Key Insights

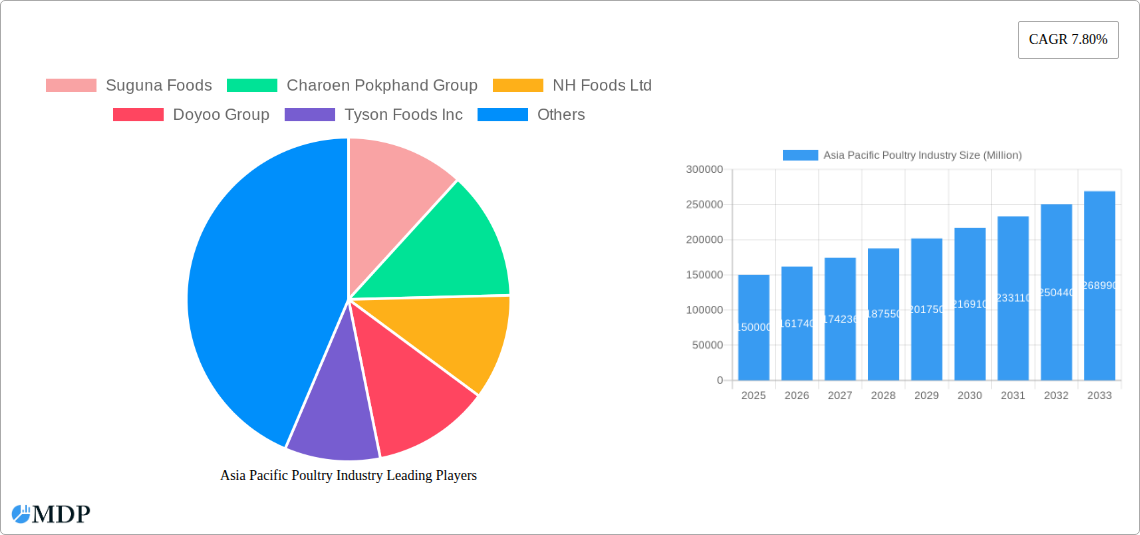

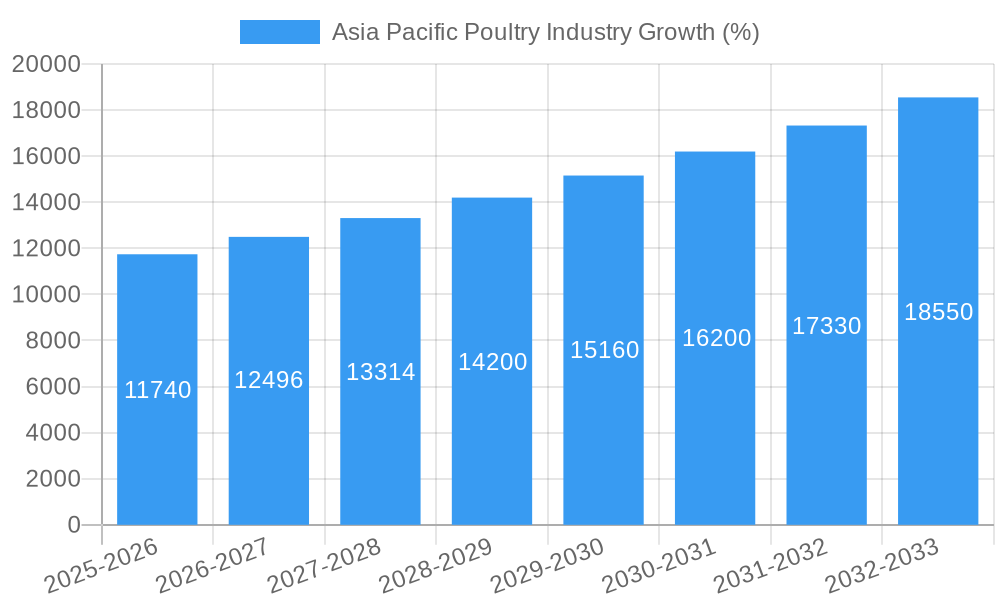

The Asia Pacific poultry industry, encompassing table eggs and chicken meat, is experiencing robust growth, driven by rising disposable incomes, increasing urbanization, and a growing preference for protein-rich diets across the region. The market, valued at approximately $XXX million in 2025 (a logical estimation based on the provided CAGR and market size would need additional information to provide a precise figure), is projected to expand significantly over the forecast period (2025-2033) at a compound annual growth rate (CAGR) of 7.80%. This expansion is fueled by factors such as population growth, particularly in developing economies like India and China, and the increasing adoption of modern poultry farming techniques resulting in higher productivity and efficiency. Key distribution channels include both on-trade (restaurants, hotels) and off-trade (supermarkets, retail stores), with the off-trade segment showing particularly strong growth due to increased consumer preference for convenience and readily available packaged poultry products. Significant players like Suguna Foods, Charoen Pokphand Group, and Tyson Foods are actively shaping market dynamics through strategic investments, technological advancements, and expansion into new markets within the region. However, challenges such as fluctuating feed prices, outbreaks of avian influenza, and stringent regulatory environments continue to present headwinds to the industry's growth.

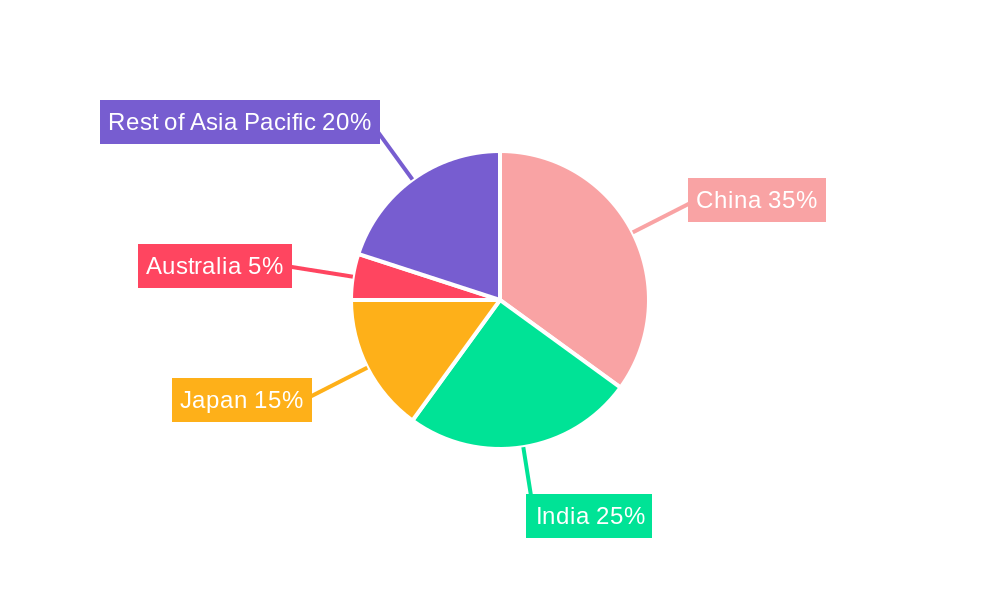

The dominance of China, India, and Japan in the Asia Pacific poultry market is undeniable. While China and India represent vast growth potential due to their massive populations and expanding middle classes, Japan's market exhibits higher per capita consumption, leading to a different growth trajectory. Australia, while a smaller market in terms of volume, displays higher value per unit due to higher standards and premium product offerings. The "Rest of Asia Pacific" segment comprises various countries with varying levels of development and consumption patterns, reflecting the diversity of market dynamics within this broad geographical area. Understanding these regional nuances is crucial for successful market entry and penetration. Segmentation by product type reveals a strong demand for both table eggs and chicken meat, with preferences shifting based on regional culinary traditions and cultural influences. Continued innovation in poultry processing, packaging, and distribution technologies will play a significant role in shaping future market trends and optimizing supply chains to meet growing consumer demand effectively.

Asia Pacific Poultry Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific poultry industry, encompassing market dynamics, leading players, emerging trends, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025, this report is essential for industry stakeholders seeking actionable insights and strategic guidance. The study includes detailed analysis of key segments like table eggs and chicken meat across various distribution channels (on-trade and off-trade) and major countries including China, India, Japan, Australia, and the Rest of Asia Pacific. Expect detailed analysis of key players such as Suguna Foods, Charoen Pokphand Group, and Tyson Foods Inc., among others.

Asia Pacific Poultry Industry Market Dynamics & Concentration

The Asia Pacific poultry industry is characterized by a dynamic interplay of factors shaping market concentration, innovation, and growth. The market is largely fragmented, with several large players and numerous smaller regional producers competing for market share. However, significant consolidation is occurring through mergers and acquisitions (M&A) as larger players seek to expand their reach and market dominance. Over the historical period (2019-2024), an estimated xx M&A deals were recorded, with a notable increase in activity in recent years.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the Asia Pacific poultry market is estimated at xx in 2025, indicating a moderately concentrated market. However, this varies significantly across countries.

- Innovation Drivers: Technological advancements in feed efficiency, disease control, and processing technologies are key drivers of innovation. The adoption of precision agriculture and automation are gaining traction.

- Regulatory Frameworks: Varying regulatory standards across countries impact production practices and trade flows. Food safety regulations and environmental concerns are increasingly shaping industry practices.

- Product Substitutes: Plant-based and cultured meat alternatives are emerging as potential substitutes, but their current market penetration remains limited.

- End-User Trends: Growing demand for convenience foods, health-conscious products, and sustainably produced poultry are shaping consumer preferences.

- M&A Activities: Strategic acquisitions and mergers are reshaping the market landscape, driving consolidation among major players. These activities often involve expanding geographical reach, strengthening product portfolios, and enhancing supply chain efficiencies.

Asia Pacific Poultry Industry Industry Trends & Analysis

The Asia Pacific poultry industry has witnessed robust growth over the past few years, driven by several key factors. A rising population, increasing urbanization, and a growing middle class with greater disposable incomes have fueled demand for poultry products. Technological advancements in poultry farming, such as improved breeding techniques and automated systems, have significantly enhanced production efficiency and output. The compound annual growth rate (CAGR) for the industry is projected at xx% during the forecast period (2025-2033), exceeding xx Million in value by 2033. Market penetration of processed poultry products is increasing, especially in urban areas. However, challenges remain, including managing disease outbreaks, ensuring food safety, and addressing sustainability concerns. Competitive dynamics are intensifying with the entry of new players and the expansion of existing ones, leading to price competition and innovation in product offerings. Changing consumer preferences, such as increasing demand for organic and ethically sourced poultry, are also shaping the market. Technological disruptions, including the rise of alternative protein sources, are beginning to impact the industry.

Leading Markets & Segments in Asia Pacific Poultry Industry

China and India dominate the Asia Pacific poultry market, driven by their vast populations and rapidly growing economies. Within product types, chicken meat accounts for the largest share, followed by table eggs. The off-trade distribution channel (retail, supermarkets) holds a larger share compared to the on-trade (restaurants, hotels).

- China: Key drivers include robust economic growth, expanding middle class, and government support for the agricultural sector.

- India: High population growth, increasing urbanization, and rising per capita income are major factors.

- Japan: Mature market with high consumer preference for high-quality poultry and processed products.

- Australia: Relatively small market compared to others but with high per capita consumption and strong export focus.

- Rest of Asia Pacific: Diverse market with significant growth potential, driven by rising incomes and changing lifestyles.

These markets are characterized by varying regulatory environments, infrastructure levels, and consumer preferences.

Asia Pacific Poultry Industry Product Developments

Recent product innovations focus on convenience, health, and sustainability. This includes ready-to-cook and ready-to-eat products, value-added processed meats, and organic poultry options. Tyson Foods’ recent launch of processed chicken products in Malaysia exemplifies this trend with a focus on halal certification and enhanced product quality (e.g., triple coating for crunch, vacuum marination for tenderness). The emergence of cultured meat represents a potential disruptive technology with Vow's Australian facility representing a significant milestone, showcasing a move towards large-scale production.

Key Drivers of Asia Pacific Poultry Industry Growth

Several factors fuel growth:

- Rising Disposable Incomes: Increasing purchasing power enables greater poultry consumption.

- Population Growth: A larger population base creates greater demand for poultry products.

- Urbanization: Urban centers see higher poultry consumption due to convenience and lifestyle changes.

- Technological Advancements: Improved breeding, feed efficiency, and disease control enhance productivity.

Challenges in the Asia Pacific Poultry Industry Market

The industry faces several hurdles:

- Disease Outbreaks: Avian influenza outbreaks disrupt production and trade. The economic impact of such outbreaks is estimated at xx Million annually.

- Supply Chain Disruptions: Logistics challenges impact product availability and costs.

- Competition: Intense competition from both domestic and international players puts pressure on pricing and profitability.

- Regulatory Changes: Varying regulations across countries complicate operations and trade.

Emerging Opportunities in Asia Pacific Poultry Industry

Long-term growth hinges on:

- Technological innovation: Automation and precision agriculture will enhance productivity.

- Sustainable practices: Environmentally friendly poultry farming will gain traction and appeal to consumers.

- Strategic partnerships: Collaborations across the value chain (from feed to retail) improve efficiency and sustainability.

- Market expansion: Growth in untapped markets within Asia Pacific will drive demand.

Leading Players in the Asia Pacific Poultry Industry Sector

- Suguna Foods

- Charoen Pokphand Group

- NH Foods Ltd

- Doyoo Group

- Tyson Foods Inc

- VH Group

- New Hope Liuhe

- Cargill Inc

- Wen's Food Group

- Sunner Development Co

Key Milestones in Asia Pacific Poultry Industry Industry

- September 2022: Tyson Foods launches fully-cooked frozen chicken products in Malaysia, leveraging innovative cooking technologies.

- October 2022: Tyson Foods launches a range of halal-certified processed chicken products in Malaysia.

- October 2022: Vow opens its large-scale cultured meat facility in Australia, marking a significant step in alternative protein production. Factory 2 is planned for 2H FY24 with a production capacity roughly 100 times larger.

Strategic Outlook for Asia Pacific Poultry Industry Market

The Asia Pacific poultry industry presents significant opportunities for growth, driven by rising incomes, population expansion, and technological advancements. Strategic focus should be on sustainable practices, product innovation, and supply chain optimization. Further consolidation through M&A is anticipated, shaping the market landscape and increasing efficiency. The emergence of alternative proteins will continue to present both challenges and opportunities. Companies that adapt to changing consumer preferences and technological disruptions will be best positioned for long-term success.

Asia Pacific Poultry Industry Segmentation

-

1. Product Type

- 1.1. Table Eggs

-

1.2. Chicken Meat

- 1.2.1. Fresh / Chilled

- 1.2.2. Frozen / Canned

- 1.2.3. Processed

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Specialty Stores

- 2.2.3. Online Retail

- 2.2.4. Others

Asia Pacific Poultry Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Poultry Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Proteins

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Poultry Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Poultry Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Table Eggs

- 5.1.2. Chicken Meat

- 5.1.2.1. Fresh / Chilled

- 5.1.2.2. Frozen / Canned

- 5.1.2.3. Processed

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Specialty Stores

- 5.2.2.3. Online Retail

- 5.2.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia Pacific Poultry Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Poultry Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Poultry Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Poultry Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Poultry Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Poultry Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Poultry Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Suguna Foods

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Charoen Pokphand Group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 NH Foods Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Doyoo Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Tyson Foods Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 VH Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 New Hope Liuhe

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Cargill Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Wen's Food Group

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Sunner Development Co*List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Suguna Foods

List of Figures

- Figure 1: Asia Pacific Poultry Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Poultry Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Poultry Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Poultry Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Asia Pacific Poultry Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Asia Pacific Poultry Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: Asia Pacific Poultry Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Asia Pacific Poultry Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: Asia Pacific Poultry Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia Pacific Poultry Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Asia Pacific Poultry Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia Pacific Poultry Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: China Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Japan Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: India Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South Korea Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Taiwan Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Taiwan Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Asia Pacific Poultry Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Asia Pacific Poultry Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 27: Asia Pacific Poultry Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Asia Pacific Poultry Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 29: Asia Pacific Poultry Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia Pacific Poultry Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: China Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: China Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Japan Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: South Korea Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Korea Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: India Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Australia Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Australia Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: New Zealand Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: New Zealand Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Indonesia Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Indonesia Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Malaysia Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Malaysia Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Singapore Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Singapore Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: Thailand Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Thailand Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Vietnam Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Vietnam Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 53: Philippines Asia Pacific Poultry Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Philippines Asia Pacific Poultry Industry Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Poultry Industry?

The projected CAGR is approximately 7.80%.

2. Which companies are prominent players in the Asia Pacific Poultry Industry?

Key companies in the market include Suguna Foods, Charoen Pokphand Group, NH Foods Ltd, Doyoo Group, Tyson Foods Inc, VH Group, New Hope Liuhe, Cargill Inc, Wen's Food Group, Sunner Development Co*List Not Exhaustive.

3. What are the main segments of the Asia Pacific Poultry Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Increasing Demand for Poultry Products.

7. Are there any restraints impacting market growth?

Presence of Alternative Proteins.

8. Can you provide examples of recent developments in the market?

In October 2022, Vow, an Australian cultured meat start-up opened the first of two planned cultured meat facilities. The facility, Factory 1, can produce 30 tonnes of cultured meat a year, making it the largest plant in the Southern Hemisphere. Plans for Factory 2 were advanced, with the first stage of production scheduled for 2H FY24. It would be roughly 100 times the scale of Factory 1.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Poultry Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Poultry Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Poultry Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Poultry Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence