Key Insights

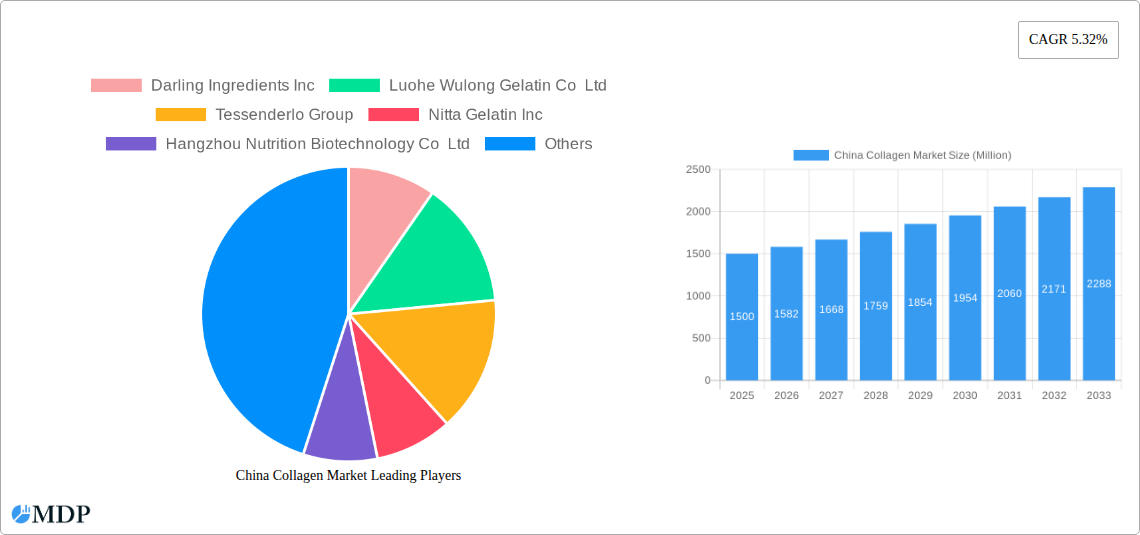

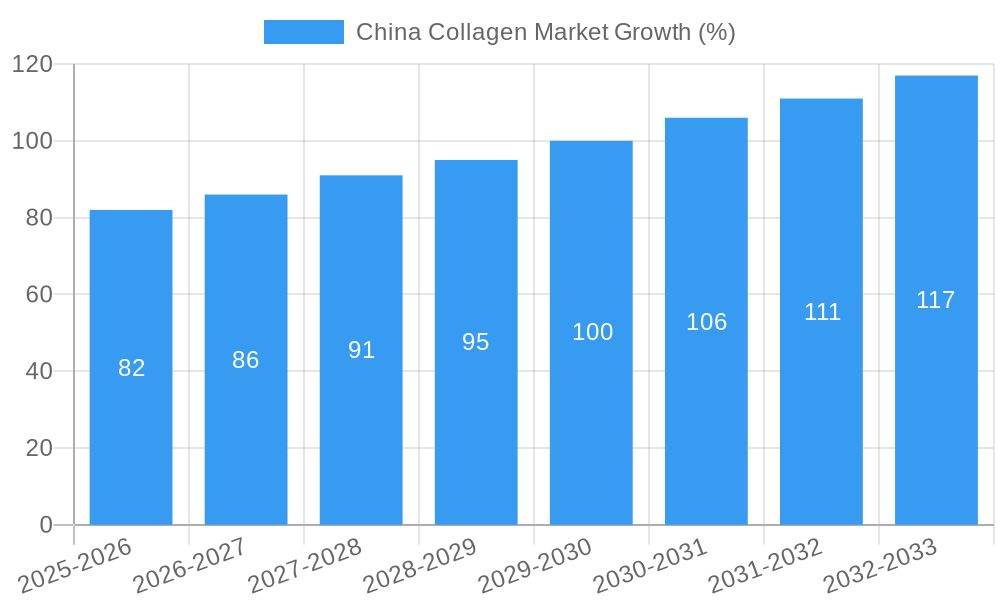

The China collagen market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.32% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning demand for collagen-based products in the animal feed industry, fueled by the increasing focus on animal health and productivity within China's expanding livestock sector, significantly contributes to market growth. Simultaneously, the rising consumer awareness of collagen's benefits for skin health and overall well-being is boosting demand within the personal care and cosmetics segment. The food and beverage industry, particularly the functional food and beverage sector, presents another significant avenue for growth, with manufacturers incorporating collagen into products aimed at health-conscious consumers. While the market faces potential restraints such as fluctuating raw material prices and stringent regulatory standards, the overall positive outlook remains strong, further enhanced by the growing popularity of collagen supplements and the expanding middle class in China with increased disposable income.

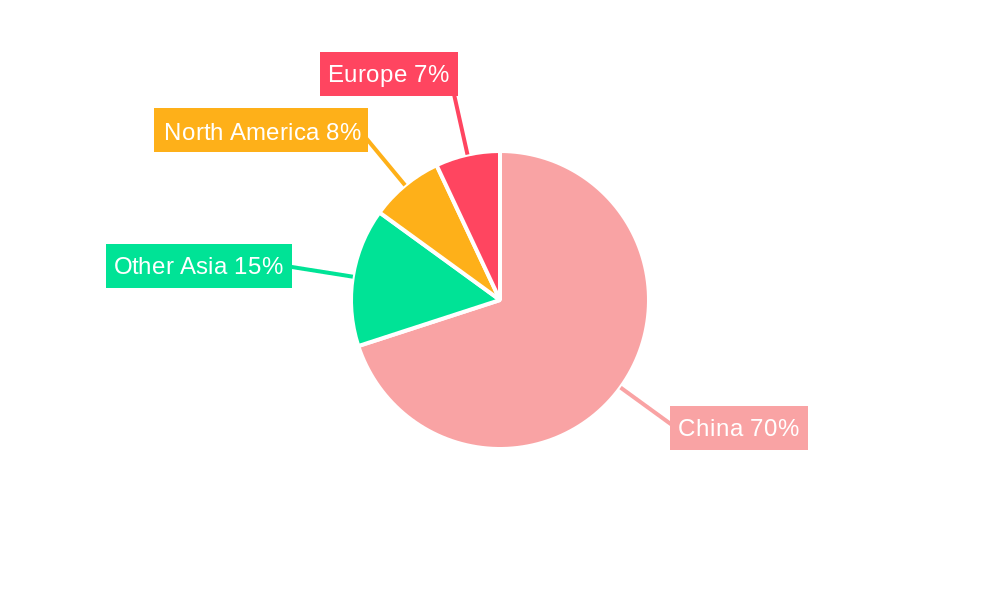

The market segmentation reveals significant opportunities across various application areas. Animal-based collagen currently dominates the market, but marine-based collagen is gaining traction due to its sustainability and ethical appeal. Regional analysis shows China as a major contributor to global collagen demand, driven by its sizable population, increasing purchasing power, and the burgeoning health and wellness sector. Key players in the market, including Darling Ingredients Inc, GELITA AG, and several prominent Chinese companies, are strategically investing in research and development and expanding their product portfolios to cater to the growing market needs. This dynamic interplay of factors suggests that the China collagen market is poised for continued expansion in the coming years, presenting lucrative prospects for both established and emerging players. Considering the historical period (2019-2024) and the projected CAGR, a conservative estimate suggests a market size exceeding $YY million by 2033 (where YY is a logically extrapolated value based on the 5.32% CAGR and the 2025 market size).

Unlocking Growth in the Booming China Collagen Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China collagen market, offering invaluable insights for businesses and investors seeking to capitalize on its significant growth potential. With a detailed examination of market dynamics, leading players, and future trends, this report is an essential resource for understanding and navigating this rapidly evolving sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024.

China Collagen Market Market Dynamics & Concentration

The China collagen market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is currently [insert market concentration metric, e.g., moderately high, with the top 5 players holding approximately xx% of the market share]. Innovation is a key driver, with companies continuously developing new collagen products and applications to cater to evolving consumer demands. The regulatory framework plays a significant role, impacting product approvals and market access. The presence of substitute products, such as plant-based alternatives, presents a competitive challenge. End-user trends, particularly the increasing demand for collagen in the personal care and cosmetics sector and functional foods, fuel market expansion. Finally, mergers and acquisitions (M&A) are reshaping the market landscape. Over the past five years, there have been approximately xx M&A deals, indicating considerable consolidation activity.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- Innovation Drivers: Development of novel collagen peptides and delivery systems.

- Regulatory Framework: Stringent food safety regulations and product approval processes.

- Product Substitutes: Plant-based collagen alternatives pose a competitive threat.

- End-User Trends: Growing demand from personal care, food & beverage, and animal feed industries.

- M&A Activity: Approx xx M&A deals in the past 5 years.

China Collagen Market Industry Trends & Analysis

The China collagen market is experiencing robust growth, driven by several key factors. The rising disposable incomes and health-conscious lifestyles among Chinese consumers are fueling demand for collagen-enriched products. Technological advancements in collagen extraction and processing are enhancing product quality and functionality. This is leading to higher market penetration across various applications. The increasing adoption of collagen in functional foods and beverages is a notable trend. Furthermore, the beauty and personal care sector's growing adoption of collagen-based products contributes significantly to the market's expansion. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). Competitive dynamics are intense, with both domestic and international players vying for market share.

Leading Markets & Segments in China Collagen Market

The China collagen market exhibits significant regional variations in growth rates and market penetration. While data on specific regional dominance is limited, we predict that [insert predicted dominant region, e.g., coastal regions] will likely lead the market due to higher consumer spending power and a concentration of manufacturing facilities.

Key Segments:

- Form: Animal-based collagen currently dominates the market due to its established presence and cost-effectiveness. Marine-based collagen is witnessing significant growth due to its potential benefits and rising demand for sustainable alternatives.

- End-User: The personal care and cosmetics segment is a major driver, with significant growth anticipated in the food and beverages sector and supplements. The animal feed segment offers a steady demand base.

Key Drivers by Segment:

- Animal Based: Established infrastructure and lower production costs.

- Marine Based: Growing awareness of sustainability and potential health benefits.

- Personal Care & Cosmetics: Increased consumer spending and focus on anti-aging products.

- Food & Beverages: Growing demand for functional foods and beverages.

- Animal Feed: Consistent demand due to collagen's nutritional benefits for livestock.

China Collagen Market Product Developments

Recent product developments focus on enhancing collagen's bioavailability, solubility, and efficacy. This involves using advanced extraction and processing techniques to create specialized collagen peptides for different applications. Innovative product formulations are emerging, incorporating collagen into novel food and beverage products, cosmetics, and dietary supplements to cater to specific health and beauty needs. The focus is on creating value-added products to meet consumer demand for high-quality, effective solutions.

Key Drivers of China Collagen Market Growth

Several factors are driving the growth of the China collagen market. Firstly, rising disposable incomes and a growing health-conscious population are boosting demand for collagen-based products. Technological advancements are leading to more efficient and cost-effective collagen production methods. Secondly, the government's focus on promoting the health and wellness industry is providing favorable regulatory support. Finally, the growing popularity of functional foods and beauty products containing collagen is further stimulating market expansion.

Challenges in the China Collagen Market

The China collagen market faces several challenges. Stringent regulatory requirements for food and cosmetic products can increase production costs and complicate market entry. Fluctuations in raw material prices and supply chain disruptions pose risks to production stability. Intense competition from both domestic and international players necessitates continuous innovation and product differentiation to maintain a competitive edge. These factors can impact profit margins and overall market growth.

Emerging Opportunities in China Collagen Market

The China collagen market presents several exciting opportunities. Technological advancements in collagen extraction and processing continue to improve product quality and efficacy, driving market expansion. Strategic partnerships between domestic and international players are fostering innovation and market penetration. Expansion into new application areas, such as nutraceuticals and pharmaceuticals, offers significant growth potential. These factors point to a bright future for the China collagen market.

Leading Players in the China Collagen Market Sector

- Darling Ingredients Inc

- Luohe Wulong Gelatin Co Ltd

- Tessenderlo Group

- Nitta Gelatin Inc

- Hangzhou Nutrition Biotechnology Co Ltd

- GELITA AG

- Jiangxi Cosen Biology Co Ltd

- PB Leine

- Nippi Japan

- Foodchem International Corporation

- Jellice Taiwan

Key Milestones in China Collagen Market Industry

- November 2022: PB Leine and Hainan Xiangtai Group establish a joint venture focusing on fish collagen peptides.

- July 2022: Jellice Taiwan launches META Collagen, expanding its product portfolio in the Chinese market.

- February 2022: Nippi (Shanghai) partners with Infobird Co. Ltd to enhance sales and market reach for collagen raw materials.

Strategic Outlook for China Collagen Market

The China collagen market shows promising potential for long-term growth, driven by continuous innovation, strategic partnerships, and expansion into new application areas. The rising demand for functional foods, beauty products, and health supplements containing collagen presents substantial opportunities. Companies adopting proactive strategies focusing on product differentiation, sustainable sourcing, and efficient supply chain management are poised to thrive in this dynamic and competitive market. The overall outlook remains positive, with considerable growth expected in the coming years.

China Collagen Market Segmentation

-

1. Form

- 1.1. Animal Based

- 1.2. Marine Based

-

2. End-User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Snacks

-

2.4. Supplements

- 2.4.1. Elderly Nutrition and Medical Nutrition

- 2.4.2. Sport/Performance Nutrition

China Collagen Market Segmentation By Geography

- 1. China

China Collagen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Inclination Towards Health

- 3.2.2 Personal Care and Anti-Aging Supplements; Increasing Consumption of Functional Beverages

- 3.3. Market Restrains

- 3.3.1. High Price of the Final Product

- 3.4. Market Trends

- 3.4.1 Growing Chinese Inclination Towards Health

- 3.4.2 Personal Care and Anti-Aging Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Collagen Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Animal Based

- 5.1.2. Marine Based

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Elderly Nutrition and Medical Nutrition

- 5.2.4.2. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Darling Ingredients Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Luohe Wulong Gelatin Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tessenderlo Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nitta Gelatin Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hangzhou Nutrition Biotechnology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GELITA AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jiangxi Cosen Biology Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PB Leine

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nippi Japan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Foodchem International Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Jellice Taiwan

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Darling Ingredients Inc

List of Figures

- Figure 1: China Collagen Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Collagen Market Share (%) by Company 2024

List of Tables

- Table 1: China Collagen Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Collagen Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: China Collagen Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: China Collagen Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Collagen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Collagen Market Revenue Million Forecast, by Form 2019 & 2032

- Table 7: China Collagen Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: China Collagen Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Collagen Market?

The projected CAGR is approximately 5.32%.

2. Which companies are prominent players in the China Collagen Market?

Key companies in the market include Darling Ingredients Inc, Luohe Wulong Gelatin Co Ltd, Tessenderlo Group, Nitta Gelatin Inc, Hangzhou Nutrition Biotechnology Co Ltd, GELITA AG, Jiangxi Cosen Biology Co Ltd, PB Leine, Nippi Japan, Foodchem International Corporation, Jellice Taiwan.

3. What are the main segments of the China Collagen Market?

The market segments include Form, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Health. Personal Care and Anti-Aging Supplements; Increasing Consumption of Functional Beverages.

6. What are the notable trends driving market growth?

Growing Chinese Inclination Towards Health. Personal Care and Anti-Aging Supplements.

7. Are there any restraints impacting market growth?

High Price of the Final Product.

8. Can you provide examples of recent developments in the market?

November 2022: PB Leiner unveiled a strategic joint venture in collaboration with Hainan Xiangtai Group, with Tessenderlo Group holding an 80% ownership stake. This partnership focuses on the production and marketing of fish collagen peptides, leveraging PB Leiner's cutting-edge technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Collagen Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Collagen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Collagen Market?

To stay informed about further developments, trends, and reports in the China Collagen Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence