Key Insights

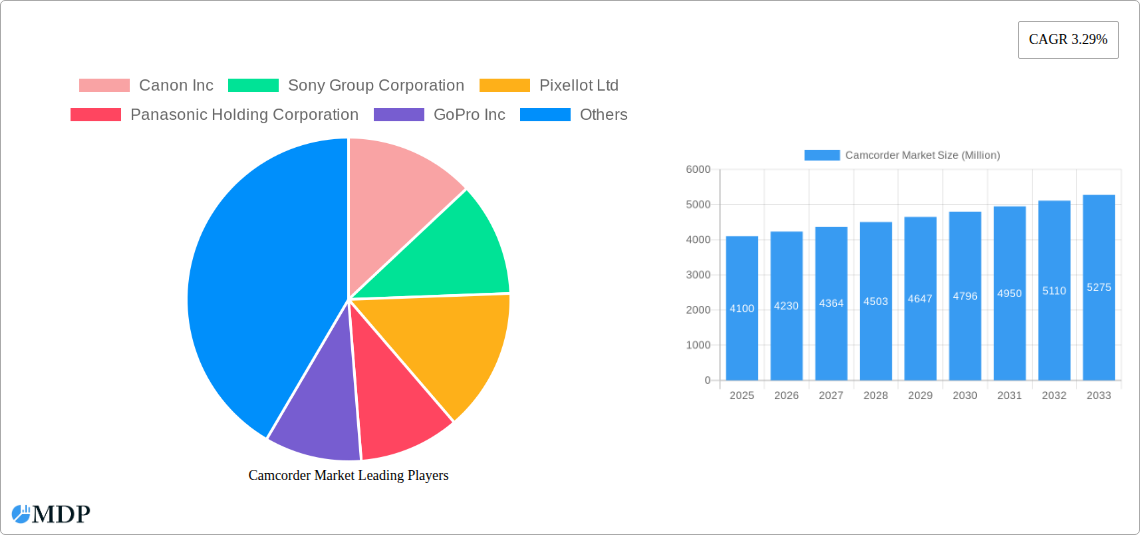

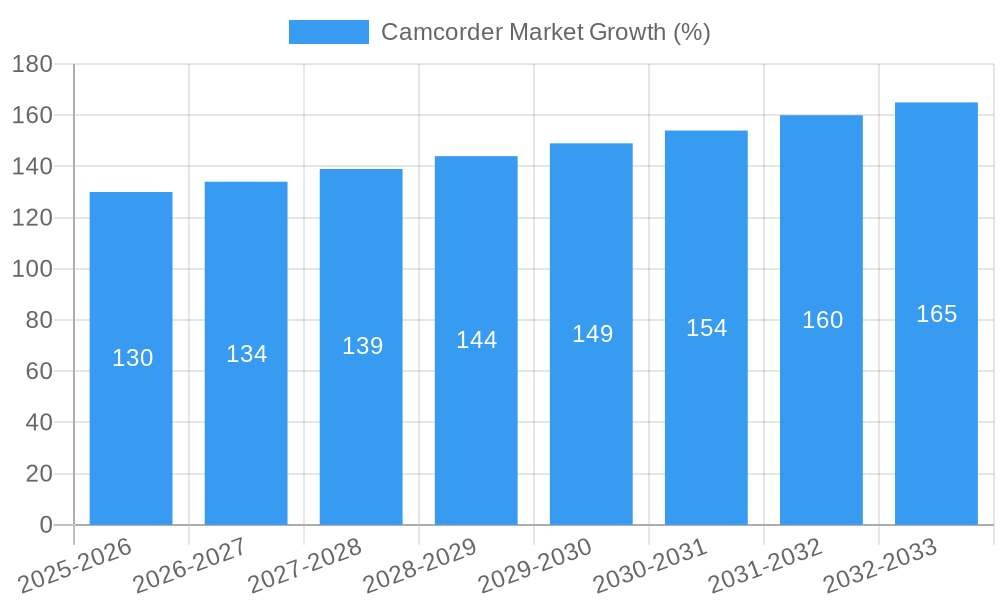

The global camcorder market, valued at $4.10 billion in 2025, is projected to experience steady growth, driven by several key factors. The increasing popularity of video content creation across various platforms, from professional filmmaking to amateur vlogging and social media engagement, fuels demand for high-quality, versatile camcorders. Technological advancements, such as improved image stabilization, 4K and even 8K resolution capabilities, and enhanced low-light performance, are also contributing to market expansion. Furthermore, the rising affordability of advanced features and the expanding availability of diverse camcorder types, catering to different budgets and needs (from compact models to professional cinema cameras), are driving broader adoption. Competition among established players like Canon, Sony, and Panasonic, alongside emerging brands, fosters innovation and ensures a wide range of options for consumers.

However, the market faces certain challenges. The increasing prevalence of high-quality smartphone cameras presents significant competition, particularly in the entry-level segment. Consumers increasingly rely on the convenience and accessibility of smartphone cameras for casual recording. While professional camcorders maintain a distinct market niche due to superior features and image quality, the pressure from smartphones necessitates continuous innovation and differentiation. Additionally, fluctuating component costs and the impact of global economic uncertainties may influence market growth in the coming years. Despite these challenges, the ongoing demand for professional-grade video content and advancements in camcorder technology are expected to maintain a positive, albeit moderate, growth trajectory throughout the forecast period (2025-2033). The market’s CAGR of 3.29% reflects a balanced outlook, anticipating consistent expansion despite competitive pressures.

Camcorder Market Report: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the global camcorder market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. From market dynamics and competitive landscapes to technological advancements and future growth projections, this report covers all key aspects of the industry. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, and the historical period covers 2019–2024. The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Camcorder Market Market Dynamics & Concentration

The global camcorder market is characterized by a moderate level of concentration, with a few key players holding significant market share. Canon Inc, Sony Group Corporation, and Panasonic Holding Corporation are among the established leaders, collectively controlling an estimated xx% of the market in 2024. However, the market also features a number of smaller players and niche competitors, particularly in the professional and specialized segments.

Market Concentration Metrics:

- 2024 Top 3 Market Share: xx%

- 2024 Number of M&A Deals: xx

- Average Deal Value (USD Million): xx

Innovation is a key driver, with continuous advancements in sensor technology, image stabilization, and video processing capabilities shaping market dynamics. Regulatory frameworks, including those related to data privacy and intellectual property, also play a significant role. The rise of smartphones with advanced camera features poses a challenge as a product substitute, impacting the lower end of the camcorder market. However, professional and enthusiast segments remain largely untouched by this trend, demanding higher quality and functionality than smartphones can provide. End-user trends favor versatile devices that cater to both professional and consumer needs. The market has witnessed a moderate level of M&A activity in recent years, primarily driven by efforts to consolidate market share and expand product portfolios.

Camcorder Market Industry Trends & Analysis

The camcorder market is experiencing a period of transition, driven by several interconnected trends. While the overall market growth rate has slowed somewhat due to the rise of smartphone cameras, specific segments are witnessing robust expansion. The professional and high-end consumer segments, driven by advancements in video quality, functionality, and post-production workflow integration, are showing significant growth. Technological disruptions such as the increasing adoption of 4K and 8K resolutions, improved image stabilization systems, and the incorporation of AI-powered features are enhancing the capabilities of camcorders.

- Market Growth Drivers: Technological advancements, demand for high-quality video content creation in professional and consumer markets, increasing adoption in live streaming and broadcasting.

- Technological Disruptions: Advancements in sensor technology, improved image stabilization, high-resolution video recording (4K, 8K), AI-powered features.

- Consumer Preferences: Demand for portability, ease of use, high-quality image and video recording capabilities, wireless connectivity, and advanced features like slow-motion and time-lapse recording.

- Competitive Dynamics: Intense competition among established players, emergence of new entrants with disruptive technologies, strategic partnerships and collaborations.

Leading Markets & Segments in Camcorder Market

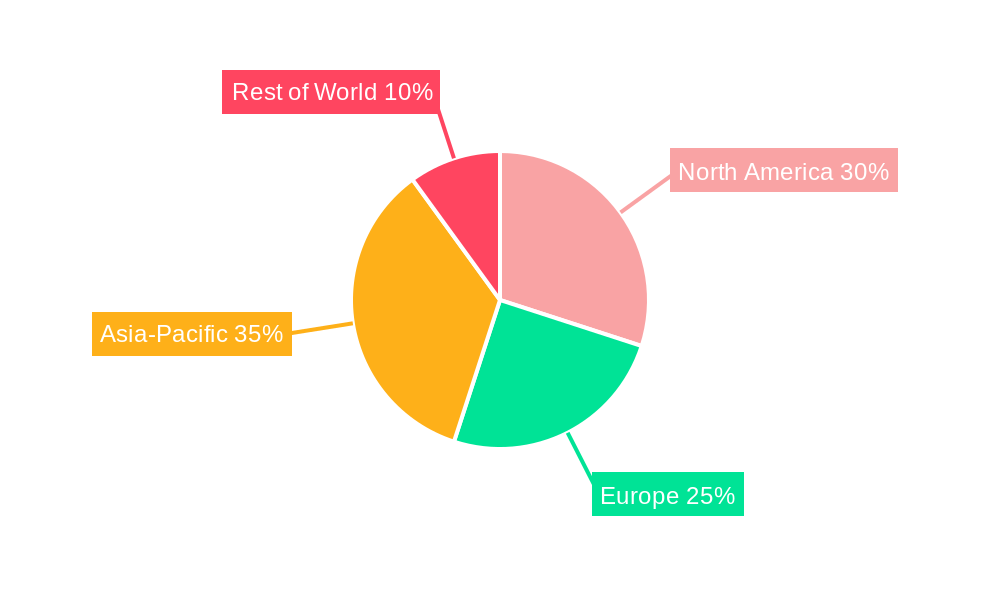

While global distribution is prevalent, certain regions display stronger market presence than others. The North American and European markets remain dominant due to high adoption of professional equipment and established infrastructure. The Asia-Pacific region is expected to witness significant growth in the coming years due to rising disposable incomes and increasing adoption of video content creation.

Key Drivers:

- North America & Europe: High disposable incomes, well-established media and entertainment industries, demand for professional-grade equipment.

- Asia-Pacific: Rapid economic growth, increasing urbanization, rising demand for video content creation, significant investments in media and entertainment infrastructure.

Dominance Analysis: The professional segment remains a crucial driver of market growth, particularly in broadcasting, filmmaking, and corporate video production. High-end consumer segments focusing on enthusiasts also represent a significant and growing part of the market.

Camcorder Market Product Developments

Recent product developments highlight a clear trend toward higher resolution sensors, improved image stabilization, and more compact form factors. Many manufacturers are integrating advanced features like AI-assisted autofocus and wireless connectivity. This aligns perfectly with market demand for better video quality, enhanced usability, and seamless content sharing capabilities. The competitive landscape is characterized by a focus on technological innovation and niche market differentiation.

Key Drivers of Camcorder Market Growth

Several factors contribute to the ongoing growth of the camcorder market:

- Technological Advancements: Continuous improvements in sensor technology, image processing, and video compression are driving demand.

- Rising Demand for High-Quality Video Content: The growing popularity of streaming platforms and social media has fueled the demand for professional-grade video content.

- Expanding Applications: Camcorders are finding applications beyond filmmaking, including corporate video production, live streaming, and security surveillance.

Challenges in the Camcorder Market Market

Several challenges hinder market growth:

- Competition from Smartphones: The increasing capabilities of smartphone cameras pose a significant challenge for lower-end camcorders.

- High Manufacturing Costs: The development and production of high-quality camcorders require significant investments.

- Supply Chain Disruptions: Global supply chain uncertainties can impact production and availability.

Emerging Opportunities in Camcorder Market

The future of the camcorder market holds several promising opportunities:

- Integration of AI & Machine Learning: Enhanced features such as automatic object tracking, scene recognition, and automatic video editing.

- Advancements in Virtual and Augmented Reality: The integration of camcorders in VR/AR applications.

- Market Expansion in Developing Economies: Increased adoption in emerging markets driven by rising disposable incomes and media consumption.

Leading Players in the Camcorder Market Sector

- Canon Inc

- Sony Group Corporation

- Pixellot Ltd

- Panasonic Holding Corporation

- GoPro Inc

- Blackmagic Design Pty Ltd

- Olympus

- Leica

- JVCKENWOOD Corporation

- Ricoh Company Ltd

Key Milestones in Camcorder Market Industry

May 2024: Blackmagic Design slashed the price of its Blackmagic Cinema Camera 6K to USD 1,575 (a 40% discount), significantly impacting the high-end professional segment. This move broadened accessibility for professionals and potentially increased market share.

March 2024: Sony launched the BURANO camera, a highly mobile digital cinema camera with in-body image stabilization and PL-Mount compatibility. This innovation caters to single-camera operators and smaller production teams, opening up new market opportunities.

Strategic Outlook for Camcorder Market Market

The camcorder market's future trajectory is promising, driven by persistent technological advancements and increasing demand for high-quality video content. Strategic partnerships, focusing on innovative solutions and catering to specific niche markets, will play a pivotal role in shaping future growth. Companies will need to adapt to evolving consumer preferences and incorporate advanced features like AI and VR/AR integration to remain competitive. The market is poised for growth, especially in the professional and high-end consumer segments.

Camcorder Market Segmentation

-

1. Type

- 1.1. Mini-DV Camcorders

- 1.2. DVD Camcorders

- 1.3. Hard Disk Drive (HDD) Camcorders

- 1.4. Flash Memory Camcorders

-

2. Application

- 2.1. Personal Use

- 2.2. Professional Use

Camcorder Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Camcorder Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.29% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Content Creation; Advancements in Technology

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Content Creation; Advancements in Technology

- 3.4. Market Trends

- 3.4.1. Professional Application Segment is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Camcorder Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mini-DV Camcorders

- 5.1.2. DVD Camcorders

- 5.1.3. Hard Disk Drive (HDD) Camcorders

- 5.1.4. Flash Memory Camcorders

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Use

- 5.2.2. Professional Use

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Camcorder Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mini-DV Camcorders

- 6.1.2. DVD Camcorders

- 6.1.3. Hard Disk Drive (HDD) Camcorders

- 6.1.4. Flash Memory Camcorders

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Personal Use

- 6.2.2. Professional Use

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Camcorder Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mini-DV Camcorders

- 7.1.2. DVD Camcorders

- 7.1.3. Hard Disk Drive (HDD) Camcorders

- 7.1.4. Flash Memory Camcorders

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Personal Use

- 7.2.2. Professional Use

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Camcorder Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mini-DV Camcorders

- 8.1.2. DVD Camcorders

- 8.1.3. Hard Disk Drive (HDD) Camcorders

- 8.1.4. Flash Memory Camcorders

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Personal Use

- 8.2.2. Professional Use

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Camcorder Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mini-DV Camcorders

- 9.1.2. DVD Camcorders

- 9.1.3. Hard Disk Drive (HDD) Camcorders

- 9.1.4. Flash Memory Camcorders

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Personal Use

- 9.2.2. Professional Use

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Camcorder Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Mini-DV Camcorders

- 10.1.2. DVD Camcorders

- 10.1.3. Hard Disk Drive (HDD) Camcorders

- 10.1.4. Flash Memory Camcorders

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Personal Use

- 10.2.2. Professional Use

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Camcorder Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Mini-DV Camcorders

- 11.1.2. DVD Camcorders

- 11.1.3. Hard Disk Drive (HDD) Camcorders

- 11.1.4. Flash Memory Camcorders

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Personal Use

- 11.2.2. Professional Use

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Canon Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Sony Group Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Pixellot Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Panasonic Holding Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 GoPro Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Blackmagic Design Pty Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Olympus

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Leica

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 JVCKENWOOD Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Ricoh Company Ltd*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Canon Inc

List of Figures

- Figure 1: Global Camcorder Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Camcorder Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Camcorder Market Revenue (Million), by Type 2024 & 2032

- Figure 4: North America Camcorder Market Volume (Billion), by Type 2024 & 2032

- Figure 5: North America Camcorder Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Camcorder Market Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Camcorder Market Revenue (Million), by Application 2024 & 2032

- Figure 8: North America Camcorder Market Volume (Billion), by Application 2024 & 2032

- Figure 9: North America Camcorder Market Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Camcorder Market Volume Share (%), by Application 2024 & 2032

- Figure 11: North America Camcorder Market Revenue (Million), by Country 2024 & 2032

- Figure 12: North America Camcorder Market Volume (Billion), by Country 2024 & 2032

- Figure 13: North America Camcorder Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Camcorder Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Europe Camcorder Market Revenue (Million), by Type 2024 & 2032

- Figure 16: Europe Camcorder Market Volume (Billion), by Type 2024 & 2032

- Figure 17: Europe Camcorder Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Camcorder Market Volume Share (%), by Type 2024 & 2032

- Figure 19: Europe Camcorder Market Revenue (Million), by Application 2024 & 2032

- Figure 20: Europe Camcorder Market Volume (Billion), by Application 2024 & 2032

- Figure 21: Europe Camcorder Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Camcorder Market Volume Share (%), by Application 2024 & 2032

- Figure 23: Europe Camcorder Market Revenue (Million), by Country 2024 & 2032

- Figure 24: Europe Camcorder Market Volume (Billion), by Country 2024 & 2032

- Figure 25: Europe Camcorder Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Camcorder Market Volume Share (%), by Country 2024 & 2032

- Figure 27: Asia Pacific Camcorder Market Revenue (Million), by Type 2024 & 2032

- Figure 28: Asia Pacific Camcorder Market Volume (Billion), by Type 2024 & 2032

- Figure 29: Asia Pacific Camcorder Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Camcorder Market Volume Share (%), by Type 2024 & 2032

- Figure 31: Asia Pacific Camcorder Market Revenue (Million), by Application 2024 & 2032

- Figure 32: Asia Pacific Camcorder Market Volume (Billion), by Application 2024 & 2032

- Figure 33: Asia Pacific Camcorder Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Asia Pacific Camcorder Market Volume Share (%), by Application 2024 & 2032

- Figure 35: Asia Pacific Camcorder Market Revenue (Million), by Country 2024 & 2032

- Figure 36: Asia Pacific Camcorder Market Volume (Billion), by Country 2024 & 2032

- Figure 37: Asia Pacific Camcorder Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific Camcorder Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Australia and New Zealand Camcorder Market Revenue (Million), by Type 2024 & 2032

- Figure 40: Australia and New Zealand Camcorder Market Volume (Billion), by Type 2024 & 2032

- Figure 41: Australia and New Zealand Camcorder Market Revenue Share (%), by Type 2024 & 2032

- Figure 42: Australia and New Zealand Camcorder Market Volume Share (%), by Type 2024 & 2032

- Figure 43: Australia and New Zealand Camcorder Market Revenue (Million), by Application 2024 & 2032

- Figure 44: Australia and New Zealand Camcorder Market Volume (Billion), by Application 2024 & 2032

- Figure 45: Australia and New Zealand Camcorder Market Revenue Share (%), by Application 2024 & 2032

- Figure 46: Australia and New Zealand Camcorder Market Volume Share (%), by Application 2024 & 2032

- Figure 47: Australia and New Zealand Camcorder Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Australia and New Zealand Camcorder Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Australia and New Zealand Camcorder Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Australia and New Zealand Camcorder Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Latin America Camcorder Market Revenue (Million), by Type 2024 & 2032

- Figure 52: Latin America Camcorder Market Volume (Billion), by Type 2024 & 2032

- Figure 53: Latin America Camcorder Market Revenue Share (%), by Type 2024 & 2032

- Figure 54: Latin America Camcorder Market Volume Share (%), by Type 2024 & 2032

- Figure 55: Latin America Camcorder Market Revenue (Million), by Application 2024 & 2032

- Figure 56: Latin America Camcorder Market Volume (Billion), by Application 2024 & 2032

- Figure 57: Latin America Camcorder Market Revenue Share (%), by Application 2024 & 2032

- Figure 58: Latin America Camcorder Market Volume Share (%), by Application 2024 & 2032

- Figure 59: Latin America Camcorder Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Latin America Camcorder Market Volume (Billion), by Country 2024 & 2032

- Figure 61: Latin America Camcorder Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Latin America Camcorder Market Volume Share (%), by Country 2024 & 2032

- Figure 63: Middle East and Africa Camcorder Market Revenue (Million), by Type 2024 & 2032

- Figure 64: Middle East and Africa Camcorder Market Volume (Billion), by Type 2024 & 2032

- Figure 65: Middle East and Africa Camcorder Market Revenue Share (%), by Type 2024 & 2032

- Figure 66: Middle East and Africa Camcorder Market Volume Share (%), by Type 2024 & 2032

- Figure 67: Middle East and Africa Camcorder Market Revenue (Million), by Application 2024 & 2032

- Figure 68: Middle East and Africa Camcorder Market Volume (Billion), by Application 2024 & 2032

- Figure 69: Middle East and Africa Camcorder Market Revenue Share (%), by Application 2024 & 2032

- Figure 70: Middle East and Africa Camcorder Market Volume Share (%), by Application 2024 & 2032

- Figure 71: Middle East and Africa Camcorder Market Revenue (Million), by Country 2024 & 2032

- Figure 72: Middle East and Africa Camcorder Market Volume (Billion), by Country 2024 & 2032

- Figure 73: Middle East and Africa Camcorder Market Revenue Share (%), by Country 2024 & 2032

- Figure 74: Middle East and Africa Camcorder Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Camcorder Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Camcorder Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Camcorder Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Camcorder Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Global Camcorder Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global Camcorder Market Volume Billion Forecast, by Application 2019 & 2032

- Table 7: Global Camcorder Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Camcorder Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Global Camcorder Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Global Camcorder Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Global Camcorder Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Global Camcorder Market Volume Billion Forecast, by Application 2019 & 2032

- Table 13: Global Camcorder Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Camcorder Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: Global Camcorder Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Camcorder Market Volume Billion Forecast, by Type 2019 & 2032

- Table 17: Global Camcorder Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Global Camcorder Market Volume Billion Forecast, by Application 2019 & 2032

- Table 19: Global Camcorder Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Camcorder Market Volume Billion Forecast, by Country 2019 & 2032

- Table 21: Global Camcorder Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Camcorder Market Volume Billion Forecast, by Type 2019 & 2032

- Table 23: Global Camcorder Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Camcorder Market Volume Billion Forecast, by Application 2019 & 2032

- Table 25: Global Camcorder Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Camcorder Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global Camcorder Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Camcorder Market Volume Billion Forecast, by Type 2019 & 2032

- Table 29: Global Camcorder Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Global Camcorder Market Volume Billion Forecast, by Application 2019 & 2032

- Table 31: Global Camcorder Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Camcorder Market Volume Billion Forecast, by Country 2019 & 2032

- Table 33: Global Camcorder Market Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Global Camcorder Market Volume Billion Forecast, by Type 2019 & 2032

- Table 35: Global Camcorder Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Camcorder Market Volume Billion Forecast, by Application 2019 & 2032

- Table 37: Global Camcorder Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Camcorder Market Volume Billion Forecast, by Country 2019 & 2032

- Table 39: Global Camcorder Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Camcorder Market Volume Billion Forecast, by Type 2019 & 2032

- Table 41: Global Camcorder Market Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Global Camcorder Market Volume Billion Forecast, by Application 2019 & 2032

- Table 43: Global Camcorder Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Camcorder Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Camcorder Market?

The projected CAGR is approximately 3.29%.

2. Which companies are prominent players in the Camcorder Market?

Key companies in the market include Canon Inc, Sony Group Corporation, Pixellot Ltd, Panasonic Holding Corporation, GoPro Inc, Blackmagic Design Pty Ltd, Olympus, Leica, JVCKENWOOD Corporation, Ricoh Company Ltd*List Not Exhaustive.

3. What are the main segments of the Camcorder Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Content Creation; Advancements in Technology.

6. What are the notable trends driving market growth?

Professional Application Segment is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

Growing Demand for Content Creation; Advancements in Technology.

8. Can you provide examples of recent developments in the market?

May 2024: Blackmagic Design slashed the price of its high-end Blackmagic Cinema Camera 6K to USD 1,575, offering a significant 40% discount. The Blackmagic Cinema Camera 6K stands out for its ability to capture precise skin tones and vibrant organic colors. Key features include a large 24 x 36 mm full-frame 6K sensor boasting a wide dynamic range, a versatile L-Mount for lenses, and a custom-designed optical low pass filter tailored to the sensor.March 2024: Sony unveiled its latest addition to the CineAlta lineup: the BURANO camera. The BURANO is equipped with a sensor that aligns with the color science of the VENICE 2. This camera seamlessly blends top-tier image quality with enhanced mobility, tailored for single-camera operators and smaller teams. Notably, it stands out as the world's inaugural digital cinema camera boasting a PL-Mount, now equipped with in-body image stabilization.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Camcorder Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Camcorder Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Camcorder Market?

To stay informed about further developments, trends, and reports in the Camcorder Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence