Key Insights

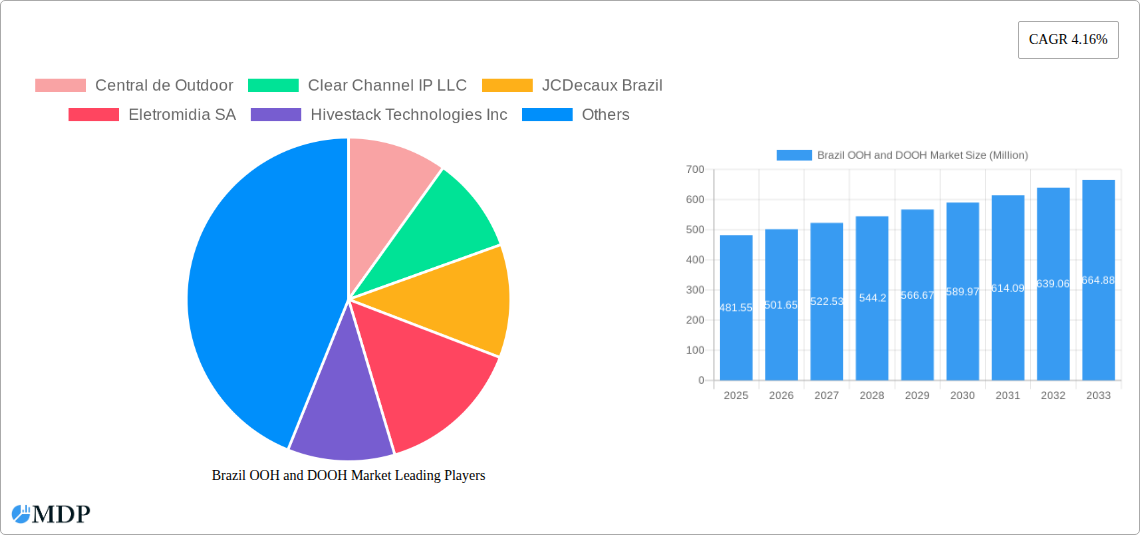

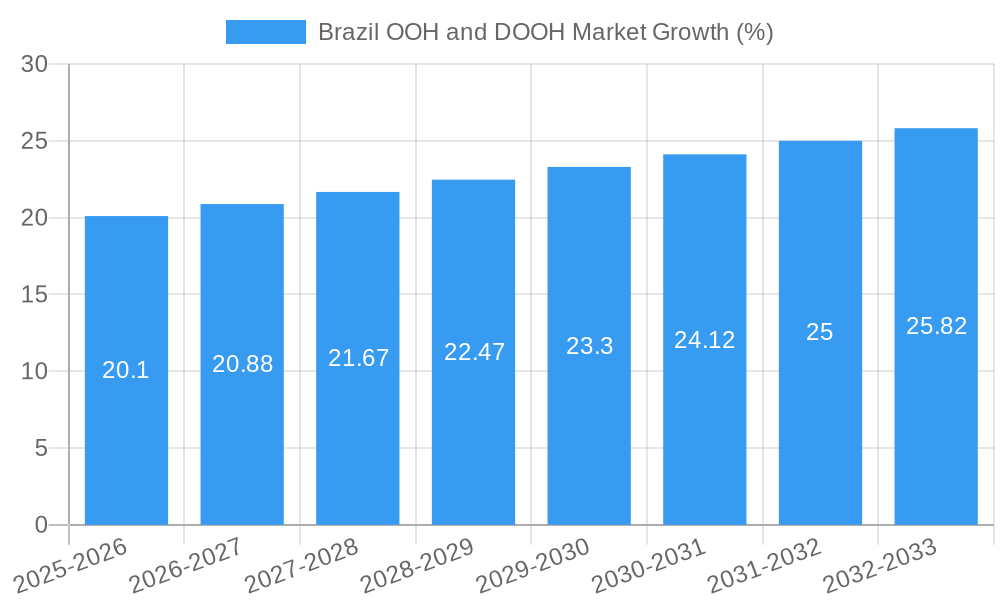

The Brazilian Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market presents a compelling growth story, projected to reach a market size of $481.55 million in 2025. A compound annual growth rate (CAGR) of 4.16% from 2025 to 2033 indicates sustained expansion, driven by several key factors. Increasing urbanization in major Brazilian cities leads to higher foot traffic and greater exposure opportunities for OOH advertisements. The rising adoption of digital technologies within the OOH landscape, particularly DOOH, facilitates targeted advertising campaigns, improved audience measurement, and dynamic content updates, attracting more advertisers. Furthermore, the expanding middle class in Brazil fuels greater consumer spending, with a portion allocated to advertising budgets, benefiting the OOH and DOOH sectors. While challenges exist, such as regulatory hurdles and competition from digital channels, the market’s inherent strengths and ongoing innovation in programmatic advertising and data-driven campaigns are expected to overcome these restraints. The presence of significant players like Central de Outdoor, Clear Channel IP LLC, and JCDecaux Brazil underscores the market's maturity and competitiveness, further indicating a positive outlook for the industry.

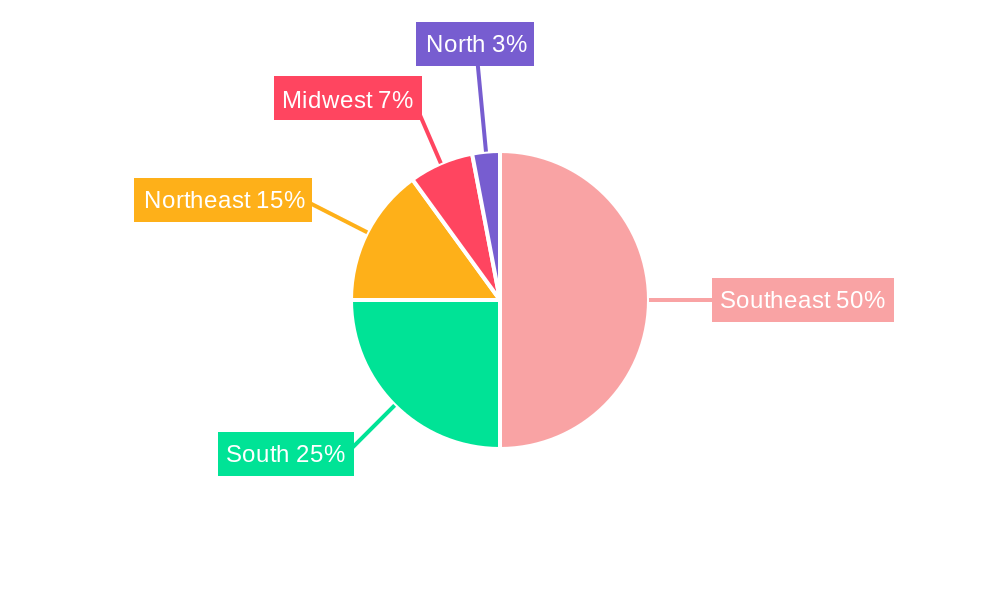

The segmentation within the Brazilian OOH and DOOH market likely includes various formats such as billboards, street furniture, transit advertising, and digital screens in malls and public spaces. A deeper understanding of these individual segments will reveal specific growth trajectories. The regional distribution of the market likely concentrates in major metropolitan areas such as São Paulo and Rio de Janeiro, reflecting higher population densities and advertising spending. Future growth will be influenced by advancements in technologies that enhance engagement and measurement, such as augmented reality and interactive displays, alongside the increasing adoption of data analytics for optimizing campaign performance. The continued investment in infrastructure and technological upgrades by key players will further contribute to this growth, while challenges concerning sustainable practices and regulatory frameworks will shape the evolution of the industry in the years to come.

Brazil OOH and DOOH Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Brazil Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market, covering the period from 2019 to 2033. The report offers invaluable insights for investors, marketers, industry professionals, and anyone seeking to understand the dynamics of this rapidly evolving sector. With a focus on market size, key players, technological advancements, and future trends, this report is your essential guide to navigating the complexities of the Brazilian OOH and DOOH landscape. Expect detailed analysis of market concentration, leading players, innovative technologies, and future growth opportunities, all supported by robust data and projections.

Brazil OOH and DOOH Market Dynamics & Concentration

The Brazilian OOH and DOOH market exhibits a moderately concentrated structure, with several key players commanding significant market share. Central de Outdoor, Clear Channel IP LLC, JCDecaux Brazil, and Eletromidia SA are among the dominant forces, shaping market dynamics through their extensive network reach and innovative offerings. The market is characterized by ongoing consolidation through mergers and acquisitions (M&A), with xx M&A deals recorded between 2019 and 2024. Innovation is driven by the increasing adoption of digital technologies, programmatic advertising, and data-driven strategies. The regulatory framework, while generally supportive, faces ongoing evolution to accommodate the rapid pace of technological change. Product substitutes, such as digital advertising platforms, pose a competitive challenge, necessitating continuous adaptation and innovation. End-user trends reveal a growing preference for targeted and measurable advertising solutions, driving the expansion of DOOH.

- Market Share (2024 Estimate): Central de Outdoor (xx%), Clear Channel IP LLC (xx%), JCDecaux Brazil (xx%), Eletromidia SA (xx%), Others (xx%).

- M&A Activity (2019-2024): xx deals, indicating a trend towards consolidation.

- Innovation Drivers: Programmatic DOOH, data analytics, interactive displays, mobile integration.

- Regulatory Framework: Evolving to address data privacy and advertising standards.

Brazil OOH and DOOH Market Industry Trends & Analysis

The Brazilian OOH and DOOH market is experiencing robust growth, fueled by several key factors. The rising adoption of digital technologies, particularly programmatic DOOH, is driving increased efficiency and targeting capabilities. This is coupled with a growing preference among advertisers for measurable and impactful campaigns. The increasing urbanization and rising disposable incomes in Brazil contribute to heightened consumer exposure to OOH and DOOH advertising formats. Competitive dynamics are characterized by a mix of established players and emerging tech companies, leading to continuous innovation and service improvements. The market's compound annual growth rate (CAGR) is estimated at xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. This growth is further supported by government initiatives promoting infrastructure development and digitalization.

Leading Markets & Segments in Brazil OOH and DOOH Market

While detailed regional breakdown data is not available, the major metropolitan areas such as São Paulo, Rio de Janeiro, and Brasília are the dominant markets for OOH and DOOH advertising in Brazil, owing to their high population density, economic activity, and infrastructure development.

- Key Drivers of Dominance:

- High Population Density: Concentrated populations create larger audiences for OOH/DOOH ads.

- Economic Activity: Higher economic activity translates to increased advertising spending.

- Developed Infrastructure: Well-developed transportation networks and urban spaces provide ideal locations for OOH installations.

- Government Initiatives: Investments in urban development indirectly support OOH expansion.

The largest segments within the market are billboards, transit advertising, and street furniture. Further segmentation by advertiser type (retail, FMCG, automotive, etc.) would require more granular data. Detailed dominance analysis reveals that the high concentration of population and commercial activities in major cities leads to disproportionately higher ad spend in these areas. The high-impact nature and diverse format options of OOH/DOOH are also key drivers of market dominance.

Brazil OOH and DOOH Market Product Developments

Recent product innovations focus on enhancing the digital capabilities of OOH and DOOH. This includes the integration of programmatic buying platforms, dynamic content delivery, and data analytics tools, allowing for real-time campaign optimization. The emphasis is on improving targeting and measurability, bridging the gap between traditional OOH and digital advertising metrics. These advancements offer advertisers greater control and more insightful performance tracking. New applications are emerging in areas such as location-based advertising and interactive displays, further expanding the potential of OOH/DOOH. These products provide a competitive advantage by allowing for more targeted, personalized, and measurable advertising campaigns compared to traditional OOH.

Key Drivers of Brazil OOH and DOOH Market Growth

Several factors fuel the growth of the Brazilian OOH and DOOH market. Technological advancements in digital signage and programmatic advertising enable improved targeting and measurement capabilities. Economic growth, particularly in urban areas, expands advertising budgets and creates greater consumer exposure. Supportive government policies promoting infrastructure development and digital transformation create a positive environment for market expansion. Furthermore, the increasing adoption of smartphones and the rise of mobile technology further enhance the effectiveness of OOH and DOOH advertising through integration and location-based targeting.

Challenges in the Brazil OOH and DOOH Market Market

The Brazilian OOH and DOOH market faces challenges including the complexity of the regulatory landscape and obtaining necessary permits for OOH installations. Supply chain disruptions, especially concerning digital hardware and software, can impact the timely delivery of projects. Furthermore, intense competition from other digital advertising channels requires continuous innovation and differentiation to maintain market share. These challenges result in increased operational costs and potential delays in project implementation. The impact is reflected in the xx% increase in operational costs due to supply chain constraints.

Emerging Opportunities in Brazil OOH and DOOH Market

Significant opportunities exist for long-term growth in the Brazilian OOH and DOOH market. The ongoing adoption of programmatic DOOH will create more efficient and transparent trading, unlocking new revenue streams. Strategic partnerships between technology providers and media owners will strengthen market capabilities and facilitate market expansion. The growth of interactive and experiential OOH advertising presents opportunities for creative campaigns that engage consumers more effectively. Moreover, expansion into smaller cities and towns, which currently have limited OOH presence, will open new markets and significantly expand the overall addressable market size.

Leading Players in the Brazil OOH and DOOH Market Sector

- Central de Outdoor

- Clear Channel IP LLC (https://www.clearchannel.com/)

- JCDecaux Brazil (https://www.jcdecaux.com/en/)

- Eletromidia SA (https://www.eletromidia.com.br/)

- Hivestack Technologies Inc (https://hivestack.com/)

- VIOOH Limited (https://viooh.com/)

- Rentbrella

Key Milestones in Brazil OOH and DOOH Market Industry

- November 2023: Displayce and Place Exchange announced a strategic integration, expanding programmatic DOOH inventory in Brazil and other Latin American markets. This significantly broadened the reach of programmatic DOOH campaigns.

- April 2024: Vistar Media partnered with PRODOOH to introduce advanced programmatic OOH capabilities to Latin America, starting with Mexico and Brazil. This collaboration is expected to accelerate the adoption of programmatic OOH in the region.

Strategic Outlook for Brazil OOH and DOOH Market Market

The future of the Brazilian OOH and DOOH market is bright. Continued technological innovation, coupled with strategic partnerships and expansion into new markets, will drive significant growth. Programmatic advertising's increasing adoption will enhance efficiency and targeting, unlocking new revenue streams for industry players. The focus on data-driven insights and measurement will increase advertiser confidence, leading to higher investment in this dynamic advertising channel. This positive outlook points toward sustained and substantial growth for the Brazilian OOH and DOOH market in the coming years.

Brazil OOH and DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Others

-

2. Application

- 2.1. Billboard

-

2.2. Transportation (Transit)

- 2.2.1. Airports

- 2.2.2. Others (Buses, etc.)

- 2.3. Street Furniture

- 2.4. Other Place-Based Media

-

3. End-User Industry

- 3.1. Automotive

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Other End Users

Brazil OOH and DOOH Market Segmentation By Geography

- 1. Brazil

Brazil OOH and DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.16% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry Driving Airport Advertisement

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry Driving Airport Advertisement

- 3.4. Market Trends

- 3.4.1. Digital OOH (LED Screens) to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil OOH and DOOH Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Billboard

- 5.2.2. Transportation (Transit)

- 5.2.2.1. Airports

- 5.2.2.2. Others (Buses, etc.)

- 5.2.3. Street Furniture

- 5.2.4. Other Place-Based Media

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Automotive

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Central de Outdoor

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Clear Channel IP LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 JCDecaux Brazil

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eletromidia SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hivestack Technologies Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VIOOH Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rentbrella*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Central de Outdoor

List of Figures

- Figure 1: Brazil OOH and DOOH Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil OOH and DOOH Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil OOH and DOOH Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil OOH and DOOH Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Brazil OOH and DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Brazil OOH and DOOH Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: Brazil OOH and DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Brazil OOH and DOOH Market Volume Million Forecast, by Application 2019 & 2032

- Table 7: Brazil OOH and DOOH Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: Brazil OOH and DOOH Market Volume Million Forecast, by End-User Industry 2019 & 2032

- Table 9: Brazil OOH and DOOH Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Brazil OOH and DOOH Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Brazil OOH and DOOH Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Brazil OOH and DOOH Market Volume Million Forecast, by Type 2019 & 2032

- Table 13: Brazil OOH and DOOH Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Brazil OOH and DOOH Market Volume Million Forecast, by Application 2019 & 2032

- Table 15: Brazil OOH and DOOH Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 16: Brazil OOH and DOOH Market Volume Million Forecast, by End-User Industry 2019 & 2032

- Table 17: Brazil OOH and DOOH Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil OOH and DOOH Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil OOH and DOOH Market?

The projected CAGR is approximately 4.16%.

2. Which companies are prominent players in the Brazil OOH and DOOH Market?

Key companies in the market include Central de Outdoor, Clear Channel IP LLC, JCDecaux Brazil, Eletromidia SA, Hivestack Technologies Inc, VIOOH Limited, Rentbrella*List Not Exhaustive.

3. What are the main segments of the Brazil OOH and DOOH Market?

The market segments include Type , Application, End-User Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 481.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry Driving Airport Advertisement.

6. What are the notable trends driving market growth?

Digital OOH (LED Screens) to Witness Major Growth.

7. Are there any restraints impacting market growth?

Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects; Increase in Air Traffic owing to Growth in Tourism Industry Driving Airport Advertisement.

8. Can you provide examples of recent developments in the market?

April 2024: Vistar Media, a global provider of technology solutions for out-of-home media, unveiled a strategic collaboration with PRODOOH. PRODOOH, Latin America's premier programmatic OOH media firm, planned to introduce Vistar's advanced advertising capabilities to the region. Leveraging Vistar's technology, the local experts at PRODOOH planned to pioneer programmatic OOH in Latin America, starting with Mexico and Brazil and further expanding into Argentina, Chile, Colombia, and Peru.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil OOH and DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil OOH and DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil OOH and DOOH Market?

To stay informed about further developments, trends, and reports in the Brazil OOH and DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence