Key Insights

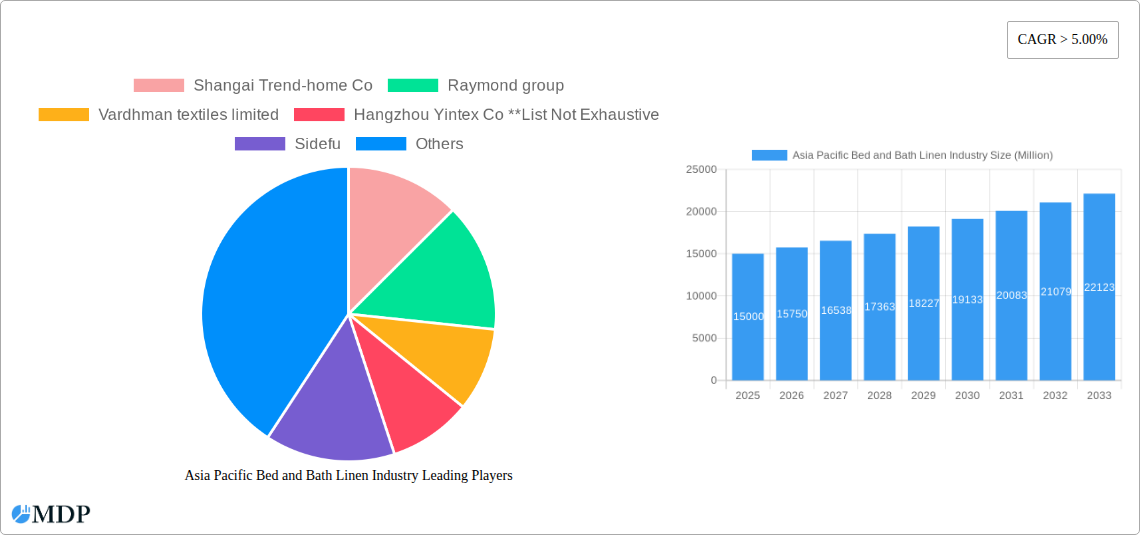

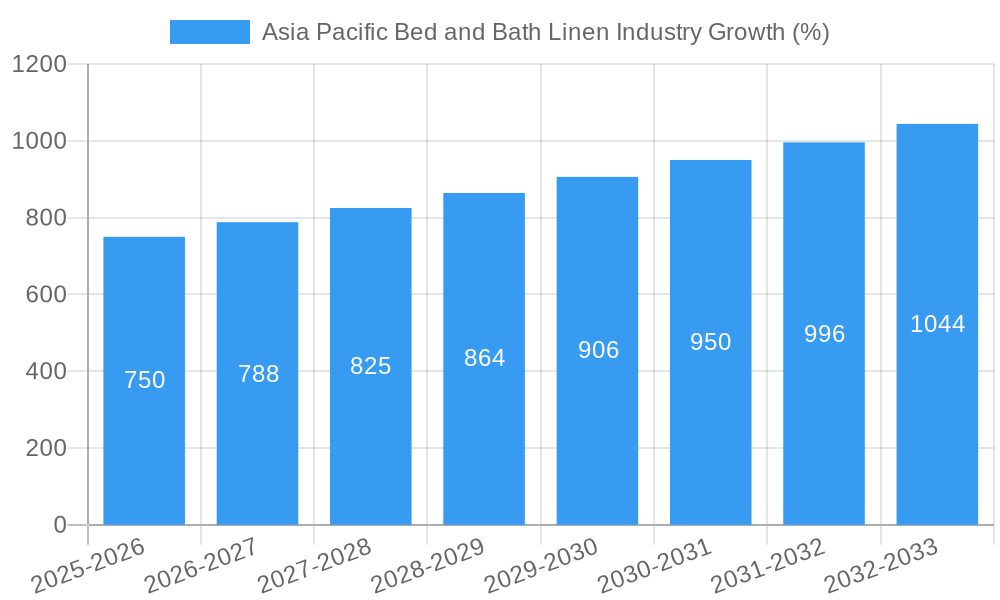

The Asia-Pacific bed and bath linen market is experiencing robust growth, driven by rising disposable incomes, increasing urbanization, and a shift towards premium and sustainable products. The market's Compound Annual Growth Rate (CAGR) exceeding 5% indicates a significant expansion trajectory from 2019 to 2033. Key segments driving this growth include e-commerce sales, which offer convenience and wider selection to consumers, and the residential end-user segment, fueled by a growing population and preference for comfortable home environments. While the market is dominated by major players like Shanghai Trend-home Co, Raymond Group, and Vardhman Textiles, the presence of numerous smaller companies and the increasing popularity of online marketplaces fosters competition and innovation. Growth is further propelled by evolving consumer preferences toward eco-friendly materials, innovative designs, and personalized bedding options. The diverse regional landscape, with significant contributions from China, India, and Japan, presents unique opportunities for both established players and new entrants. However, fluctuations in raw material prices and potential disruptions in global supply chains pose challenges to consistent market expansion. The forecast period (2025-2033) anticipates continued expansion, with a potential increase in market share for e-commerce channels and sustained demand for high-quality, comfortable, and aesthetically pleasing bed and bath linens across the region. The market's future is bright, albeit dynamic and susceptible to macroeconomic factors.

The significant growth in the Asia-Pacific bed and bath linen market is largely influenced by the burgeoning middle class in key countries such as India and China, who are increasingly willing to invest in enhancing their home comfort and aesthetics. This trend is further amplified by the growing popularity of online shopping, allowing for convenient access to a wider range of products and brands. Furthermore, the increasing focus on health and hygiene is driving demand for high-quality, hypoallergenic materials. Competitive pressures are shaping the market, pushing manufacturers to innovate in terms of product design, material sourcing, and sustainability initiatives. The segment showing the highest potential for future growth is the e-commerce channel, driven by the increasing adoption of online shopping in the region. However, challenges remain, including maintaining consistent quality, managing supply chain complexities, and adapting to changing consumer preferences. Strategic partnerships, focused marketing campaigns, and a strong emphasis on customer satisfaction are crucial for companies to thrive in this dynamic market. Accurate forecasting requires considering factors like economic stability, evolving consumer behaviors, and the continuous emergence of innovative products.

Asia Pacific Bed and Bath Linen Industry Market Report: 2019-2033

Dive deep into the booming Asia Pacific bed and bath linen market with this comprehensive report, covering market dynamics, trends, leading players, and future projections. This in-depth analysis provides actionable insights for businesses, investors, and stakeholders navigating this dynamic landscape. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market size is estimated at xx Million USD in 2025.

Asia Pacific Bed and Bath Linen Industry Market Dynamics & Concentration

The Asia Pacific bed and bath linen market exhibits a moderately concentrated landscape, with key players such as Shangai Trend-home Co, Raymond group, Vardhman textiles limited, Hangzhou Yintex Co, Sidefu, Trident limited, Indo Count Industries, Welspun Global, Nantong Kelin Textiles Co Ltd, and Bombay dyeing holding significant market share. Market concentration is influenced by factors such as brand recognition, economies of scale, and vertical integration. Innovation, particularly in sustainable and technologically advanced materials (e.g., antimicrobial fabrics, quick-drying technologies), is a crucial driver. Regulatory frameworks related to textile manufacturing and environmental standards significantly impact the industry. Product substitutes, such as synthetic alternatives, present competitive challenges. End-user trends, particularly towards premiumization and personalized products, are reshaping the market. M&A activities, such as the acquisition of Raymond Consumer Care Ltd by Godrej Consumer Products Ltd in April 2023, showcase consolidation within the industry, indicating a shift towards larger players.

- Market Share: Top 5 players hold approximately xx% of the market share (2024).

- M&A Deal Count: An estimated xx M&A deals occurred between 2019 and 2024.

- Key Innovation Drivers: Sustainability, technological advancements in fabric production, and personalization.

- Regulatory Impact: Environmental regulations and labor standards significantly influence operational costs.

Asia Pacific Bed and Bath Linen Industry Industry Trends & Analysis

The Asia Pacific bed and bath linen market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for comfortable and aesthetically pleasing home furnishings. Technological advancements, particularly in automated manufacturing processes and the introduction of innovative materials, are enhancing product quality and efficiency. Consumer preferences are shifting towards sustainable and ethically sourced products, influencing the demand for eco-friendly materials and transparent supply chains. The competitive landscape is characterized by both established players and emerging brands focusing on niche segments. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), with significant market penetration in emerging economies. The growth is particularly fueled by the expanding e-commerce sector, providing new avenues for market expansion.

Leading Markets & Segments in Asia Pacific Bed and Bath Linen Industry

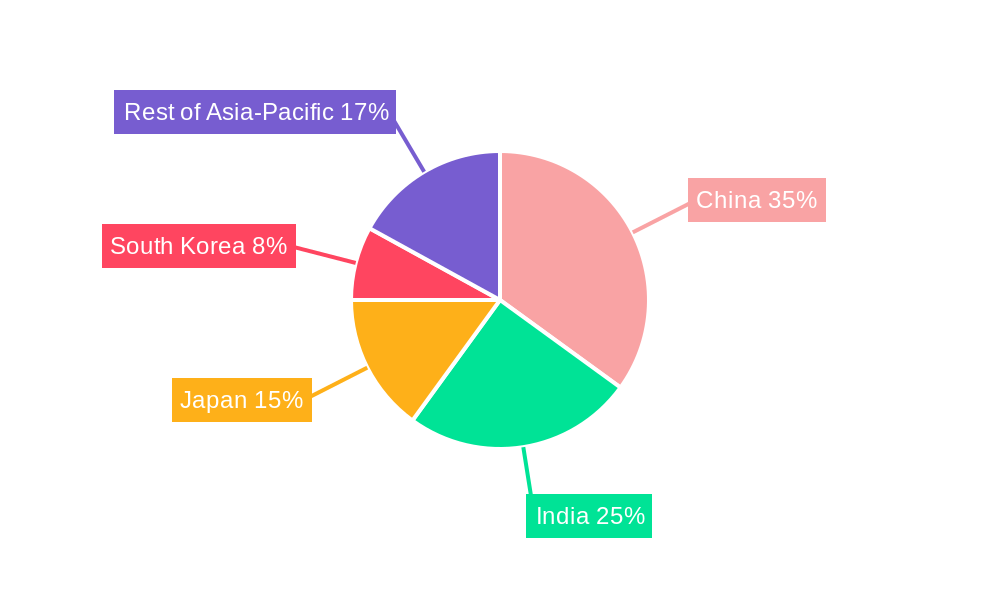

China and India dominate the Asia Pacific bed and bath linen market, driven by their large populations, expanding middle classes, and robust manufacturing capabilities. Within the market segments:

- By Type: Bed linen holds a larger market share than bath linen, reflecting high demand for bedding products.

- By Distribution Channel: E-commerce is experiencing rapid growth, while supermarkets/hypermarkets maintain significant market presence.

- By End User: The residential segment is the largest, followed by the commercial sector (hotels, hospitality).

Key Drivers for Dominant Regions/Segments:

- China: Strong manufacturing base, large consumer base, supportive government policies.

- India: Growing middle class, increasing disposable income, government initiatives promoting textile industry.

- E-commerce: Convenience, accessibility, wider product range.

- Residential Segment: High demand for home furnishings.

Asia Pacific Bed and Bath Linen Industry Product Developments

Recent product innovations include the introduction of antimicrobial and hypoallergenic bed linens, quick-drying and wrinkle-resistant fabrics, and sustainable materials like organic cotton and bamboo. These innovations cater to health-conscious consumers and address environmental concerns. The market also sees advancements in smart textiles that incorporate technology for temperature regulation and personalized comfort. These developments provide a competitive advantage by enhancing product features and value proposition.

Key Drivers of Asia Pacific Bed and Bath Linen Industry Growth

The Asia Pacific bed and bath linen industry's growth is propelled by several factors:

- Rising Disposable Incomes: Increased purchasing power allows consumers to invest in higher-quality products.

- Technological Advancements: Innovations in manufacturing processes and materials enhance product quality and efficiency.

- E-commerce Expansion: Online channels broaden market access and reach.

- Government Support: Policies in some countries promote textile manufacturing.

Challenges in the Asia Pacific Bed and Bath Linen Industry Market

The industry faces challenges such as:

- Fluctuating Raw Material Prices: Impacts production costs and profitability.

- Supply Chain Disruptions: Global events can affect raw material sourcing and distribution.

- Intense Competition: A large number of players creates a competitive landscape.

- Environmental Regulations: Stricter environmental standards increase compliance costs.

Emerging Opportunities in Asia Pacific Bed and Bath Linen Industry

Long-term growth is fueled by the growing demand for sustainable and high-quality products, the expansion of e-commerce platforms, and increased consumer awareness of sleep health and wellness. Strategic partnerships among textile manufacturers, retailers, and technology companies offer promising opportunities for product innovation and market expansion. The development of smart textiles and personalized bedding solutions presents a substantial opportunity for growth.

Leading Players in the Asia Pacific Bed and Bath Linen Industry Sector

- Raymond group

- Vardhman textiles limited

- Welspun Global

- Trident limited

- Indo Count Industries

- Shangai Trend-home Co

- Hangzhou Yintex Co

- Sidefu

- Nantong Kelin Textiles Co Ltd

- Bombay dyeing

Key Milestones in Asia Pacific Bed and Bath Linen Industry Industry

- April 2023: Godrej Consumer Products Ltd acquires Raymond Consumer Care Ltd's consumer goods business for USD 345 Million.

- February 2022: Welspun Group invests Rs 2,000 crore in Telangana (India), establishing an advanced textile facility.

Strategic Outlook for Asia Pacific Bed and Bath Linen Industry Market

The Asia Pacific bed and bath linen market presents significant growth potential, driven by sustained economic growth, rising consumer demand, and technological innovation. Strategic opportunities lie in focusing on sustainable and ethically sourced products, leveraging e-commerce platforms for expanded reach, and investing in research and development to create innovative and high-value products. Companies focusing on differentiation through branding, quality, and sustainable practices will be better positioned for success.

Asia Pacific Bed and Bath Linen Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia Pacific Bed and Bath Linen Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Bed and Bath Linen Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 India

- 3.2.2 Australia and China Leading textile export globally; China leading the bedding industry globally supporting its bed linen market growth

- 3.3. Market Restrains

- 3.3.1. Negative impact of covid on small bed and bath linen industries in Asia Pacific; Increasing rent of bedroom apartments in Asia Pacific

- 3.4. Market Trends

- 3.4.1. Growing E-Commerce is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Bed and Bath Linen Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Asia Pacific Bed and Bath Linen Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Bed and Bath Linen Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Bed and Bath Linen Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Bed and Bath Linen Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Bed and Bath Linen Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Bed and Bath Linen Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Bed and Bath Linen Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Shangai Trend-home Co

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Raymond group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Vardhman textiles limited

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Hangzhou Yintex Co **List Not Exhaustive

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Sidefu

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Trident limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Indo Count Industries

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Welspun Global

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Nantong Kelin Textiles Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Bombay dyeing

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Shangai Trend-home Co

List of Figures

- Figure 1: Asia Pacific Bed and Bath Linen Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Bed and Bath Linen Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Bed and Bath Linen Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Bed and Bath Linen Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Asia Pacific Bed and Bath Linen Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Asia Pacific Bed and Bath Linen Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Asia Pacific Bed and Bath Linen Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Asia Pacific Bed and Bath Linen Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Asia Pacific Bed and Bath Linen Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia Pacific Bed and Bath Linen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Taiwan Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Asia-Pacific Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Asia Pacific Bed and Bath Linen Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Asia Pacific Bed and Bath Linen Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Asia Pacific Bed and Bath Linen Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Asia Pacific Bed and Bath Linen Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Asia Pacific Bed and Bath Linen Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Asia Pacific Bed and Bath Linen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: India Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: New Zealand Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Malaysia Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailand Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Vietnam Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Philippines Asia Pacific Bed and Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Bed and Bath Linen Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Asia Pacific Bed and Bath Linen Industry?

Key companies in the market include Shangai Trend-home Co, Raymond group, Vardhman textiles limited, Hangzhou Yintex Co **List Not Exhaustive, Sidefu, Trident limited, Indo Count Industries, Welspun Global, Nantong Kelin Textiles Co Ltd, Bombay dyeing.

3. What are the main segments of the Asia Pacific Bed and Bath Linen Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

India. Australia and China Leading textile export globally; China leading the bedding industry globally supporting its bed linen market growth.

6. What are the notable trends driving market growth?

Growing E-Commerce is Driving the Market.

7. Are there any restraints impacting market growth?

Negative impact of covid on small bed and bath linen industries in Asia Pacific; Increasing rent of bedroom apartments in Asia Pacific.

8. Can you provide examples of recent developments in the market?

On April 2023, India's Godrej Consumer Products Ltd acquired the consumer goods business of Raymond Consumer Care Ltd for USD 345 million, bolstering its portfolio of brands in the country's fast-growing retail market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Bed and Bath Linen Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Bed and Bath Linen Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Bed and Bath Linen Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Bed and Bath Linen Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence