Key Insights

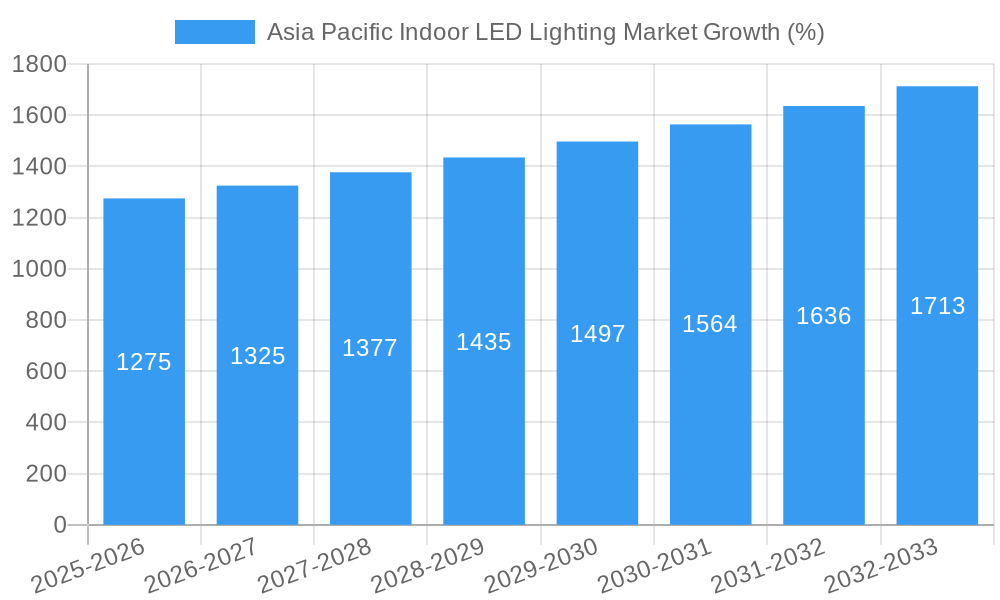

The Asia-Pacific indoor LED lighting market is experiencing robust growth, driven by increasing energy efficiency concerns, government initiatives promoting sustainable technologies, and a rising preference for aesthetically pleasing and long-lasting lighting solutions in both residential and commercial sectors. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 5.10% and the unspecified 2019 market size), is projected to witness significant expansion over the forecast period (2025-2033). Key growth drivers include the increasing adoption of smart lighting systems, the widespread refurbishment and construction of buildings across the region, and the continuous advancements in LED technology, leading to improved brightness, color rendering, and energy efficiency. The segment encompassing commercial and industrial applications is expected to dominate the market, fuelled by the demand for energy-efficient and cost-effective lighting solutions in large-scale projects and businesses. China, India, and Japan are major contributors to the overall market size, with their extensive infrastructure development and large populations driving considerable demand. However, challenges such as the high initial investment costs associated with LED adoption and the potential for counterfeit products in certain markets may act as restraints on growth.

Within the product type segment, downlights, spotlights, and recessed lights are widely popular, owing to their versatility and adaptability in various indoor settings. Linear lighting systems are also gaining traction, particularly in commercial spaces requiring uniform illumination. The residential segment is projected to exhibit steady growth, fueled by increasing disposable incomes and growing awareness of the benefits of energy-efficient lighting. While the Asia-Pacific market is leading the growth, other regions such as South Korea, Taiwan, and Australia are also showing promising growth potential and contributing to the overall market expansion. Competitive landscape analysis reveals the presence of both global and regional players, leading to increased market competition and innovation in product design, features, and pricing. This competitive environment benefits consumers with a wider variety of choices and continuous improvements in LED lighting technology.

Asia Pacific Indoor LED Lighting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia Pacific Indoor LED Lighting Market, covering market dynamics, industry trends, leading segments, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, investors, and businesses looking to capitalize on growth opportunities within this dynamic market. The market is segmented by product type (Downlights, Spotlights, Recessed Lights, Linear Lighting Systems), end-user industry (Commercial, Industrial, Residential, Agricultural Lighting), and geography (China, India, Japan, Rest of Asia-Pacific).

Asia Pacific Indoor LED Lighting Market Market Dynamics & Concentration

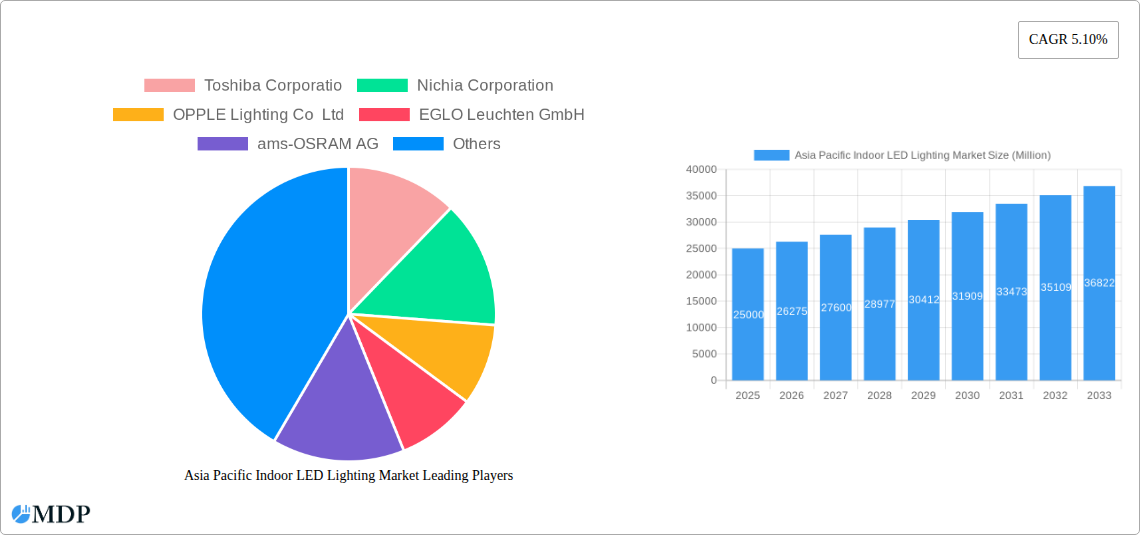

The Asia Pacific indoor LED lighting market exhibits a moderately concentrated landscape, with key players like Toshiba Corporation, Nichia Corporation, OPPLE Lighting Co Ltd, EGLO Leuchten GmbH, ams-OSRAM AG, Signify (Philips), Endo Lighting Corporation, ACUITY BRANDS INC, Guangdong PAK Corporation Co Ltd, and Panasonic Holdings Corporation holding significant market share. Market concentration is influenced by factors such as economies of scale, brand recognition, and technological advancements. The market share of these companies is estimated at xx%, with the top five players accounting for approximately xx% of the total revenue in 2025. Innovation is a key driver, with companies constantly developing energy-efficient and smart lighting solutions. Stringent regulatory frameworks promoting energy conservation further influence market dynamics. The presence of alternative lighting technologies, although limited, represents a subtle competitive threat. End-user trends, favoring aesthetically pleasing and smart lighting solutions, are shaping product development. M&A activity in the sector has been moderate, with approximately xx deals recorded between 2019 and 2024.

Asia Pacific Indoor LED Lighting Market Industry Trends & Analysis

The Asia Pacific indoor LED lighting market is projected to witness robust growth during the forecast period (2025-2033), driven by increasing urbanization, rising disposable incomes, and government initiatives promoting energy efficiency. Technological disruptions, such as the integration of IoT and smart home technologies, are transforming the market, leading to the adoption of smart lighting systems. Consumer preferences are shifting towards energy-efficient, aesthetically pleasing, and customizable lighting solutions. The market exhibits a competitive landscape with both established players and emerging companies vying for market share. The Compound Annual Growth Rate (CAGR) is estimated to be xx% during the forecast period. Market penetration of LED lighting is expected to reach xx% by 2033, driven by decreasing LED prices and increasing awareness of energy efficiency.

Leading Markets & Segments in Asia Pacific Indoor LED Lighting Market

China dominates the Asia Pacific indoor LED lighting market, followed by India and Japan. This dominance is primarily due to rapid urbanization, infrastructure development, and increasing investments in commercial and residential construction.

Key Drivers for China:

- Robust economic growth and government initiatives supporting energy efficiency

- Extensive infrastructure development projects

- High demand from commercial and residential sectors

Key Drivers for India:

- Rapid urbanization and rising disposable incomes

- Government emphasis on energy conservation

- Increasing adoption of LED lighting in various sectors

Key Drivers for Japan:

- Technological advancements in LED lighting

- Focus on energy efficiency and sustainability

- High consumer demand for high-quality lighting products

Dominant Segments:

- Product Type: Downlights and Recessed Lights hold a significant market share due to widespread adoption in commercial and residential settings.

- End-User Industry: The commercial sector, driven by office spaces, retail establishments, and hospitality, accounts for the largest share of the market.

Asia Pacific Indoor LED Lighting Market Product Developments

Recent product innovations focus on enhanced energy efficiency, improved aesthetics, smart functionalities (IoT integration), and customization options. Manufacturers are incorporating advanced technologies like tunable white and human-centric lighting to cater to diverse consumer needs. This is leading to the development of advanced lighting systems which increase the competitive edge, improving market fit through superior performance and user experience.

Key Drivers of Asia Pacific Indoor LED Lighting Market Growth

Technological advancements, such as the development of more efficient and cost-effective LED chips, are a primary driver. Government regulations promoting energy efficiency incentivize LED adoption. The growing demand for energy-efficient lighting solutions, coupled with increasing disposable incomes and urbanization in the region, fuels market growth. Specific examples include government subsidies for LED lighting and stricter energy efficiency standards in building codes.

Challenges in the Asia Pacific Indoor LED Lighting Market Market

Supply chain disruptions can lead to price fluctuations and delays in product delivery, impacting profitability. Intense competition among manufacturers puts pressure on pricing and profit margins. Regulatory hurdles and varying standards across different countries complicate market entry and expansion. These factors, estimated to collectively impact market growth by xx% annually, require strategic mitigation strategies by market players.

Emerging Opportunities in Asia Pacific Indoor LED Lighting Market

The integration of smart lighting technologies with IoT platforms, creating smart homes and smart cities, presents significant opportunities. Strategic partnerships between LED lighting manufacturers and technology companies can accelerate market penetration and product development. Expansion into niche segments like agricultural lighting and specialized industrial applications offers high-growth potential. These factors promise to propel the market’s long-term growth trajectory.

Leading Players in the Asia Pacific Indoor LED Lighting Market Sector

- Toshiba Corporation

- Nichia Corporation

- OPPLE Lighting Co Ltd

- EGLO Leuchten GmbH

- ams-OSRAM AG

- Signify (Philips)

- Endo Lighting Corporation

- ACUITY BRANDS INC

- Guangdong PAK Corporation Co Ltd

- Panasonic Holdings Corporation

Key Milestones in Asia Pacific Indoor LED Lighting Market Industry

- March 2023: Signify and Perfect Plants expand their collaboration on grow lights, signifying increased focus on specialized lighting applications.

- April 2023: Luminaire LED launches its Vandal Resistant Downlight (VRDL) line, showcasing innovation in robust lighting solutions.

- April 2023: Luminis introduces the Inline series of external luminaires, expanding product offerings beyond indoor applications.

Strategic Outlook for Asia Pacific Indoor LED Lighting Market Market

The Asia Pacific indoor LED lighting market presents substantial growth potential driven by continued urbanization, technological innovation, and favorable government policies. Companies should focus on developing energy-efficient, smart, and aesthetically appealing lighting solutions to cater to evolving consumer preferences. Strategic partnerships and expansion into niche markets will be crucial for securing a competitive edge and maximizing market share. Long-term growth is projected to be fueled by both technological advancement and increasing consumer awareness of sustainable lighting solutions.

Asia Pacific Indoor LED Lighting Market Segmentation

-

1. Indoor Lighting

- 1.1. Agricultural Lighting

-

1.2. Commercial

- 1.2.1. Office

- 1.2.2. Retail

- 1.2.3. Others

- 1.3. Industrial and Warehouse

- 1.4. Residential

Asia Pacific Indoor LED Lighting Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Indoor LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Precision and Accuracy over Conventional Alternatives; Miniaturization of Component Parts

- 3.3. Market Restrains

- 3.3.1. Regulation Compliance Associated with Laser Usage

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 5.1.1. Agricultural Lighting

- 5.1.2. Commercial

- 5.1.2.1. Office

- 5.1.2.2. Retail

- 5.1.2.3. Others

- 5.1.3. Industrial and Warehouse

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Indoor Lighting

- 6. Asia Pacific Asia Pacific Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1. undefined

- 7. China Asia Pacific Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1. undefined

- 8. Japan Asia Pacific Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1. undefined

- 9. India Asia Pacific Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. South Korea Asia Pacific Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1. undefined

- 11. Taiwan Asia Pacific Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Australia Asia Pacific Indoor LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Toshiba Corporatio

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nichia Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 OPPLE Lighting Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 EGLO Leuchten GmbH

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 ams-OSRAM AG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Signify (Philips)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Endo Lighting Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 ACUITY BRANDS INC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Guangdong PAK Corporation Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Panasonic Holdings Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Toshiba Corporatio

List of Figures

- Figure 1: Asia Pacific Indoor LED Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Indoor LED Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Indoor LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Indoor LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Asia Pacific Indoor LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 4: Asia Pacific Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2019 & 2032

- Table 5: Asia Pacific Indoor LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia Pacific Indoor LED Lighting Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Asia Pacific Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Asia Pacific Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Asia Pacific Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia Pacific Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Asia Pacific Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Asia Pacific Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Asia Pacific Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Asia Pacific Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Asia Pacific Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Asia Pacific Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Asia Pacific Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia Pacific Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Asia Pacific Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Asia Pacific Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Asia Pacific Indoor LED Lighting Market Revenue Million Forecast, by Indoor Lighting 2019 & 2032

- Table 22: Asia Pacific Indoor LED Lighting Market Volume K Unit Forecast, by Indoor Lighting 2019 & 2032

- Table 23: Asia Pacific Indoor LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Asia Pacific Indoor LED Lighting Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: China Asia Pacific Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: China Asia Pacific Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Japan Asia Pacific Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Japan Asia Pacific Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: South Korea Asia Pacific Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: South Korea Asia Pacific Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: India Asia Pacific Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: India Asia Pacific Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Australia Asia Pacific Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Australia Asia Pacific Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: New Zealand Asia Pacific Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: New Zealand Asia Pacific Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Indonesia Asia Pacific Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Indonesia Asia Pacific Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Malaysia Asia Pacific Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Malaysia Asia Pacific Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Singapore Asia Pacific Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Singapore Asia Pacific Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Thailand Asia Pacific Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Thailand Asia Pacific Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Vietnam Asia Pacific Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Vietnam Asia Pacific Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Philippines Asia Pacific Indoor LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Philippines Asia Pacific Indoor LED Lighting Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Indoor LED Lighting Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the Asia Pacific Indoor LED Lighting Market?

Key companies in the market include Toshiba Corporatio, Nichia Corporation, OPPLE Lighting Co Ltd, EGLO Leuchten GmbH, ams-OSRAM AG, Signify (Philips), Endo Lighting Corporation, ACUITY BRANDS INC, Guangdong PAK Corporation Co Ltd, Panasonic Holdings Corporation.

3. What are the main segments of the Asia Pacific Indoor LED Lighting Market?

The market segments include Indoor Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Precision and Accuracy over Conventional Alternatives; Miniaturization of Component Parts.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Regulation Compliance Associated with Laser Usage.

8. Can you provide examples of recent developments in the market?

April 2023: Luminis, a recognized innovator and manufacturer of specification-grade lighting systems, has developed the Inline series of external luminaires. With various heights and lighting module options, inline bollards and columns elevate outside areas.April 2023: Luminaire LED, a recognized leader in vandal-resistant lighting systems, announced the launch of its Vandal Resistant Downlight (VRDL) line, the company's first downlight. The architecturally designed series has a clean, elegant style while also being able to withstand hard abuse and demanding situations.March 2023: Signify, and Perfect Plants has expanded their collaboration on grow lights. Driving this partnership is Perfect Plant’s ambition to become a prominent manufacturer of starting materials for medicinal cannabis cultivation. Perfect Plants has branches in the Netherlands, Canada, and South Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Indoor LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Indoor LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Indoor LED Lighting Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Indoor LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence