Key Insights

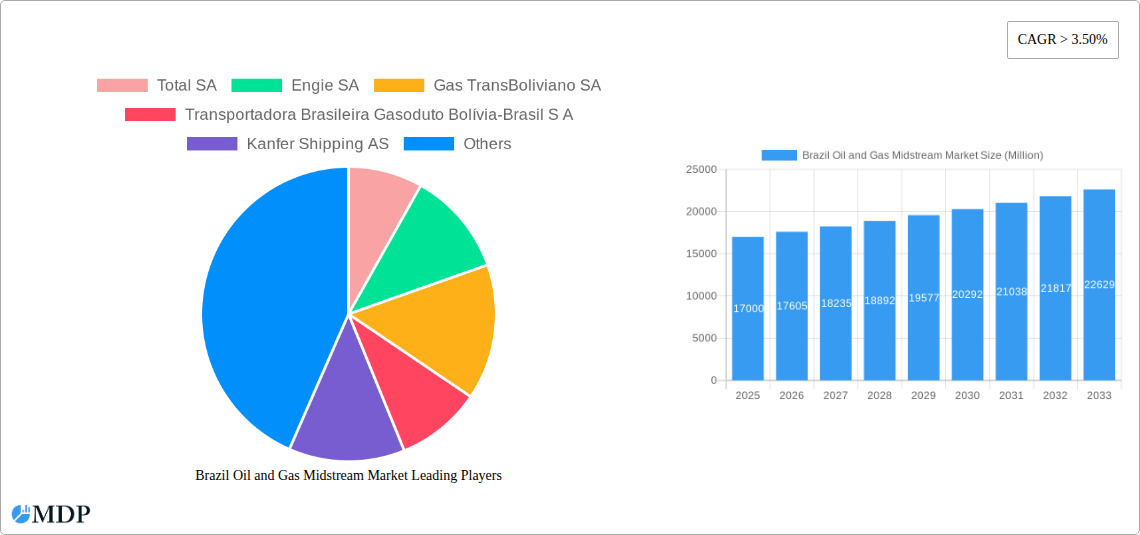

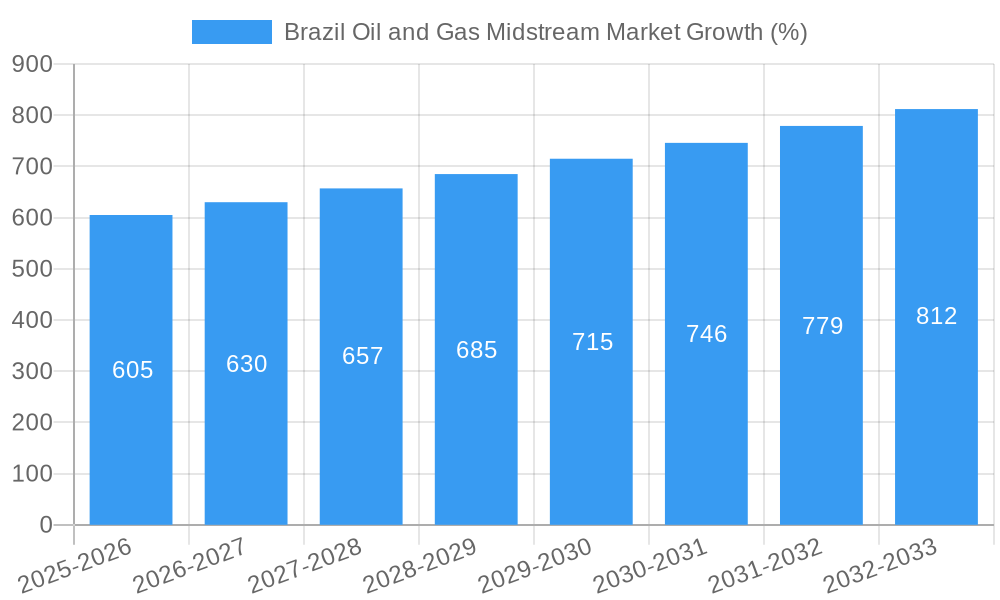

The Brazil oil and gas midstream market, encompassing transportation, storage, and LNG terminal operations, is experiencing robust growth, fueled by increasing domestic energy demand and strategic investments in infrastructure development. With a CAGR exceeding 3.50% from 2019 to 2024 and a projected continuation of this trend, the market presents significant opportunities for both established players and new entrants. The market size in 2025 is estimated to be in the range of $15-20 billion USD, considering the substantial investments in pipelines, expansion of storage capacities (including underground facilities and floating storage units), and the growing demand for LNG. Key drivers include the government's focus on energy security, the expansion of offshore oil and gas production, and increasing liquefied natural gas (LNG) imports. This growth is further enhanced by the development of new pipelines and terminal facilities, catering to the evolving energy needs of Brazil. While regulatory hurdles and potential environmental concerns could act as restraints, the overall outlook remains positive, driven by the considerable investments in infrastructure modernization and expansion.

The market segmentation reveals significant contributions from all three key areas: transportation, storage, and LNG terminals. Transportation infrastructure, including pipelines, terminals, and storage facilities dedicated to oil and gas, is crucial for efficient distribution. The growth in this segment is closely tied to the overall expansion of oil and gas production and refining activities. Storage solutions, involving underground facilities and floating units, are equally critical in managing supply and demand fluctuations. Finally, the burgeoning LNG terminal sector reflects Brazil's increasing reliance on imported LNG to supplement its energy mix. Major players like Petroleo Brasileiro SA and other international companies are actively involved in shaping this dynamic market, contributing to both competition and innovation. The Brazilian government's policies and investments will play a critical role in further defining the trajectory of this market in the coming years. Continued investments in infrastructure, along with a stable regulatory environment, are essential to unlock the full potential of the Brazilian oil and gas midstream sector.

Brazil Oil & Gas Midstream Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil oil and gas midstream market, covering market dynamics, industry trends, leading segments, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive data and analysis to provide actionable insights into this rapidly evolving market.

Brazil Oil and Gas Midstream Market Dynamics & Concentration

This section delves into the competitive landscape of the Brazilian oil and gas midstream market, analyzing market concentration, innovation drivers, regulatory frameworks, and M&A activities. The market is characterized by a mix of large multinational corporations and smaller, specialized companies. Petroleo Brasileiro SA (Petrobras) maintains a significant market share, though its recent divestment strategies are reshaping the competitive dynamics.

- Market Concentration: The market exhibits moderate concentration, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025, indicating the presence of both large and smaller players.

- Innovation Drivers: Technological advancements in pipeline management, storage solutions (including floating storage units and salt caverns), and LNG regasification are driving market innovation.

- Regulatory Framework: The regulatory environment influences investment decisions and market entry. Changes in regulations concerning environmental protection and pipeline safety have impacted market activities.

- Product Substitutes: While direct substitutes are limited, efficiency improvements and alternative transportation methods present indirect competition.

- End-User Trends: Growing energy demand and shifts toward cleaner energy sources are impacting midstream infrastructure needs.

- M&A Activities: The market has witnessed several significant mergers and acquisitions, including Petrobras' consideration of selling its stake in the Bolivia-Brazil pipeline (March 2022), resulting in an estimated USD 500 Million revenue for the company. The number of M&A deals in the sector averaged xx per year during the historical period (2019-2024), indicating a dynamic environment.

Brazil Oil and Gas Midstream Market Industry Trends & Analysis

This section provides a detailed analysis of the market's growth trajectory, technological disruptions, consumer preferences, and competitive dynamics. The Brazilian oil and gas midstream market is projected to experience significant growth driven by increasing domestic energy demand and expansion of LNG infrastructure.

The market is expected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of advanced technologies, such as digital pipeline monitoring and automated storage management systems, is gradually increasing. However, fluctuating oil and gas prices pose challenges to market growth. Increased investment in pipeline infrastructure, particularly for natural gas transportation, is a significant driver. Competition among midstream companies focuses on efficiency, cost optimization, and the ability to adapt to evolving market conditions and regulatory requirements. The increasing adoption of LNG as a fuel source is creating opportunities for new LNG terminal developments and expansion of related services.

Leading Markets & Segments in Brazil Oil and Gas Midstream Market

This section identifies the dominant regions, countries, and segments within the Brazilian oil and gas midstream market.

Transportation: Pipelines remain the dominant mode of oil and gas transportation due to their cost-effectiveness and large transport capacity. The Southeast region, due to its high energy consumption and industrial activity, dominates this segment.

Storage: Underground storage facilities and salt caverns are widely utilized for oil and gas storage. The need for efficient storage solutions to address seasonal demand fluctuations and supply disruptions is driving expansion in this segment. The development of floating storage units (FSUs) is gaining traction, particularly for LNG.

LNG Terminals: The expansion of LNG import and regasification terminals is a key trend, fueled by rising LNG demand and diversification of energy sources. This segment is likely to experience significant growth in the coming years.

Key Drivers:

- Favorable Government Policies: Government initiatives to support infrastructure development are driving investment in midstream projects.

- Economic Growth: Continued economic growth in Brazil fuels energy demand, thereby creating a need for efficient midstream infrastructure.

- Infrastructure Development: Ongoing investments in pipeline networks, storage facilities, and LNG terminals are crucial for market expansion.

Brazil Oil and Gas Midstream Market Product Developments

Recent product innovations focus on enhancing efficiency, safety, and environmental sustainability. Advances in pipeline monitoring technology, digitalization of operations, and the development of floating storage units (FSUs) are shaping the market. These technological advancements allow for better pipeline integrity management, optimized storage capacity, and reduced operational costs, thereby improving overall market competitiveness.

Key Drivers of Brazil Oil and Gas Midstream Market Growth

Several factors contribute to the growth of Brazil's oil and gas midstream market. These include:

- Rising Domestic Energy Demand: Increased energy consumption across various sectors drives the need for efficient transportation and storage infrastructure.

- Government Initiatives: Government policies promoting energy security and infrastructure development incentivize private investment.

- Technological Advancements: Innovation in pipeline technology, storage solutions, and LNG handling improves efficiency and reduces environmental impact.

Challenges in the Brazil Oil and Gas Midstream Market Market

The market faces certain challenges:

- Regulatory Hurdles: Complex regulatory processes can delay project approvals and increase costs.

- Infrastructure Limitations: Limited pipeline capacity in certain regions may constrain growth.

- Competitive Pressure: Intense competition among existing and new market entrants requires continuous efficiency improvements.

Emerging Opportunities in Brazil Oil and Gas Midstream Market

Several opportunities are poised to drive long-term growth. Increased investments in LNG infrastructure, expansion of pipeline networks to underserved areas, and strategic partnerships are some of the key catalysts for future expansion. The adoption of innovative technologies, such as digital twins and AI-powered predictive maintenance, will enhance operational efficiency and optimize asset management.

Leading Players in the Brazil Oil and Gas Midstream Market Sector

- TotalEnergies SA (TotalEnergies SA)

- Engie SA (Engie SA)

- Gas TransBoliviano SA

- Transportadora Brasileira Gasoduto Bolívia-Brasil S A

- Kanfer Shipping AS

- Petróleo Brasileiro S.A. - Petrobras (Petrobras)

- Nimofast Brasil S A

- Alvopetro Energy Ltd

Key Milestones in Brazil Oil and Gas Midstream Market Industry

- November 2022: Kanfer Shipping AS and Nimofast Brasil S.A. partnered to offer small- and medium-scale LNG shipping and bunkering solutions in Brazil from 2025. This signals growing interest in small-scale LNG infrastructure.

- March 2022: Petrobras considered selling its stake in the Bolivia-Brazil pipeline (TBG) to EIG Energy Partners for over USD 500 Million. This reflects a shift towards privatization and increased private sector participation in midstream assets.

Strategic Outlook for Brazil Oil and Gas Midstream Market Market

The future of the Brazilian oil and gas midstream market is bright, driven by continued growth in energy demand, government support for infrastructure development, and technological innovations. Companies focused on efficiency, sustainability, and strategic partnerships will be best positioned for success. The growing emphasis on LNG infrastructure presents significant opportunities for expansion and investment.

Brazil Oil and Gas Midstream Market Segmentation

-

1. Transportation

- 1.1. Overview

-

1.2. Key Projects

- 1.2.1. Existing Projects

- 1.2.2. Projects in Pipeline

- 1.2.3. Upcoming Projects

-

2. Storage

- 2.1. Overview

-

2.2. Key Projects

- 2.2.1. Existing Infrastructure

- 2.2.2. Projects in Pipeline

-

3. LNG Terminals

- 3.1. Overview

-

3.2. Key Projects

- 3.2.1. Existing Infrastructure

- 3.2.2. Projects in Pipeline

- 3.2.3. Upcoming Projects

Brazil Oil and Gas Midstream Market Segmentation By Geography

- 1. Brazil

Brazil Oil and Gas Midstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Recovering Number of Air Passengers

- 3.2.2 on Account of the Cheaper Airfare in Recent Times4.; Increasing Disposable Income of Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Share of Fossil-Fuel-Based Aviation Fuels in South American Countries

- 3.4. Market Trends

- 3.4.1. Transportation as a Significant Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Oil and Gas Midstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.1.1. Overview

- 5.1.2. Key Projects

- 5.1.2.1. Existing Projects

- 5.1.2.2. Projects in Pipeline

- 5.1.2.3. Upcoming Projects

- 5.2. Market Analysis, Insights and Forecast - by Storage

- 5.2.1. Overview

- 5.2.2. Key Projects

- 5.2.2.1. Existing Infrastructure

- 5.2.2.2. Projects in Pipeline

- 5.3. Market Analysis, Insights and Forecast - by LNG Terminals

- 5.3.1. Overview

- 5.3.2. Key Projects

- 5.3.2.1. Existing Infrastructure

- 5.3.2.2. Projects in Pipeline

- 5.3.2.3. Upcoming Projects

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Total SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Engie SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gas TransBoliviano SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Transportadora Brasileira Gasoduto Bolívia-Brasil S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kanfer Shipping AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Petroleo Brasileiro SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nimofast Brasil S A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alvopetro Energy Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Total SA

List of Figures

- Figure 1: Brazil Oil and Gas Midstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Oil and Gas Midstream Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Oil and Gas Midstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Oil and Gas Midstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Brazil Oil and Gas Midstream Market Revenue Million Forecast, by Transportation 2019 & 2032

- Table 4: Brazil Oil and Gas Midstream Market Volume Million Forecast, by Transportation 2019 & 2032

- Table 5: Brazil Oil and Gas Midstream Market Revenue Million Forecast, by Storage 2019 & 2032

- Table 6: Brazil Oil and Gas Midstream Market Volume Million Forecast, by Storage 2019 & 2032

- Table 7: Brazil Oil and Gas Midstream Market Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 8: Brazil Oil and Gas Midstream Market Volume Million Forecast, by LNG Terminals 2019 & 2032

- Table 9: Brazil Oil and Gas Midstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Brazil Oil and Gas Midstream Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Brazil Oil and Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Oil and Gas Midstream Market Volume Million Forecast, by Country 2019 & 2032

- Table 13: Brazil Oil and Gas Midstream Market Revenue Million Forecast, by Transportation 2019 & 2032

- Table 14: Brazil Oil and Gas Midstream Market Volume Million Forecast, by Transportation 2019 & 2032

- Table 15: Brazil Oil and Gas Midstream Market Revenue Million Forecast, by Storage 2019 & 2032

- Table 16: Brazil Oil and Gas Midstream Market Volume Million Forecast, by Storage 2019 & 2032

- Table 17: Brazil Oil and Gas Midstream Market Revenue Million Forecast, by LNG Terminals 2019 & 2032

- Table 18: Brazil Oil and Gas Midstream Market Volume Million Forecast, by LNG Terminals 2019 & 2032

- Table 19: Brazil Oil and Gas Midstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil Oil and Gas Midstream Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Oil and Gas Midstream Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Brazil Oil and Gas Midstream Market?

Key companies in the market include Total SA, Engie SA, Gas TransBoliviano SA, Transportadora Brasileira Gasoduto Bolívia-Brasil S A, Kanfer Shipping AS, Petroleo Brasileiro SA, Nimofast Brasil S A, Alvopetro Energy Ltd.

3. What are the main segments of the Brazil Oil and Gas Midstream Market?

The market segments include Transportation, Storage, LNG Terminals.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Recovering Number of Air Passengers. on Account of the Cheaper Airfare in Recent Times4.; Increasing Disposable Income of Population.

6. What are the notable trends driving market growth?

Transportation as a Significant Segment.

7. Are there any restraints impacting market growth?

4.; High Share of Fossil-Fuel-Based Aviation Fuels in South American Countries.

8. Can you provide examples of recent developments in the market?

November 2022: The Norwegian company Kanfer Shipping AS entered into a partnership agreement with Nimofast Brasil S.A. to establish small- and medium-scale LNG shipping, small-scale floating storage units (FSUs), and LNG bunkering solutions in Brazil from 2025 onward.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Oil and Gas Midstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Oil and Gas Midstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Oil and Gas Midstream Market?

To stay informed about further developments, trends, and reports in the Brazil Oil and Gas Midstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence