Key Insights

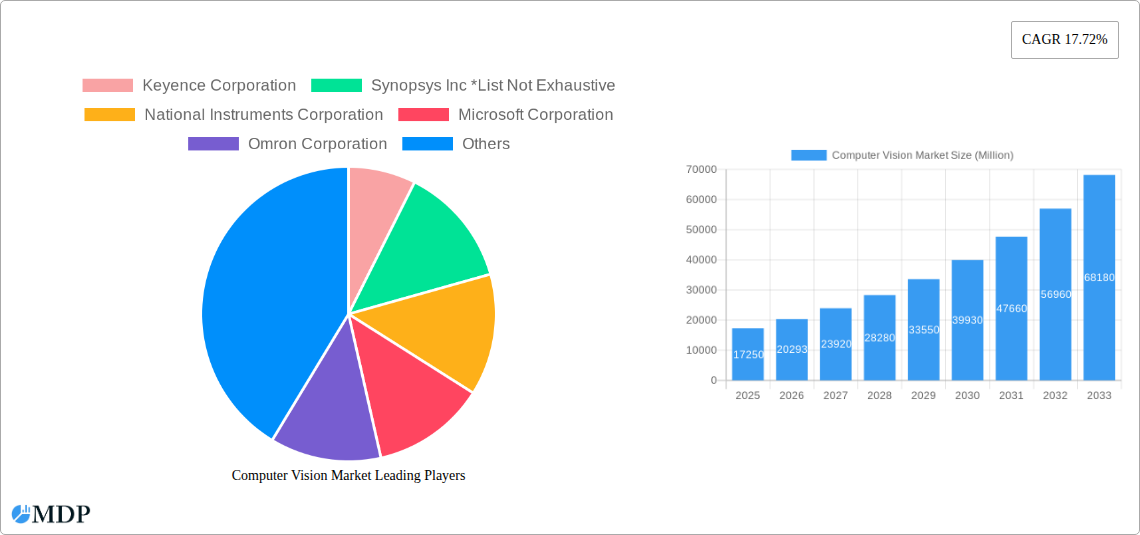

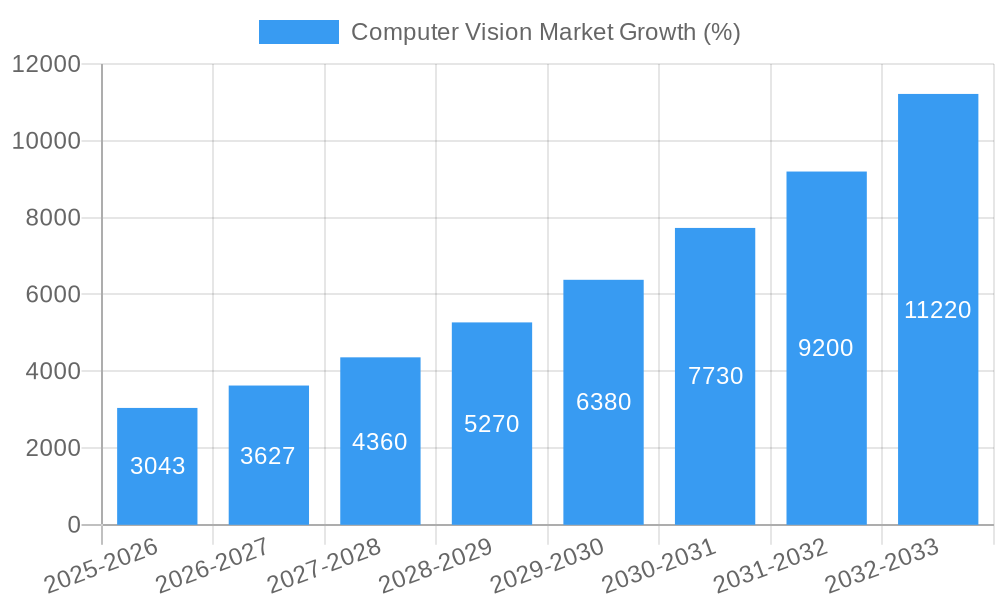

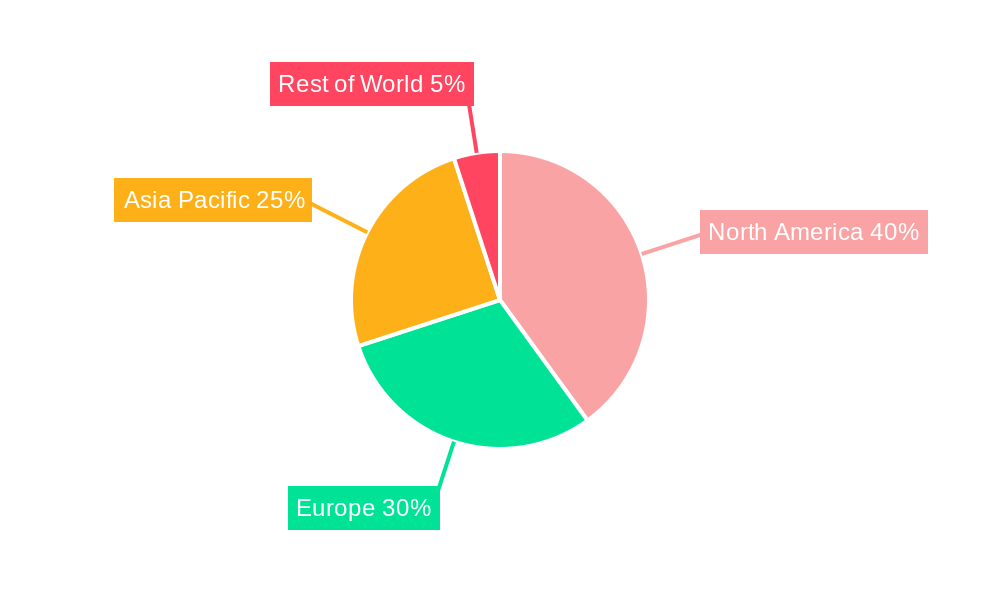

The computer vision market is experiencing robust growth, projected to reach \$17.25 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 17.72% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of automation across various industries, particularly manufacturing, automotive, and defense & security, is a major catalyst. Advanced imaging sensors, powerful processing capabilities, and sophisticated algorithms are enabling more accurate and efficient visual data analysis, leading to improved process optimization and enhanced decision-making. Furthermore, the rising demand for AI-powered solutions for tasks such as object recognition, image classification, and video analysis across diverse sectors like life sciences (e.g., medical imaging) is further bolstering market growth. The development of more robust and cost-effective computer vision technologies is also a significant factor. However, challenges such as data privacy concerns, the need for high-quality data for training algorithms, and the complexity of integrating computer vision systems into existing infrastructure act as restraints on market expansion. The market is segmented by components (hardware and software) and end-user industries, with North America, Europe, and Asia Pacific representing the major regional markets, each exhibiting unique growth trajectories influenced by technological advancements and industry-specific adoption rates. The competitive landscape features a mix of established technology companies like Keyence, Synopsys, National Instruments, Microsoft, and Omron, alongside specialized players. Continuous innovation in deep learning, edge computing, and 3D vision technologies will continue to shape the future of this dynamic market.

The forecast period (2025-2033) anticipates continued strong growth, driven by ongoing technological innovation and increased industry adoption. The market’s segmentation presents opportunities for specialized players to cater to niche demands within specific end-user industries. For instance, the life sciences sector's growing reliance on image analysis for diagnostics and research will likely drive substantial growth in specialized software and hardware solutions. Similarly, the automotive sector's focus on autonomous driving and advanced driver-assistance systems (ADAS) will continue to fuel demand. Competitive pressures will likely result in continuous improvements in cost-effectiveness and performance, making computer vision technologies accessible to a broader range of applications and industries. Strategic partnerships and mergers and acquisitions will likely further consolidate the market landscape and accelerate innovation.

Computer Vision Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Computer Vision Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's current state, future trajectory, and key growth drivers. The market is expected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Computer Vision Market Market Dynamics & Concentration

The Computer Vision market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is currently moderate, with several key players holding significant shares. However, the landscape is evolving rapidly due to continuous technological advancements and strategic mergers and acquisitions (M&A). The number of M&A deals in the sector has increased significantly in recent years, exceeding xx in 2024. This reflects the intensifying competition and strategic moves by leading companies to expand their market presence and product portfolios.

Key innovation drivers include the development of sophisticated algorithms, improved sensor technologies (including LiDAR), and the increasing availability of powerful computing resources. Regulatory frameworks, while generally supportive of innovation, vary across regions and impact market access and product compliance. Product substitutes, such as traditional manual inspection methods, are gradually losing ground due to the superior efficiency and accuracy of computer vision solutions. End-user trends reveal a growing preference for AI-powered solutions that offer automation, improved productivity, and enhanced decision-making capabilities.

- Market Share: Key players like Keyence Corporation, Synopsys Inc., and Microsoft Corporation hold significant shares, with the top 5 companies accounting for approximately xx% of the market in 2024.

- M&A Activity: The number of M&A deals is projected to reach xx by 2033, driven by consolidation efforts and the pursuit of complementary technologies.

Computer Vision Market Industry Trends & Analysis

The Computer Vision market is experiencing exponential growth, fueled by several key trends. Technological disruptions, particularly in deep learning and artificial intelligence (AI), are driving significant advancements in image recognition, object detection, and scene understanding. Consumer preferences are shifting towards smart, automated systems that enhance safety, security, and convenience. This is evident across various sectors, including automotive, manufacturing, and healthcare.

Competitive dynamics are intensifying, with companies investing heavily in R&D, strategic partnerships, and M&A activities to gain a competitive edge. Market penetration is rapidly increasing in emerging markets, driven by affordability and accessibility of computer vision technologies. The market is segmented by components (hardware and software) and end-user industries (life sciences, manufacturing, defense & security, automotive, and others). The automotive industry is witnessing particularly strong growth due to the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies.

Leading Markets & Segments in Computer Vision Market

The North American region currently holds the dominant position in the Computer Vision market, driven by strong technological innovation, substantial investments in R&D, and a well-established ecosystem of players. Within the segments, the software segment is experiencing faster growth compared to the hardware segment due to the increasing adoption of cloud-based solutions and software-as-a-service (SaaS) models.

In terms of end-user industries, the manufacturing sector represents a significant market segment, driven by the need for automation, quality control, and predictive maintenance. The automotive industry is also a major contributor, with increasing demand for ADAS and autonomous driving functionalities.

- Key Drivers for North American Dominance:

- Strong R&D investments and technological advancements.

- Presence of major technology companies and a robust ecosystem.

- Favorable regulatory environment supporting technological innovation.

- High adoption rate of computer vision solutions across various sectors.

- Software Segment Growth Drivers:

- Cloud-based and SaaS solutions offer scalability and cost-effectiveness.

- Ease of implementation and integration with existing systems.

- Continuous advancements in algorithms and AI capabilities.

Computer Vision Market Product Developments

Recent product innovations focus on enhancing the accuracy, speed, and efficiency of computer vision systems. Advancements in deep learning algorithms, combined with improved sensor technologies, are leading to more robust and reliable solutions. The market is witnessing the emergence of specialized computer vision solutions tailored to specific applications, such as medical imaging, autonomous vehicles, and industrial automation. This tailored approach enhances market fit and provides competitive advantages.

Key Drivers of Computer Vision Market Growth

Several factors are driving the growth of the Computer Vision market. Technological advancements, particularly in AI and deep learning, are enabling the development of more sophisticated and accurate computer vision systems. Increasing government support for R&D and the growing adoption of AI across diverse industries are also contributing factors. Furthermore, cost reduction and improvement in computing power have made computer vision technology more accessible to a broader range of businesses and industries.

Challenges in the Computer Vision Market Market

The Computer Vision market faces several challenges, including the high cost of development and implementation of advanced systems. Data privacy and security concerns also pose significant hurdles. Furthermore, the lack of skilled workforce and the need for high computational power in processing complex image data also restrict market expansion. The market also faces challenges related to the standardization of algorithms and the integration of diverse hardware and software components. This results in an estimated xx Million loss annually for companies due to integration difficulties.

Emerging Opportunities in Computer Vision Market

The Computer Vision market is poised for significant growth due to expanding applications in various fields, including healthcare, robotics, and smart cities. The integration of computer vision with other technologies, such as the Internet of Things (IoT) and augmented reality (AR), creates new avenues for innovation. Strategic partnerships and collaborations between technology companies and industry-specific players will accelerate market expansion and adoption.

Leading Players in the Computer Vision Market Sector

- Keyence Corporation

- Synopsys Inc

- National Instruments Corporation

- Microsoft Corporation

- Omron Corporation

- SAS Institute

- Texas Instruments Incorporated

- Cadence Design Systems Inc

- Intel Corporation

- Sony Corporation

Key Milestones in Computer Vision Market Industry

- June 2022: Visionary.ai and Innoviz Technologies Ltd. partnered to enhance 3D computer vision performance.

- March 2022: Intel Corporation announced solutions transforming healthcare patient rooms.

- January 2022: Amazon Web Services launched AWS Panorama in Asia Pacific for visual inspection automation.

Strategic Outlook for Computer Vision Market Market

The Computer Vision market is poised for continued strong growth, driven by technological advancements, increasing adoption across various sectors, and supportive government policies. Strategic partnerships, acquisitions, and investments in R&D will play a crucial role in shaping the future of the market. Focusing on developing robust, reliable, and cost-effective solutions will be key to success in this rapidly evolving landscape. The market presents significant opportunities for companies that can adapt to the evolving needs of the market and leverage emerging technologies to enhance the performance and applicability of their products.

Computer Vision Market Segmentation

-

1. Components

- 1.1. Hardware

- 1.2. Software

-

2. End-user Industry

- 2.1. Life science

- 2.2. Manufacturing

- 2.3. Defense & Security

- 2.4. Automotive

- 2.5. Other End User Industries

Computer Vision Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of World

Computer Vision Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.72% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Need for Quality Inspection and Automation; Growing Demand for Vision-Guided Robotic Systems

- 3.3. Market Restrains

- 3.3.1. Complexity in Integrating Computer Vision Systems

- 3.4. Market Trends

- 3.4.1. Manufacturing Sector is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Computer Vision Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Components

- 5.1.1. Hardware

- 5.1.2. Software

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Life science

- 5.2.2. Manufacturing

- 5.2.3. Defense & Security

- 5.2.4. Automotive

- 5.2.5. Other End User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Components

- 6. North America Computer Vision Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Components

- 6.1.1. Hardware

- 6.1.2. Software

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Life science

- 6.2.2. Manufacturing

- 6.2.3. Defense & Security

- 6.2.4. Automotive

- 6.2.5. Other End User Industries

- 6.1. Market Analysis, Insights and Forecast - by Components

- 7. Europe Computer Vision Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Components

- 7.1.1. Hardware

- 7.1.2. Software

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Life science

- 7.2.2. Manufacturing

- 7.2.3. Defense & Security

- 7.2.4. Automotive

- 7.2.5. Other End User Industries

- 7.1. Market Analysis, Insights and Forecast - by Components

- 8. Asia Pacific Computer Vision Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Components

- 8.1.1. Hardware

- 8.1.2. Software

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Life science

- 8.2.2. Manufacturing

- 8.2.3. Defense & Security

- 8.2.4. Automotive

- 8.2.5. Other End User Industries

- 8.1. Market Analysis, Insights and Forecast - by Components

- 9. Rest of World Computer Vision Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Components

- 9.1.1. Hardware

- 9.1.2. Software

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Life science

- 9.2.2. Manufacturing

- 9.2.3. Defense & Security

- 9.2.4. Automotive

- 9.2.5. Other End User Industries

- 9.1. Market Analysis, Insights and Forecast - by Components

- 10. North America Computer Vision Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Computer Vision Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Computer Vision Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of World Computer Vision Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Keyence Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Synopsys Inc *List Not Exhaustive

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 National Instruments Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Microsoft Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Omron Corporation

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 SAS Institute

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Texas Instruments Incorporated

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Cadence Design Systems Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Intel Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Sony Corporation

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Keyence Corporation

List of Figures

- Figure 1: Global Computer Vision Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Computer Vision Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Computer Vision Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Computer Vision Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Computer Vision Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Computer Vision Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Computer Vision Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of World Computer Vision Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of World Computer Vision Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Computer Vision Market Revenue (Million), by Components 2024 & 2032

- Figure 11: North America Computer Vision Market Revenue Share (%), by Components 2024 & 2032

- Figure 12: North America Computer Vision Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 13: North America Computer Vision Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 14: North America Computer Vision Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Computer Vision Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Computer Vision Market Revenue (Million), by Components 2024 & 2032

- Figure 17: Europe Computer Vision Market Revenue Share (%), by Components 2024 & 2032

- Figure 18: Europe Computer Vision Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: Europe Computer Vision Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: Europe Computer Vision Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Computer Vision Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Computer Vision Market Revenue (Million), by Components 2024 & 2032

- Figure 23: Asia Pacific Computer Vision Market Revenue Share (%), by Components 2024 & 2032

- Figure 24: Asia Pacific Computer Vision Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Asia Pacific Computer Vision Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Asia Pacific Computer Vision Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Computer Vision Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of World Computer Vision Market Revenue (Million), by Components 2024 & 2032

- Figure 29: Rest of World Computer Vision Market Revenue Share (%), by Components 2024 & 2032

- Figure 30: Rest of World Computer Vision Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 31: Rest of World Computer Vision Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 32: Rest of World Computer Vision Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of World Computer Vision Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Computer Vision Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Computer Vision Market Revenue Million Forecast, by Components 2019 & 2032

- Table 3: Global Computer Vision Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Computer Vision Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Computer Vision Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Computer Vision Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Computer Vision Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Computer Vision Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Computer Vision Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Computer Vision Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Computer Vision Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Computer Vision Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Computer Vision Market Revenue Million Forecast, by Components 2019 & 2032

- Table 14: Global Computer Vision Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Global Computer Vision Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Computer Vision Market Revenue Million Forecast, by Components 2019 & 2032

- Table 17: Global Computer Vision Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Global Computer Vision Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Computer Vision Market Revenue Million Forecast, by Components 2019 & 2032

- Table 20: Global Computer Vision Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global Computer Vision Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Computer Vision Market Revenue Million Forecast, by Components 2019 & 2032

- Table 23: Global Computer Vision Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Global Computer Vision Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Computer Vision Market?

The projected CAGR is approximately 17.72%.

2. Which companies are prominent players in the Computer Vision Market?

Key companies in the market include Keyence Corporation, Synopsys Inc *List Not Exhaustive, National Instruments Corporation, Microsoft Corporation, Omron Corporation, SAS Institute, Texas Instruments Incorporated, Cadence Design Systems Inc, Intel Corporation, Sony Corporation.

3. What are the main segments of the Computer Vision Market?

The market segments include Components, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Quality Inspection and Automation; Growing Demand for Vision-Guided Robotic Systems.

6. What are the notable trends driving market growth?

Manufacturing Sector is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

Complexity in Integrating Computer Vision Systems.

8. Can you provide examples of recent developments in the market?

June 2022 - Image signal processor (ISP) software vendor Visionary.ai joined forces with LiDAR sensor producer Innoviz Technologies Ltd. To enhance the performance of 3D computer vision for various applications, including drones, robots, and smart cities, the alliance seeks to offer a combined service of ISP software and LiDAR sensors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Computer Vision Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Computer Vision Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Computer Vision Market?

To stay informed about further developments, trends, and reports in the Computer Vision Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence