia. However, market penetration remains relatively high in developed markets like North America and Europe, leaving less room for immediate expansion. Technological disruptions, particularly the rise of e-commerce and omnichannel strategies, are reshaping the competitive landscape. Consumer preferences are shifting towards personalized experiences, sustainable products, and seamless omnichannel shopping journeys. Competitive dynamics are intense, with players focusing on enhancing their online presence, optimizing supply chains, and developing loyalty programs to retain customers.

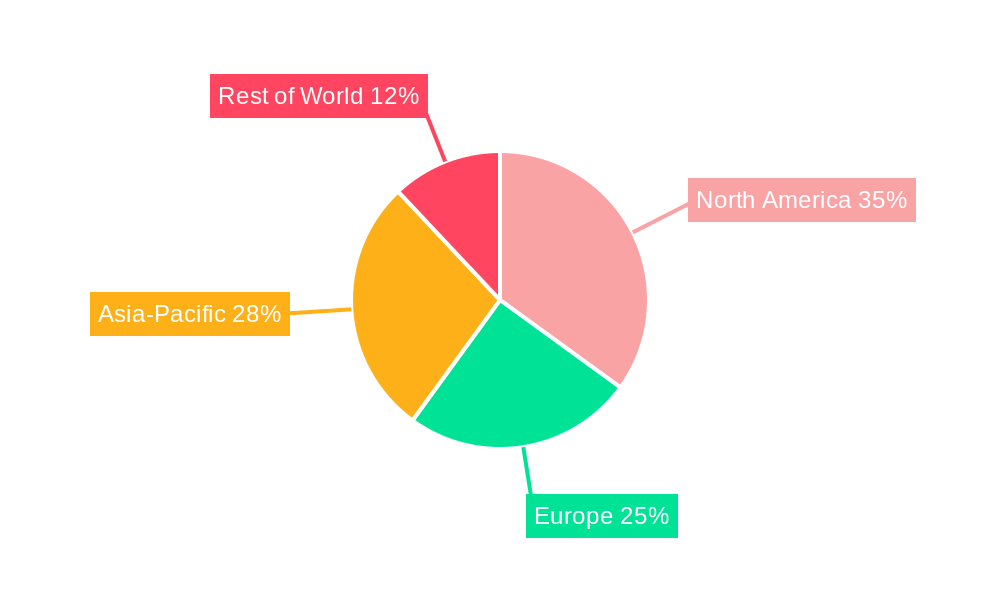

Leading Markets & Segments in Department Stores Market

The North American market currently dominates the global department store landscape, driven by strong consumer spending, established retail infrastructure, and the presence of major players like Macy's and Nordstrom. Key drivers for this dominance include:

- Strong Consumer Spending: High disposable incomes fuel demand for a wide range of products.

- Developed Retail Infrastructure: Extensive logistics networks support efficient distribution.

- Established Player Presence: Major department store chains have strong brand recognition and market share.

However, the Asia-Pacific region is experiencing rapid growth, with significant potential for future expansion driven by increasing urbanization and rising middle-class incomes. While specific segment data requires further analysis (xx Million in estimated revenue for apparel segment in 2025), the overall market is projected for robust growth due to the aforementioned factors.

Department Stores Market Product Developments

Recent product developments focus on enhancing the customer experience through personalized recommendations, improved online shopping interfaces, and the integration of technology to personalize the in-store experience. The use of augmented reality (AR) and virtual reality (VR) is emerging to allow customers to visualize products in their homes or interact with products before buying them. The focus is on creating seamless omnichannel experiences and offering curated selections to cater to specific customer segments.

Key Drivers of Department Stores Market Growth

Several key factors are driving growth in the Department Stores Market. Technological advancements, including improved e-commerce platforms and personalized marketing strategies, are enhancing customer engagement. Economic factors, such as rising disposable incomes in developing economies and increasing consumer spending, are fueling demand. Regulatory changes promoting fair competition and consumer protection further stabilize the market and encourage investment. Specific examples include the growth of mobile commerce and the increasing use of data analytics to personalize shopping experiences.

Challenges in the Department Stores Market Market

The Department Stores Market faces several challenges. Intense competition from online retailers and specialty stores is eroding market share. Supply chain disruptions and rising costs are impacting profitability. Regulatory hurdles and evolving consumer preferences require constant adaptation and innovation. These challenges translate into reduced profit margins (estimated xx% reduction in 2024 compared to 2019) and increased pressure to maintain competitiveness.

Emerging Opportunities in Department Stores Market

Strategic partnerships with complementary businesses, such as technology companies and experience providers, present significant growth opportunities. Expanding into new markets, especially those with growing middle classes, offers substantial potential. Technological breakthroughs in areas like personalized shopping experiences and omnichannel integration will drive future growth. The focus on sustainability and ethical sourcing also represents a significant opportunity to attract environmentally conscious consumers.

Leading Players in the Department Stores Market Sector

- Marks and Spencer Group Plc

- Macy's Inc

- Sears Holdings Corp

- Target Corporation

- Nordstrom Inc

- Walmart Inc

- Isetan Mitsukoshi Holdings Ltd

- Kohl's Corporation

- Chongqing Department Store Co Ltd

- Lotte Department Store

Key Milestones in Department Stores Market Industry

- January 2023: Marks and Spencer announced a nearly half-a-billion investment in upgrading its UK stores, creating over 3,400 new jobs, and enhancing the customer experience. This signifies a significant commitment to long-term growth and market competitiveness.

- February 2023: Macy's launched PATTERN Beauty, expanding its hair care portfolio and establishing a partnership with a leading hair care brand. This strategic move diversifies Macy's product offerings and caters to specific consumer needs.

Strategic Outlook for Department Stores Market Market

The Department Stores Market is poised for continued growth, driven by technological advancements, strategic partnerships, and expanding into new markets. Companies that successfully adapt to evolving consumer preferences, embrace technological innovation, and develop effective omnichannel strategies are well-positioned to capitalize on future growth opportunities. Focus on sustainability and enhancing the customer experience will be crucial for long-term success.

Department Stores Market Segmentation

-

1. Product Type

- 1.1. Apparel and Accessories

- 1.2. FMCG

- 1.3. Hardline and Softline

Department Stores Market Segmentation By Geography

-

1. North America

- 1.1. U

-

2. Canada

- 2.1. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. Italy

- 3.4. U

-

4. Spain

- 4.1. Rest of Europe

-

5. Asia Pacific

- 5.1. China

- 5.2. Japan

- 5.3. South Korea

- 5.4. India

- 5.5. Australia

- 5.6. Rest of Asia Pacific

-

6. Middle East and Africa

- 6.1. Saudi Arab

- 6.2. South Africa

- 6.3. UAE

- 6.4. Rest of Middle East and Africa

-

7. South America

- 7.1. Brazil

- 7.2. Mexico

- 7.3. Rest of South America

Department Stores Market Regional Market Share

Geographic Coverage of Department Stores Market

Department Stores Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Retail E-Commerce Sales have the Negative Impact on Department Stores Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Apparel and Accessories

- 5.1.2. FMCG

- 5.1.3. Hardline and Softline

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Canada

- 5.2.3. Europe

- 5.2.4. Spain

- 5.2.5. Asia Pacific

- 5.2.6. Middle East and Africa

- 5.2.7. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Apparel and Accessories

- 6.1.2. FMCG

- 6.1.3. Hardline and Softline

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Apparel and Accessories

- 7.1.2. FMCG

- 7.1.3. Hardline and Softline

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Apparel and Accessories

- 8.1.2. FMCG

- 8.1.3. Hardline and Softline

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Spain Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Apparel and Accessories

- 9.1.2. FMCG

- 9.1.3. Hardline and Softline

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Apparel and Accessories

- 10.1.2. FMCG

- 10.1.3. Hardline and Softline

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Apparel and Accessories

- 11.1.2. FMCG

- 11.1.3. Hardline and Softline

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. South America Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Apparel and Accessories

- 12.1.2. FMCG

- 12.1.3. Hardline and Softline

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Marks and Spencer Group Plc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Macy's Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Sears Holdings Corp

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Target Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Nordstrom Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Walmart Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Isetan Mitsukoshi Holdings Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kohl's Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Chongqing Department Store Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Lotte Department Store**List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Marks and Spencer Group Plc

List of Figures

- Figure 1: Global Department Stores Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Canada Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 7: Canada Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: Canada Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Canada Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 11: Europe Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Spain Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Spain Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Spain Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Spain Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 23: Middle East and Africa Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Middle East and Africa Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: South America Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 29: South America Department Stores Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Department Stores Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 4: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: U Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Rest of North America Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Germany Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: France Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Italy Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: U Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 16: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Rest of Europe Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 19: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: China Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: India Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Australia Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 27: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Saudi Arab Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: South Africa Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: UAE Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 33: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Brazil Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Mexico Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Department Stores Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Department Stores Market?

Key companies in the market include Marks and Spencer Group Plc, Macy's Inc, Sears Holdings Corp, Target Corporation, Nordstrom Inc, Walmart Inc, Isetan Mitsukoshi Holdings Ltd, Kohl's Corporation, Chongqing Department Store Co Ltd, Lotte Department Store**List Not Exhaustive.

3. What are the main segments of the Department Stores Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Retail E-Commerce Sales have the Negative Impact on Department Stores Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Macy's launches PATTERN Beauty with the brand's extensive assortment of washes, treatments, styling tools, and more. As the brand's first-ever department store partner, PATTERN expands Macy's portfolio of hair care products, specifically in the curl category.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Department Stores Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Department Stores Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Department Stores Market?

To stay informed about further developments, trends, and reports in the Department Stores Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence