Key Insights

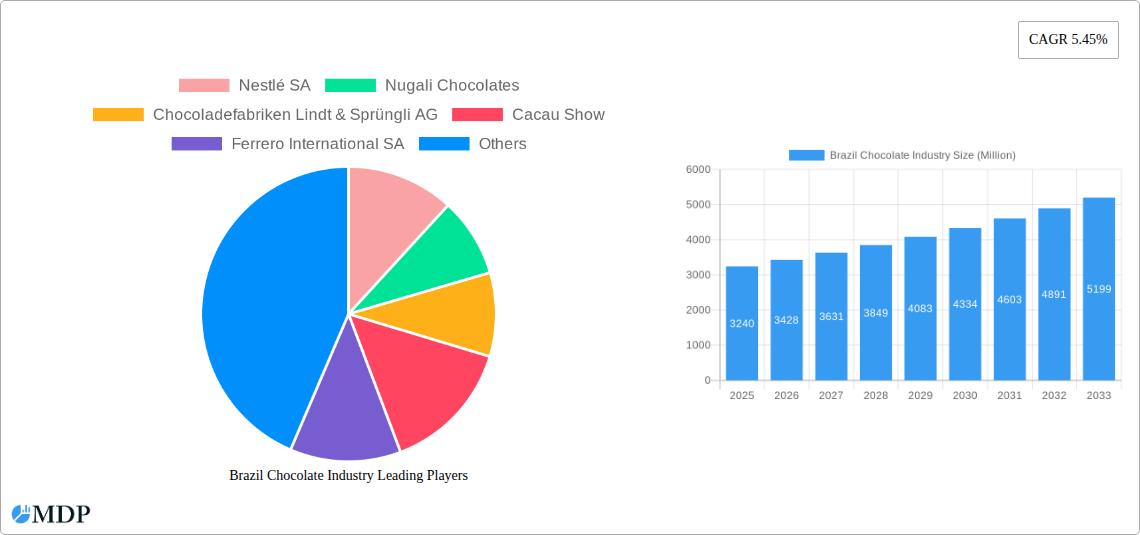

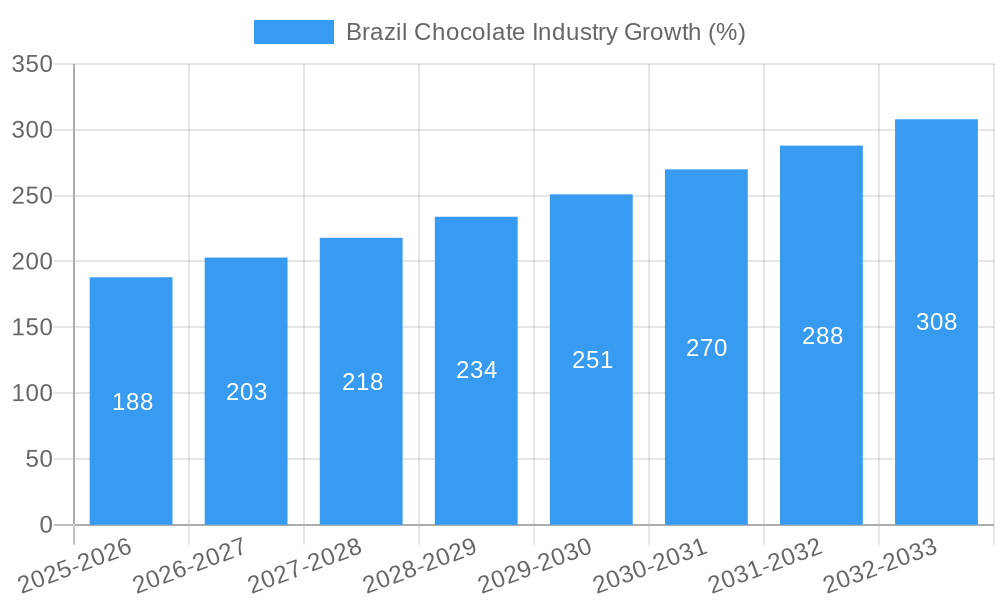

The Brazilian chocolate market, valued at $3.24 billion in 2025, is projected to experience robust growth, driven by rising disposable incomes, increasing consumer preference for premium chocolate, and the expanding popularity of gifting chocolates during holidays and special occasions. The market's Compound Annual Growth Rate (CAGR) of 5.45% from 2019 to 2025 indicates a consistent upward trajectory. Key segments driving this growth include dark chocolate, preferred for its health benefits, and milk and white chocolate, catering to broader consumer tastes. Convenience stores and supermarkets/hypermarkets remain dominant distribution channels, although online retail is rapidly expanding its market share, leveraging the convenience of e-commerce. Competition is fierce, with established international players like Nestlé, Lindt, and Ferrero facing challenges from local brands such as Cacau Show and Dengo Chocolates. These local brands often hold a stronger connection with Brazilian consumers through targeted marketing and regionally specific product offerings. The market's growth is further fueled by product innovation, including the introduction of unique flavors and healthier alternatives. However, economic fluctuations and inflationary pressures remain potential restraints on market expansion.

Looking ahead to 2033, the Brazilian chocolate market is poised for further growth, driven by evolving consumer preferences and the increasing penetration of premium chocolate segments. While the dominance of established players is expected to continue, smaller, locally focused brands will likely carve out increasing market share by capitalizing on unique flavor profiles and sustainable production practices. The expanding middle class will continue to fuel demand, particularly for higher-priced chocolates. Furthermore, the rise of online retail will lead to greater accessibility and broader market reach. The chocolate industry will likely need to adapt to changing consumer preferences, particularly regarding health-conscious options and sustainable sourcing practices, to maintain its growth trajectory in the coming years. Understanding these consumer trends and adapting accordingly will be critical for success in this dynamic market.

Uncover the lucrative opportunities and challenges shaping the Brazilian chocolate market with our comprehensive report. This in-depth analysis provides a granular view of market dynamics, key players, and future growth projections, empowering stakeholders to make informed decisions.

This report provides a detailed analysis of the Brazilian chocolate industry, covering the period 2019-2033, with a focus on 2025. We examine market trends, leading companies, and future growth potential, offering actionable insights for businesses operating in or considering entry into this dynamic market. The report utilizes data from various sources and provides predicted values where precise data is unavailable.

Brazil Chocolate Industry Market Dynamics & Concentration

The Brazilian chocolate market, valued at $xx Million in 2024, is characterized by a moderately concentrated landscape, with several multinational corporations holding significant market share. Nestlé SA, Mars Incorporated, and Mondelez International Inc. are prominent players, along with strong domestic brands like Cacau Show. Market concentration is further influenced by ongoing mergers and acquisitions (M&A) activity, as evidenced by recent deals. The market displays considerable innovation, driven by consumer demand for premium and specialized chocolates, including organic, fair-trade, and functional options. The regulatory framework, while generally supportive, presents some challenges related to labeling and ingredient standards. Product substitutes, such as candies and other confectioneries, exert some competitive pressure. Consumer preferences are shifting towards healthier options and premium experiences, prompting companies to adapt their product offerings.

- Market Share (2024): Nestlé SA (xx%), Mars Incorporated (xx%), Mondelez International Inc. (xx%), Cacau Show (xx%), Others (xx%).

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: Premiumization, health & wellness trends, sustainability concerns.

- Regulatory Focus: Labeling regulations, ingredient sourcing.

Brazil Chocolate Industry Industry Trends & Analysis

The Brazilian chocolate market exhibits robust growth, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by rising disposable incomes, a growing middle class, and increasing chocolate consumption per capita. Technological disruptions, particularly in manufacturing processes and supply chain management, are improving efficiency and reducing costs. Consumer preferences are evolving, with a growing demand for diverse flavors, unique textures, and ethically sourced products. The competitive landscape is intensely dynamic, with both domestic and international companies vying for market share through product innovation, strategic partnerships, and aggressive marketing campaigns. Market penetration remains high in urban areas, but significant opportunities exist in expanding reach to rural regions.

Leading Markets & Segments in Brazil Chocolate Industry

The Brazilian chocolate market is geographically diverse, with consumption varying across regions due to factors like income levels and cultural preferences. However, major metropolitan areas generally exhibit higher consumption rates. Milk chocolate continues to dominate the confectionery variant segment, followed by dark chocolate and white chocolate. Supermarkets/hypermarkets remain the primary distribution channel, though online retail is rapidly gaining traction. Convenience stores also play a significant role, particularly in urban settings.

- Dominant Segment: Milk Chocolate (xx% market share in 2024)

- Key Distribution Channel: Supermarket/Hypermarket (xx% market share in 2024)

- Dominant Region: Southeast Brazil

- Key Drivers:

- Economic Policies: Growing disposable incomes, increased consumer spending.

- Infrastructure: Well-developed retail infrastructure, especially in urban centers.

- Consumer Preferences: Strong preference for milk chocolate, increasing demand for premium options.

Brazil Chocolate Industry Product Developments

Recent product innovations in the Brazilian chocolate market center on premiumization, health-conscious formulations, and unique flavor profiles. Companies are introducing organic, fair-trade, and functional chocolates targeting health-conscious consumers. Technological advancements, such as improved tempering techniques and customized production lines, are enhancing product quality and efficiency. This focus on differentiation through product innovation is crucial for maintaining competitiveness in this dynamic market.

Key Drivers of Brazil Chocolate Industry Growth

Several factors are driving the growth of the Brazilian chocolate industry. First, the rising disposable incomes and a growing middle class are boosting chocolate consumption. Secondly, technological advancements in production processes are leading to higher efficiency and reduced costs. Finally, the government's policies supporting the agricultural sector and promoting domestic industries are contributing to the overall growth.

Challenges in the Brazil Chocolate Industry Market

The Brazilian chocolate industry faces several challenges, including high input costs (e.g., cocoa beans, sugar), fluctuating exchange rates, and intense competition. Supply chain disruptions and infrastructure limitations in certain regions add to these difficulties. The regulatory environment, while generally supportive, may create complexity in labeling and compliance. These factors impact profitability and potentially limit market expansion.

Emerging Opportunities in Brazil Chocolate Industry

The Brazilian chocolate industry presents exciting opportunities for growth. Expanding into underserved rural markets, capitalizing on the growing demand for premium and specialized chocolates (e.g., organic, vegan, functional), and strategically leveraging e-commerce platforms offer substantial potential. Partnerships with local farmers and cooperatives to secure sustainable cocoa bean sourcing are also key strategic avenues for future growth.

Leading Players in the Brazil Chocolate Industry Sector

- Nestlé SA

- Nugali Chocolates

- Chocoladefabriken Lindt & Sprüngli AG

- Cacau Show

- Ferrero International SA

- Florestal Alimentos SA

- Mars Incorporated

- Arcor S A I C

- Dori Alimentos SA

- Dengo Chocolates SA

- Fuji Oil Holdings Inc

- Mondelēz International Inc

- The Peccin S

- The Hershey Company

Key Milestones in Brazil Chocolate Industry Industry

- July 2023: Ferrara Candy Co. (Ferrero) acquires Dori Alimentos, expanding its presence in the Brazilian confectionery market.

- July 2023: Ferrara Candy Company's acquisition of Dori Alimentos strengthens its position within the Brazilian confectionery sector.

- December 2022: Mars Incorporated launches Snickers Caramelo & Bacon, targeting specific consumer preferences and driving innovation.

Strategic Outlook for Brazil Chocolate Industry Market

The Brazilian chocolate market is poised for sustained growth, driven by rising incomes, changing consumer preferences, and technological advancements. Companies that prioritize product innovation, sustainable sourcing, and effective marketing strategies will be best positioned to capture market share and drive long-term profitability. Expansion into new geographic markets and distribution channels, along with strategic partnerships, will further enhance growth prospects.

Brazil Chocolate Industry Segmentation

-

1. Confectionery Variant

- 1.1. Dark Chocolate

- 1.2. Milk and White Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Brazil Chocolate Industry Segmentation By Geography

- 1. Brazil

Brazil Chocolate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for meat alternatives

- 3.3. Market Restrains

- 3.3.1. Presence of numerous alternatives in the plant proteins

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Chocolate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Dark Chocolate

- 5.1.2. Milk and White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Nestlé SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nugali Chocolates

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chocoladefabriken Lindt & Sprüngli AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cacau Show

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ferrero International SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Florestal Alimentos SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mars Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arcor S A I C

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dori Alimentos SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dengo Chocolates SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Fuji Oil Holdings Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Mondelēz International Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 The Peccin S

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 The Hershey Company

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Nestlé SA

List of Figures

- Figure 1: Brazil Chocolate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Chocolate Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Chocolate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Chocolate Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Brazil Chocolate Industry Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 4: Brazil Chocolate Industry Volume K Tons Forecast, by Confectionery Variant 2019 & 2032

- Table 5: Brazil Chocolate Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Brazil Chocolate Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: Brazil Chocolate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Chocolate Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Brazil Chocolate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Brazil Chocolate Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Brazil Chocolate Industry Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 12: Brazil Chocolate Industry Volume K Tons Forecast, by Confectionery Variant 2019 & 2032

- Table 13: Brazil Chocolate Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Brazil Chocolate Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 15: Brazil Chocolate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Brazil Chocolate Industry Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Chocolate Industry?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Brazil Chocolate Industry?

Key companies in the market include Nestlé SA, Nugali Chocolates, Chocoladefabriken Lindt & Sprüngli AG, Cacau Show, Ferrero International SA, Florestal Alimentos SA, Mars Incorporated, Arcor S A I C, Dori Alimentos SA, Dengo Chocolates SA, Fuji Oil Holdings Inc, Mondelēz International Inc, The Peccin S, The Hershey Company.

3. What are the main segments of the Brazil Chocolate Industry?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3240 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for meat alternatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of numerous alternatives in the plant proteins.

8. Can you provide examples of recent developments in the market?

July 2023: Ferrero's sister company, Ferrara Candy Co., announced the acquisition of Brazilian snacks company Dori Alimentos, which sells a variety of chocolate and sugar confectionery brands, including Dori, Pettiz, and Jubes.July 2023: Ferrara Candy Company, a Ferrero-related company, signed an agreement to acquire Dori Alimentos to expand its network in the fast-growing Brazilian confectionery market.December 2022: Mars Incorporated launched Snickers Caramelo & Bacon limited edition chocolate bars in Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Chocolate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Chocolate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Chocolate Industry?

To stay informed about further developments, trends, and reports in the Brazil Chocolate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence