Key Insights

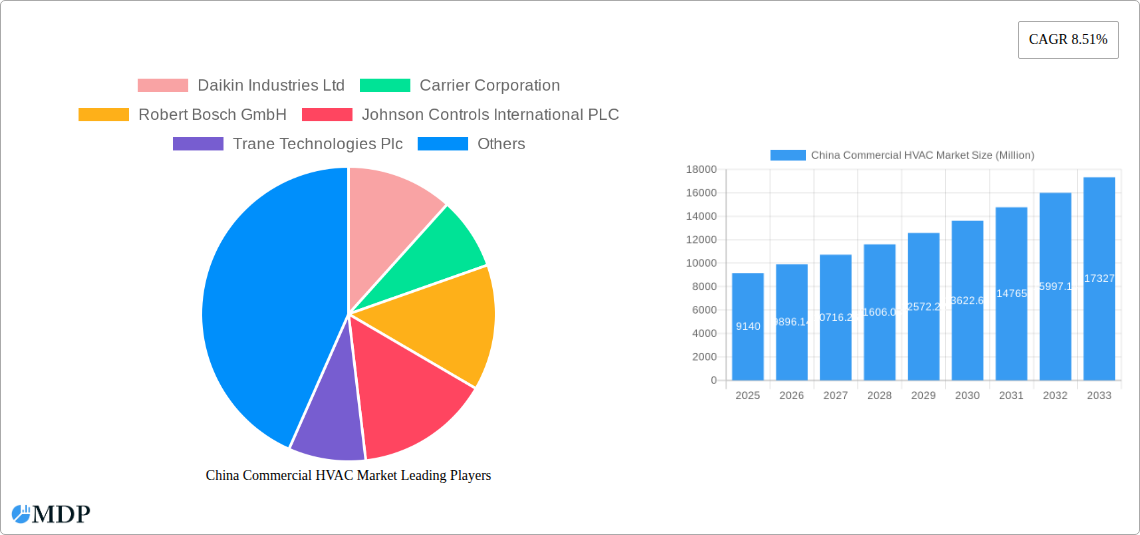

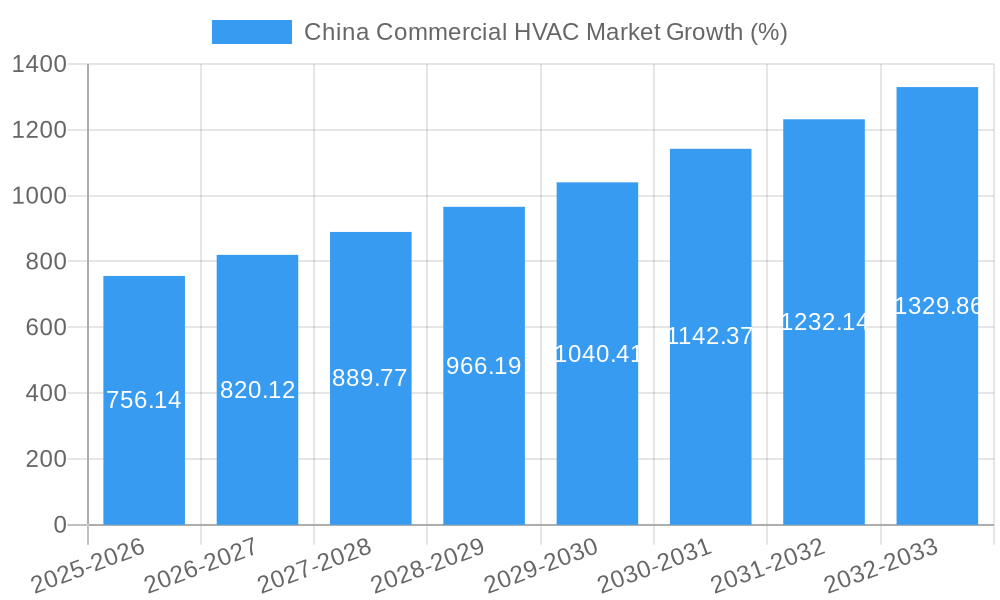

The China commercial HVAC market, valued at $9.14 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.51% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, rapid urbanization and infrastructure development across China are creating a surge in demand for efficient and reliable HVAC systems in commercial buildings, including offices, retail spaces, and hotels. Secondly, increasing awareness of energy efficiency and sustainability is pushing adoption of energy-saving HVAC technologies, like Variable Refrigerant Flow (VRF) systems and building automation systems (BAS). Government initiatives promoting green building practices further bolster this trend. Finally, rising disposable incomes and a growing middle class are increasing spending on improved indoor comfort and productivity in commercial settings, driving demand for higher-quality HVAC solutions.

However, the market also faces certain challenges. Supply chain disruptions, particularly those experienced in recent years, can impact the availability and pricing of components. Furthermore, intense competition among established international and domestic players necessitates continuous innovation and strategic pricing to maintain market share. Despite these constraints, the long-term outlook remains positive, driven by ongoing economic growth, government support for sustainable development, and the increasing need for advanced climate control solutions in diverse commercial applications across China's rapidly evolving urban landscape. The market segmentation is likely diversified, encompassing various system types (VRF, chillers, AHUs), capacity ranges, and technological advancements. Leading players, including Daikin, Carrier, Bosch, Johnson Controls, Trane, Mitsubishi Electric, LG Electronics, Danfoss, System Air, and Midea, are actively competing through technological innovation, strategic partnerships, and market penetration strategies to capture a larger share of this lucrative market.

China Commercial HVAC Market: A Comprehensive Report (2019-2033)

Unlocking Growth in China's Thriving Commercial HVAC Sector: An In-depth Market Analysis

This comprehensive report provides a detailed analysis of the China Commercial HVAC market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic landscape. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. Discover key trends, growth drivers, challenges, and opportunities shaping this multi-billion dollar market. Expect in-depth analysis across various segments and leading players, including Daikin Industries Ltd, Carrier Corporation, Robert Bosch GmbH, Johnson Controls International PLC, Trane Technologies Plc, Mitsubishi Electric Hydronics & IT Cooling Systems S p A, LG Electronics Inc, Danfoss Inc, System Air AB, and Midea Group.

China Commercial HVAC Market Market Dynamics & Concentration

The China Commercial HVAC market, valued at xx Million in 2024, exhibits a complex interplay of factors driving its growth and concentration. Market concentration is moderate, with several key players holding significant market share, but also room for smaller, specialized players to thrive. Innovation, particularly in energy-efficient and environmentally friendly technologies, acts as a crucial driver. Stringent government regulations promoting energy conservation and emission reduction significantly shape market dynamics. The market witnesses continuous product substitution, with newer, more efficient technologies replacing older systems. End-user preferences are shifting towards smart, connected HVAC solutions that enhance operational efficiency and provide better control. The landscape is further shaped by mergers and acquisitions (M&A) activities, with larger players seeking to expand their market share and product portfolios. Over the historical period (2019-2024), there were approximately xx M&A deals involving major market players.

- Market Concentration: The top five players hold approximately xx% of the market share.

- Innovation Drivers: Energy efficiency standards, smart technology integration, and environmental concerns.

- Regulatory Frameworks: Stringent emission regulations and energy efficiency standards drive adoption of advanced technologies.

- Product Substitutes: Heat pumps and other energy-efficient alternatives challenge traditional HVAC systems.

- End-User Trends: Growing demand for smart, connected, and energy-efficient HVAC systems.

- M&A Activities: Consolidation is expected to continue, driving growth and shaping market leadership.

China Commercial HVAC Market Industry Trends & Analysis

The China Commercial HVAC market demonstrates robust growth, driven by rapid urbanization, increasing disposable incomes, and rising demand for better indoor environmental quality. The market is experiencing a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, particularly the rise of smart HVAC systems and energy-efficient solutions, are reshaping the competitive landscape. Consumer preferences are increasingly influenced by factors such as energy efficiency, sustainability, and smart home integration. Market penetration of energy-efficient technologies remains relatively low, presenting significant opportunities for growth. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants with innovative technologies.

Leading Markets & Segments in China Commercial HVAC Market

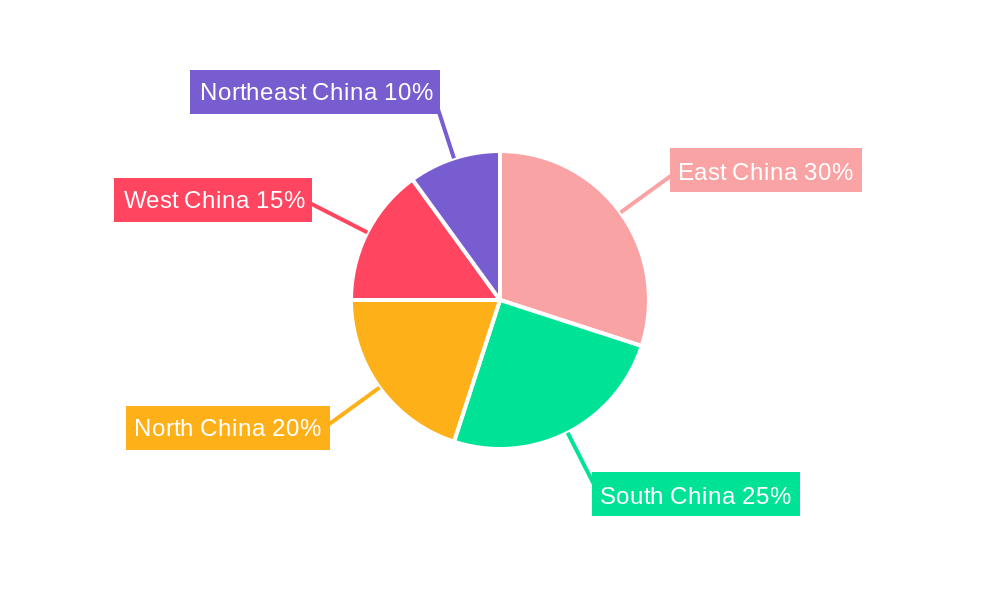

The eastern coastal regions of China, including major cities like Beijing, Shanghai, and Guangzhou, dominate the Commercial HVAC market. This dominance is fueled by robust economic activity, advanced infrastructure, and a high concentration of commercial buildings.

- Key Drivers in Dominant Regions:

- Rapid urbanization and infrastructure development.

- Strong economic growth and rising disposable incomes.

- Government initiatives promoting energy efficiency and sustainable development.

- Dominance Analysis: The eastern coastal regions represent approximately xx% of the total market, benefiting from higher construction activity and a concentration of commercial properties. This region is expected to maintain its leadership throughout the forecast period.

China Commercial HVAC Market Product Developments

Recent product innovations focus on energy efficiency, smart technology integration, and improved sustainability. New products incorporate features such as variable refrigerant flow (VRF) systems, air-source heat pumps, and advanced control systems. These innovations offer enhanced energy savings, reduced environmental impact, and improved operational efficiency. The competitive landscape is driven by a continuous push to offer superior energy performance, advanced features, and competitive pricing.

Key Drivers of China Commercial HVAC Market Growth

Several key factors drive the growth of the China Commercial HVAC market:

- Technological Advancements: Energy-efficient technologies like heat pumps and VRF systems.

- Economic Growth: Rising disposable incomes and increased investments in commercial infrastructure.

- Government Policies: Stringent regulations promoting energy efficiency and environmental sustainability.

Challenges in the China Commercial HVAC Market Market

The market faces several challenges:

- Regulatory Hurdles: Navigating complex regulations and obtaining necessary permits.

- Supply Chain Disruptions: Dependence on global supply chains and potential disruptions.

- Intense Competition: Pressure from established and emerging players.

Emerging Opportunities in China Commercial HVAC Market

Significant long-term growth opportunities exist:

- Technological Breakthroughs: Development and adoption of innovative, energy-efficient technologies.

- Strategic Partnerships: Collaborations among players to develop and deploy advanced solutions.

- Market Expansion: Penetration into less-developed regions with growing commercial construction.

Leading Players in the China Commercial HVAC Market Sector

- Daikin Industries Ltd

- Carrier Corporation

- Robert Bosch GmbH

- Johnson Controls International PLC

- Trane Technologies Plc

- Mitsubishi Electric Hydronics & IT Cooling Systems S p A

- LG Electronics Inc

- Danfoss Inc

- System Air AB

- Midea Group

Key Milestones in China Commercial HVAC Market Industry

- July 2024: Daikin Applied launches enhanced Rebel HVAC systems with air-source heat pumps, boosting energy efficiency by up to 55%.

- February 2024: SPRSUN begins construction of a new smart factory dedicated to producing energy-efficient heat pumps.

Strategic Outlook for China Commercial HVAC Market Market

The China Commercial HVAC market holds significant long-term growth potential. Strategic opportunities exist for companies that can adapt to evolving technological advancements, navigate regulatory changes effectively, and cater to changing consumer preferences for energy-efficient and sustainable solutions. Continued expansion into less-developed regions and strategic partnerships will be crucial for long-term success.

China Commercial HVAC Market Segmentation

-

1. Type of Component

-

1.1. HVAC Equipment

- 1.1.1. Heating Equipment

- 1.1.2. Air Conditioning /Ventillation Equipment

- 1.2. HVAC Services

-

1.1. HVAC Equipment

-

2. End-User Industry

- 2.1. Hospitality

- 2.2. Commercial Buildings

- 2.3. Public Buildings

- 2.4. Others

China Commercial HVAC Market Segmentation By Geography

- 1. China

China Commercial HVAC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Energy-Efficient Devices; Growing Demand for Replacement and Retrofit Services

- 3.3. Market Restrains

- 3.3.1. Increasing Demand For Energy-Efficient Devices; Growing Demand for Replacement and Retrofit Services

- 3.4. Market Trends

- 3.4.1. Commercial Buildings is Expected to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Commercial HVAC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 5.1.1. HVAC Equipment

- 5.1.1.1. Heating Equipment

- 5.1.1.2. Air Conditioning /Ventillation Equipment

- 5.1.2. HVAC Services

- 5.1.1. HVAC Equipment

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Hospitality

- 5.2.2. Commercial Buildings

- 5.2.3. Public Buildings

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Daikin Industries Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carrier Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Robert Bosch GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Johnson Controls International PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Trane Technologies Plc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Hydronics & IT Cooling Systems S p A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LG Electronics Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Danfoss Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 System Air AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Midea Grou

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Daikin Industries Ltd

List of Figures

- Figure 1: China Commercial HVAC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Commercial HVAC Market Share (%) by Company 2024

List of Tables

- Table 1: China Commercial HVAC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Commercial HVAC Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: China Commercial HVAC Market Revenue Million Forecast, by Type of Component 2019 & 2032

- Table 4: China Commercial HVAC Market Volume Billion Forecast, by Type of Component 2019 & 2032

- Table 5: China Commercial HVAC Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: China Commercial HVAC Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 7: China Commercial HVAC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China Commercial HVAC Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: China Commercial HVAC Market Revenue Million Forecast, by Type of Component 2019 & 2032

- Table 10: China Commercial HVAC Market Volume Billion Forecast, by Type of Component 2019 & 2032

- Table 11: China Commercial HVAC Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 12: China Commercial HVAC Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 13: China Commercial HVAC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Commercial HVAC Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Commercial HVAC Market?

The projected CAGR is approximately 8.51%.

2. Which companies are prominent players in the China Commercial HVAC Market?

Key companies in the market include Daikin Industries Ltd, Carrier Corporation, Robert Bosch GmbH, Johnson Controls International PLC, Trane Technologies Plc, Mitsubishi Electric Hydronics & IT Cooling Systems S p A, LG Electronics Inc, Danfoss Inc, System Air AB, Midea Grou.

3. What are the main segments of the China Commercial HVAC Market?

The market segments include Type of Component, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Energy-Efficient Devices; Growing Demand for Replacement and Retrofit Services.

6. What are the notable trends driving market growth?

Commercial Buildings is Expected to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

Increasing Demand For Energy-Efficient Devices; Growing Demand for Replacement and Retrofit Services.

8. Can you provide examples of recent developments in the market?

July 2024: Daikin Applied enhanced its Rebel and Rebel Applied packaged rooftop HVAC systems by incorporating air-source heat pumps and other advanced technologies. This move aligns with the company's goal of aiding customers in transitioning to electric heating and cooling, contributing to decarbonization efforts. These systems, designed for low-rise commercial buildings, boast energy savings that surpass ASHRAE standards by up to 55%, according to Daikin Applied.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Commercial HVAC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Commercial HVAC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Commercial HVAC Market?

To stay informed about further developments, trends, and reports in the China Commercial HVAC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence