Key Insights

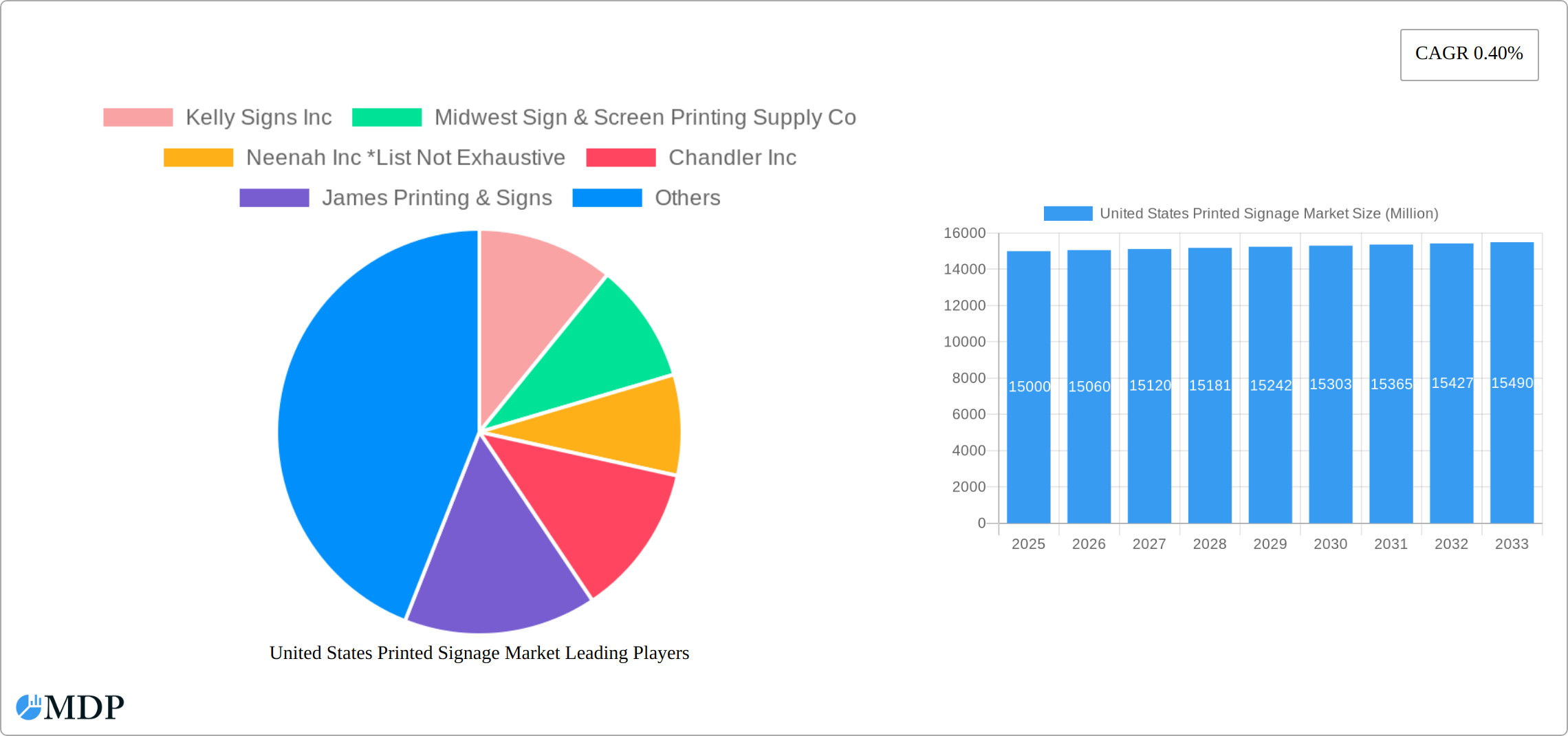

The United States printed signage market, while exhibiting a modest Compound Annual Growth Rate (CAGR) of 0.40% between 2019 and 2024, shows potential for expansion driven by several key factors. The robust retail sector, particularly e-commerce fulfillment centers requiring robust wayfinding signage, and the burgeoning entertainment and sports industries demanding engaging visual displays, are significant contributors to market growth. Furthermore, increasing investment in outdoor advertising, especially in high-traffic urban areas, fuels demand for durable and visually appealing outdoor printed signage. The market is segmented into various product types, including billboards, backlit displays, and banners, each catering to specific needs and contributing to the overall market size. Within these segments, innovative materials and printing technologies continue to emerge, offering improved durability, vibrant colors, and cost-effectiveness, further propelling market expansion. The prominent presence of established players like Avery Dennison and smaller regional companies suggests a healthy competitive landscape driving innovation and accessibility within the market.

United States Printed Signage Market Market Size (In Billion)

Despite the positive trends, challenges remain. The market faces competition from digital signage technologies, which offer greater flexibility and dynamic content updates. Economic fluctuations can also affect marketing and advertising budgets, impacting demand for printed signage. However, the inherent tactile and visual appeal of printed materials, coupled with the proven effectiveness of outdoor advertising, ensures the continued relevance of printed signage. The market's relatively low CAGR suggests a mature market, but the ongoing diversification of product offerings and the increasing adoption of sustainable printing practices are expected to drive moderate, steady growth in the coming years. This sustained growth will primarily be driven by a combination of factors including increasing investments in outdoor advertising, expansion of retail spaces, and advancements in printing technology.

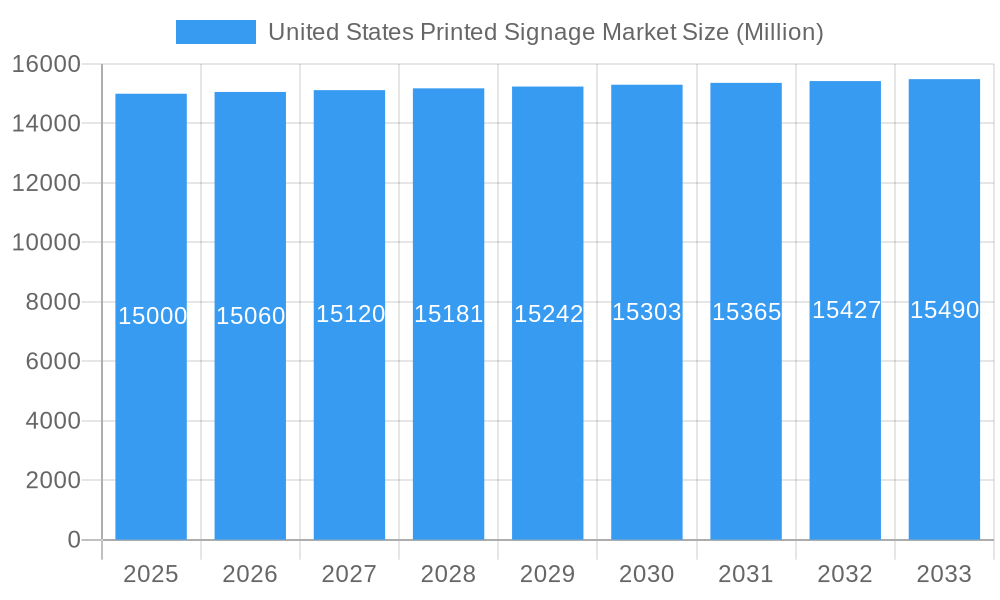

United States Printed Signage Market Company Market Share

United States Printed Signage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Printed Signage Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. Market size is presented in Millions.

United States Printed Signage Market Market Dynamics & Concentration

This section delves into the competitive landscape of the US printed signage market, analyzing market concentration, innovation drivers, regulatory influences, and overarching market dynamics. We meticulously examine the impact of emerging substitute products, evolving end-user trends, and strategic mergers & acquisitions (M&A) activities on the overall market growth trajectory. The analysis incorporates detailed data on market share distribution among key players and the frequency of M&A deals throughout the defined study period, providing a comprehensive view of market consolidation and competitive intensity.

- Market Concentration: The US printed signage market exhibits a [XX]% market concentration ratio, indicating a [moderately/highly/lowly] fragmented market structure. This dynamic is primarily driven by the presence of a diverse ecosystem, encompassing both large multinational corporations with extensive operational footprints and a significant number of agile, smaller regional players that cater to niche markets and local demands.

- Innovation Drivers: The market's growth and evolution are significantly propelled by continuous technological advancements. Key among these are breakthroughs in printing technologies, such as the widespread adoption of high-speed, large-format inkjet printing and versatile UV printing capabilities, which offer enhanced durability and vibrant color reproduction. Furthermore, sophisticated digital design software empowers businesses with greater customization options and improved cost-effectiveness in signage production.

- Regulatory Framework: Navigating the [Discuss relevant regulations related to signage, permits, and environmental concerns, outlining their impact on the market]. The compliance costs associated with these regulations can vary substantially based on the complexity of the signage, its intended application, and the specific geographic locations within the US.

- Product Substitutes: The printed signage market faces robust competition from alternative visual communication channels. Prominent among these are digital signage solutions, which offer dynamic content updates and interactivity, and a wide array of other advertising mediums. The estimated impact of these substitutes on market share is approximately [XX]%.

- End-User Trends: A key factor influencing product development and market strategy is the analysis of shifting consumer preferences and evolving demands within diverse end-user verticals. For instance, there is a discernible and growing demand for sustainable signage materials, driven by corporate social responsibility initiatives and increased consumer awareness regarding environmental impact, which is directly influencing product development and material sourcing strategies.

- M&A Activity: The M&A landscape within the US printed signage industry during the historical period (2019-2024) reveals a consistent level of strategic consolidation. The average number of M&A deals observed per year was [XX], suggesting [high/moderate/low] levels of consolidation as companies seek to expand their market reach, acquire new technologies, or achieve economies of scale.

United States Printed Signage Market Industry Trends & Analysis

This section presents a detailed analysis of the pivotal industry trends that are actively shaping the US printed signage market. We explore the primary market growth drivers, the influence of disruptive technologies, evolving consumer preferences, and the dynamics of competitive landscapes. Specific, quantifiable metrics such as the Compound Annual Growth Rate (CAGR) and market penetration rates for various key segments are provided to offer a data-driven perspective on market performance and future potential.

The US printed signage market is currently experiencing robust growth, fueled by several interconnected factors. Increasing advertising expenditure across various sectors, coupled with ongoing urbanization and the expansion of commercial infrastructure, directly translates to a higher demand for effective and visible signage solutions. Technological disruptions are also playing a transformative role. The continued rise of digital printing technologies, offering enhanced speed, quality, and versatility, alongside emerging applications like 3D printing for specialized signage, are redefining production capabilities. Consumer preferences are increasingly leaning towards sustainable materials, driven by a global push for environmental responsibility and a desire for eco-friendly branding. Furthermore, the demand for personalized signage, tailored to specific brand identities and customer experiences, is a significant trend influencing product development. In terms of competitive dynamics, players are focusing on strategic pricing strategies to remain competitive while emphasizing product differentiation through unique materials, innovative designs, and superior customer service. The market's Compound Annual Growth Rate (CAGR) is projected to be [XX]% over the forecast period, with notable market penetration rates for segments such as [mention specific segments, e.g., retail signage, fleet graphics] at approximately [XX]%.

Leading Markets & Segments in United States Printed Signage Market

This section identifies the leading regions, countries, and market segments within the US printed signage market. We analyze the key drivers of dominance for each segment—Product (Billboards, Backlit Displays, Pop Displays, Banners, Flags, and Backdrops, Corporate Graphics, Exhibition, and Trade Show Materials, Others Products), Type (Indoor Printed Signage, Outdoor Printed Signage), and End-user Vertical (BFSI, Retail, Sports & Leisure, Entertainment, Transportation & Logistics, Healthcare, Other end-user verticals).

Dominant Segments: [Identify the leading segments and provide a rationale. For example, the Retail segment is the largest due to high demand for point-of-sale displays and brand promotion. Outdoor signage dominates the Type segment due to its high visibility].

Key Drivers:

- Economic Policies: [Discuss government initiatives and economic conditions that influence market growth]

- Infrastructure Development: [Analyze the impact of infrastructure projects on demand for signage]

- Consumer Spending: [Assess the influence of consumer confidence and spending patterns on market demand]

[Insert detailed paragraphs explaining the reasons for dominance of specific segments, supported by data and analysis].

United States Printed Signage Market Product Developments

Recent years have witnessed a surge of significant product innovations within the US printed signage market, fundamentally expanding the scope of applications and enhancing competitive advantages. Key technological advancements, including the widespread adoption of high-resolution printing for unparalleled visual clarity, the development and utilization of eco-friendly and sustainable materials that align with market demand, and the introduction of interactive signage solutions that engage audiences more effectively, are at the forefront of this evolution. These innovations are directly catering to an increasingly discerning consumer base that prioritizes sustainability in their purchasing decisions, demands personalized and bespoke signage solutions that reflect their unique brand identities, and seeks engaging visual experiences that capture attention and convey messages with greater impact.

Specific product innovations include the advent of advanced UV-curable inks that offer enhanced durability, scratch resistance, and vibrant color reproduction, making printed signage suitable for a wider range of environmental conditions. The development of biodegradable and recyclable substrates is a major focus, driven by the demand for sustainable practices. Furthermore, the integration of augmented reality (AR) capabilities into printed signage is creating interactive and immersive experiences for consumers. The market adoption of these technologies is steadily increasing, with a notable surge in the adoption of digital printing for short-run, variable data printing of signage, allowing for greater customization and on-demand production. The impact on market competitiveness is substantial, with companies investing heavily in R&D to stay ahead of these evolving trends.

Key Drivers of United States Printed Signage Market Growth

The growth of the US printed signage market is driven by several key factors:

- Technological advancements in printing technology, enabling higher quality, faster production, and greater customization options.

- Increasing advertising spending across various industries, driving demand for eye-catching signage to enhance brand visibility.

- Expansion of retail spaces and commercial infrastructure, creating opportunities for new signage installations.

- Growing demand for interactive and digital signage, enhancing customer engagement and information dissemination.

Challenges in the United States Printed Signage Market

The US printed signage market, while robust, navigates a landscape marked by several significant challenges:

- Competition: The market is characterized by intense competition, not only from established, long-standing players but also from an influx of new entrants. This competitive pressure often leads to significant price wars and impacts profit margins for many businesses.

- Supply Chain Disruptions: The market is susceptible to fluctuations in raw material prices, such as plastics, metals, and printing inks. Potential supply chain bottlenecks, whether due to global events, transportation issues, or material scarcity, can directly impact production costs, lead times, and the overall ability to meet client demand efficiently.

- Regulatory Hurdles: Navigating the complex web of local zoning regulations, building codes, and permit requirements across different municipalities can be a significant challenge. The process of obtaining necessary permits can be time-consuming, costly, and often requires specialized knowledge, thereby impacting project timelines and increasing operational overhead.

Emerging Opportunities in United States Printed Signage Market

Emerging opportunities exist for growth in the US printed signage market through the adoption of sustainable materials, integration of interactive technologies, and expansion into new markets. Strategic partnerships and collaborations among players in the signage industry and related sectors are expected to further accelerate innovation and market growth.

[Insert 150 words discussing specific emerging opportunities.]

Leading Players in the United States Printed Signage Market Sector

- Kelly Signs Inc

- Midwest Sign & Screen Printing Supply Co

- Neenah Inc

- Chandler Inc

- James Printing & Signs

- Sabre Digital Marketing

- Vistaprint (Cimpress plc)

- AJ Printing & Graphics Inc

- Avery Dennison Corporation

- RJ Courtney LLC

- Southwest Printing Co

- 3A Composites USA Inc

Key Milestones in United States Printed Signage Market Industry

- [Insert bullet points detailing key milestones with year/month, e.g., "2022-Q3: Launch of new eco-friendly signage material by Avery Dennison." Focus on mergers, acquisitions, and significant product launches].

Strategic Outlook for United States Printed Signage Market Market

The US printed signage market is poised for continued growth, driven by increasing demand for high-quality, innovative signage solutions across various industries. Strategic opportunities lie in expanding into new market segments, adopting sustainable practices, and leveraging technological advancements to enhance product offerings and customer experiences. Focus on personalized and interactive signage will be key to driving future market growth. The projected market size in 2033 is estimated at [XX] Million.

United States Printed Signage Market Segmentation

-

1. Product

- 1.1. Billboards

- 1.2. Backlit Displays

- 1.3. Pop Displays

- 1.4. Banners, Flags, and Backdrops

- 1.5. Corporat

- 1.6. Others Products

-

2. Type

- 2.1. Indoor Printed Signage

- 2.2. Outdoor Printed Signage

-

3. End-user Vertical

- 3.1. BFSI

- 3.2. Retail

- 3.3. Sports & Leisure

- 3.4. Entertainment

- 3.5. Transportation & Logistics

- 3.6. Healthcare

- 3.7. Other end-user verticals

United States Printed Signage Market Segmentation By Geography

- 1. United States

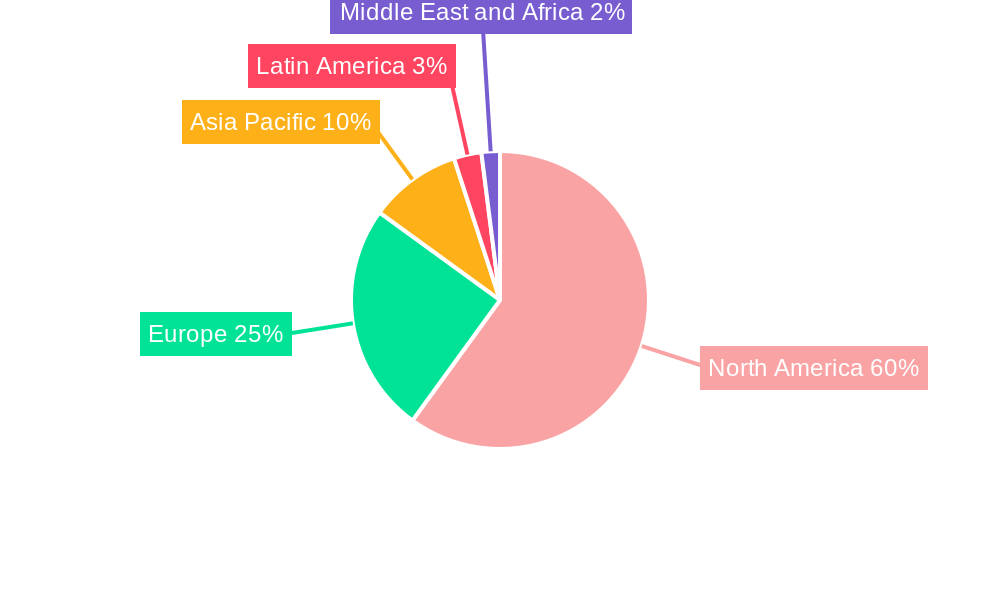

United States Printed Signage Market Regional Market Share

Geographic Coverage of United States Printed Signage Market

United States Printed Signage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Cost Effectiveness of Printed Signage

- 3.3. Market Restrains

- 3.3.1 Lack of Ubiquitous Standards

- 3.3.2 Safety Concerns

- 3.3.3 and Inability to withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. Printed Billboards are Expected to Witness Downfall

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Printed Signage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Billboards

- 5.1.2. Backlit Displays

- 5.1.3. Pop Displays

- 5.1.4. Banners, Flags, and Backdrops

- 5.1.5. Corporat

- 5.1.6. Others Products

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Indoor Printed Signage

- 5.2.2. Outdoor Printed Signage

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. Sports & Leisure

- 5.3.4. Entertainment

- 5.3.5. Transportation & Logistics

- 5.3.6. Healthcare

- 5.3.7. Other end-user verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kelly Signs Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Midwest Sign & Screen Printing Supply Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Neenah Inc *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chandler Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 James Printing & Signs

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sabre Digital Marketing

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vistaprint ( Cimpress plc)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AJ Printing & Graphics Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Avery Dennison Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RJ Courtney LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Southwest Printing Co

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 3A Composites USA Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Kelly Signs Inc

List of Figures

- Figure 1: United States Printed Signage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Printed Signage Market Share (%) by Company 2025

List of Tables

- Table 1: United States Printed Signage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: United States Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: United States Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: United States Printed Signage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Printed Signage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: United States Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: United States Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: United States Printed Signage Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Printed Signage Market?

The projected CAGR is approximately 0.40%.

2. Which companies are prominent players in the United States Printed Signage Market?

Key companies in the market include Kelly Signs Inc, Midwest Sign & Screen Printing Supply Co, Neenah Inc *List Not Exhaustive, Chandler Inc, James Printing & Signs, Sabre Digital Marketing, Vistaprint ( Cimpress plc), AJ Printing & Graphics Inc, Avery Dennison Corporation, RJ Courtney LLC, Southwest Printing Co, 3A Composites USA Inc.

3. What are the main segments of the United States Printed Signage Market?

The market segments include Product, Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Cost Effectiveness of Printed Signage.

6. What are the notable trends driving market growth?

Printed Billboards are Expected to Witness Downfall.

7. Are there any restraints impacting market growth?

Lack of Ubiquitous Standards. Safety Concerns. and Inability to withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Printed Signage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Printed Signage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Printed Signage Market?

To stay informed about further developments, trends, and reports in the United States Printed Signage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence