Key Insights

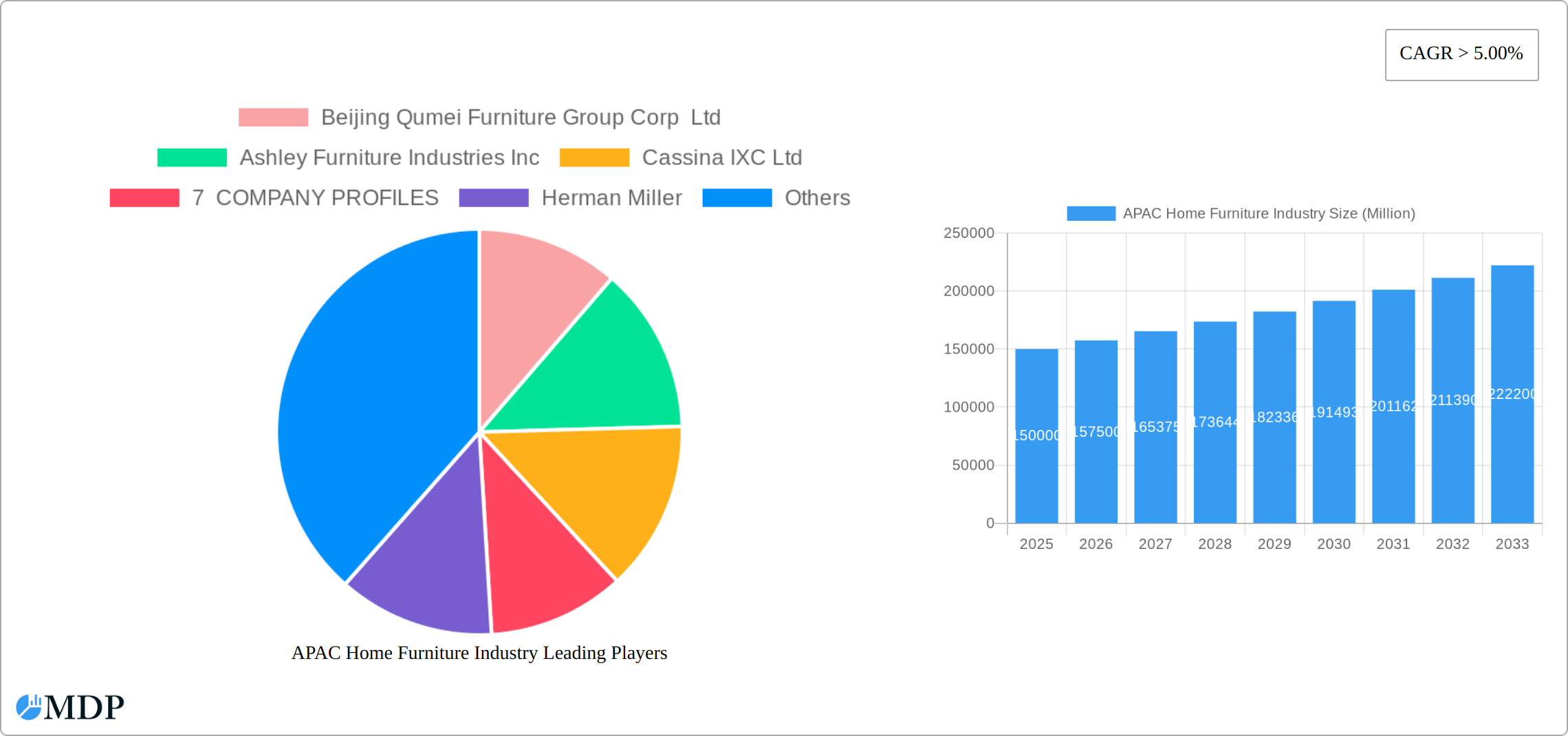

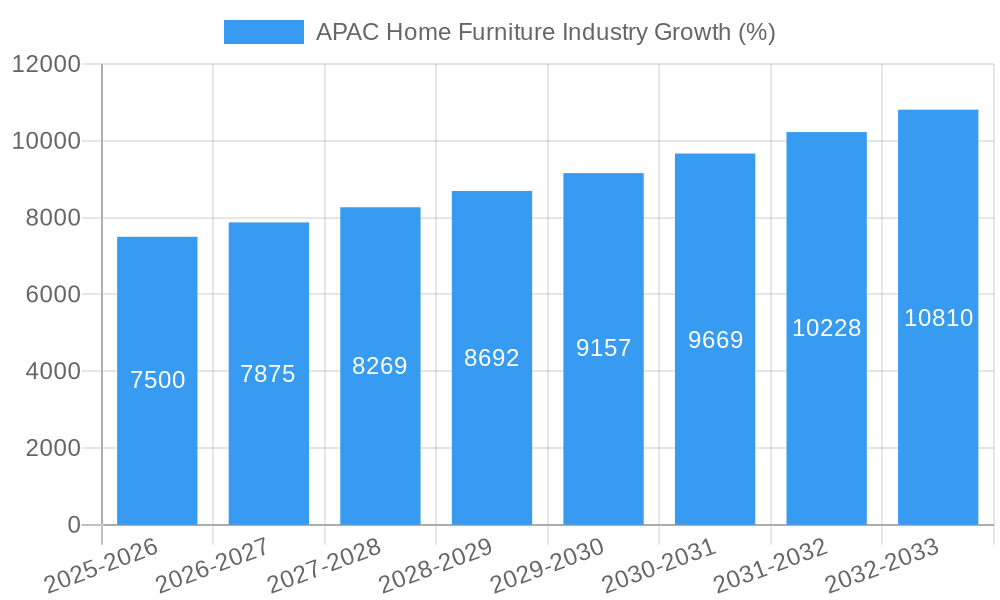

The Asia-Pacific (APAC) home furniture market, currently experiencing robust growth exceeding a 5% Compound Annual Growth Rate (CAGR), presents a lucrative opportunity for investors and businesses. Driven by rising disposable incomes, rapid urbanization, and a burgeoning middle class particularly in India and China, demand for home furniture is soaring. This growth is further fueled by evolving consumer preferences towards stylish, functional, and sustainable furniture, aligning with global trends toward minimalist and eco-conscious designs. The market is segmented by product type (living room, bedroom, kitchen furniture, lighting, and others) and distribution channels (supermarkets, specialty stores, and increasingly, online platforms). While the dominance of traditional retail remains, the online channel is rapidly gaining traction, offering convenience and wider product choices. Challenges include fluctuations in raw material prices, intense competition, and the need to adapt to changing consumer preferences and technological advancements in manufacturing and design. Key players such as Beijing Qumei Furniture Group Corp Ltd, Ashley Furniture Industries Inc, and Godrej Interio are strategically positioning themselves to capitalize on these trends through product diversification, expansion into e-commerce, and a focus on sustainable practices. The market's expansion is projected to continue throughout the forecast period (2025-2033), presenting significant potential for both established players and new entrants.

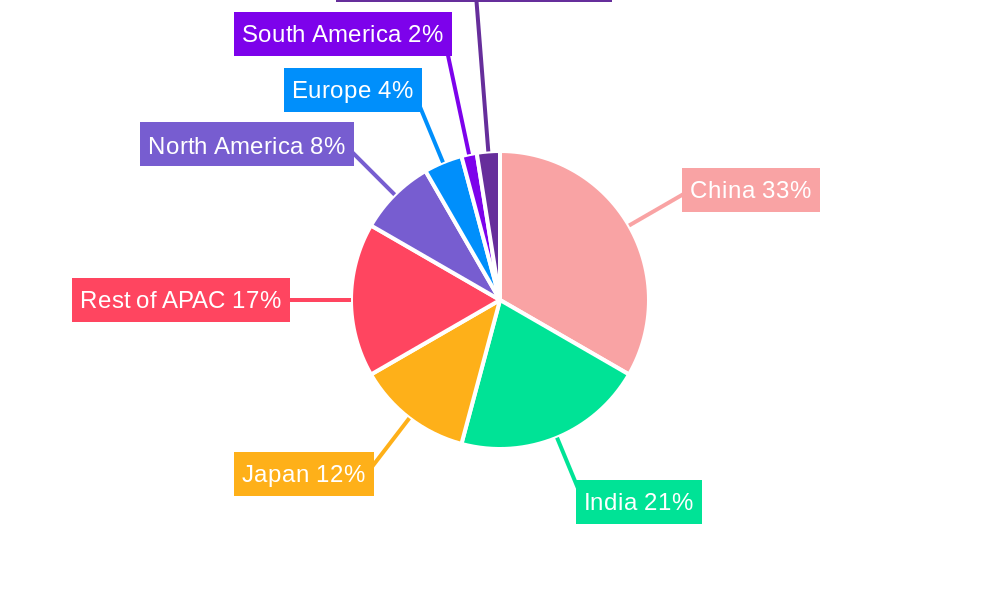

Japan, India, and China form the core of the APAC market, but significant growth is also anticipated in other countries within the region as rising living standards create a demand for improved home furnishings. The market is witnessing a shift towards higher-quality, modular, and customizable furniture, reflecting a growing preference for personalized home decor. The integration of technology, such as smart furniture and augmented reality for online shopping, is also expected to influence market dynamics. While supply chain disruptions and economic uncertainties pose potential restraints, the long-term growth outlook remains positive, driven by consistent population growth and increasing urbanization in many APAC nations. Strategic investments in research and development, coupled with efficient supply chain management, will be crucial for companies aiming to achieve sustained success within this dynamic and expanding market.

APAC Home Furniture Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific (APAC) home furniture industry, covering market dynamics, trends, leading players, and future growth opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry stakeholders, investors, and businesses operating in or looking to enter this dynamic market. The report leverages extensive data analysis and incorporates recent industry developments to deliver actionable insights. The total market size is predicted to reach xx Million by 2033.

APAC Home Furniture Industry Market Dynamics & Concentration

The APAC home furniture market is characterized by a complex interplay of factors influencing its concentration and growth trajectory. Market share is highly fragmented, with a few major players like Beijing Qumei Furniture Group Corp Ltd and Ashley Furniture Industries Inc holding significant positions, but numerous smaller regional players occupying considerable segments. The estimated market concentration ratio (CR4) for 2025 is xx%, indicating a moderately concentrated market. Innovation, driven by technological advancements in materials and manufacturing processes, plays a crucial role. Regulatory frameworks, varying across countries in the APAC region, impact product standards, import/export regulations, and environmental compliance. Furthermore, rising disposable incomes and changing lifestyles are pushing demand for more stylish and functional furniture. The industry also faces competition from substitutes like readily available secondhand furniture or rental services.

- Market Share (2025 Estimate): Beijing Qumei Furniture Group Corp Ltd: xx%; Ashley Furniture Industries Inc: xx%; Others: xx%.

- M&A Activity (2019-2024): xx deals, predominantly focused on consolidation and expansion into new markets.

- Key Innovation Drivers: Sustainable materials, smart home integration, 3D printing, customization options.

- Regulatory Factors: Varying building codes and environmental regulations impacting product design and materials.

APAC Home Furniture Industry Industry Trends & Analysis

The APAC home furniture market is experiencing robust growth, projected at a CAGR of xx% during 2025-2033. This growth is driven by several factors. Rising urbanization and increasing disposable incomes across major APAC economies like China and India fuel a surge in demand for home furnishings. E-commerce expansion, with platforms like Alibaba and Amazon, has significantly improved access to a wider range of products and increased market penetration for online furniture retailers. Changing consumer preferences toward modern aesthetics and sustainable practices are also shaping the market. However, fluctuations in raw material costs and economic downturns present challenges. Competitive dynamics are influenced by both established global players and rapidly growing local brands. The market penetration of online sales is approximately xx% in 2025, expected to grow to xx% by 2033.

Leading Markets & Segments in APAC Home Furniture Industry

China remains the dominant market in the APAC region, driven by its massive population, rapid urbanization, and growing middle class. India is experiencing rapid growth, fueled by its expanding economy and young population. Within product segments, Living-Room and Dining-Room furniture commands the largest market share, followed by Bedroom Furniture. Specialty stores continue to be a significant distribution channel, although online sales are rapidly gaining traction.

- Key Drivers for China: Robust economic growth, government infrastructure projects, and significant investments in real estate.

- Key Drivers for India: Rising disposable incomes, increasing urbanization, and a young, aspirational population.

- Dominant Product Segment: Living-Room and Dining-Room Furniture (xx% market share in 2025).

- Dominant Distribution Channel: Specialty Stores (xx% market share in 2025).

APAC Home Furniture Industry Product Developments

Recent product innovations focus on sustainable materials (e.g., recycled wood and bamboo), smart home integration (e.g., voice-controlled lighting and adjustable furniture), and modular designs offering flexibility and customization. These advancements cater to evolving consumer preferences for environmentally friendly and technologically advanced furniture. Competition is driving manufacturers to offer unique designs, superior quality, and enhanced functionality to stand out in the crowded market.

Key Drivers of APAC Home Furniture Industry Growth

Several factors are propelling the growth of the APAC home furniture industry. Firstly, rapid urbanization across the region is creating substantial demand for housing and home furnishings. Secondly, rising disposable incomes, particularly in emerging economies, enable consumers to invest more in home improvement and décor. Thirdly, government initiatives to stimulate the construction and real estate sectors further boost the demand.

Challenges in the APAP Home Furniture Industry Market

The APAC home furniture market faces several challenges, including fluctuating raw material costs impacting production margins, increased competition from both international and domestic players, and supply chain disruptions. These factors influence pricing strategies and profitability. Furthermore, varying regulatory standards across countries increase compliance costs and logistical complexity. The impact of these challenges on industry growth is estimated at xx% in 2025.

Emerging Opportunities in APAC Home Furniture Industry

The APAC home furniture industry presents significant long-term growth opportunities, driven by technological advancements such as 3D printing and sustainable manufacturing processes. Strategic partnerships between furniture manufacturers and e-commerce platforms will further expand market reach and sales. Furthermore, untapped markets in certain APAC countries and the potential for market expansion into adjacent segments like home décor hold substantial promise.

Leading Players in the APAC Home Furniture Industry Sector

- Beijing Qumei Furniture Group Corp Ltd

- Ashley Furniture Industries Inc

- Cassina IXC Ltd

- 7 COMPANY PROFILES

- Herman Miller

- Bals Corporation

- Dalian Huafeng Furniture Group Co Ltd

- Zuari Furniture

- Durian Furniture

- Markor International Furniture Co Ltd

- Godrej Interio

Key Milestones in APAC Home Furniture Industry Industry

- March 2023: Wriver launches new furniture collections in collaboration with leading design studios, exclusively at India Design 2023, signaling a focus on luxury and craftsmanship.

- March 2023: Kave Home expands into Southeast Asia through a partnership with Nook & Cranny, highlighting the growing importance of strategic alliances.

- February 2023: IKEA launches three new home and furniture collections for spring 2023, demonstrating continued innovation and market responsiveness.

Strategic Outlook for APAC Home Furniture Industry Market

The APAC home furniture market is poised for sustained growth, driven by favorable demographics, economic expansion, and technological advancements. Companies focusing on innovation, sustainability, and strategic partnerships will be well-positioned to capture significant market share. The long-term potential for growth is substantial, particularly in emerging markets within the region. Investing in advanced manufacturing techniques, e-commerce capabilities, and supply chain optimization will be key to long-term success.

APAC Home Furniture Industry Segmentation

-

1. Product

- 1.1. Living-Room and Dining-Room Furniture

- 1.2. Bedroom Furniture

- 1.3. Kitchen Furniture

- 1.4. Lamps and Lighting Furniture

- 1.5. Plastic and Other Furniture

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

APAC Home Furniture Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Home Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Shifts in lifestyle and home preferences

- 3.2.2 such as the desire for multifunctional and space-saving furniture

- 3.2.3 are driving demand. Modern consumers are looking for furniture that combines style with practicality and efficiency.

- 3.3. Market Restrains

- 3.3.1 The cost of high-quality materials

- 3.3.2 such as solid wood and premium fabrics

- 3.3.3 can be high. This can impact the pricing of furniture products and limit affordability for some consumers.

- 3.4. Market Trends

- 3.4.1 There is a growing demand for sustainable and eco-friendly home furniture in APAC. Consumers are increasingly seeking products made from recycled materials

- 3.4.2 responsibly sourced wood

- 3.4.3 and environmentally friendly finishes.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Home Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Living-Room and Dining-Room Furniture

- 5.1.2. Bedroom Furniture

- 5.1.3. Kitchen Furniture

- 5.1.4. Lamps and Lighting Furniture

- 5.1.5. Plastic and Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America APAC Home Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Living-Room and Dining-Room Furniture

- 6.1.2. Bedroom Furniture

- 6.1.3. Kitchen Furniture

- 6.1.4. Lamps and Lighting Furniture

- 6.1.5. Plastic and Other Furniture

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America APAC Home Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Living-Room and Dining-Room Furniture

- 7.1.2. Bedroom Furniture

- 7.1.3. Kitchen Furniture

- 7.1.4. Lamps and Lighting Furniture

- 7.1.5. Plastic and Other Furniture

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe APAC Home Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Living-Room and Dining-Room Furniture

- 8.1.2. Bedroom Furniture

- 8.1.3. Kitchen Furniture

- 8.1.4. Lamps and Lighting Furniture

- 8.1.5. Plastic and Other Furniture

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa APAC Home Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Living-Room and Dining-Room Furniture

- 9.1.2. Bedroom Furniture

- 9.1.3. Kitchen Furniture

- 9.1.4. Lamps and Lighting Furniture

- 9.1.5. Plastic and Other Furniture

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific APAC Home Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Living-Room and Dining-Room Furniture

- 10.1.2. Bedroom Furniture

- 10.1.3. Kitchen Furniture

- 10.1.4. Lamps and Lighting Furniture

- 10.1.5. Plastic and Other Furniture

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Asia Pacific APAC Home Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 China

- 11.1.2 India

- 11.1.3 Japan

- 11.1.4 South Korea

- 11.1.5 Rest of Asia Pacific

- 12. North America APAC Home Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe APAC Home Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 Italy

- 13.1.4 France

- 13.1.5 Rest of Europe

- 14. South America APAC Home Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa APAC Home Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 South Africa

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Beijing Qumei Furniture Group Corp Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Ashley Furniture Industries Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Cassina IXC Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 7 COMPANY PROFILES

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Herman Miller

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Bals Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Dalian Huafeng Furniture Group Co Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Zuari Furniture

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Durian Furniture

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Markor International Furniture Co Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Godrej Interio

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Beijing Qumei Furniture Group Corp Ltd

List of Figures

- Figure 1: Global APAC Home Furniture Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific APAC Home Furniture Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: Asia Pacific APAC Home Furniture Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America APAC Home Furniture Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: North America APAC Home Furniture Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe APAC Home Furniture Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Europe APAC Home Furniture Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America APAC Home Furniture Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America APAC Home Furniture Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa APAC Home Furniture Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa APAC Home Furniture Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America APAC Home Furniture Industry Revenue (Million), by Product 2024 & 2032

- Figure 13: North America APAC Home Furniture Industry Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America APAC Home Furniture Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 15: North America APAC Home Furniture Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 16: North America APAC Home Furniture Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America APAC Home Furniture Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America APAC Home Furniture Industry Revenue (Million), by Product 2024 & 2032

- Figure 19: South America APAC Home Furniture Industry Revenue Share (%), by Product 2024 & 2032

- Figure 20: South America APAC Home Furniture Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: South America APAC Home Furniture Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: South America APAC Home Furniture Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: South America APAC Home Furniture Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe APAC Home Furniture Industry Revenue (Million), by Product 2024 & 2032

- Figure 25: Europe APAC Home Furniture Industry Revenue Share (%), by Product 2024 & 2032

- Figure 26: Europe APAC Home Furniture Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 27: Europe APAC Home Furniture Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 28: Europe APAC Home Furniture Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe APAC Home Furniture Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East & Africa APAC Home Furniture Industry Revenue (Million), by Product 2024 & 2032

- Figure 31: Middle East & Africa APAC Home Furniture Industry Revenue Share (%), by Product 2024 & 2032

- Figure 32: Middle East & Africa APAC Home Furniture Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: Middle East & Africa APAC Home Furniture Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: Middle East & Africa APAC Home Furniture Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa APAC Home Furniture Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific APAC Home Furniture Industry Revenue (Million), by Product 2024 & 2032

- Figure 37: Asia Pacific APAC Home Furniture Industry Revenue Share (%), by Product 2024 & 2032

- Figure 38: Asia Pacific APAC Home Furniture Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 39: Asia Pacific APAC Home Furniture Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 40: Asia Pacific APAC Home Furniture Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific APAC Home Furniture Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global APAC Home Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global APAC Home Furniture Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global APAC Home Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global APAC Home Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global APAC Home Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Asia Pacific APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global APAC Home Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global APAC Home Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Germany APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Italy APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global APAC Home Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global APAC Home Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Saudi Arabia APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Africa APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East and Africa APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global APAC Home Furniture Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 30: Global APAC Home Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 31: Global APAC Home Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Canada APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global APAC Home Furniture Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 36: Global APAC Home Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 37: Global APAC Home Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Brazil APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Argentina APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global APAC Home Furniture Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 42: Global APAC Home Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 43: Global APAC Home Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: United Kingdom APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Germany APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: France APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Italy APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Spain APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Russia APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Benelux APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Nordics APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Rest of Europe APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Global APAC Home Furniture Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 54: Global APAC Home Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 55: Global APAC Home Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Turkey APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Israel APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: GCC APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: North Africa APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: South Africa APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Rest of Middle East & Africa APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Global APAC Home Furniture Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 63: Global APAC Home Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 64: Global APAC Home Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 65: China APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: India APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Japan APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: South Korea APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: ASEAN APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Oceania APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Rest of Asia Pacific APAC Home Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Home Furniture Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the APAC Home Furniture Industry?

Key companies in the market include Beijing Qumei Furniture Group Corp Ltd, Ashley Furniture Industries Inc, Cassina IXC Ltd, 7 COMPANY PROFILES, Herman Miller, Bals Corporation, Dalian Huafeng Furniture Group Co Ltd, Zuari Furniture, Durian Furniture, Markor International Furniture Co Ltd, Godrej Interio.

3. What are the main segments of the APAC Home Furniture Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Shifts in lifestyle and home preferences. such as the desire for multifunctional and space-saving furniture. are driving demand. Modern consumers are looking for furniture that combines style with practicality and efficiency..

6. What are the notable trends driving market growth?

There is a growing demand for sustainable and eco-friendly home furniture in APAC. Consumers are increasingly seeking products made from recycled materials. responsibly sourced wood. and environmentally friendly finishes..

7. Are there any restraints impacting market growth?

The cost of high-quality materials. such as solid wood and premium fabrics. can be high. This can impact the pricing of furniture products and limit affordability for some consumers..

8. Can you provide examples of recent developments in the market?

March 2023: Celebrated luxury furniture brand, Wriver, has announced the launch of a range of new furniture pieces designed in collaboration with the eminent award-winning design studios Morph Lab, MuseLAB, Studio Sumeet Nagi, and Wriver Design Studio, exclusively at India Design 2023. With the aim of syncing rare craftsmanship and material innovation and furthering their vision of 'energizing modern living', the collections are grounded in international sensibilities and crafted to empower interior designs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Home Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Home Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Home Furniture Industry?

To stay informed about further developments, trends, and reports in the APAC Home Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence