Key Insights

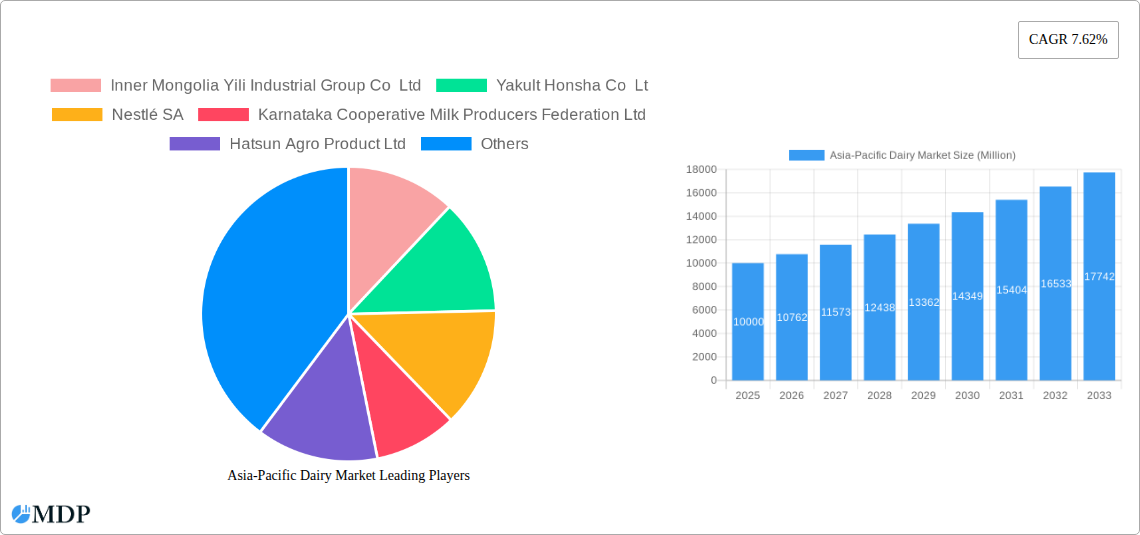

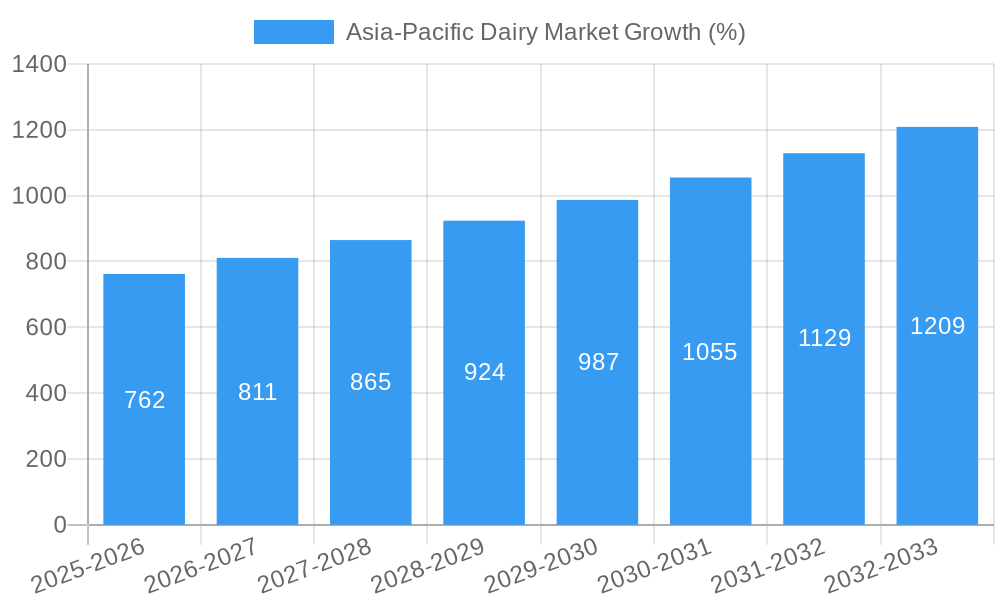

The Asia-Pacific dairy market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.62% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes across several Asian nations, particularly in rapidly developing economies like India and Indonesia, are leading to increased consumer spending on dairy products. A growing preference for convenient and nutritious dairy options, including yogurt, cheese, and specialized milk formulations (e.g., lactose-free, high-protein), is further stimulating demand. The burgeoning food service industry and expanding retail channels, including e-commerce platforms, are also contributing to market growth. However, factors such as fluctuating milk prices, stringent regulatory frameworks in some regions, and the potential impact of climate change on milk production pose challenges to sustained growth. The market is highly segmented by product category (butter, others), distribution channel (on-trade, off-trade), and country. Key players such as Inner Mongolia Yili Industrial Group Co Ltd, Nestlé SA, and Fonterra Co-operative Group Limited are actively competing through product innovation, strategic partnerships, and expansion into new markets within the region.

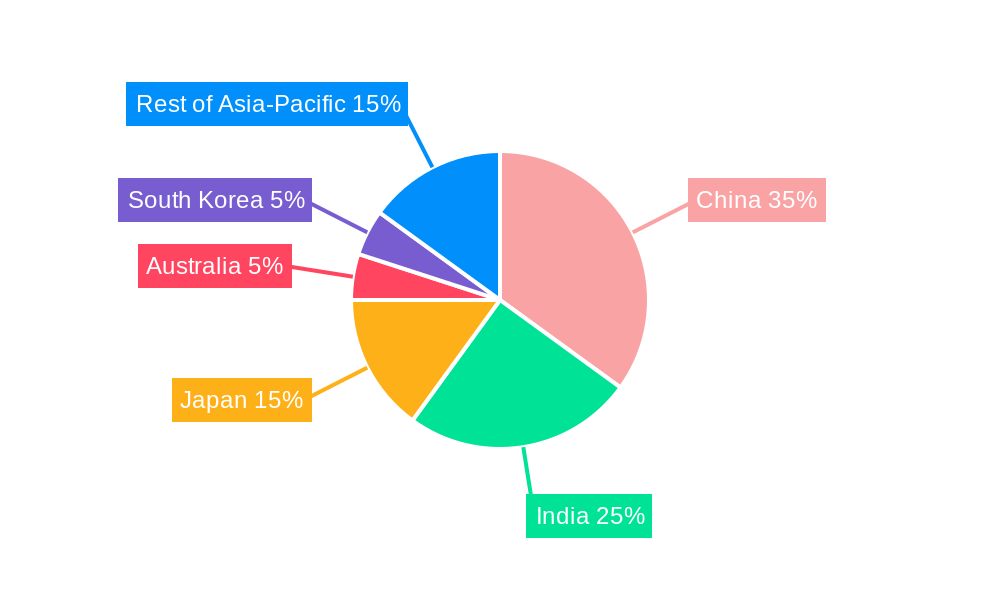

The regional distribution of market share within Asia-Pacific reveals considerable variation. China and India, with their massive populations and growing middle classes, are the dominant markets, representing a significant portion of overall revenue. Japan, South Korea, and Australia also contribute substantial value to the market, though their growth rates may be slightly lower compared to the emerging economies. The "Rest of Asia-Pacific" segment presents a promising opportunity for future expansion, given the presence of several rapidly developing nations with rising dairy consumption patterns. Competition is intense, with both multinational corporations and regional dairy producers vying for market share. Success will depend on factors such as efficient supply chains, brand building, and the ability to meet the evolving needs and preferences of consumers in diverse cultural contexts across the region.

Asia-Pacific Dairy Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific dairy market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, leading players, and future growth opportunities across key segments and countries within the region. The report projects a xx Million market value by 2033, showcasing significant growth potential.

Asia-Pacific Dairy Market Dynamics & Concentration

The Asia-Pacific dairy market is characterized by a dynamic interplay of factors influencing its concentration and growth trajectory. Market concentration is moderate, with a few large players like Nestlé SA and Inner Mongolia Yili Industrial Group Co Ltd holding significant market share, while numerous regional and local players contribute to the overall landscape. Innovation, driven by evolving consumer preferences for healthier and more convenient dairy products, is a key driver. Stringent regulatory frameworks governing food safety and labeling influence product development and market entry. The presence of substitute products, such as plant-based alternatives, poses a competitive challenge. Consumer trends, including increasing health consciousness and demand for premium products, significantly impact market growth. Furthermore, mergers and acquisitions (M&A) activity, as evidenced by recent deals like China Mengniu’s acquisition of Bellamy's Australia, plays a crucial role in shaping market dynamics.

- Market Share: Nestlé SA and Inner Mongolia Yili Industrial Group Co Ltd hold approximately xx% and xx% of market share respectively (estimated 2025).

- M&A Activity: Over the historical period (2019-2024), an estimated xx M&A deals were recorded in the Asia-Pacific dairy sector.

Asia-Pacific Dairy Market Industry Trends & Analysis

The Asia-Pacific dairy market exhibits robust growth driven by several key factors. Rising disposable incomes, particularly in emerging economies like India and Indonesia, fuel increased dairy consumption. Technological advancements in processing and packaging enhance product quality, shelf life, and convenience, further boosting demand. Consumer preferences are shifting towards healthier options, such as low-fat and organic dairy products, creating new market opportunities. The competitive landscape is intense, with both established multinational corporations and local players vying for market share, leading to price competition and innovation. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), driven primarily by increased consumption in key markets like China and India. Market penetration of premium dairy products is growing steadily, representing a significant segment of overall market expansion.

Leading Markets & Segments in Asia-Pacific Dairy Market

China, India, and Japan represent the leading markets within the Asia-Pacific dairy sector, contributing a significant share to overall market value (estimated at xx Million, xx Million, and xx Million respectively in 2025). The "Others" category within dairy products, encompassing specialized items such as flavored milk and functional dairy drinks, shows substantial growth potential. The off-trade distribution channel dominates, reflecting the substantial contribution of retail channels like supermarkets and hypermarkets.

- Key Drivers in Leading Markets:

- China: Robust economic growth, expanding middle class, and government support for the dairy industry.

- India: Large population, growing demand for dairy products, and government initiatives to improve dairy farming practices.

- Japan: High per capita dairy consumption, preference for premium products, and advanced distribution infrastructure.

- Segment Dominance: The off-trade channel holds a larger market share compared to the on-trade channel. The "Others" category demonstrates strong growth potential compared to the Butter segment due to increasing diversification in dairy product offerings.

Asia-Pacific Dairy Market Product Developments

Recent years have witnessed significant innovation in dairy product development, driven by consumer demand for convenience and health-conscious options. Technological advancements in processing and packaging have enabled the creation of extended-shelf life products and new product formats, such as ready-to-drink beverages and single-serve portions. Companies are focusing on developing products with functional benefits, incorporating ingredients that promote health and well-being. This focus on innovation is pivotal in gaining a competitive advantage and responding to the evolving needs of the Asia-Pacific consumer base.

Key Drivers of Asia-Pacific Dairy Market Growth

Several key factors fuel the growth of the Asia-Pacific dairy market. Rising disposable incomes and urbanization are driving increased dairy consumption. Government initiatives promoting dairy farming and improving milk quality further boost market expansion. Advancements in dairy processing technologies enhance product quality and efficiency, while favorable demographic trends, particularly a growing middle class, are expected to maintain strong demand for dairy products.

Challenges in the Asia-Pacific Dairy Market

The Asia-Pacific dairy market faces several challenges. Fluctuations in milk prices and supply chain disruptions impact profitability. Stringent regulatory requirements for food safety and labeling increase compliance costs. Intense competition from both established players and emerging brands exerts pressure on profit margins. Furthermore, the rise of plant-based alternatives presents a significant competitive challenge. These factors collectively impact market growth and profitability.

Emerging Opportunities in Asia-Pacific Dairy Market

Significant opportunities exist for growth in the Asia-Pacific dairy market. The growing demand for convenient and value-added products presents opportunities for innovation. Strategic partnerships and collaborations, as well as technological advancements, such as precision farming techniques and improved processing technologies, will significantly contribute to increasing productivity and efficiency. Expanding into underserved markets in the region represents a compelling route to market expansion.

Leading Players in the Asia-Pacific Dairy Market Sector

- Inner Mongolia Yili Industrial Group Co Ltd

- Yakult Honsha Co Ltd

- Nestlé SA

- Karnataka Cooperative Milk Producers Federation Ltd

- Hatsun Agro Product Ltd

- Fonterra Co-operative Group Limited

- Meiji Dairies Corporation

- Gujarat Co-operative Milk Marketing Federation Ltd

- Dodla Dairy Ltd

- China Mengniu Dairy Company Ltd

Key Milestones in Asia-Pacific Dairy Market Industry

- September 2023: China Mengniu acquired organic infant formula producer Bellamy's Australia for USD 1 Billion, significantly expanding its presence in the infant nutrition segment.

- July 2022: Nestlé launched Nescafe Gold Cappuccino ice cream in Malaysia, expanding its product portfolio in the region.

- July 2022: Yili opened a new dairy hub in North China to enhance production of fresh milk, infant formula, and cheese, strengthening its local manufacturing capabilities.

Strategic Outlook for Asia-Pacific Dairy Market

The Asia-Pacific dairy market is poised for sustained growth, driven by a combination of factors including rising incomes, changing consumer preferences, and technological advancements. Companies can leverage this growth potential by focusing on innovation, developing premium and value-added products, and strengthening their supply chain capabilities. Strategic partnerships and acquisitions will be instrumental in enhancing market reach and expanding product portfolios. The market’s future success hinges on adaptability, sustainability, and responsiveness to the changing needs of a dynamic consumer landscape.

Asia-Pacific Dairy Market Segmentation

-

1. Category

-

1.1. Butter

-

1.1.1. By Product Type

- 1.1.1.1. Cultured Butter

- 1.1.1.2. Uncultured Butter

-

1.1.1. By Product Type

-

1.2. Cheese

- 1.2.1. Natural Cheese

- 1.2.2. Processed Cheese

-

1.3. Cream

- 1.3.1. Double Cream

- 1.3.2. Single Cream

- 1.3.3. Whipping Cream

- 1.3.4. Others

-

1.4. Dairy Desserts

- 1.4.1. Cheesecakes

- 1.4.2. Frozen Desserts

- 1.4.3. Ice Cream

- 1.4.4. Mousses

-

1.5. Milk

- 1.5.1. Condensed milk

- 1.5.2. Flavored Milk

- 1.5.3. Fresh Milk

- 1.5.4. Powdered Milk

- 1.5.5. UHT Milk

- 1.6. Sour Milk Drinks

-

1.7. Yogurt

- 1.7.1. Flavored Yogurt

- 1.7.2. Unflavored Yogurt

-

1.1. Butter

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

Asia-Pacific Dairy Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Dairy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Application and Benefits of Collagen Across End-User Industry; Implementation of Business Strategies by Market Players

- 3.3. Market Restrains

- 3.3.1. Intolerance of Vegetarian/Vegan Population Towards Animal Sourced Protein

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Butter

- 5.1.1.1. By Product Type

- 5.1.1.1.1. Cultured Butter

- 5.1.1.1.2. Uncultured Butter

- 5.1.1.1. By Product Type

- 5.1.2. Cheese

- 5.1.2.1. Natural Cheese

- 5.1.2.2. Processed Cheese

- 5.1.3. Cream

- 5.1.3.1. Double Cream

- 5.1.3.2. Single Cream

- 5.1.3.3. Whipping Cream

- 5.1.3.4. Others

- 5.1.4. Dairy Desserts

- 5.1.4.1. Cheesecakes

- 5.1.4.2. Frozen Desserts

- 5.1.4.3. Ice Cream

- 5.1.4.4. Mousses

- 5.1.5. Milk

- 5.1.5.1. Condensed milk

- 5.1.5.2. Flavored Milk

- 5.1.5.3. Fresh Milk

- 5.1.5.4. Powdered Milk

- 5.1.5.5. UHT Milk

- 5.1.6. Sour Milk Drinks

- 5.1.7. Yogurt

- 5.1.7.1. Flavored Yogurt

- 5.1.7.2. Unflavored Yogurt

- 5.1.1. Butter

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. China Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Inner Mongolia Yili Industrial Group Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Yakult Honsha Co Lt

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Nestlé SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Karnataka Cooperative Milk Producers Federation Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hatsun Agro Product Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Fonterra Co-operative Group Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Meiji Dairies Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Gujarat Co-operative Milk Marketing Federation Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Dodla Dairy Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 China Mengniu Dairy Company Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Inner Mongolia Yili Industrial Group Co Ltd

List of Figures

- Figure 1: Asia-Pacific Dairy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Dairy Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Dairy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Dairy Market Revenue Million Forecast, by Category 2019 & 2032

- Table 3: Asia-Pacific Dairy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Asia-Pacific Dairy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Dairy Market Revenue Million Forecast, by Category 2019 & 2032

- Table 14: Asia-Pacific Dairy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Asia-Pacific Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Dairy Market?

The projected CAGR is approximately 7.62%.

2. Which companies are prominent players in the Asia-Pacific Dairy Market?

Key companies in the market include Inner Mongolia Yili Industrial Group Co Ltd, Yakult Honsha Co Lt, Nestlé SA, Karnataka Cooperative Milk Producers Federation Ltd, Hatsun Agro Product Ltd, Fonterra Co-operative Group Limited, Meiji Dairies Corporation, Gujarat Co-operative Milk Marketing Federation Ltd, Dodla Dairy Ltd, China Mengniu Dairy Company Ltd.

3. What are the main segments of the Asia-Pacific Dairy Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Application and Benefits of Collagen Across End-User Industry; Implementation of Business Strategies by Market Players.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Intolerance of Vegetarian/Vegan Population Towards Animal Sourced Protein.

8. Can you provide examples of recent developments in the market?

September 2023: China Mengniu acquired organic infant formula producer Bellamy's Australia for USD 1 billion.July 2022: Nestle launched Nescafe Gold Cappuccino ice cream in Malaysia.July 2022: In order to produce fresh milk, infant formula, and cheese, Yili opened a dairy hub in the area where the business is based, in North China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Dairy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Dairy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Dairy Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Dairy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence