Key Insights

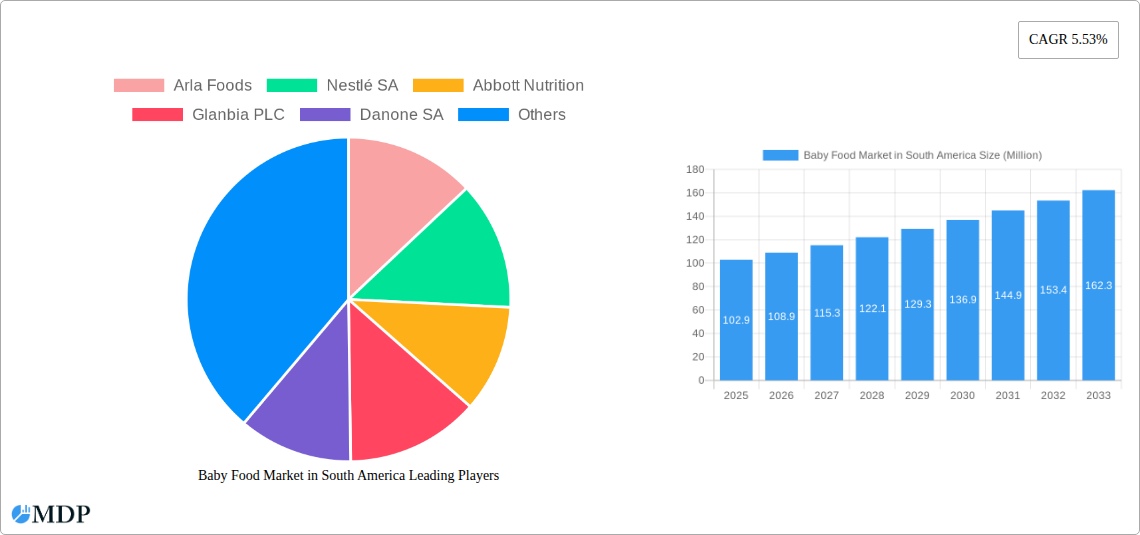

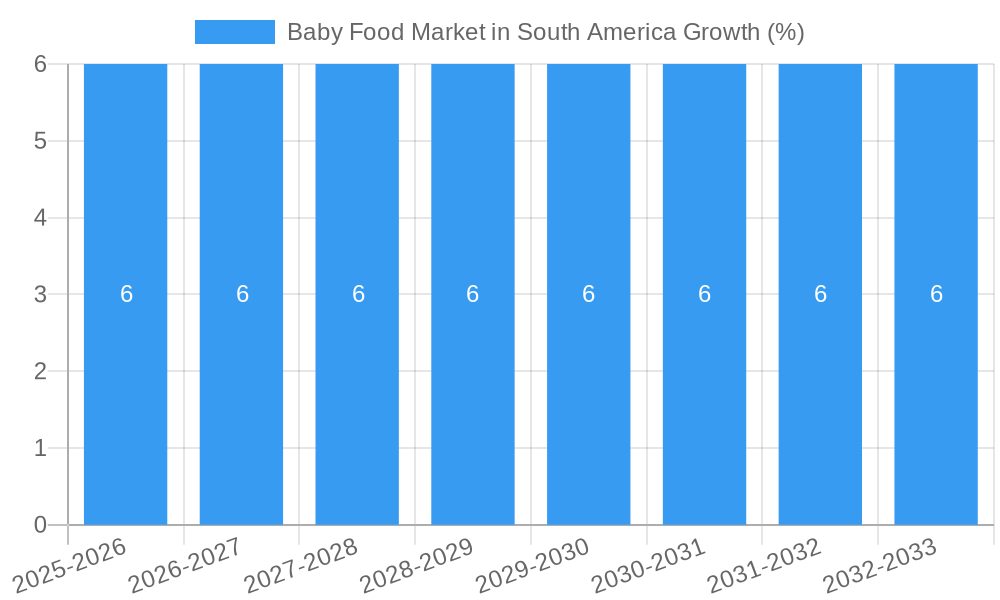

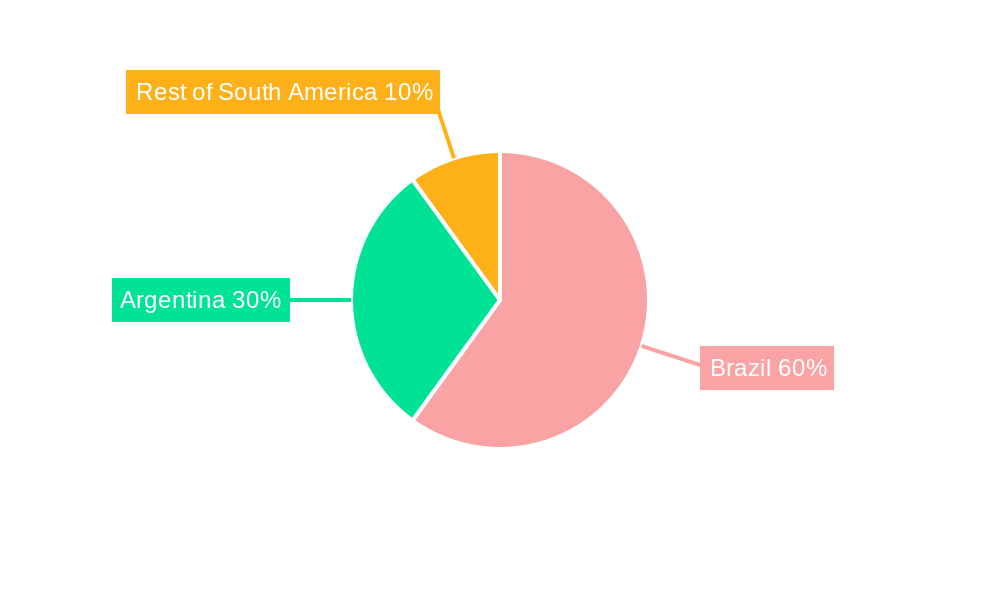

The South American baby food market, valued at $102.9 million in 2025, is projected to experience robust growth, driven by rising disposable incomes, increasing urbanization, and a growing awareness of the importance of nutrition in early childhood development. The market's Compound Annual Growth Rate (CAGR) of 5.53% from 2025 to 2033 indicates a significant expansion opportunity. Key segments fueling this growth include milk formula, which benefits from increasing breastfeeding alternatives and convenience; prepared baby food, driven by busy lifestyles and the desire for convenient, nutritious options; and dried baby food, reflecting a preference for longer shelf life and ease of storage. Brazil and Argentina represent the largest markets within South America, with Brazil likely holding a larger share due to its significantly larger population. Distribution channels are diverse, with hypermarkets/supermarkets holding a dominant position due to their wide reach and established presence. However, the growth of online retail channels is expected to gradually increase their market share in the coming years. Competitive pressures are intense, with major players like Nestlé, Abbott, and Danone vying for market share against regional and smaller brands. Challenges include fluctuating raw material prices and maintaining consistent product quality across the diverse South American landscape.

The market's future trajectory will depend on several factors. Government initiatives promoting nutrition and child health, as well as the growing middle class's increasing spending power will play a significant role. Innovative product development, focusing on organic, natural, and specialized formulations to meet diverse dietary needs, will also be crucial for market expansion. Companies are likely to invest more in marketing and distribution networks to reach a broader customer base, especially in more remote areas. Moreover, addressing consumer concerns regarding food safety and sustainability will be paramount for sustained success in this growing market. The presence of both multinational giants and local players creates a dynamic market environment, where both innovation and cost-effectiveness will drive future growth.

Baby Food Market in South America: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Baby Food Market in South America, covering market dynamics, industry trends, leading segments, product developments, key players, and future growth prospects. The report utilizes data from 2019-2024 (Historical Period), with the base year set at 2025 and a forecast period extending to 2033 (Forecast Period: 2025-2033). This essential resource is designed for industry stakeholders, investors, and businesses seeking to understand and capitalize on the opportunities within this dynamic market. The total market size is predicted to reach xx Million by 2033.

Baby Food Market in South America Market Dynamics & Concentration

The South American baby food market is characterized by a moderate level of concentration, with key players such as Nestlé SA, Abbott Nutrition, and Danone SA holding significant market share. However, the market also exhibits considerable fragmentation, with the presence of numerous regional and smaller players. Market share data for 2025 estimates Nestlé SA at approximately 30%, Abbott Nutrition at 25%, and Danone SA at 15%, with the remaining 30% distributed among other competitors.

Several factors influence market dynamics:

- Innovation Drivers: The continuous development of new products, including organic options, fortified formulas, and specialized foods catering to specific dietary needs, drives market growth.

- Regulatory Frameworks: Government regulations related to food safety, labeling, and marketing significantly impact market operations. Variations in regulations across different South American countries present both challenges and opportunities.

- Product Substitutes: Breastfeeding remains a major competitor, while homemade baby food also represents a viable alternative for some consumers.

- End-User Trends: Increasing awareness of nutrition and health among parents fuels the demand for premium and specialized baby food products. The growing middle class and rising disposable incomes further contribute to this demand.

- M&A Activities: The market has witnessed several mergers and acquisitions (M&A) in recent years, primarily driven by companies seeking to expand their market reach and product portfolio. The estimated number of M&A deals in the period 2019-2024 was 15, indicating a moderately active consolidation phase.

Baby Food Market in South America Industry Trends & Analysis

The South American baby food market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by several key factors:

- Rising Birth Rates: While birth rates vary across South American countries, overall population growth continues to fuel demand.

- Increasing Urbanization: Urbanization leads to increased access to modern retail channels, facilitating the distribution of baby food products.

- Changing Consumer Preferences: A shift towards premium and specialized baby food products, such as organic and hypoallergenic options, is driving market segmentation and price premium.

- Technological Disruptions: E-commerce platforms and online retail channels are expanding access to baby food products, particularly in urban areas. Innovative packaging solutions enhancing product shelf life and convenience are also gaining traction.

- Competitive Dynamics: The competitive landscape is characterized by intense competition among major international and regional players, resulting in strategic product launches, marketing initiatives, and pricing strategies. Market penetration of premium baby food is around 10% in 2025, expected to rise to 20% by 2033.

Leading Markets & Segments in Baby Food Market in South America

Brazil and Mexico are the dominant markets within South America, accounting for a combined xx% of total market value in 2025. Several factors contribute to their dominance:

- Larger Population Bases: Both countries boast substantial populations, directly impacting demand for baby food.

- Stronger Economies: Relatively robust economies in Brazil and Mexico translate into increased consumer spending power.

- Developed Retail Infrastructure: A well-developed retail network facilitates the distribution of baby food products.

In terms of product segments:

- Milk Formula: This segment maintains the largest market share due to its widespread acceptance as a convenient and nutritious feeding option.

- Prepared Baby Food: This segment witnesses growing popularity due to convenience and diverse product options.

- Dried Baby Food: The dried baby food segment is experiencing moderate growth driven by affordability and longer shelf life.

- Other Types: This category includes specialized baby foods catering to specific dietary needs, showing promising growth.

In terms of distribution channels:

- Hypermarkets/Supermarkets: These remain the dominant distribution channel, owing to their broad reach and established presence.

- Drugstores/Pharmacies: Drugstores/Pharmacies provide a crucial distribution channel for specialized baby food products.

- Convenience Stores: Convenience stores play a smaller but growing role, especially for smaller-sized products.

Baby Food Market in South America Product Developments

Recent product innovations focus on enhancing nutritional value and convenience. Formulas enriched with probiotics, prebiotics, and essential nutrients are gaining traction. Ready-to-eat pouches and single-serving containers cater to the increasing demand for convenient meal options for busy parents. Furthermore, organic and hypoallergenic options are becoming increasingly popular, reflecting the growing emphasis on health and wellness.

Key Drivers of Baby Food Market in South America Growth

The growth of the South American baby food market is fueled by a convergence of factors:

- Rising Disposable Incomes: Increased purchasing power allows more parents to afford premium baby food options.

- Growing Awareness of Nutrition: A rising awareness of the importance of nutrition in early childhood development leads to increased demand for nutritious baby food products.

- Government Initiatives: Government support for programs promoting infant health and nutrition indirectly boosts market growth.

Challenges in the Baby Food Market in South America

Several challenges impede market growth:

- Economic Instability: Economic fluctuations in some South American countries can impact consumer spending on non-essential goods like baby food.

- Supply Chain Disruptions: Logistics and infrastructure limitations can impact the efficient distribution of baby food products, particularly in remote areas.

- Competition: Intense competition among numerous players makes it challenging for some brands to achieve market dominance.

Emerging Opportunities in Baby Food Market in South America

Significant growth potential exists in:

- Expanding E-commerce Presence: Online retailers offer new distribution channels to reach a broader audience.

- Developing Specialized Products: Catering to specific dietary needs and preferences opens doors to niche markets.

- Investing in R&D: Innovation in product formulation and packaging can lead to market differentiation and increased consumer loyalty.

Leading Players in the Baby Food Market in South America Sector

- Arla Foods

- Nestlé SA

- Abbott Nutrition

- Glanbia PLC

- Danone SA

- The Hero Group

- Neptune Wellness Company

- Sun-Maid Growers of California

- Dairy Farmers of America Inc

- Holle baby food AG

Key Milestones in Baby Food Market in South America Industry

- March 2021: Sun-Maid Growers of California acquired Plum Organics, expanding its presence in the organic baby food segment. This significantly impacted market competition, particularly within the premium segment.

- July 2021: Abbott Nutrition launched Similac pro-Advance and Similac Pro-Sensative, adding innovative products to the formula market and enhancing its competitive position.

- November 2021: Abbott Nutrition launched Similac 360 Total Care, further strengthening its product portfolio with a focus on enhanced immune support and brain development. These launches demonstrate a strong focus on innovation in the baby formula sector.

Strategic Outlook for Baby Food Market in South America Market

The South American baby food market presents substantial long-term growth prospects. Companies can capitalize on this potential through strategic investments in product innovation, expanding distribution networks, particularly within the e-commerce sector, and adapting to the changing preferences of health-conscious parents. A focus on sustainable and ethically sourced ingredients is also gaining importance, presenting another avenue for differentiation and market growth.

Baby Food Market in South America Segmentation

-

1. Type

- 1.1. Milk Formula

- 1.2. Dried Baby Food

- 1.3. Prepared Baby Food

- 1.4. Other Types

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Drugstores/Pharmacies

- 2.3. Convenience Stores

- 2.4. Other Distribution Channels

-

3. Geography

-

3.1. South America

- 3.1.1. Brazil

- 3.1.2. Argentina

- 3.1.3. Rest of South America

-

3.1. South America

Baby Food Market in South America Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

Baby Food Market in South America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for sports nutritional supplements

- 3.3. Market Restrains

- 3.3.1. Rising demand for plant-based protein

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Organic Baby Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Baby Food Market in South America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Milk Formula

- 5.1.2. Dried Baby Food

- 5.1.3. Prepared Baby Food

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Drugstores/Pharmacies

- 5.2.3. Convenience Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South America

- 5.3.1.1. Brazil

- 5.3.1.2. Argentina

- 5.3.1.3. Rest of South America

- 5.3.1. South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Baby Food Market in South America Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Baby Food Market in South America Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America Baby Food Market in South America Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Arla Foods

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Nestlé SA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Abbott Nutrition

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Glanbia PLC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Danone SA

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 The Hero Group

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Neptune Wellness Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Sun-Maid Growers of California

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Dairy Farmers of America Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Holle baby food AG*List Not Exhaustive

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Arla Foods

List of Figures

- Figure 1: Baby Food Market in South America Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Baby Food Market in South America Share (%) by Company 2024

List of Tables

- Table 1: Baby Food Market in South America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Baby Food Market in South America Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Baby Food Market in South America Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Baby Food Market in South America Volume K Tons Forecast, by Type 2019 & 2032

- Table 5: Baby Food Market in South America Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Baby Food Market in South America Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: Baby Food Market in South America Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Baby Food Market in South America Volume K Tons Forecast, by Geography 2019 & 2032

- Table 9: Baby Food Market in South America Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Baby Food Market in South America Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: Baby Food Market in South America Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Baby Food Market in South America Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: Brazil Baby Food Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Brazil Baby Food Market in South America Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Argentina Baby Food Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Baby Food Market in South America Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Baby Food Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of South America Baby Food Market in South America Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Baby Food Market in South America Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Baby Food Market in South America Volume K Tons Forecast, by Type 2019 & 2032

- Table 21: Baby Food Market in South America Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: Baby Food Market in South America Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 23: Baby Food Market in South America Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Baby Food Market in South America Volume K Tons Forecast, by Geography 2019 & 2032

- Table 25: Baby Food Market in South America Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Baby Food Market in South America Volume K Tons Forecast, by Country 2019 & 2032

- Table 27: Brazil Baby Food Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Baby Food Market in South America Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: Argentina Baby Food Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Baby Food Market in South America Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Baby Food Market in South America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Baby Food Market in South America Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Baby Food Market in South America?

The projected CAGR is approximately 5.53%.

2. Which companies are prominent players in the Baby Food Market in South America?

Key companies in the market include Arla Foods, Nestlé SA, Abbott Nutrition, Glanbia PLC, Danone SA, The Hero Group, Neptune Wellness Company, Sun-Maid Growers of California, Dairy Farmers of America Inc, Holle baby food AG*List Not Exhaustive.

3. What are the main segments of the Baby Food Market in South America?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 102900 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for sports nutritional supplements.

6. What are the notable trends driving market growth?

Increasing Demand for Organic Baby Food.

7. Are there any restraints impacting market growth?

Rising demand for plant-based protein.

8. Can you provide examples of recent developments in the market?

November 2021: Abbott Nutrition Launched Similac 360 Total Care, a baby formula containing five HMO probiotics designed to support babies' immune systems and brain development.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Baby Food Market in South America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Baby Food Market in South America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Baby Food Market in South America?

To stay informed about further developments, trends, and reports in the Baby Food Market in South America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence