Key Insights

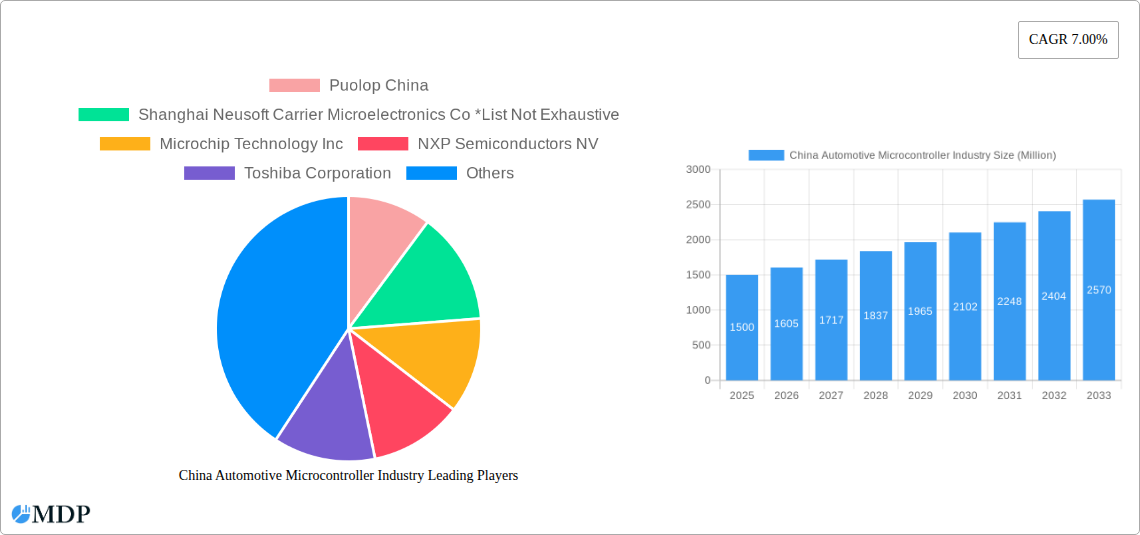

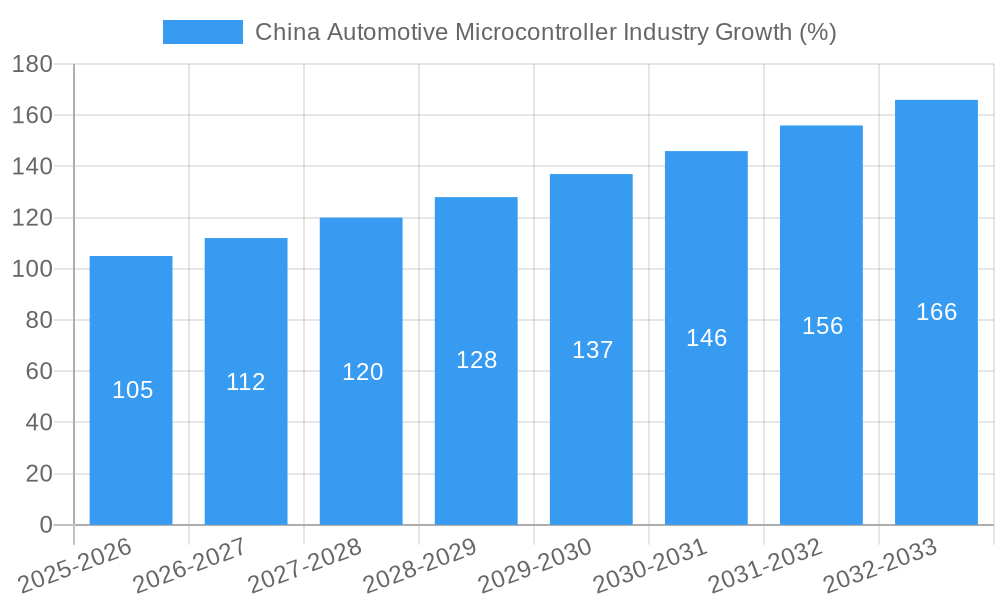

The China automotive microcontroller market is experiencing robust growth, fueled by the nation's expanding automotive sector and the increasing integration of advanced driver-assistance systems (ADAS), connected car technologies, and electric vehicles (EVs). The market, currently valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR and market size), is projected to maintain a Compound Annual Growth Rate (CAGR) of 7.00% from 2025 to 2033. This growth is primarily driven by the government's supportive policies promoting technological advancements in the automotive industry, rising consumer demand for feature-rich vehicles, and the continuous development of sophisticated microcontrollers capable of handling complex functionalities. The segmentation reveals a strong demand across various microcontroller types, with 32-bit and 64-bit microcontrollers leading the way due to their enhanced processing capabilities. Applications like ADAS, telematics, and infotainment systems are major contributors to market expansion, reflecting the trend towards increased vehicle intelligence and connectivity.

However, challenges exist. The market faces restraints such as the global chip shortage, potentially impacting supply chains and production timelines. Furthermore, intense competition among numerous domestic and international players like Puolop China, Shanghai Neusoft, Microchip Technology, NXP Semiconductors, and Renesas Electronics necessitates continuous innovation and cost optimization for sustained market share. Despite these restraints, the long-term outlook remains positive, driven by technological innovation in areas like artificial intelligence (AI) and the Internet of Vehicles (IoV), further increasing the demand for high-performance automotive microcontrollers in the Chinese market. The dominance of the 32-bit and 64-bit microcontroller segments, along with the increasing adoption of advanced automotive applications, positions the market for significant expansion throughout the forecast period.

China Automotive Microcontroller Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning China automotive microcontroller industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. From market size and segmentation to leading players and future trends, this report delivers actionable intelligence for strategic decision-making. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

China Automotive Microcontroller Industry Market Dynamics & Concentration

This section delves into the competitive landscape of the Chinese automotive microcontroller market, analyzing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. We examine the market share held by key players such as Puolop China, Shanghai Neusoft Carrier Microelectronics Co., Microchip Technology Inc., NXP Semiconductors NV, Toshiba Corporation, Sunplus Innovation Technology Inc., STMicroelectronics, Bojuxing Industrial, Renesas Electronics Corporation, and Holtek Semiconductor Inc. The report quantifies market concentration using the Herfindahl-Hirschman Index (HHI) and analyzes the impact of recent mergers and acquisitions (M&A) activities, estimating a total of xx M&A deals within the studied period. The analysis also considers the influence of government regulations on technological innovation and the adoption of new microcontroller technologies. The increasing demand for advanced driver-assistance systems (ADAS) and the rising penetration of electric vehicles (EVs) are identified as key drivers shaping market dynamics. Furthermore, the report examines the impact of substitute technologies and evolving end-user preferences on the market's competitive landscape.

China Automotive Microcontroller Industry Industry Trends & Analysis

This section provides a detailed analysis of the trends shaping the China automotive microcontroller industry. We explore the market growth drivers, including the burgeoning EV market, the increasing adoption of ADAS features, and the continuous advancements in automotive electronics. The report examines technological disruptions, such as the transition to higher-bit microcontrollers and the integration of artificial intelligence (AI) capabilities. Further analysis focuses on consumer preferences toward advanced vehicle features and the impact of these preferences on market demand. The competitive dynamics are scrutinized, highlighting the strategies employed by leading players to maintain their market positions and expand their market share. The report quantifies market growth using the Compound Annual Growth Rate (CAGR) and analyzes market penetration rates for various microcontroller types and applications. We project a xx% market penetration of 64-bit microcontrollers by 2033.

Leading Markets & Segments in China Automotive Microcontroller Industry

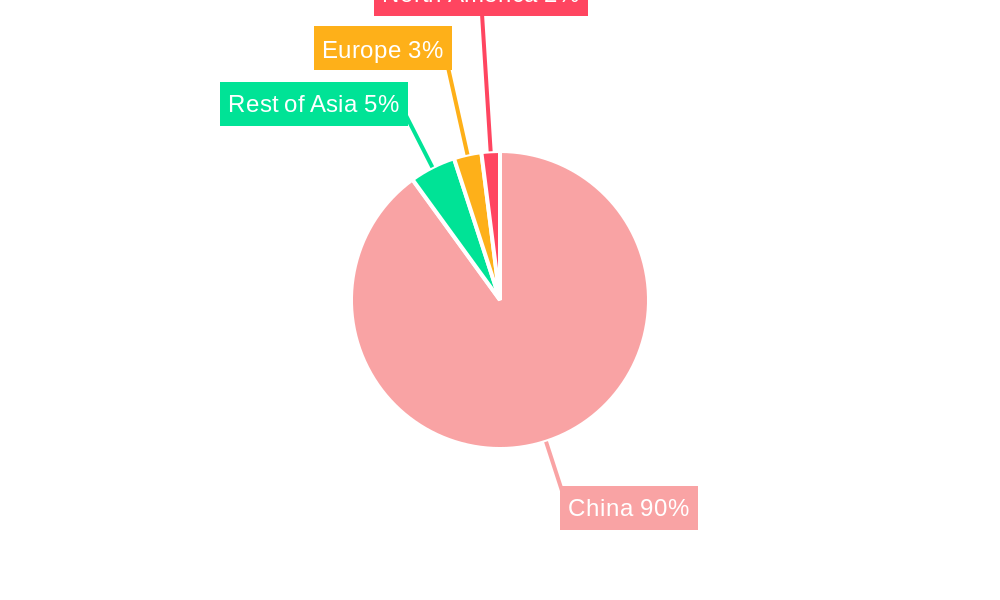

This section identifies the dominant segments and regions within the Chinese automotive microcontroller market. The analysis covers the key segments by microcontroller type (8 & 16-bit, 32-bit, 64-bit) and application (Safety & Security, Body Electronics, Telematics & Infotainment, Powertrain & Chassis).

Dominant Regions: The report will identify the leading provinces/regions driving market growth based on factors such as automotive manufacturing hubs and government incentives.

Dominant Microcontroller Types: A detailed analysis of the market share for each microcontroller type will be provided, highlighting the factors contributing to the dominance of specific types. This includes evaluating technological advancements, cost-effectiveness, and suitability for specific applications.

Dominant Applications: The section analyzes the market share held by each application segment, exploring the key drivers behind the growth of these segments. This analysis will include an examination of the influence of government regulations, consumer preferences, and technological advancements on market growth.

The analysis further explores the key drivers in each segment, including:

- Economic policies: Government incentives for EV adoption and automotive industry development.

- Infrastructure development: Investments in charging stations and related infrastructure.

- Technological advancements: The ongoing development of higher-performance microcontrollers with enhanced functionalities.

China Automotive Microcontroller Industry Product Developments

This section provides an overview of recent product innovations in the Chinese automotive microcontroller market. It examines the latest technological trends, highlighting the development of high-performance, low-power, and highly integrated microcontrollers tailored to the specific needs of the automotive industry. The report will assess the competitive advantages offered by these new products and their market fit, considering factors such as cost, performance, and ease of integration. The integration of advanced safety features and the increasing demand for connected car functionalities are identified as major drivers of product innovation.

Key Drivers of China Automotive Microcontroller Industry Growth

The growth of the China automotive microcontroller industry is propelled by several key factors. Technological advancements, such as the development of more powerful and efficient microcontrollers, are enabling the integration of advanced features in vehicles. Simultaneously, the government's supportive policies promoting the growth of the electric vehicle industry and the expansion of automotive manufacturing capacity are stimulating demand for microcontrollers. Furthermore, the increasing consumer preference for advanced safety features and connected car functionalities is driving the adoption of sophisticated microcontroller-based systems.

Challenges in the China Automotive Microcontroller Industry Market

The China automotive microcontroller market faces several challenges. Stringent regulatory requirements for automotive electronics and the need for rigorous quality and safety certifications can pose significant hurdles for manufacturers. Moreover, disruptions in the global supply chain and increasing trade tensions can affect the availability and cost of components. Intense competition among established and emerging players also creates pressure on pricing and profit margins, requiring companies to continuously innovate and improve their products. The projected impact of these challenges on the market growth will be quantified where possible.

Emerging Opportunities in China Automotive Microcontroller Industry

Despite the challenges, the China automotive microcontroller industry presents numerous opportunities. Technological breakthroughs, such as the development of artificial intelligence (AI) enabled microcontrollers and advanced driver-assistance systems (ADAS), are opening up new avenues for growth. Strategic partnerships between microcontroller manufacturers and automotive companies can lead to the development of innovative solutions and accelerate market expansion. Furthermore, the continued growth of the electric vehicle market and the increasing penetration of connected car technologies are expected to drive long-term demand for automotive microcontrollers.

Leading Players in the China Automotive Microcontroller Industry Sector

- Puolop China

- Shanghai Neusoft Carrier Microelectronics Co

- Microchip Technology Inc

- NXP Semiconductors NV

- Toshiba Corporation

- Sunplus Innovation Technology Inc

- STMicroelectronics

- Bojuxing Industrial

- Renesas Electronics Corporation

- Holtek Semiconductor Inc

Key Milestones in China Automotive Microcontroller Industry Industry

- 2020/Q4: Introduction of a new 64-bit microcontroller by Renesas Electronics Corporation, significantly improving ADAS capabilities.

- 2021/Q2: Major acquisition of a Chinese microcontroller manufacturer by NXP Semiconductors NV, expanding their market presence.

- 2022/Q3: Launch of a new low-power microcontroller by STMicroelectronics, targeting the EV market. (Further milestones will be detailed within the full report)

Strategic Outlook for China Automotive Microcontroller Industry Market

The future of the China automotive microcontroller market appears bright, driven by sustained growth in the automotive industry and ongoing technological advancements. The increasing adoption of electric vehicles, the growing demand for advanced safety features, and the proliferation of connected car technologies will continue to propel market expansion. Strategic partnerships and investments in research and development will be crucial for companies to maintain their competitiveness and capitalize on emerging opportunities. The market is poised for significant growth, with opportunities for both established and emerging players.

China Automotive Microcontroller Industry Segmentation

-

1. Type

- 1.1. 8 and 16-bit microcontrollers

- 1.2. 64-bit microcontrollers

-

2. Application

- 2.1. Safety and Security (ADAS, etc.)

- 2.2. Body Electronics

- 2.3. Telematics and Infotainment

- 2.4. Powertrain and Chassis

China Automotive Microcontroller Industry Segmentation By Geography

- 1. China

China Automotive Microcontroller Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Electric Vehicles in Major Regions; Rising Demand for Safety and Infotainment-based Features; Anticipated Rise in Advanced Features from the Mid and High-end Segments

- 3.3. Market Restrains

- 3.3.1. ; Ongoing Trade Stand-off and Recent Decline in the Automotive Sector Expected to Have an Adverse Impact; Low-end MCU Manufacturers Posing a Strong Challenge for Established Vendors; Operational and Adaptability Related Concerns

- 3.4. Market Trends

- 3.4.1. ADAS to Witness a Significant Growth in the Safety and Security Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Automotive Microcontroller Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. 8 and 16-bit microcontrollers

- 5.1.2. 64-bit microcontrollers

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Safety and Security (ADAS, etc.)

- 5.2.2. Body Electronics

- 5.2.3. Telematics and Infotainment

- 5.2.4. Powertrain and Chassis

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Puolop China

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shanghai Neusoft Carrier Microelectronics Co *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Microchip Technology Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NXP Semiconductors NV

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toshiba Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sunplus Innovation Technology Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 STMicroelectronics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bojuxing Industrial

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Renesas Electronics Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Holtek Semiconductor Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Puolop China

List of Figures

- Figure 1: China Automotive Microcontroller Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Automotive Microcontroller Industry Share (%) by Company 2024

List of Tables

- Table 1: China Automotive Microcontroller Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Automotive Microcontroller Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: China Automotive Microcontroller Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: China Automotive Microcontroller Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Automotive Microcontroller Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Automotive Microcontroller Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: China Automotive Microcontroller Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: China Automotive Microcontroller Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Automotive Microcontroller Industry?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the China Automotive Microcontroller Industry?

Key companies in the market include Puolop China, Shanghai Neusoft Carrier Microelectronics Co *List Not Exhaustive, Microchip Technology Inc, NXP Semiconductors NV, Toshiba Corporation, Sunplus Innovation Technology Inc, STMicroelectronics, Bojuxing Industrial, Renesas Electronics Corporation, Holtek Semiconductor Inc.

3. What are the main segments of the China Automotive Microcontroller Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Electric Vehicles in Major Regions; Rising Demand for Safety and Infotainment-based Features; Anticipated Rise in Advanced Features from the Mid and High-end Segments.

6. What are the notable trends driving market growth?

ADAS to Witness a Significant Growth in the Safety and Security Segment.

7. Are there any restraints impacting market growth?

; Ongoing Trade Stand-off and Recent Decline in the Automotive Sector Expected to Have an Adverse Impact; Low-end MCU Manufacturers Posing a Strong Challenge for Established Vendors; Operational and Adaptability Related Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Automotive Microcontroller Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Automotive Microcontroller Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Automotive Microcontroller Industry?

To stay informed about further developments, trends, and reports in the China Automotive Microcontroller Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence