Key Insights

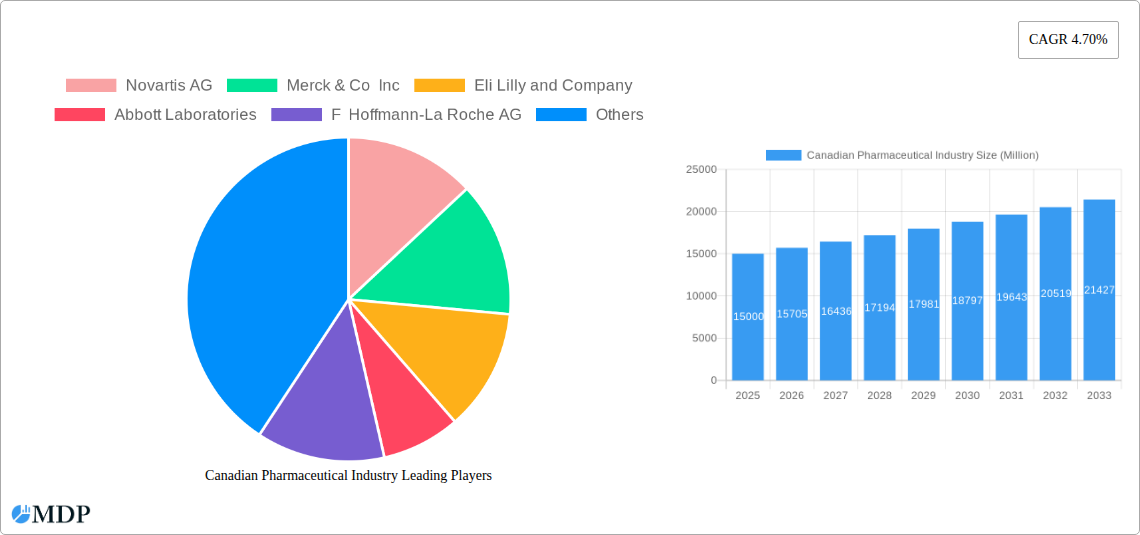

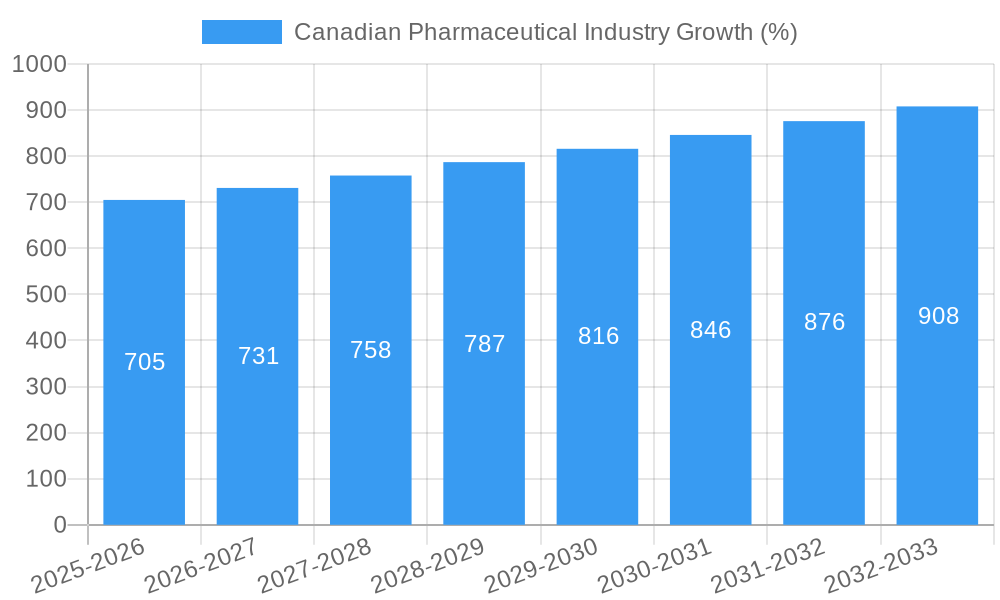

The Canadian pharmaceutical industry, a significant component of the North American market, is projected to experience steady growth, mirroring global trends. With a 2025 market size estimated at $15 billion (assuming Canada represents approximately 10% of the North American market based on population and economic factors), the sector is driven by an aging population requiring more medication, increasing prevalence of chronic diseases like diabetes and cardiovascular conditions, and the continued development and adoption of innovative therapies. Governmental regulations and healthcare spending influence market dynamics, shaping pricing strategies and drug accessibility. Growth is further fueled by rising investments in research and development by both domestic and international pharmaceutical companies, leading to the introduction of new and improved medications. The segment dominated by prescription drugs shows significant potential, further supported by the expansion of generic drug availability, which enhances affordability and accessibility. The prevalence of chronic diseases and aging population in Canada ensures consistent demand for pharmaceuticals.

Competition within the Canadian pharmaceutical market is intense, with both multinational giants like Novartis, Pfizer, and Johnson & Johnson and domestic players vying for market share. However, pricing regulations and patent expiries continue to exert pressure on profitability. Market segmentation by therapeutic area reveals strong growth in areas such as cardiovascular drugs, oncology medications, and treatments for neurological disorders, reflecting Canada's evolving health priorities. Future growth will likely be influenced by factors such as advancements in personalized medicine, increased focus on biosimilars, and the ongoing evolution of healthcare policies, impacting both pricing and reimbursement schemes. The strategic focus is likely to shift towards developing innovative therapies and streamlining manufacturing processes to remain competitive in a constantly evolving landscape.

Canadian Pharmaceutical Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canadian pharmaceutical industry, covering market dynamics, leading players, key trends, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and researchers seeking to understand and navigate this dynamic market. The report incorporates data from the historical period (2019-2024) and provides actionable insights for strategic decision-making. The total market value in 2025 is estimated at xx Million.

Canadian Pharmaceutical Industry Market Dynamics & Concentration

The Canadian pharmaceutical market is characterized by a high level of concentration, with a few multinational corporations holding significant market share. Market share data for 2025 indicates that the top five players—Novartis AG, Merck & Co Inc, Eli Lilly and Company, Abbott Laboratories, and F Hoffmann-La Roche AG—collectively account for approximately xx Million of the total market. However, the presence of generic drug manufacturers like Apotex Inc. also plays a crucial role in shaping the competitive landscape and pricing dynamics. Innovation in areas like biologics, targeted therapies, and personalized medicine are key drivers, while regulatory approvals and pricing policies from Health Canada significantly impact market access and profitability. The industry faces pressure from increasing generic competition and pricing regulations, alongside ongoing consolidation through mergers and acquisitions (M&A).

- Market Concentration: Top 5 players holding approximately xx% market share in 2025.

- Innovation Drivers: Biologics, targeted therapies, personalized medicine.

- Regulatory Frameworks: Health Canada approvals, pricing regulations.

- Product Substitutes: Generic drugs, biosimilars.

- End-User Trends: Growing demand for innovative treatments, increased patient awareness.

- M&A Activity: xx M&A deals recorded between 2019 and 2024.

Canadian Pharmaceutical Industry Industry Trends & Analysis

The Canadian pharmaceutical market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily fueled by an aging population, increasing prevalence of chronic diseases (such as diabetes and cardiovascular diseases), and rising healthcare expenditure. Technological disruptions, such as the increasing adoption of telemedicine and digital health solutions, are transforming how pharmaceuticals are prescribed, dispensed, and monitored. Consumer preferences are shifting towards personalized medicine and convenient drug delivery systems. Competitive dynamics are intense, with both multinational and domestic players vying for market share through product launches, strategic partnerships, and pricing strategies. Market penetration of innovative drugs varies significantly across therapeutic areas.

Leading Markets & Segments in Canadian Pharmaceutical Industry

While precise regional breakdowns are not available without further data, the Canadian pharmaceutical market is nationally distributed. However, some segments within the ATC/Therapeutic Class classification and drug type exhibit dominance:

By ATC/Therapeutic Class: Antineoplastic and Immunomodulating Agents, Cardiovascular System, and Nervous System drugs consistently represent a large portion of the market due to the high prevalence of related diseases.

By Drug Type: Prescription drugs dominate the market, with a growing segment for generic medications driving competition and affordability. OTC drugs maintain a steady presence but represent a smaller share of the total market.

Key Drivers (General for all Segments):

- Aging population leading to increased demand for chronic disease treatments.

- Government healthcare initiatives and funding.

- Technological advancements in drug discovery and development.

Canadian Pharmaceutical Industry Product Developments

Recent product innovations demonstrate a focus on targeted therapies, biosimilars, and improved drug delivery systems. The Canadian market is witnessing the introduction of novel therapies and generic alternatives to existing branded drugs, driving increased competition and improved affordability. Companies are focusing on developing products with enhanced efficacy, reduced side effects, and better patient compliance. Technological advancements in drug delivery systems (e.g., extended-release formulations, inhalers) are improving patient outcomes and convenience. The success of these products hinges on securing Health Canada approvals and demonstrating a clear clinical advantage and market fit.

Key Drivers of Canadian Pharmaceutical Industry Growth

The Canadian pharmaceutical market's growth is driven by several factors. Firstly, an aging population necessitates increased demand for medications to manage chronic conditions. Secondly, advancements in biotechnology and pharmaceutical research continually introduce innovative treatments and therapies. Thirdly, supportive government regulations and policies foster investment and innovation within the industry.

Challenges in the Canadian Pharmaceutical Industry Market

The Canadian pharmaceutical market faces several significant challenges. Strict regulatory hurdles imposed by Health Canada can delay drug approvals and increase development costs. Supply chain disruptions, particularly exacerbated by global events, can lead to drug shortages and impact market access. Furthermore, intense competition, particularly from generic drug manufacturers, puts downward pressure on drug pricing and profitability. These factors collectively affect industry profitability and access to innovative treatments for patients.

Emerging Opportunities in Canadian Pharmaceutical Industry

Significant long-term growth opportunities exist in the Canadian pharmaceutical sector. Advances in personalized medicine and targeted therapies promise improved treatment outcomes and patient experiences. Strategic partnerships between pharmaceutical companies and technology providers can further accelerate innovation and market access. Finally, expansion into new therapeutic areas and the development of innovative drug delivery systems present additional avenues for future growth.

Leading Players in the Canadian Pharmaceutical Industry Sector

- Novartis AG

- Merck & Co Inc

- Eli Lilly and Company

- Abbott Laboratories

- F Hoffmann-La Roche AG

- Apotex Inc

- AbbVie Inc

- Bristol Myers Squibb Company

- Johnson & Johnson

- Pfizer Inc

Key Milestones in Canadian Pharmaceutical Industry Industry

- October 2023: Panacea Biotec, through its partner Apotex Inc., launched Paclitaxel protein-bound particles for injectable suspension, treating metastatic breast cancer, non-small cell lung cancer, and pancreatic adenocarcinoma. This launch expands treatment options for these cancers in Canada.

- March 2023: Natco Pharma introduced a generic version of Pomalidomide Capsules, the first generic alternative to Celgene Corporation’s Pomalyst, approved by Health Canada for multiple myeloma treatment. This increased competition and likely lowered prices for this medication.

Strategic Outlook for Canadian Pharmaceutical Industry Market

The Canadian pharmaceutical market presents a strong outlook for continued growth. Strategic investments in research and development, coupled with a focus on personalized medicine and innovative drug delivery systems, will be critical for success. Companies that can effectively navigate regulatory hurdles and build strong partnerships will be best positioned to capture market share and drive long-term growth. The market's future potential lies in addressing unmet medical needs and delivering high-value therapies to patients.

Canadian Pharmaceutical Industry Segmentation

-

1. ATC/Therapeutic Class

- 1.1. Alimentary Tract and Metabolism

- 1.2. Blood and Blood-forming Organs

- 1.3. Cardiovascular System

- 1.4. Dermatologicals

- 1.5. Genito Urinary System and Sex Hormones

- 1.6. Systemic Hormonal Preparations

- 1.7. Antiinfectives for Systemic Use

- 1.8. Antineoplastic and Immunomodulating Agents

- 1.9. Musculoskeletal System

- 1.10. Nervous System

- 1.11. Antipara

- 1.12. Respiratory System

- 1.13. Sensory Organs

- 1.14. Various Other ATC/Therapeutic Classes

- 1.15. Others

-

2. Drug Type

-

2.1. By Prescription Type

- 2.1.1. Branded

- 2.1.2. Generic

- 2.2. OTC Drugs

-

2.1. By Prescription Type

Canadian Pharmaceutical Industry Segmentation By Geography

- 1. Canada

Canadian Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Geriatric Population; Rising Incidence of Chronic Disease

- 3.3. Market Restrains

- 3.3.1. Highly Expensive Drugs

- 3.4. Market Trends

- 3.4.1. The Alimentary Tract and Metabolism Segment is Expected to Register Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Canadian Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 5.1.1. Alimentary Tract and Metabolism

- 5.1.2. Blood and Blood-forming Organs

- 5.1.3. Cardiovascular System

- 5.1.4. Dermatologicals

- 5.1.5. Genito Urinary System and Sex Hormones

- 5.1.6. Systemic Hormonal Preparations

- 5.1.7. Antiinfectives for Systemic Use

- 5.1.8. Antineoplastic and Immunomodulating Agents

- 5.1.9. Musculoskeletal System

- 5.1.10. Nervous System

- 5.1.11. Antipara

- 5.1.12. Respiratory System

- 5.1.13. Sensory Organs

- 5.1.14. Various Other ATC/Therapeutic Classes

- 5.1.15. Others

- 5.2. Market Analysis, Insights and Forecast - by Drug Type

- 5.2.1. By Prescription Type

- 5.2.1.1. Branded

- 5.2.1.2. Generic

- 5.2.2. OTC Drugs

- 5.2.1. By Prescription Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 6. North America Canadian Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 7. Europe Canadian Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Germany

- 7.1.2 United Kingdom

- 7.1.3 France

- 7.1.4 Italy

- 7.1.5 Spain

- 7.1.6 Rest of Europe

- 8. Asia Pacific Canadian Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 Australia

- 8.1.5 South Korea

- 8.1.6 Rest of Asia Pacific

- 9. Middle East and Africa Canadian Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 GCC

- 9.1.2 South Africa

- 9.1.3 Rest of Middle East and Africa

- 10. South America Canadian Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 Brazil

- 10.1.2 Argentina

- 10.1.3 Rest of South America

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Novartis AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merck & Co Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eli Lilly and Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abbott Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 F Hoffmann-La Roche AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Apotex Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AbbVie Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bristol Myers Squibb Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pfizer Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Novartis AG

List of Figures

- Figure 1: Global Canadian Pharmaceutical Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Canadian Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Canadian Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Canadian Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Canadian Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Canadian Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Canadian Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Canadian Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Canadian Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Canadian Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Canadian Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Canada Canadian Pharmaceutical Industry Revenue (Million), by ATC/Therapeutic Class 2024 & 2032

- Figure 13: Canada Canadian Pharmaceutical Industry Revenue Share (%), by ATC/Therapeutic Class 2024 & 2032

- Figure 14: Canada Canadian Pharmaceutical Industry Revenue (Million), by Drug Type 2024 & 2032

- Figure 15: Canada Canadian Pharmaceutical Industry Revenue Share (%), by Drug Type 2024 & 2032

- Figure 16: Canada Canadian Pharmaceutical Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: Canada Canadian Pharmaceutical Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 3: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 4: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: GCC Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Brazil Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Argentina Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Canadian Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 32: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 33: Global Canadian Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canadian Pharmaceutical Industry?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Canadian Pharmaceutical Industry?

Key companies in the market include Novartis AG, Merck & Co Inc, Eli Lilly and Company, Abbott Laboratories, F Hoffmann-La Roche AG, Apotex Inc , AbbVie Inc, Bristol Myers Squibb Company, Johnson & Johnson, Pfizer Inc.

3. What are the main segments of the Canadian Pharmaceutical Industry?

The market segments include ATC/Therapeutic Class, Drug Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Geriatric Population; Rising Incidence of Chronic Disease.

6. What are the notable trends driving market growth?

The Alimentary Tract and Metabolism Segment is Expected to Register Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Highly Expensive Drugs.

8. Can you provide examples of recent developments in the market?

October 2023: Panacea Biotec launched Paclitaxel protein-bound particles for injectable suspension (albumin-bound), which is indicated for the treatment of metastatic breast cancer, non-small cell lung cancer, and adenocarcinoma of the pancreas in the Canadian market through its strategic partner, Apotex Inc. of Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canadian Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canadian Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canadian Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the Canadian Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence