Key Insights

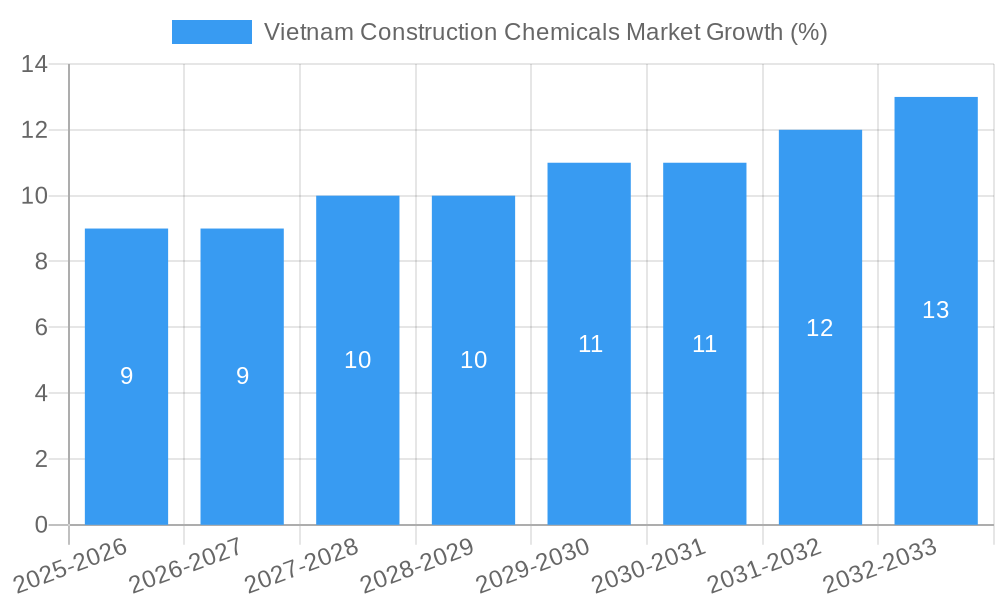

The Vietnam construction chemicals market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5.5% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, Vietnam's robust infrastructure development initiatives, including significant investments in transportation networks, industrial parks, and urban renewal projects, are creating substantial demand for construction chemicals. Secondly, the burgeoning residential sector, driven by a growing population and rising urbanization, further boosts market growth. The increasing adoption of sustainable building practices and the rising demand for high-performance construction materials that enhance durability and longevity also contribute to market expansion. Key product segments driving growth include adhesives, sealants, and coatings, owing to their widespread use in various construction applications. Major players like Arkema, Saint-Gobain, and Sika are actively participating in this dynamic market, leveraging their established presence and technological expertise to cater to the evolving needs of Vietnamese construction projects.

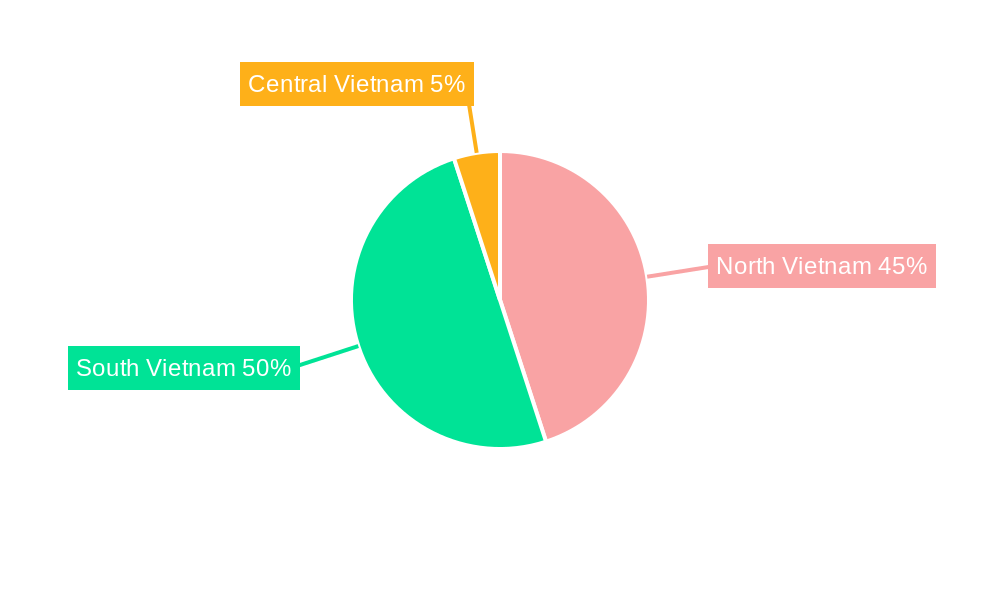

However, the market also faces challenges. Fluctuations in raw material prices, coupled with potential supply chain disruptions, can impact profitability. Furthermore, the market's competitiveness necessitates continuous innovation and product differentiation to retain market share. Despite these challenges, the long-term outlook for the Vietnam construction chemicals market remains positive, driven by sustained government investments in infrastructure and the country's consistent economic growth. The market segmentation, encompassing commercial, industrial, infrastructure, and residential end-use sectors, along with diverse product offerings (adhesives, membranes, sealants, coatings, and fire retardants), presents ample opportunities for both established players and new entrants. The diverse geographic distribution within Vietnam offers opportunities for focused regional strategies.

This in-depth report provides a comprehensive analysis of the Vietnam Construction Chemicals market, covering market dynamics, industry trends, leading segments, key players, and future opportunities. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report is essential for industry stakeholders, investors, and businesses seeking to understand and capitalize on the growth potential of this dynamic market. The market size is projected to reach xx Million by 2033.

Vietnam Construction Chemicals Market Market Dynamics & Concentration

The Vietnam Construction Chemicals market is characterized by a moderately concentrated landscape, with both international and domestic players vying for market share. Key drivers of market innovation include government initiatives promoting sustainable construction practices and the increasing demand for high-performance building materials. The regulatory framework, while evolving, generally supports market growth, albeit with potential hurdles related to environmental regulations and import/export policies. Product substitutes, such as traditional materials, exist, but their limitations in terms of performance and durability are increasingly prompting a shift towards construction chemicals. End-user trends favor improved aesthetics, durability, and energy efficiency, impacting demand for specific product categories. Mergers and acquisitions (M&A) are a significant factor; recent years have seen xx M&A deals, primarily involving international players expanding their presence or acquiring local companies.

- Market Concentration: The market is moderately concentrated, with the top 5 players holding an estimated xx% market share in 2025.

- Innovation Drivers: Government sustainability initiatives and demand for high-performance materials are key drivers.

- Regulatory Framework: Evolving regulations, including environmental standards, impact market dynamics.

- Product Substitutes: Traditional materials provide competition, but their limitations fuel demand for chemical alternatives.

- End-User Trends: Emphasis on aesthetics, durability, and energy efficiency shape product demand.

- M&A Activity: Recent years have witnessed xx M&A deals, indicating consolidation and expansion within the market.

Vietnam Construction Chemicals Market Industry Trends & Analysis

The Vietnam Construction Chemicals market exhibits a robust growth trajectory, driven by the nation's expanding construction sector and rising urbanization. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is estimated to be xx%, fueled by factors such as increasing infrastructure investment, rising disposable incomes, and government initiatives to improve housing and infrastructure. Technological advancements, such as the development of eco-friendly and high-performance materials, are transforming the industry. Consumer preferences lean towards sustainable and durable products, creating opportunities for manufacturers focusing on these aspects. Competitive dynamics are marked by both price competition and differentiation through product innovation and brand reputation. Market penetration of construction chemicals in various segments, particularly in the residential sector, is experiencing significant growth.

Leading Markets & Segments in Vietnam Construction Chemicals Market

The Infrastructure segment dominates the Vietnam Construction Chemicals market, driven by substantial government investments in road networks, railways, and other public works. The Residential segment is a rapidly growing sector, driven by urbanization and rising disposable incomes. Within product categories, Adhesives and Sealants exhibit the highest demand due to their widespread use across various construction activities.

Key Drivers:

- Infrastructure Development: Government investments in large-scale projects fuel demand.

- Residential Construction Boom: Urbanization and rising incomes drive significant growth in this segment.

- Economic Growth: Overall economic expansion contributes positively to construction activities.

- Government Policies: Supportive policies promote both residential and infrastructure construction.

Dominance Analysis:

The Infrastructure sector's dominance stems from large-scale government projects that require significant quantities of construction chemicals. The rapid growth of the Residential sector reflects the increasing urbanization and private investment. The strong demand for Adhesives and Sealants is a consequence of their essential role across various construction activities.

Vietnam Construction Chemicals Market Product Developments

The market is witnessing continuous product innovation, with a focus on developing sustainable, high-performance materials. Manufacturers are introducing eco-friendly formulations, enhancing product durability and performance characteristics, and improving ease of application. These developments aim to cater to the increasing demand for sustainable and efficient construction solutions, offering competitive advantages in a growing market.

Key Drivers of Vietnam Construction Chemicals Market Growth

Several key factors drive the growth of the Vietnam Construction Chemicals Market. Firstly, substantial government investments in infrastructure development projects contribute significantly to market expansion. Secondly, the rapid urbanization trend fuels the demand for construction materials, including chemicals. Thirdly, rising disposable incomes support increased spending on housing and infrastructure improvement. Finally, supportive government policies promote both residential and commercial construction, further stimulating market growth.

Challenges in the Vietnam Construction Chemicals Market Market

The market faces challenges, including fluctuating raw material prices, potential supply chain disruptions, and increasing competition. Stringent environmental regulations can also increase production costs and complexity. Moreover, the market's relatively fragmented nature presents challenges for smaller players to compete effectively with established multinational corporations. These factors may affect the market's growth trajectory, and businesses must adapt to navigate these challenges.

Emerging Opportunities in Vietnam Construction Chemicals Market

Long-term growth opportunities lie in leveraging technological advancements to develop innovative, sustainable products, such as self-healing concrete and recycled-content materials. Strategic partnerships and collaborations can improve supply chain efficiency and market penetration. Expansion into niche segments, such as green building materials and specialized construction applications, also present significant potential.

Leading Players in the Vietnam Construction Chemicals Market Sector

- Arkema

- Saint-Gobain

- RPM International Inc

- MBCC Group

- KKS GROUP JSC

- Fosroc Inc

- Sika A

- MAPEI S p A

- Bestmix Corporation

- MC-Bauchemie

Key Milestones in Vietnam Construction Chemicals Market Industry

- May 2023: Sika acquired the MBCC Group, significantly impacting market share and product offerings. This acquisition broadened Sika's portfolio and strengthened its market position in Vietnam.

- February 2023: Master Builders Solutions opened a new offshore grout production plant, indicating increasing demand in specialized construction segments. This enhances supply chain capabilities in the region.

- November 2022: Saint-Gobain's Chryso launched CHRYSO Dem Aqua 800, showcasing innovation in sustainable and high-performance products. This introduction highlights the trend towards eco-friendly construction materials.

Strategic Outlook for Vietnam Construction Chemicals Market Market

The Vietnam Construction Chemicals market is poised for continued growth, driven by sustained infrastructure investment, urbanization, and a growing focus on sustainable building practices. Strategic opportunities include focusing on innovation, developing strong supply chains, and adapting to evolving regulatory landscapes. Companies that prioritize sustainable solutions and leverage technological advancements will be best positioned for success in this expanding market.

Vietnam Construction Chemicals Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Product

-

2.1. Adhesives

-

2.1.1. By Sub Product

- 2.1.1.1. Hot Melt

- 2.1.1.2. Reactive

- 2.1.1.3. Solvent-borne

- 2.1.1.4. Water-borne

-

2.1.1. By Sub Product

-

2.2. Anchors and Grouts

- 2.2.1. Cementitious Fixing

- 2.2.2. Resin Fixing

- 2.2.3. Other Types

-

2.3. Concrete Admixtures

- 2.3.1. Accelerator

- 2.3.2. Air Entraining Admixture

- 2.3.3. High Range Water Reducer (Super Plasticizer)

- 2.3.4. Retarder

- 2.3.5. Shrinkage Reducing Admixture

- 2.3.6. Viscosity Modifier

- 2.3.7. Water Reducer (Plasticizer)

-

2.4. Concrete Protective Coatings

- 2.4.1. Acrylic

- 2.4.2. Alkyd

- 2.4.3. Epoxy

- 2.4.4. Polyurethane

- 2.4.5. Other Resin Types

-

2.5. Flooring Resins

- 2.5.1. Polyaspartic

-

2.6. Repair and Rehabilitation Chemicals

- 2.6.1. Fiber Wrapping Systems

- 2.6.2. Injection Grouting Materials

- 2.6.3. Micro-concrete Mortars

- 2.6.4. Modified Mortars

- 2.6.5. Rebar Protectors

-

2.7. Sealants

- 2.7.1. Silicone

-

2.8. Surface Treatment Chemicals

- 2.8.1. Curing Compounds

- 2.8.2. Mold Release Agents

- 2.8.3. Other Product Types

-

2.9. Waterproofing Solutions

- 2.9.1. Membranes

-

2.1. Adhesives

Vietnam Construction Chemicals Market Segmentation By Geography

- 1. Vietnam

Vietnam Construction Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption for Polyethylene Terephthalate in the Packaging Sector; Significant Demand of Polyester Fibers from the Textile Sector in Asia Pacific

- 3.3. Market Restrains

- 3.3.1. Toxic Effects of Terephthalic Acid

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Construction Chemicals Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Adhesives

- 5.2.1.1. By Sub Product

- 5.2.1.1.1. Hot Melt

- 5.2.1.1.2. Reactive

- 5.2.1.1.3. Solvent-borne

- 5.2.1.1.4. Water-borne

- 5.2.1.1. By Sub Product

- 5.2.2. Anchors and Grouts

- 5.2.2.1. Cementitious Fixing

- 5.2.2.2. Resin Fixing

- 5.2.2.3. Other Types

- 5.2.3. Concrete Admixtures

- 5.2.3.1. Accelerator

- 5.2.3.2. Air Entraining Admixture

- 5.2.3.3. High Range Water Reducer (Super Plasticizer)

- 5.2.3.4. Retarder

- 5.2.3.5. Shrinkage Reducing Admixture

- 5.2.3.6. Viscosity Modifier

- 5.2.3.7. Water Reducer (Plasticizer)

- 5.2.4. Concrete Protective Coatings

- 5.2.4.1. Acrylic

- 5.2.4.2. Alkyd

- 5.2.4.3. Epoxy

- 5.2.4.4. Polyurethane

- 5.2.4.5. Other Resin Types

- 5.2.5. Flooring Resins

- 5.2.5.1. Polyaspartic

- 5.2.6. Repair and Rehabilitation Chemicals

- 5.2.6.1. Fiber Wrapping Systems

- 5.2.6.2. Injection Grouting Materials

- 5.2.6.3. Micro-concrete Mortars

- 5.2.6.4. Modified Mortars

- 5.2.6.5. Rebar Protectors

- 5.2.7. Sealants

- 5.2.7.1. Silicone

- 5.2.8. Surface Treatment Chemicals

- 5.2.8.1. Curing Compounds

- 5.2.8.2. Mold Release Agents

- 5.2.8.3. Other Product Types

- 5.2.9. Waterproofing Solutions

- 5.2.9.1. Membranes

- 5.2.1. Adhesives

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Arkema

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saint-Gobain

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RPM International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MBCC Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 KKS GROUP JSC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fosroc Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sika A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MAPEI S p A

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bestmix Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MC-Bauchemie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Arkema

List of Figures

- Figure 1: Vietnam Construction Chemicals Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Construction Chemicals Market Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Construction Chemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Construction Chemicals Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Vietnam Construction Chemicals Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 4: Vietnam Construction Chemicals Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 5: Vietnam Construction Chemicals Market Revenue Million Forecast, by Product 2019 & 2032

- Table 6: Vietnam Construction Chemicals Market Volume K Tons Forecast, by Product 2019 & 2032

- Table 7: Vietnam Construction Chemicals Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Vietnam Construction Chemicals Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Vietnam Construction Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Vietnam Construction Chemicals Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Vietnam Construction Chemicals Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 12: Vietnam Construction Chemicals Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 13: Vietnam Construction Chemicals Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Vietnam Construction Chemicals Market Volume K Tons Forecast, by Product 2019 & 2032

- Table 15: Vietnam Construction Chemicals Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Vietnam Construction Chemicals Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Construction Chemicals Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Vietnam Construction Chemicals Market?

Key companies in the market include Arkema, Saint-Gobain, RPM International Inc, MBCC Group, KKS GROUP JSC, Fosroc Inc, Sika A, MAPEI S p A, Bestmix Corporation, MC-Bauchemie.

3. What are the main segments of the Vietnam Construction Chemicals Market?

The market segments include End Use Sector, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption for Polyethylene Terephthalate in the Packaging Sector; Significant Demand of Polyester Fibers from the Textile Sector in Asia Pacific.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Toxic Effects of Terephthalic Acid.

8. Can you provide examples of recent developments in the market?

May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.February 2023: Master Builders Solutions, an MBCC Group brand, inaugurated a new offshore grout production plant in Taichung, Taiwan, in order to meet the ongoing demand of the offshore wind turbine market.November 2022: Saint-Gobain's subsidiary, Chryso, introduced CHRYSO Dem Aqua 800, a vegetable oil emulsion-based mold release agent for different concrete applications to provide excellent surface finish quality, mold protection, HSE profile, and optimized consumption.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Construction Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Construction Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Construction Chemicals Market?

To stay informed about further developments, trends, and reports in the Vietnam Construction Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence