Key Insights

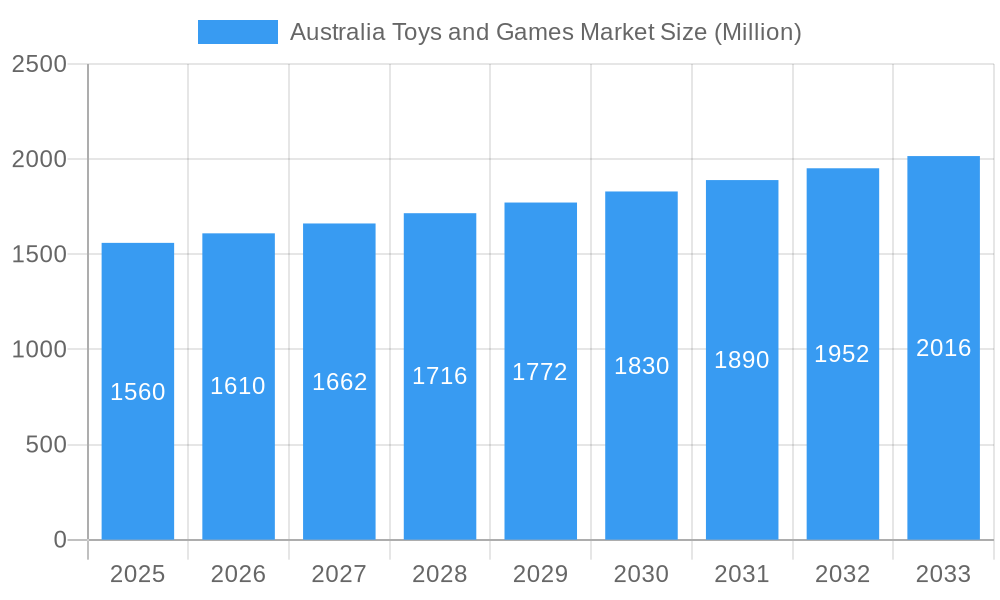

The Australian toys and games market, valued at $1.56 billion in 2025, exhibits a steady growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 3.23% from 2025 to 2033. This growth is fueled by several key factors. Increasing disposable incomes among Australian households, particularly in urban centers, contribute significantly to higher spending on toys and games. The rising popularity of online retail channels, driven by convenience and wider product selections offered by players like Amazon Australia, Kmart Group, and others, is another major driver. Furthermore, evolving trends in toy preferences, including a surge in demand for educational toys, STEM-focused products, and interactive gaming experiences, are reshaping the market landscape. The robust e-commerce infrastructure and a strong focus on innovation within the toy industry itself further support this expansion.

Australia Toys and Games Market Market Size (In Billion)

However, the market faces certain constraints. Fluctuations in the Australian economy and potential shifts in consumer spending habits due to economic uncertainties could impact sales. Increasing competition, both domestically and from international brands entering the market, necessitates strategic pricing and marketing strategies for established players. Additionally, growing concerns about responsible consumption and the environmental impact of toy manufacturing could influence consumer preferences and brand loyalty, posing challenges to businesses operating within the sector. Maintaining a balance between affordability, quality, and sustainability will be crucial for sustained market growth in the coming years.

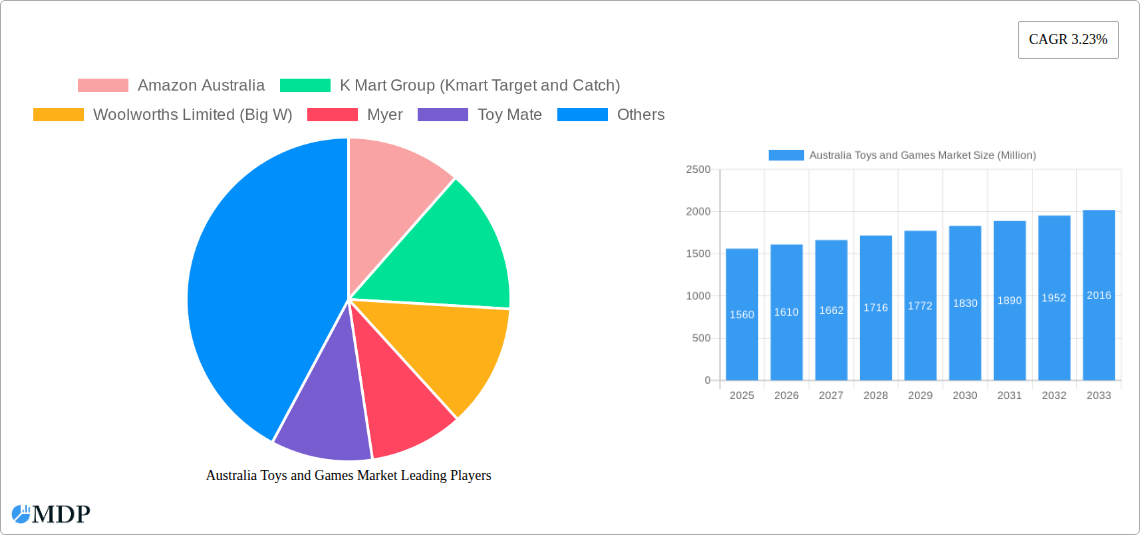

Australia Toys and Games Market Company Market Share

Australia Toys and Games Market Report: 2019-2033 Forecast

This comprehensive report provides a detailed analysis of the Australian toys and games market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of past performance, current trends, and future projections. The report leverages extensive market research and data analysis to provide actionable insights and strategic recommendations. The Australian toys and games market is estimated to be worth xx Million in 2025, exhibiting a CAGR of xx% during the forecast period.

Australia Toys and Games Market Market Dynamics & Concentration

The Australian toys and games market is characterized by a moderately concentrated landscape, with key players such as Amazon Australia, Kmart Group (Kmart, Target, and Catch), Woolworths Limited (Big W), and others holding significant market share. However, the market also features a substantial number of smaller players, including specialty toy stores and online retailers. Innovation is a key driver, with ongoing development of interactive toys, educational games, and technologically advanced products. Regulatory frameworks, such as product safety standards, influence market operations. Substitute products, like video games and digital entertainment, present competitive challenges. Consumer preferences, particularly those of children and parents, significantly impact demand. Mergers and acquisitions (M&A) activity has been relatively moderate, with xx M&A deals recorded between 2019 and 2024, resulting in a shift in market share among key players.

- Market Concentration: Moderately concentrated, with top players holding xx% market share collectively.

- Innovation Drivers: Interactive toys, educational games, technologically advanced products.

- Regulatory Framework: Stringent product safety standards and regulations.

- Product Substitutes: Video games, digital entertainment, outdoor activities.

- End-User Trends: Growing demand for educational and STEM-focused toys, increasing preference for sustainable and ethically sourced toys.

- M&A Activity: xx M&A deals between 2019 and 2024.

Australia Toys and Games Market Industry Trends & Analysis

The Australian toys and games market exhibits robust growth driven by increasing disposable incomes, changing consumer preferences, and technological advancements. The market’s CAGR from 2019 to 2024 was xx%, and is projected to maintain healthy growth during the forecast period. Technological disruptions, such as the rise of augmented reality (AR) and virtual reality (VR) toys, are reshaping the market. Consumer preferences lean towards educational and STEM-focused toys, eco-friendly options, and products that promote creativity and imaginative play. Competitive dynamics are intense, with both established players and new entrants vying for market share. Market penetration of online sales continues to increase, with e-commerce platforms gaining traction.

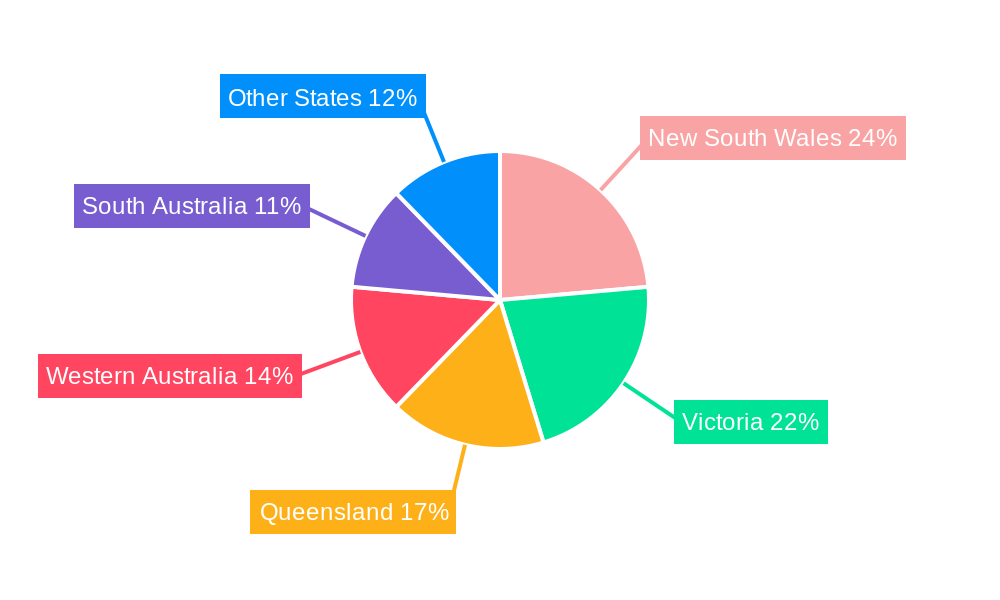

Leading Markets & Segments in Australia Toys and Games Market

The Australian toys and games market is geographically diverse, with no single region dominating. However, major metropolitan areas like Sydney and Melbourne exhibit higher sales volumes due to population density and higher disposable incomes. The key segments include preschool toys, action figures, construction toys, games and puzzles, and dolls. The preschool toy segment is particularly dynamic, driven by the growing number of young children and increasing parental spending on early childhood development.

- Key Drivers for Dominant Segments:

- Preschool Toys: Growing birth rates, parental emphasis on early childhood development.

- Action Figures/Dolls: Continued popularity of licensed characters and franchises.

- Games & Puzzles: Growing interest in family-friendly activities and engagement.

- Dominance Analysis: Market leadership is shared amongst several major retailers, with online sales channels rapidly gaining ground.

Australia Toys and Games Market Product Developments

Recent product innovations include interactive toys incorporating AR/VR technology, educational games utilizing AI, and sustainable toys made from eco-friendly materials. These innovations cater to the increasing demand for engaging, educational, and environmentally conscious products. Companies are leveraging technological advancements to enhance product features, improve user experience, and gain a competitive edge. The market is witnessing a convergence of traditional toys with digital technologies.

Key Drivers of Australia Toys and Games Market Growth

Several factors propel the Australian toys and games market’s growth. Rising disposable incomes and a growing population contribute significantly. Increasing parental spending on children's education and development fuels demand for educational toys. The increasing popularity of online shopping platforms expands market reach and accessibility. Government initiatives promoting early childhood education also positively impact the market.

Challenges in the Australia Toys and Games Market Market

The Australian toys and games market faces certain challenges. Fluctuations in the economy can impact consumer spending on non-essential items like toys. Supply chain disruptions, especially post-pandemic, can impact product availability and pricing. Intense competition among various players necessitates continuous innovation and effective marketing strategies. Maintaining compliance with stringent safety and quality standards poses an ongoing challenge.

Emerging Opportunities in Australia Toys and Games Market

The Australian toys and games market presents significant long-term growth opportunities. The expanding adoption of AR/VR technology promises innovative product development. Strategic partnerships between toy manufacturers and educational institutions can broaden market reach and brand visibility. Expanding into niche markets, such as educational toys or sustainable products, offers opportunities for differentiation and growth. The rise of influencer marketing offers powerful promotional avenues.

Leading Players in the Australia Toys and Games Market Sector

- Amazon Australia

- K Mart Group (Kmart, Target, and Catch)

- Woolworths Limited (Big W)

- Myer

- Toy Mate

- David Jones

- Mighty Ape

- Toyworld

- ebay

- EB Games

- JB Hifi

- Other Prominent Retailers (Online Toys Australia, Kogan, Temple & Webster, Costco etc.)

Key Milestones in Australia Toys and Games Market Industry

- January 2023: Amazon Web Services (AWS) launched its second infrastructure region in Australia, improving data processing and storage for businesses in the sector.

- June 2023: ImmediateScripts, a telehealth company, was acquired by API for approximately USD 135 Million, indirectly impacting the market through potential shifts in healthcare-related toy sales.

Strategic Outlook for Australia Toys and Games Market Market

The Australian toys and games market holds substantial long-term growth potential. Continued innovation in product design and technology will be key to attracting consumers. Expanding online presence and leveraging e-commerce platforms will be crucial for reaching a wider audience. Strategic partnerships and collaborations will be instrumental in driving market penetration and brand visibility. Focusing on sustainability and ethical sourcing will appeal to environmentally conscious consumers. Companies that effectively adapt to evolving consumer preferences and technological advancements will be best positioned for success.

Australia Toys and Games Market Segmentation

-

1. Type

- 1.1. Card Games

- 1.2. Construction Sets and Models

- 1.3. Dolls and Stuffed Toys

- 1.4. Plastic and Other Toys

- 1.5. Puzzles

- 1.6. Toys for Toddlers and Kids

- 1.7. Video Game Consoles

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

Australia Toys and Games Market Segmentation By Geography

- 1. Australia

Australia Toys and Games Market Regional Market Share

Geographic Coverage of Australia Toys and Games Market

Australia Toys and Games Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Eco-Friendly and Sustainable Toys; Increasing Awareness of Early Childhood Development

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Eco-Friendly and Sustainable Toys; Increasing Awareness of Early Childhood Development

- 3.4. Market Trends

- 3.4.1. Rise in the Number of People Buying Video Games

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Toys and Games Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Card Games

- 5.1.2. Construction Sets and Models

- 5.1.3. Dolls and Stuffed Toys

- 5.1.4. Plastic and Other Toys

- 5.1.5. Puzzles

- 5.1.6. Toys for Toddlers and Kids

- 5.1.7. Video Game Consoles

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon Australia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 K Mart Group (Kmart Target and Catch)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Woolworths Limited (Big W)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Myer

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toy Mate

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 David Jones

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mighty Ape

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyworld

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ebay

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 EB Games

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 JB Hifi

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Other Prominent Retailers (Online Toys Australia KoganTemple & Webster Costco etc )**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Amazon Australia

List of Figures

- Figure 1: Australia Toys and Games Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Toys and Games Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Toys and Games Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Australia Toys and Games Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Australia Toys and Games Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Australia Toys and Games Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Australia Toys and Games Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Australia Toys and Games Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Australia Toys and Games Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Australia Toys and Games Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Australia Toys and Games Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Australia Toys and Games Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Australia Toys and Games Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Australia Toys and Games Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Toys and Games Market?

The projected CAGR is approximately 3.23%.

2. Which companies are prominent players in the Australia Toys and Games Market?

Key companies in the market include Amazon Australia, K Mart Group (Kmart Target and Catch), Woolworths Limited (Big W), Myer, Toy Mate, David Jones, Mighty Ape, Toyworld, ebay, EB Games, JB Hifi, Other Prominent Retailers (Online Toys Australia KoganTemple & Webster Costco etc )**List Not Exhaustive.

3. What are the main segments of the Australia Toys and Games Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Eco-Friendly and Sustainable Toys; Increasing Awareness of Early Childhood Development.

6. What are the notable trends driving market growth?

Rise in the Number of People Buying Video Games.

7. Are there any restraints impacting market growth?

Growing Demand for Eco-Friendly and Sustainable Toys; Increasing Awareness of Early Childhood Development.

8. Can you provide examples of recent developments in the market?

January 2023: Amazon Web Services (AWS) introduced the second AWS infrastructure Region in Australia, constituting a global physical site with clustered data centers. The recently launched AWS Asia-Pacific (Melbourne) Region aims to bring advanced AWS technologies, including computing, storage, artificial intelligence (AI), and machine learning, in closer proximity to a broader customer base. This initiative aims to reduce network latency, enabling customers to meet local data residency regulations more effectively.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Toys and Games Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Toys and Games Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Toys and Games Market?

To stay informed about further developments, trends, and reports in the Australia Toys and Games Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence