Key Insights

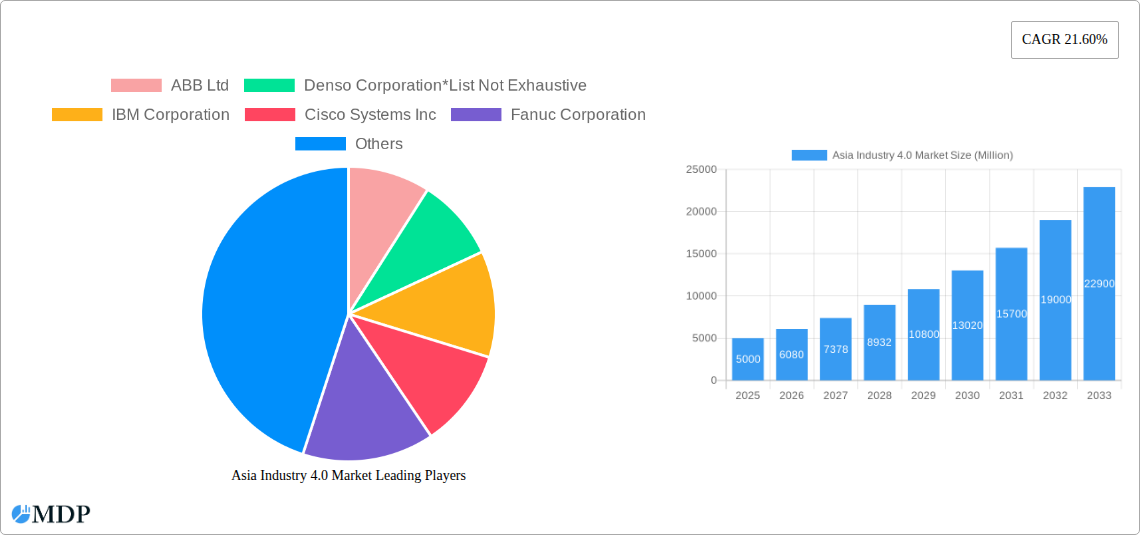

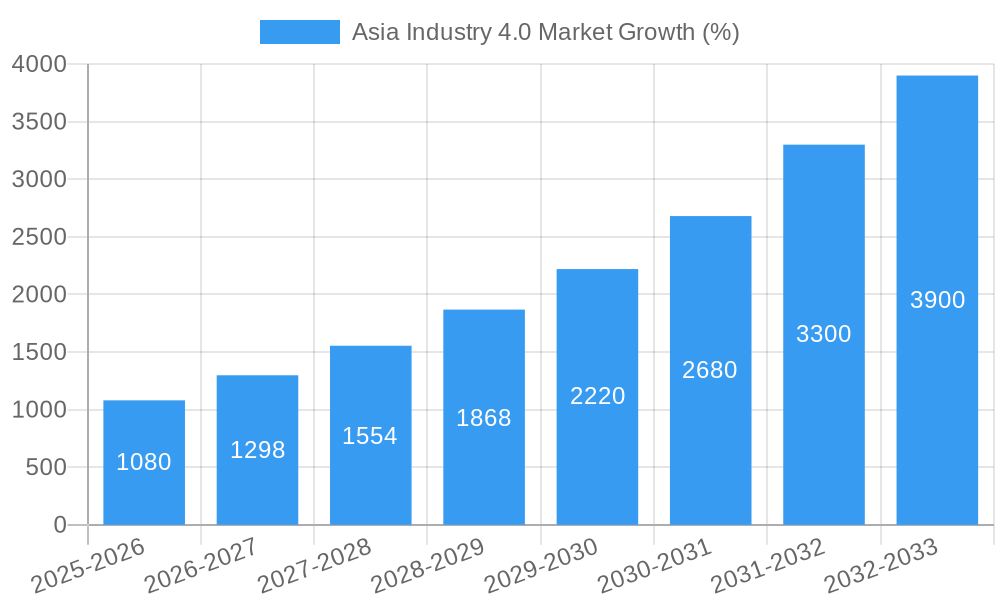

The Asia Industry 4.0 market is experiencing explosive growth, driven by increasing government support for digital transformation initiatives across key sectors like manufacturing, automotive, and electronics. A compound annual growth rate (CAGR) of 21.60% from 2019 to 2024 suggests a significant market expansion, with a projected market size exceeding $XX million in 2025. This robust growth is fueled by the adoption of advanced technologies such as Industrial Robotics, AI and ML, and IIoT, which are enhancing efficiency, productivity, and overall competitiveness across various industries. China, Japan, South Korea, and India are leading the charge, leveraging their robust manufacturing bases and technological expertise to drive this transformation. The integration of digital twins for predictive maintenance, the implementation of blockchain for supply chain optimization, and the utilization of extended reality (XR) technologies for training and remote operations are all contributing to the market's upward trajectory. However, challenges such as cybersecurity concerns, the need for skilled workforce development, and the high initial investment costs associated with adopting Industry 4.0 technologies represent potential restraints to growth. Despite these challenges, the long-term outlook for the Asia Industry 4.0 market remains exceptionally positive, with continued technological advancements and increasing government incentives expected to accelerate adoption in the coming years.

The significant investments in research and development within the region, particularly in areas like Artificial Intelligence and Machine Learning, are further catalyzing the growth of this market. The focus on automation and smart manufacturing solutions is evident across various sectors, and this trend is set to continue. The manufacturing sector remains the primary driver, leveraging Industry 4.0 technologies to optimize production lines and enhance product quality. However, other industries, such as energy and utilities, are also increasingly embracing these technologies to improve operational efficiency and reduce costs. The increasing interconnectedness of devices and systems through the Internet of Things (IoT) is also a key facilitator of growth, providing the foundation for data-driven decision-making and improved operational visibility. The competitive landscape is characterized by a mix of established multinational corporations and innovative local players, fostering a dynamic market environment. Sustained growth is anticipated throughout the forecast period (2025-2033), albeit potentially at a slightly moderated pace as the market matures.

Asia Industry 4.0 Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Industry 4.0 market, encompassing market dynamics, trends, leading segments, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers actionable insights for industry stakeholders seeking to navigate this rapidly evolving landscape. The report covers key segments including Industrial Robotics, IIoT, AI and ML, and more across various end-user industries and countries within Asia. Expect detailed analysis of market concentration, technological advancements, and competitive dynamics, accompanied by quantifiable data and projections to illuminate growth opportunities and potential challenges. Discover the key drivers propelling growth, the significant hurdles to overcome, and the emerging opportunities shaping the future of Industry 4.0 in Asia.

Asia Industry 4.0 Market Dynamics & Concentration

The Asia Industry 4.0 market is experiencing significant growth, driven by increasing government support for digital transformation initiatives, rising investments in automation and technological advancements. Market concentration is moderate, with several large multinational corporations and a growing number of regional players competing for market share. The market is characterized by intense competition, leading to strategic partnerships, mergers, and acquisitions (M&A) to expand product portfolios and geographic reach.

- Market Concentration: The market share of the top 5 players is estimated at xx%, indicating a moderately concentrated market with opportunities for both established players and new entrants.

- Innovation Drivers: Government initiatives promoting digitalization, increasing R&D investments by leading technology companies, and the growing need for enhanced operational efficiency are key drivers of innovation.

- Regulatory Frameworks: Government regulations regarding data privacy, cybersecurity, and standardization of Industry 4.0 technologies are shaping market dynamics and influencing investment decisions.

- Product Substitutes: The absence of readily available substitutes for advanced Industry 4.0 technologies limits substitution risks, however, cost-effective alternatives are continuously emerging.

- End-User Trends: Growing adoption of cloud-based solutions, demand for real-time data analytics, and increasing focus on automation are major end-user trends driving market growth.

- M&A Activities: The number of M&A deals in the Asia Industry 4.0 market has increased significantly in recent years, with an estimated xx deals in 2024, driven primarily by strategic acquisitions aimed at expanding product lines and market reach.

Asia Industry 4.0 Market Industry Trends & Analysis

The Asia Industry 4.0 market is experiencing robust growth, projected to reach xx Million by 2033, with a CAGR of xx% during the forecast period. This growth is fueled by several key factors:

- Technological Disruptions: The rapid adoption of technologies such as AI, ML, IIoT, and blockchain is transforming manufacturing processes, supply chains, and customer engagement strategies. Companies are increasingly adopting these technologies to optimize operations and enhance their competitive edge.

- Market Growth Drivers: Strong economic growth in several Asian countries, increasing industrialization, and growing government support for digitalization are creating favorable conditions for Industry 4.0 adoption.

- Consumer Preferences: Growing consumer demand for personalized products and services is driving companies to adopt Industry 4.0 technologies to enhance product customization and improve delivery speed.

- Competitive Dynamics: Intense competition among technology providers and system integrators is leading to innovation and price reductions, making Industry 4.0 solutions more accessible to a wider range of businesses. Market penetration of Industry 4.0 technologies is increasing steadily, with an estimated xx% penetration rate in the manufacturing sector by 2025.

Leading Markets & Segments in Asia Industry 4.0 Market

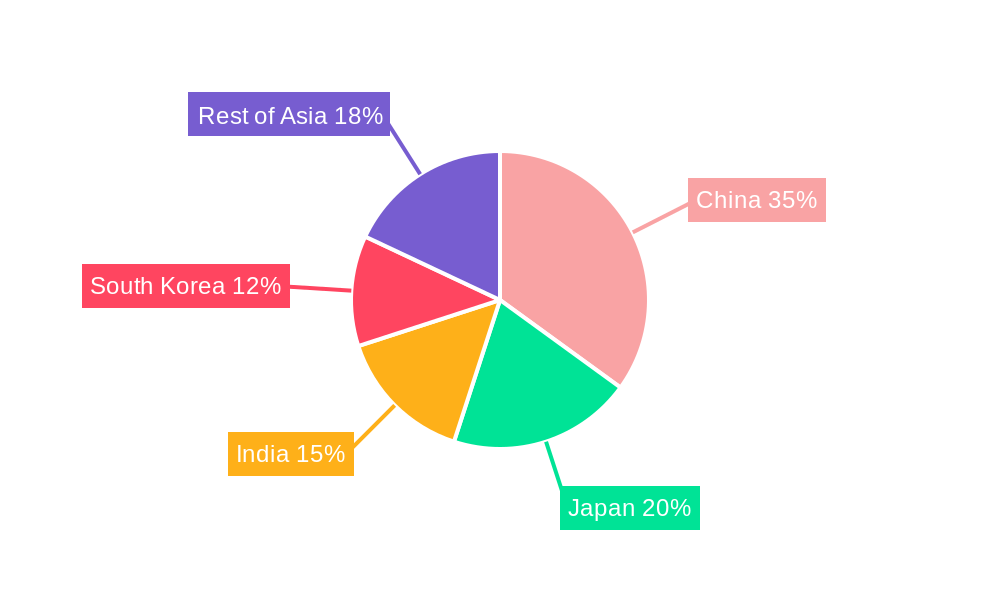

China remains the dominant market in Asia for Industry 4.0, driven by its massive manufacturing sector, strong government support for technological advancement, and extensive infrastructure investments. However, other countries like South Korea, Japan, and India are witnessing rapid growth.

By Technology Type:

- Industrial Robotics: This segment holds a significant market share, driven by increasing automation in manufacturing and logistics.

- IIoT: The IIoT segment is experiencing rapid growth, fueled by the increasing adoption of connected devices and sensors to improve operational efficiency and data analytics capabilities.

- AI and ML: AI and ML are transforming several Industry 4.0 applications, enhancing decision-making, predictive maintenance, and product development.

- Other Technology Types: Other technologies, including Blockchain, Extended Reality (XR), Digital Twins, and 3D Printing are gaining traction but currently possess smaller market shares.

By End-user Industry:

- Manufacturing: The manufacturing sector is the largest adopter of Industry 4.0 technologies, driven by the need to optimize production processes, improve quality control, and enhance supply chain efficiency.

- Automotive: The automotive industry is also a major adopter of Industry 4.0 technologies, particularly in areas such as autonomous driving and connected vehicles.

- Other End-user Industries: Other sectors such as Oil and Gas, Energy and Utilities, Electronics and Foundry, Food and Beverage, and Aerospace and Defense are increasingly adopting Industry 4.0 technologies to improve operational efficiency, productivity and sustainability.

By Country:

- China: Strong government support, large manufacturing base, and abundant capital have made China the leading market for Industry 4.0 in Asia. Key drivers include government policies promoting digital transformation and significant investments in infrastructure.

- South Korea: A strong technological base and a focus on innovation have propelled South Korea's Industry 4.0 market. Extensive investments in R&D and robust technological capabilities contribute to rapid market growth.

- Japan: Japan’s advanced manufacturing capabilities and a history of technological leadership contribute to its significant presence. Key drivers include a highly skilled workforce and a long history of automation adoption.

- India: Growing industrialization, a large and young workforce, and government initiatives fostering digitalization are driving India's Industry 4.0 market. Key drivers include initiatives to promote 'Make in India' and the rising adoption of automation and digital technologies.

- Rest of Asia: Other Asian countries are demonstrating growing adoption rates driven by industrialization and technological advancement.

Asia Industry 4.0 Market Product Developments

Recent product developments focus on cloud-based solutions, AI-powered analytics, and enhanced cybersecurity features. These developments are improving the integration of IT and OT systems, facilitating real-time data analysis, and strengthening the resilience of Industry 4.0 infrastructure. Companies are focusing on providing comprehensive, integrated solutions that address the specific needs of various industries, fostering seamless integration and enhancing operational efficiency. The market emphasizes modularity and scalability to cater to the diverse requirements of businesses of all sizes.

Key Drivers of Asia Industry 4.0 Market Growth

Several factors are driving the growth of the Asia Industry 4.0 market:

- Technological Advancements: Continuous innovation in areas like AI, ML, IoT, and robotics is fueling the adoption of Industry 4.0 technologies.

- Government Initiatives: Many Asian governments are actively promoting digital transformation through policy support, financial incentives, and infrastructure development.

- Economic Growth: The strong economic growth in many Asian countries is creating a favorable environment for investment in Industry 4.0 technologies.

- Increased Productivity and Efficiency: Industry 4.0 technologies offer the potential for significant improvements in productivity and operational efficiency, attracting businesses seeking to optimize their operations.

Challenges in the Asia Industry 4.0 Market

Despite the significant growth potential, the Asia Industry 4.0 market faces several challenges:

- Cybersecurity Risks: The increasing interconnectedness of Industry 4.0 systems exposes businesses to cyberattacks, posing a major threat to operational security and data integrity.

- Data Privacy Concerns: Concerns around data privacy and security are hindering the widespread adoption of Industry 4.0 technologies in some sectors.

- Skills Gap: A shortage of skilled workers proficient in Industry 4.0 technologies is limiting the rate of adoption and implementation.

- High Implementation Costs: The high initial investment required for implementing Industry 4.0 technologies can be a barrier for small and medium-sized enterprises (SMEs).

Emerging Opportunities in Asia Industry 4.0 Market

Several emerging opportunities are expected to drive long-term growth in the Asia Industry 4.0 market. These include the expanding adoption of edge computing to process data closer to the source, the increasing use of digital twins for predictive maintenance and simulation, and the growing demand for cybersecurity solutions to mitigate risks associated with interconnected systems. Strategic partnerships between technology providers and end-user industries will play a crucial role in unlocking the full potential of Industry 4.0 in Asia. Furthermore, market expansion into less developed regions within Asia will present significant opportunities for growth.

Leading Players in the Asia Industry 4.0 Market Sector

- ABB Ltd

- Denso Corporation

- IBM Corporation

- Cisco Systems Inc

- Fanuc Corporation

- Omron Corporation

- Robert Bosch GmbH

- Yokogawa Electric Corporation

- Mitsubishi Electric

- General Electric Company

- Intel Corporation

- Yaskawa Electric Corporation

Key Milestones in Asia Industry 4.0 Market Industry

- June 2022: Yokogawa Electric Corporation released OpreX asset health insights, a cloud-based plant asset monitoring service leveraging ML and AI for real-time asset optimization. This highlights the increasing trend towards cloud-based asset management solutions.

- February 2022: Mitsubishi Electric Corporation received the SAP Japan Customer Award 2021 for its leadership in digital transformation, showcasing the successful integration of IT and OT systems in Industry 4.0 applications.

Strategic Outlook for Asia Industry 4.0 Market

The Asia Industry 4.0 market is poised for continued strong growth, driven by technological advancements, supportive government policies, and increasing business adoption. Companies are focusing on developing integrated, scalable solutions to cater to diverse industry needs. Strategic partnerships, investments in R&D, and the expansion into new markets will be key success factors in this dynamic landscape. The focus on enhanced cybersecurity, data privacy, and workforce development will be crucial for realizing the full potential of Industry 4.0 in Asia.

Asia Industry 4.0 Market Segmentation

-

1. Technology Type

- 1.1. Industrial Robotics

- 1.2. IIoT

- 1.3. AI and ML

- 1.4. Blockchain

- 1.5. Extended Reality

- 1.6. Digital Twin

- 1.7. 3D Printing

- 1.8. Other Technology Types

-

2. End-user Industry

- 2.1. Manufacturing

- 2.2. Automotive

- 2.3. Oil and Gas

- 2.4. Energy and Utilities

- 2.5. Electronics and Foundry

- 2.6. Food and Beverage

- 2.7. Aerospace and Defense

- 2.8. Other End-user Industries

Asia Industry 4.0 Market Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asia Industry 4.0 Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Governmental Initiatives and Collaborations Between Stakeholders in the Region; Growth in Demand for Industrial Robotics; Digital Transformation Initiatives Undertaken by SMEs

- 3.3. Market Restrains

- 3.3.1. Sluggish Adoption of New Technologies

- 3.4. Market Trends

- 3.4.1. Manufacturing Industry to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 5.1.1. Industrial Robotics

- 5.1.2. IIoT

- 5.1.3. AI and ML

- 5.1.4. Blockchain

- 5.1.5. Extended Reality

- 5.1.6. Digital Twin

- 5.1.7. 3D Printing

- 5.1.8. Other Technology Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Manufacturing

- 5.2.2. Automotive

- 5.2.3. Oil and Gas

- 5.2.4. Energy and Utilities

- 5.2.5. Electronics and Foundry

- 5.2.6. Food and Beverage

- 5.2.7. Aerospace and Defense

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 6. China Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Industry 4.0 Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ABB Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Denso Corporation*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 IBM Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Cisco Systems Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fanuc Corporation

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Omron Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Robert Bosch GmbH

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Yokogawa Electric Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Mitsubishi Electric

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 General Electric Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Intel Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Yaskawa Electric Corporation

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 ABB Ltd

List of Figures

- Figure 1: Asia Industry 4.0 Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Industry 4.0 Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Industry 4.0 Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Industry 4.0 Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 3: Asia Industry 4.0 Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Asia Industry 4.0 Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Industry 4.0 Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Industry 4.0 Market Revenue Million Forecast, by Technology Type 2019 & 2032

- Table 14: Asia Industry 4.0 Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Asia Industry 4.0 Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Indonesia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Malaysia Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Singapore Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Thailand Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Vietnam Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Philippines Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Bangladesh Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Pakistan Asia Industry 4.0 Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Industry 4.0 Market?

The projected CAGR is approximately 21.60%.

2. Which companies are prominent players in the Asia Industry 4.0 Market?

Key companies in the market include ABB Ltd, Denso Corporation*List Not Exhaustive, IBM Corporation, Cisco Systems Inc, Fanuc Corporation, Omron Corporation, Robert Bosch GmbH, Yokogawa Electric Corporation, Mitsubishi Electric, General Electric Company, Intel Corporation, Yaskawa Electric Corporation.

3. What are the main segments of the Asia Industry 4.0 Market?

The market segments include Technology Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Governmental Initiatives and Collaborations Between Stakeholders in the Region; Growth in Demand for Industrial Robotics; Digital Transformation Initiatives Undertaken by SMEs.

6. What are the notable trends driving market growth?

Manufacturing Industry to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Sluggish Adoption of New Technologies.

8. Can you provide examples of recent developments in the market?

June 2022: Yokogawa Electric Corporation released OpreX asset health insights. OpreX is a cloud-based plant asset monitoring service that refines, collects, and aggregates operational technology data from distributed assets. Asset Health Insights Oprex powered by Yokogawa Cloud is equipped with ML and AI analytics capability. As the adoption of Industry 4.0 technologies continues to pace in the region, companies are changing the way they do asset management by introducing cloud-based technologies that can monitor assets from anywhere in the world and optimize their performance in real-time. Driven by customers' focus on integrated, remote, and increasingly autonomous operations, Yokogawa Electric developed Asset Health Insights to make data more visible, integrated, and actionable.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Industry 4.0 Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Industry 4.0 Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Industry 4.0 Market?

To stay informed about further developments, trends, and reports in the Asia Industry 4.0 Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence