Key Insights

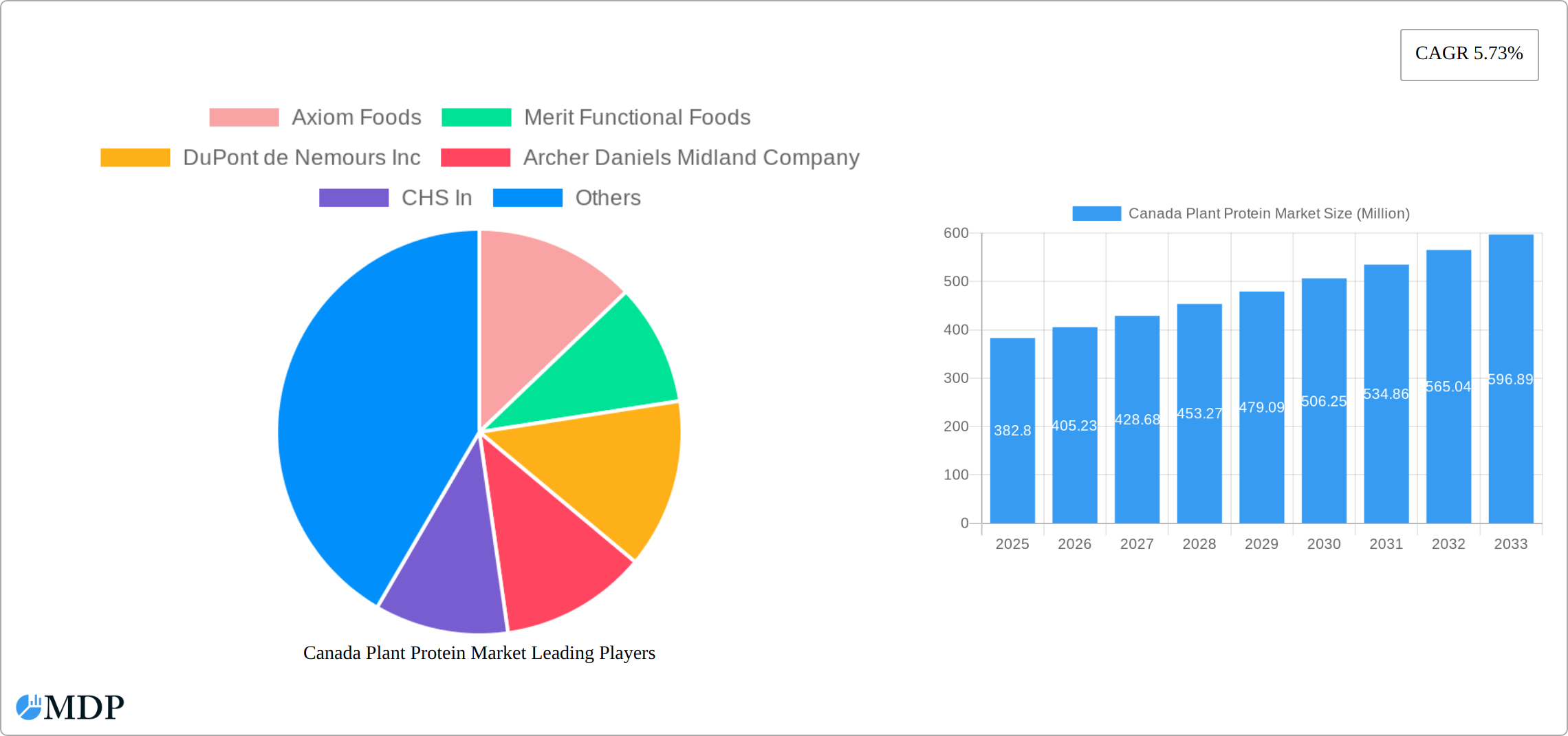

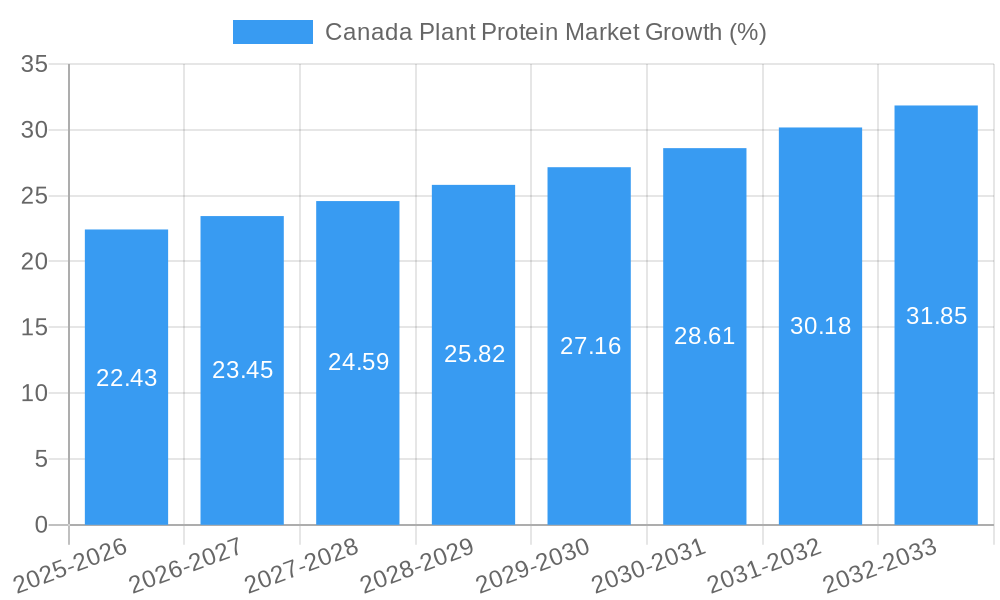

The Canadian plant protein market, valued at $382.80 million in 2025, is projected to experience robust growth, driven by increasing consumer demand for plant-based alternatives and a heightened awareness of health and sustainability. This surge is fueled by several key factors: the rising popularity of vegetarian and vegan diets, increasing concerns about animal welfare, the growing recognition of plant protein's health benefits (e.g., lower cholesterol, reduced risk of certain diseases), and the expanding availability of diverse and palatable plant-based protein sources in various food and beverage applications. The market's segmentation reveals strong growth potential across various end-user sectors, including animal feed, personal care, food and beverages, and supplements. Specifically, the demand for hemp, pea, soy, and oat protein is anticipated to be particularly high, given their functional and nutritional properties. Leading companies like Axiom Foods, Merit Functional Foods, and DuPont are heavily investing in research and development to innovate and expand their product lines within this burgeoning sector.

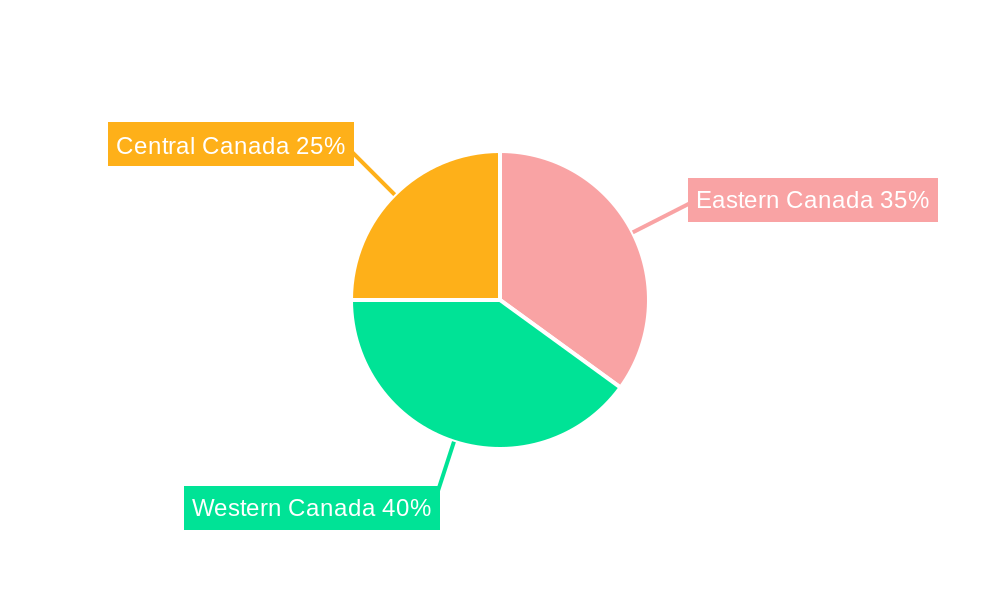

Regional variations within Canada exist, with potentially higher growth rates in urban centers and regions with strong health-conscious populations. However, factors such as price volatility of raw materials and potential supply chain challenges could pose some restraints to market expansion. Nevertheless, the overall outlook for the Canadian plant protein market remains positive, with continued growth expected throughout the forecast period (2025-2033). The consistent 5.73% CAGR reflects a healthy and sustainable trajectory, promising significant opportunities for both established players and new entrants in this dynamic market. Further market penetration is anticipated through product diversification, strategic partnerships, and enhanced consumer education regarding the nutritional and environmental benefits of plant-based proteins.

Canada Plant Protein Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Canada plant protein market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (historical period: 2019-2024; base year: 2025; forecast period: 2025-2033), this report unveils the market's dynamics, trends, leading segments, and key players. With a focus on high-growth segments like pea protein and oat protein, and key end-users including food & beverages and supplements, this report is essential for navigating the complexities of this rapidly evolving market. Expect detailed analysis of market size (in Millions), CAGR, and competitive landscape, empowering informed strategic planning.

Canada Plant Protein Market Market Dynamics & Concentration

The Canadian plant protein market is experiencing robust growth, driven by increasing consumer demand for plant-based alternatives, heightened health consciousness, and supportive government policies promoting sustainable agriculture. Market concentration is moderate, with several major players holding significant market share, yet also allowing for smaller, specialized firms to thrive. Innovation is a key driver, with continuous advancements in protein extraction, processing, and formulation enhancing product quality and functionality. Regulatory frameworks, while largely supportive, require ongoing monitoring for potential adjustments. The presence of substitute products (e.g., animal proteins) creates competitive pressure, necessitating continuous product improvement and differentiation.

- Market Share: Pea protein and soy protein currently dominate the market, holding approximately xx% and yy% respectively, while other protein types exhibit significant growth potential.

- M&A Activity: The number of mergers and acquisitions (M&A) in the sector has increased in recent years, signaling consolidation and an influx of investment. A total of xx M&A deals were recorded from 2019-2024. These activities reflect the strategic importance of securing market share and technological capabilities.

- End-User Trends: Growing demand from the food and beverage sector is a primary market driver, particularly for plant-based meat alternatives, dairy substitutes, and protein-enriched snacks. The supplements segment also presents significant growth opportunities.

- Innovation Drivers: Technological advancements in protein extraction, processing, and formulation are continually improving the taste, texture, and functionality of plant-based proteins, overcoming historical limitations and increasing their appeal to consumers.

Canada Plant Protein Market Industry Trends & Analysis

The Canada plant protein market exhibits a strong growth trajectory, projected to reach xx Million by 2033, registering a CAGR of xx% during the forecast period. This expansion is fueled by several key factors. Firstly, the rising global awareness of the environmental impact of animal agriculture is driving consumer preference towards plant-based protein sources. Secondly, the increasing prevalence of health-conscious consumers seeking high-protein diets is significantly boosting demand. Thirdly, technological breakthroughs are continuously improving the quality and functionality of plant-based proteins, making them increasingly competitive with traditional sources. Lastly, government initiatives promoting sustainable agriculture and food security are further supporting market growth. Competitive dynamics are intense, with established food companies and emerging plant protein specialists vying for market share. Market penetration of plant-based protein is steadily rising, currently estimated at xx%, with a projected increase to xx% by 2033.

Leading Markets & Segments in Canada Plant Protein Market

The Canadian plant protein market is geographically diverse, with significant growth across various provinces. However, specific regional data is not available. Within the segment analysis:

End-User: The food and beverage sector dominates, followed by the animal feed and supplement industries. The personal care and cosmetics sector shows promising growth potential.

Protein Type: Pea protein currently holds the largest market share due to its functional properties, affordability, and sustainability. However, other proteins such as soy, oat, and hemp are also witnessing substantial growth.

Key Drivers for Dominant Segments:

- Food & Beverages: Growing demand for plant-based meat alternatives, dairy substitutes, and protein-enriched snacks. Increased consumer awareness of health and sustainability.

- Animal Feed: Rising demand for sustainable and cost-effective animal feed ingredients. Growing focus on improving animal health and productivity.

- Supplements: Increasing consumer interest in dietary supplements to boost protein intake and support overall wellness.

Canada Plant Protein Market Product Developments

Recent innovations focus on enhancing the taste, texture, and functionality of plant-based proteins. Companies are utilizing advanced processing techniques to improve digestibility, reduce off-flavors, and enhance the overall sensory experience. These improvements are crucial for expanding market penetration and attracting a wider range of consumers. The development of novel protein blends and formulations is also prevalent, aiming to offer optimized nutritional profiles and tailored applications. This focus on improved product quality is key to sustaining the market's rapid growth.

Key Drivers of Canada Plant Protein Market Growth

The Canadian plant protein market's growth is fueled by a convergence of factors: a surge in consumer demand for plant-based diets, driven by health and environmental concerns; technological advancements improving protein extraction and functionality; supportive government policies encouraging sustainable agriculture; and the increasing availability of plant-based products in mainstream retail channels. The expanding food and beverage sector, particularly the plant-based meat alternatives market, is a key driver of market expansion.

Challenges in the Canada Plant Protein Market Market

The Canadian plant protein market faces certain challenges. Supply chain volatility can lead to price fluctuations and production disruptions. Maintaining consistent product quality across various production batches is vital. Competition from established players and new entrants necessitates continuous innovation and product differentiation. Meeting growing consumer demand while ensuring the sustainability of sourcing raw materials is a crucial ongoing issue. Achieving consistent and cost-effective scaling of production to meet rising demand is another key obstacle.

Emerging Opportunities in Canada Plant Protein Market

Significant opportunities exist for strategic partnerships between plant protein producers and food companies to develop innovative plant-based products. Technological advancements offer scope for further optimization of protein extraction and formulation. Exploring new protein sources and expanding into underpenetrated markets present further opportunities. The growing interest in sustainable and ethical food production creates a favorable environment for expansion.

Leading Players in the Canada Plant Protein Market Sector

- Axiom Foods

- Merit Functional Foods

- DuPont de Nemours Inc

- Archer Daniels Midland Company

- CHS Inc

- Kerry Group PLC

- Cargill Inc

- The Scoular Company

- Roquette Freres

- Glanbia Plc

Key Milestones in Canada Plant Protein Market Industry

- February 2021: Merit Functional Foods opened a new plant-based protein facility in Winnipeg, Manitoba, capable of processing 25,000 tons of raw materials initially, with future expansion potential exceeding 100,000 tons. This significantly increased pea and canola protein production capacity.

- October 2021: Roquette Freres launched a new pea protein production facility in Canada, boosting its global pea protein supply and solidifying its position in the market.

- May 2022: PIP International launched UP.P, a novel pea protein with enhanced taste, appearance, and texture, highlighting continuous innovation in the sector.

Strategic Outlook for Canada Plant Protein Market Market

The Canada plant protein market holds immense potential for future growth. Strategic partnerships, technological advancements, and a focus on sustainability will be crucial for companies to capitalize on emerging opportunities. Meeting rising consumer demand for high-quality, affordable, and sustainable plant-based proteins requires continuous innovation and efficient scaling of production. The market's trajectory is set for sustained expansion, driven by evolving consumer preferences and industry-wide innovation.

Canada Plant Protein Market Segmentation

-

1. Protein Type

- 1.1. Hemp Protein

- 1.2. Oat Protein

- 1.3. Pea Protein

- 1.4. Potato Protein

- 1.5. Rice Protein

- 1.6. Soy Protein

- 1.7. Wheat Protein

-

2. End-User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Confectionery

- 2.3.5. Dairy and Dairy Alternative Products

- 2.3.6. RTE/RTC Food Products

- 2.3.7. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Canada Plant Protein Market Segmentation By Geography

- 1. Canada

Canada Plant Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.73% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Plant-Based Food and Beverages; Increasing Application of Plant Proteins in Animal Feed

- 3.3. Market Restrains

- 3.3.1. Higher Cost of Production of Plant Proteins

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Plant-Based Food and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Plant Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 5.1.1. Hemp Protein

- 5.1.2. Oat Protein

- 5.1.3. Pea Protein

- 5.1.4. Potato Protein

- 5.1.5. Rice Protein

- 5.1.6. Soy Protein

- 5.1.7. Wheat Protein

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Confectionery

- 5.2.3.5. Dairy and Dairy Alternative Products

- 5.2.3.6. RTE/RTC Food Products

- 5.2.3.7. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 6. Eastern Canada Canada Plant Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Plant Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Plant Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Axiom Foods

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Merit Functional Foods

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 DuPont de Nemours Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Archer Daniels Midland Company

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 CHS In

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Kerry Group PLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Cargill Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 The Scoular Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Roquette Freres

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Glanbia Plc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Axiom Foods

List of Figures

- Figure 1: Canada Plant Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Plant Protein Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Plant Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Plant Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Canada Plant Protein Market Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 4: Canada Plant Protein Market Volume K Tons Forecast, by Protein Type 2019 & 2032

- Table 5: Canada Plant Protein Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Canada Plant Protein Market Volume K Tons Forecast, by End-User 2019 & 2032

- Table 7: Canada Plant Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Canada Plant Protein Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Canada Plant Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Canada Plant Protein Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Eastern Canada Canada Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Eastern Canada Canada Plant Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Western Canada Canada Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Western Canada Canada Plant Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Central Canada Canada Plant Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Central Canada Canada Plant Protein Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Canada Plant Protein Market Revenue Million Forecast, by Protein Type 2019 & 2032

- Table 18: Canada Plant Protein Market Volume K Tons Forecast, by Protein Type 2019 & 2032

- Table 19: Canada Plant Protein Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 20: Canada Plant Protein Market Volume K Tons Forecast, by End-User 2019 & 2032

- Table 21: Canada Plant Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Canada Plant Protein Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Plant Protein Market?

The projected CAGR is approximately 5.73%.

2. Which companies are prominent players in the Canada Plant Protein Market?

Key companies in the market include Axiom Foods, Merit Functional Foods, DuPont de Nemours Inc, Archer Daniels Midland Company, CHS In, Kerry Group PLC, Cargill Inc, The Scoular Company, Roquette Freres, Glanbia Plc.

3. What are the main segments of the Canada Plant Protein Market?

The market segments include Protein Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 382.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Plant-Based Food and Beverages; Increasing Application of Plant Proteins in Animal Feed.

6. What are the notable trends driving market growth?

Increasing Demand for Plant-Based Food and Beverages.

7. Are there any restraints impacting market growth?

Higher Cost of Production of Plant Proteins.

8. Can you provide examples of recent developments in the market?

May 2022: Canadian Ag-tech plant-based processor PIP International introduced UP.P, a novel pea protein known for its exceptional quality and functionality. The company asserts that it has successfully enhanced the taste, appearance, and texture of its ingredients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Plant Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Plant Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Plant Protein Market?

To stay informed about further developments, trends, and reports in the Canada Plant Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence