Key Insights

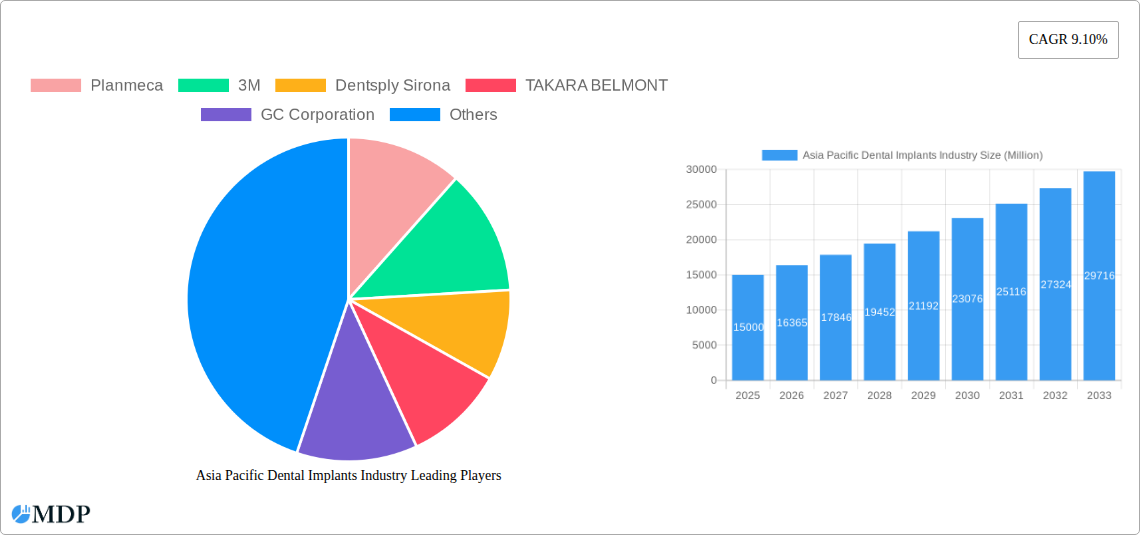

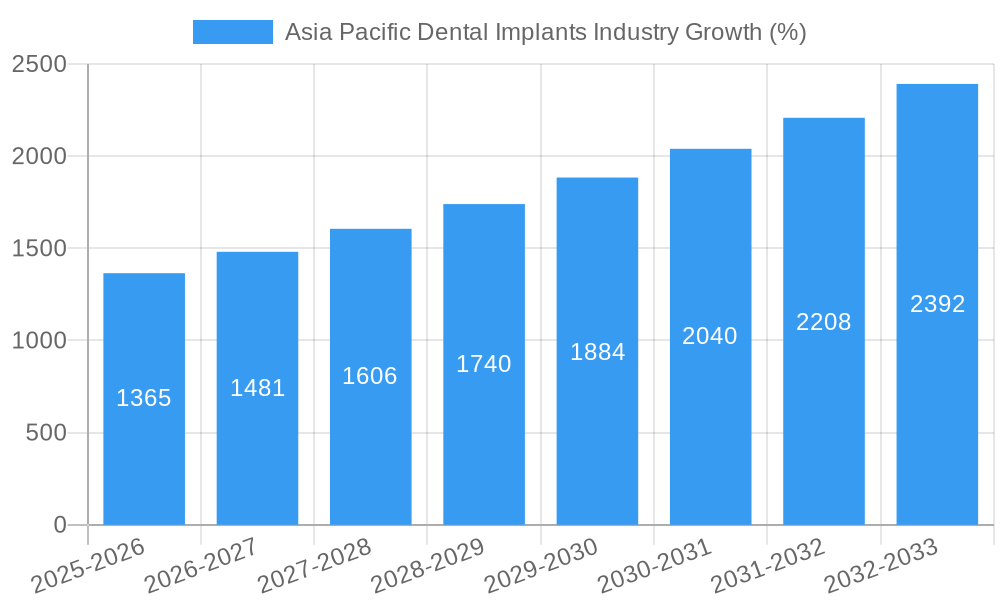

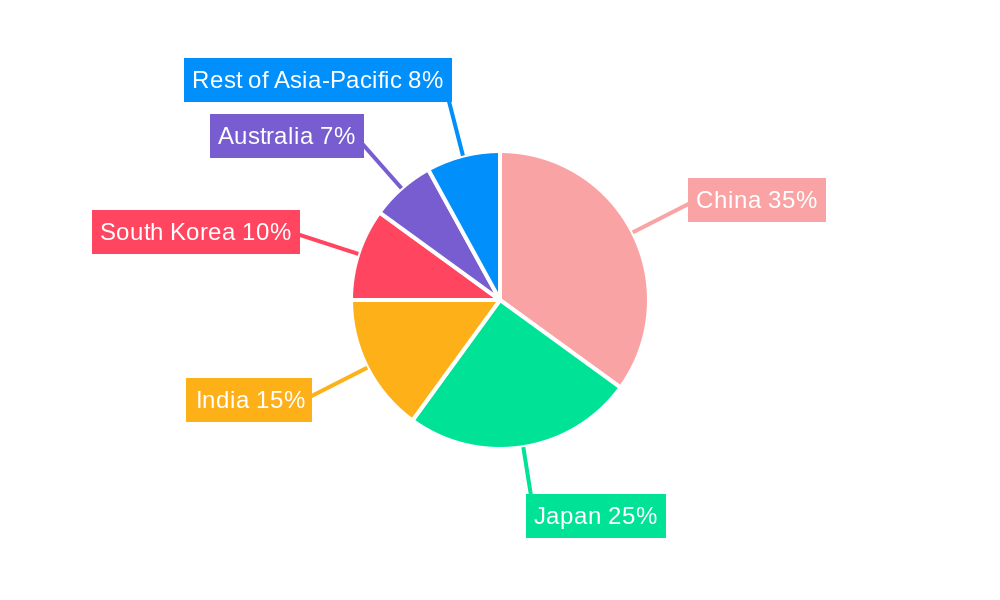

The Asia-Pacific dental implants market is experiencing robust growth, driven by factors such as rising prevalence of dental diseases, increasing geriatric population, improving oral healthcare infrastructure, and growing awareness about cosmetic dentistry. The region's diverse demographics and varying levels of economic development contribute to a complex market landscape. While countries like China, Japan, and India represent significant market segments due to their large populations and expanding middle classes with greater disposable income, countries like South Korea and Australia showcase advanced dental technologies and higher per capita spending on dental care. The 9.10% CAGR suggests a substantial increase in market value over the forecast period (2025-2033). This growth is further fueled by technological advancements in implant materials, minimally invasive surgical techniques, and digital dentistry solutions. However, high treatment costs and uneven distribution of dental professionals across the region present challenges. The market is segmented by product type (dental lasers and radiology equipment), treatment type (orthodontic, endodontic, periodontic, prosthodontic), and end-user (hospitals, clinics, and other end-users). Competition is intense, with a mix of global players like 3M, Dentsply Sirona, and Danaher Corporation alongside regional players vying for market share. The segment of hard tissue lasers within dental lasers is anticipated to witness particularly strong growth due to their efficacy in various dental procedures. Further research into specific regional data, particularly at the country level within Asia-Pacific, will help refine market projections and pinpoint specific growth opportunities.

The forecast period of 2025-2033 presents significant opportunities for market expansion, particularly in areas with burgeoning middle classes and growing awareness of dental health. Strategic partnerships, expansion into underserved markets, and investment in research and development of innovative technologies will be crucial for success. The market's segmentation offers scope for targeted marketing strategies focusing on specific needs of individual segments, for instance, developing cost-effective solutions for emerging markets or advanced technologies for developed ones. Furthermore, addressing issues of uneven access to dental care and affordability will be crucial to unlock the full potential of this rapidly growing market. Companies are likely to focus on creating value-added services and improving the overall patient experience to gain a competitive edge in this dynamic sector.

Asia Pacific Dental Implants Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Asia Pacific dental implants industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report delves into market dynamics, leading players, and future growth opportunities. The report utilizes robust data and analysis to project a market valued at xx Million by 2033.

Asia Pacific Dental Implants Industry Market Dynamics & Concentration

The Asia Pacific dental implants market is experiencing significant growth, driven by factors including rising disposable incomes, increasing prevalence of dental diseases, and advancements in implant technology. Market concentration is moderate, with several key players vying for market share. The market share of the top five players is estimated at xx%, indicating a competitive landscape. Innovation is a key driver, with companies constantly developing new materials, techniques, and equipment. Regulatory frameworks vary across the region, impacting market access and product approvals. Substitutes, such as dentures and bridges, still exist, but the demand for implants is steadily increasing due to their superior functionality and aesthetics. End-user trends favor minimally invasive procedures and advanced technologies. Mergers and acquisitions (M&A) activities are frequent, with xx M&A deals recorded between 2019 and 2024, reflecting consolidation and expansion strategies within the industry.

- Market Concentration: Moderate, top 5 players holding xx% market share.

- Innovation Drivers: Advancements in materials, techniques, and digital dentistry.

- Regulatory Frameworks: Vary across countries, impacting market access.

- Product Substitutes: Dentures and bridges, but implant demand is growing.

- End-User Trends: Preference for minimally invasive and technologically advanced procedures.

- M&A Activity: xx deals between 2019 and 2024, indicating industry consolidation.

Asia Pacific Dental Implants Industry Industry Trends & Analysis

The Asia Pacific dental implants market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This robust growth is fueled by several key factors. Rising awareness of oral health and the increasing prevalence of periodontal diseases are major contributors. Technological advancements, particularly in digital dentistry and minimally invasive techniques, are enhancing treatment efficacy and patient experience. Changing consumer preferences are leaning towards aesthetic and functional improvements, boosting demand for dental implants. Intense competition among established players and new entrants is driving innovation and price competitiveness, benefiting consumers. Market penetration of dental implants remains relatively low in some regions, providing significant growth potential. Specific growth drivers include government initiatives promoting oral healthcare, increased dental insurance coverage, and the rising middle class with higher disposable income.

Leading Markets & Segments in Asia Pacific Dental Implants Industry

Japan, China, Australia, and South Korea are the leading markets in the Asia Pacific region. The strong economic growth and increasing healthcare expenditure in these countries are key drivers.

Key Drivers:

- Japan: High prevalence of dental diseases and strong technological adoption.

- China: Rapid economic growth, expanding middle class, and government initiatives.

- Australia: High disposable incomes and strong private healthcare sector.

- South Korea: Advanced healthcare infrastructure and high consumer demand for aesthetic treatments.

Segment Analysis:

- Dental Laser: Soft tissue lasers dominate due to their widespread applications in various dental procedures. Hard tissue lasers are gradually gaining traction due to their precision and efficacy.

- Radiology Equipment: Intra-oral radiology equipment enjoys higher demand owing to its widespread availability and affordability compared to extra-oral equipment.

- By Treatment: Prosthodontic segment is leading due to its broad applications and market share.

- By End-User: Hospitals and specialized dental clinics are leading segments, with clinics particularly driving demand due to their high number.

Asia Pacific Dental Implants Industry Product Developments

Recent innovations focus on improving implant materials, design, and surgical techniques. Biocompatible materials like zirconia and titanium alloys are gaining popularity due to their enhanced osseointegration. Digital workflows, including CAD/CAM technology and 3D printing, are revolutionizing implant placement. Miniature implants and guided surgery techniques minimize invasiveness and improve patient outcomes. These advancements enhance implant longevity, reduce complications, and improve overall patient satisfaction, driving market growth.

Key Drivers of Asia Pacific Dental Implants Industry Growth

Several key drivers are propelling the growth of the Asia Pacific dental implants market. Technological advancements, including the adoption of CAD/CAM technology and digital imaging, enable precise implant placement and improved outcomes. The rising prevalence of periodontal diseases and tooth loss is increasing the demand for restorative solutions. Growing disposable incomes and increased awareness of oral health amongst the population fuel the market growth. Government initiatives promoting oral healthcare access and improved insurance coverage further contribute to this growth.

Challenges in the Asia Pacific Dental Implants Industry Market

The Asia Pacific dental implants market faces challenges such as high treatment costs limiting access, particularly in lower-income populations. Variations in regulatory standards across the region create complexity for manufacturers seeking broader market access. Supply chain disruptions and fluctuations in raw material prices can impact product availability and cost. Intense competition and pricing pressures necessitate continuous innovation and efficiency improvements to maintain profitability. The market is facing a xx% decline in revenue due to the above mentioned factors.

Emerging Opportunities in Asia Pacific Dental Implants Industry

The Asia Pacific dental implants market presents significant opportunities for growth. The rising adoption of digital technologies opens doors for more efficient implant procedures and reduced treatment times. Strategic partnerships between manufacturers, dental professionals, and healthcare providers can improve access to implants in underserved areas. Expanding into emerging markets with lower market penetration rates presents considerable growth potential. The focus on minimally invasive treatments and personalized medicine presents exciting avenues for innovation.

Leading Players in the Asia Pacific Dental Implants Industry Sector

- Planmeca

- 3M

- Dentsply Sirona

- TAKARA BELMONT

- GC Corporation

- Danaher Corporation (Gendex Dental Systems)

- Carestream Health

- Yoshida Dental Mfg Co Ltd

- Straumann Holding AG

Key Milestones in Asia Pacific Dental Implants Industry Industry

- March 2022: CGbio signed a five-year contract worth USD 8.0 Million (10 billion KRW) with Kerunxi Medical to export Bongros Dental, a bone graft material, significantly expanding its market reach.

- January 2022: Neoss Group established Neoss China by acquiring Legend Life Tech, strengthening its presence in a key growth market and enhancing its market share.

Strategic Outlook for Asia Pacific Dental Implants Industry Market

The Asia Pacific dental implants market exhibits strong growth potential, driven by technological advancements, rising disposable incomes, and increased awareness of oral health. Strategic partnerships, focusing on innovation and market expansion, will be crucial for success. Companies should prioritize the development of cost-effective, minimally invasive solutions to cater to a broader patient base. Expanding into emerging markets and enhancing distribution networks will be vital in capturing the significant growth opportunities within this dynamic market.

Asia Pacific Dental Implants Industry Segmentation

-

1. Product

-

1.1. General and Diagnostics Equipment

-

1.1.1. Dental Laser

- 1.1.1.1. Soft Tissue Lasers

- 1.1.1.2. Hard Tissue Lasers

-

1.1.2. Radiology Equipment

- 1.1.2.1. Extra Oral Radiology Equipment

- 1.1.2.2. Intra-oral Radiology Equipment

- 1.1.3. Dental Chair and Equipment

- 1.1.4. Other General and Diagnostic Equipment

-

1.1.1. Dental Laser

-

1.2. Dental Consumables

- 1.2.1. Dental Biomaterial

- 1.2.2. Dental Implants

- 1.2.3. Crowns and Bridges

- 1.2.4. Other Dental Consumables

- 1.3. Other Dental Devices

-

1.1. General and Diagnostics Equipment

-

2. Treatment

- 2.1. Orthodontic

- 2.2. Endodontic

- 2.3. Peridontic

- 2.4. Prosthodontic

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End Users

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. South Korea

- 4.6. Rest of Asia-Pacific

Asia Pacific Dental Implants Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. South Korea

- 6. Rest of Asia Pacific

Asia Pacific Dental Implants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Aging Population; Rising Demand for Cosmetic Dentistry

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Reimbursement of Dental Care; Increasing Cost of Surgeries

- 3.4. Market Trends

- 3.4.1. Prosthodontic Equipment is Expected to Hold a Significant Market Share in the Over The Forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. General and Diagnostics Equipment

- 5.1.1.1. Dental Laser

- 5.1.1.1.1. Soft Tissue Lasers

- 5.1.1.1.2. Hard Tissue Lasers

- 5.1.1.2. Radiology Equipment

- 5.1.1.2.1. Extra Oral Radiology Equipment

- 5.1.1.2.2. Intra-oral Radiology Equipment

- 5.1.1.3. Dental Chair and Equipment

- 5.1.1.4. Other General and Diagnostic Equipment

- 5.1.1.1. Dental Laser

- 5.1.2. Dental Consumables

- 5.1.2.1. Dental Biomaterial

- 5.1.2.2. Dental Implants

- 5.1.2.3. Crowns and Bridges

- 5.1.2.4. Other Dental Consumables

- 5.1.3. Other Dental Devices

- 5.1.1. General and Diagnostics Equipment

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontic

- 5.2.2. Endodontic

- 5.2.3. Peridontic

- 5.2.4. Prosthodontic

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.5.5. South Korea

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. China Asia Pacific Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. General and Diagnostics Equipment

- 6.1.1.1. Dental Laser

- 6.1.1.1.1. Soft Tissue Lasers

- 6.1.1.1.2. Hard Tissue Lasers

- 6.1.1.2. Radiology Equipment

- 6.1.1.2.1. Extra Oral Radiology Equipment

- 6.1.1.2.2. Intra-oral Radiology Equipment

- 6.1.1.3. Dental Chair and Equipment

- 6.1.1.4. Other General and Diagnostic Equipment

- 6.1.1.1. Dental Laser

- 6.1.2. Dental Consumables

- 6.1.2.1. Dental Biomaterial

- 6.1.2.2. Dental Implants

- 6.1.2.3. Crowns and Bridges

- 6.1.2.4. Other Dental Consumables

- 6.1.3. Other Dental Devices

- 6.1.1. General and Diagnostics Equipment

- 6.2. Market Analysis, Insights and Forecast - by Treatment

- 6.2.1. Orthodontic

- 6.2.2. Endodontic

- 6.2.3. Peridontic

- 6.2.4. Prosthodontic

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Clinics

- 6.3.3. Other End Users

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. South Korea

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Japan Asia Pacific Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. General and Diagnostics Equipment

- 7.1.1.1. Dental Laser

- 7.1.1.1.1. Soft Tissue Lasers

- 7.1.1.1.2. Hard Tissue Lasers

- 7.1.1.2. Radiology Equipment

- 7.1.1.2.1. Extra Oral Radiology Equipment

- 7.1.1.2.2. Intra-oral Radiology Equipment

- 7.1.1.3. Dental Chair and Equipment

- 7.1.1.4. Other General and Diagnostic Equipment

- 7.1.1.1. Dental Laser

- 7.1.2. Dental Consumables

- 7.1.2.1. Dental Biomaterial

- 7.1.2.2. Dental Implants

- 7.1.2.3. Crowns and Bridges

- 7.1.2.4. Other Dental Consumables

- 7.1.3. Other Dental Devices

- 7.1.1. General and Diagnostics Equipment

- 7.2. Market Analysis, Insights and Forecast - by Treatment

- 7.2.1. Orthodontic

- 7.2.2. Endodontic

- 7.2.3. Peridontic

- 7.2.4. Prosthodontic

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Clinics

- 7.3.3. Other End Users

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. South Korea

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. India Asia Pacific Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. General and Diagnostics Equipment

- 8.1.1.1. Dental Laser

- 8.1.1.1.1. Soft Tissue Lasers

- 8.1.1.1.2. Hard Tissue Lasers

- 8.1.1.2. Radiology Equipment

- 8.1.1.2.1. Extra Oral Radiology Equipment

- 8.1.1.2.2. Intra-oral Radiology Equipment

- 8.1.1.3. Dental Chair and Equipment

- 8.1.1.4. Other General and Diagnostic Equipment

- 8.1.1.1. Dental Laser

- 8.1.2. Dental Consumables

- 8.1.2.1. Dental Biomaterial

- 8.1.2.2. Dental Implants

- 8.1.2.3. Crowns and Bridges

- 8.1.2.4. Other Dental Consumables

- 8.1.3. Other Dental Devices

- 8.1.1. General and Diagnostics Equipment

- 8.2. Market Analysis, Insights and Forecast - by Treatment

- 8.2.1. Orthodontic

- 8.2.2. Endodontic

- 8.2.3. Peridontic

- 8.2.4. Prosthodontic

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Clinics

- 8.3.3. Other End Users

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. South Korea

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Australia Asia Pacific Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. General and Diagnostics Equipment

- 9.1.1.1. Dental Laser

- 9.1.1.1.1. Soft Tissue Lasers

- 9.1.1.1.2. Hard Tissue Lasers

- 9.1.1.2. Radiology Equipment

- 9.1.1.2.1. Extra Oral Radiology Equipment

- 9.1.1.2.2. Intra-oral Radiology Equipment

- 9.1.1.3. Dental Chair and Equipment

- 9.1.1.4. Other General and Diagnostic Equipment

- 9.1.1.1. Dental Laser

- 9.1.2. Dental Consumables

- 9.1.2.1. Dental Biomaterial

- 9.1.2.2. Dental Implants

- 9.1.2.3. Crowns and Bridges

- 9.1.2.4. Other Dental Consumables

- 9.1.3. Other Dental Devices

- 9.1.1. General and Diagnostics Equipment

- 9.2. Market Analysis, Insights and Forecast - by Treatment

- 9.2.1. Orthodontic

- 9.2.2. Endodontic

- 9.2.3. Peridontic

- 9.2.4. Prosthodontic

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Clinics

- 9.3.3. Other End Users

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. South Korea

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South Korea Asia Pacific Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. General and Diagnostics Equipment

- 10.1.1.1. Dental Laser

- 10.1.1.1.1. Soft Tissue Lasers

- 10.1.1.1.2. Hard Tissue Lasers

- 10.1.1.2. Radiology Equipment

- 10.1.1.2.1. Extra Oral Radiology Equipment

- 10.1.1.2.2. Intra-oral Radiology Equipment

- 10.1.1.3. Dental Chair and Equipment

- 10.1.1.4. Other General and Diagnostic Equipment

- 10.1.1.1. Dental Laser

- 10.1.2. Dental Consumables

- 10.1.2.1. Dental Biomaterial

- 10.1.2.2. Dental Implants

- 10.1.2.3. Crowns and Bridges

- 10.1.2.4. Other Dental Consumables

- 10.1.3. Other Dental Devices

- 10.1.1. General and Diagnostics Equipment

- 10.2. Market Analysis, Insights and Forecast - by Treatment

- 10.2.1. Orthodontic

- 10.2.2. Endodontic

- 10.2.3. Peridontic

- 10.2.4. Prosthodontic

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Clinics

- 10.3.3. Other End Users

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. South Korea

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Asia Pacific Asia Pacific Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. General and Diagnostics Equipment

- 11.1.1.1. Dental Laser

- 11.1.1.1.1. Soft Tissue Lasers

- 11.1.1.1.2. Hard Tissue Lasers

- 11.1.1.2. Radiology Equipment

- 11.1.1.2.1. Extra Oral Radiology Equipment

- 11.1.1.2.2. Intra-oral Radiology Equipment

- 11.1.1.3. Dental Chair and Equipment

- 11.1.1.4. Other General and Diagnostic Equipment

- 11.1.1.1. Dental Laser

- 11.1.2. Dental Consumables

- 11.1.2.1. Dental Biomaterial

- 11.1.2.2. Dental Implants

- 11.1.2.3. Crowns and Bridges

- 11.1.2.4. Other Dental Consumables

- 11.1.3. Other Dental Devices

- 11.1.1. General and Diagnostics Equipment

- 11.2. Market Analysis, Insights and Forecast - by Treatment

- 11.2.1. Orthodontic

- 11.2.2. Endodontic

- 11.2.3. Peridontic

- 11.2.4. Prosthodontic

- 11.3. Market Analysis, Insights and Forecast - by End User

- 11.3.1. Hospitals

- 11.3.2. Clinics

- 11.3.3. Other End Users

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. Japan

- 11.4.3. India

- 11.4.4. Australia

- 11.4.5. South Korea

- 11.4.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. China Asia Pacific Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 13. Japan Asia Pacific Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 14. India Asia Pacific Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 15. South Korea Asia Pacific Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 16. Taiwan Asia Pacific Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 17. Australia Asia Pacific Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Asia-Pacific Asia Pacific Dental Implants Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Planmeca

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 3M

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Dentsply Sirona

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 TAKARA BELMONT

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 GC Corporation

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Danaher Corporation (Gendex Dental Systems)

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Carestream Health

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Yoshida Dental Mfg Co Ltd *List Not Exhaustive

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Straumann Holding AG

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.1 Planmeca

List of Figures

- Figure 1: Asia Pacific Dental Implants Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Dental Implants Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 5: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 6: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Treatment 2019 & 2032

- Table 7: Asia Pacific Dental Implants Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Asia Pacific Dental Implants Industry Volume K Units Forecast, by End User 2019 & 2032

- Table 9: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 11: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 13: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 15: China Asia Pacific Dental Implants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: China Asia Pacific Dental Implants Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Pacific Dental Implants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Asia Pacific Dental Implants Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: India Asia Pacific Dental Implants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India Asia Pacific Dental Implants Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 21: South Korea Asia Pacific Dental Implants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Asia Pacific Dental Implants Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: Taiwan Asia Pacific Dental Implants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Taiwan Asia Pacific Dental Implants Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 25: Australia Asia Pacific Dental Implants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Asia Pacific Dental Implants Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 27: Rest of Asia-Pacific Asia Pacific Dental Implants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Asia-Pacific Asia Pacific Dental Implants Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 29: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 30: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 31: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 32: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Treatment 2019 & 2032

- Table 33: Asia Pacific Dental Implants Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 34: Asia Pacific Dental Implants Industry Volume K Units Forecast, by End User 2019 & 2032

- Table 35: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 36: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 37: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 39: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 40: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 41: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 42: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Treatment 2019 & 2032

- Table 43: Asia Pacific Dental Implants Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 44: Asia Pacific Dental Implants Industry Volume K Units Forecast, by End User 2019 & 2032

- Table 45: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 47: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 49: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 50: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 51: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 52: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Treatment 2019 & 2032

- Table 53: Asia Pacific Dental Implants Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 54: Asia Pacific Dental Implants Industry Volume K Units Forecast, by End User 2019 & 2032

- Table 55: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 56: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 57: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 59: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 60: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 61: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 62: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Treatment 2019 & 2032

- Table 63: Asia Pacific Dental Implants Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 64: Asia Pacific Dental Implants Industry Volume K Units Forecast, by End User 2019 & 2032

- Table 65: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 66: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 67: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 68: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 69: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 70: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 71: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 72: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Treatment 2019 & 2032

- Table 73: Asia Pacific Dental Implants Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 74: Asia Pacific Dental Implants Industry Volume K Units Forecast, by End User 2019 & 2032

- Table 75: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 76: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 77: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 78: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 79: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 80: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Product 2019 & 2032

- Table 81: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Treatment 2019 & 2032

- Table 82: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Treatment 2019 & 2032

- Table 83: Asia Pacific Dental Implants Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 84: Asia Pacific Dental Implants Industry Volume K Units Forecast, by End User 2019 & 2032

- Table 85: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 86: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Geography 2019 & 2032

- Table 87: Asia Pacific Dental Implants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 88: Asia Pacific Dental Implants Industry Volume K Units Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Dental Implants Industry?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the Asia Pacific Dental Implants Industry?

Key companies in the market include Planmeca, 3M, Dentsply Sirona, TAKARA BELMONT, GC Corporation, Danaher Corporation (Gendex Dental Systems), Carestream Health, Yoshida Dental Mfg Co Ltd *List Not Exhaustive, Straumann Holding AG.

3. What are the main segments of the Asia Pacific Dental Implants Industry?

The market segments include Product, Treatment, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Aging Population; Rising Demand for Cosmetic Dentistry.

6. What are the notable trends driving market growth?

Prosthodontic Equipment is Expected to Hold a Significant Market Share in the Over The Forecast period.

7. Are there any restraints impacting market growth?

Lack of Proper Reimbursement of Dental Care; Increasing Cost of Surgeries.

8. Can you provide examples of recent developments in the market?

March 2022: CGbio signed a five-year contract worth USD 8.0 million (10 billion KRW) with Kerunxi Medical to export Bongros Dental, a bone graft material.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Dental Implants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Dental Implants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Dental Implants Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Dental Implants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence