Key Insights

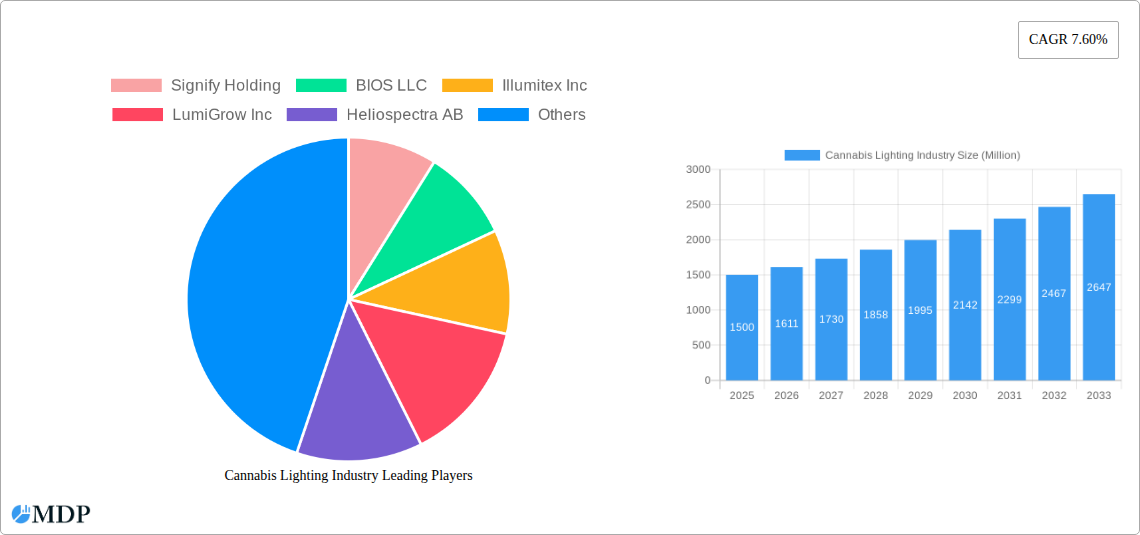

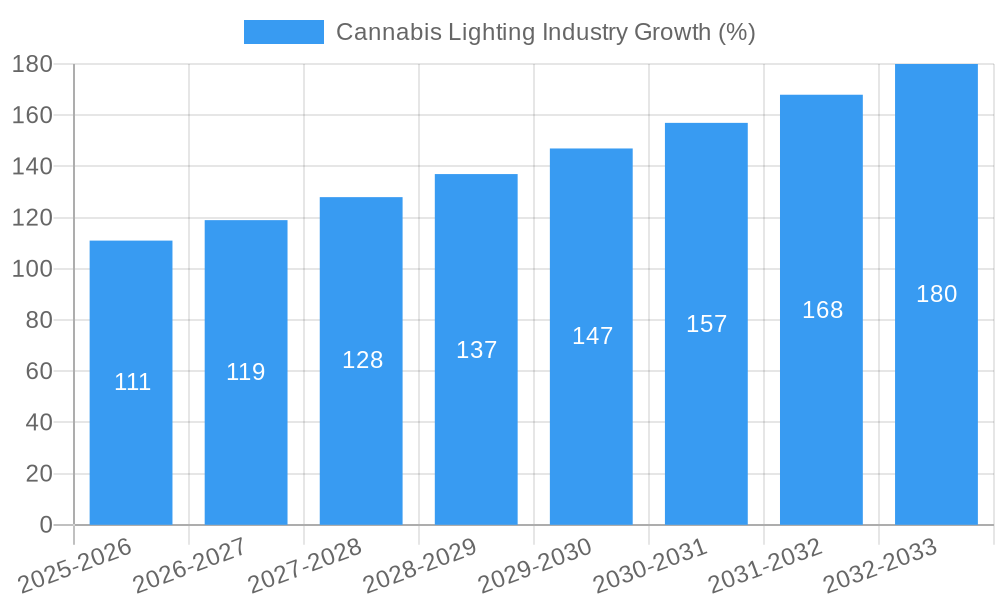

The cannabis lighting market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a 7.60% CAGR from 2025 to 2033. This expansion is fueled by several key drivers. The increasing legalization and acceptance of cannabis for both recreational and medicinal purposes globally is a primary catalyst, leading to significant investment in indoor and greenhouse cultivation facilities. Furthermore, advancements in LED lighting technology, offering energy efficiency and optimized spectral output for enhanced plant growth and yield, are driving market adoption. The preference for controlled-environment agriculture (CEA), including vertical farming and indoor cultivation, further boosts demand for specialized cannabis lighting solutions. However, the market faces certain restraints, including the stringent regulatory landscape surrounding cannabis cultivation in various regions and the high initial investment costs associated with advanced lighting systems. Segmentation reveals a significant market share held by LED lighting technologies due to their energy efficiency and customization options, while the greenhouse application segment dominates due to the scalability and cost-effectiveness of cultivating cannabis in greenhouses, especially in regions with favorable climates. Major players like Signify Holding, BIOS LLC, and LumiGrow Inc. are shaping the market landscape through innovation and strategic partnerships.

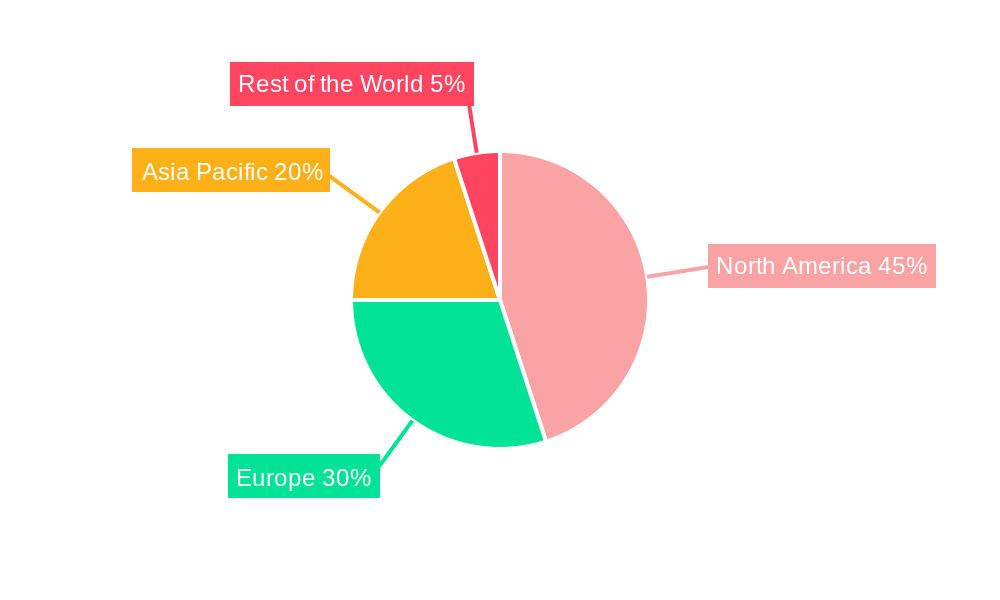

The geographical distribution of the cannabis lighting market reflects the varying levels of cannabis legalization and cultivation practices across different regions. North America, with its established cannabis industry, is anticipated to hold a dominant market share, followed by Europe and the Asia-Pacific region, where the market is showing promising growth potential due to increasing legalization efforts and expanding cultivation activities. The Rest of the World segment will also contribute, albeit at a smaller scale, as cannabis legislation evolves and adoption increases. The forecast period (2025-2033) anticipates consistent growth driven by technological innovations, expanding cultivation practices, and increasing demand for high-quality cannabis products, leading to significant market expansion and the emergence of new players focused on specialized lighting solutions tailored to specific cannabis strains and cultivation methods. Future market trends point towards increased integration of smart technologies, data analytics, and automation in cannabis lighting systems, further improving efficiency and yield.

Cannabis Lighting Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Cannabis Lighting Industry, projecting a market value exceeding $XX Million by 2033. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry stakeholders, investors, and anyone seeking to understand the growth trajectory of this dynamic market. It leverages extensive research, incorporating key performance indicators (KPIs) and detailed market segmentation to deliver actionable insights.

Cannabis Lighting Industry Market Dynamics & Concentration

The Cannabis Lighting Industry is characterized by a moderately concentrated market with several key players vying for dominance. Market share is fluid, influenced by innovation, regulatory shifts, and strategic mergers and acquisitions (M&A). Signify Holding, OSRAM Licht AG, and other established lighting companies hold significant shares, but smaller, specialized firms are also making significant inroads with innovative technologies. The industry is driven by increasing cannabis cultivation, particularly in legal markets. However, regulatory uncertainties and varying legal landscapes across different regions pose challenges to market consolidation.

- Market Concentration: The top 5 players account for approximately XX% of the market share in 2025.

- Innovation Drivers: The ongoing development of energy-efficient LEDs, advanced spectral control, and smart lighting systems.

- Regulatory Frameworks: Differing regulations across jurisdictions significantly impact market growth and investment.

- Product Substitutes: While LEDs are dominant, other technologies like HPS lights still hold a niche.

- End-User Trends: A growing preference for high-quality, consistent yields drives demand for specialized lighting solutions.

- M&A Activities: The past five years have witnessed approximately XX M&A deals within the industry, primarily focused on expanding product portfolios and market access.

Cannabis Lighting Industry Industry Trends & Analysis

The Cannabis Lighting Industry is experiencing robust growth, driven by the expanding legal cannabis market globally. The Compound Annual Growth Rate (CAGR) from 2025-2033 is projected to be XX%. This growth is fueled by several factors: increasing consumer demand for cannabis products, technological advancements in lighting systems, and the rising popularity of indoor and vertical farming techniques. Market penetration of LED lighting systems is increasing steadily, replacing traditional technologies due to their energy efficiency and superior performance. Competitive dynamics are characterized by both established lighting manufacturers and specialized cannabis-focused companies striving for market share. Consumer preference for high-quality cannabis necessitates sophisticated lighting solutions capable of optimizing plant growth.

Leading Markets & Segments in Cannabis Lighting Industry

The North American market, specifically the USA and Canada, holds the largest share of the global Cannabis Lighting Industry. Within this region, indoor cultivation and vertical farming applications dominate due to their climate control and efficiency.

By Lighting Technology:

- LEDs: Dominant segment, driven by energy efficiency, customizable spectrums, and long lifespan. Market share in 2025 is predicted to be approximately XX%.

- Other Technologies: HPS, T5, and other technologies maintain a niche presence, particularly in regions with lower adoption of LEDs.

By Application:

- Indoor: Largest segment, driven by precise climate control and year-round cultivation.

- Greenhouse: Significant market share, offering a balance between environmental control and cost-effectiveness.

- Vertical Farming: A rapidly growing segment with higher initial investment but optimized yield and space utilization.

Key Drivers:

- Favorable regulatory environments in certain regions are stimulating investment and expansion.

- Technological advancements continuously improve lighting efficiency and efficacy.

- Growing consumer demand for cannabis products necessitates improved cultivation techniques.

Cannabis Lighting Industry Product Developments

Recent product innovations focus on enhanced spectral control, improved energy efficiency, and smart lighting solutions for precise environmental control. LEDs are at the forefront, with new designs featuring higher lumen output, enhanced spectral tuning capabilities, and integrated sensors for automated control. This allows growers to optimize plant growth, yield, and quality more efficiently, offering a clear competitive advantage in the market. Integration with smart farming technologies further enhances market appeal.

Key Drivers of Cannabis Lighting Industry Growth

The Cannabis Lighting Industry's growth is propelled by:

- Technological Advancements: The ongoing development of high-efficiency LEDs and smart lighting systems.

- Economic Factors: The expansion of the legal cannabis market globally fuels demand.

- Regulatory Changes: Legalization and supportive regulatory frameworks in various jurisdictions.

Challenges in the Cannabis Lighting Industry Market

The industry faces challenges including:

- Regulatory Hurdles: Varied and evolving regulations across different jurisdictions complicate market access.

- Supply Chain Issues: Potential disruptions in the supply chain can impact production and cost.

- Competitive Pressures: Intense competition from established players and new entrants is putting downward pressure on pricing.

Emerging Opportunities in Cannabis Lighting Industry

Significant growth opportunities lie in:

- Technological Innovation: Continued advancements in LED technology, spectral tuning, and smart controls.

- Strategic Partnerships: Collaboration between lighting manufacturers and cannabis cultivators.

- Market Expansion: Penetration into new geographical markets with emerging legal cannabis frameworks.

Leading Players in the Cannabis Lighting Industry Sector

- Signify Holding

- BIOS LLC

- Illumitex Inc

- LumiGrow Inc

- Heliospectra AB

- Cultilux

- OSRAM Licht AG

- Gavita Holland BV

- General Electric Company

- Vivosun

- Sun System

Key Milestones in Cannabis Lighting Industry Industry

- May 2022: OSRAM launched the OSLON Optimal family of LEDs for horticulture lighting, offering high efficiency and performance. This launch significantly advanced the capabilities of LED lighting in the cannabis cultivation sector.

Strategic Outlook for Cannabis Lighting Industry Market

The Cannabis Lighting Industry is poised for continued growth, driven by technological innovation and the expanding legal cannabis market. Strategic partnerships, market expansion into new regions, and focus on delivering high-value, efficient lighting solutions will be crucial for success. The market offers significant opportunities for both established players and innovative newcomers.

Cannabis Lighting Industry Segmentation

-

1. Lighting Technology

- 1.1. Light Emitting Diodes (LEDs)

- 1.2. T5 High Output Fluorescent Light

- 1.3. Ceramic Metal Halide Light

- 1.4. Compact Fluorescent Light

- 1.5. Magnetic Induction Light

- 1.6. Other Lighting Preferences

-

2. Application

- 2.1. Greenhouse

- 2.2. Indoor

- 2.3. Vertical Farming

Cannabis Lighting Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Cannabis Lighting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Legalization of Medical Cannabis in Various Countries

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Cloud; Cost Ineffectiveness with High Data Growth

- 3.4. Market Trends

- 3.4.1. LED Light is Expected to Occupy Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 5.1.1. Light Emitting Diodes (LEDs)

- 5.1.2. T5 High Output Fluorescent Light

- 5.1.3. Ceramic Metal Halide Light

- 5.1.4. Compact Fluorescent Light

- 5.1.5. Magnetic Induction Light

- 5.1.6. Other Lighting Preferences

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Greenhouse

- 5.2.2. Indoor

- 5.2.3. Vertical Farming

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 6. North America Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 6.1.1. Light Emitting Diodes (LEDs)

- 6.1.2. T5 High Output Fluorescent Light

- 6.1.3. Ceramic Metal Halide Light

- 6.1.4. Compact Fluorescent Light

- 6.1.5. Magnetic Induction Light

- 6.1.6. Other Lighting Preferences

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Greenhouse

- 6.2.2. Indoor

- 6.2.3. Vertical Farming

- 6.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 7. Europe Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 7.1.1. Light Emitting Diodes (LEDs)

- 7.1.2. T5 High Output Fluorescent Light

- 7.1.3. Ceramic Metal Halide Light

- 7.1.4. Compact Fluorescent Light

- 7.1.5. Magnetic Induction Light

- 7.1.6. Other Lighting Preferences

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Greenhouse

- 7.2.2. Indoor

- 7.2.3. Vertical Farming

- 7.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 8. Asia Pacific Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 8.1.1. Light Emitting Diodes (LEDs)

- 8.1.2. T5 High Output Fluorescent Light

- 8.1.3. Ceramic Metal Halide Light

- 8.1.4. Compact Fluorescent Light

- 8.1.5. Magnetic Induction Light

- 8.1.6. Other Lighting Preferences

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Greenhouse

- 8.2.2. Indoor

- 8.2.3. Vertical Farming

- 8.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 9. Rest of the World Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 9.1.1. Light Emitting Diodes (LEDs)

- 9.1.2. T5 High Output Fluorescent Light

- 9.1.3. Ceramic Metal Halide Light

- 9.1.4. Compact Fluorescent Light

- 9.1.5. Magnetic Induction Light

- 9.1.6. Other Lighting Preferences

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Greenhouse

- 9.2.2. Indoor

- 9.2.3. Vertical Farming

- 9.1. Market Analysis, Insights and Forecast - by Lighting Technology

- 10. North America Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Cannabis Lighting Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Signify Holding

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 BIOS LLC

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Illumitex Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 LumiGrow Inc

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Heliospectra AB

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Cultilux

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 OSRAM Licht AG

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Gavita Holland BV

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 General Electric Company

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Vivosun

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Sun System*List Not Exhaustive

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.1 Signify Holding

List of Figures

- Figure 1: Global Cannabis Lighting Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Cannabis Lighting Industry Revenue (Million), by Lighting Technology 2024 & 2032

- Figure 11: North America Cannabis Lighting Industry Revenue Share (%), by Lighting Technology 2024 & 2032

- Figure 12: North America Cannabis Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Cannabis Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Cannabis Lighting Industry Revenue (Million), by Lighting Technology 2024 & 2032

- Figure 17: Europe Cannabis Lighting Industry Revenue Share (%), by Lighting Technology 2024 & 2032

- Figure 18: Europe Cannabis Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Cannabis Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Cannabis Lighting Industry Revenue (Million), by Lighting Technology 2024 & 2032

- Figure 23: Asia Pacific Cannabis Lighting Industry Revenue Share (%), by Lighting Technology 2024 & 2032

- Figure 24: Asia Pacific Cannabis Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Pacific Cannabis Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Pacific Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Cannabis Lighting Industry Revenue (Million), by Lighting Technology 2024 & 2032

- Figure 29: Rest of the World Cannabis Lighting Industry Revenue Share (%), by Lighting Technology 2024 & 2032

- Figure 30: Rest of the World Cannabis Lighting Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Rest of the World Cannabis Lighting Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Rest of the World Cannabis Lighting Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Cannabis Lighting Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cannabis Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cannabis Lighting Industry Revenue Million Forecast, by Lighting Technology 2019 & 2032

- Table 3: Global Cannabis Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Cannabis Lighting Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Cannabis Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Cannabis Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Cannabis Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Cannabis Lighting Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Cannabis Lighting Industry Revenue Million Forecast, by Lighting Technology 2019 & 2032

- Table 14: Global Cannabis Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Cannabis Lighting Industry Revenue Million Forecast, by Lighting Technology 2019 & 2032

- Table 17: Global Cannabis Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Cannabis Lighting Industry Revenue Million Forecast, by Lighting Technology 2019 & 2032

- Table 20: Global Cannabis Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Cannabis Lighting Industry Revenue Million Forecast, by Lighting Technology 2019 & 2032

- Table 23: Global Cannabis Lighting Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Cannabis Lighting Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cannabis Lighting Industry?

The projected CAGR is approximately 7.60%.

2. Which companies are prominent players in the Cannabis Lighting Industry?

Key companies in the market include Signify Holding, BIOS LLC, Illumitex Inc, LumiGrow Inc, Heliospectra AB, Cultilux, OSRAM Licht AG, Gavita Holland BV, General Electric Company, Vivosun, Sun System*List Not Exhaustive.

3. What are the main segments of the Cannabis Lighting Industry?

The market segments include Lighting Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Legalization of Medical Cannabis in Various Countries.

6. What are the notable trends driving market growth?

LED Light is Expected to Occupy Significant Share.

7. Are there any restraints impacting market growth?

Increasing Adoption of Cloud; Cost Ineffectiveness with High Data Growth.

8. Can you provide examples of recent developments in the market?

May 2022 - OSRM, a global leader in optical solutions, announced the launch of the OSLON Optimal family of LEDs for horticulture lighting, based on the latest ams OSRAM 1mm2 chip, which offers an outstanding combination of high efficiency, dependable performance, and great value.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cannabis Lighting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cannabis Lighting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cannabis Lighting Industry?

To stay informed about further developments, trends, and reports in the Cannabis Lighting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence