Key Insights

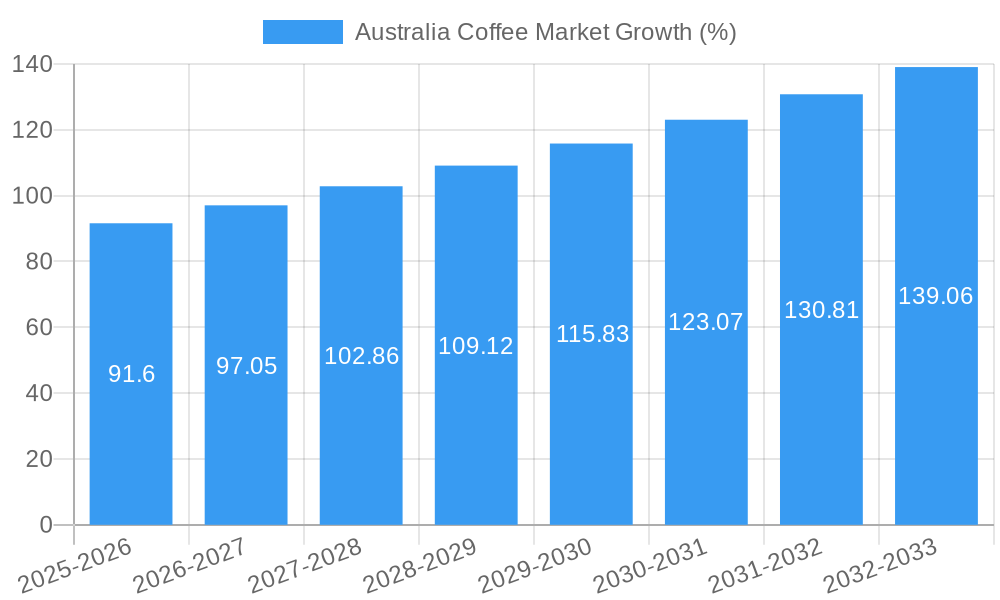

The Australian coffee market, valued at $1.55 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 5.73% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes and a strong café culture contribute significantly to increased coffee consumption. The preference for specialty coffee and premium blends drives demand for higher-quality beans and innovative brewing methods. Furthermore, the expansion of online retail channels offers convenient access to a wider variety of coffee products, supporting market expansion. The market segmentation reveals a diverse landscape, with whole bean coffee, ground coffee, and coffee pods and capsules holding significant shares within the product type segment. Distribution channels are similarly diverse, with hypermarkets/supermarkets maintaining a substantial market presence, complemented by the increasing popularity of online retail and convenience stores. Key players, including JAB Holding Company, Nestlé SA, and numerous local roasters, are engaged in intense competition, fostering innovation and product diversification. The Australian coffee market's future growth hinges on maintaining the appeal of specialty coffee, adapting to changing consumer preferences, and successfully navigating the competitive landscape.

The projected growth trajectory suggests a market value exceeding $2.5 billion by 2033. This optimistic outlook considers the continued strong performance of the café sector, the burgeoning specialty coffee market segment, and the ongoing expansion of e-commerce. However, potential challenges exist, including fluctuations in global coffee bean prices and the impact of economic conditions on consumer spending. Sustaining growth will require continuous innovation in product offerings, effective marketing strategies targeting diverse consumer segments, and a focus on sustainability and ethical sourcing to cater to increasingly environmentally conscious consumers. The competitive landscape will remain dynamic, necessitating strategic adaptation and responsiveness to evolving market trends.

Australia Coffee Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Australian coffee market, encompassing market dynamics, industry trends, leading segments, key players, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for industry stakeholders, investors, and anyone seeking to understand this dynamic market. The report utilizes a wealth of data and insights to provide actionable intelligence for informed decision-making. The total market value is estimated at xx Million in 2025, projected to reach xx Million by 2033.

Australia Coffee Market Market Dynamics & Concentration

The Australian coffee market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, the presence of numerous smaller, specialized roasters and cafes fosters a dynamic competitive landscape. Innovation is a key driver, with companies constantly introducing new products, brewing methods, and sustainability initiatives. Regulatory frameworks related to food safety, labeling, and ethical sourcing influence market operations. The market sees strong competition from tea and other beverages, but coffee's cultural significance and ingrained consumer habits maintain its dominant position. Mergers and acquisitions (M&A) activity has been moderate, with larger players looking to consolidate market share and expand their product portfolios. Between 2019 and 2024, approximately xx M&A deals were recorded, contributing to increased market consolidation. The estimated market share of the top 5 players in 2025 is approximately xx%.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Innovation Drivers: New product launches, sustainable sourcing practices, technological advancements in brewing.

- Regulatory Frameworks: Food safety standards, labeling requirements, ethical sourcing regulations.

- Product Substitutes: Tea, other hot beverages, energy drinks.

- End-User Trends: Growing demand for specialty coffee, increasing focus on ethical and sustainable consumption.

- M&A Activity: Approximately xx deals between 2019 and 2024.

Australia Coffee Market Industry Trends & Analysis

The Australian coffee market is characterized by robust growth, driven by increasing disposable incomes, a strong café culture, and evolving consumer preferences. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 was xx%, and is projected to be xx% from 2025-2033. Technological advancements, such as automated brewing systems and improved roasting techniques, are improving efficiency and product quality. Consumer preferences are shifting towards specialty coffee, single-origin beans, and ethically sourced products. The competitive landscape is intense, with established players facing challenges from both smaller niche roasters and international brands. Market penetration of specialty coffee is estimated at xx% in 2025, indicating significant potential for further growth. The growing popularity of coffee pods and capsules is also shaping market dynamics.

Leading Markets & Segments in Australia Coffee Market

The Australian coffee market is geographically diverse, with consumption concentrated in major metropolitan areas. However, growth is evident across all regions. The ground coffee segment holds the largest market share, driven by its convenience and versatility. However, the coffee pods and capsules segment is experiencing the fastest growth, fueled by consumer preference for convenience and consistency.

Product Type:

- Ground Coffee: Largest market share due to versatility and established consumer base.

- Whole Bean Coffee: Growing segment driven by the rise in home brewing and specialty coffee demand.

- Instant Coffee: Mature segment with steady demand, mainly driven by convenience.

- Coffee Pods & Capsules: Fastest-growing segment due to convenience and ease of use.

Distribution Channel:

- Hypermarkets/Supermarkets: Dominate the market due to wide reach and established distribution networks.

- Convenience/Grocery Stores: Significant channel providing access to a broad customer base.

- Online Retail Stores: Growing rapidly, offering convenience and a wide selection of products.

- Other Distribution Channels: Cafes, restaurants, and specialty coffee shops play a significant role.

Australia Coffee Market Product Developments

Recent product developments highlight a trend towards premiumization, convenience, and sustainability. The market sees innovative brewing technologies, single-origin beans, and ethically sourced coffee gaining popularity. Companies are investing in sustainable packaging and ethical sourcing practices to appeal to environmentally conscious consumers. The growing demand for convenience is driving innovation in pod and capsule formats, alongside ready-to-drink options.

Key Drivers of Australia Coffee Market Growth

Several factors drive the growth of the Australian coffee market: rising disposable incomes fueling premiumization; increasing consumer demand for convenience reflected in pod sales; and the continuous innovation in brewing methods and bean sourcing that enhances the coffee experience. Furthermore, the flourishing café culture and the strong preference for ethically-sourced coffee products are important growth drivers.

Challenges in the Australia Coffee Market Market

The Australian coffee market faces challenges such as fluctuations in global coffee bean prices impacting profitability and supply chain disruptions due to international events. Increased competition from established and emerging players adds further pressure. Furthermore, evolving consumer preferences and the need to maintain sustainability are key challenges for market players. The impact of these challenges on overall market growth is estimated at xx% in 2025.

Emerging Opportunities in Australia Coffee Market

Opportunities lie in expanding into new regions, particularly in regional areas. The growing popularity of plant-based milk alternatives presents an avenue for innovation and product development. Furthermore, strategic partnerships with complementary businesses and technological advancements such as AI-powered brewing systems can foster further growth.

Leading Players in the Australia Coffee Market Sector

- JAB Holding Company

- Nestle SA

- FreshFood Services Pty Ltd

- DC Roasters Pty Ltd

- Vittoria Coffee Pty Ltd

- Sensory Lab Australia Pty Ltd

- Illycaffè SpA

- St Ali Pty Ltd

- Republica Coffee Pty Ltd

- Luigi Lavazza SpA

Key Milestones in Australia Coffee Market Industry

- February 2024: L’OR Espresso partnered with Ferrari, enhancing brand image and visibility.

- April 2024: Nescafe and Arnott's launched Nescafe White Choc Mocha, leveraging existing brand recognition.

- May 2024: Nutella and Lavazza launched a joint product, creating a unique market offering and extending product lines.

Strategic Outlook for Australia Coffee Market Market

The Australian coffee market presents strong long-term growth potential. Strategic opportunities include focusing on premiumization, expanding into new product categories (e.g., ready-to-drink coffee), and leveraging digital marketing channels. Companies that embrace sustainability and ethical sourcing practices will be best positioned to capture market share and drive long-term success. The forecast period of 2025-2033 is expected to show a sustained growth trajectory.

Australia Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. Hypermarkets/ Supermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Australia Coffee Market Segmentation By Geography

- 1. Australia

Australia Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.73% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 There is a growing trend towards specialty coffee

- 3.2.2 with consumers increasingly seeking out single-origin beans

- 3.2.3 artisanal roasting

- 3.2.4 and unique flavor profiles. The rise of independent cafés and micro-roasters has fueled this trend.

- 3.3. Market Restrains

- 3.3.1 The Australian coffee market is highly competitive

- 3.3.2 with numerous local and international players. This can lead to price wars and challenges for new entrants trying to establish a foothold.

- 3.4. Market Trends

- 3.4.1 The demand for fair-trade

- 3.4.2 organic

- 3.4.3 and sustainably sourced coffee is on the rise. Consumers are increasingly looking for products that align with their environmental and social values.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarkets/ Supermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 JAB Holding Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FreshFood Services Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DC Roasters Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vittoria Coffee Pty Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sensory Lab Australia Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Illycaffè SpA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 St Ali Pty Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Republica Coffee Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Luigi Lavazza SpA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JAB Holding Company

List of Figures

- Figure 1: Australia Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Australia Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Australia Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Australia Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Australia Coffee Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Coffee Market?

The projected CAGR is approximately 5.73%.

2. Which companies are prominent players in the Australia Coffee Market?

Key companies in the market include JAB Holding Company, Nestle SA, FreshFood Services Pty Ltd, DC Roasters Pty Ltd, Vittoria Coffee Pty Ltd, Sensory Lab Australia Pty Ltd, Illycaffè SpA, St Ali Pty Ltd, Republica Coffee Pty Ltd, Luigi Lavazza SpA.

3. What are the main segments of the Australia Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.55 Million as of 2022.

5. What are some drivers contributing to market growth?

There is a growing trend towards specialty coffee. with consumers increasingly seeking out single-origin beans. artisanal roasting. and unique flavor profiles. The rise of independent cafés and micro-roasters has fueled this trend..

6. What are the notable trends driving market growth?

The demand for fair-trade. organic. and sustainably sourced coffee is on the rise. Consumers are increasingly looking for products that align with their environmental and social values..

7. Are there any restraints impacting market growth?

The Australian coffee market is highly competitive. with numerous local and international players. This can lead to price wars and challenges for new entrants trying to establish a foothold..

8. Can you provide examples of recent developments in the market?

May 2024: Nutella partnered with Lavazza to launch Nutella & Lavazza’s biscuits and coffee ‘Perfect Match.’ Lavazza also offers the Espresso Barista coffee range, which uses beans from Central and South America, Africa, and Asia and has aromatic notes of flowers, cocoa, and wood.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Coffee Market?

To stay informed about further developments, trends, and reports in the Australia Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence