Key Insights

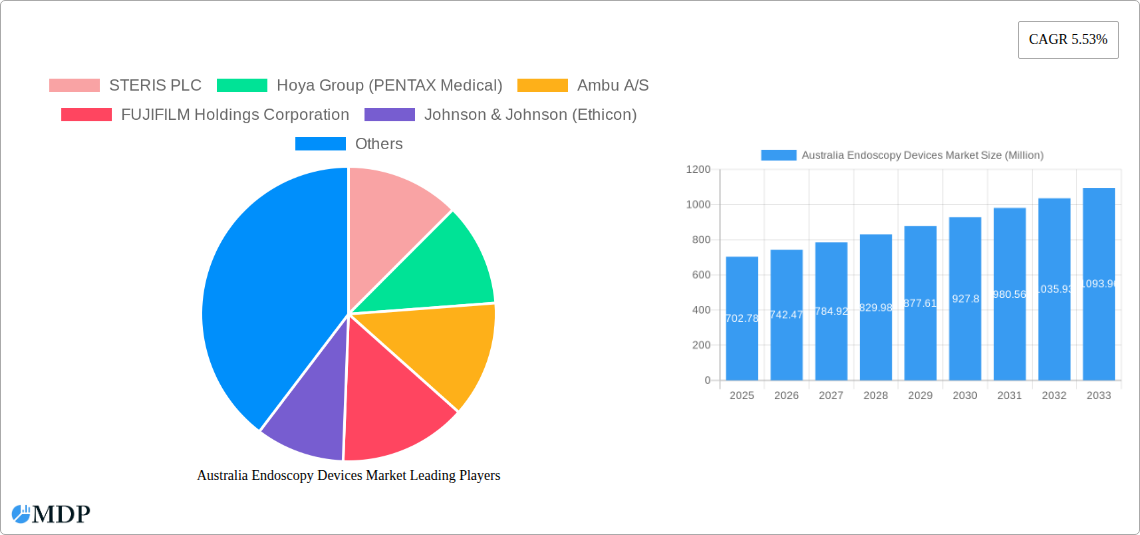

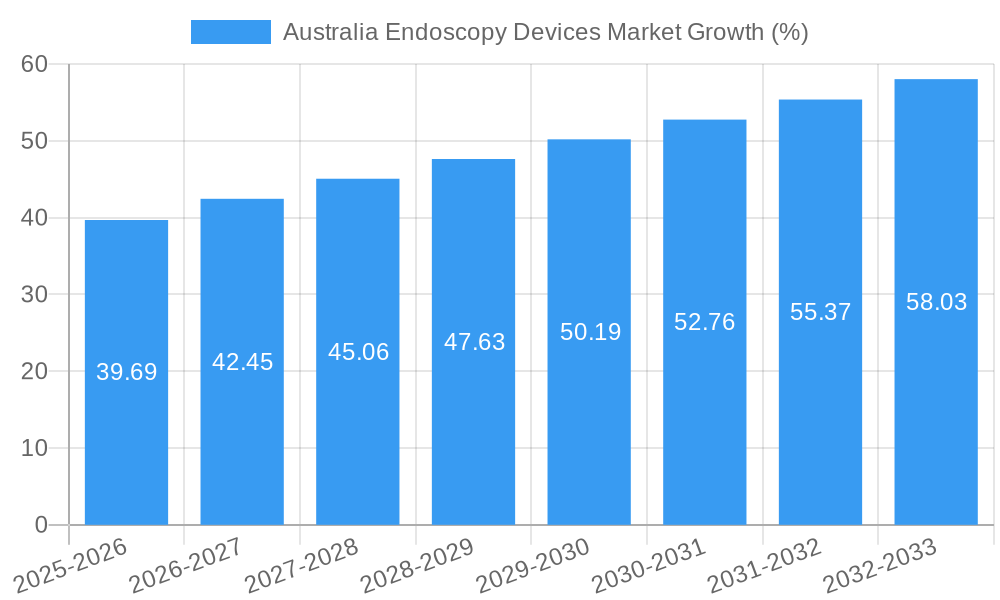

The Australian endoscopy devices market, valued at $702.78 million in 2025, is projected to experience robust growth, driven by a rising geriatric population necessitating more frequent diagnostic and interventional procedures. Technological advancements, such as the integration of artificial intelligence and improved image quality in robotic-assisted endoscopes, are further fueling market expansion. Increased adoption of minimally invasive surgical techniques, particularly in gastroenterology and pulmonology, contributes significantly to the market's growth trajectory. While the market faces some constraints related to high equipment costs and the need for skilled professionals to operate advanced devices, the overall positive outlook is reinforced by government initiatives promoting advanced healthcare infrastructure and the increasing prevalence of chronic diseases requiring endoscopic intervention. The market segmentation reveals significant opportunities across various applications (gastroenterology, pulmonology, etc.) and device types (endoscopes, visualization equipment), with robotic-assisted endoscopy expected to witness particularly strong growth due to its improved precision and reduced invasiveness. Leading players like STERIS PLC, PENTAX Medical, Ambu A/S, and Olympus Corporation are strategically investing in R&D and expanding their product portfolios to capitalize on this growing market. The forecast period of 2025-2033 suggests a continued upward trend, with a Compound Annual Growth Rate (CAGR) of 5.53%, indicating a promising future for the Australian endoscopy devices sector.

The continued growth in the Australian endoscopy devices market is expected to be influenced by several factors including an aging population, increasing prevalence of chronic diseases requiring endoscopic procedures, and a greater emphasis on minimally invasive surgical techniques. Further driving growth are factors like technological innovations that provide better image clarity, enhanced precision, and improved workflow. The market is segmented by application (e.g., gastroenterology, cardiology) and device type (e.g., endoscopes, visualization equipment), offering numerous growth opportunities for both established and emerging players. The competitive landscape is characterized by a mix of global and regional companies constantly striving to improve product quality and expand their market share through strategic acquisitions, partnerships, and technological advancements. Given the positive demographic and technological drivers, the Australian endoscopy devices market is well-positioned for sustained expansion throughout the forecast period, underpinned by the ongoing commitment to improving healthcare infrastructure and patient outcomes.

Australia Endoscopy Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Australia Endoscopy Devices market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The market is segmented by type of device, application, and technology, providing a granular understanding of its growth dynamics. Key players such as STERIS PLC, Hoya Group (PENTAX Medical), Ambu A/S, FUJIFILM Holdings Corporation, Johnson & Johnson (Ethicon), Karl Storz GmbH & Co KG, Medtronic Plc, B Braun Melsungen AG, Stryker Corporation, and Olympus Corporation are analyzed in detail. The report projects a market valued at xx Million by 2033.

Australia Endoscopy Devices Market Market Dynamics & Concentration

The Australian endoscopy devices market exhibits a moderately concentrated structure, with the top 10 players holding approximately xx% of the market share in 2025. Market concentration is influenced by factors including the high capital investment required for R&D, stringent regulatory approvals, and the need for specialized expertise in manufacturing and distribution.

Innovation Drivers: Continuous technological advancements, such as the development of robotic-assisted endoscopes and minimally invasive procedures, are driving market growth. The demand for improved image quality, enhanced precision, and reduced invasiveness fuels innovation.

Regulatory Frameworks: The Therapeutic Goods Administration (TGA) plays a crucial role in regulating medical devices in Australia, ensuring safety and efficacy. Compliance with TGA regulations influences market entry and product development strategies.

Product Substitutes: While endoscopy remains the gold standard for many diagnostic and therapeutic procedures, alternative techniques, such as advanced imaging modalities, are emerging as potential substitutes in certain applications. However, the overall market is expected to remain resilient due to the irreplaceable role of endoscopy in many medical specialties.

End-User Trends: The increasing prevalence of chronic diseases such as gastrointestinal cancers, respiratory ailments, and cardiovascular diseases, coupled with a growing aging population, fuels the demand for endoscopy procedures, driving market growth.

M&A Activities: The Australian endoscopy devices market has witnessed a moderate level of mergers and acquisitions activity in recent years. The number of deals is estimated at approximately xx between 2019 and 2024, primarily driven by strategic expansions and diversification efforts by larger companies.

Australia Endoscopy Devices Market Industry Trends & Analysis

The Australian endoscopy devices market is experiencing robust growth, driven by a confluence of factors. Technological advancements, such as the development of sophisticated robotic-assisted systems and improved visualization equipment, are significantly enhancing the accuracy and effectiveness of endoscopic procedures. This is complemented by a rising prevalence of chronic diseases requiring endoscopic interventions, an aging population, and increasing awareness of minimally invasive surgical techniques.

The market is expected to register a CAGR of xx% during the forecast period (2025-2033). This growth is also fueled by government initiatives promoting advancements in healthcare infrastructure and technological integration within the healthcare system. The market penetration of advanced endoscopy devices is expected to increase significantly, driven by the rising adoption of minimally invasive procedures across various medical specializations. The competitive landscape is characterized by intense competition among established global players and the emergence of innovative start-ups. This rivalry promotes continuous innovation and drives down prices, making advanced endoscopy devices more accessible to healthcare providers and patients. Furthermore, consumer preferences are increasingly shifting towards less invasive procedures with faster recovery times, furthering the growth trajectory of this market.

Leading Markets & Segments in Australia Endoscopy Devices Market

Dominant Segments:

By Application: Gastroenterology remains the largest segment, driven by the high prevalence of gastrointestinal disorders. However, other applications like pulmonology and cardiology are experiencing substantial growth due to technological improvements.

By Type of Device: Endoscopes constitute the largest segment, reflecting the fundamental role these devices play in diagnostic and therapeutic procedures. The market for visualization equipment, including cameras and monitors, is also growing, driven by technological improvements in image quality and resolution.

By Technology: The market for robot-assisted endoscopes is growing rapidly, although it represents a relatively smaller market share compared to other endoscopy technologies. The high cost of these devices limits their widespread adoption, although this is expected to gradually change as the technology improves and becomes more cost-effective.

Key Drivers:

Increased healthcare spending: The Australian government's investment in healthcare infrastructure and technological advancements is a significant growth driver.

Growing prevalence of chronic diseases: The rising incidence of chronic diseases, such as cancer and cardiovascular disease, directly increases demand for endoscopic procedures.

Technological advancements: Improved imaging quality, minimally invasive techniques, and the emergence of robotic-assisted surgery all contribute to growth.

Australia Endoscopy Devices Market Product Developments

Recent product developments focus on enhanced visualization capabilities, improved ergonomics, and integration of advanced technologies like AI and machine learning for better diagnostic accuracy. The development of minimally invasive devices, such as single-use endoscopes, is gaining traction due to reduced infection risk and cost effectiveness. These innovations cater to evolving market demands for safer, more efficient, and cost-effective procedures. The introduction of flexible endoscopes with advanced image resolution, and robotic assistance for precise procedures have significantly enhanced their applications in various medical fields.

Key Drivers of Australia Endoscopy Devices Market Growth

The Australian endoscopy devices market is propelled by several factors. Technological advancements, like the development of single-use endoscopes reducing infection risks, are key. The rising prevalence of chronic diseases necessitates increased diagnostic and therapeutic procedures, further boosting demand. Government initiatives promoting better healthcare infrastructure and technological adoption in hospitals further accelerate market expansion. Finally, the growing aging population, requiring more frequent endoscopic interventions, contributes to consistent growth.

Challenges in the Australia Endoscopy Devices Market Market

The market faces challenges like stringent TGA regulations requiring extensive approvals for new devices, increasing the time and cost of market entry. Supply chain disruptions related to global events can affect the availability of components and finished products. Finally, strong competition among established players requires ongoing innovation and marketing efforts for market share gains. These factors collectively impact market growth and profitability.

Emerging Opportunities in Australia Endoscopy Devices Market

The Australian market presents several long-term growth catalysts. Technological advancements, particularly in AI-powered image analysis and robotic-assisted surgery, will enhance procedure accuracy and reduce invasiveness. Strategic partnerships between device manufacturers and healthcare providers can optimize workflows and enhance market access. Expanding into underserved regions within Australia and focusing on unmet medical needs can also unlock significant growth potential for companies.

Leading Players in the Australia Endoscopy Devices Market Sector

- STERIS PLC

- Hoya Group (PENTAX Medical)

- Ambu A/S

- FUJIFILM Holdings Corporation

- Johnson & Johnson (Ethicon)

- Karl Storz GmbH & Co KG

- Medtronic Plc

- B Braun Melsungen AG

- Stryker Corporation

- Olympus Corporation

Key Milestones in Australia Endoscopy Devices Market Industry

- November 2021: Ambu announced positive clinical trial results for aScope Duodeno 1.5, planning Australia, Europe, and US launch. This signals significant technological advancements and expansion into the Australian market.

- April 2021: Endotherapeutics partnered with Cook Medical to distribute OHNS products, expanding market access and distribution networks.

Strategic Outlook for Australia Endoscopy Devices Market Market

The Australian endoscopy devices market displays strong potential for future growth, driven by technological innovation, increasing prevalence of chronic diseases, and government support for healthcare modernization. Strategic partnerships, focused R&D efforts, and expansion into niche areas will be crucial for companies to capitalize on this market opportunity. Companies focusing on minimally invasive procedures, AI-integrated devices, and robust distribution networks will be well-positioned to achieve significant market share and profitability.

Australia Endoscopy Devices Market Segmentation

-

1. Type of Device

- 1.1. Endoscopes

- 1.2. Endoscopic Operative Device

- 1.3. Visualization Equipment

-

2. Application

- 2.1. Gastroenterology

- 2.2. Pulmonology

- 2.3. Orthopedic Surgery

- 2.4. Cardiology

- 2.5. ENT Surgery

- 2.6. Gynecology

- 2.7. Other Applications

Australia Endoscopy Devices Market Segmentation By Geography

- 1. Australia

Australia Endoscopy Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Preference for Minimally Invasive Surgeries; Rise in the Prevalence of Diseases that Require Endoscopy Procedures

- 3.3. Market Restrains

- 3.3.1. High Cost of Sophisticated Endoscopy Devices

- 3.4. Market Trends

- 3.4.1. Cardiology Segment is Expected to Witness a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Endoscopy Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Endoscopes

- 5.1.2. Endoscopic Operative Device

- 5.1.3. Visualization Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gastroenterology

- 5.2.2. Pulmonology

- 5.2.3. Orthopedic Surgery

- 5.2.4. Cardiology

- 5.2.5. ENT Surgery

- 5.2.6. Gynecology

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 STERIS PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hoya Group (PENTAX Medical)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ambu A/S

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FUJIFILM Holdings Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson & Johnson (Ethicon)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Karl Storz GmbH & Co KG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Medtronic Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 B Braun Melsungen AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stryker Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Olympus Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 STERIS PLC

List of Figures

- Figure 1: Australia Endoscopy Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Endoscopy Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Endoscopy Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Endoscopy Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Australia Endoscopy Devices Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 4: Australia Endoscopy Devices Market Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 5: Australia Endoscopy Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Australia Endoscopy Devices Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Australia Endoscopy Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Australia Endoscopy Devices Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Australia Endoscopy Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Australia Endoscopy Devices Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Australia Endoscopy Devices Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 12: Australia Endoscopy Devices Market Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 13: Australia Endoscopy Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Australia Endoscopy Devices Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 15: Australia Endoscopy Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Australia Endoscopy Devices Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Endoscopy Devices Market?

The projected CAGR is approximately 5.53%.

2. Which companies are prominent players in the Australia Endoscopy Devices Market?

Key companies in the market include STERIS PLC, Hoya Group (PENTAX Medical), Ambu A/S, FUJIFILM Holdings Corporation, Johnson & Johnson (Ethicon), Karl Storz GmbH & Co KG, Medtronic Plc, B Braun Melsungen AG, Stryker Corporation, Olympus Corporation.

3. What are the main segments of the Australia Endoscopy Devices Market?

The market segments include Type of Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 702.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Preference for Minimally Invasive Surgeries; Rise in the Prevalence of Diseases that Require Endoscopy Procedures.

6. What are the notable trends driving market growth?

Cardiology Segment is Expected to Witness a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Sophisticated Endoscopy Devices.

8. Can you provide examples of recent developments in the market?

In November 2021, Ambu announced early clinical trial results for aScope Duodeno 1.5 showing a 100.0% procedure success rate and was planning to launch across Australia, Europe, and the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Endoscopy Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Endoscopy Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Endoscopy Devices Market?

To stay informed about further developments, trends, and reports in the Australia Endoscopy Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence