Key Insights

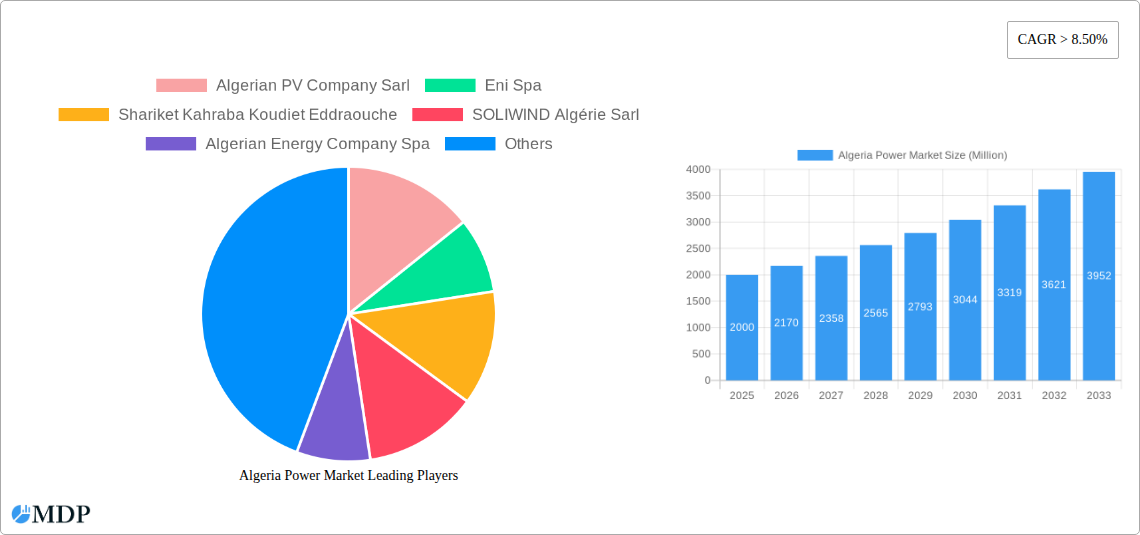

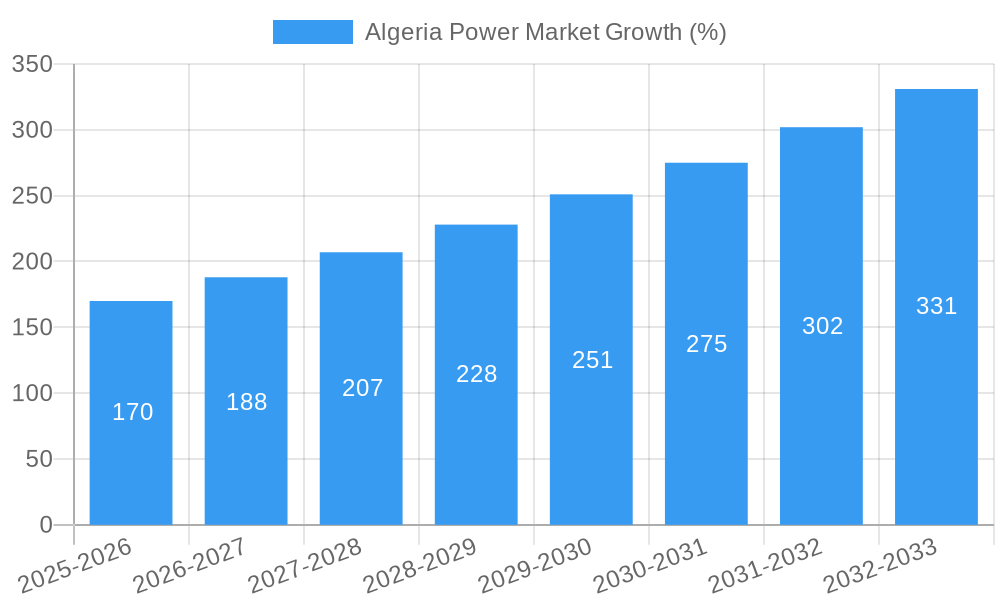

The Algerian power market, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding an 8.5% CAGR from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, increasing energy demand driven by population growth and industrialization necessitates significant capacity additions to the existing power infrastructure. Secondly, the Algerian government's commitment to diversifying its energy sources, moving away from heavy reliance on hydrocarbons, is fostering investment in renewable energy technologies such as solar and wind power. This shift is evident in the presence of companies like SOLIWIND Algérie Sarl actively participating in the market. Thirdly, improving grid infrastructure and modernization efforts contribute to enhanced electricity distribution and reliability, further stimulating market growth. However, challenges remain. Constraints like limited access to financing for large-scale projects and regulatory hurdles might hinder the market's full potential. The market is segmented by end-user (oil and gas, power generation, chemical, and others) and geography (Russia, Norway, the United Kingdom, and the Rest of Europe, with a primary focus on Algeria). Key players include Algerian PV Company Sarl, Eni Spa, Shariket Kahraba Koudiet Eddraouche, and General Electric Company, signifying a mix of local and international involvement. The historical period (2019-2024) provides a base for projecting future growth, taking into account fluctuations and regional specificities. The forecast period (2025-2033) offers a comprehensive outlook for potential investors and stakeholders.

The substantial growth forecast hinges on the successful implementation of government initiatives promoting renewable energy adoption and infrastructure development. The competitive landscape includes both established international players and local companies, indicating a dynamic market with opportunities for both foreign direct investment and indigenous growth. Continuous monitoring of regulatory changes and energy policy adjustments is crucial for effective market participation. While the market presents significant opportunities, potential investors and participants must carefully assess the associated risks, including geopolitical factors and financial constraints, to make informed decisions. The market segmentation provides a granular understanding of specific growth pockets, enabling targeted investment strategies and facilitating a more precise market analysis.

Algeria Power Market: A Comprehensive Report (2019-2033)

Unlock the potential of Algeria's dynamic power sector with this in-depth market analysis. This comprehensive report provides a detailed overview of the Algerian power market, covering market dynamics, industry trends, leading segments, key players, and future opportunities. This report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The report helps stakeholders understand the evolving landscape of the Algerian power market and make informed decisions. This report is optimized for high search visibility using industry-relevant keywords like "Algeria power market," "Algerian energy sector," "renewable energy Algeria," and "power generation Algeria".

Algeria Power Market Market Dynamics & Concentration

The Algerian power market exhibits a moderate level of concentration, with several key players vying for market share. The market's dynamics are shaped by a complex interplay of factors, including government regulations, technological advancements, and evolving end-user demands. Innovation is driven by the need to diversify energy sources and improve efficiency. The regulatory framework, while aiming to foster growth, presents certain challenges, especially concerning permitting and licensing. The market witnesses a considerable amount of product substitution, particularly from traditional fossil fuels to renewable energy sources. Significant mergers and acquisitions (M&A) activities are observed, reflecting the industry’s consolidation and expansion efforts.

- Market Share: The top 3 players hold approximately xx% of the market share in 2025.

- M&A Activity: An estimated xx M&A deals occurred within the Algerian power sector between 2019 and 2024.

- End-User Trends: A growing shift towards renewable energy solutions within the Oil & Gas segment is noted.

Algeria Power Market Industry Trends & Analysis

The Algerian power market is poised for substantial growth driven by increased energy demand, government initiatives promoting renewable energy, and investments in infrastructure development. The CAGR for the period 2025-2033 is projected to be xx%. Market penetration of renewable energy sources is expected to reach xx% by 2033. Technological disruptions, particularly in solar and wind power technologies, are reshaping the competitive landscape. Consumer preferences are increasingly aligning with sustainable and reliable energy solutions. The competitive dynamics are intensifying, with both domestic and international players vying for market share. Furthermore, the government’s focus on energy independence and diversification is driving significant investment into the sector. This is impacting the adoption of newer technologies.

Leading Markets & Segments in Algeria Power Market

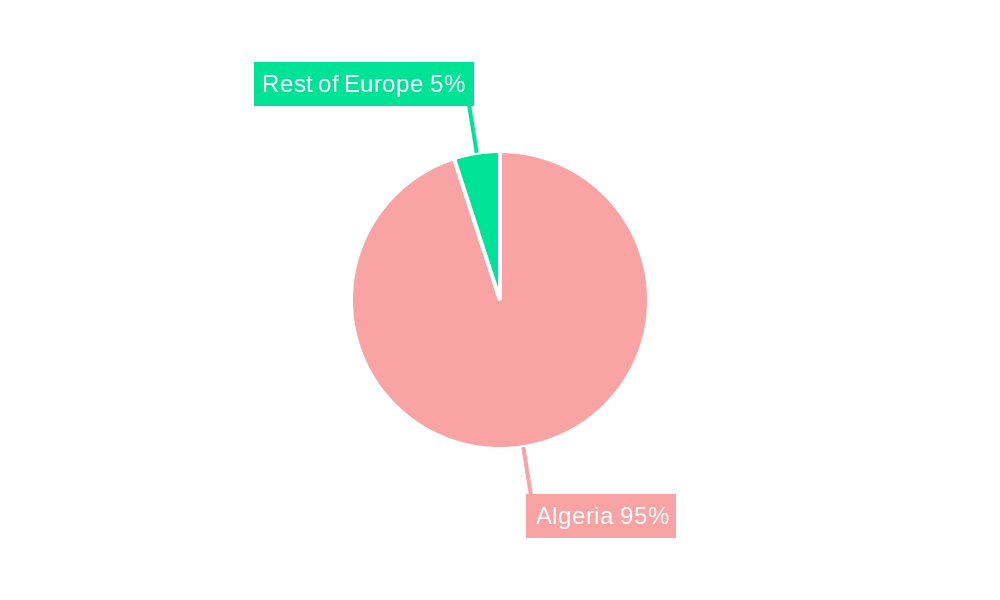

The Power Generation segment is the dominant end-user market, accounting for approximately xx% of the total market value in 2025. Within the geographical breakdown, the domestic market dominates, accounting for the majority of power consumption and investment.

Key Drivers for Power Generation Segment Dominance:

- Increasing energy demand: Driven by industrialization and population growth.

- Government investment: Significant investments in new power plants and infrastructure projects.

- Energy security: A strategic focus on enhancing energy independence.

Other segments (Oil & Gas, Chemical, Others): These sectors contribute a significant portion of the market demand for electricity. The Oil & Gas segment is particularly reliant on reliable power supply for its operations.

Geographical analysis: While the domestic market holds the major share, there are opportunities in the Rest of Europe sector for Algerian energy exports in the longer term.

Algeria Power Market Product Developments

Recent product developments focus on integrating advanced technologies such as smart grids, energy storage solutions, and improved renewable energy technologies. This is leading to enhanced efficiency, reliability, and sustainability in power generation and distribution. The market is witnessing the adoption of advanced metering infrastructure (AMI) and grid modernization initiatives, reflecting a trend toward smart power systems. These developments improve energy management and minimize losses within the grid.

Key Drivers of Algeria Power Market Growth

Key drivers fueling the growth of the Algerian power market include:

- Government support for renewable energy: Incentive schemes, subsidies, and regulatory frameworks promoting solar, wind, and other renewable energy sources.

- Rising energy demand: Driven by economic growth, population increase, and industrialization.

- Investments in infrastructure: Development of new power plants, transmission lines, and distribution networks.

- Technological advancements: Increased efficiency and cost-effectiveness of renewable energy technologies.

Challenges in the Algeria Power Market Market

Significant challenges include:

- Regulatory hurdles: Bureaucratic processes, licensing complexities, and regulatory uncertainty.

- Supply chain constraints: Difficulties in securing necessary equipment and materials, potentially impacting project timelines.

- Investment limitations: Limited access to financing for large-scale projects could hamper growth. This contributes to a slow pace of development.

Emerging Opportunities in Algeria Power Market

The long-term growth of the Algerian power market is supported by:

- Technological breakthroughs: Continuous improvements in renewable energy technologies (solar, wind, etc.), potentially lowering costs and enhancing efficiency.

- Strategic partnerships: Collaborations between domestic and international players can leverage expertise and investment.

- Market expansion: Increased exports of renewable energy to neighboring countries, presenting a growth opportunity.

Leading Players in the Algeria Power Market Sector

- Eni Spa

- General Electric Company

- Algerian PV Company Sarl

- Shariket Kahraba Koudiet Eddraouche

- SOLIWIND Algérie Sarl

- Algerian Energy Company Spa

- Condor Electronics SPA

Key Milestones in Algeria Power Market Industry

- 2020: Launch of the National Renewable Energy Plan, outlining ambitious targets for renewable energy integration.

- 2022: Significant investment announced for a large-scale solar power project.

- 2023: Several new wind farms commenced operation. xx Megawatts of capacity added.

Strategic Outlook for Algeria Power Market Market

The Algerian power market holds substantial promise for growth. The strategic focus on renewable energy integration, alongside government support and investments, will drive the sector's expansion in the coming years. The development of smart grids and energy storage solutions will further enhance the market's resilience and efficiency. Opportunities exist for strategic partnerships to leverage both domestic and international expertise. The market’s future prospects are closely tied to the successful implementation of the government's energy diversification and sustainability agenda.

Algeria Power Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Algeria Power Market Segmentation By Geography

- 1. Algeria

Algeria Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Replacement of Existing Grids and the Expansion of Distribution Networks

- 3.3. Market Restrains

- 3.3.1. High Installation Costs

- 3.4. Market Trends

- 3.4.1. Non-hydropower Renewables Energy Generation to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Algeria Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Algeria

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Algerian PV Company Sarl

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eni Spa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shariket Kahraba Koudiet Eddraouche

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SOLIWIND Algérie Sarl

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Algerian Energy Company Spa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 General Electric Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Condor Electronics SPA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Algerian PV Company Sarl

List of Figures

- Figure 1: Algeria Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Algeria Power Market Share (%) by Company 2024

List of Tables

- Table 1: Algeria Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Algeria Power Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 3: Algeria Power Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: Algeria Power Market Volume Gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 5: Algeria Power Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: Algeria Power Market Volume Gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 7: Algeria Power Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: Algeria Power Market Volume Gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: Algeria Power Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: Algeria Power Market Volume Gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: Algeria Power Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: Algeria Power Market Volume Gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: Algeria Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Algeria Power Market Volume Gigawatt Forecast, by Region 2019 & 2032

- Table 15: Algeria Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Algeria Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

- Table 17: Algeria Power Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 18: Algeria Power Market Volume Gigawatt Forecast, by Production Analysis 2019 & 2032

- Table 19: Algeria Power Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 20: Algeria Power Market Volume Gigawatt Forecast, by Consumption Analysis 2019 & 2032

- Table 21: Algeria Power Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 22: Algeria Power Market Volume Gigawatt Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 23: Algeria Power Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 24: Algeria Power Market Volume Gigawatt Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 25: Algeria Power Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 26: Algeria Power Market Volume Gigawatt Forecast, by Price Trend Analysis 2019 & 2032

- Table 27: Algeria Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Algeria Power Market Volume Gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algeria Power Market?

The projected CAGR is approximately > 8.50%.

2. Which companies are prominent players in the Algeria Power Market?

Key companies in the market include Algerian PV Company Sarl, Eni Spa, Shariket Kahraba Koudiet Eddraouche, SOLIWIND Algérie Sarl, Algerian Energy Company Spa, General Electric Company, Condor Electronics SPA.

3. What are the main segments of the Algeria Power Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Replacement of Existing Grids and the Expansion of Distribution Networks.

6. What are the notable trends driving market growth?

Non-hydropower Renewables Energy Generation to Dominate the Market.

7. Are there any restraints impacting market growth?

High Installation Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algeria Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algeria Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algeria Power Market?

To stay informed about further developments, trends, and reports in the Algeria Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence